Professional Documents

Culture Documents

Research Paper

Uploaded by

mahyargh377Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Research Paper

Uploaded by

mahyargh377Copyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/370954110

Research Paper

Conference Paper · May 2023

CITATIONS READS

0 124

2 authors, including:

Deepti Kuhar

Geeta University Panipat

11 PUBLICATIONS 298 CITATIONS

SEE PROFILE

All content following this page was uploaded by Deepti Kuhar on 23 May 2023.

The user has requested enhancement of the downloaded file.

JOURNAL OF MANAGEMENT & ENTREPRENEURSHIP

ISSN : 2229-5348

UGC Care Group 1 Journal

AN EXPLORATORY STUDY OF CUSTOMER'S AWARENESS &

USAGE BEHAVIOUR TOWARDS SELF-SERVICE BANKING TECHNOLOGIES

Dr. Deepti, Assistant Professor, Chanderprabhu Jain College of Higher Studies and School of

Law, GGSIPU, New Delhi

Dr. Parul Agarwal, Associate Professor, Chanderprabhu Jain College of Higher Studies and

School of Law, GGSIPU, New Delhi

Ms. Jyoti, Assistant Professor, Chanderprabhu Jain College of Higher Studies and School of

Law, GGSIPU, New Delhi

Ms.Saumya Goel, Assistant Professor, Chanderprabhu Jain College of Higher Studies and

School of Law, GGSIPU, New Delhi

Abstract: Self-Service Technologies (SSTs) are the services operated by the customers without any

direct involvement or interaction with the service organization’s employees. Advances in technology,

cost savings, competitive advantage, convenience, accessibility, ease of use have allowed the

introduction of a wide range of self-service technologies i.e. ATMs, Internet banking, Mobile banking,

Telephone Banking etc. by the banking industry. The present study aims to study the demographic

profile of customers using SSTs, customer’s experience and perception towards banks, customer’s

level of awareness towards technology enabled banking self-services, customer’s usage of banking

services, utility of self-service banking technologies, preference of customers towards selected public

and private sector banks based on banking services features. The study based on primary data

observed that customers are frequently using SSTs like Online banking, Mobile Banking, ATMS to

meet their banking requirements like utility bill payments, cheque book services, checking account

statements for Debit/Credit card statements, domestic and international fund transfer, investment

services, checking loyalty related offers. Further, majority of customers stated that they can complete

banking transactions using technology, they can learn & work more quickly with new technologies.

Almost half of them stated they would recommend use of technology to their friends and relatives.

Key-words: SSTs, e-commerce, private banks, public banks, technology enable banking self-services,

self-service banking technology.

Introduction:

Self-Service Technologies (SSTs) are the technical interfaces that enable clients to create services

without a direct service employee's involvement. Using SSTs, a consumer can conduct electronic

banking transactions without visiting a physical facility (Wang, So& Sparks, 2017). Many face-to-face

service interactions are being replaced by SSTs in an effort to make service transactions more accurate,

convenient, and quick. SSTs are characterized by the automated direct distribution of new and old

banking goods and services to clients via electronic and interactive communication channels

(Parasuraman et al., 1985). The words personal computer banking, Internet banking, virtual banking,

online banking, home banking, remote electronic banking, and phone banking relate to one or several

SSTs. Electronic banking is not a novel concept for banks or their consumers. Through software

programmes, banks have provided their services to clients online for years (Xu, Thong & Venkatesh,

2014; Yeo, Goh & Rezaei, 2017).

The rapid growth of the banking sector in India will be significantly influenced by technological

advancements (Cronin, Brady, & Hult, 2000; Cronin & Taylor, 1992; Parasuraman et al.. 1985). This

technology has led to a rise in the number of individuals who utilise financial services. It includes the

systems that enable customers of financial institutions, be they individuals or businesses, to access

various services, such as account information, repayment services, cheque and card services, domestic

and international funds transfer, utility bill payments, investment services, support services (complaint

submission, ATM location, etc. ), insurance services, and content services (weather updates, news and

Vol. 16, No.4 (II), October - December 2022 177

JOURNAL OF MANAGEMENT & ENTREPRENEURSHIP

ISSN : 2229-5348

UGC Care Group 1 Journal

loyalty related services) (Lehtinen & Lehtinen, 1991) (Jain & Gupta, 2004; Lehtinen & Lehtinen,

1991).

People have adopted banking services to save time, conduct streamlined transactions, experience

enhanced service quality, and furthermore to explore technology. In today's competitive environment,

the banking sector has emerged as one of the most competitive industries, with second-tier banks

struggling to retain rather than acquire new clients (Turner & Shockley, 2014). In addition, the

banking industry sector is confronted with a high customer churn rate, wherein customers easily switch

to a different bank whenever they perceive that banks are less responsive in understanding Customers'

desires and perceptions regarding banking services (Fornell, 1992).

The banking sector is anticipated to be a leader in e-business. While banks in developed nations rely

primarily on the Internet as non-branch institutions, banks in developing nations use the Internet to

improve customer relationships through information delivery (Jones et al..2003). Despite the fact that

numerous nations in Asia are well-connected to the Internet, security remains the primary concern

limiting the spread of e-banking (Anderson et al., 1994; Bowen and Chen, 2001; Fornell et al., 1996).

Access to high-quality e-banking services is also a problem. In comparison to affluent nations, the

majority of Asian banks offer just the most fundamental services. In Asia, e-banking appears to have

a promising future (Kotler, Philip dan A.B. Susanto. 2000). According to a poll conducted by

McKinsey (2008), e-banking will be effective provided fundamental functionality, such as bill

payment, are handled competently. Forty percent of survey respondents indicated that bill payment

was the most popular function. However, it would be difficult for Asian banks to provide this service,

as it demands a high level of security and the coordination of transactions with several parties

(McGrath & Astell, 2017; Meuter, et al., 2000; Tsou and Hsu, 2017).

Comparatively, between 5 and 6 percent of high- and middle-income group banking clients in

Singapore and South Korea utilised the Internet to complete their financial transactions in 2000. In

2001, a survey conducted by the Reserve Bank of India revealed that more than 20 major banks offered

or planned to offer e-banking services at various levels (Kurniasih, Apriyani. 2012). In 2001, the

private banks ICICI Bank, HDFC Bank, IndusInd Bank, IDBI Bank, Citibank, Global Trust Bank,

Bank of Punjab, and UTI Bank provided e-banking services. In the same year, nearly 17 percent of

the projected 0. 9 million Internet users were reported to use online banking. The aforementioned

statistics demonstrate that India has a substantial growth potential for e-banking. The banks have

already begun to concentrate on expanding and enhancing their online banking services (Hestu, 2013).

The Internet is hastening the restructuring of the European banking sector into three distinct

businesses: production, distribution, and advising. The Internet is accelerating this reconfiguration due

to the combined effects of the emergence of more focused new business models and technological

capabilities that reduce the cost of banking relationships and transactions (Lovelock, Patterson and

Walter, 1998). In contrast to their American counterparts, Europe's big banks enjoy a competitive

advantage due to their capacity to spend extensively in innovative technology. While the Internet has

enabled banks to supply requested products and services more rapidly and affordably, they face the

problem of enhancing customer contact through e- channels, which is crucial for client retention

(Martins, Oliveira and Popovic, 2014). To be successful on the Internet, banks must continually

differentiate themselves from their competitors, expand their market, and offer products and services

that provide value. As a result, banks are establishing online financial communities where users may

present and pay invoices and fulfil other financial and informational demands (Lovelock, Christopher

and Wright, 2007).

By bringing customers and vendors together on a single platform, financial institutions may capitalise

on their clients' confidence in them and act as an intermediary to guarantee that billers are paid and

consumers receive satisfying services. Banks may be required to conduct periodic surveys and solicit

customer feedback regarding the usability and simplicity of their websites and other e-banking

initiatives. (Bitner, et al.. 2000; White, 1998) Technological advancements have provided novel ways

of utilising electronic technology to deliver services to clients. Numerous authors believe that merely

Vol. 16, No.4 (II), October - December 2022 178

JOURNAL OF MANAGEMENT & ENTREPRENEURSHIP

ISSN : 2229-5348

UGC Care Group 1 Journal

satisfying customers to an almost-satisfactory degree is insufficient; rather, customer satisfaction must

be correlated with their behaviour and purchasing decisions, so that by measuring customer

satisfaction, a higher score indicates whether a customer will become a loyal customer or not (Ganguli

and Roy, 2011).

It is believed that customer satisfaction will lead to customer loyalty, and by measuring customer

satisfaction, we can determine the number of potential customers who will repurchase the same

product or remain affiliated with the company for a longer period of time. Banks are expected to

deliver high-quality services to its clients in order to keep or gain customer loyalty; if they fail to do

so, consumers will migrate to a different bank. According to Tjiptono and Chandra (2005), the benefits

of service quality include how to establish a larger client database, more customer loyalty, improved

productivity, a greater number of satisfied customers, and to have a competitive advantage by

increasing market share.

Expected service quality and perceived service quality are the two factors that have a direct impact on

customer satisfaction and the delivery of quality services (Makanyeza et al., 2017). Numerous banks

are in competition with one another to increase their quality of services and relationship marketing

techniques, which will help them please their clients and develop satisfying connections with them

(McGrath & Astell, 2017). This article will investigate the many facets of self-service technology and

the public's awareness of those facets.

