Professional Documents

Culture Documents

B326 TMA 23-24 (Fall) V1

Uploaded by

adel.dahbour9733%(3)33% found this document useful (3 votes)

97 views5 pagesOriginal Title

B326 TMA 23-24(Fall) V1 (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

33%(3)33% found this document useful (3 votes)

97 views5 pagesB326 TMA 23-24 (Fall) V1

Uploaded by

adel.dahbour97Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

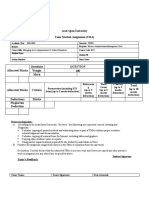

Arab Open University

B326: Advanced Financial Accounting

TMA – Fall 2023-2024 V1

Cut-Off Date: As decided by the Deanship

About TMA:

The TMA covers the advanced accounting concepts and practices in the businesses. It is marked

out of 100 and is worth 15% of the overall assessment component. This TMA requires you to apply the

course concepts. The TMA is intended to:

Assess students’ understanding of key learning points within chapter 1, 3, 4 and 5.

Increase the students’ knowledge about the reality of the advanced accounting issues.

Develop students’ communication skills, such as memo writing, essay writing, analysis and

presentation of material.

Develop the students’ ability to understand and analyze different issues that corporations might

face in real world.

Develop basic ICT skills such as using the internet.

The TMA requires you to:

1- Review various study chapters in addition to supplementary materials.

2- Conduct a deep information search using the internet and your E-Library. You are expected

to use E-library sources to support your answers. A minimum of 3 sources is required.

3- It’s imperative that you write your answer using your own words. Plagiarism will be

penalized depending on its severity and according to AOU plagiarism policy.

4- You should use a Microsoft Office Word and Times New Roman Font of 12 points.

5- You should use Harvard referencing style for in-text citation and list of references.

For Cut-off date: Check LMS

Criteria for Grade Distribution:

Content Structure

Criteri Referencing and Total

a Part A Part B Part C & E-library Presentation marks

of ideas

Marks 40 30 30 (5) (5) 100

The TMA Questions:

PART A

Access Philips Company website and download: the annual report for 2021. Note: this file is

available at:

https://www.results.philips.com/publications/ar22/downloads/pdf/en/

PhilipsFullAnnualReport2022-English.pdf?v=20230426085127

From 2021 annual report, answer the following questions:

1. Determine the total amount of non-controlling interest in 2020 & 2021and state in which

statement it is disclosed and in which section.

2. State the amount of controlling interest share and non-controlling interest share in Philips

Company’s profit for 2020 & 2021

3. State Philips Company acquisitions during 2021and the aggregated goodwill resulted from

these acquisitions. How does each acquisition affect the goodwill? Support your answer by

writhing the page number in annual report.

4. State the amounts of impairment losses of goodwill & other intangible assets in 2021.Also,

State which cash generating unit/division/segment suffered an impairment loss related to

goodwill in 2021?

5. How did Philips reflect the 2021 goodwill impairment in its in its Financial statements?

6. Philips Company prepared its consolidated financial statements in accordance with the

International Financial Reporting Standards (“IFRS”), as mentioned in its annual report.

Assuming that it was not mentioned in the annual report that the company is following

IFRS; provide evidence from annual report (related to course subjects studied) that indicate

7.

that the company is following IFRS and not following GAAP?

Write your answer in the space provided in the following table:

Answer Page(s) in

Annual report

1-

2-

3-

4-

5-

6-

*** Answers not provided in a tabular format will be disregarded

(40 marks)

PART B

1) Provide one example from the real world for successful mergers and acquisitions case in

recent years and state the specific reasons behind their success.

Notes:

Do not provide general reasons behind success [as it will not be considered]

Write your answer in the space provided in the following table:

* Names of the companies

& Detailed information about this business Reasons for Success

combination

Answers not provided in a tabular format will be disregarded.

** Examples dated before 2006 will not be considered. (10 Marks)

2) What are the different types of synergies in mergers and acquisitions?

Write your answer in the space provided in the following table:

* Type: Explanation:

….. Synergies

….. Synergies

….. Synergies

Answers not provided in a tabular format will be disregarded.

