Professional Documents

Culture Documents

Topic 8 BFIN 313

Uploaded by

Shaina LimOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Topic 8 BFIN 313

Uploaded by

Shaina LimCopyright:

Available Formats

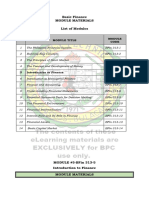

Basic Finance

MODULE MATERIALS

List of Modules

No. MODULE

MODULE TITLE

CODE

1 The Philippine Financial System BFin 313-1

2 Banking Key Concepts BFin 313-2

3 The Principles of Stock Market BFin 313-3

4 The Concept and Development of Money BFin 313-4

5 Introduction to Finance BFin 313-5

6 Introduction to Managerial Finance BFin 313-6

7 Finance and Accounting BFin 313-7

8 Understanding Financial Statements BFin 313-8

9 Financial Statement Tools for Decision Making BFin 313-9

10 The Financial Environment BFin 313-10

11 Financial Intermediation BFin 313-11

12 Interest Rate and Its Role in Finance BFin 313-12

13 Financial Assets BFin 313-13

14 Basic Capital Market BFin 313-14

MODULE #8-BFin 313-8

Understanding Financial Statements

MODULE MATERIALS

Bachelor of Science in Bulacan Date Developed:

Accounting Information June 2020

Polytechnic Date Revised:

Page 110 of 204

System

College

Basic Finance Document No. Developed by:

Revision # 02

BFIN 313 40-BFIN 313 Eugene A. Ruano

UNDERSTANDING

FINANCIAL

STATEMENTS

(BFIN 313-8)

Bachelor of Science in Bulacan Date Developed:

Accounting Information June 2020

Polytechnic Date Revised:

Page 111 of 204

System

College

Basic Finance Document No. Developed by:

Revision # 02

BFIN 313 40-BFIN 313 Eugene A. Ruano

MODULE CONTENT

COURSE TITLE: Basic Finance

MODULE TITLE Understanding Financial Statements

NOMINAL DURATION: 6 Hours

SPECIFIC LEARNING OBJECTIVES:

At the end of this module you MUST be able to:

1. Identify the users of financial statements and their needs.

2. Demonstrate an understanding of the purposes and uses of each

statement.

3. Identify the major components and classifications of each statement.

4. Know the differences of preparing income statement for a merchandising

business and manufacturing business.

5. Explain the different kinds of basic costs.

6. Understand market value and book value.

7. Prepare financial statements and retained earnings.

TOPIC: (SUB-TOPICS)

1. Definition of Financial Statements

2. Basic Financial Statements

3. Income Statement of Manufacturing and Merchandising Business

4. Product Costs versus Period Costs

5. Variable and Fixed costs

6. Pro-forma of Balance Sheet Presentation

7. Market Value versus Book value

8. Statement of Retained Earnings

ASSESSMENT METHOD/S:

Quiz-Multiple Choice

REFERENCE/S:

1. Leuterio, M.M. & Estepa, C.B.

Banking Theory & Practice (Revised Edition), 2018

Pasig City: Anvil Publishing, Inc.

2. Fajardo, Feliciano R. & Manansala, Manuel M.

Money, Credit and Banking 4th Edition, 2017

Mandaluyong City: National Book Store

3. A) Mejorada, N.D.

Introduction to Management Accounting, 2018 Edition

Makati City: Goodwill Trading Co.,Inc.

B) Edlagan and Mercado

Management Advisory Services (Concepts, Methods and

Applications) Volume 1, 2016 Edition

Makati City: Goodwill Trading Co.,Inc.

