Professional Documents

Culture Documents

Harsh Electricals: Analyzing Cost in Search of Profit

Uploaded by

SanJana Nahata0 ratings0% found this document useful (0 votes)

155 views11 pagesOriginal Title

Analysis1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

155 views11 pagesHarsh Electricals: Analyzing Cost in Search of Profit

Uploaded by

SanJana NahataCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 11

Harsh Electricals: Analyzing

Cost in Search of Profit

GROUP 9: SECTION A

Aditya Kumar: 20P004

Himanshi Vardhani: 20P022

Sachin Heda: 20P047

Shivam Singla: 20P055

Kerfegar Dalal: 20P030

Devinder Kumar: 19FPM131

Situational Analysis

● Mr. Madhusudan Gupta, founder of Harsh electricals had been a specialist supplier of home appliances in

Andhra Pradesh

● Initially, he invested Rs. 8,00,000 in the form of equity to begin his business to business trading in 2008

● The business was a huge success and sales reached Rs. 4 million and post tax reached Rs. 6,50,000 for

financial year 2008-2009.

● In FY 2009-10. he expanded his business in neighboring states of Maharashtra and karnataka

● The business performed well till FY 2010-11 and dropped in next 2 consecutive years FY 2011-2012 and FY

2012-13

● The decline in financial performance can be attributed to two major reason:

(a) Decline in profit margin due to the increased marketing and servicing cost

(b) Surge in post repairs and replacement costs due to inferior quality of products

Situational Analysis

● The number of manufacturers who were providing quality products could fulfill demand of only 30-40% of

demand

● For sustainable growth of his business, he considered shifting the focus of his business to manufacturing

quality appliances

● The competitive strategy of Harsh Electricals was to manufacture fibre air coolers with high cooling capacity

at a competitive price.

● Mr. Gupta onboarded Mr. N Nagesh, an industrial engineer and a skilled mechanical expert

● Both concluded to manufacture two different models of fibre air coolers- Standard Model and Baleno

model.

COST ANALYSIS

Manufacturing Costs: Fixed

Costs

Raw Material Cost:

● Stable for the production of each cooler unit and changes proportionately with the total

volume of production

● Procured 40% raw materials from suppliers at a credit of 15 days and rest was procured on

cash

● Firm had a moderate working capital policy

● Fixed order inventory management system where supplies were reordered only when the stock

reached a previously set minimum limit

Manufacturing Costs: Fixed Costs

Continued

Labor Cost:

● Required 5 casual workers on a daily basis to run the assembly line for the production of 40

units

● Casual workers required for 8 hours each day at a minimum wage of ₹200 per day

● Standard & Baleno model were expected to consume 60 & 72 minutes of assembly line labor

respectively

● Staff member with a monthly salary of Rs 6,000 was also hired to set up the machines before

each production run and to handle the materials

Additonal Expenses

● Delivery of raw material from suppliers would come at an additional cost of 0.5%

● The cost for drilling remained constant at Rs 10 per cooler irrespective of the model of the

cooler to be drilled

● Fixed costs like rent were to be paid on a monthly basis while the drilling and assembly line

labor were to be paid every two weeks

● Electricity costs were Rs 10 per unit with a minimum bill to be charged for 1000 units per

month

● Fixed cost for workshop insurance at Rs 25000 per year

● Cost incurred on wires, screws, nuts and bolts, and oiling was estimated to be ₹45,000 per year

