Professional Documents

Culture Documents

Slides

Slides

Uploaded by

////Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Slides

Slides

Uploaded by

////Copyright:

Available Formats

Briefing Session of Revisions to

Consolidated Results Forecasts

Fiscal Year Ending March 31, 2013

March 26, 2013

1 SQUARE ENIX HOLDINGS CO., LTD.

Statements made in this document with respect to SQUARE ENIX HOLDINGS CO., LTD. and its

consolidated subsidiaries' (together, “SQUARE ENIX GROUP") plans, estimates, strategies and beliefs are

forward-looking statements about the future performance of SQUARE ENIX GROUP.

These statements are based on management's assumptions and beliefs in light of information available to it

at the time these material were drafted and, therefore, the reader should not place undue reliance on them.

Also, the reader should not assume that statements made in this document will remain accurate or operative at

a later time.

A number of factors could cause actual results to be materially different from and worse than those

discussed in forward-looking statements. Such factors include, but not limited to:

1. changes in economic conditions affecting our operations;

2. fluctuations in currency exchange rates, particularly with respect to the value of the Japanese

yen, the U.S. dollar and the Euro;

3. SQUARE ENIX GROUP’s ability to continue to win acceptance of our products and services, which are

offered in highly competitive markets characterized by the continuous introduction of new products and

services, rapid developments in technology, and subjective and changing consumer

preferences;

4. SQUARE ENIX GROUP’s ability to expand international success with a focus on our businesses; and

5. regulatory developments and changes and our ability to respond and adapt to those changes.

The forward-looking statements regarding earnings contained in these materials were valid at the time these

materials were drafted. SQUARE ENIX GROUP assumes no obligation to update or revise any forward-looking

statements, including forecasts or projections, whether as a result of new information, subsequent events or

otherwise.

The financial information presented in this document is prepared according to generally accepted accounting

principles in Japan.

2 SQUARE ENIX HOLDINGS CO., LTD.

Revisions to

Consolidated Results Forecasts

Fiscal Year Ending March 31, 2013

3 SQUARE ENIX HOLDINGS CO., LTD.

Fiscal Year Ending March 31, 2013 Forecast

Billions of Yen

Previous forecasts(*) Revised forecasts

% % Change

Net Sales 150.0 100% 145.0 100% (5.0)

Operating Income 7.5 5% (6.0) - (13.5)

Recurring Income 6.5 4% (5.0) - (11.5)

Net Income 3.5 2% (13.0) - (16.5)

*Based on the results forecasts announced on October 30. 2012

(Ref.) Comparisons with the previous fiscal year

Billions of Yen

Fiscal Year Fiscal Year

Ended 3/12 % Ending 3/13 % Change

Net Sales 127.9 100% 145.0 100% 17.1

Operating Income 10.7 8% (6.0) - (16.7)

Recurring Income 10.3 8% (5.0) - (15.3)

Net Income 6.1 5% (13.0) - (19.1)

4 SQUARE ENIX HOLDINGS CO., LTD.

Fiscal Year Ending March 31, 2013 Forecast by Business Segment

①Fiscal Year Ending March 31, 2013 Forecast (Revised)

Billions of Yen

Digital Eliminations

Amusement Publication Merchandising Total

Entertainment or unallocated

Net Sales 87.0 44.0 11.0 3.0 (0.0) 145.0

Operating Income 1.0 (0.5) 2.2 0.5 (9.2) (6.0)

Operating Margin 1.1% - 20.0% 16.7% - -

②Fiscal Year Ending March 31, 2013 Forecast (Previous)

Billions of Yen

Digital Eliminations

Amusement Publication Merchandising Total

Entertainment or unallocated

Net Sales 94.5 43.0 9.5 3.0 (0.0) 150.0

Operating Income 13.8 0.0 1.5 0.5 (8.3) 7.5

Operating Margin 14.6% - 15.8% 16.7% - 5.0%

③Changes(①-②)

Billions of Yen

Digital Eliminations

Amusement Publication Merchandising Total

Entertainment or unallocated

Net Sales (7.5) 1.0 1.5 - (0.0) (5.0)

Operating Income (12.8) (0.5) 0.7 - (0.9) (13.5)

