Professional Documents

Culture Documents

04 - Quiz - 1 (3) - MA-PONCE

Uploaded by

Von Marvic PonceOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

04 - Quiz - 1 (3) - MA-PONCE

Uploaded by

Von Marvic PonceCopyright:

Available Formats

BM1915

NAME: V o n M a r v i c M . P o n c e DATE: 1 3 / 1 0 / 2 0 2 3 SCORE:

QUIZ

I. MULTIPLE CHOICE

Encircle the letter of the correct answer.

1. From which one of the following is the break-even point NOT determinable? C

a. Using a mathematical equation

b. Using contribution margin

c. Using high-low method

d. Deriving it from a CVP graph

2. Which statement describes a fixed cost? B

a. It varies in total at every level of activity.

b. The amount per unit varies depending on the activity level.

c. Its total varies proportionally to the level of activity.

d. It remains the same per unit regardless of activity level.

3. A company incurred an increase in its level of activity. What are the effects of this increase in unit costs for

variable and fixed costs? C

a. A decrease in variable cost per unit and a constant fixed cost per unit

b. Both variable and fixed cost per unit increase

c. Increase in fixed cost per unit and a constant variable cost per unit

d. A constant variable cost and a decrease in fixed cost per unit

4. Which of the following is an assumption of CVP analysis? D

a. Sales in units remain constant.

b. All costs are variable.

c. The change in the beginning and ending inventories is reflected in the analysis.

d. The behavior costs and revenues are linear within the relevant range.

5. Which of the following is CORRECT concerning contribution margin? D

a. It is calculated by subtracting product variable costs from sales.

b. It equals sales revenue minus total variable costs.

c. It is calculated by subtracting total manufacturing costs from sales revenue.

d. It excludes selling costs from its calculation.

II. PROBLEM SOLVING

Read and analyze the following problem. Write your answer on the space provided or on a separate sheet of

paper. Show your computations. (10 items x 5 points)

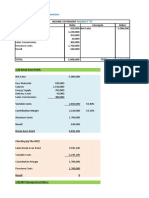

1. Warriors Baseball Company makes baseballs that sell for P12.00 per unit. Current annual production and sales

are 980,392 baseballs.

Variable cost per unit:

Direct materials P4.00

Direct labor 3.50

Manufacturing overhead 1.00

Sales commission 0.50

Fixed costs:

Manufacturing overhead P1,200,000

Administrative costs 300,000

Required:

a. Contribution margin ratio = P3 / P12 = 0.25 * 100 =25%

b. Break-even point in number of baseballs = Total fixed cost per unit

Cm per unit

04 Quiz 1 *Property of STI

Page 1 of 3

BM1915

1,500,000

3

= 500,000 units

c. Break-even point in pesos = Total Fixed Cost CM ratio

CM ratio

1,500,000

25%

= P6,000,00.00

d. Margin of safety in number of baseballs = Sales in units – BEP in units

980,000 – 500,000

= 480,392 units

e. Margin of safety in pesos = Sales in pesos – BEP in pesos

(P12* 980,392) – P6,000,000

11, 764,704 – 6,000,000

= P5,764,704.00

f. Desired sales in number of baseballs if the company wants to earn P420,000 in profit

= Total fixed cost + Desired Sales

Contribution Margin

1,500,000 + 420,000

3

= 640,000 units

g. Desired sales in pesos if the company wants to earn P420,000 in profit

= Total Fixed Cost + Desired Sales

Contribution Margin Ratio

980,392 + 420, 000

25%

1,400,392

25%

= P5,601,568.00

04 Quiz 1 *Property of STI

Page 2 of 3

BM1915

2. Salvatore Tire Company manufactures tires for bicycles. The tires sell for P72 and variable cost per tire is P54.

The monthly fixed cost is P480,000. The company is currently selling 40,000 tires monthly. The contribution

margin income statement of Salvatore is shown below:

Sales P2,880,000

Variable Costs 2,160,000

Contribution Margin 720,000

Fixed Costs 480,000

Profit P240,000

Required:

a. Degree of operating leverage = Total Contribution Margin

Profit

720,000

240,000

=3

b. If the company can increase sales volume by 15% above the current level, what is the percentage change in

profit? Indicate if increase or decrease.

15% x3

= 45%

c. What is the increase (decrease) in profit?