4. Melicher, Ron & Norton, Edgar

Introduction to Finance, 2018 Edition

New York: John Wiley & Sons

5. A) Brigham, Eugene F.

Bachelor of Science in Bulacan Date Developed:

Accounting Information June 2020

Polytechnic Date Revised:

Page 112 of 204

System

College

Basic Finance Document No. Developed by:

Revision # 02

BFIN 313 40-BFIN 313 Eugene A. Ruano

Fundamentals of Financial Management, 20th Edition 2016

Hoboken, New Jersey, USA: John Wiley and Sons

B) Dr. Hughes

Personal Finance 12th Edition, 2017

Upper Saddle River, New Jersey, USA: Pearson Prentice Hall

Information Sheet-BFin 313-8

Understanding Financial Statements

Learning Objectives:

After reading this INFORMATION SHEET, YOU MUST be able to:

1. Identify the limitations of each financial statement.

2. Identify how various financial transactions affect the elements of each of

the financial statements and determine the proper classification of the

transaction.

3. Demonstrate an understanding of the relationship among the financial

statements.

4. Demonstrate an understanding of how the financial statements are

prepared.

5. Illustrate an actual application of the preparation of financial statements.

INTRODUCTION

If you are in business, you need to understand financial statements. For

one thing, the law no longer allows high-ranking executives to plead ignorance

or fall back on delegation of authority when it comes to taking responsibility for

a firm’s financial reporting.

In a business environment tainted by episodes of fraudulent financial

reporting and other corporate misdeeds, top managers are now being held

accountable for the financial statements issued by the people who report them.

For another thing, top managers need to know if the company is hitting on all

cylinders or sputtering down the road to bankruptcy. If he did not understand

the financial statements issued by the company’s accountants, an executive

would be like an airplane pilot who does not know how to read the instrument

in the cockpit. He might be able to keep the plane in the air for a while, but he

would not recognize any signs of impending trouble until it was too late.

FINANCIAL STATEMENTS

• the product of financial accounting.

• show the results of operation, financial condition, changes in

owner’s equity and sources and uses of cash

BASIC FINANCIAL STATEMENTS

• Income Statement or Statement of Comprehensive Income

• Balance Sheet or Statement of Financial Position or Statement of

Financial Condition

• Statement of Changes in Owner’s Equity (for a sole proprietorship) or

Statement of Changes in Partners’ Equity (for partnership) or

Statement of Changes in Stockholders’ Equity (for a corporation)

• Cash Flow Statement or Statement of Cash Flows

INCOME STATEMENT

Bachelor of Science in Bulacan Date Developed:

Accounting Information June 2020

Polytechnic Date Revised:

Page 113 of 204

System

College

Basic Finance Document No. Developed by:

Revision # 02

BFIN 313 40-BFIN 313 Eugene A. Ruano

• now called “Statement of Comprehensive Income”, details the

revenues earned and the expenses incurred by a company

• shows the results of operation of a company

• the “bottom line” in business parlance is the net profit or the net

loss

• shows profitability of the firm

• covers a certain accounting period, a month, a quarter, a six-month

period, or a year.

INCOME STATEMENT OF A SERVICE ENTERPRISE

• very simple.

• simply lists the income from operations, like service revenue or

professional fees and deducts from such revenue the total operating

expenses

• OPERATING PROFIT – if the income is greater than the operating

expenses

• OPERATING LOSS – if the income is less than the operating

expenses

• To the operating profit or loss is added the net of the other income

(interest income, rent income, commission income, among others)

less the other expenses (interest expense, finance charges, among

others).

INCOME STATEMENT OF A MERCHANDISING FIRM/TRADING FIRM

• a little complicated

• shows the sales figure and deductions from gross sales like sales

discount and sales return and allowance to arrive at net sales

• From net sales, the cost of sales is deducted which is computed by

adding the beginning inventory to the net cost of purchases and

deducting the ending inventory.

Bachelor of Science in Bulacan Date Developed:

Accounting Information June 2020

Polytechnic Date Revised:

Page 114 of 204

System

College

Basic Finance Document No. Developed by:

Revision # 02

BFIN 313 40-BFIN 313 Eugene A. Ruano

• The cost of sales is deducted from the net sales to arrive at the gross

profit.