with an expected increase of ₹5,000 with every 1,000 subsequent units produced

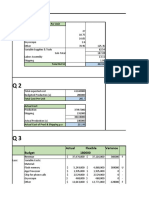

Financials

Revenue

Price 2300

Profit Margin 15%

Cost Price 2000

Quantity Sold 4000 4500 5000

Revenue 9200000 10350000 11500000

Cost 8000000 9000000 10000000

Profit 1200000 1350000 1500000

NP Margin 13.04% 13.04% 13.04%

Segment Standard Model Baleno Model Total

Number of Units (during season) 3200 800 4000

Selling Price (in Rs) 2500 3000

Total Revenu during Season 8000000 2400000 10400000

Number of Units (during off season) 60 10

Total Revenue During off season 150000 30000 180000

Total Revenue segment wise 8150000 2430000 10580000

Total Revenue (in Rs) 10580000

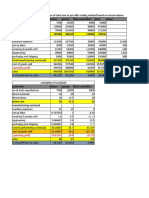

Per unit Cost

Labour Cost Standard Baleno

Baleno

Direct Materials Consumed 1778 2185

Casual Worker Expense Standard Model Model

Assembly Line Time (in Min) 60 72 Procurement Charges 8.9 10.9

Assembly Line Time (in Hrs) 1 1.2 Labor Cost 25 30

Number of Air-Coolers produced during season 3200 800 Drilling Bit 10 10

Number of Air-Coolers produced for off season 60 10 Electricity 10 10

Total Quantity Produced 3260 810

Prime Cost 1831.9 2245.9

Total Assembly Line Time (in Hrs) 3260 972

Payment for casual lobor ( per day 8hrs) 200 200 Raw Material

Per Hour Charge 25 25 Per Unit

Total Cost for Casual Workers (in Rs) 81500 24300 Component Standard Baleno

Body 650 830

Total Compensation for Casual Workers (in Rs) 105800 Motor 500 630

Pump 90 110

Blade, Clamp & Wiring 168 205

Total Salary Expense Amount Pipe, Water, Distributor & Panel Set 190 210

Nagesh's Salary 600000 Diverter 110 110

Staff Member Salary (6000 per month for 6 Packing 40 50

months) 36000 Wheel 30 40

Total (in Rs) 1778 2185

Casual Workers Salary 105800

Total Salary Expense 741800

Total quantity sold during season 3200 800

Total Quantity sold off season 60 10

Total Quantity 3260 810

Raw Material Cost per Unit 1778 2185

Total Raw material Cost per segment 5796280 1769850

Premium (0.5%) 28981 8849

Total Raw material cost 7566130

Procurement Cost 37831

COGS

Amount

Direct Materials 7709761

Raw Material Cost 7566130

Direct Manufacturing Labor (Casual Labor) 105800

Procurement Expense 37831

Drilling Cost 40700

Manufacturing Overhead Cost 946150

Indirect Manufacturing Labor

Nagesh's Salary 600000

Supervisor's Salary 36000

Factory Electricity 115850

Depreciation on factory machinery, furnitures 64000

Consumables 4500

Factory Insurance 25000

Factory Rent 100800

Total COGS 8655911

You might also like

- Harsh - Electricals - PPTX 2 11Document10 pagesHarsh - Electricals - PPTX 2 11Niya ThomasNo ratings yet

- Group 13 Harsh Electricals COGS Exercise and BEPDocument12 pagesGroup 13 Harsh Electricals COGS Exercise and BEPShoaib100% (3)

- Harsh ElectricalsDocument8 pagesHarsh Electricalsmayank.dce123No ratings yet

- Case Harsh Electrics MADocument4 pagesCase Harsh Electrics MAAbhishek PathakNo ratings yet

- Managerial Accounting II Case Study Analysis Harsh ElectricalsDocument7 pagesManagerial Accounting II Case Study Analysis Harsh ElectricalsSiddharth GargNo ratings yet

- Harsh Electricals Analyzing Cost in Search of Profit-Case StudyDocument8 pagesHarsh Electricals Analyzing Cost in Search of Profit-Case StudyAl- Noor0% (1)

- Various Types of Cost Classifications Basis Cost Concept ExampleDocument15 pagesVarious Types of Cost Classifications Basis Cost Concept ExampleUtkarsh SharmaNo ratings yet

