Professional Documents

Culture Documents

4362 Dna2b Ug

Uploaded by

Spice MobileOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4362 Dna2b Ug

Uploaded by

Spice MobileCopyright:

Available Formats

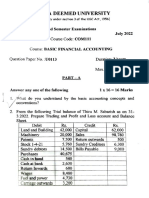

Wk6

Reg. No. : ...............................

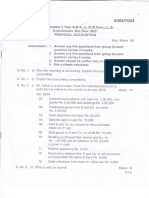

Code No. : 4362 Sub. Code : DNA 2 B

B.C.A. DEGREE EXAMINATION, MAY 2016.

Second Year — Non-Semester

Computer Applications — Main (DD & CE)

Paper VI — ACCOUNTANCY

(For those who joined in July 2008 onwards)

Time : Three hours Maximum : 100 marks

PART A — (5 5 = 25 marks)

Answer any FIVE questions out of Eight.

1. Enter the following transactions in proper

subsidiary books and post in the ledger.

2000 Jan. Rs.

1 Bought goods from B. Balan 1,000

2 Sold goods to S. Solomon 500

8 D. David sold goods to us 500

10 S. Sankar bought goods from us 350

12 Received goods returned by S. Solomon 40

15 We returned goods to B. Balan 25

19 Sold goods to. M. John 250

Wk6

2000 Jan. Rs.

20 Purchased goods from E. Edward 300

23 Damaged goods returned to D. David 60

25 Sold goods to S. Sankar 320

30 S. Sankar returned goods 70

2. On 31st December 1978. Your cash book showed a

debit balance of Rs. 8,500. Before that date you

had issued cheques amounting to Rs. 3,200, but

they were not yet presented for payment. A cheque

of Rs. 600 paid by you into the Bank was not

credited. There were entries for interest on

current account Rs. 35 and for Bank charges Rs. 8

in the pass book. Prepare a bank reconciliation

statement.

3. The following are the balances in the ledger of Mr.

Shankar for the year ended 31st March 1996.

Rs.

Opening stock :

Raw materials 20,000

Work-in-progress 3,000

Finished goods 10,800

Purchase of raw materials 50,000

Sales 2,40,000

Page 2 Code No. : 4362

Wk6

Rs.

Fuel and coal 1,000

Wages 32,000

Factory expenses 40,000

Office expenses 30,000

Depreciation on plant and machinery 3,000

Closing stock :

Raw materials 20,000

Work-in-progress 4,000

Finished goods 8,000

Prepare manufacturing and trading account for

the year ended 31st March, 1996.

4. Pass necessary adjustment entries for the

following adjustments :

(a) Interest has accrued on investments Rs. 500

(b) Commission received in advance Rs. 1,000

(c) To provide 10% interest on capital of

Rs. 2,50,000

(d) Interest charged on drawings Rs. 520

(e) Rs. 2,000 to be transferred to reserve fund.

Page 3 Code No. : 4362

Wk6

5. How do you incorporate the following in the

Tanjore turf club balance sheet for the year

31.3.1997

Rs.

Medal distribution fund 98,400

Interest on the fund investments 28,900

Medals distributed 28,700

Medal distribution fund investments 98,000

6. Find out the amount of salaries to be debited to

income and expenditure account for 1999 from the

details given below :

Rs.

Payments made for salaries during 1999 48,000

Outstanding salary as on 31.12.98 2,000

Outstanding salary as on 31.12.99 3,200

Paid salary as on 31.12.98 1,200

Prepaid salary as on 31.12.99 1,600

7. The Sa Mines Co. Ltd. took from D a lease of a

mine for a period of 25 years from 1st January,

2000 on a royalty of Rs. 5.00 per tonne of mineral

got with a dead rent of Rs. 20,000 and power to

recoup short workings during the first five years of

the lease.

Page 4 Code No. : 4362

Wk6

The annual outputs were as follows :

2000-2000 tonnes ; 2001-3000 tonnes ;

2002-4000 tonnes ; 2003-4500 tonnes;

2004-5000 tonnes.