Actual Proposed Difference %

Sales P2,880,000 3,312,000 432,000.00 15.00%

Variable Costs P2,160.00 2,484,000 324,000.00

Contribution Margin P720,000 828,000 108,000.00

(Including Fixed

Cost)

Fixed Cost P480,000 480,000

Profit 240,000 348,000 108,000.00 45.00%

Rubric for scoring:

Performance Indicators Points

Correct accounts and amounts used 3

Computed final amounts are correct/balanced 2

Total 5

04 Quiz 1 *Property of STI

Page 3 of 3

You might also like

- Business Plan Template Excel FreeDocument13 pagesBusiness Plan Template Excel FreeUsmanNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- MS-1stPB 10.22Document12 pagesMS-1stPB 10.22Harold Dan Acebedo0% (1)

- Answer Key MAS Prelim - 1Document8 pagesAnswer Key MAS Prelim - 1jaimeNo ratings yet

- MAS Final Preboard QuestionsDocument12 pagesMAS Final Preboard QuestionsVillanueva, Mariella De VeraNo ratings yet

- Year Project A Project B: Total PV NPVDocument19 pagesYear Project A Project B: Total PV NPVChin EENo ratings yet

- Quiz On CVP AnalysisDocument9 pagesQuiz On CVP AnalysisRodolfo ManalacNo ratings yet

- Multiple Choice. Select The Letter That Corresponds To The Best Answer. This ExaminationDocument14 pagesMultiple Choice. Select The Letter That Corresponds To The Best Answer. This ExaminationBella ChoiNo ratings yet

- Let's Practise: Maths Workbook Coursebook 7From EverandLet's Practise: Maths Workbook Coursebook 7No ratings yet

- Business IB HL NotesDocument56 pagesBusiness IB HL NotesSamruddhiSatav93% (14)

- Capacity Planning ProblemsDocument6 pagesCapacity Planning Problemsvita sarasi100% (1)

- This Study Resource Was: Problem 3 (Adapted)Document3 pagesThis Study Resource Was: Problem 3 (Adapted)MEHENo ratings yet

- Lecture 11 - Price-Setting in B2B MarketsDocument36 pagesLecture 11 - Price-Setting in B2B MarketsMihaela Popazova100% (1)

- ADDITIONAL PROBLEMS-CVP AnalysisDocument4 pagesADDITIONAL PROBLEMS-CVP AnalysisFerb CruzadaNo ratings yet

- CVP Quiz - Bsa 2Document3 pagesCVP Quiz - Bsa 2Levi AckermanNo ratings yet

- Chapter 4 Cost Volume Profit AnalysisDocument12 pagesChapter 4 Cost Volume Profit AnalysisItzi Estrella100% (3)

- Cost Acc G4 2Document6 pagesCost Acc G4 2Asdfghjkl LkjhgfdsaNo ratings yet

- CVP Solution (Quiz)Document9 pagesCVP Solution (Quiz)Angela Miles DizonNo ratings yet

- 27 Chap - Module 4 - Pricing StrategiesDocument7 pages27 Chap - Module 4 - Pricing StrategiesraisehellNo ratings yet

- MBA 504 Ch4 SolutionsDocument25 pagesMBA 504 Ch4 SolutionsPiyush JainNo ratings yet

- Project Work Mba Finance 2012 D. GopiDocument72 pagesProject Work Mba Finance 2012 D. GopiRamesh AnkathiNo ratings yet

- 3 Mas Answer KeyDocument25 pages3 Mas Answer KeyAngelie0% (1)

- CVP Analysis - Assignment 1Document2 pagesCVP Analysis - Assignment 1Cherrelyne AlmazanNo ratings yet

- Managerial accountingBEP, CM T. ProfitDocument4 pagesManagerial accountingBEP, CM T. ProfitZeinab MohamadNo ratings yet

- Cost II AssignmentDocument18 pagesCost II AssignmentAddisNo ratings yet

- Marginal Costing - E-Notes - Udesh Regular - Group 1Document42 pagesMarginal Costing - E-Notes - Udesh Regular - Group 1Dhiraj JaiswalNo ratings yet

- 3 Ways of Conducting Cost-Volume-Profit Analysis or Breakeven Analysis Contribution Approach 2. Algebraic or Formula Approach 3. Graphical ApproachDocument7 pages3 Ways of Conducting Cost-Volume-Profit Analysis or Breakeven Analysis Contribution Approach 2. Algebraic or Formula Approach 3. Graphical ApproachDenver AcenasNo ratings yet

- Managerial Accounting Assignment 1Document20 pagesManagerial Accounting Assignment 1Eagle eye ጌታ-ሁን ተስፋዬNo ratings yet

- Cost - Chapter Two - FinalDocument50 pagesCost - Chapter Two - FinaltewodrosbayisaNo ratings yet

- CVP - GitttDocument15 pagesCVP - GitttFarid RezaNo ratings yet

- Chapter 2 DPB20053Document13 pagesChapter 2 DPB20053F2020 ADRIANANo ratings yet

- Arba Minch University: College of Business and EconomicsDocument20 pagesArba Minch University: College of Business and Economicsyared yisehakNo ratings yet