• From the gross profit, the operating expenses are deducted to obtain the

profit from operations or operating profit.

• From the operating profit is added the net of other incomes and other

expenses to arrive at the “bottom line” or profit (or loss, if expenses are

greater than revenue).

INCOME STATEMENT OF A MANUFACTURING COMPANY

• More complicated than a trading firm because of the different costs

involved (cost of goods manufactured and the cost of goods sold) in

addition to the operating expenses.

• Different costs involve direct materials, direct labor and

manufacturing overhead.

• The manufacturing firm’s cost is complicated due to the fact that its

manufacturing operations detail the cost of goods manufactured first

before the cost of goods sold is computed.

• Manufacturing cost is broken down into direct materials, direct labor and

manufacturing overhead, the three components of manufacturing cost.

Then there is the work in process inventories and the finished goods in

inventories.

Bachelor of Science in Bulacan Date Developed:

Accounting Information June 2020

Polytechnic Date Revised:

Page 115 of 204

System

College

Basic Finance Document No. Developed by:

Revision # 02

BFIN 313 40-BFIN 313 Eugene A. Ruano

• Schedule A

1. total manufacturing cost

Direct materials Pxxx

Direct labor xxx

Manufacturing Overhead xxx

TOTAL MANUFACTURING COSTS Pxxx

To the total manufacturing cost is added the beginning work in process

inventory and from the total thus obtained is deducted the ending work in

process to yield total cost of goods manufactured.

Thus we have:

2. total cost of goods manufactured

Total Manufacturing Cost Pxxx

Work in Process, Beginning xxx

Work in Process, End (xxx)

TOTAL COST OF GOODS MANUFACTURED Pxxx

To the cost of goods manufactured is added the beginning finished goods

inventory to arrive at the total goods available for sale and then from the

total thus obtained is deducted the ending finished goods inventory to

arrive at the cost of goods sold.

Similarly, we have:

3. total goods available for sale & 4. cost of goods sold

Total Cost of Goods Manufactured Pxxx

Finished Goods Inventory, Beginning xxx

Total Goods Available for Sale xxx

Finished Goods Inventory, End (xxx)

Bachelor of Science in Bulacan Date Developed:

Accounting Information June 2020

Polytechnic Date Revised:

Page 116 of 204

System

College

Basic Finance Document No. Developed by:

Revision # 02

BFIN 313 40-BFIN 313 Eugene A. Ruano

Cost of Goods Sold Pxxx

• Schedule B - shows the details of the selling or marketing expenses.

Expenses related to sales are grouped under the selling or marketing

expenses

Bachelor of Science in Bulacan Date Developed:

Accounting Information June 2020

Polytechnic Date Revised:

Page 117 of 204

System

College

Basic Finance Document No. Developed by:

Revision # 02

BFIN 313 40-BFIN 313 Eugene A. Ruano

• Schedule C – is the schedule of the general or administrative

expenses. These expenses refer to those operating expenses related

to the office/general/administrative operations. The salary of the

president and the different vice presidents and managers are all part

of the general or administrative expenses. The rent expense for the

office space is administrative.

PRODUCT COSTS VERSUS PERIOD COSTS

Bachelor of Science in Bulacan Date Developed:

Accounting Information June 2020

Polytechnic Date Revised:

Page 118 of 204

System

College

Basic Finance Document No. Developed by:

Revision # 02

BFIN 313 40-BFIN 313 Eugene A. Ruano

• Product costs are the costs of direct materials, direct labor and

overhead, also called manufacturing cost (Schedule A) while

• Period costs refer to the costs incurred during a particular time

period and reported either as selling or marketing expenses

(Schedule B) and administrative or general expenses (Schedule C)

VARIABLE COSTS VERSUS FIXED COSTS

• Like product costs, they could be variable (e.g., income taxes,

commission expense, utilities expense, among others) or fixed (e.g.,

officers’ salaries, office rent depreciation for office building and office

equipment, among others)

