Professional Documents

Culture Documents

Exercice 1 - Correction

Uploaded by

Fagoul Jad0 ratings0% found this document useful (0 votes)

11 views5 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views5 pagesExercice 1 - Correction

Uploaded by

Fagoul JadCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 5

The company ABC sells two different types of product : Trainers and flip flop.

The selling price of the trainers is 60€, the selling price of the flip flop is 25€.

The company planned to sell 9 950 trainers and 14 500 flip flop

To be carefull the company want to have an closing stock of 2000 flip flops and 1500 trainers next month. We want 5 kg of

Each trainers require 100g of fabric and 60g of leather, the flip flops require 20g of fabric and 50g of leather

The price of the leather is 60€/kilo and the price of the fabric 10€/kilo. The trainers requires 1h of labour, and 30min for th

The current inventory is the following

Finished goods trainers 981

Finished goods flip flops 1,172

Fabric (in kg) 3.32

Leather 1.03

Determine the cost of each product

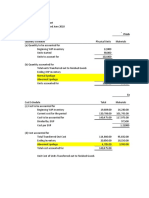

SALES BUDGET Forecasted sales Selling price Total revenue

Trainers 9950 60 597000

Flip flop 14500 25 362500

Total 959500

PRODUCTION BUDGET Trainers Flip flops

Units to be sold 9950 14500

+ Planned closing stock 1500 2000

=Total units required for sales and stocks 11450 16500

- Planned opening stock 981 1,172

= units to be produced 10469 15328

MATERIALS USAGE BUDGET Trainers Flip flops Total

Fabric (in grams) 100 20

Total (in kg) 1046.9 306.56 1353.46

Leather (in grams) 60 50

Total (in kg) 628.14 766.4 1394.54

Direct labour 1 0.5

MATERIALS PURCHASE BUDGET Fabric Leather

Quantity necessary to meet requirements 1353.46 1394.54

+ Planned closing stock 5 5

- Planned opening stock 3.32 1.03

= Total units to be purchased 1355.14 1398.51

X Standard cost (planned unit purchase price) 10 60

= Budgeted cost (purchase budget in value) 13551.4 83910.6

LABOUR BUDGET Trainers Flip flops TOTAL

Production volume (units) 10,469 15328

x Standard labour hours 1 0.5

= Total number of hours 10469 7664 18133

x Standard labour rate 11 11

= Total cost (Labour budget in value) 115159 84304 199463

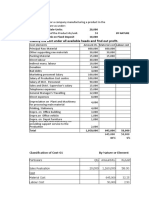

PRODUCTION OVERHEAD BUDGET TRAINERS FLIP FLOPS BUDGETED TRAINERS

Standard variable overhead rates

Indirect materials 1.1 0.45 11515.9

Indirect labour 0.9 0.9 9422.1

Power (variable portion) 0.3 0.15 3140.7

Maintenance (variable portion) 0.2 0.25 2093.8

TOTAL VARIABLE OVERHEADS 26172.5

Budgeted fixed overheads

Depreciation 50,000 22,000

Supervision 30,000 11,000

Power (fiwed portion 25,000 5,000

Maintenance (fixxed portion) 10,000 3,000

TOTAL FIXED OVERHEADS 115,000 41,000

TOTAL COST TRAINERS

304,489

Estimated non-manufacturing overheads €

Stationary (Administration) 3,000

Salaries

Sales 41,000

Office 28,000

Commissions 12,000

Car expenses (sales) 3,000

Advertising 40,000

Miscellaneous 4,000

131,000

s next month. We want 5 kg of each raw materials in our closing stock

d 50g of leather

1h of labour, and 30min for the flip flops for a Standard labour rate of 11€

We will now focus only on trainers and the variances we faced

Actual results Static budget Static budget variances

Units sold 10,140 9950 190

Revenues 609,000 597000 12,000

Manufacturing variable costs 201,160 189,489 11,671

Contribution margin 407,840 407,511 329

Fixed costs 156,000 156,000 0

Operating profit 251,840 251,511 329

Per unit Volume Total

Revenues 60 10,140 608400

Fabric 1 10140

Leather 3.6 36504

Labour 11 111540

Overheads

Indirect materials 1.1 11154

Indirect labour 0.9 9126