SST Channels in the banking industry include Internet Banking, Mobile Banking, Automated Teller

Machine and electronic fund transfer. The technologies have made it possible for the customers to

withdraw money, transfer the fund anytime, anywhere as they want. 24x7 banking from any place,

less workload on branches, less waiting time, no need of teller’s services and lower cost of transactions

are some of the advantages of Self-Service Technologies. To survive in the competitive era and to

improve the standards of customer services, adoption of SST is becoming a common trend among

banks.

Literature on SSTs

The idea of service quality comprises delivery process (Parasuraman et al.. 1985) and service result

(Lehtinen & Lehtinen, 1991). In the preceding decades, the discussion over service quality

characteristics and their assessment emerged as a new phenomenon (Jain & Gupta, 2004; Lehtinen &

Lehtinen, 1991). Numerous studies have been reviewed to examine the paradigm of service quality

(Cronin, Brady, & Hult, 2000; Cronin & Taylor, 1992; Parasuraman et al.. 1985). In terms of its idea

and structure, Parasuraman et al. (1988) conceived service quality as a five-dimensional entity. These

characteristics consist of (1) Dependability, (2) Responsiveness, (3) Assurance, (4) Empathy, and (5)

Tangibility.

In order to achieve efficacy and efficiency, especially in addressing consumer needs, it is currently

impossible to separate day-to-day banking operations from the use of computer technology. The

application of technology such as self-service technology (SST) in online banking systems, internet

banking, mobile banking, mobile phone-based (phone banking), and the use of Automatic Teller

Machine (ATM) is one of the bank's strategies for retaining and satisfying customers and creating a

competitive advantage to compete with other banks. According to Bobbitt and Dabholkar (2001),

customers' access to numerous services, including banking services, has altered as a result of the fast

use of self-service technologies. Since the beginning of the 21st century, the number of products or

services employing technology and the significance of technology in manufacturer-customer

interactions have increased at a rapid rate (Parasuraman, 2000; Howard and Worboys, 2003).

In addition, according to Devlin (2005), the banking industry is one of the forerunners in the adoption

of automation services, since automation is considered as a technological advance in banking services

that allows providers to differentiate themselves from rivals. Specifically, banks that were enthusiastic

adopters of self-service technology of various types, such as automated teller machines (ATMs),

Vol. 16, No.4 (II), October - December 2022 179

JOURNAL OF MANAGEMENT & ENTREPRENEURSHIP

ISSN : 2229-5348

UGC Care Group 1 Journal

telephone banking, internet banking, and mobile banking or SMS banking, which customers could use

independently to meet their needs without interacting with bank employees (Meuter et al., 2000).

Service quality, particularly in the banking industry, is a major factor in a bank's ability to keep clients

and acquire new ones. As a result, ensuring service quality has become a priority for the majority of

banks. According to Zeithaml (1988), service quality is a consumer's evaluation of a product's total

excellence. Parasuraman et al. (1988) defined service quality as the contrast between customer

expectations and perceived performance. The Model of Service Quality Gaps and SERVQUAL scales

developed by Parasuraman et al. (1985, 1988) are generally acknowledged instruments for assessing

service quality.

Evaluation of service quality was not based just on the final quality of the service, but also on the

process of service delivery. These factors had a substantial impact on future expectations of a bank's

service, although their relative importance varied from service encounter to service encounter (Bitner,

1990). In follow-up study, Parasuraman et al. (1988) developed five characteristics for assessing

service quality: tangible, dependability, responsiveness, assurance, and empathy.

In practise, several research provide strategies for controlling service quality in relation to boosting

customer happiness (Jones et al.. 2007; Ranaweera and Prabhu, 2003). There is a race among banks

to give consumers with a high degree of satisfaction, since the level of competition among them is

intensifying. Achieving a high level of customer satisfaction is essential and the key to fostering client

loyalty, as banks will gain a great deal from the success of this goal. In addition to keeping clients

from transferring to other banks, a high degree of satisfaction may be supplied to lower customers'

price sensitivity, so reducing service costs and enhancing the reputation of marketing failures (Fornell,

1992).

This can increase client loyalty, which will generate positive word-of-mouth regarding the bank's

reputation. Receiving the required degree of satisfaction, consumers will express a high level of

satisfaction, which is the first stage in managing customers to set reasonable expectations (Jones et

al..2003). Moreover, Ranaweera and Prabhu (2003) noted that if customers were progressively happy

with the company's products and services, they would be increasingly inclined to remain loyal.

According to Fecikova (2004), the key to the sustainability of an organisation or business is the

persistence of internal and external client pleasure.

Therefore, a portion of the company's success is defined by the amount of customer loyalty, which is

impacted by (driven) customer happiness (Anderson et al.. 1994; Bowen and Chen, 2001; Fornell et

al.. 1996). This is corroborated by Lovelock et al. (1998), who found that customer happiness would

result in several advantages for the company and increased customer loyalty. According to Kotler and

Susanto (2000), customer satisfaction may be described as the amount of a customer's sentiments after

comparing the actual performance or outcomes to their expectations.

If performance falls short of a customer's expectations, the consumer will be dissatisfied, however if

performance surpasses expectations, the client will be ecstatic.

Engel et al. (1990) contended that customer satisfaction is the post-service evaluation in which the

selected option meets or surpasses customer expectations. Otherwise, discontent will occur if the

outcomes do not meet expectations. According to Jamal and Naser (2002), client happiness may be

quantified utilising the following indicators: extremely satisfied, fulfils expectations, and

performance. In the era of globalisation, the expectation for corporations and banks to continue

expanding might be centred on cultivating client loyalty.

To keep loyal consumers, this motivates businesses and banks to build a competitive edge via new

initiatives and inventiveness. Oliver (1996) described customer loyalty as the commitment of

consumers to regularly buy a product or service in the future, notwithstanding events that may induce

a change in behaviour, such as the influence of other individuals or the marketing efforts of rivals.

Guiltinan et al. (1997) also discovered that happy consumers were more inclined to repurchase items

or services and even become devoted customers who would never consider switching banks.

Vol. 16, No.4 (II), October - December 2022 180

JOURNAL OF MANAGEMENT & ENTREPRENEURSHIP

ISSN : 2229-5348

UGC Care Group 1 Journal

RATIONALE BEHIND THE STUDY

Indian banking is passing through a phase of transformation. Bank customers in India are not only

using traditional personal banking but readily adopting innovative and modern Self-Service

Technologies. In spite of the many benefits like cost reduction, increased efficiency, time saving and

more control on transactions, a large section of customers is still having psychological and behavioural

hindrances towards using these SSTs. Further, lack of digital and financial literacy has blocked the

way for adoption of these technologies. So, in background of these developments, there is promising

need to study the factors which influence the mind set of customers to adopt Self Service Technologies.

A comprehensive study inquiring the rationale, extent of use, adoption, attitude towards SSTs, its

impact on customer satisfaction and loyalty in all the three main SST channels i.e. ATM, internet

banking, mobile banking has not attempted by any previous researcher. The rationale behind choosing

the Chandigarh region is mainly its favourable environment for application of these self-service

technologies. The findings of the study will provide valuable inputs and suggestions to decision-

makers in the banking sector to formulate the practical strategies to attain the higher levels of customer

service standards.

OBJECTIVES OF THE STUDY

The objectives of the study are mentioned as under:

1. To study the demographic profile of the banking customers using technology enabled banking

services.

2. To study the level of awareness towards technology enabled banking SSTs.

3. To analyze the usage pattern of selected banking services.

4. To analyze the purpose of using Self-Service Banking services.

5. To analyze the ranking preferences of customers for diverse features of banking services.

RESEARCH METHODOLOGY

The survey was conducted in the Chandīgarh region and all those respondents who are using mobile

and internet banking, were taken into consideration. The convenience sampling method was adopted

to collect the data. The present study collected and analyzed the demographic profile of customers

using SSTs, customer’s experience and perception towards banks, customer’s level of awareness

towards technology enabled banking self-services, customer’s usage of banking services, utility of

self-service banking technologies, preference of customers towards selected public and private sector

banks based on banking services features. The Researcher has distributed more than 1000

questionnaires through google form, physical contact and interviews and have received 720

questionnaires due to pandemic conditions. Furthermore, the collected responses were undergone the

screening process and 34 questionnaires were discarded due to missing entries, or incomplete

responses. Finally, 686 questionnaires complete in all respect were kept after screening and analysed

for research.

ANALYSIS & INTERPRETATION OF DATA

This section of the paper deals with analysis and interpretation of the collected data to achieve

objectives of the study

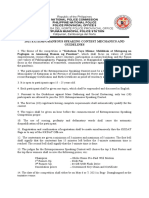

Table 1 Demographic Profile of Respondents

Demographics of the Respondents

Cumulative Cumulative

Percent Percent

Percent Percent

Male 52 52 Education

Female 48 100 Under Graduate 22.9 22.9

Age Graduate 28.9 51.8

Vol. 16, No.4 (II), October - December 2022 181

JOURNAL OF MANAGEMENT & ENTREPRENEURSHIP

ISSN : 2229-5348

UGC Care Group 1 Journal

Below 20 Years 18.4 18.4 Post Graduate 16.3 68.1

20-30 Years 21.1 39.5 Doctorate 11.3 79.4

30-40 Years 18.8 58.3 Others 20.6 100

40-50 Years 28.4 86.7 Income (p.m.)