BALANCE SHEET

• Or statement of financial condition, sometimes also called statement

of financial position

• Shows the assets, liabilities and owner’s equity of a business

• Shows financial condition or financial position of the business

• Details the company’s resources and obligations and the

composition of the owner’s equity

• Assets – Liabilities = Owner’s Equity

• it also shows the liquidity and solvency of the firm

CURRENT AND NONCURRENT ASSETS

• Total assets are divided into current and non-current assets

• Current assets are the resources that will be used for current

operations (short term) or within the operating cycle. Examples:

cash, prepaid expenses, accounts receivable, inventory

• Non-current assets refer to the resources of the firm that are

durable or will last longer than a year like land, equipment,

furniture and fixture and long-term investments.

CURRENT AND NONCURRENT LIABILITIES

• Total liabilities are divided into current liabilities and non-current

liabilities or long-term liabilities.

• Current liabilities are obligations of the firm that will mature or need

payment during the accounting period or accounting year.

Examples: accrued liabilities (accrued property taxes payable),

payroll liabilities (salaries and wages due within the year), company

liabilities (accounts payable, dividends payable)

• Non-current liabilities are obligations of the firm that will mature or

become due within more than a year. That portion of the long-term

liability that is due during the current period is classified as a current

liability and the rest or balance is classified as long-term or non-current.

Examples: long-term loans, deferred revenues, deferred income taxes,

capital leases

Bachelor of Science in Bulacan Date Developed:

Accounting Information June 2020

Polytechnic Date Revised:

Page 119 of 204

System

College

Basic Finance Document No. Developed by:

Revision # 02

BFIN 313 40-BFIN 313 Eugene A. Ruano

Bachelor of Science in Bulacan Date Developed:

Accounting Information June 2020

Polytechnic Date Revised:

Page 120 of 204

System

College

Basic Finance Document No. Developed by:

Revision # 02

BFIN 313 40-BFIN 313 Eugene A. Ruano

ACCOUNT FORM AND REPORT FORM

• A balance sheet can be reported using the account form where

assets are listed on the left side and liabilities and owner’s equity on

the right side. The report form lists the assets followed by the

liabilities and the owner’s equity.

MARKET VALUE VERSUS BOOK VALUE

• The book value of an asset is its original purchase cost, adjusted for

any subsequent changes, such as for impairment or depreciation.

Market value is the price that could be obtained by selling an asset

on a competitive, open market.

• For example, a company buys a machine for $100,000 and

subsequently records depreciation of $20,000 for that machine,

resulting in net book value of $80,000. If the company were to then

sell the machine at its current market price of $90,000, the business

would record a gain on the sale of $10,000.

STATEMENT OF CHANGES IN OWNER’S EQUITY

• Shows the investments made by the owner reduced by his

withdrawals and increased by net profit (or reduced by net loss) for a

sole proprietorship or partnership

Bachelor of Science in Bulacan Date Developed:

Accounting Information June 2020

Polytechnic Date Revised:

Page 121 of 204

System

College

Basic Finance Document No. Developed by:

Revision # 02

BFIN 313 40-BFIN 313 Eugene A. Ruano

• For a corporation, the statement of changes in stockholders’ equity

shows the capital stock at the beginning of the period increased by

any additional issues of shares.

Bachelor of Science in Bulacan Date Developed:

Accounting Information June 2020

Polytechnic Date Revised:

Page 122 of 204

System

College

Basic Finance Document No. Developed by:

Revision # 02

BFIN 313 40-BFIN 313 Eugene A. Ruano

STATEMENT OF RETAINED EARNINGS

• For a corporation, the accumulated profits of the company are

reflected in the retained earnings account.

• Retained earnings account details the beginning retained earnings,

the profit/loss of the corporation, dividends declared, retained

earnings appropriated and the return of appropriation of retained

earnings.