Power (var portion) 0.3 3042

Maintenance (var portion) 0.2 2028

Total variable cost 18.1 183534

Contribution margin 424866

Manufacturing fixed costs 115,000

Operating profit 309,866

Actual results Flexible budget Static budget

Units sold 10,140 10,140 9950

Revenues 609,000 608,400 597000

Manufacturing variable costs 201,160 183534 189488.9

Contribution margin 407,840 424866 407511.1

Fixed costs 156,000 115,000 156000

Operating profit 251,840 309,866 251511.1

BUDGETED FLIP FLOPS

3448.8

6897.6

1149.6

1916

13412

TOTAL COST FLIP FLOPS

187,766

and the variances we faced

tic budget variances

You might also like

- Harsh Electricals: Analyzing Cost in Search of ProfitDocument11 pagesHarsh Electricals: Analyzing Cost in Search of ProfitSanJana NahataNo ratings yet

- Harsh - Electricals - PPTX 2 11Document10 pagesHarsh - Electricals - PPTX 2 11Niya ThomasNo ratings yet

- Massey Ferguson MF7600 Technician Workshop ManualDocument798 pagesMassey Ferguson MF7600 Technician Workshop Manualgavcin100% (5)

- About TableauDocument22 pagesAbout TableauTarun Sharma67% (3)

- Grange Fencing Garden Products Brochure PDFDocument44 pagesGrange Fencing Garden Products Brochure PDFDan Joleys100% (1)

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Farr Ceramics Production Division: A Budgetary Analysis: Name: Id: Course: Section: Submission To: Submission DateDocument9 pagesFarr Ceramics Production Division: A Budgetary Analysis: Name: Id: Course: Section: Submission To: Submission DateAffan AhmedNo ratings yet

- Prestige Telephone CompanyDocument8 pagesPrestige Telephone CompanyRiandy Ar RasyidNo ratings yet

- Preliminary Voters ListDocument86 pagesPreliminary Voters Listمحمد منيب عبادNo ratings yet

- Review of Related Literature and Related StudiesDocument23 pagesReview of Related Literature and Related StudiesReynhard Dale100% (3)

- Practice Quiz Reflection Project Initiation and Key ComponentsDocument3 pagesPractice Quiz Reflection Project Initiation and Key ComponentsFalastin Tanani67% (3)

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Colin - BookDocument15 pagesColin - BookrizwanNo ratings yet

- CA Work Sheet Unit 2Document23 pagesCA Work Sheet Unit 2Shalini SavioNo ratings yet

- UntitledDocument3 pagesUntitledVatsal ChangoiwalaNo ratings yet

- BTEC Higher National Diploma (HND) in Business: Guildhall CollegeDocument15 pagesBTEC Higher National Diploma (HND) in Business: Guildhall CollegeNayeem SiddiqueNo ratings yet

- Budgeting Example-Worked OutDocument27 pagesBudgeting Example-Worked Outgabriel mwendwaNo ratings yet

- Round 5 ReprtsDocument29 pagesRound 5 ReprtsrahulNo ratings yet

- 30 Dec COST SHEET - PGDMDocument15 pages30 Dec COST SHEET - PGDMPoonamNo ratings yet

- Montex Pens - ABCDocument2 pagesMontex Pens - ABCRocket BhatNo ratings yet

- Activity Based CostingDocument17 pagesActivity Based CostingArpit GargNo ratings yet

- 2m00154 S.y.b.com - Bms Sem Ivchoice Based 78512 Group A Finance Strategic Cost Management Q.p.code53273Document5 pages2m00154 S.y.b.com - Bms Sem Ivchoice Based 78512 Group A Finance Strategic Cost Management Q.p.code53273Navira MirajkarNo ratings yet

- Solution To Compiled QuestionsDocument7 pagesSolution To Compiled Questionslovia mensahNo ratings yet

- Komoa Farm Carrots: Fixed and Variable CostsDocument11 pagesKomoa Farm Carrots: Fixed and Variable CostsMadi KomoaNo ratings yet

- Cma Budget ExcelDocument6 pagesCma Budget ExcelDristi SinghNo ratings yet

- Particulars Units Unit Cost (RS) Total Cost (RS)Document3 pagesParticulars Units Unit Cost (RS) Total Cost (RS)ginish12No ratings yet

- A 02 A CAP01 Fin StmtsDocument5 pagesA 02 A CAP01 Fin StmtspraveenjuturNo ratings yet