More than 50 Years 13.3 100 Less than Rs 25000 15.7 15.7

Occupation Rs 25000 - Rs 40000 19.1 34.8

Business Person 19.5 19.5 Rs 40000 - Rs 55000 26.7 61.5

Salaried 33.1 52.6 Rs 55000- Rs 70000 18.1 79.6

Professionals 21.3 73.9 More than Rs 70000 20.4 100

Self Employed 26.1 100

Source: Primary Data (SPSS 21 Version)

Table 1 depicts the results of demographics of the respondents. This consist of basic variable of

respondents such as gender, age, education, occupation, and income. The table represents that the data

consists of almost equal proportion of male and female respondents, where male respondents are

slightly higher than female respondents. It is found that majority of the respondents belongs to age

group 40 to 50 years ( 28.4% ) followed by 20 to 30 years of age (21.1%), whereas 13.3% of the

respondents are older than 50 years of age, and 18.4% of the respondents are in the age group of less

than 20 years. In case of education, large chunk of people are graduate i,e 28.9% whereas 22.9% are

studying or have obtained education less than graduation. People, who are professionally qualified

constitute 20.6% in numbers followed by 16.3 % of postgraduates

The data includes 33.1% of salaried class followed by self-employed which consists of 26.1 percent,

Moreover the professionals who are providing their services as a freelancer consists of (21.3%)

followed by businessman having 19.5%of total respondents. It is further found that majority of people

are earning between Rs 40000 to Rs 50000 followed by people having income more than Rs 70000.

Although it is found that almost similar proportion of people are earning in all categories having

income slots more than Rs 25000 and 15.7% are earning less than Rs 25000.

Table 2 Customers experience and perception towards banks

Association with Bank

Frequency Percent Cumulative Percent

SBI and Associates 141 20.6 20.6

PNB and alliances 187 27.3 47.9

ICICI Bank 171 24.9 72.7

HDFC Bank 116 16.9 89.7

AXIS Bank 71 10.3 100.0

Bank Experience as Customer

Less than 3 Years Nil

3-5 years 38 5.5 5.5

5-8 years 160 23.3 28.9

8-11 Years 376 54.8 83.7

More than 11 Years 112 16.3 100.0

Reasons for visiting Bank Branch

To make deposit 232 33.8 33.8

To withdraw cash 263 38.3 72.2

To get advice on 191 27.8

100.0

investment options

Transaction Frequency

Daily 166 24.2 24.2

Bi-Weekly 137 20.0 44.2

Vol. 16, No.4 (II), October - December 2022 182

JOURNAL OF MANAGEMENT & ENTREPRENEURSHIP

ISSN : 2229-5348

UGC Care Group 1 Journal

Weekly 191 27.8 72.0

Fortnightly 126 18.4 90.4

Monthly 66 9.6 100.0

Banking Transactions Availed

Branch Banking 86 12.5 12.5

Net Banking 227 33.1 45.6

Phone Banking 318 46.4 92.0

ATM 55 8.0 100.0

Source: Primary Data (SPSS 21 Version)

Table 2 interprets the experience and perception of customers towards banks. It is found that 47.9%

of the respondents are associated with public banks whereas rest are associated with private banks.

This shows that private banks have strong hold among customers. Almost 94% of the customers are

associated with any bank for more than 5 years whereas 70% are associated with the banks for more

than 8 years. only few customers have been associated with banks between 3 to 5 years. It is found

further that majority of the people are visiting banks either for withdrawing the money or depositing

the money only 27% visit the banks for consulting banking employees to get some advice on any

investment options. Furthermore, it is found that 24.2% of the respondents are doing transactions on

daily basis whereas 50% of the respondents are using banking services at-least once in a week and rest

are availing banking facilities once or twice in a month. Subsequently, majority of the customers are

using phone banking services (46.4%) and one third are using net-banking for their financial activities

and rest of the customers are visiting branch or ATM for their financial needs.

It is found that more than one third of the customers are having accounts with 4 banks followed by

28% have account with 5 banks and 24.3% with 3 banks. This highlights that people using multiple

banking accounts for handling any emergency in future. In addition to this, it is found that one third

of the customers are using public banks for their transactions and half of the customers are using both

private and public bank’s services whereas only 20% are found to be availing services of private banks.

This shows that people still prefer public banks and believe public banks are more secure than private

banks. The data reveals that majority of the customers are preferring public banks (53.2%) for

conducting their financial activities than private banks (29.3%) whereas 17.2% have neutral responses

and using both the banks.

Table 3 Customers usage of banking services

SELF SERVICE FACILITIES For how long you have been using the following

services?

ATM ATM

Frequenc Cumulativ Frequenc Cumulativ

Percent Percent

y e Percent y e Percent

Daily 28 4.1 4.1 3-5 years 86 12.5 12.5

Bi-

29.0 33.1 5-8 years 222 32.4 44.9

Weekly 199

Weekly 361 52.6 85.7 8-11 Years 323 47.1 92.0

More than 11

Monthly 98 14.3 100.0 55 8.0 100.0

Years

Internet banking Internet banking

Daily 30 4.4 4.4 3-5 years 209 30.5 30.5

Bi-Weekly 167 24.3 28.7 5-8 years 157 22.9 53.4

Weekly 240 35.0 63.7 8-11 Years 228 33.2 86.6

More than 11

Fortnightly 193 28.1 91.8 29 4.2 90.8

Years

Monthly 56 8.2 100.0 3-5 years 63 9.2 100.0

Vol. 16, No.4 (II), October - December 2022 183

JOURNAL OF MANAGEMENT & ENTREPRENEURSHIP

ISSN : 2229-5348

UGC Care Group 1 Journal

Use of Kiosks Use of Kiosks

Bi-Weekly 175 25.5 25.5 3-5 years 171 24.9 24.9

Weekly 248 36.2 61.7 5-8 years 263 38.3 63.3

Fortnightly 221 32.2 93.9 8-11 Years 213 31.0 94.3

More than 11

Monthly 42 6.1 100.0 39 5.7 100.0

Years

Mobile Banking Mobile Banking

Less than 02

Daily 141 20.6 20.6 137 20.0 20.0

Years

Bi-Weekly 325 47.4 67.9 2 to 4 Years 345 50.3 70.3

Weekly 110 16.0 84.0 4-6 years 114 16.6 86.9

More than 6

Fortnightly 110 16.0 100.0 90 13.1 100.0

years

Total 686 100.0 Total 686 100.0

Source: Primary Data (SPSS 21 Version)

Table 3 reports the usage of banking services by the customers. This shows that almost 80% of the

customers are using ATM services once or twice in a week and 4.1% are using it on daily basis and

only 8% are using only once in a month. This highlights the dependency of people on ATM services.

During the survey, people said that they need to operate all their bank accounts’ ATM for withdrawing

the money to avoid fee charges on the withdrawals. Similarly, in case of internet banking, 65% are

using internet banking either on daily basis on twice in a week, whereas 28% are using it twice in a

month and 8% are using it once in a month. People believe that it is not convenience to transact all the

activities via internet such as shopping vegetables or clothes from market need cash than any internet

transfers. Therefore, they have to use ATM services more than internet banking. In case of kiosks and

mobile banking, similar pattern is followed i.e. one third are availing both the services twice in a week

and rest of the respondents are using twice or once in a month.

In case of using the services, it is found that majority of the people are using ATM services for more

than 5 years, whereas 12.5 % have started using the services in between previous 3 to 5 years. This

shows that ATM plays significant role in withdrawing money than waiting in queue within the banks.

This has assisted them with smooth financial services to fulfil their needs. During the survey, it was

found that some people use the ATM for deposit purpose also. On the other hand, in case of internet

banking, majority of the people (30.5%) have started using internet banking for less than 5 years

followed by 33.2% who are using the internet services around 10 years and only 9.2 stated that they

are using internet services for more than 11 years. Mobile banking services have been used widely in

India. It is found that majority of the respondents (70.3%) have started using M-Banking for any

financial transaction for less than 4 years whereas 16.6% have started using the services between 4 to

6 years and 13.1% of customers, who have strongly believed in their banking services are using M-

banking for more than 6 years. This shows that update technology and pandemic need have provided

such a platform for banks where maximum customers have adopted the M-banking services to

smoothen their financial transactions to fulfil their daily needs.