• Retained earnings appropriated are the appropriation of the company’s

accumulated earnings for such purposes as plant expansion, building

construction, land acquisition, bond retirement and other purposes as

the corporation sees fit.

• Appropriated retained earnings portion shows all appropriations of

retained earnings at the beginning of the period and to each respective

appropriation are added additional appropriations and deducted all

reversal of appropriated retained earnings back to the unappropriated

retained earnings. New appropriations for the year are also included in

the statement.

STATEMENT OF CASH FLOWS OR FUND FLOWS

Bachelor of Science in Bulacan Date Developed:

Accounting Information June 2020

Polytechnic Date Revised:

Page 123 of 204

System

College

Basic Finance Document No. Developed by:

Revision # 02

BFIN 313 40-BFIN 313 Eugene A. Ruano

• Is sometimes called the funds flow statement or the statement of the

sources and uses of cash or the statement of sources and uses of

funds.

• Accrual method – recognition of income and expenses are made

when income is earned, regardless when cash is received and

expenses are recognized when expenses are incurred, irrespective of

when they are paid.

• The profit or net income shown in the income statement does not show

the cash position of the company. Income in the income statement can

only be “paper profits” if receivables are not collected and converted into

cash. This is the basic reason why the cash flow is important to provide

additional information as to the cash position, which is an indication of

the liquidity of the firm.

• Net cash inflow from investing activities shows purchases and

sales of fixed assets.

• Net cash inflow from financing activities shows sales of capital

stock, payment of dividends and repayment of long-term liabilities.

• Operating activities are all operation-related earning activities of the

company – rendering service for a firm, selling goods for a trading

concern and manufacturing and selling activities for a manufacturing

company.

• Financing activities involve obtaining resources from owners (issuances

of capital stock) and paying them dividends as their share in the profit of

the company.

• Investing activities involve all activities related to non-current assets—

disposing of them or selling them and buying them.

Bachelor of Science in Bulacan Date Developed:

Accounting Information June 2020

Polytechnic Date Revised:

Page 124 of 204

System

College

Basic Finance Document No. Developed by:

Revision # 02

BFIN 313 40-BFIN 313 Eugene A. Ruano

Bachelor of Science in Bulacan Date Developed:

Accounting Information June 2020

Polytechnic Date Revised:

Page 125 of 204

System

College

Basic Finance Document No. Developed by:

Revision # 02

BFIN 313 40-BFIN 313 Eugene A. Ruano

Diagrams of Statement of Cash Flows Showing the Two Methods

Bachelor of Science in Bulacan Date Developed:

Accounting Information June 2020

Polytechnic Date Revised:

Page 126 of 204

System

College

Basic Finance Document No. Developed by:

Revision # 02

BFIN 313 40-BFIN 313 Eugene A. Ruano

Bachelor of Science in Bulacan Date Developed:

Accounting Information June 2020

Polytechnic Date Revised:

Page 127 of 204

System

College

Basic Finance Document No. Developed by:

Revision # 02

BFIN 313 40-BFIN 313 Eugene A. Ruano

You might also like

- Financial Decision MakingDocument7 pagesFinancial Decision MakingDalreen GamageNo ratings yet

- Accounting and Finance Personal StatementDocument3 pagesAccounting and Finance Personal StatementBojan IvanovićNo ratings yet

- Basic Accounting Notes (Finale)Document33 pagesBasic Accounting Notes (Finale)Chreann Rachel100% (3)

- Sample Church Audit ReportDocument5 pagesSample Church Audit Reportvrasshen580% (5)

- P2 41 2 42 SolutionsDocument3 pagesP2 41 2 42 SolutionsMarjorie PalmaNo ratings yet

- Business Finance Lesson 3Document34 pagesBusiness Finance Lesson 3Iekzkad RealvillaNo ratings yet

- Basic Finance Module Materials List of Modules: No. Module Title CodeDocument49 pagesBasic Finance Module Materials List of Modules: No. Module Title CodeShaina LimNo ratings yet