(10 Marks)

3) There are differences between the IFRS and GAAP (after FASB issued ASU 2020-04 to

simplify the accounting for goodwill impairment) regarding the following:

A. Assignment/allocation of goodwill. (i.e., The levels at which goodwill is assigned

/allocated)

B. Impairment of goodwill and test(s) applied and its steps (i.e., Methods of determining

impairment of goodwill)

C. How impairment loss is recognized and allocated. (i.e., impairment loss[charge] calculation

and allocation)

D. Amortization and impairment of intangible assets other than goodwill

Discuss the accounting treatment of the preceding points under IFRS only. (Comparison

is not required)

Write your answer in the space provided in the following table:

IFRS

A-

B-

C-

D-

(You must support your answer in this question with quality and up to date references.)

(10 Marks)

PART C

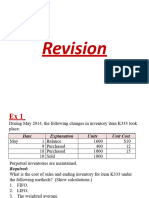

Pat Corporation acquired an 80 percent interest in Sci Corporation for $480,000 on January 1,

2021, when Sci’s stockholders’ equity consisted of $400,000 capital stock and $50,000 retained

earnings. The excess fair value over book value acquired was assigned to plant assets that were

undervalued by$100,000 and to goodwill. The undervalued plant assets had a four-year useful

life.

Additional Information

1. Pat’s account receivable includes $10,000 owed by Sci.

2. Sci mailed its check for $40,000 to Pat on December 30, 2022, in settlement of the advance.

3. A $20,000 dividend was declared by Sci on December 30, 2022, but was not recorded by

Pat.

4. Financial statements for Pat and Sci Corporations for 2022 follow (in thousands):

Statements of Income and Retained Earnings Pal Sci

for the Year Ended December 31

Sales $1,800 $600

Income from Sci 76 -

Cost of sales (1.200) (300)

Operating expenses (380) (180)

Net Income 296 120

Add: Retained earnings January 1 244 100

Less: Dividends (200)

100 (40)

Retained earnings $ 340 $180

Balance Sheet at December 31

Cash $12 $30

Accounts receivable-net 52 40

Inventories 164 120

Advance to Sci 40 -

Other current assets 160 10

Land 320 60

Plant assets—net 680 460

Investment in Sci 560

Total assets $1,988 $720

Accounts payable $48 $30

Dividends payable — 20

Other liabilities 200 90

Capital stock 1,400 400

Retained earnings 340 180

Total liabilities and stockholders' Equity $1,988 $720

Required:

1) Prepare the elimination entries required for consolidation on December 31, 2022. Show

all required computations

2) Prepare the consolidation working papers for Parent and Subsidiary for the year ended

December 31, 2022.

3) State which items have been amortized and which have not, and why?

(30 Marks)

[END OF TMA]

You might also like

- Section A - ALL 15 Questions Are Compulsory and MUST Be AttemptedDocument17 pagesSection A - ALL 15 Questions Are Compulsory and MUST Be AttemptedAdnan SiddiquiNo ratings yet

- Sir Saud Tariq: 13 Important Revision Questions On Each TopicDocument29 pagesSir Saud Tariq: 13 Important Revision Questions On Each TopicShehrozST100% (1)

- Week 13 SolutionsDocument7 pagesWeek 13 SolutionsStanley RobertNo ratings yet

- Gross Profit AnalysisDocument5 pagesGross Profit AnalysisInayat Ur RehmanNo ratings yet

- 2016 BAR EXAMINATIONS Suggested AnswersDocument11 pages2016 BAR EXAMINATIONS Suggested AnswersAudreyNo ratings yet

- Winfield Refuse Management Inc. Raising Debt vs. EquityDocument13 pagesWinfield Refuse Management Inc. Raising Debt vs. EquitynmenalopezNo ratings yet

- 6 - Dividend - DividendPolicy - FM - Mahesh MeenaDocument9 pages6 - Dividend - DividendPolicy - FM - Mahesh MeenaIshvinder SinghNo ratings yet

- MESL Compilation - Terms PDFDocument412 pagesMESL Compilation - Terms PDFJaypes ManzanoNo ratings yet

- Ias 7 Cash FlowDocument15 pagesIas 7 Cash FlowManda simzNo ratings yet

- Basic Accounting Level II by Marks SolutionsDocument63 pagesBasic Accounting Level II by Marks Solutionsganesanmani1985100% (2)

- Gagnon Company Reported The Following Sales and Quality Costs ForDocument1 pageGagnon Company Reported The Following Sales and Quality Costs ForAmit PandeyNo ratings yet