- FC - 1 - Master Budgeting CS - Stylistic 2021 - With SolutionDocument18 pagesFC - 1 - Master Budgeting CS - Stylistic 2021 - With SolutionQuang NhựtNo ratings yet

- Classic Pen Company: Case Analysis - Activity Based Cost System Group - 07Document16 pagesClassic Pen Company: Case Analysis - Activity Based Cost System Group - 07Anupriya Sen100% (1)

- Alberta Gauge Company CaseDocument2 pagesAlberta Gauge Company Casenidhu291No ratings yet

- The Kalamazoo ZooDocument4 pagesThe Kalamazoo ZooDantong Shan100% (5)

- Manac Asn4 HydrochemDocument6 pagesManac Asn4 HydrochemNikhil JindalNo ratings yet

- Business CaseDocument4 pagesBusiness CaseJoseph GonzalesNo ratings yet

- Brookstone Ob-Gyn Associates Case SummaryDocument2 pagesBrookstone Ob-Gyn Associates Case SummaryRoderick Jackson JrNo ratings yet

- Format For Preparing Cash Flow Statement - Start With PBT: (4) Reclassify Interest Paid Under Financing Activities +Document2 pagesFormat For Preparing Cash Flow Statement - Start With PBT: (4) Reclassify Interest Paid Under Financing Activities +shidupk5 pkNo ratings yet

- Stafford Press CaseDocument4 pagesStafford Press CaseAmit Kumar AroraNo ratings yet

- Variable Cost Structure and Budget AnalysisTITLECost Variance Analysis for Phone ProductionTITLECalculation of Material and Labor VariancesDocument6 pagesVariable Cost Structure and Budget AnalysisTITLECost Variance Analysis for Phone ProductionTITLECalculation of Material and Labor VariancesArindam MandalNo ratings yet

- Magal Murthi Case StudyDocument3 pagesMagal Murthi Case Studyrajesh0% (3)

- Wilkerson CompanyDocument2 pagesWilkerson CompanyAnkit VermaNo ratings yet

- Activity-Based Cost Systems: The Classic Pen Company A Case AnalysisDocument14 pagesActivity-Based Cost Systems: The Classic Pen Company A Case AnalysisSarveshwar Sharma50% (2)

- Bill FrenchDocument6 pagesBill FrenchRohit AcharyaNo ratings yet

- Daud Engine Parts CompanyDocument3 pagesDaud Engine Parts CompanyJawadNo ratings yet

- Hydrochem standard vs actual costingDocument7 pagesHydrochem standard vs actual costingSaransh Kejriwal100% (2)

- Case - 2 - Kalamazoo - Zoo SolutionDocument27 pagesCase - 2 - Kalamazoo - Zoo SolutionAnandNo ratings yet

- Dakota Office ProductsDocument10 pagesDakota Office ProductsMithun KarthikeyanNo ratings yet

- HydroChem Inc.Document6 pagesHydroChem Inc.samacster50% (4)

- Bill French Accountant - Case AnalysisDocument8 pagesBill French Accountant - Case Analysischirag0% (2)

- Why was Dakota's existing pricing system inadequateDocument10 pagesWhy was Dakota's existing pricing system inadequatesourabhphanaseNo ratings yet

- Dakota Office Products Activity-Based Costing Case StudyDocument5 pagesDakota Office Products Activity-Based Costing Case StudyAriyo Roberto Carlos BanureaNo ratings yet

- Baldwin Bicycle Accepts Hi-Valu OfferDocument14 pagesBaldwin Bicycle Accepts Hi-Valu OfferCristina Fernandez SanchezNo ratings yet

- Chapter 15&16 Problems and AnswersDocument22 pagesChapter 15&16 Problems and AnswersMa-an Maroma100% (10)

- Iron Pit Foundry Income Statement and Barbell AnalysisDocument3 pagesIron Pit Foundry Income Statement and Barbell AnalysisAbhijit KoundinyaNo ratings yet