Give journal entries in the books of the company.

8. A company leased a colliery on 1.1.92 at a

minimum rent of Rs. 20,000 merging into a royalty

of Rs. 1.50 per tonne with power to recoup short

workings over the first four years of the lease. The

output for the colliery for the first four years was

9000 tonnes, 12000 tonnes, 16000 tonnes and

20000 tonnes respectively. Give journal entries for

four years in the books of lease.

PART B — (5 × 15 = 75 marks)

Answer any FIVE questions out of Eight.

9. Enter the following transactions in a cash book

with cash, bank and discount columns :

1968 Rs.

Jan. 1 Muthu commenced business with 10,000

2 Remitted into current account with bank 9,000

6 Paid to Kannan by cheque was

allowed discount Rs. 100 4,000

10 Cash sales 4,000

11 Paid into bank 3,000

15 Manickam paid into our bank account 1,000

19 Issued a cheque to Neelan for furniture purchased 2,000

Page 5 Code No. : 4362

Wk6

1968 Rs.

Jan. 20 Received from Nandan 500

Discount allowed 50

22 Withdraw from bank 200

25 Cash purchases paid by cheque 800

31 Paid salaries by cheque 1,200

10. Petty cashier received Rs. 600 on April 1, 1999

from the head cashier. Prepare a petty cash book

on the imprest system for the month of April 1999

from the following items :

Rs.

3 Stamps 50

5 Taxi fare 100

6 Pencils and pads 75

7 Register 25

10 Speed post 45

12 Telegram 35

15 Refreshment 55

16 Autofare 20

19 Typing paper 60

20 Busfare 15

22 Trunk calls 43

25 Office cleaning 18

30 Courier services 17

Page 6 Code No. : 4362

Wk6

Show the analysis of payments as postage and

stamps, telephone and telegrams, conveyance,

stationary and sundry expenses.

Assume imprest amount of Rs. 600.

11. Prepare the trial balance of Sukumaran as at 30th

June 1966.

Rs.

Cash 370

Opening stock 5,700

Debtors 3,200

Sales 63,900

Wages 13,200

Creditors 5,200

Bad debts reserve 400

Carriage 300

Trade marks 5,300

Advertising 1,250

Salaries 10,900

Machinery 28,900

Land and buildings 28,000

Rent received 5,000

Page 7 Code No. : 4362

Wk6

Rs.

Electricity 6,500

Bills receivable 1,700

Travelling expenses 2,300

Insurance 3,600

Purchases 12,000

Purchases returns 500

Discounts 300

Bad debts 700

Bank 8,500

Capital 58,720

12. Define the term ‘Asset’. How are assets generally

classified? Give two examples for each type of

assets.

13. A firm had the following balances on 1st January,

1964 :

Rs.

Provision for bad and doubtful debts 650

Provision for discount on debtors 320

Reserve for discount on creditors 480

Page 8 Code No. : 4362

Wk6

During the year bad debts amounted to Rs. 450;

discount allowed were Rs. 1,580 and discounts

received were Rs. 970. During 1965 bad debts

amounting to Rs. 230 were written off while

discounts allowed and received were Rs. 1,250 and

Rs. 890 respectively. Sundry debtors were

Rs. 15,000 on December 31, 1964 and Rs. 9,000 on

December 31, 1965. Sundry creditors on these two

dates were Rs. 10,500 and Rs. 12,600. It is the

firm’s policy to maintain a provision of 5 per cent

against bad and doubtful debts and 3% for

discounts on debtors and a reserve of 2% on

creditors.

Show the accounts relating to provision an debtors

and reserve on creditors for the years 1964 and

1965.

14. The following particulars relate to the sports club

of India.

Income and expenditure account for the year

ended 31st December, 1975.

Rs. Rs.