5 SQUARE ENIX HOLDINGS CO., LTD.

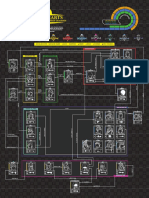

Net Sales by Business Segment

■ Digital Entertainment

■ Amusement

(Billions of Yen)

■ Publication

192.3

200.0 ■ Merchandising

150.0

150.0 145.0

135.7

120.1 125.3 127.9

59.1 87.0 94.5

100.0

64.2 71.9

50.0 59.9 52.3

45.0 41.9 44.0 43.0

13.0 14.4 13.0 11.3 11.0 9.5

0.0 3.8 5.5 3.0 2.8 3.0 3.0

2009/3 2010/3 2011/3 2012/3 2013/3 2013/3

(Revised) (Previous)

(Projections)

6 SQUARE ENIX HOLDINGS CO., LTD.

Operating Income by Business Segment

■ Digital Entertainment

(Billions of Yen)

■ Amusement

40.0 28.2

■ Publication

1.8

35.0 ■ Merchandising

4.1

30.0 2.9

Operating Income

25.0

12.3 10.7

7.3

20.0 0.8 0.7 7.5

0.7 2.6

3.5

15.0 28.4 3.2

2.6

0.5

1.5

3.2 2.2

10.0

▲6.0

11.0 11.3 12.6 13.8

5.0 0.5

2.2

0.0 1.0

-0.5

2009/3 2010/3 2011/3 2012/3

-5.0

2013/3 2013/3

(Revised) (Previous)

(Projections)

7 SQUARE ENIX HOLDINGS CO., LTD.

Digital Entertainment Segment-Net Sales

■ HD Games

■ Social Gaming and Others

(Billions of Yen) ■ MMO

150.0

120.1

94.5

100.0 87.0

71.9

59.1 64.2

50.0

0.0

2009/3 2010/3 2011/3 2012/3 2013/3 2013/3

(Revised) (Previous)

(Projections)

8 SQUARE ENIX HOLDINGS CO., LTD.

Digital Entertainment Segment- HD Games

Weak sales of big console titles in NA and EU.

・The latest situations:

*1

Title Release Date Metascore Expected Units Sold in FY13 *2

SLEEPING DOGS Aug. 2012 Approx. 1.75 Millions

HITMAN: ABSOLUTION Nov. 2012 Approx. 3.6 Millions

TOMB RAIDER Mar. 2013 Approx. 3.4 Millions

*1 An average of scores for X360/PS3/PC versions.

*2 Not including download.

- Despite the high critical acclaim, failed to meet each target.

- In particular, NA sales force was ineffective, ending up with 2/3

of number of units sold in Europe.

- Moreover, price pressure was strong, which forced spending

additional channel costs such as price protection.

9 SQUARE ENIX HOLDINGS CO., LTD.

Digital Entertainment Segment

- Social Gaming and Others

(Billions of Yen)

8.0

7.0

6.0

5.0

4.0

3.0

2.0

1.0

0.0

2012/3 2013/3

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q (Forecast)

Steady increase in profit through tightened development and KPI

managements.

10 SQUARE ENIX HOLDINGS CO., LTD.

Digital Entertainment Segment

- Social Gaming and Others

- Major titles released in Japan are growing steadily.

- Successfully started in the Asian markets

(“Million Arthur” became a smash hit in Korea).

(A Major Title in Japan- “Sengoku IXA Chiyorozunohasya) (“Million Arthur ” in Korea)

© 2012 SQUARE ENIX CO., LTD. All Rights Reserved. ©2012-2013 SQUARE ENIX CO., LTD. All Rights Reserved.

Published by Actoz Soft

- A smartphone version of “Sengoku -“Million Arthur,” a megahit title in

IXA,” the long-run popular PC online Japan since Apr. 2012, started

game since Aug. 2010. service in Korea from Dec. 2012. *

- Launched in Apr. 2012. - Registered users exceeded 1 million

- Acquired 450K+ registered users. only in two months.

*Operated by Actoz Soft, a Korean game company,

under license by Square Enix.

11 SQUARE ENIX HOLDINGS CO., LTD.

Extraordinary Loss

In view of the rapidly changing environment of the game

businesses, extraordinary loss (loss from restructuring) of

approximately ¥10 billion will be incurred.

Major items:

- Loss on disposal of content : approximately ¥4 billion,

- Loss on evaluation of content: approximately ¥4 billion

- Others: approximately ¥2 billion.