- Marion Case Study PracticeDocument6 pagesMarion Case Study Practicechomka0% (1)

- Gibson Insurance CompanyDocument3 pagesGibson Insurance CompanyMart Anthony Dela Peña100% (2)

- Classic Pen CompanyDocument4 pagesClassic Pen CompanyGaurav Kataria0% (1)

- Accounting Case 2Document3 pagesAccounting Case 2ayushishahNo ratings yet

- Case Study Star EngineeringDocument5 pagesCase Study Star EngineeringSaurabh Jha0% (2)

- Autumn 2011 - Midterm Assessment (25089)Document8 pagesAutumn 2011 - Midterm Assessment (25089)Marwa Nabil Shouman0% (1)

- Kalamazoo ZooDocument4 pagesKalamazoo ZooMISRET 2018 IEI JSC100% (1)

- CAMELBACK COMMUNICATIONS REVAMPS COSTING SYSTEMDocument23 pagesCAMELBACK COMMUNICATIONS REVAMPS COSTING SYSTEMVidya Sagar Ch100% (2)

- Cci CaseDocument3 pagesCci CaseDanielle Eller BurnettNo ratings yet

- Balance Sheet as of March 30th 2006Document6 pagesBalance Sheet as of March 30th 2006subratajuNo ratings yet

- Marion Boat - GroupDocument8 pagesMarion Boat - GroupgvermaravNo ratings yet

- Answer To VMD Medical Imaging CenterDocument2 pagesAnswer To VMD Medical Imaging CenterPragathi SundarNo ratings yet

- Cash Flow StatementDocument4 pagesCash Flow StatementRavina Singh100% (1)

- Import Distributors Case Analysis: Television Dept ContinuationDocument3 pagesImport Distributors Case Analysis: Television Dept ContinuationKram Olegna Anagerg0% (1)

- Lecture 19Document32 pagesLecture 19Riaz Baloch NotezaiNo ratings yet

- Standard Costing I SolutionDocument7 pagesStandard Costing I SolutionDheeraj DoliyaNo ratings yet

- Modern Pharma SolnDocument3 pagesModern Pharma SolnSakshiNo ratings yet

- Hospital SupplyDocument3 pagesHospital SupplyJeanne Madrona100% (1)

- Dakota AnalysisDocument13 pagesDakota Analysistonylcaston100% (2)

- MAC Davey Brothers - AkshatDocument4 pagesMAC Davey Brothers - AkshatPRIKSHIT SAINI IPM 2019-24 BatchNo ratings yet

- Running Head: HALLSTEAD JEWELERS 1Document12 pagesRunning Head: HALLSTEAD JEWELERS 1KathGu100% (1)

- Case-Bill FrenchDocument3 pagesCase-Bill FrenchthearpanNo ratings yet

- Wilkerson Company ABCDocument4 pagesWilkerson Company ABCrajyalakshmiNo ratings yet

- Overheads - IBADocument6 pagesOverheads - IBAZehra HussainNo ratings yet

- 5 Job CostingDocument22 pages5 Job CostingAbimanyu Shenil0% (1)

- Question Accounting For OverheadDocument2 pagesQuestion Accounting For OverheadsatyaNo ratings yet

- Assignment: Table of ContentDocument9 pagesAssignment: Table of ContentAhsanur HossainNo ratings yet

- Grand Test - Question PaperDocument3 pagesGrand Test - Question PaperWaseim khan Barik zaiNo ratings yet

- Supply Chain Management For Retailing by Rajesh RayDocument444 pagesSupply Chain Management For Retailing by Rajesh RaySanJana NahataNo ratings yet