To Salary 1,500 By Entrance fees 10,500

To Printing and stationary 2,200 By Subscriptions 15,600

To Advertising 1,600 By Rent

To Audit fees 500 receivable 4,000

To Fire insurance 1,000

To Depreciation on sports 9,000

equipment

To Excess of income over 14,300

expenditure

30,100 30,100

Page 9 Code No. : 4362

Wk6

Receipts and payments account for the

year ended 31st Dec, 1975

1 Jan. 1975

st By Salary 1,000

To Balance b/d 4,200 By Printing and stationary 2,600

To Entrance fees 1974 1,000 By Advertising 1,600

1975 10,000 By Fire insurance 1,200

To Subscriptions 1974 600 By Investments 20,000

1975 15,000 By Balance c/d 7,800

1976 400

To Rent received 3,000

34,200 34,200

The assets on 1st January 1975 included club

grounds and pavilion Rs. 44,000, sports equipment

Rs. 25,000 and furniture and fixture Rs. 4,000.

Prepare the opening and closing balance sheets.

15. From the following income and expenditure

account for the year ended 31st Dec. 1979, you are

required to prepare the receipts and payments

account for the year ending 31st Dec., 1979.

Income and Expenditure a/c for the year ending

31st Dec. 1979

Expenditure Rs. Income Rs.

To Salaries 4,500 By Subscription 9,800

To Stationary 800 By Profit on sports meet

To Rent 1,200 conducted 800

To Postage 300 By Interest received at 5% 500

To Sundry expenses 1,500

To Depreciation (building) 1,000

To Excess of income over 1,800

expenditure

11,100 11,100

Page 10 Code No. : 4362

Wk6

Other information on 1st January 1979

subscription due was Rs. 300 and stock of

stationary was Rs. 150 and on 31st December 1979

Rs. 100 Expenses outstanding on 1st January 1979

was Rs. 200 and on 31st Dec., 1979 Rs. 100. Rent

prepaid on 1st Jan., 1979 was Rs. 200 and

outstanding on 31st December 1979 was Rs. 100

16. On 1st January, 1990 Binani obtained a mining

lease and on 1st January 1991 he sub leased part

of the mine to Chidambaram. Show ledger a/cs in

Binani’s books on the basis of the following

particulars.

Year Lease Sub-lease

1990 tonnes raised 6000 -

1991 tonnes raised 28000 5000

1992 tonnes raised 33000 7000

1993 tonnes raised 29000 9000

Royalty per tonne Re. 1 Re. 1.50

Minimum rent p.a Rs. 25,500 Rs. 11,000

————————

Page 11 Code No. : 4362

You might also like

- Reg. No.:: APRIL 2023Document7 pagesReg. No.:: APRIL 2023rishab.jain2903No ratings yet

- Financial Accounting Unit 1Document7 pagesFinancial Accounting Unit 1MOAAZ AHMEDNo ratings yet

- Paper II Financial Accounting IIDocument7 pagesPaper II Financial Accounting IIPoonam JainNo ratings yet

- June, 2004 Q.P JRDocument4 pagesJune, 2004 Q.P JRM JEEVARATHNAM NAIDUNo ratings yet

- M2 Jornal, Subsidiary, Leadger PracticalDocument7 pagesM2 Jornal, Subsidiary, Leadger Practicalsimran.patilNo ratings yet

- Accounting Send Up TestDocument3 pagesAccounting Send Up TestKashifNo ratings yet

- Faculty of Commerce: Code No. 10001Document4 pagesFaculty of Commerce: Code No. 10001Madasu BalnarsimhaNo ratings yet

- MB0025Document6 pagesMB0025pramodp@eim.aeNo ratings yet

- FR2 Past Papers 24 AttemptsDocument107 pagesFR2 Past Papers 24 AttemptsAbdullah FarooqiNo ratings yet

- Financial Reporting, Statement & Analysis - Assignment1Document5 pagesFinancial Reporting, Statement & Analysis - Assignment1sumanNo ratings yet