12 SQUARE ENIX HOLDINGS CO., LTD.

Rebuild the Management Team

13 SQUARE ENIX HOLDINGS CO., LTD.

Refresh the long-serving management team

since the Company’s establishment in 2003

to advance thorough structural reforms.

- Wada, President and Representative Director, will not

be re-elected as director at the expiration of the current

term until late Jun. 2013. *

- President candidate is Yosuke Matsuda, Representative

Director. **

- Phil Rogers will be nominated as a director candidate. **

- Matsuda is selecting the other board members.

* Directors’ term of office is 1 year under the Company’s Articles of Incorporation.

** Subject to resolutions by the Company’s annual general meeting of shareholders

to be held in late Jun. 2013.

14 SQUARE ENIX HOLDINGS CO., LTD.

Briefing Session of Revisions to

Consolidated Results Forecasts

Fiscal Year Ending March 31, 2013

March 26, 2013

15 SQUARE ENIX HOLDINGS CO., LTD.

You might also like

- Final Fantasy XIII Piano CollectionsDocument55 pagesFinal Fantasy XIII Piano Collectionssesshomaru12345688% (24)

- Chrono Trigger - Flames of Eternity Mini GuideDocument9 pagesChrono Trigger - Flames of Eternity Mini GuideAnonymous BWVVQpxNo ratings yet

- Cmalbertsen0131 Fin311 HW 1Document6 pagesCmalbertsen0131 Fin311 HW 1api-575715390No ratings yet

- Aerith's Theme (Lonlonjp Version)Document3 pagesAerith's Theme (Lonlonjp Version)Karam M. Bouzid100% (1)

- Final Fantasy - Prelude (Guitar) (Arr. by Dåvid Luis)Document2 pagesFinal Fantasy - Prelude (Guitar) (Arr. by Dåvid Luis)Ultramelodic100% (2)

- Nintendo Power - Final Fantasy Crystal ChroniclesDocument148 pagesNintendo Power - Final Fantasy Crystal ChroniclesPedro Ernias100% (4)

- 1000 Words Final Fantasy X-2 Piano Music SheetDocument6 pages1000 Words Final Fantasy X-2 Piano Music SheetKitty YuffieNo ratings yet

- NYSF Practice TemplateDocument22 pagesNYSF Practice TemplaterapsjadeNo ratings yet

- New Heritage Doll CompanyDocument11 pagesNew Heritage Doll CompanyLightning SalehNo ratings yet

- Tidus Yuna ThemeDocument3 pagesTidus Yuna ThemePatrick QuimioNo ratings yet

- Time Scar (Lonlonjp Version)Document4 pagesTime Scar (Lonlonjp Version)Lance King100% (2)

- Honeywell Automation India Ltd. (India) : INR / Ten Millions 2020 Y 2019 YDocument2 pagesHoneywell Automation India Ltd. (India) : INR / Ten Millions 2020 Y 2019 YNishalNo ratings yet

- Nokia Results 2023 q2Document31 pagesNokia Results 2023 q2yalemorgan69No ratings yet

- YHOO Q110EarningsPresentation FinalDocument23 pagesYHOO Q110EarningsPresentation Finalhblodget6728No ratings yet

- Lenovo Group Limited 2013/14 Annual Report: Stock Code 992Document199 pagesLenovo Group Limited 2013/14 Annual Report: Stock Code 992Emanuel LaraNo ratings yet

- FR 2021Document165 pagesFR 2021Bunny KanungoNo ratings yet

- Fundamental Analysis of Bosch (BOSCH LTD)Document6 pagesFundamental Analysis of Bosch (BOSCH LTD)Jeffry MahiNo ratings yet

- Date Fin Si Indicatori METROREXDocument26 pagesDate Fin Si Indicatori METROREXPepi KaNo ratings yet

- BKSL 2011 ArDocument175 pagesBKSL 2011 ArPanama TreasureNo ratings yet

- Minexpo 2016: Rod Schrader, Chairman and Ceo Komatsu America CorpDocument30 pagesMinexpo 2016: Rod Schrader, Chairman and Ceo Komatsu America CorpSebastian MaggioraNo ratings yet