- RSCM Deck 1Document7 pagesRSCM Deck 1SanJana NahataNo ratings yet

- JSW 5Document1 pageJSW 5SanJana NahataNo ratings yet

- H&M Case (4645)Document16 pagesH&M Case (4645)SanJana NahataNo ratings yet

- RSCM Deck 2Document8 pagesRSCM Deck 2SanJana NahataNo ratings yet

- TBD Decors (4408)Document4 pagesTBD Decors (4408)SanJana NahataNo ratings yet

- Online Grocery Delivery Models 2022-23Document4 pagesOnline Grocery Delivery Models 2022-23SanJana NahataNo ratings yet

- JSW 2Document1 pageJSW 2SanJana NahataNo ratings yet

- CGE AssignmentDocument3 pagesCGE AssignmentSanJana NahataNo ratings yet

- Canada GDP, trade plummet due to CovidDocument5 pagesCanada GDP, trade plummet due to CovidSanJana NahataNo ratings yet

- ProjectDocument1 pageProjectSanJana NahataNo ratings yet

- EthicsDocument2 pagesEthicsSanJana NahataNo ratings yet

- JSW 1Document1 pageJSW 1SanJana NahataNo ratings yet

- JSW 4Document2 pagesJSW 4SanJana NahataNo ratings yet

- Management Discussion and AnalysisDocument1 pageManagement Discussion and AnalysisSanJana NahataNo ratings yet

- Industry Review Global Apparel IndustryDocument1 pageIndustry Review Global Apparel IndustrySanJana NahataNo ratings yet

- JSW 3Document1 pageJSW 3SanJana NahataNo ratings yet

- Outlook 1Document2 pagesOutlook 1SanJana NahataNo ratings yet

- Upload 8Document1 pageUpload 8SanJana NahataNo ratings yet

- Digitalisation Has Been A Major Focus of Our Innovation EffortsDocument1 pageDigitalisation Has Been A Major Focus of Our Innovation EffortsSanJana NahataNo ratings yet

- Upload 9Document2 pagesUpload 9SanJana NahataNo ratings yet

- Electric Vehicle Industry in IndiaDocument2 pagesElectric Vehicle Industry in IndiaSanJana NahataNo ratings yet

- KEYWORDS: Electric Vehicle, Consumer Perception, India, Electric MobilityDocument1 pageKEYWORDS: Electric Vehicle, Consumer Perception, India, Electric MobilitySanJana NahataNo ratings yet

- THREAT OF NEW ENTRANTS-This Force Determines The Risk To The Existing PlayersDocument2 pagesTHREAT OF NEW ENTRANTS-This Force Determines The Risk To The Existing PlayersSanJana NahataNo ratings yet

- Cloud Kitchen Industry in IndiaDocument1 pageCloud Kitchen Industry in IndiaSanJana NahataNo ratings yet

- Pestel Analysis of Cloud Kicthen IndustryDocument2 pagesPestel Analysis of Cloud Kicthen IndustrySanJana NahataNo ratings yet

- Upload 10Document2 pagesUpload 10SanJana NahataNo ratings yet

- Porter's Five Forces Analysis of the Cloud Kitchen IndustryDocument2 pagesPorter's Five Forces Analysis of the Cloud Kitchen IndustrySanJana NahataNo ratings yet

- Inventory ExcelDocument1 pageInventory ExcelSanJana NahataNo ratings yet

- BARGAINING POWER OF SUPPLIERS-The Suppliers in The Cloud Kitchen IndustryDocument1 pageBARGAINING POWER OF SUPPLIERS-The Suppliers in The Cloud Kitchen IndustrySanJana NahataNo ratings yet

- Make or Buy: Economic DecisionsDocument4 pagesMake or Buy: Economic DecisionsBossx BellaNo ratings yet

- Gropu 4 Quiz Expenditure CycleDocument4 pagesGropu 4 Quiz Expenditure Cyclerheazeenylaya16No ratings yet

- FTI Tech Trends 2022 Book10Document62 pagesFTI Tech Trends 2022 Book10NicolasMontoreRosNo ratings yet