- Talk To ChuckDocument28 pagesTalk To ChuckAshish Dadoo100% (1)

- Chap 4 - IAS 36 (Questions)Document4 pagesChap 4 - IAS 36 (Questions)Kamoke LibraryNo ratings yet

- Final Chapter 2 Revised 2015Document92 pagesFinal Chapter 2 Revised 2015Nearchos A. IoannouNo ratings yet

- The Cash Account in The General Ledger of Ciavarella CorporationDocument2 pagesThe Cash Account in The General Ledger of Ciavarella Corporationamit raajNo ratings yet

- CH 03Document21 pagesCH 03Damy RoseNo ratings yet

- B326 TMA 23-24 (Fall) V1Document9 pagesB326 TMA 23-24 (Fall) V1Reham Abdelaziz100% (2)

- Statement of Cash Flows Lecture Questions and AnswersDocument9 pagesStatement of Cash Flows Lecture Questions and AnswersSaaniya AbbasiNo ratings yet

- Seminar 2-3Document8 pagesSeminar 2-3Nguyen Hien0% (1)

- Orchid LimitedDocument3 pagesOrchid LimitedANo ratings yet

- Solution Practice 6 Consolidations 3Document8 pagesSolution Practice 6 Consolidations 3Mya Hmuu KhinNo ratings yet

- Practice Questions: Global Certified Management AccountantDocument23 pagesPractice Questions: Global Certified Management AccountantThiha WinNo ratings yet

- Marginal and Absorption CostingDocument8 pagesMarginal and Absorption CostingEniola OgunmonaNo ratings yet

- Sujit 1-134-380 PDFDocument247 pagesSujit 1-134-380 PDFŞâh ŠůmiťNo ratings yet

- Chapter 4Document17 pagesChapter 4RBNo ratings yet

- ACCA F7 MockDocument17 pagesACCA F7 MockayeshaghufranNo ratings yet

- Busi Comb ConsoDocument5 pagesBusi Comb ConsoKaren Yvonne R. BilonNo ratings yet

- Mac006 A T2 2021 FexDocument7 pagesMac006 A T2 2021 FexHaris MalikNo ratings yet

- Advanced Corporate ReportingDocument9 pagesAdvanced Corporate ReportingCD463No ratings yet

- Slopes Inc Manufactures and Sells Snowboards Slopes Manufacture A SingleDocument2 pagesSlopes Inc Manufactures and Sells Snowboards Slopes Manufacture A SingleAmit PandeyNo ratings yet

- Financial Accounting and Reporting: RequirementsDocument4 pagesFinancial Accounting and Reporting: RequirementsebshuvoNo ratings yet

- Beechy7e Vol 1 SM Ch08Document59 pagesBeechy7e Vol 1 SM Ch08Aayush AgarwalNo ratings yet

- Great Zimbabwe University Faculty of CommerceDocument6 pagesGreat Zimbabwe University Faculty of CommerceTawanda Tatenda HerbertNo ratings yet

- IND AS 103 - Bhavik Chokshi - FR ShieldDocument26 pagesIND AS 103 - Bhavik Chokshi - FR ShieldSoham Upadhyay100% (1)

- f7 Mock QuestionDocument20 pagesf7 Mock Questionnoor ul anumNo ratings yet

- 2-5int 2001 Dec QDocument11 pages2-5int 2001 Dec Qapi-3728790100% (3)

- F2 Mock 5Document9 pagesF2 Mock 5deepakNo ratings yet

- Week 1 - Problem SetDocument3 pagesWeek 1 - Problem SetIlpram YTNo ratings yet

- A211 Syllabus BKAR1013-StudentDocument7 pagesA211 Syllabus BKAR1013-StudentVinoshini DeviNo ratings yet

- Solutions To Review Exam Papers 1 To 3Document171 pagesSolutions To Review Exam Papers 1 To 3Roi NyanNo ratings yet

- Pullman Inc Manufactures Chain Hoists The Raw Materials Inventories OnDocument2 pagesPullman Inc Manufactures Chain Hoists The Raw Materials Inventories OnAmit Pandey0% (1)

- ACC For Stock IssuesDocument9 pagesACC For Stock IssuesJasonSpringNo ratings yet

