Professional Documents

Culture Documents

B-MGAC203 Long Quiz

Uploaded by

Ma. Yelena Italia TalabocOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

B-MGAC203 Long Quiz

Uploaded by

Ma. Yelena Italia TalabocCopyright:

Available Formats

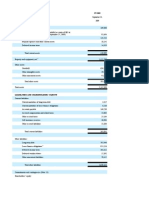

Walmart Inc.

Consolidated Balance Sheet

As of January 31 ($Millions)

2019 2018

ASSETS

Current Assets:

Cash and Equivalents 7,722 6,756

Accounts Receivable 6,283 5,614

Inventory 44,269 43,783

Prepaid Expenses 3,623 3,511

Total Current Assets 61,897 59,664

Net Property, Plant, and Equipment 111,395 114,818

Goodwill 31,181 18,242

Other Long-Term Assets 14,822 11,798

Total Assets 219,295 204,522

LIABILITIES

Current Liabilities:

Accounts Payable 47,060 46,092

Accrued Liabilities 22,159 22,122

Short-Term Borrowings 5,225 5,257

Current Portion of Long-Term Debt & Capital Lea 2,605 4,405

Other Current Liabilities 428 645

Total Current Liabilities 77,477 78,521

Long-Term Debt and Capital Leases 50,203 36,825

Deferred Income Taxes and Other 11,981 8,354

Total Liabilities 139,661 123,700

EQUITY

Common Stock and Paid-In Capital 3,253 2,943

Retained Earnings 80,785 85,107

Other Comprehensive Income (Loss) (11,542) (10,181)

Total Common Equity 72,496 77,869

Non-Controlling Interest 7,138 2,953

Total Equity 79,634 80,822

Total Liabilities and Equity 219,295 204,522

Total Debt (interest-bearing): Weights

Long-Term Debt & Capital Leases 50,203.0000

Current Portion of Long-Term Debt & Capital Lea 2,605.0000

Short-term Borrowings 5,225.0000

58,033.0000 40.8%

Total Equity:

Common Stock and Paid-In Capital 3,253.0000

Retained Earnings 80,785.0000

84,038.0000 59.2%

Total Liabilities & Equity 142,071.0000 100.0%

Walmart 2030 bond (as of February 19 2019)

Annual Semi-Annual(Input Values)

Time to maturity - years 11 22

Coupon rate 7.55% $3.775

Current price 136.38 -136.38

Face value $100 $100

>> Yield 1.77%

Compute After-Tax Cost of Debt: Kd YTM

Kd = Before-tax Kd x ( 1 - tax rate) = 3.53%

Compute Cost of Equiy: Ke RF

Ke = Rf + β x MRP = 2.61% +

1 Computation of WACC using Market Values

MV

MV of Debt 72,019.5504

Equity 300,979.0000

Total Capital 372,998.5504

2 Computation of WACC using Book Values

BV weight

Debt 58,033.00 0.408

Equity 84,038.00 0.592

Total Capital 142,071.00

Compute for WACC using Market Value Weights;

1 and 5.4955%

Compute for WACC using book value weights

based on information derived from the

2 consolidated BS (Exhibit 2) 4.7542%

Information from case

Beta

RF

Shares outstanding

Tax rate

RM

Coupon rate

Current price

Face value

MRP

Stock price

nnual(Input Values)

semi-annual periods (nper) MV of Debt

semi-annual dollar coupons (pmt) BV of S-T Obligations

present value (pv) MV of LT Debt

future value (fv)

MV of Equity

3.53% =rate (nper,pmt,pv,fv) * 2 Price of Stock * Pr /Share

(1-Tc) After-Tax Cost of Debt

77% = 2.72%

Beta (Rm-Rf)

0.71 x 5.00% =

weight cost

0.193 x 2.72% =

0.8069 x 6.16% =

WACC

cost wtd avg

x 2.72% = 1.1104%

x 6.16% = 3.6438%

WACC 4.7542%

mation from case

0.71

2.61%

2945

23%

7%

7.55%

$136.38

$100.00

5%

102.2

MV of Debt

5,225.0000 As reported in Balance Sheet

72,019.5504 Bonds * MV of Debt

MV of Equity

300,979.0000

Cost of Equity

6.16%

wtd avg

0.5249%

4.9706%

5.4955%

You might also like

- RatioDocument4 pagesRatioMd Junayed IslamNo ratings yet

- FIN-5823 - Financial Analysis ExampleDocument15 pagesFIN-5823 - Financial Analysis ExampleGPA FOURNo ratings yet