- Topic 7 BFIN 313Document16 pagesTopic 7 BFIN 313Shaina LimNo ratings yet

- Topic 5 Bfin 313Document18 pagesTopic 5 Bfin 313Shaina LimNo ratings yet

- Topic 3 BFIN 313Document12 pagesTopic 3 BFIN 313Shaina LimNo ratings yet

- Cruz, Aiyana Gabrielle - CFAS 04Document3 pagesCruz, Aiyana Gabrielle - CFAS 04Misha Laine de LeonNo ratings yet

- Topic 4 BFIN 313Document18 pagesTopic 4 BFIN 313Shaina LimNo ratings yet

- FMPR 2 - Lesson 2Document12 pagesFMPR 2 - Lesson 2jannypagalanNo ratings yet

- Flores, Erika - CFAS 04Document3 pagesFlores, Erika - CFAS 04Misha Laine de LeonNo ratings yet

- Financial StatemenDocument26 pagesFinancial StatemenSarthak SomaniNo ratings yet

- CH 01Document60 pagesCH 01intania larasatiNo ratings yet

- Module IIDocument18 pagesModule IIBradleeNo ratings yet

- Institute-University School of Business Department-MbaDocument12 pagesInstitute-University School of Business Department-MbaAbhishek kumarNo ratings yet

- B215 AC01 - Numbers and Words - 6th Presentation - 17apr2009Document23 pagesB215 AC01 - Numbers and Words - 6th Presentation - 17apr2009tohqinzhiNo ratings yet

- Module 2 Financial StatementsDocument17 pagesModule 2 Financial StatementsRoss JorgensenNo ratings yet

- Module IIDocument22 pagesModule IIElla Joy B. IgnacioNo ratings yet

- Module 1Document13 pagesModule 1Liz PobleteNo ratings yet

- IM On ACCO 20033 Financial Accounting and Reporting Part 1 Revised Cover PageDocument97 pagesIM On ACCO 20033 Financial Accounting and Reporting Part 1 Revised Cover PagePatricia may RiveraNo ratings yet

- Accounting Module PDFDocument96 pagesAccounting Module PDFjanineNo ratings yet

- Course Material 6 - Trial Balance, Financial Reports and StatementDocument22 pagesCourse Material 6 - Trial Balance, Financial Reports and StatementJayvee BernalNo ratings yet

- AE 24 Module 4 FS AnalysisDocument20 pagesAE 24 Module 4 FS AnalysisShamae Duma-anNo ratings yet

- Module 2 - Financial Statements - Organized PDFDocument14 pagesModule 2 - Financial Statements - Organized PDFSandyNo ratings yet

- Modul 6 Full Disclosure in Financial Reporting2 PDFDocument42 pagesModul 6 Full Disclosure in Financial Reporting2 PDFBenjamin Engel100% (1)

- FAR Lesson 1 65Document38 pagesFAR Lesson 1 65Janine Charmie Manongsong OlivarNo ratings yet

- AE 19 Chapter I Lecture Notes PDFDocument11 pagesAE 19 Chapter I Lecture Notes PDFJhomel Domingo GalvezNo ratings yet

- Module 1Document23 pagesModule 1esparagozanichole01No ratings yet

- DBFI302 Unit-02Document25 pagesDBFI302 Unit-02Vibhor KhandelwalNo ratings yet

- Module 1Document15 pagesModule 1Jeremiah NayosanNo ratings yet

- Module 6 Ratio Analysis and InterpretationDocument9 pagesModule 6 Ratio Analysis and InterpretationHeart MacedaNo ratings yet

- UBL ReportDocument26 pagesUBL Reportmuhammadtaimoorkhan0% (1)

- Analysis of Financial Statements: After Studying This Chapter, You Would Be Able ToDocument26 pagesAnalysis of Financial Statements: After Studying This Chapter, You Would Be Able ToKumar PoudelNo ratings yet