- Aafr Ias 12 Icap Past Paper With SolutionDocument17 pagesAafr Ias 12 Icap Past Paper With SolutionAqib Sheikh100% (1)

- Section A - QuestionsDocument27 pagesSection A - Questionsnek_akhtar87250% (1)

- Chapter 15 - Consolidation: Controlled Entities: Review QuestionsDocument13 pagesChapter 15 - Consolidation: Controlled Entities: Review QuestionsShek Kwun Hei100% (1)

- 05 DEC AnswersDocument15 pages05 DEC Answerskhengmai100% (5)

- CAT T10 - 2010 - Dec - ADocument9 pagesCAT T10 - 2010 - Dec - AHussain MeskinzadaNo ratings yet

- Assessment IDocument2 pagesAssessment IAli OptimisticNo ratings yet

- Selected Account Balances and Transactions of Titan Foundry Inc Follow MayDocument2 pagesSelected Account Balances and Transactions of Titan Foundry Inc Follow MayAmit PandeyNo ratings yet

- Partnership Liquidation: Answers To Questions 1Document28 pagesPartnership Liquidation: Answers To Questions 1El Carl Sontellinosa0% (1)

- Employment Income UdomDocument13 pagesEmployment Income UdomMaster KihimbwaNo ratings yet

- 13-ACCA-FA2-Chp 13Document22 pages13-ACCA-FA2-Chp 13SMS PrintingNo ratings yet

- Adoption Status of BFRS, BAS, BSADocument7 pagesAdoption Status of BFRS, BAS, BSAAl RajeeNo ratings yet

- A Company Produces Several Products Which Pass Through The TwoDocument1 pageA Company Produces Several Products Which Pass Through The TwoAmit PandeyNo ratings yet

- PR Advance 1 Problem 10-7 Statement of AffairsDocument4 pagesPR Advance 1 Problem 10-7 Statement of AffairsReynaldi100% (1)

- IFRS 2 - Share Based Payment1Document7 pagesIFRS 2 - Share Based Payment1EmmaNo ratings yet

- Comprehension Questions: 1. What Are Minimum Lease Payments'?Document13 pagesComprehension Questions: 1. What Are Minimum Lease Payments'?Amit ShuklaNo ratings yet

- caCAF 01 Suggested Solution Autumn 2014Document8 pagescaCAF 01 Suggested Solution Autumn 2014shahroozkhanNo ratings yet

- 7e Solutions Ch05Document40 pages7e Solutions Ch05Yves KochNo ratings yet

- PDF VERSION Highveld BPP Amended CONSOLIDATION QUESTIONDocument2 pagesPDF VERSION Highveld BPP Amended CONSOLIDATION QUESTIONGueagen1969No ratings yet

- 06 JUNE AnswersDocument13 pages06 JUNE AnswerskhengmaiNo ratings yet

- Chap 2Document47 pagesChap 2ADITYA JAIN100% (1)

- Arab Open University B326: Advanced Financial Accounting TMA - Spring 2023-2024. VDocument6 pagesArab Open University B326: Advanced Financial Accounting TMA - Spring 2023-2024. VMido AymanNo ratings yet

- Arab Open University B326: Advanced Financial Accounting TMA - Spring 2022-2023 V2Document7 pagesArab Open University B326: Advanced Financial Accounting TMA - Spring 2022-2023 V2samiaNo ratings yet

- The TMA Requires You To:: Criteria For Grade DistributionDocument5 pagesThe TMA Requires You To:: Criteria For Grade DistributionF190962 Muhammad Hammad KhizerNo ratings yet

- L5-BFE Assignment Guide 2023Document9 pagesL5-BFE Assignment Guide 2023himanshusharma9435No ratings yet

- b392 Tma - Summer 2023 - QQQQDocument5 pagesb392 Tma - Summer 2023 - QQQQadel.dahbour97No ratings yet

- B392 PT3 Form - FALL 2024Document1 pageB392 PT3 Form - FALL 2024adel.dahbour97No ratings yet

- b392 Tma - Summer 2023 - QQQQDocument5 pagesb392 Tma - Summer 2023 - QQQQadel.dahbour97No ratings yet

- B392 PT3 Form - FALL 2024Document1 pageB392 PT3 Form - FALL 2024adel.dahbour97No ratings yet

