Professional Documents

Culture Documents

Notes Kay Antonyo

Notes Kay Antonyo

Uploaded by

Heart EspineliOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notes Kay Antonyo

Notes Kay Antonyo

Uploaded by

Heart EspineliCopyright:

Available Formats

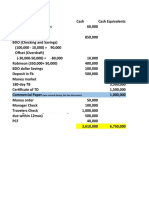

Under PAS 7, treasury bills,

money market placement and

time deposit normally qualify as

cash

equivalents only when they

have a short maturity of three

months or less from the date of

acquisition.

In the absence of specific term,

money market account is short-

term investment of three months

or less.

The treasury bill is classified as

cash equivalent because the

term is three months.

The time deposit is not a cash

equivalent because the term is

four months.

Under PAS 7, treasury bills,

money market placement and

time deposit normally qualify as

cash

equivalents only when they

have a short maturity of three

months or less from the date of

acquisition.

In the absence of specific term,

money market account is short-

term investment of three months

or less.

The treasury bill is classified as

cash equivalent because the

term is three months.

The time deposit is not a cash

equivalent because the term is

four months.

Problem 1-18 Problem 1-20

The customer check of P2,000,000 payable to Ral is properly not included in

cash because it is The NSF customer check of P500, 000 should be reverted The sinking fund is included in cash and cash equivalents because the

to accounts receivable on December 31, 2012 postdated January 2, 2013.

bond payable is already due within one year from the end of the

because it was redeposited after December 31, 2012. The check of P300,000

drawn by Ral is undelivered on December 31,2012. Thus, the undelivered reporting period. The classification of a cash fund should parallel the

check is restored to cash by debiting cash and crediting accounts payable.

classification of the related liability.

Problem 1-14 Problem 1-10

Under PAS 7,

Since the compensating balance is legally restricted, it is excluded from the

amount shown as cash. In this case, the compensating balance is shown as

"cash held as compensating balance" as a current asset because the related

loan is short-term. The term of the time deposit is not given. It is assumed

that it is three months or less, this being the normal banking practice.

Accordingly, the time deposit is a cash equivalent. . In this case, the

compensating balance is shown as "cash held as compensating

balance" as a current asset because the related loan is short-

treasury bills,

(Sum of all deposit – sum of all checks)

(Checks that are not included in the book)

Zodiac company

Bank reconciliation

(collection of note + interest on note)

March 31

balance per book april 30 ₱ 1,100,000.00

CM for note collected ₱ 60,000.00

Outstanding checks:

no: 1331 ₱ 40,000.00

no: 1332 30000

no: 1334 ₱ 60,000.00

no: 1335 ₱ 10,000.00 ₱ 140,000.00

total ₱ 1,300,000.00

less: bank service charge -₱ 5,000.00

NSF Check -₱ 25,000.00

Undeposited Collection -₱ 270,000.00 -₱ 300,000.00

balance per bank april 30 ₱ 1,000,000.00

adjusting entry DR CR

cash in bank ₱ 60,000.00

note receivable ₱ 60,000.00

bank service charge ₱ 5,000.00

accounts receivable ₱ 25,000.00

Cash in bank ₱ 30,000.00

balance per book april 30 ₱ 1,100,000.00

CM for note collected ₱ 60,000.00

less; Bank Service charge -₱ 5,000.00

less: Nsf check -₱ 25,000.00

adjusted Cash in bank ₱ 1,130,000.00

You might also like

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- SPL Updated Syllabus - 2020 PDFDocument6 pagesSPL Updated Syllabus - 2020 PDFCiara De LeonNo ratings yet

- Bank ReconciliationDocument6 pagesBank ReconciliationXienaNo ratings yet

- Audit of CashDocument9 pagesAudit of CashEmma Mariz Garcia25% (8)

- New Product Business Case + Financials CaseDocument9 pagesNew Product Business Case + Financials CaseAmreen Akhtar100% (1)

- Chapter 8 & 9 AssignmentDocument8 pagesChapter 8 & 9 AssignmentSamantha Charlize Vizconde67% (3)

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Quiz 3-Audit CashDocument8 pagesQuiz 3-Audit CashCindy CrausNo ratings yet

- Practical Auditing Empleo Sol Man Chapter 3Document6 pagesPractical Auditing Empleo Sol Man Chapter 3Elaine AntonioNo ratings yet