- Suzuki Motors (AutoRecovered)Document8 pagesSuzuki Motors (AutoRecovered)AIOU Fast AcademyNo ratings yet

- Front Valuation Page: Un-Levered Firm ValueDocument61 pagesFront Valuation Page: Un-Levered Firm Valueneelakanta srikar100% (1)

- Case Submission On: Mellon Financial and The Bank of New YorkDocument3 pagesCase Submission On: Mellon Financial and The Bank of New Yorkneelakanta srikarNo ratings yet

- HorizontalDocument4 pagesHorizontal30 Odicta, Justine AnneNo ratings yet

- SAPM Assignment: Company: Ashok Leyland Student Name and PRNDocument15 pagesSAPM Assignment: Company: Ashok Leyland Student Name and PRNAkshat JainNo ratings yet

- Small Bank Pro Forma Model: Balance Sheets Thousand $Document5 pagesSmall Bank Pro Forma Model: Balance Sheets Thousand $jam7ak3275No ratings yet

- Particulars (All Values in Lakhs Unless Specified Otherwise) 2019 2018Document6 pagesParticulars (All Values in Lakhs Unless Specified Otherwise) 2019 2018MOHIT MARHATTANo ratings yet

- 1 800 Flowers Com. Financial Statements EJ 1Document28 pages1 800 Flowers Com. Financial Statements EJ 1PuMuK03No ratings yet

- SENEA Financial AnalysisDocument22 pagesSENEA Financial Analysissidrajaffri72No ratings yet

- Managements Discussion Analysis 2022Document111 pagesManagements Discussion Analysis 2022arvind sharmaNo ratings yet

- Income Statement - PEPSICODocument11 pagesIncome Statement - PEPSICOAdriana MartinezNo ratings yet

- Term Valued CFDocument14 pagesTerm Valued CFEl MemmetNo ratings yet

- DCF Guide ExampleDocument4 pagesDCF Guide ExampleAlexander RiosNo ratings yet

- Excel Workings ITE ValuationDocument19 pagesExcel Workings ITE Valuationalka murarka100% (1)

- Steel Authority of India Limited.: Particulars Amt. (In Crore)Document8 pagesSteel Authority of India Limited.: Particulars Amt. (In Crore)1075SYBPATEL DHRUVNo ratings yet

- Competitors Bajaj MotorsDocument11 pagesCompetitors Bajaj MotorsdeepaksikriNo ratings yet

- Asf ExcleDocument6 pagesAsf ExcleAnam AbrarNo ratings yet

- Receivable Breakdown Type of Inventory Amount of Receivable Days Overdue RemarkDocument6 pagesReceivable Breakdown Type of Inventory Amount of Receivable Days Overdue RemarkYonatanNo ratings yet

- AIS Final ReqDocument10 pagesAIS Final ReqSucreNo ratings yet

- Financial TTDocument4 pagesFinancial TTJamilexNo ratings yet

- Colgate Estados Financieros 2021Document3 pagesColgate Estados Financieros 2021Lluvia RamosNo ratings yet

- Samsung RatiosDocument11 pagesSamsung RatiosjunaidNo ratings yet

- MBA5002 Sample Case Study 2Document13 pagesMBA5002 Sample Case Study 2Mohamed NaieemNo ratings yet

- Particular Formulae RatiosDocument13 pagesParticular Formulae RatiosRahul SinghNo ratings yet

- Long-Term Debt Handout (UPDATED 8-27-22)Document9 pagesLong-Term Debt Handout (UPDATED 8-27-22)Charudatta MundeNo ratings yet

- J&J FS AnalysisDocument5 pagesJ&J FS AnalysisEarl Justine FerrerNo ratings yet

- Cash Flow Statement Examples2Document8 pagesCash Flow Statement Examples2ReactorAkkharNo ratings yet

- 16453Document2 pages16453fazal nadeemNo ratings yet

- Basel Disclosure Ashad2080Document4 pagesBasel Disclosure Ashad2080Na Bee NaNo ratings yet

- AscascaDocument9 pagesAscascaDhruba DasNo ratings yet

- Consolidated Balance Sheet Metapower International, IncDocument12 pagesConsolidated Balance Sheet Metapower International, IncJha YaNo ratings yet