Table 4 Customers level of awareness towards technology enabled banking self-services

LEVEL OF AWARENESS TOWARDS TECHNOLOGY ENABLED BANKING SELF

SERVICES

Awareness about technology enabled banking self-services

I can complete banking transaction using Technology does not fail at the crucial time

technology if I had built-in help available for

assistance

Frequency Percen Cumulativ Frequenc Percent Cumulativ

Vol. 16, No.4 (II), October - December 2022 184

JOURNAL OF MANAGEMENT & ENTREPRENEURSHIP

ISSN : 2229-5348

UGC Care Group 1 Journal

t e Percent y e Percent

SD 3 .4 .4 D 18 2.6 2.6

D 43 6.3 6.7 N 193 28.1 30.8

N 192 28.0 34.7 A 325 47.4 78.1

A 356 51.9 86.6 SA 150 21.9 100.0

SA 92 13.4 100.0

I learn & work more quickly with new It is safe to do any kind of financial business

technologies than others using Technology

SD 4 .6 .6 D 15 2.2 2.2

D 43 6.3 6.9 N 170 24.8 27.0

N 188 27.4 34.3 A 372 54.2 81.2

A 357 52.0 86.3 SA 129 18.8 100.0

SA 94 13.7 100.0

I do not need a lot of time to complete

I will always use the technology in future

banking transaction using technology

SD 1 .1 .1 N 228 33.2 35.6

D 34 5.0 5.1 A 340 49.6 85.1

N 118 17.2 22.3 SA 102 14.9 100.0

A 443 64.6 86.9

SA 90 13.1 100.0

I like the idea of Self-service technology as I I feel confident while using technology for

am not limited to regular banking hours banking Activities

SD 1 .1 .1 D 140 20.4 24.6

D 26 3.8 3.9 N 242 35.3 59.9

N 181 26.4 30.3 A 227 33.1 93.0

A 353 51.5 81.8 SA 48 7.0 100.0

SA 125 18.2 100.0

I prefer talking to a person rather than

I would recommend to my friends & relatives

working on a machine for all business

to use the technology facilities

activities

D 36 5.2 5.2 D 19 2.8 2.8

N 181 26.4 31.6 N 196 28.6 31.3

A 344 50.1 81.8 A 365 53.2 84.5

SA 125 18.2 100.0 SA 106 15.5 100.0

Total 686 100.0 Total 686 100.0

Source: Primary Data (SPSS 21 Version) (SD= Strongly disagree, D= disagree, N=Neutral,

A=agree, SA= Strongly agree)

Table 4 elaborates the results of awareness level of customers for different self-service technologies

provided by the banks to them. The results depict that majority of the customers believed that they can

complete any transaction with the help of built in banking technology whereas approximately 7% think

that all the financial transactions cannot be completed with self-service technologies. More than 75%

believe that they can easily learn and adapt the new technologies whereas rest of the people believe

that they need some training and assistance to operate new technology or updated version of any self-

service service. Almost all the people have shown their willingness to use advanced technology to

conduct their financial transactions in future because they perceived that SSTs are not restricted or

limited to time frame, they can use anytime anywhere, which is best alternative to mitigate their

emergency needs and works as backup for the emergency plans. Moreover, more than 90% believe

that technology does not fail at very crucial time and find it safe and secure to use SSTs for their

financial needs. All the respondents think that advanced SSTs are time saving and provide expedite

Vol. 16, No.4 (II), October - December 2022 185

JOURNAL OF MANAGEMENT & ENTREPRENEURSHIP

ISSN : 2229-5348

UGC Care Group 1 Journal

solutions to their needs. Thus, safety, security and responsiveness of SSTs make the customers more

confident and encourage them to exploit SSTs to the maximum. Even more than 70% of the people

affirm that they recommend and convince their friends, relative and family members to adopt advanced

SSTs for their financial needs and can save plenty of time by not visiting banks. In some

circumstances, around 30% have indicated that they would prefer physical touch with the banking

employees over advanced technologies because they have sometimes faced some issues in conducting

and operating SSTs.

Thus, with the passage of time, people are becoming more advanced and are ready to adopt the new

technologies to fulfill their needs. People said that security assured by banks for their privacy and

promptness of the SSTs have changed their perception towards banking services. The opening of new

account can be done in less than half hour, but the traditional banking system required almost two to

three days to open an account, can deposit or withdrawal can be done at kiosk machines anytime during

day or night rather than waiting in a queue for hours and passbook printing with barcodes take less

than a min without any fail. Thus, they are ready to adopt the newly advanced system.

Table 5 Utility of Self-Service Banking Technologies

BANKING INFORMATION

General utility bill payments

Account Information (balance checking, Cumulativ

Percen

monitoring deposits, alerts on account activities) Frequency e Percent

t

No 21 3.1 3.1 No 219 31.9 31.9

Yes 665 96.9 100.0 Yes 467 68.1 100.0

Investment services (share trading,

Repayment services

personalized alerts on security prices)

No 93 13.6 13.6 No 153 22.3 22.3

Yes 593 86.4 100.0 Yes 533 77.7 100.0

Cheque book services (ordering of cheques, status Support services (complaint lodging &

of cheques, stop payment) Tracking, ATM location, credit request status

No 88 12.8 12.8 No 111 16.2 16.2

Yes 598 87.2 100.0 Yes 575 83.8 100.0

Credit /Debit card services (card requests, access

Insurance services

to card statements)

No 38 5.5 5.5 No 194 28.3 28.3

Yes 648 94.5 100.0 Yes 492 71.7 100.0

Domestic and International fund transfer Content services (loyalty related offers)

No 68 9.9 9.9 No 216 31.5 31.5

Yes 618 90.1 100.0 Yes 470 68.5 100.0

Total 686 100.0 Total 686 100.0

Source: Primary Data (SPSS 21 Version)

Table 5 represents the utility of banking services by the customers. The data consist of all those

customers who are using all the SSTs services. It is found that 96.9% are using SSTs for checking

their account balance, 87% placing a request for check book and 94.5% to check their mini statement

or monthly statements of either credit cards or bank accounts. Furthermore, around 90% of the

customers are advancing banking services for their international or national fund transfers, which

includes payment received from PayPal, overseas banks and more financial institutions. 68.1% of the

customers are using the SSTs for paying bills of their grocery items through different online

applications, 77.7% are using the SSTs for performing their investment options such as trading, share

Vol. 16, No.4 (II), October - December 2022 186

JOURNAL OF MANAGEMENT & ENTREPRENEURSHIP

ISSN : 2229-5348

UGC Care Group 1 Journal

market, stocking, SIP and mutual funds etc., and around 83% are using SSTs for lodging any complaint

regarding anything related to their bank accounts such redeeming credit card late fee by mailing or

telephonic banking, reversing the miscellaneous or examining their installment charges and many

more. Lastly, 71,7% use the SSTs to explore insurance benefits and 68.5% for loyalty offer reward

points services availed to them through shopping. It can be concluded that the utility of banking

services has been improved a lot and people are benefitting a lot from this advanced banking system.

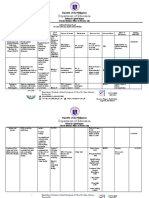

Table 6 Ranking preferences of customers for various banks based on their features

SBI and PNB and ICICI HDFC AXIS

Sr

Associates Alliances

No

Reasons Rank Rank Rank Rank Rank

a Locational Convenience 1 1 5 4 5

b Better Service & Friendly Staff 5 5 1 1 4

c Bank’s image 4 4 2 2 2

Employer’s insistence For Salary 6 6 4 5 3

d

A/C

Availability of Online Banking, 2 2 3 3 1

e Mobile Banking, Telebanking etc.

f Greater Spread of ATMs 3 3 7 7 7

Recommendations by friends / 8 8 8 8 8

g

relatives

h Investment Options 7 7 6 6 6

i Any other Please Specify ………. 9 9 9 9 9

Source: Primary Data (SPSS 21 Version)

Table 6 indicates the ranking preferences of customers for various features perceived by them through

SSTs of all the banks. The results indicate the comparison of largest public (SBI and PNB) and private

banks (ICICI, HDFC and AXIS) of India. The seven parameters are examined, and customers are

asked to give their preferences for every criterion and based on their preferences, the overall ranks are

assigned to all the parameters. In case of public banks, respondents have given 1 st rank to SBI, PNB

for location convenience so people are very satisfied with the accessibility to banks, the higher number

of branches is the key to their success followed by their availability of SSTs and image in the market.

However, ICICI & AXIS Banks are given 5th rank and HDFC bank is given 4th rank for locational

convenience. Although, people have placed services and staff behavior at 5th position and opening

their salary account in the bank at 6th place but overall, they have shown their satisfied behavior

towards the public banks because of improving features and advanced technology features. But people

believed that public banking staff do not convince them for more investment options such as SIP, share

market, Mutual Funds and do not encourage them to invest more into such services to earn more

money. Lastly, recommendations to friends and family members are ranked at 8th position.

In case of private banks, people are satisfied with their staff’s friendly behavior and better services

and bank’s image thus, they ranked these as 1st and 2nd position followed by their provision of SST

availability of online banking, mobile banking, telebanking etc. Public sector banks are given 4th rank

for parameter of bank image. ICICI & HDFC banks are given third rank for provision of SST whereas

Axis bank is assigned rank 1 for this feature. Public sector banks are given rank 3 for ATM spread

whereas private sector banks are assigned rank 7th for the same so private banks have limited ATMs

as compared to public banks whereas people said that private banks highly convince them to invest

into other sources or options as compared to public banks. So private banks are given 6 th rank and

public sectors banks are given 7th rank for investment options. There is no crystal ranking in feature

Vol. 16, No.4 (II), October - December 2022 187

JOURNAL OF MANAGEMENT & ENTREPRENEURSHIP

ISSN : 2229-5348

UGC Care Group 1 Journal

like employee’s insistence for the salary account for private banks, however public banks are ranked

6th at this parameter usually due to the compulsion of employer to open salary account in public sector

banks. It is found that all the customers have given last ranks to recommendations of banks to their

near and dear ones because now a days everyone is having bank accounts.