- Quiz - Chapter 3 - Bank ReconciliationDocument6 pagesQuiz - Chapter 3 - Bank ReconciliationSHE82% (11)

- Tugas Kas PiutangDocument14 pagesTugas Kas PiutangDeby Nailatun FitriyahNo ratings yet

- Lecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetDocument36 pagesLecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetRahul GautamNo ratings yet

- Activity 4 Bank Reconciliation: Multiple Choice: TheoriesDocument4 pagesActivity 4 Bank Reconciliation: Multiple Choice: TheoriesKrissa Mae Longos100% (1)

- Activity 4 Bank Reconciliation PDFDocument4 pagesActivity 4 Bank Reconciliation PDFSharmin ReulaNo ratings yet

- 02-Analysing BIM Implementation in EgyptianDocument14 pages02-Analysing BIM Implementation in EgyptianAhmed Youssef El-Arabi100% (1)

- Cash-And-Cash-Equivalent - Answers On HandoutDocument6 pagesCash-And-Cash-Equivalent - Answers On HandoutElaine AntonioNo ratings yet

- MCQ - Cash and Cash Equivalents Practice Solving - Robles and EmpleoDocument8 pagesMCQ - Cash and Cash Equivalents Practice Solving - Robles and EmpleoLeah La MadridNo ratings yet

- Nudjpia Far and Afar Solutions - CashDocument5 pagesNudjpia Far and Afar Solutions - CashKyla Artuz Dela CruzNo ratings yet

- Cash and Cash EquivalentsDocument7 pagesCash and Cash Equivalentszarnaih SmithNo ratings yet

- AKM TUGAS CHAPTER 7 Kel 4Document20 pagesAKM TUGAS CHAPTER 7 Kel 4kezia evangeliaNo ratings yet

- C2 AnswersDocument5 pagesC2 AnswersScarlet DragonNo ratings yet

- ZZZZZZZ - Quiz 7Document2 pagesZZZZZZZ - Quiz 7Prin CessNo ratings yet

- Notes Kay AntonyoDocument5 pagesNotes Kay AntonyoHeart EspineliNo ratings yet

- Cash and Cash Equivalents Multiple Choice QuestionsDocument13 pagesCash and Cash Equivalents Multiple Choice QuestionsddalgisznNo ratings yet

- Bank Reconciliation IllustrationDocument2 pagesBank Reconciliation IllustrationRia BryleNo ratings yet

- Intermediate Accounting Chapter 1 Exercises - ValixDocument46 pagesIntermediate Accounting Chapter 1 Exercises - ValixAbbie ProfugoNo ratings yet

- Problem 7 - 24 Candid CompanyDocument13 pagesProblem 7 - 24 Candid CompanyJames Eldrin O PadillaNo ratings yet

- Gerald N. Roman Bsba FM 2-C Financial Analysis and ReportingDocument4 pagesGerald N. Roman Bsba FM 2-C Financial Analysis and ReportingGerald Noveda RomanNo ratings yet

- NOTES Practice Solving - Robles and EmpleoDocument52 pagesNOTES Practice Solving - Robles and EmpleoLeah La MadridNo ratings yet

- Activity No. 1 - Cash & Cash Equivalents (Salvador)Document9 pagesActivity No. 1 - Cash & Cash Equivalents (Salvador)Princess Aleia SalvadorNo ratings yet

- First Quiz in Prac 1Document10 pagesFirst Quiz in Prac 1ai shiNo ratings yet

- ZZZZZZZDocument9 pagesZZZZZZZZymelle Princess FernandezNo ratings yet

- Bank ReconcilDocument2 pagesBank ReconcilAlthea Lyn ReyesNo ratings yet

- Cash&Cash EquivalentDocument16 pagesCash&Cash EquivalentJessicaNo ratings yet

- Cash & Cash EquivalentsDocument2 pagesCash & Cash EquivalentsYoonah KimNo ratings yet

- Icpa - Ia1Document26 pagesIcpa - Ia1john paulNo ratings yet

- Cash Oxley AssignmentDocument13 pagesCash Oxley AssignmentKaRl MariNo ratings yet