- La Consolacion College Manila: Finman IiDocument14 pagesLa Consolacion College Manila: Finman Iigerald calignerNo ratings yet

- MEDX 58 Total Productive MaintenanceDocument3 pagesMEDX 58 Total Productive Maintenancerajee101No ratings yet

- Pipe Cistern0Document4 pagesPipe Cistern0AbhishekNo ratings yet

- RCSA Risk Control Self Assessment GuideDocument9 pagesRCSA Risk Control Self Assessment GuideTejendrasinh GohilNo ratings yet

- ISCEA Flyer 2023 - (NEW)Document17 pagesISCEA Flyer 2023 - (NEW)arubinaldoNo ratings yet

- Assessment IDocument2 pagesAssessment IAli OptimisticNo ratings yet

- A Comparative Research Between Palmolive and Sunsilk The Effectiveness of The Commercial of The CompanyDocument8 pagesA Comparative Research Between Palmolive and Sunsilk The Effectiveness of The Commercial of The CompanybarriodelimanilaNo ratings yet

- PRS 402 Week 1Document8 pagesPRS 402 Week 1mathew nuruNo ratings yet

- Social Media Marketing Impact On Delivery CompaniesDocument12 pagesSocial Media Marketing Impact On Delivery CompaniesSaima AsadNo ratings yet

- National Income and Price DeterminationDocument3 pagesNational Income and Price Determinationbustiman20No ratings yet

- حق الاضراب لموظفي الدولةDocument67 pagesحق الاضراب لموظفي الدولةelmansoury hichamNo ratings yet

- Chapter 3 The Project Management Process GroupsDocument13 pagesChapter 3 The Project Management Process GroupsKristel Joy Eledia NietesNo ratings yet

- 1.3 CET 402 Quantity Surveying and ValuationDocument12 pages1.3 CET 402 Quantity Surveying and ValuationOwsu KurianNo ratings yet

- WPR Ehsan CVDocument6 pagesWPR Ehsan CVShahid BhattiNo ratings yet

- Launch Jasper ReportDocument1 pageLaunch Jasper ReportElias Abubeker AhmedNo ratings yet

- FACILITY PLANNING BCT&CA NotesDocument128 pagesFACILITY PLANNING BCT&CA Notesgowthamkaringi0% (1)

- Cold Email TemplateDocument15 pagesCold Email TemplateJordyNo ratings yet

- DIAGNOSE AND IMPROVE YOUR BUSINESSDocument23 pagesDIAGNOSE AND IMPROVE YOUR BUSINESSabelu habite neriNo ratings yet

- FIN433 Ahm BEST REPORT Alif Akhi Samia JulfiqureDocument31 pagesFIN433 Ahm BEST REPORT Alif Akhi Samia JulfiqureMd Al Alif Hossain 2121155630No ratings yet

- Lahore Waste Management Company PDFDocument3 pagesLahore Waste Management Company PDFBint e HawaNo ratings yet

- Qlik Connectors For SAP: Data SheetDocument6 pagesQlik Connectors For SAP: Data Sheetsousou27No ratings yet

- Managing IT Integration Risk in AcquisitionsDocument20 pagesManaging IT Integration Risk in AcquisitionsYurnida PangestutiNo ratings yet

- Switzer, Janet - Instant IncomeDocument338 pagesSwitzer, Janet - Instant IncomeMichael Andrews100% (2)

- Assignment No.2Document4 pagesAssignment No.2Aamer MansoorNo ratings yet

- Topher Forex LAB: Volatility 75 Index LaboratoryDocument7 pagesTopher Forex LAB: Volatility 75 Index LaboratoryAvdhoot RathodNo ratings yet

- How To Get Powerful Testimonials That SellDocument10 pagesHow To Get Powerful Testimonials That SellMobile MentorNo ratings yet

- Dak WsaDocument47 pagesDak WsasugamsehgalNo ratings yet