CONCLUSION

The study observed that majority of the customers are frequently using SSTs like Online banking,

Mobile Banking, ATMS to meet their banking requirements. Mobile banking is relatively more

frequently used on bi-weekly basis as compared to ATM and Net banking. The analysis of awareness

towards technology revealed that most of the customers can complete banking transactions using

technology, they can learn & work more quickly with new technologies. Respondents stated they

prefer using SSTs as it is not limited to banking hours, it does not fail at crucial time, and they feel

confident using technology for banking activities. Almost of half of them stated they would

recommend use of technology to their friends and relatives. The survey part of utility of Self-Service

banking technology reveals that majority of people are using SSTs for general utility bill payments,

cheque book services, checking account statements for Debit/Credit card statements, domestic and

international fund transfer, investment services, checking loyalty related offers. The ranking

preferences of customers for various banks based on various features shows that bank customers have

given 1st rank to Public Sector banks (SBI & Associates, PNB and alliances) for ‘locational

convenience’. Private sector banks ranked either 4th or 5th on this feature. It may be due to the higher

presence of public sector bank branches as compared to private sector banks. Private Sector Banks

ranked either 1st and 2nd for the features i.e., ‘better service and friendly staff’ and ‘Banks Image’. Axis

bank is ranked number 1 for SSTs availability like Online banking, Mobile banking, net banking, etc.

SBI & Associates, PNB and alliances are ranked 2nd, whereas selected public sector banks given 3rd

rank by the customers. On the feature ‘Greater Spread of ATMs’ Public sector banks enjoyed higher

rank (3rd) as compared to Private Sector Banks(7th). Customers have given higher rank (6th) to private

sector banks over public sector banks (7th) to the feature ‘investment options. It is obvious that public

sector bank employees do not convince them for investment options/products like opening DMAT A/c

for trading, mutual funds, insurance etc. The feature ‘Recommendations by friends and relatives’ been

given the least preference i.e. 8th rank/position by the customers. To conclude, customer awareness

and participation is the key to success of SSTs. Some customers enjoy self-service, whereas others

prefer the service performed (i.e. by employees) entirely for them. Despite the services available via

the Internet, many customers still prefer human, high-contact service delivery rather than self-service.

Because of these differences in preferences, banks typically customize their services by offering both

automated self-service options and high-touch, human delivery options.

REFERENCES

● Alfred Owusu, Dwomoh Harriet Akosua (2017), Investigating Customer Satisfaction Levels with Self

Service Technology Within Banking Sector: A Case Study of Automated Teller Machines (ATMs),

American Journal of Operations Management and Information Systems, vol.2(4) PP (97-104) Nov.

● Bhosale and Sawant (2012), Technological Developments in Indian Banking Sector, the Journal of

Banking.

● Cheng, Y.-M., Towards an understanding of the factors affecting m-learning acceptance: Roles of

technological characteristics and compatibility, (2015) Asia Pacific Management Review, 20 (3), pp. 109-

119. Cited 93 times. DOI: 10.1016/j.apmrv.2014.12.011

● Choudhary Shovana, (2018) Preference of Retail Self Service Customers towards Self Service Technology

in Indian Banking Sector: A Comparative study of selected Public and Private Sector Banks in Jharkhand

Doctoral Thesis, Doctor of Philosophy in Management, ICFAI University, Jharkhand (Jan.)

● Curran, J.M., Meuter, M.L. and Surprenant, C.F. (2003), Intentions to use self-service technologies: a

confluence of multiple attitudes, Journal of Service Research, Vol. 5 No. 3, pp. 209-24.

Vol. 16, No.4 (II), October - December 2022 188

JOURNAL OF MANAGEMENT & ENTREPRENEURSHIP

ISSN : 2229-5348

UGC Care Group 1 Journal

● Dabholkar, P. A. (1996). Consumer evaluations of new technology-based self-options: an investigation of

alternative models of service quality. International Journal of Research in Marketing, 13(1), 29–52.

● Dobdinga Cletus Fonchamnyo (2013), Customers’ Perception of E-banking Adoption in Cameroon: An

Empirical Assessment of an Extended TAM International Journal of Economics and Finance, Vol. 5, pp-

166-176.

● DjajantoLudfi, Nimran Umar, KumadjiSrikandi, Kertahadi (2014) The Effect of Self Service

Technology, Service Quality, and Relationship Marketing on Customer Satisfaction and Loyalty IOSR

Journal of Vol. 16, Issue 1 Ver. 6, PP (39-50) Feb.

● Feng, W., Tu, R., Lu, T., Zhou, Z.,(2019) Understanding forced adoption of self-service technology: the

impacts of users’ psychological reactance, Behaviour and Information Technology, 38 (8), pp. 820-832.

Cited 11 times. DOI: 10.1080/0144929X.2018.1557745

● Fier Chai Keng (2008) Self Service Technology and Internet Banking: An Investigation of Consumers’

Trial decision a research project for Master of Business Administration submitted to University of Malaya

(July)

● GeethaK.T. & V.Malarvizhi (2011), A study on acceptance of e-banking among customers, Journal of

Management and Science, ISSN: 2249 - 1260.

● Gunawardana H.M.R.S.S., Kulathunga D., and Petata W.L.M., (2015) Impact of Self-Service

Technology Quality on Customer Satisfaction: A Case of Retail Banks in Western Province in Sri Lanka,

Gadjah Mada International Journal of Business, Vol.17, No.1 (January-April 2015) PP (1-24).

● Ongori Masabo Henry (2013) Self Service Technology and Customer Satisfaction in Commercial Banks

in Kenya Management Research Project University of Nairobi(Oct.)

● Parasuraman, A., Zeithaml, V.A. and Berry, L.L. (1988). SERVQUAL: a multiple-item scale for

measuring consumer perceptions of service quality. Journal of Retailing, 64, 12-40

● Alma, Buchari. 2009. Manajemen Pemasaran dan Pemasaran Jasa. Penerbit Alfabeta. Bandung.

● Anderson, E.W., Claes Fornell, and R. Lehmann. 1994. “Customer Satisfaction Market Share, and

Profitability: Finding from Sweden”. Journal of Marketing. Vol. 58. No. 1: 53-56.

● Baloglu, Seyhmus. 2002. “Dimensions of customer loyalty: Separating friends from well wishers”. Cornell

Hotel and Restourant Administration Quarterly. Vol. 43. No. 1. February: 47.

● Barrett, M., Davidson, E., Prabhu, J., & Vargo, S. L. (2015). Service innovation in the digital age: Key

contributionsand future directions. MIS Quarterly, 39(1), 135–154. https://doi.org/10.25300/MISQ

● Berry, L.L., 1983. Relationship marketing: Emerging Perspectives of Services Marketing, American

Marketing Association, Chicago, IL.

● Bitner, M. J. 1990. "Evaluating Service Encounters: The Effects of Physical Surroundings and Employee

Responses." Journal of Marketing 54(2): 69-82.

● Bloemer, Josee and Ko de Ruyter. 1998. "Investigating drivers of bank loyalty: the complex relationship

between image, servicequality", International Journal of Bank Marketing. Volume 16. Number 6/7: 276-

286.

● Bobbitt, L. and P. Dabholkar. 2001. “Integrating attitudinal theories to understand and predict

use to technology-based self-service. The internet as an illustration”. International Journal of Service

Industry Management, Vol. 12. No. 5: 423-50.

● Bowen, J.T. and S.I. Chen. 2001. " The relationship between Customer loyalty and customer satisfaction".

International Journal of contemporary Hospitality Management. Vol.13. No. 5: 213-217.

● Buell, Ryan W., Campbell D. and F.X. Frei. 2010. “Are Self-Service Customers Satisfied or Stuck?”.

Production and Operations Management Journal. Vol. 19, No. 6, November– December: 679–697.

● Calonius, H. 1988.“A buying process model”. Proceedings of the XVII Annual Conference of the European

Marketing Academy on Innovative Marketing. University of Bradford: 86-103.

● Caruana, Albert and Malta Msida. 2002. “Service loyalty: The effect of service quality and the mediating

role of customer satisfaction”. European Journal of Marketing. Vol. 36. No. 7/8: 811-828.

● Chin, W. W. 1998. The Partial Least Squares Approach to Structural Equation Modeling. Modern Methods

for Business Research.

● Dabholkar, P.A., 1996. “Consumer evaluations of new technology-based self-service options: an

investigation of alternative models of service quality”. International Journal of Research in Marketing. Vol.

13. No. 1: 29-51.

● Devlin, J., 1995. “Technology and innovation in retail banking distribution”, International Journal of Bank

Vol. 16, No.4 (II), October - December 2022 189

JOURNAL OF MANAGEMENT & ENTREPRENEURSHIP

ISSN : 2229-5348

UGC Care Group 1 Journal

Marketing, Vol. 13 No. 4: 19-25.