- B392 PT3 Form - FALL 2024Document1 pageB392 PT3 Form - FALL 2024adel.dahbour97No ratings yet

- B327 PT3 TMA Form - Branches - FALL 2023-24Document1 pageB327 PT3 TMA Form - Branches - FALL 2023-24adel.dahbour97No ratings yet

- Pt3 Managing To Collaborate b325Document1 pagePt3 Managing To Collaborate b325Sahar HamzehNo ratings yet

- B291 Revision - File 1Document15 pagesB291 Revision - File 1adel.dahbour97No ratings yet

- B291 TMA - Summer 2023Document3 pagesB291 TMA - Summer 2023ghawiNo ratings yet

- B292-TMA-Fall 2023-2024-ADocument5 pagesB292-TMA-Fall 2023-2024-Aadel.dahbour97No ratings yet

- B205B TMA Project Summer 2022 - 2023Document9 pagesB205B TMA Project Summer 2022 - 2023adel.dahbour97No ratings yet

- B-03 01problemDocument1 pageB-03 01problemmnrk 1997No ratings yet

- 200 Questions of Economics With Answers Including 8 Chapters..Document21 pages200 Questions of Economics With Answers Including 8 Chapters..Lea PortalNo ratings yet

- Googles Success Ben Morrow Thesis 2008 PDFDocument31 pagesGoogles Success Ben Morrow Thesis 2008 PDFAzim MohammedNo ratings yet

- Indofood CBP Sukses Makmur - Bilingual - 31 - Mar - 21Document129 pagesIndofood CBP Sukses Makmur - Bilingual - 31 - Mar - 21NicoleNo ratings yet

- Business Plan For Rechargeable Mosquito MatDocument29 pagesBusiness Plan For Rechargeable Mosquito MatRabbir Rashedin TirnoNo ratings yet

- KrisEnergy 2017 Annual ReportDocument144 pagesKrisEnergy 2017 Annual Reportener0% (1)

- Practice Paper (Solved) : Quantitative AptitudeDocument23 pagesPractice Paper (Solved) : Quantitative AptitudeTuku SinghNo ratings yet

- Sybcom AccountsDocument42 pagesSybcom AccountsAnandkumar Gupta0% (1)

- Correction of Errors Lecture Notes 6Document10 pagesCorrection of Errors Lecture Notes 6Gerald MagaitaNo ratings yet

- Retail MathDocument50 pagesRetail MathMauro PérezNo ratings yet

- Practice For Midterm 1Document136 pagesPractice For Midterm 1ennaira 06No ratings yet

- Does Economics Growth Bring Increased Living StandardsDocument6 pagesDoes Economics Growth Bring Increased Living StandardsViet Quoc CaoNo ratings yet

- Exam 1 F08 A430-530 With SolutionDocument13 pagesExam 1 F08 A430-530 With Solutionkrstn_hghtwrNo ratings yet

- KSCDCDocument45 pagesKSCDCRahul B Raj50% (2)

- Acc414 Fin43 mgt45 Midterm-ExamDocument11 pagesAcc414 Fin43 mgt45 Midterm-ExamNicole Athena CruzNo ratings yet

- 08 NPC Vs CabanatuanDocument2 pages08 NPC Vs CabanatuanJanno SangalangNo ratings yet

- Ionut TintaruDocument6 pagesIonut TintaruBalent AndreeaNo ratings yet

- IFM Chapter 01Document33 pagesIFM Chapter 01Mahbub TalukderNo ratings yet

- ASSIGNMENTDocument4 pagesASSIGNMENTfarhan ali theboNo ratings yet

- Honda 2011 Annual ReportDocument80 pagesHonda 2011 Annual Reportbabar hayatNo ratings yet

- EOS Accounts and Budget Services Level IVDocument90 pagesEOS Accounts and Budget Services Level IVGAGE COLLEGE REGISTRAR100% (14)

- Adcb and NabdDocument17 pagesAdcb and Nabdوليد الراويNo ratings yet

- BALIC Annual Report11 12 PDFDocument148 pagesBALIC Annual Report11 12 PDFAlfa LokhandeNo ratings yet

- Chapter7-Stock Price Behavior & Market EfficiencyDocument9 pagesChapter7-Stock Price Behavior & Market Efficiencytconn8276No ratings yet