- True or False: Basadre, Jessa G. Bsa 3 Yr Managerial Accounting Assignment No. 2 - CVP RelationshipDocument3 pagesTrue or False: Basadre, Jessa G. Bsa 3 Yr Managerial Accounting Assignment No. 2 - CVP RelationshipJessa BasadreNo ratings yet

- 1G CVP ANALYSIS EXCEL SCDocument49 pages1G CVP ANALYSIS EXCEL SCAlmirah H. AliNo ratings yet

- Cost Accounting Activity - Answer Key2Document6 pagesCost Accounting Activity - Answer Key2Janen Redondo TumangdayNo ratings yet

- ACCOUNTING P2 MEMO GR10 NOV 2019 - EnglishDocument10 pagesACCOUNTING P2 MEMO GR10 NOV 2019 - EnglishmthabisovictoriaNo ratings yet

- Answer Key To Test #1 - ACCT-312 - Fall 2019Document8 pagesAnswer Key To Test #1 - ACCT-312 - Fall 2019Amir ContrerasNo ratings yet

- BEP ExercisesDocument13 pagesBEP ExercisesBarack MikeNo ratings yet

- AE22 ChapterTest 4 6 - AnswerKeyDocument6 pagesAE22 ChapterTest 4 6 - AnswerKeyElrey IncisoNo ratings yet

- 04 Activity 1 ManagerialDocument3 pages04 Activity 1 ManagerialRalph Louise PoncianoNo ratings yet

- SOS222 Cost Analysis Review 4 2018Document3 pagesSOS222 Cost Analysis Review 4 2018nikolasNo ratings yet

- Tutorial 5 - CHAPTER 9 - QDocument13 pagesTutorial 5 - CHAPTER 9 - QThuỳ PhạmNo ratings yet

- Break EvenDocument28 pagesBreak EvenShovon KaizerNo ratings yet

- 4 Cvpbe PROB EXDocument5 pages4 Cvpbe PROB EXjulia4razoNo ratings yet

- Class WorkDocument10 pagesClass WorkRajesh MongerNo ratings yet

- AF102 Final Exam Revision PackageDocument22 pagesAF102 Final Exam Revision Packagetb66jfpbrzNo ratings yet

- CVP AnalysisDocument5 pagesCVP AnalysisAzumi RaeNo ratings yet

- Contribution Margin: TechniquesDocument4 pagesContribution Margin: TechniquesMaria BeatriceNo ratings yet

- Chapter - 5 Marginal CostingDocument9 pagesChapter - 5 Marginal CostingDipen AdhikariNo ratings yet

- Institute of Certified General Accountants of Bangladesh (ICGAB) Performance Management (P13) LC-3: CVP AnalysisDocument5 pagesInstitute of Certified General Accountants of Bangladesh (ICGAB) Performance Management (P13) LC-3: CVP AnalysisMozid RahmanNo ratings yet

- Sri Balaji University Pune (Sbup) Bitm SEMESTER-I-BATCH - 2020-22 Management Accounting - Assignment - Vi (UNIT-IV)Document7 pagesSri Balaji University Pune (Sbup) Bitm SEMESTER-I-BATCH - 2020-22 Management Accounting - Assignment - Vi (UNIT-IV)Jaya BharneNo ratings yet

- SOLUTION For Break Even Analysis Example ProblemDocument11 pagesSOLUTION For Break Even Analysis Example ProblemArly Kurt TorresNo ratings yet

- Session 4 AnswersDocument5 pagesSession 4 AnswersOllid Kline Jayson JNo ratings yet

- Cost Accounting A Break Even AnalysisDocument23 pagesCost Accounting A Break Even AnalysisMy wifeNo ratings yet

- CVP 220902 092550Document29 pagesCVP 220902 092550Jason BourneNo ratings yet

- Total Peso Sales Required 120,000 / (.25-0.1) 800,000 Less Prior Sales 400,000Document2 pagesTotal Peso Sales Required 120,000 / (.25-0.1) 800,000 Less Prior Sales 400,000kmarisseeNo ratings yet

- A. Contribution Margin: AnswerDocument3 pagesA. Contribution Margin: Answerrook semayNo ratings yet

- Assignment 3Document11 pagesAssignment 3Engr Hasan SaeedNo ratings yet

- MODULE 1.0 - Break Even & Marginal AnalysisDocument6 pagesMODULE 1.0 - Break Even & Marginal AnalysisTyron TayloNo ratings yet

- A. Determine A Break Even Point Break Even Point in Unit: Break Even Point in PesosDocument4 pagesA. Determine A Break Even Point Break Even Point in Unit: Break Even Point in PesosGio TangalanNo ratings yet

- Quiz Management AccountingDocument8 pagesQuiz Management AccountingLouise Kyle NgoNo ratings yet

- Topic 11 - Cost Volume Profit Analysis - LectureDocument23 pagesTopic 11 - Cost Volume Profit Analysis - LectureshamimahNo ratings yet