- Fiscal Year 2022 Interim Report: ( (KlelwDocument31 pagesFiscal Year 2022 Interim Report: ( (KlelwdgafghfdgdhNo ratings yet

- FY2020 Q1 Presentation MaterialsDocument21 pagesFY2020 Q1 Presentation MaterialsJanet1403No ratings yet

- Workbook CH 7Document6 pagesWorkbook CH 7Perencanaan Itjen KemdikbudNo ratings yet

- Date Fin Si Indicatori SATBDocument25 pagesDate Fin Si Indicatori SATBPepi KaNo ratings yet

- Nissan Motor Co., LTD.: Financial Information As of March 31, 2021Document156 pagesNissan Motor Co., LTD.: Financial Information As of March 31, 2021Noura KakiNo ratings yet

- Complete Report of Apple Inc, Financial Statements AnalysisDocument12 pagesComplete Report of Apple Inc, Financial Statements AnalysisDOWLA KHANNo ratings yet

- Ratio - Tesco AssignmentDocument11 pagesRatio - Tesco AssignmentaXnIkaran100% (1)

- Q2 Presentation 2018-19Document14 pagesQ2 Presentation 2018-19Archana patilNo ratings yet

- AR Ali 101Document1 pageAR Ali 101Lieder CLNo ratings yet

- Trabajo 123Document30 pagesTrabajo 123GIANPIER YNOCENTE SANCHEZNo ratings yet

- Chapter 12. Tool Kit For Financial Planning and Forecasting Financial StatementsDocument57 pagesChapter 12. Tool Kit For Financial Planning and Forecasting Financial StatementsHenry RizqyNo ratings yet

- Ch05 - Basics of AnalysisDocument37 pagesCh05 - Basics of AnalysisSamar MessaoudNo ratings yet

- Nestle Holdings Inc Financial Statements 2020Document72 pagesNestle Holdings Inc Financial Statements 2020Michael ScottNo ratings yet

- MBA FM - 3102 Security Analysis and Portfolio ManagementDocument6 pagesMBA FM - 3102 Security Analysis and Portfolio ManagementAsh KoulNo ratings yet

- TOMY Company LTD.: Fiscal Year 2013 1 Half (6 Months) Results (April 1, 2013 - September 30, 2013)Document24 pagesTOMY Company LTD.: Fiscal Year 2013 1 Half (6 Months) Results (April 1, 2013 - September 30, 2013)Sharingan ShenaniganNo ratings yet

- BN1190 - IT in BusinessDocument17 pagesBN1190 - IT in BusinessAshar Sultan KayaniNo ratings yet

- 2015 Annual Report: Maple Leaf Foods IncDocument94 pages2015 Annual Report: Maple Leaf Foods IncElijah TaylorNo ratings yet

- Comparative StatementDocument21 pagesComparative StatementMukulNo ratings yet

- Annual Report 2020 SudiDocument110 pagesAnnual Report 2020 SudinamasayanazlyaNo ratings yet

- NYSF Walmart Solutionv2Document41 pagesNYSF Walmart Solutionv2Vianna NgNo ratings yet

- V Guard IndustriDocument93 pagesV Guard IndustriAshley KamalasanNo ratings yet

- Unit 2Document17 pagesUnit 2hassan19951996hNo ratings yet

- Income Statement - ComparativeDocument2 pagesIncome Statement - ComparativehilarytevesNo ratings yet

- Five Years' Financial Summary: REPORT 2015Document2 pagesFive Years' Financial Summary: REPORT 2015Rizwan ZisanNo ratings yet

- Practice Questions (L4)Document58 pagesPractice Questions (L4)simraNo ratings yet

- Practice Questions (L5)Document34 pagesPractice Questions (L5)simraNo ratings yet

- Fancl Annual ReportDocument60 pagesFancl Annual ReportRosetine SewNo ratings yet

- Module 3 Problems On Income StatementDocument8 pagesModule 3 Problems On Income StatementShruthi PNo ratings yet

- A - Case Study: Dreaming Corp.: The Financial Statements of Dreaming Corp. Are The Following (In K )Document7 pagesA - Case Study: Dreaming Corp.: The Financial Statements of Dreaming Corp. Are The Following (In K )Mohamed Lamine SanohNo ratings yet

- Financial Statement Analysis: ACCT 100Document62 pagesFinancial Statement Analysis: ACCT 100Tejashri GawaiNo ratings yet