- Hydrochem AnalysisDocument7 pagesHydrochem AnalysisSaransh Kejriwal100% (2)

- Hydrochem PDFDocument7 pagesHydrochem PDFSaransh KejriwalNo ratings yet

- Hassan Exame 21 AugustrDocument4 pagesHassan Exame 21 Augustrsardar hussainNo ratings yet

- Millichem Solution XDocument6 pagesMillichem Solution XMuhammad JunaidNo ratings yet

- AC - CostAcctg Process Costing - Production LossesDocument10 pagesAC - CostAcctg Process Costing - Production LossesEloisa Joy MoredoNo ratings yet

- CMA SessionDocument10 pagesCMA Sessionrishabh tyagiNo ratings yet

- Questions Fifo AverageDocument4 pagesQuestions Fifo AverageClaire BarbaNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 21Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 21Roshan RamkhalawonNo ratings yet

- Basic Financial Plan: Rent-O-Robe: Startup Costs INR Fixed Costs (For A Month) INR Salary Per EmployeeDocument2 pagesBasic Financial Plan: Rent-O-Robe: Startup Costs INR Fixed Costs (For A Month) INR Salary Per EmployeeshubhNo ratings yet

- Case SolutionsDocument11 pagesCase SolutionsMohit AgrawalNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 20Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 20Roshan RamkhalawonNo ratings yet

- This Examples Are Adapted FROM Cost and Management Accounting (1996) Prentice Hall ISBN 0-13-205923-1Document10 pagesThis Examples Are Adapted FROM Cost and Management Accounting (1996) Prentice Hall ISBN 0-13-205923-1pandy1604No ratings yet

- Laporan Laba RugiDocument1 pageLaporan Laba Ruginiluh yamadaNo ratings yet

- Additional Chapter AssignmentDocument4 pagesAdditional Chapter AssignmentM GualNo ratings yet

- Group 5Document16 pagesGroup 5Amelia AndrianiNo ratings yet

- Brgy. Clearance 150.00 Business Permit 1,500.00 Police Clearance 160.00 BIR 500.00 DTI 1,000.00 5yrs ValidityDocument42 pagesBrgy. Clearance 150.00 Business Permit 1,500.00 Police Clearance 160.00 BIR 500.00 DTI 1,000.00 5yrs ValidityJOEMAR LEGRESONo ratings yet

- 106 - Prajwal Khandare - ABM Case 2 (Pepe Denim)Document6 pages106 - Prajwal Khandare - ABM Case 2 (Pepe Denim)Prajwal KhandareNo ratings yet

- Solve Question Q2Document1 pageSolve Question Q2saeedakNo ratings yet

- Acc 4Document3 pagesAcc 4Izzah NawawiNo ratings yet

- MAF Assignment QuestionDocument13 pagesMAF Assignment QuestionKietHuynhNo ratings yet

- Business PlanDocument5 pagesBusiness PlanPradeep KumarNo ratings yet

- Matrix CosmeticDocument2 pagesMatrix Cosmeticyimin liuNo ratings yet

- Cma ProblemsDocument25 pagesCma ProblemsPridhvi Raj ReddyNo ratings yet

- Classic Pen Company: Syndicate 101Document4 pagesClassic Pen Company: Syndicate 101Silvia WongNo ratings yet

- Activity Based-WPS (Number 1 C)Document9 pagesActivity Based-WPS (Number 1 C)Takudzwa BenjaminNo ratings yet

- Chapter 4-Test Material 4 1Document6 pagesChapter 4-Test Material 4 1Marcus MonocayNo ratings yet

- Masterpad Solution PresentationDocument19 pagesMasterpad Solution PresentationnoursfoodforthoughtNo ratings yet

- PK VCDocument16 pagesPK VClidiawuNo ratings yet

- Cases On Activity Based Costing SystemDocument6 pagesCases On Activity Based Costing SystemEnusah PeterNo ratings yet

- Classify The Cost Under All Available Heads and Find Out ProfitDocument37 pagesClassify The Cost Under All Available Heads and Find Out ProfitKaustuv RathNo ratings yet

- Past Year 2019 Sem 2 Ans (ZW)Document4 pagesPast Year 2019 Sem 2 Ans (ZW)zhaoweiNo ratings yet

- Chapter 5 Factory Overhead Accounting ExercisesDocument10 pagesChapter 5 Factory Overhead Accounting ExercisesxicoyiNo ratings yet