- Accounts Mock - 29178435Document6 pagesAccounts Mock - 29178435mopibam555No ratings yet

- FAA Ist AssignemntDocument9 pagesFAA Ist AssignemntRameshNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Paper A1Document3 pagesTime Allowed: 3 Hours Max Marks: 100: Paper A1KashifNo ratings yet

- PART B Financial AccountingDocument11 pagesPART B Financial AccountingKavitha Kavi KaviNo ratings yet

- Assignment 1Document12 pagesAssignment 1anniekohliNo ratings yet

- XI AccountancyDocument5 pagesXI Accountancytechnical hackerNo ratings yet

- Inter May, 2008Document4 pagesInter May, 2008M JEEVARATHNAM NAIDUNo ratings yet

- Question Paper Accounting (3702) : January 2004: Answer Any Two From The Four Questions Given BelowDocument16 pagesQuestion Paper Accounting (3702) : January 2004: Answer Any Two From The Four Questions Given BelowRaveendra KJNo ratings yet

- M.B.A. (2013 Pattern) 2017 PDFDocument125 pagesM.B.A. (2013 Pattern) 2017 PDFAkdev 118No ratings yet

- Vijayam Junior College::Chittoor: Sr. I Terminal ExaminationsDocument4 pagesVijayam Junior College::Chittoor: Sr. I Terminal ExaminationsM JEEVARATHNAM NAIDUNo ratings yet

- Principles of Financial Accounting: The University of ZambiaDocument4 pagesPrinciples of Financial Accounting: The University of ZambiaNguvuluNo ratings yet

- ACCOUNTANCYDocument2 pagesACCOUNTANCYIshika GautamNo ratings yet

- Financial Accounting First Midterm Test Ii BcaDocument2 pagesFinancial Accounting First Midterm Test Ii BcasuryaNo ratings yet

- Module I Basic AccountingDocument11 pagesModule I Basic Accountingpaul amo100% (1)

- Vijayam Junior College:: Chittoor: I Answer Eight of The Following Questions. 8X5 40Document2 pagesVijayam Junior College:: Chittoor: I Answer Eight of The Following Questions. 8X5 40M JEEVARATHNAM NAIDUNo ratings yet

- Model Question Paper - 2011 Class - XII Subject - AccountancyDocument6 pagesModel Question Paper - 2011 Class - XII Subject - AccountancyKunal AggarwalNo ratings yet

- Sem 2 - End Sem PapersDocument23 pagesSem 2 - End Sem Paperslalith sasankaNo ratings yet

- Source Documents and Books of Original Entry QDocument6 pagesSource Documents and Books of Original Entry QMoses IngudiaNo ratings yet

- Current Liabilities and Warranties p2Document4 pagesCurrent Liabilities and Warranties p2James AngklaNo ratings yet

- 1bba FOA Prep QPDocument2 pages1bba FOA Prep QPSuhail AhmedNo ratings yet

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Document5 pagesMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNo ratings yet

- Contentitemfile Clal2kacze0km0a21x7daf3m2 PDFDocument3 pagesContentitemfile Clal2kacze0km0a21x7daf3m2 PDFJoseph OndariNo ratings yet

- CBSE Class 11 Accountancy WorksheetDocument3 pagesCBSE Class 11 Accountancy WorksheetyashNo ratings yet

- PT TEST (Assignment)Document2 pagesPT TEST (Assignment)Asmee JahanNo ratings yet

- 2017-06 ICMAB FL 001 PAC Year Question JUNE 2017Document3 pages2017-06 ICMAB FL 001 PAC Year Question JUNE 2017Mohammad ShahidNo ratings yet

- S.3 Ent 1Document4 pagesS.3 Ent 1changhonga30No ratings yet

- Fa 66Document7 pagesFa 66shreya yadavNo ratings yet

- Final Semester Examination: (March 2011 Session)Document6 pagesFinal Semester Examination: (March 2011 Session)unknown gtrNo ratings yet