- Cash and Cash EquivalentsDocument5 pagesCash and Cash EquivalentsDexter Joseph CuevasNo ratings yet

- 6703194011-Sofyanhadi-43-01-Rekonsiliasi BankDocument7 pages6703194011-Sofyanhadi-43-01-Rekonsiliasi BankSofyan HadyNo ratings yet

- Chapter 3 - Bank ReconciliationDocument2 pagesChapter 3 - Bank ReconciliationJerome_JadeNo ratings yet

- Fabm Notes (3 - 5 - 2023)Document2 pagesFabm Notes (3 - 5 - 2023)Yssa Sophia JumalonNo ratings yet

- Cash and Cash Equivalents Sample Problems PDFDocument7 pagesCash and Cash Equivalents Sample Problems PDFMarcos Jose AveNo ratings yet

- Audit of Cash - IllustrationDocument6 pagesAudit of Cash - IllustrationRNo ratings yet

- Bank ReconciliationDocument7 pagesBank ReconciliationOCAMPO Julia ConereeNo ratings yet

- Bank ReconciliationDocument64 pagesBank ReconciliationmarkjohnmagcalengNo ratings yet

- Cash SeatworkDocument3 pagesCash SeatworkRed TigerNo ratings yet

- PR 8-3B Bank Reconciliation and EntriesDocument2 pagesPR 8-3B Bank Reconciliation and EntriesKevin FernandaNo ratings yet

- Lecture Notes Cash & Cash Equivalent: Page 1 of 7Document7 pagesLecture Notes Cash & Cash Equivalent: Page 1 of 7Dalia DelrosarioNo ratings yet

- Chapter 7 Practice SolutionsDocument5 pagesChapter 7 Practice Solutionslemanhan240103No ratings yet

- SAMPLEDocument3 pagesSAMPLEkrizzmaaaayNo ratings yet

- Financial Accounting Review, Problem Preliminary Examination Problem 1Document16 pagesFinancial Accounting Review, Problem Preliminary Examination Problem 1John Emerson PatricioNo ratings yet

- Answer To Problems On Cash & Cash Equivalents - Reinforcement DiscussionDocument8 pagesAnswer To Problems On Cash & Cash Equivalents - Reinforcement DiscussionAnnie RapanutNo ratings yet

- Quiz 1 Cash and Cash Equivalent (A)Document2 pagesQuiz 1 Cash and Cash Equivalent (A)JHERRY MIG SEVILLANo ratings yet

- Cash and Cash EquivalentsDocument4 pagesCash and Cash Equivalentsattiva jadeNo ratings yet

- Intermediate Accounting 1 - Cash Straight ProblemsDocument3 pagesIntermediate Accounting 1 - Cash Straight ProblemsCzarhiena SantiagoNo ratings yet

- AACONAPPS2 A433 - Audit of Cash & Cash Equivalents (v2)Document16 pagesAACONAPPS2 A433 - Audit of Cash & Cash Equivalents (v2)Dawson Dela CruzNo ratings yet

- Assignment and Quiz 2 Accounting For CashDocument5 pagesAssignment and Quiz 2 Accounting For CashGab BautroNo ratings yet

- Chapter 111213Document8 pagesChapter 111213Angel Alejo Acoba0% (1)

- Chapter 1Document16 pagesChapter 1Liza Mae MirandaNo ratings yet

- Cash To InventoriesDocument63 pagesCash To InventoriesPrincess Grace Baarde CastroNo ratings yet

- Bank Reconciliation and Proof of Cash Problems 01 04 - 043916Document2 pagesBank Reconciliation and Proof of Cash Problems 01 04 - 043916azazelrallosNo ratings yet

- Ac3a Qe Oct2014 (TQ)Document15 pagesAc3a Qe Oct2014 (TQ)Julrick Cubio EgbusNo ratings yet

- Chapter 8 9 AssignmentDocument8 pagesChapter 8 9 AssignmentDax CruzNo ratings yet

- ReSA B42 FAR First PB Exam Questions Answers Solutions-1Document25 pagesReSA B42 FAR First PB Exam Questions Answers Solutions-1Heart EspineliNo ratings yet

- STRATCOSTDocument4 pagesSTRATCOSTHeart EspineliNo ratings yet

- Notes Kay AntonyoDocument5 pagesNotes Kay AntonyoHeart EspineliNo ratings yet

- Theory of Accounts QualiDocument5 pagesTheory of Accounts QualiHeart EspineliNo ratings yet