- Assignment: Table of ContentDocument9 pagesAssignment: Table of ContentAhsanur HossainNo ratings yet

- Ponderosa-IncDocument6 pagesPonderosa-IncpompomNo ratings yet

- Daniel Dobbins PDFDocument1 pageDaniel Dobbins PDFAbhishek MishraNo ratings yet

- Profit (Sales-Cost of Sales) 110,000.00Document4 pagesProfit (Sales-Cost of Sales) 110,000.00Rajshri SaranNo ratings yet

- Assignment On Cost SheetDocument3 pagesAssignment On Cost SheetRashmi KumariNo ratings yet

- V & A Question Bank SolutionsDocument14 pagesV & A Question Bank SolutionsTamaraNo ratings yet

- Salil - Case StudyDocument6 pagesSalil - Case StudySalil DasNo ratings yet

- Sharp Product-Catalogue 2019 enDocument48 pagesSharp Product-Catalogue 2019 enMiki di KaprioNo ratings yet

- Episode Transcript: Episode 34 - Chinese Han Lacquer CupDocument2 pagesEpisode Transcript: Episode 34 - Chinese Han Lacquer CupParvathy SubramanianNo ratings yet

- SalerioDocument28 pagesSalerioRizqaFebrilianyNo ratings yet

- Pe8 Mod5Document16 pagesPe8 Mod5Cryzel MuniNo ratings yet

- Complex Poly (Lactic Acid) - Based - 1Document20 pagesComplex Poly (Lactic Acid) - Based - 1Irina PaslaruNo ratings yet

- MT4 EA Installation Guide Digital - EnglishDocument7 pagesMT4 EA Installation Guide Digital - EnglishThe Trading PitNo ratings yet

- Nokia 3g Full Ip CommissioningDocument30 pagesNokia 3g Full Ip CommissioningMehul JoshiNo ratings yet

- DD 3600 3500 3000 Parts CatalogDocument46 pagesDD 3600 3500 3000 Parts CatalogAndres Fdo Mora D100% (2)

- MSS SP 69pdfDocument18 pagesMSS SP 69pdfLaura CaballeroNo ratings yet

- Chapter 3 Mine Ventialtion ProblemDocument3 pagesChapter 3 Mine Ventialtion ProblemfahimNo ratings yet

- Engineering Mathematics Questions and AnswersDocument9 pagesEngineering Mathematics Questions and AnswersZaky Muzaffar100% (1)

- Perfect Picture SummaryDocument3 pagesPerfect Picture SummaryReiaNo ratings yet

- EHR StandardsIndia - August 2013-32630521Document54 pagesEHR StandardsIndia - August 2013-32630521kartiksinhNo ratings yet

- ENGLISH 4 (General & Specific Sentence, Main Idea & Key Sentence) )Document3 pagesENGLISH 4 (General & Specific Sentence, Main Idea & Key Sentence) )Analiza Dequinto BalagosaNo ratings yet

- I - Pronunciation Choose The Word Whose Stress Pattern Is Different From The Other Three in The Following QuestionsDocument6 pagesI - Pronunciation Choose The Word Whose Stress Pattern Is Different From The Other Three in The Following QuestionsHaNo ratings yet

- Program Logic FormulationDocument69 pagesProgram Logic FormulationIan OffemariaNo ratings yet

- Shaft DeflectionDocument15 pagesShaft Deflectionfreek_jamesNo ratings yet

- APS PresentationDocument32 pagesAPS PresentationRozack Ya ZhackNo ratings yet

- SM-G900F Esquematico Completo Anibal Garcia IrepairDocument2 pagesSM-G900F Esquematico Completo Anibal Garcia Irepairfix marketNo ratings yet

- No ApprovedDocument154 pagesNo ApprovedAnnaNo ratings yet

- Teccrs 3800Document431 pagesTeccrs 3800Genus SumNo ratings yet

- PROP CASES OUTLINE 7 - Right of Way - Light & ViewDocument108 pagesPROP CASES OUTLINE 7 - Right of Way - Light & ViewKringle Lim - DansalNo ratings yet

- Rise of Al JazeeraDocument1 pageRise of Al Jazeeraইlish ProductionsNo ratings yet

- RCD ManagementDocument6 pagesRCD ManagementPindoterONo ratings yet