- Financial Accounting Past Paper 2019Document3 pagesFinancial Accounting Past Paper 2019Rana Hanzila TahirNo ratings yet

- Reg. No.Document4 pagesReg. No.madhumithaNo ratings yet

- Accounting From Incomplete Records For BookDocument21 pagesAccounting From Incomplete Records For BookbinuNo ratings yet

- BFC 3125 Financial Accounting IDocument5 pagesBFC 3125 Financial Accounting Ikorirenock764No ratings yet

- Contentitemfile Clakzwt9mx9sk0a212lma0ytv PDFDocument4 pagesContentitemfile Clakzwt9mx9sk0a212lma0ytv PDFJoseph OndariNo ratings yet

- Class XI Practice PaperDocument4 pagesClass XI Practice PaperAyush MathiyanNo ratings yet

- Class 11 Accounts Half Yearly SPDocument9 pagesClass 11 Accounts Half Yearly SPRakesh AgarwalNo ratings yet

- Exam June 2007Document9 pagesExam June 2007kalowekamoNo ratings yet

- Assignment 1 2021Document3 pagesAssignment 1 2021Hunain WarisNo ratings yet

- Sample Paper For See Acc Xi - 1Document6 pagesSample Paper For See Acc Xi - 1Piyush JNo ratings yet

- D.K.M. College For Women (Autonomous), Vellore - 1 Semester Examinations November - 2018 15CCO1A/CCO1A Financial Accounting - IDocument8 pagesD.K.M. College For Women (Autonomous), Vellore - 1 Semester Examinations November - 2018 15CCO1A/CCO1A Financial Accounting - IChandu Raju0% (1)

- Topic 4 Class ExerciseDocument5 pagesTopic 4 Class ExerciseAzim OthmanNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: BC 1502 - Financial AccountingDocument4 pagesLoyola College (Autonomous), Chennai - 600 034: BC 1502 - Financial AccountingIPloboNo ratings yet

- Commerce First YearDocument7 pagesCommerce First Yearravulapallysona93No ratings yet

- Part - A (: Time Allowed: 3 Hours Maximum Marks: 90Document4 pagesPart - A (: Time Allowed: 3 Hours Maximum Marks: 90NameNo ratings yet

- (C) Prepare Suman Account With The Following Transactions:: I. Answer Any Two of The Following: 2 X 5 10Document3 pages(C) Prepare Suman Account With The Following Transactions:: I. Answer Any Two of The Following: 2 X 5 10M JEEVARATHNAM NAIDUNo ratings yet

- (RSS) Financial Accounting - I: Debit CreditDocument8 pages(RSS) Financial Accounting - I: Debit CreditNiteeshaNo ratings yet

- Contentitemfile Clakzz57bxlrw0a21yjksjcx8 PDFDocument4 pagesContentitemfile Clakzz57bxlrw0a21yjksjcx8 PDFJoseph OndariNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- BRS ExerciseDocument7 pagesBRS ExerciseMuskan LohariwalNo ratings yet

- Sanction LetterDocument5 pagesSanction LetterIssac EbbuNo ratings yet

- Kalpataru Scheme TCDocument1 pageKalpataru Scheme TCram dhukeNo ratings yet

- ManualDocument6 pagesManualMark Dela CruzNo ratings yet

- Service Charges and Fees-Federal BankDocument10 pagesService Charges and Fees-Federal Bankakhil kurianNo ratings yet

- Notes For CBSEDocument11 pagesNotes For CBSEBinoy TrevadiaNo ratings yet

- FAB SHARE Credit Cards TCs EnglishDocument9 pagesFAB SHARE Credit Cards TCs EnglishAnkur shahNo ratings yet

- Customer Perception Towards Plastic Money PDF FreeDocument65 pagesCustomer Perception Towards Plastic Money PDF FreeAmit bailwalNo ratings yet