- Basic Financial Statement: It's Importance: Reflection Paper OnDocument34 pagesBasic Financial Statement: It's Importance: Reflection Paper OnpolmalondaNo ratings yet

- FinMan Financial ControlDocument16 pagesFinMan Financial ControlKezzi Ervin UngayNo ratings yet

- Financial and Corporate ReportingDocument257 pagesFinancial and Corporate Reportinganon_636625652100% (1)

- I1.2 FR Notes and Past PapersDocument209 pagesI1.2 FR Notes and Past PapersJustin MUNYAMAHORONo ratings yet

- Final AccountsDocument91 pagesFinal AccountsKartikey swami0% (1)

- Naid Naid-550 FormatoalumnotrabajofinalDocument10 pagesNaid Naid-550 FormatoalumnotrabajofinalAbigail Vargas De la CruzNo ratings yet

- Accounts Unit 2Document12 pagesAccounts Unit 2Durdana NasserNo ratings yet

- Module 1 Financial Reporting LMSDocument15 pagesModule 1 Financial Reporting LMSGAZA MARY ANGELINENo ratings yet

- Fin StatementDocument18 pagesFin StatementDRISYANo ratings yet

- Ia 3 Chapter 1 DraftDocument20 pagesIa 3 Chapter 1 DraftRuiz, CherryjaneNo ratings yet

- Business Finance: FinalDocument8 pagesBusiness Finance: FinalBryanNo ratings yet

- FR V2 Concept Notes by Pratik Jagati @mission - CA - FinalDocument131 pagesFR V2 Concept Notes by Pratik Jagati @mission - CA - FinalVrinda KNo ratings yet

- Topic Overview - Week 2Document23 pagesTopic Overview - Week 2Awike IiyambulaNo ratings yet

- BSIS ePA 313 - Preparation of Statement of Changes in EquityDocument6 pagesBSIS ePA 313 - Preparation of Statement of Changes in EquityKen ChanNo ratings yet

- Intermediate AccountingDocument60 pagesIntermediate AccountingSuwarno Noto JamanNo ratings yet

- 1 Understanding Financial StatementsDocument26 pages1 Understanding Financial StatementsLileth Lastra QuiridoNo ratings yet

- Accounting For Managers - Block-2 PDFDocument64 pagesAccounting For Managers - Block-2 PDFHimanshu NaugainNo ratings yet

- Lesson 5 Financial Statements (PAS No.1)Document4 pagesLesson 5 Financial Statements (PAS No.1)Land DoranNo ratings yet

- 4 6003688552603322754 PDFDocument21 pages4 6003688552603322754 PDFHadeel Abdul SalamNo ratings yet

- P1 Accounting ScannerDocument286 pagesP1 Accounting Scannervishal jalan100% (1)

- First Semester - AY 2020-2021: C-AE13: Financial Accounting and ReportingDocument6 pagesFirst Semester - AY 2020-2021: C-AE13: Financial Accounting and Reportingfirestorm riveraNo ratings yet

- Information Sheet - BKKPG-8 - Preparing Financial StatementsDocument10 pagesInformation Sheet - BKKPG-8 - Preparing Financial StatementsEron Roi Centina-gacutanNo ratings yet

- Bos 46132 CP 15Document26 pagesBos 46132 CP 15rishib2116No ratings yet

- Nature of Financial Accounting: Faculty of Economy and Business Mercubuana University 2018Document15 pagesNature of Financial Accounting: Faculty of Economy and Business Mercubuana University 2018AgusMaulanaEntrepreneurshipSuksesNo ratings yet

- Internship Report On Faysal Bank Limited Peshawar Main CantDocument47 pagesInternship Report On Faysal Bank Limited Peshawar Main CantWaqar HassanNo ratings yet

- Financial Statement Analysis For Small Businesses: A Resource GuideDocument47 pagesFinancial Statement Analysis For Small Businesses: A Resource GuideRichardus YudistiraNo ratings yet