- Ain 20201025074Document8 pagesAin 20201025074HAMMADHRNo ratings yet

- Foreign Institutional Investors (FII) : Shareholders (As of 31 December 2015) Promoter Group (HDFC)Document10 pagesForeign Institutional Investors (FII) : Shareholders (As of 31 December 2015) Promoter Group (HDFC)Vinod KananiNo ratings yet

- Financial Reporting Case: What Is It Worth?: Property of STIDocument2 pagesFinancial Reporting Case: What Is It Worth?: Property of STIJoannie Cercado RabiaNo ratings yet

- Financial Statement BICDocument4 pagesFinancial Statement BICQuynh NguyenNo ratings yet

- PTRY AnalysisDocument5 pagesPTRY AnalysisthesaneinvestorNo ratings yet

- 01 ELMS Activity 1Document2 pages01 ELMS Activity 1Emperor SavageNo ratings yet

- Societe Generale Ghana PLC Unaudited Financial Statements For The Quarter Ended 30 September 2021Document2 pagesSociete Generale Ghana PLC Unaudited Financial Statements For The Quarter Ended 30 September 2021Fuaad DodooNo ratings yet

- E I D-Parry (India) LTD.: Balance Sheet Summary: Mar 2011 - Mar 2020: Non-Annualised: Rs. CroreDocument15 pagesE I D-Parry (India) LTD.: Balance Sheet Summary: Mar 2011 - Mar 2020: Non-Annualised: Rs. Crorehardik aroraNo ratings yet

- Balance Sheet: Liquidity Analysis RatiosDocument7 pagesBalance Sheet: Liquidity Analysis RatiosJan OleteNo ratings yet

- Chapter 3. Finance Department 3.1 Essar Steel LTD.: 3.1.1 P&L AccountDocument8 pagesChapter 3. Finance Department 3.1 Essar Steel LTD.: 3.1.1 P&L AccountT.Y.B68PATEL DHRUVNo ratings yet

- Accounting Assignment QuestionDocument14 pagesAccounting Assignment QuestionsureshdassNo ratings yet

- ValuationDocument31 pagesValuationAman TaterNo ratings yet

- Cash Flow Statement Examples3Document3 pagesCash Flow Statement Examples3ReactorAkkharNo ratings yet

- Q3 Financial Statement q3 For Period 30 September 2021Document2 pagesQ3 Financial Statement q3 For Period 30 September 2021Fuaad DodooNo ratings yet

- Farag HWCH 3Document8 pagesFarag HWCH 3drenghalaNo ratings yet

- Assessment 4 Written Assignment Final Zhaoming ZhengDocument4 pagesAssessment 4 Written Assignment Final Zhaoming ZhengNawshin DastagirNo ratings yet

- Elnusa 2019Document3 pagesElnusa 2019Pieri MosesNo ratings yet

- Globe Vertical AnalysisDocument22 pagesGlobe Vertical AnalysisArriana RefugioNo ratings yet

- Bibliography: BooksDocument17 pagesBibliography: BooksshravanigangampalliNo ratings yet

- Bajaj Finance Limited Fra ProjectDocument12 pagesBajaj Finance Limited Fra ProjectSUBASH S 2019No ratings yet

- Byte Back, Inc. FS June 30, 2009Document17 pagesByte Back, Inc. FS June 30, 2009byteback2No ratings yet

- Chapter 3 108-117Document10 pagesChapter 3 108-117Leony SantikaNo ratings yet

- Trident, Inc. Consolidated Balance Sheets: Execonline - Mastering Finance FundamentalsDocument3 pagesTrident, Inc. Consolidated Balance Sheets: Execonline - Mastering Finance Fundamentalschemicalchouhan9303No ratings yet

- Final AnalyticsDocument10 pagesFinal AnalyticsAries BautistaNo ratings yet

- PayTM FinancialsDocument43 pagesPayTM FinancialststNo ratings yet

- Assets: PAYNET, Inc. Consolidated Balance SheetsDocument3 pagesAssets: PAYNET, Inc. Consolidated Balance Sheetschemicalchouhan9303No ratings yet

- Test Bank AISDocument12 pagesTest Bank AISJOCELYN BERDULNo ratings yet

- Final Assignment Strategy Formulation: Sheraz Hassan Mba 1.5 2nd Roll No F-016 - 019 Subject Strategic ManagementDocument9 pagesFinal Assignment Strategy Formulation: Sheraz Hassan Mba 1.5 2nd Roll No F-016 - 019 Subject Strategic ManagementFaisal AwanNo ratings yet