- 47 - 20210609083456 - Tugas Pertemuan 11 CVP AnalysisDocument5 pages47 - 20210609083456 - Tugas Pertemuan 11 CVP Analysistantri novebiNo ratings yet

- Examination Midterm MASDocument4 pagesExamination Midterm MASPrincess Claris ArauctoNo ratings yet

- BEP ExercisesDocument11 pagesBEP ExercisesBarack MikeNo ratings yet

- XXX SCMDocument8 pagesXXX SCMGailNo ratings yet

- MANACC - NotesW - Answers - BEP - The Master BudgetDocument6 pagesMANACC - NotesW - Answers - BEP - The Master Budgetldeguzman210000000953No ratings yet

- PRACTICAL CASES 28 and 29Document5 pagesPRACTICAL CASES 28 and 29loliNo ratings yet

- Mas Quizzer - Anaylysis 2021 Part 2Document9 pagesMas Quizzer - Anaylysis 2021 Part 2Ma Teresa B. CerezoNo ratings yet

- 09 Quiz 1Document1 page09 Quiz 1Von Marvic PonceNo ratings yet

- 07 Quiz 1Document2 pages07 Quiz 1Von Marvic PonceNo ratings yet

- 06 Worksheet 1 - ARG-GGSR-PONCEDocument2 pages06 Worksheet 1 - ARG-GGSR-PONCEVon Marvic PonceNo ratings yet

- PONCE - 02 Performance Task (Prelim) - ARGDocument1 pagePONCE - 02 Performance Task (Prelim) - ARGVon Marvic PonceNo ratings yet

- 05 Quiz 1Document3 pages05 Quiz 1Von Marvic PonceNo ratings yet

- Accounting 2 Chapters 21 and 22Document6 pagesAccounting 2 Chapters 21 and 22Fabian NonesNo ratings yet

- Energy Conservation Business Plan (Green Power Consultancy) : Executive SummaryDocument14 pagesEnergy Conservation Business Plan (Green Power Consultancy) : Executive SummarymelojeanjunioNo ratings yet

- MAS Preboard Ctdi May 2018 AnswersDocument30 pagesMAS Preboard Ctdi May 2018 AnswersKrizza MaeNo ratings yet

- Case Study Solution of Turner Test Prep CompanyDocument5 pagesCase Study Solution of Turner Test Prep CompanyMujahid Reza100% (2)

- Vinamilk OM Report Group 4 EBDB 1Document31 pagesVinamilk OM Report Group 4 EBDB 1Nguyễn DatNo ratings yet

- Product Details:: Steps To Make BakarkhaniDocument7 pagesProduct Details:: Steps To Make Bakarkhanilimon islamNo ratings yet

- ACT360 EXcel FileDocument24 pagesACT360 EXcel FileAnikaNo ratings yet

- Pie Restaurant Business PlanDocument45 pagesPie Restaurant Business PlanVuinsia BcsbacNo ratings yet

- Financalfeasibilitystudy 180726141644Document52 pagesFinancalfeasibilitystudy 180726141644derejeabebeNo ratings yet

- A Business Proposal On Cassava Farming and Garri Production in Nigeria - Agroraf - Net Present Value - Internal Rate of ReturnDocument9 pagesA Business Proposal On Cassava Farming and Garri Production in Nigeria - Agroraf - Net Present Value - Internal Rate of ReturnArc Pontip StephenNo ratings yet

- Guidebook RBAC Season 3Document64 pagesGuidebook RBAC Season 3Manson LeeNo ratings yet

- Cost Behavior and CVPDocument4 pagesCost Behavior and CVPChiodos OliverNo ratings yet

- Resource Use Efficiency of Hybrid Maize Production in Chhindwara District of Madhya PradeshDocument10 pagesResource Use Efficiency of Hybrid Maize Production in Chhindwara District of Madhya PradeshImpact JournalsNo ratings yet

- Executive Summary1Document19 pagesExecutive Summary1Izyan NurbaitiNo ratings yet

- Assignment 1Document5 pagesAssignment 1kamrulkawserNo ratings yet

- CostingDocument56 pagesCostingKartNo ratings yet

- LBA Auditing Financial PlanDocument24 pagesLBA Auditing Financial PlanwillieNo ratings yet

- Workshop F2 May 2011Document18 pagesWorkshop F2 May 2011roukaiya_peerkhanNo ratings yet

- Ef Assessment 2Document5 pagesEf Assessment 2Charbel HatemNo ratings yet

- Technological University of The Philippines: Ayala Boulevard, Ermita, Manila College of Industrial TechnologyDocument17 pagesTechnological University of The Philippines: Ayala Boulevard, Ermita, Manila College of Industrial Technologylorina p del rosarioNo ratings yet