- Business Plan AbmDocument42 pagesBusiness Plan AbmMikaela MassalangNo ratings yet

- Hotel Voucher: IN - Out Price Night Sub TotalDocument1 pageHotel Voucher: IN - Out Price Night Sub TotalMozza OyazNo ratings yet

- 1 ++Marginal+CostingDocument71 pages1 ++Marginal+CostingB GANAPATHYNo ratings yet

- Accounting Fundamentals in Society ACCY111: DR Sanja PupovacDocument24 pagesAccounting Fundamentals in Society ACCY111: DR Sanja PupovacStephanie BuiNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Final Exam Autumn 2011 v1Document38 pagesFinal Exam Autumn 2011 v1peter kongNo ratings yet

- Ifsa Chapter9Document42 pagesIfsa Chapter9Iwan PutraNo ratings yet

- Adidas Balance SheetDocument1 pageAdidas Balance SheetApol Disimulacion0% (1)

- Mid Term BBA 24th AuditDocument2 pagesMid Term BBA 24th AuditMahruf ShahriarNo ratings yet

- Imran. Javaid - FCCA ACA CVDocument5 pagesImran. Javaid - FCCA ACA CVImran JavaidNo ratings yet

- How SAP RE-FX Makes You Comply With The New IFRS16 Leasing Rules - PIKON BLOGDocument9 pagesHow SAP RE-FX Makes You Comply With The New IFRS16 Leasing Rules - PIKON BLOGBruce ChengNo ratings yet

- Tugas Tutorial Ke-2 Analisis Informasi Keuangan PDFDocument4 pagesTugas Tutorial Ke-2 Analisis Informasi Keuangan PDFputridewitawinantiNo ratings yet

- Nathan Pierski Cover LetterDocument1 pageNathan Pierski Cover Letterapi-350314755No ratings yet

- Accounting Concept, Process Flow, Enterprise Structure FICODocument26 pagesAccounting Concept, Process Flow, Enterprise Structure FICOMaurya Shantanu100% (6)

- Waseem Electronics Motor Cycle Registration Detail Daska BranchDocument9 pagesWaseem Electronics Motor Cycle Registration Detail Daska BranchHarry JackNo ratings yet

- Key Terms Introduced or Emphasized in Chapter 4Document2 pagesKey Terms Introduced or Emphasized in Chapter 4Faryal MughalNo ratings yet

- Chapter 02Document32 pagesChapter 02蓝依旎No ratings yet

- Disqualification LetterDocument3 pagesDisqualification LetterLhen Gale67% (3)

- Members and Firm 2018 2019 17 07 2018Document405 pagesMembers and Firm 2018 2019 17 07 2018Sajib Chandra Roy100% (1)

- Bookkeeping NC III Accounting Recording Process: JournalizingDocument3 pagesBookkeeping NC III Accounting Recording Process: JournalizingLav Casal CorpuzNo ratings yet

- (03A) Cash Quiz ANSWER KEYDocument11 pages(03A) Cash Quiz ANSWER KEYGabriel Adrian ObungenNo ratings yet

- Rectification of ErrorsDocument6 pagesRectification of ErrorsJuhi JadhavNo ratings yet

- Aali - LK TW Iii 2019Document68 pagesAali - LK TW Iii 2019PrayogaNo ratings yet

- Unit Test: The Accounting Cycle Part A: Completing The Accounting CycleDocument7 pagesUnit Test: The Accounting Cycle Part A: Completing The Accounting CycleKevin PanesarNo ratings yet

- Managerial AccountingDocument21 pagesManagerial AccountingRam KnowlesNo ratings yet

- Correction of Errors in AccountingDocument27 pagesCorrection of Errors in AccountingPhares ConstantineNo ratings yet

- Review in Midterm Examination - Acc 204Document18 pagesReview in Midterm Examination - Acc 204Diane Marinel De LeonNo ratings yet