● Dewi, N.I.K., C. G. P. Yudistira dan G. Santanu. 2008. “Pendekatan Relationship Marketing untuk Loyalitas

Pelanggan: Kasus Denpasar Front Office Qantas Airways di Bali”. Jurnal Sarathi. Vol. 15 No. 1. Januari:

114-128.

● Elu, Wilfridus B., 1997. Membangun keunggulan melalui strategi relationship marketing.

Manajemen Usahawan Indonesia. 3/THN.XXVI, Maret: 14-16.

● Engel, J.F., R.D. Blackwell, and P.W. Miniard. 1990. Consumer Behavior. The Dryden Press. Orlando.

● Espejel, Joel, Carmina Fandos and Carlos Flavian. 2008. “Consumer satisfaction a key factor of consumer

loyalty and buying intention of a PDO food product”. British Food Journal. Vol. 110. No. 9: 865-881.

● Fecikova, I., 2004. “An index method of customer satisfaction”. TQM Magazine. Vol. 16. No. 1: 57-66.

● Ferdinand, A., 2005. Structural Equation Modelling dalam Penelitian Manajemen. BP-UNDIP. Semarang.

● Fornell, C., 1992. A national customer satisfaction barometer: the Swedish experience. J. Mark., 56: 6-21.

● Fornell, C., M.D. Johnson, E.W. Anderson, J. Cha, and B.E. Bryant. 1996. “The American customer

satisfaction index: nature, purpose, and findings”. Journal of Marketing, Vol. 60: 7- 18.

● G. A. Marcoulides. Mahwah. Lawrence Erlbaum Associates. NJ.

● Ganguli, Shirshendu and S.K. Roy. 2011. “Generic technology-based service quality dimensions in banking

Impact on customer satisfaction and loyalty”. International Journal of Bank Marketing. Vol. 29 No. 2: 168-

189.

● Gerson, F Richard. 2001. Mengukur Kepuasan Pelanggan. PPM. Jakarta.

● Ghozali, Imam. 2006. Structural Equation Modeling, Metode Alternatif dengan Partial Least Square.

Semarang, Badan Penerbit Universitas Diponegoro.

● Gilaninia, Shahram, H. Shahi and S.J. Mousavian. 2011. “The Effect of Relationship Marketing Dimensions

by Customer Satisfaction to Customer Loyalty”. Interdisciplinary Journal of Contemporary Research in

Business. Vol. 3. No. 4. August: 74-84.

● Griffin, Jill. 2005. Customer Loyalty. Erlangga. Jakarta

● Gronroos, Christian. 1990a. Service Management and Marketing. Lexington Books. Toronto.

● Gronroos, Christian. 1990b. “Relationship Approach to The Marketing Function in Service Contexts”.

Journal of Business Research.

● Hien, N. M. (2014). A study on evaluation of e-government service quality. International Journal of Social,

Management,Economics and Business Engineering, 8(1), 16–19.

● Host, Viggo, and Andersen, Michael Knie. 2004. “Modeling Customer Satisfaction In Mortgage Credit

Companies”, Emerald, The International Journal of Bank Marketing, Denmark.

● Howard, M. and C. Worboys. 2003. “Self-service – a contradiction in terms or customer-led choice?”,

Journal of Consumer Behavior, Vol. 2 No. 4: 382-92.

● https://doi.org/10.1108/IJBM-11-2016-0164

● Iqbal, M. S., Hassan, M. U., Sharif, S., & Habibah, U. (2017). Interrelationship among corporate image, service

quality,customer satisfaction, and customer loyalty: Testing the moderating impact of complaint handling.

International Journal of Academic Research in Business and Social Sciences, 7(11), 667–688.

● Jamal, Ahmad and Kamal Naser. 2002. “Customer satisfaction and retail banking: an assessment of some of

the key antacedents of customer satisfaction in retail banking”. International journal of Bank Marketing.

Vol. 20. No. 4: 146-160.

● Jamal, Ahmad and Kamal Naser. 2002. “Customer satisfaction and retail banking: an assessment of some of

the key antacedents of customer satisfaction in retail banking”. International journal of Bank Marketing.

Vol. 20. No. 4: 146-160.

● Jones, M.A., Reynolds, K.E., Mothersbaugh, D.L. and Beatty, S.E. 2007. “The positive and negative effects

of switching costs on relational outcomes”. Journal of Service Research. Vol. 9 (4): 335-55.

● Juscius, Vytautas and Viktorija Grigaite. 2011. “Relationship marketing practice in Lithuanian logistics

organizations”. Baltic Journal of Management. Vol. 6. No. 1: 71-88.

● Kelly, P., Lawlor, J., & Mulvey, M. (2017). Customer roles in self- service technology encounters in a tourism

context. Journal of Travel & Tourism Marketing, 34(2), 222–238.

https://doi.org/10.1080/10548408.2016.1156612

● Kim, M., & Qu, H. (2014). Travelers’ behavioral intention toward hotel self-service kiosks usage.

International Journal of Contemporary Hospitality Management, 26(2), 225–245.

https://doi.org/10.1108/IJCHM-09-2012-0165

Vol. 16, No.4 (II), October - December 2022 190

JOURNAL OF MANAGEMENT & ENTREPRENEURSHIP

ISSN : 2229-5348

UGC Care Group 1 Journal

● Kotler, Philip dan A.B. Susanto. 2000. Manajemen Pemasaran: Analisis, Perencanaan, Implementasi, dan

Pengendalian. Salemba Empat. Yogyakarta.

● Kurniasih, Apriyani. 2012. “Penabung BCA Masih Paling Loyal”. Infobank. No. 394. Vol. XXXIII. Januari:

24-28.

● Lestari, Hestu. 2013. Uji Linieritas. Statistika Pendidikan. http//:statistikapendidikan.com.

● Lovelock, C. H., P. G. Patterson, dan R. H. Walter. 1998. Service Marketing: Australia and New Zealand.

Prentice Hall. Sydney.

● Lovelock, Christopher H. and L.K. Wright. 2007. Service Marketing Management. Prentice- Hall, Inc. New

Jersey. Diterjemahkan oleh Agus Widyantoro dan tim. 2005. Manajemen Pemasaran Jasa. Cetakan ke 2. PT.

Macanan Jaya Cemerlang. Jakarta.

● Makanyeza, C., Makanyeza, C., Chikazhe, L., & Chikazhe, L. (2017). Mediators of the relationship between

service quality and customer loyalty: Evidence from the banking sector in Zimbabwe. International Journal

of Bank Marketing, 35(3), 540–556.

● Martins, C., Oliveira, T., & Popovič, A. (2014). Understanding the Internet banking adoption: A unified theory of

acceptance and use of technology and perceived risk application. International Journal of Information

Management, 34(1), 1–13. https://doi.org/10.1016/j.ijinfomgt.2013.06.002

● McGrath, C., & Astell, A. (2017). The benefits and barriers to technology acquisition: Understanding the

decision- making processes of older adults with age-related vision loss (ARVL). British Journal of Occupational

Therapy, 80(2),123–131. https://doi.org/10.1177/0308022616667959

● Meuter, M.L., A.L. Ostrom, R.I. Roundtree, and M.J. Bitner. 2000. “Self-service technologies:

understanding customer satisfaction with technology-based service encounters”, Journal of Marketing, Vol.

64 No. 3: 50-64.

● Mohsan, Faizan, M.M. Nawaz, M. S. Khan, Z. Shaukat, and N. Aslam. 2011. “Impact of Customer

Satisfaction on Customer Loyalty and Intentions to Switch: Evidence from Banking Sector of

Pakistan”. International Journal of Business and Social Science. Vol. 2 No. 16. September: 263-

270.

● Mols, P., 1998. “The behavioral consequences of PC banking”, International Journal of Bank

Marketing, Vol. 16 No. 5: 195-201.

● Moorman, C., G. Zaltman, and R. Deshpande. 1992. “Relationships Between Providers and Users

of Marketing Research: The Dynamics of Trust Within and Between Organizations,”Journal of

Marketing Research. Vol.29, August: 314-329.

● Morgan, Robert M and Hunt, Shelby D., 1994. “The Commitment Trust Theory of Relationship

Marketing,” Journal of Marketing, Vol.58, July: 20-28.

● Ndubisi, Nelson O., 2007. “Relationship marketing and customer loyalty”. Marketing Intelligence

& Planning. Vol. 25 No. 1: 98- 106.

● Oliver, Richard L., 1993. “A Conceptual model of service quality and service satisfaction:

compatible goals, different concept”. Advance in Service Marketing and Management, Vol.2: 65-

85.

● Oliver, Richard. 1996. Satisfaction a behavior perspective on the customer. Mc Graw Hill. New

York.

● Parasuraman, A, V.A. Zeithami and L.L Berry. 1988. “ A Multiple-Item Scale for Measuring

Consumer Consumer Perceptions of Service Quality,” Journal of Retailing, Vol.64: 12-40.

● Parasuraman, A, V.A. Zeithami and L.L Berry. 1990. Delivering Quality Service Balancing

Customer Perceptions and Expectation. The Fress Press, New York.

● Parasuraman, A, V.A. Zeithami and L.L Berry. 1994. “Reassessment of Expectations as a

Comparison Standar in Measuring Service Quality: Implication for Further Research“. Journal of

Marketing, January (58):111-124.