- Non Abm 1 Information Sheet 3.2Document3 pagesNon Abm 1 Information Sheet 3.2Johnmer AvelinoNo ratings yet

- Elpro International LTDDocument3 pagesElpro International LTDHimanshuNo ratings yet

- Fs With AnswersDocument8 pagesFs With AnswersJomar VillenaNo ratings yet

- Software Services Relative ValuationDocument5 pagesSoftware Services Relative ValuationSrilekha BasavojuNo ratings yet

- Vertical and Horizontal AnalysisDocument4 pagesVertical and Horizontal AnalysisEmadeldin AbdelghaniNo ratings yet

- Announcement of The Results For The Three Months Ended March 31, 2023Document27 pagesAnnouncement of The Results For The Three Months Ended March 31, 2023charles shawNo ratings yet

- Fi Nissan 2015Document139 pagesFi Nissan 2015Mehdi RostamiNo ratings yet

- 2017 Annual Financial Report TOYOTA PDFDocument109 pages2017 Annual Financial Report TOYOTA PDFrafa avisenaNo ratings yet

- Nestle Group Alternative Performance Measures February 2020 enDocument12 pagesNestle Group Alternative Performance Measures February 2020 enMehdi Ben ahmedNo ratings yet

- The Colombo Fort Land & Building PLC: Annual Report 2017/18Document156 pagesThe Colombo Fort Land & Building PLC: Annual Report 2017/18sandun suranjanNo ratings yet

- Presentacion 2019 PDFDocument9 pagesPresentacion 2019 PDFWilsonNo ratings yet

- Key Performance Indicators of The Roche GroupDocument4 pagesKey Performance Indicators of The Roche GroupSanjay RathiNo ratings yet

- Nintendo Annual ResultsDocument70 pagesNintendo Annual ResultsJosé António Cardoso RodriguesNo ratings yet

- AR Ali 102Document1 pageAR Ali 102Lieder CLNo ratings yet

- Ind-Swift LabsDocument44 pagesInd-Swift Labssingh66222No ratings yet

- Renesas 2019-Financial-ReportDocument96 pagesRenesas 2019-Financial-ReportramjiramNo ratings yet

- ROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.From EverandROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.No ratings yet

- 404 - Not Found - Providence EquityDocument2 pages404 - Not Found - Providence Equity////No ratings yet

- 410 - Page ArchivedDocument1 page410 - Page Archived////No ratings yet

- Sapio F Hands On Artificial Intelligence With Unreal Engine - PDFDocument652 pagesSapio F Hands On Artificial Intelligence With Unreal Engine - PDF////No ratings yet

- لقد اصبح موقع Telairity.com جزءا من موقع المعرفة! - موقع المعرفةDocument5 pagesلقد اصبح موقع Telairity.com جزءا من موقع المعرفة! - موقع المعرفة////No ratings yet

- ErrorDocument1 pageError////No ratings yet

- 404 Not FoundDocument1 page404 Not Found////No ratings yet

- 340177Document7 pages340177////No ratings yet

- BSI - Bundesamt Für Sicherheit in Der Informationstechnik - The Requested Page CDocument3 pagesBSI - Bundesamt Für Sicherheit in Der Informationstechnik - The Requested Page C////No ratings yet

- AxiomDocument2 pagesAxiom////No ratings yet

- SaBTO PC ReportDocument60 pagesSaBTO PC Report////No ratings yet

- 404 - File or Directory Not Found.Document1 page404 - File or Directory Not Found.////No ratings yet

- Book No 120 WebDocument18 pagesBook No 120 Web////No ratings yet

- 2014 - RT Spec Sheet ENDocument3 pages2014 - RT Spec Sheet EN////No ratings yet

- LSE Research Online: Article (Refereed)Document19 pagesLSE Research Online: Article (Refereed)////No ratings yet

- Safari - Oct 9, 2023 at 10:33 PMDocument1 pageSafari - Oct 9, 2023 at 10:33 PM////No ratings yet

- WLS4 2015 KotasekDocument14 pagesWLS4 2015 Kotasek////No ratings yet

- Witchcraft Report INSECDocument32 pagesWitchcraft Report INSEC////No ratings yet