- Contemporary World - ReviewerDocument3 pagesContemporary World - ReviewerHeart EspineliNo ratings yet

- StandaloneDocument5 pagesStandaloneHeart EspineliNo ratings yet

- Cfas Reporting ScriptDocument1 pageCfas Reporting ScriptHeart EspineliNo ratings yet

- Star Health and Allied Insurance Company Limited: R MargabandhuDocument5 pagesStar Health and Allied Insurance Company Limited: R MargabandhuSai PRANAV 05 -NFSNo ratings yet

- GCMMF-Case StudyDocument18 pagesGCMMF-Case StudyNAMRATA GUPTANo ratings yet

- PM Pillar Breakdown Analysis v1Document60 pagesPM Pillar Breakdown Analysis v1bhavesh_balasNo ratings yet

- CV Welly UpdateDocument31 pagesCV Welly UpdateNadia Ratnasari ByuNo ratings yet

- About Financial Statements: Prepared By: Mohammad Shahidul Islam MBA, ACADocument31 pagesAbout Financial Statements: Prepared By: Mohammad Shahidul Islam MBA, ACAShahid MahmudNo ratings yet

- 998-20793748 Gma-Us 208-480V Rom D WebDocument12 pages998-20793748 Gma-Us 208-480V Rom D WebAlexander NuzNo ratings yet

- HappyCow SalesComparisonDocument4 pagesHappyCow SalesComparisonMohini Roy ChowdhuryNo ratings yet

- Sap DemoDocument8 pagesSap DemoRahulNo ratings yet

- 11 Agust 2022Document3 pages11 Agust 2022Fadia Haya WNo ratings yet

- Dear Ms Nash WilliamsDocument3 pagesDear Ms Nash WilliamsÁnh TuyếtNo ratings yet

- Topic 2 Process ManagementDocument33 pagesTopic 2 Process ManagementsyakirahNo ratings yet

- ZL30320 DataSheetDocument87 pagesZL30320 DataSheetPhongNo ratings yet

- The Revised Corporation Code of The Philippines Republic Act No. 11232Document30 pagesThe Revised Corporation Code of The Philippines Republic Act No. 11232Poison IvyNo ratings yet

- HRM 450Document5 pagesHRM 450Fahmid Rahman Siam 1812798630No ratings yet

- Innovation and CreativityDocument3 pagesInnovation and Creativity89pankajNo ratings yet

- Ict Support Services SlaDocument8 pagesIct Support Services Slajohnkimani243No ratings yet

- Chapter 1 - Accounting For Partnership Firms - Fundamentals - Volume IDocument68 pagesChapter 1 - Accounting For Partnership Firms - Fundamentals - Volume IVISHNUKUMAR S VNo ratings yet

- Numerical Questions On Price Discrimination: D D F F D FDocument3 pagesNumerical Questions On Price Discrimination: D D F F D FArnica Traders50% (2)

- Alpha - ESS - Economic-On (LatAm) - Draft-AgreementDocument5 pagesAlpha - ESS - Economic-On (LatAm) - Draft-AgreementLu VernNo ratings yet

- 5ec809db244c8ce377528562 - Tom's Shoes Business Case PaperDocument10 pages5ec809db244c8ce377528562 - Tom's Shoes Business Case PaperHasan PatowaryNo ratings yet

- Wedding - Consultant - Business - COMPUTER PROJECTDocument15 pagesWedding - Consultant - Business - COMPUTER PROJECTGoodangel BlessingNo ratings yet

- Kerala Shops and Commercial Establishments Acts and RulesDocument34 pagesKerala Shops and Commercial Establishments Acts and RulesHR RecruiterNo ratings yet

- EmeraldDocument11 pagesEmeralddidiNo ratings yet

- Grievance and Grievance ProcedureDocument9 pagesGrievance and Grievance ProcedurePatricia Bianca ArceoNo ratings yet

- CSC 371 Lecture NoteDocument68 pagesCSC 371 Lecture NoteCharlesNo ratings yet

- PDF Answer Key Workbook DDDocument15 pagesPDF Answer Key Workbook DDZr0nNo ratings yet