● Parasuraman, A., 2000. “Technology readiness index (TRI): a multiple-item scale to measure

readiness to embrace new technologies”, Journal of Service Research, Vol. 2 No. 4: 307-20.

● Parasuraman, A., V.A. Zeithaml, and L.L. Berry. .1985. „„A conceptual model of service quality

and its implications for future research‟‟. Journal of Marketing, Vol. 49: 41-50.

Vol. 16, No.4 (II), October - December 2022 191

JOURNAL OF MANAGEMENT & ENTREPRENEURSHIP

ISSN : 2229-5348

UGC Care Group 1 Journal

● Prasad, Ch. J. S. and A. R. Aryasri. 2008. Study of customer relationship marketing practices in

organized retailing in food and grocery sector in India: An empirical analysis. The Journal of

Business Perspective. Vol. 12 No. 4: 33-43.

● Proenca, Joao F. and M.A. Rodrigues. 2011. A comparison of users and non-users of banking self-

service technology in Portugal. Managing Service Quality. Vol. 21 No. 2: 192-210.

● Ranaweera, C. and Prabhu, J. 2003. “The influence of satisfaction, trust and switching barriers on

customer retention in a continuous purchase setting”. International Journal of Service Industry

Management. Vol. 14 (4): 374-95.

● Reichheld, F.E. and Sasser, W.E. Jr. 1990. “Jr Zero defections: Quality comes to service”. Harvard

Business Review.Vol. 68: 105-11.

● Sin, Leo Y.M., Tse and Yan. 2002. “The effect of relationship marketing orientation on business

performance in a service oriented economy”, JQSM, Vol. 16. No.7.

● Singarimbun, Masri dan Sofian Effendi. 2011. Metode Penelitian Survei. Cetakan keempat.

Penerbit LP3ES. Jakarta.

● Sivadass, E. and J.L. Baker-Prewitt. 2000. “An Examination of the Relationship between Service

Quality, Customer Satisfaction, and Store Loyalty”. International Journal of Retail & Distribution

Management, 28 (2): 73-82.

● Srinivasan, Madhav. 1996. “New Insights into Switching Customer Behavior”. Journal of

Marketing Research. Vol. 8 No. 3: 27-28.

● Subkhan, Farid. 2012. “Empat Tahap Mengukur Indeks Loyalitas”. Infobank. No. 394. Vol.

XXXIII. Januari: 22-23.

● Tjiptono, Fandy dan G. Chandra. 2005. Service, Quality & Satisfaction. Penerbit Andi. Yogyakarta.

● Too, Leanne H.Y, Souchon Anne L, and Thirkell Peter C., 2000. “Relationship Marketing and

Customer Loyalty in A Retail Setting: A Dyadic Exploration”. Aston Bussines School Research

Institute. June: 1-36.

● Tsou, H.-T., & Hsu, H.-Y. (2017). Self-Service technology investment, electronic customer relationship

management practices, and service innovation capability. In Marketing at the Confluence between

Entertainment and Analytics (pp. 477–481). Berlin: Springer. https://doi.org/10.1007/978-3-319-

47331-4

● Turner, T., & Shockley, J. (2014). Creating shopper value: Co- creation roles, in-store self-service

technology use, and value differentiation. Journal of Promotion Management, 20(3), 311–327.

https://doi.org/10.1080/10496491.2014.885480

● Vol. 29 No.1: 3-12.

● Wallace, D., J. Giese, J. Johnson. 2004. “Customer retailer loyalty in the context of multiple

channel strategies”. J. Retail. 80(4): 249– 263.

● Wang, Y., So, K. K. F., & Sparks, B. A. (2017). Technology readiness and customer satisfaction with

travel technologies: A cross-country investigation. Journal of Travel Research, 56(5), 563–577.

https://doi.org/10.1177/0047287516657891

● Xu, X., Thong, J. Y., & Venkatesh, V. (2014). Effects of ICT service innovation and complementary

strategies on brand equity and customer loyalty in a consumer technology market. Information Systems

Research, 25(4), 710–729. https://doi.org/10.1287/isre.2014.0540

● Yeo, V. C. S., Goh, S.-K., & Rezaei, S. (2017). Consumer experiences, attitude and behavioral intention

towardonline food delivery (OFD) services. Journal of Retailingand Consumer Services, 35, 150–162.

https://doi.org/10.1016/j.jretconser.2016.12.013

● Zeithaml, Valerie A., 1988. "Consumer Perceptions of Price, Quality, and Value: A Means-End

Model and Synthesis of Evidence", Journal of Marketing, Volume 52, Number 3: 2-22.

● Zeithaml, Valerie A., L.L. Berry, L.L. and A. Parasuraman. 1996. “The behavioural consequences

of service quality”. Journal of Marketing. Vol. 60: 31-46.

Vol. 16, No.4 (II), October - December 2022 192

View publication stats

You might also like

- Perceptions of Customers On Implementation of Internet Banking in IndiaDocument8 pagesPerceptions of Customers On Implementation of Internet Banking in IndiaRakeshconclaveNo ratings yet

- Digital Banking Services Customer PerspectivesDocument7 pagesDigital Banking Services Customer PerspectivesAltaf ShaikhNo ratings yet

- Study of Internet Banking Scenario in IndiaDocument6 pagesStudy of Internet Banking Scenario in IndiaShabeerNo ratings yet

- IJRBM - Review of The Literature On The Electronic Banking Adoption Bankers PerspectiveDocument10 pagesIJRBM - Review of The Literature On The Electronic Banking Adoption Bankers PerspectiveImpact JournalsNo ratings yet

- Practice of E-Banking in Commercial Bank: An Empirical Study in BangladeshDocument11 pagesPractice of E-Banking in Commercial Bank: An Empirical Study in Bangladeshmamun khanNo ratings yet

- Analysis of Perception of The Customers Towards Digitization of Banking SectorDocument11 pagesAnalysis of Perception of The Customers Towards Digitization of Banking SectorHARSH MALPANINo ratings yet

- 1..research Paper-FebDocument18 pages1..research Paper-FebPooja AdhikariNo ratings yet

- 1..research Paper-FebDocument18 pages1..research Paper-FebShivangi SinghNo ratings yet

- 1..research Paper FebDocument18 pages1..research Paper FebABHISHEK CHATTERJEENo ratings yet

- Factors Affection Intention To Use On The Digital Banking ServicesDocument14 pagesFactors Affection Intention To Use On The Digital Banking ServicesTrishia CabasagNo ratings yet

- E Banking in India A Case Study of KanDocument12 pagesE Banking in India A Case Study of KanPrathameshNo ratings yet

- Customer Experience With Digital LendingDocument16 pagesCustomer Experience With Digital LendingYOGESH AGGARWALNo ratings yet

- E BankingDocument72 pagesE Bankingmuhammad_hasnai243850% (2)

- ALiterature Study of Consumer Perception Towards Digital Payment Mode in IndiaDocument17 pagesALiterature Study of Consumer Perception Towards Digital Payment Mode in IndiaManipal SinghNo ratings yet

- Literature ReviewDocument4 pagesLiterature Reviewdivya100% (1)

- Electronic Banking and Customer Satisfaction in Rwanda A Study On Bank of Kigali, RwandaDocument10 pagesElectronic Banking and Customer Satisfaction in Rwanda A Study On Bank of Kigali, RwandaEditor IJTSRDNo ratings yet

- A Study of Consumer Behavior Towards E-Banking Services in Faridabad CityDocument9 pagesA Study of Consumer Behavior Towards E-Banking Services in Faridabad CityNguyễn Ngọc Đoan DuyênNo ratings yet

- A Study of Consumer Behavior Towards E-Banking Services in Faridabad CityDocument9 pagesA Study of Consumer Behavior Towards E-Banking Services in Faridabad CityNguyễn Ngọc Đoan DuyênNo ratings yet

- Chapter 1 PDFDocument26 pagesChapter 1 PDFPriyanka KanseNo ratings yet

- E BANKING Intro To CV Nov 22Document111 pagesE BANKING Intro To CV Nov 22PaupauNo ratings yet

- 72pada CSITEdDocument16 pages72pada CSITEdHamid ihsanNo ratings yet

- RELEVANCE OF ONLINE BANKING FOR UEP STUDENTSDocument35 pagesRELEVANCE OF ONLINE BANKING FOR UEP STUDENTSEstrada, Jemuel A.No ratings yet

- Factors Affecting Internet Banking Adoption Among Internal and External Customers: A Case of PakistanDocument15 pagesFactors Affecting Internet Banking Adoption Among Internal and External Customers: A Case of PakistanFAHEEMNo ratings yet

- Exploring The Role of Trust in Mobile-Banking Use by Indonesian Customer Using Unified Theory of Acceptance and Usage TechnologyDocument10 pagesExploring The Role of Trust in Mobile-Banking Use by Indonesian Customer Using Unified Theory of Acceptance and Usage TechnologyNaveed AhmadNo ratings yet

- 1018am - 72.EPRA JOURNALS 10728Document7 pages1018am - 72.EPRA JOURNALS 10728shamelesss.0724No ratings yet

- 108am - 2.epra Journals 5833Document5 pages108am - 2.epra Journals 5833roilesatheaNo ratings yet