- Usenix2010 LiDocument14 pagesUsenix2010 Li////No ratings yet

- Zelchenko Educational Leadership 02-99Document5 pagesZelchenko Educational Leadership 02-99////No ratings yet

- BDAT Specification v4.0 Draft5 - 0Document67 pagesBDAT Specification v4.0 Draft5 - 0////No ratings yet

- Call For 2020 Mars Science Rover-GDocument3 pagesCall For 2020 Mars Science Rover-G////No ratings yet

- Witzel ShamanismNorthernDocument54 pagesWitzel ShamanismNorthern////No ratings yet

- UASG021D EN EAI Readiness in TLDsDocument4 pagesUASG021D EN EAI Readiness in TLDs////No ratings yet

- US 13 Daigniere TLS Secrets SlidesDocument51 pagesUS 13 Daigniere TLS Secrets Slides////No ratings yet

- Journal of The Cork Historical and Archaeological SocietyDocument12 pagesJournal of The Cork Historical and Archaeological Society////No ratings yet

- Ben YehudaDocument14 pagesBen Yehuda////No ratings yet

- BF 03201016Document5 pagesBF 03201016////No ratings yet

- TURING Alan MathisonDocument24 pagesTURING Alan Mathison////No ratings yet

- Trev 310-LundDocument12 pagesTrev 310-Lund////No ratings yet

- Black Hole Thermodynamics: More Than An Analogy?: John Dougherty and Craig Callender October 4, 2016Document25 pagesBlack Hole Thermodynamics: More Than An Analogy?: John Dougherty and Craig Callender October 4, 2016////No ratings yet

- 1,000 Words - Final Fantasy X-2Document3 pages1,000 Words - Final Fantasy X-2yong lok ngNo ratings yet

- Scus 941.63Document2 pagesScus 941.63Abdur RafiNo ratings yet

- Aeris Theme String Quartet - Nobuo Uematsu-PartsDocument13 pagesAeris Theme String Quartet - Nobuo Uematsu-PartsMaurice Alexander OfGillan67% (3)

- Super Smash Bros. Brawl - TUBA1Document2 pagesSuper Smash Bros. Brawl - TUBA1vladsoadNo ratings yet

- Distant Worlds II BookDocument7 pagesDistant Worlds II BookJoaoPauloNo ratings yet

- Patch 2 FFX IntDocument4 pagesPatch 2 FFX Intricky changNo ratings yet

- Chrono Cross - Dream of The Shore Near Another WorldDocument1 pageChrono Cross - Dream of The Shore Near Another WorldKatsumikg100% (1)

- FF 18Document4 pagesFF 18Edru SalcedoNo ratings yet

- S UlusDocument9 pagesS UlusChristian Liyanto0% (1)

- Final Fantasy VIIDocument2 pagesFinal Fantasy VIIAndres GallegosNo ratings yet

- DDFF - Gmo ListDocument5 pagesDDFF - Gmo ListAswat Bin RidwanNo ratings yet

- Dissidia BuildsDocument14 pagesDissidia BuildsAmarantineNo ratings yet

- Soundtrack From Kamisama No Inai NichiyoubiDocument3 pagesSoundtrack From Kamisama No Inai NichiyoubiYasmin OngNo ratings yet

- Enlir's FFRK DatabaseDocument621 pagesEnlir's FFRK DatabaseAntwan HaynesNo ratings yet

- Aerith Theme Guitar TabDocument3 pagesAerith Theme Guitar TabEdwardGuangcoNo ratings yet

- Final Fantasy RPG 465464Document408 pagesFinal Fantasy RPG 465464mojmailNo ratings yet

- Frog's Theme: Arranged by Isac SalehDocument2 pagesFrog's Theme: Arranged by Isac SalehKyoka SuigetsuNo ratings yet

- Chrono Trigger Game GenieDocument6 pagesChrono Trigger Game Genieadrian_minterNo ratings yet

- Ivalice FinalDocument115 pagesIvalice FinalIlknerSilva0% (1)

- Kingdom Hearts Character Relationship DiagramDocument1 pageKingdom Hearts Character Relationship DiagramLuthfan Rasyad MaulanaNo ratings yet

- FFX 2 WalklthroughDocument5 pagesFFX 2 WalklthroughRyan FauzanNo ratings yet

- Final Fantasy 14Document8 pagesFinal Fantasy 14Nur Syamilah RazaieNo ratings yet