- A Study On Consumer Buying Behaviour in Retail Readymade Garment ShopsDocument2 pagesA Study On Consumer Buying Behaviour in Retail Readymade Garment ShopsATSx room clashNo ratings yet

- Mckinsey-Full Article 25 PDFDocument7 pagesMckinsey-Full Article 25 PDFjcmunevar1484No ratings yet

- Internal Controls Checklist: Yes No Not Sure Not ApplicableDocument5 pagesInternal Controls Checklist: Yes No Not Sure Not Applicableijlal_1100% (1)

- News Just In:: Et 500 CompaniesDocument2 pagesNews Just In:: Et 500 CompaniesAshutosh ApteNo ratings yet

- Event Management For Tourism Cultural Business andDocument13 pagesEvent Management For Tourism Cultural Business andSarthak DasNo ratings yet

- SantiagoDocument3 pagesSantiagoMia Valerie JumanguinNo ratings yet

- Brewin Dolphin - Our-Services-And-Charges-Sept18Document16 pagesBrewin Dolphin - Our-Services-And-Charges-Sept18srowbothamNo ratings yet

- ECO162 - Grab Holdings IncDocument19 pagesECO162 - Grab Holdings Incdewi balqisNo ratings yet

- Financial Reports: Agha Steel Industries LTDDocument33 pagesFinancial Reports: Agha Steel Industries LTDeman shafiqueNo ratings yet

- Zagreb Logistics Park BrochureDocument10 pagesZagreb Logistics Park BrochureZeljko Stevic RusNo ratings yet

- New Importer Security Filing ISF 10Document6 pagesNew Importer Security Filing ISF 10Jonathan Freitas100% (1)

- Coursera Courses For 2nd Year StudentsDocument2 pagesCoursera Courses For 2nd Year StudentsNaziya TamboliNo ratings yet

- A Study On Buying Behavior of Teenagers in Kannur DistrictDocument5 pagesA Study On Buying Behavior of Teenagers in Kannur DistrictEditor IJRITCCNo ratings yet

- Aud TheoDocument10 pagesAud TheoNicole Anne Santiago SibuloNo ratings yet

- Kinney9eChapter 17 InstructorDocument35 pagesKinney9eChapter 17 InstructorPatricia Allison GaniganNo ratings yet

- ICT Tender Final - Website - Before PrebidDocument219 pagesICT Tender Final - Website - Before PrebidTouheed KhalidNo ratings yet

- Industry Structure AnalysisDocument71 pagesIndustry Structure AnalysisSanat Kumar100% (2)

- Far Reviewer - Conceptual FrameworkDocument3 pagesFar Reviewer - Conceptual Frameworkprish yeolhanNo ratings yet

- #2. C2-Product DesignDocument14 pages#2. C2-Product DesignHashane PereraNo ratings yet

- CBSE Woksheets For Class 12 Entrepreneurship Chapter 5 Business Arithmetic PDFDocument2 pagesCBSE Woksheets For Class 12 Entrepreneurship Chapter 5 Business Arithmetic PDFAbheejit VijayNo ratings yet

- RachitKaw CVDocument3 pagesRachitKaw CVrachit_kawNo ratings yet

- Corpuz, Aily F-Fm2-2-Midterm Practice ProblemDocument5 pagesCorpuz, Aily F-Fm2-2-Midterm Practice ProblemAily CorpuzNo ratings yet

- Top 900 Pharma Cos Admin Heads - SampleDocument7 pagesTop 900 Pharma Cos Admin Heads - SampleRahil Saeed 07889582701No ratings yet

- Welcome Aboard 3 Year Bsa!!Document61 pagesWelcome Aboard 3 Year Bsa!!Riza Mae AlceNo ratings yet

- HR Business Partner Benchmarking ReportDocument25 pagesHR Business Partner Benchmarking ReportTara Selvam100% (1)

- What Is NCFM Exam? What Is Nism Exam? NCFM, Nism Mock Test at WWW - Modelexam.in.Document15 pagesWhat Is NCFM Exam? What Is Nism Exam? NCFM, Nism Mock Test at WWW - Modelexam.in.SRINIVASAN100% (4)

- 3 Payroll ReportDocument4 pages3 Payroll ReportBen NgNo ratings yet

- ConceptualizingDocument8 pagesConceptualizingHyacinth'Faith Espesor IIINo ratings yet