- Problems Faced by Consumers While Using Internet Banking Services A SurveyDocument12 pagesProblems Faced by Consumers While Using Internet Banking Services A Surveyarcherselevators0% (1)

- Customer Perception Towards E-Banking Services: A Study On Public and Private BanksDocument7 pagesCustomer Perception Towards E-Banking Services: A Study On Public and Private BanksIJRASETPublicationsNo ratings yet

- Onlinejournal - Aue ChitkarauivprocedingsDocument7 pagesOnlinejournal - Aue ChitkarauivprocedingsMita DasNo ratings yet

- Understanding Online Banking Adoption in A Developing CountryDocument23 pagesUnderstanding Online Banking Adoption in A Developing CountryMuhammad AsifNo ratings yet

- Google Pay vs Paytm Usage and Satisfaction StudyDocument7 pagesGoogle Pay vs Paytm Usage and Satisfaction StudySakina Khatoon 10No ratings yet

- An Essential Review of Internet Banking Services in Developing CountriesDocument15 pagesAn Essential Review of Internet Banking Services in Developing CountriesKAUSHLESH CHOUDHARYNo ratings yet

- (45-54) Factors Influencing Online Banking Customer Satisfaction and Their Importance in Improving Overall Retention LevelsDocument10 pages(45-54) Factors Influencing Online Banking Customer Satisfaction and Their Importance in Improving Overall Retention LevelsiisteNo ratings yet

- Perception of Internet BankingDocument15 pagesPerception of Internet BankingFeral DsouzaNo ratings yet

- Customer Perception On E-Banking Services of Public and Private Sector Banks in Hyderabad RegionDocument13 pagesCustomer Perception On E-Banking Services of Public and Private Sector Banks in Hyderabad RegionIJRASETPublicationsNo ratings yet

- Consumer Perception On Influence of Technology in Banking SectorDocument8 pagesConsumer Perception On Influence of Technology in Banking SectorIJRASETPublicationsNo ratings yet

- A Study On Customer's Perception and Satisfaction Towards Electronic Banking in Khammam DistrictDocument8 pagesA Study On Customer's Perception and Satisfaction Towards Electronic Banking in Khammam DistrictIOSRjournalNo ratings yet

- Electronic Banking in India-366 PDFDocument8 pagesElectronic Banking in India-366 PDFAmal HameedNo ratings yet

- Users' Preference Towards Traditional Banking Versus E-Banking - An Analysis Dr. S. Anthony Rahul GoldenDocument6 pagesUsers' Preference Towards Traditional Banking Versus E-Banking - An Analysis Dr. S. Anthony Rahul GoldenOmotayo AkinpelumiNo ratings yet

- Customers Perception of Online Banking in QatarDocument12 pagesCustomers Perception of Online Banking in QatarmuinbossNo ratings yet

- A Literature Study of Consumer Perception Towards Digital Payment Mode in IndiaDocument16 pagesA Literature Study of Consumer Perception Towards Digital Payment Mode in IndiaSimon ShresthaNo ratings yet

- Role of Technology in Banking-6748Document4 pagesRole of Technology in Banking-6748d Vaishnavi OsmaniaUniversityNo ratings yet

- Agyei2021-Trust To BI in IBDocument19 pagesAgyei2021-Trust To BI in IBGreta WidiarNo ratings yet

- Bharati Vidyapeeth Institute of Management and Research MBA (Masters of Business Administratio)Document19 pagesBharati Vidyapeeth Institute of Management and Research MBA (Masters of Business Administratio)nisha chopraNo ratings yet

- Use of technology transforms banking sectorDocument10 pagesUse of technology transforms banking sectorjavaid IqbalNo ratings yet

- 5 Epra+journals+12158Document4 pages5 Epra+journals+12158Chiara WhiteNo ratings yet

- Role of E - Banking Services in The Banking Sector: ProfDocument10 pagesRole of E - Banking Services in The Banking Sector: ProfArjun Prasad RijalNo ratings yet

- NupurDocument12 pagesNupursagarsbhNo ratings yet

- HDFC NetBanking SynopsisDocument5 pagesHDFC NetBanking SynopsisPranavi Paul PandeyNo ratings yet

- E-BANKING_OPPORTUNITIES_AND_CHALLENGES_IN_INDIA (1)Document21 pagesE-BANKING_OPPORTUNITIES_AND_CHALLENGES_IN_INDIA (1)Sheetal SaylekarNo ratings yet

- I J M E R: Online Copy Available: WWW - Ijmer.inDocument8 pagesI J M E R: Online Copy Available: WWW - Ijmer.insatish kumar jhaNo ratings yet

- E-Banking in India: Current and Future Prospects: January 2016Document14 pagesE-Banking in India: Current and Future Prospects: January 2016Varsha GuptaNo ratings yet

- 5cdd76ffc710d GladysC - DakaDocument11 pages5cdd76ffc710d GladysC - Dakakktok520No ratings yet

- SECURITY ISSUES IN E-BANKINGDocument16 pagesSECURITY ISSUES IN E-BANKINGmansiNo ratings yet

- Security Issues in E-Banking An ExplDocument19 pagesSecurity Issues in E-Banking An ExplVijayendra GuptaNo ratings yet

- Impact of Mobile Banking On Customer Satisfaction: A Study With Special Reference To Addis Ababa, EthiopiaDocument7 pagesImpact of Mobile Banking On Customer Satisfaction: A Study With Special Reference To Addis Ababa, EthiopiaGedionNo ratings yet

- Internet Banking in Sri Lanka - Customer Concern: Pratheesh. N, Pretheeba PDocument5 pagesInternet Banking in Sri Lanka - Customer Concern: Pratheesh. N, Pretheeba PPretheeba PratheeshNo ratings yet

- BEHAVIOURAL INFLUENCE OF SELF-SERVICE TECHNOLOGY IN MANAGING INTERFACE IN THE AVIATION INDUSTRYFrom EverandBEHAVIOURAL INFLUENCE OF SELF-SERVICE TECHNOLOGY IN MANAGING INTERFACE IN THE AVIATION INDUSTRYNo ratings yet

- ANALYSIS OF CONSUMERS PERCEPTION TOWARDS DIGITALIZATION IN BANKING SECTOR WITH SPECIAL-with-cover-page-v2Document9 pagesANALYSIS OF CONSUMERS PERCEPTION TOWARDS DIGITALIZATION IN BANKING SECTOR WITH SPECIAL-with-cover-page-v2Shweta ChaudharyNo ratings yet

- EC-Council Certification Path Senior Security Forensics Advanced Disaster Recovery Secure Programmer LawyersDocument1 pageEC-Council Certification Path Senior Security Forensics Advanced Disaster Recovery Secure Programmer Lawyersrusty rawatNo ratings yet

- P 11.4A Pressurization System InspectionDocument3 pagesP 11.4A Pressurization System Inspectioncrye shotNo ratings yet

- Non Faculty Application FormDocument6 pagesNon Faculty Application FormBharat KumarNo ratings yet

- RSP Robinson R44 Quick Start Guide BETA1.1Document14 pagesRSP Robinson R44 Quick Start Guide BETA1.1CristianoVelosodeQueirozNo ratings yet

- AWS Global Infra, IAM - DoneDocument6 pagesAWS Global Infra, IAM - DoneFazir M FahmyNo ratings yet

- Object-Oriented Programming Assignment 2 - Library Management SystemDocument13 pagesObject-Oriented Programming Assignment 2 - Library Management SystemMohamed AhmedNo ratings yet

- Unit 1Document112 pagesUnit 1gemerb505No ratings yet

- Service & Support: Communication Between SIMATIC S5 and Simatic S7 Over ProfibusDocument30 pagesService & Support: Communication Between SIMATIC S5 and Simatic S7 Over ProfibusMhd Samer AlHamwiNo ratings yet

- AIRPORTS AUTHORITY OF INDIA I CardDocument2 pagesAIRPORTS AUTHORITY OF INDIA I Cardkallul5551350100% (1)

- USA IT Staffing - Roles of Bench Sale RecruitersDocument37 pagesUSA IT Staffing - Roles of Bench Sale Recruitersyaminika singereddyNo ratings yet

- Develop Calendar App in CDocument5 pagesDevelop Calendar App in CAshish AmbiNo ratings yet

- Stat Lesson 1 PDFDocument19 pagesStat Lesson 1 PDFCharles Contridas100% (1)

- Employee Payroll System ProjectDocument21 pagesEmployee Payroll System ProjectZeeshan Hyder BhattiNo ratings yet

- Modelica03 AdvancedTutorialDocument34 pagesModelica03 AdvancedTutorialWuberestNo ratings yet

- Vb2012me Preview PDFDocument39 pagesVb2012me Preview PDFsomaliyow17No ratings yet

- RULES and GUIDELINES Extempo and Poster Making ContestDocument4 pagesRULES and GUIDELINES Extempo and Poster Making ContestChrisa C. TabiliranNo ratings yet

- CMT1Document10 pagesCMT1Dongneu Nguyen100% (1)

- Progress Test 02Document21 pagesProgress Test 02andrewlaurenNo ratings yet

- Electrode Selection As Per Base Metal With Preheat, Postheat and Hardness DetailsDocument1 pageElectrode Selection As Per Base Metal With Preheat, Postheat and Hardness DetailsJlkKumar100% (1)