- 04 Task Performance 1 ARG ScriptDocument3 pages04 Task Performance 1 ARG Scriptthalhia navaNo ratings yet

- QUIZ 4, Prepared by Baroda Academy, AHMEDABAD - Print - QuizizzDocument27 pagesQUIZ 4, Prepared by Baroda Academy, AHMEDABAD - Print - QuizizzShilpa JhaNo ratings yet

- Merchant Processing Agreement - Merchant ApplicationDocument3 pagesMerchant Processing Agreement - Merchant ApplicationtonerangerNo ratings yet

- COMPREHENSION PASSAGE 2022 3rd AND 4THDocument4 pagesCOMPREHENSION PASSAGE 2022 3rd AND 4THSumit RajkumarNo ratings yet

- IDFC FIRST Bank Credit Card Statement 24052022Document3 pagesIDFC FIRST Bank Credit Card Statement 24052022avisinghoo7No ratings yet

- Credit Card Statement TemplateDocument2 pagesCredit Card Statement TemplateShanti SharmaNo ratings yet

- Your Hopper Booking Confirmation: LR38D2HBMQTK: Your Stay at Hotel Ayenda Puerto Vigía 1807 Has Been ConfirmedDocument4 pagesYour Hopper Booking Confirmation: LR38D2HBMQTK: Your Stay at Hotel Ayenda Puerto Vigía 1807 Has Been ConfirmedMauricio HerreraNo ratings yet

- LM-HBZ-CM-001 General TsCs-Business CONVENTIONALDocument11 pagesLM-HBZ-CM-001 General TsCs-Business CONVENTIONALXolani Radebe RadebeNo ratings yet

- Meeting 9: Cashless Economy A. Learning Objectives: Away Rest Growing Hard Destined Extent Cashless PrepaidDocument3 pagesMeeting 9: Cashless Economy A. Learning Objectives: Away Rest Growing Hard Destined Extent Cashless PrepaidnisaNo ratings yet

- The Internal Controls of CashDocument3 pagesThe Internal Controls of CashbelliissiimmaaNo ratings yet

- Perjanjian Kerjasama ESPAY Payment Gateway (Indo - Eng Version) With Newest ChannelDocument23 pagesPerjanjian Kerjasama ESPAY Payment Gateway (Indo - Eng Version) With Newest ChannelZaynull Abideen NoahNo ratings yet

- Learning Guide: Accounts and Budget Support Level IiiDocument19 pagesLearning Guide: Accounts and Budget Support Level IiiNigussie BerhanuNo ratings yet

- Assignment 2023 For BPOI-102 (002) (DBPOFA Prog)Document2 pagesAssignment 2023 For BPOI-102 (002) (DBPOFA Prog)Pawar ComputerNo ratings yet

- Monthly Statement: This Month's SummaryDocument7 pagesMonthly Statement: This Month's SummaryAbhishek ChippalakattiNo ratings yet

- Module in Credit and Collection.01Document39 pagesModule in Credit and Collection.01Jay Rose WasanNo ratings yet

- Account Statement From 1 Jan 2017 To 31 Dec 2017: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument6 pagesAccount Statement From 1 Jan 2017 To 31 Dec 2017: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancePraveen Kumar pkNo ratings yet

- Banking InsuranceDocument2 pagesBanking InsuranceArghadeep ChandaNo ratings yet

- Bank Reconciliation Solution - Uhuru Sacco LTD V1Document9 pagesBank Reconciliation Solution - Uhuru Sacco LTD V1Daniel Dayan SabilaNo ratings yet

- Ticket Booking SystemDocument5 pagesTicket Booking SystemsaddiqueNo ratings yet

- Scarb Fun GuideDocument118 pagesScarb Fun GuideSangeethaNo ratings yet

- Paxum Personal Account FeesDocument5 pagesPaxum Personal Account FeesFarid PrimadiNo ratings yet

- Monthly SummaryDocument1 pageMonthly SummaryHamza KhanNo ratings yet