Professional Documents

Culture Documents

ESG Industria

Uploaded by

Diego Ponce0 ratings0% found this document useful (0 votes)

5 views5 pagesOriginal Title

ESG industria

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views5 pagesESG Industria

Uploaded by

Diego PonceCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 5

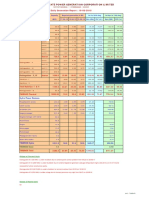

Name RobecoSAMSustainalytISS Govern ESG DisclosCDP Integr % Indep Dir% Women oCEO TenureTotal Comp Awarde

Median 65 25.97 7 51.18 6 45.8 18.18% 3.5 1.43M

Tesla Inc 70 25.23 9 51.18 0 75 25.00% 14.25 0

Toyota Motor Corp 74 29.76 9 -- 7 40 10.00% 6.33 7.39M

BYD Co Ltd 36 26.69 6 57.38 0 50 0.00% 20.58 914.12k

Dr Ing hc F Porsche AG -- 17.1 10 47.64 -- -- 30.00% 7.25 6.34k

Mercedes-Benz Group AG 68 20.88 3 -- 8 50 35.00% 3.67 7.47M

Bayerische Motoren Werke AG 81 24.75 7 -- 7 40 30.00% 3.42 7.50M

Volkswagen AG 88 25.97 10 -- 7 20 40.00% 0.33 16.10M

Stellantis NV 79 23.44 -- 70.84 0 54.55 27.27% 2 24.71M

Honda Motor Co Ltd 97 28.66 2 -- 6 45.45 18.18% 2 2.57M

Ferrari NV 85 24.78 2 -- 6 80 30.00% 1.33 3.98M

Ford Motor Co 63 22.35 10 70.25 8 64.29 28.57% 2.25 21.00M

General Motors Co 93 28.5 4 -- 7 92.31 46.15% 9 28.98M

Maruti Suzuki India Ltd 64 25.8 8 67.84 0 33.33 8.33% 1 1.28M

Li Auto Inc 48 21.43 -- 56.38 0 50 12.50% -- --

Hyundai Motor Co 100 28.31 3 -- 7 54.55 9.09% 1.58 2.99M

Tata Motors Ltd 89 27.5 8 -- 6 62.5 25.00% -- --

Kia Corp 90 24.55 3 51.18 7 55.56 22.22% 4.5 2.90M

Great Wall Motor Co Ltd 44 29.01 4 -- 0 42.86 28.57% -- --

SAIC Motor Corp Ltd 26 36.61 5 47.86 0 42.86 0.00% 3.5 617.38k

Mahindra & Mahindra Ltd 96 28.3 8 66.51 6 58.33 25.00% 1 1.88M

Suzuki Motor Corp 42 25.31 5 41.42 6 33.33 11.11% 7.83 1.27M

Rivian Automotive Inc 18 28.12 10 37.57 -- 85.71 42.86% 11.83 1.01M

Nissan Motor Co Ltd 77 27.19 1 -- 7 60 20.00% 3.33 4.98M

Chongqing Changan Automobile C 7 37.9 2 46.06 0 53.33 0.00% 2.25 370.63k

NIO Inc 53 28.43 -- -- 0 50 16.67% -- --

XPeng Inc 75 24.13 -- 56.95 0 37.5 12.50% 5.42 202.99k

Subaru Corp 59 30.36 5 -- 7 37.5 12.50% 4.83 909.83k

Lucid Group Inc 10 20.81 7 32.9 -- 88.89 33.33% 3.75 596.43k

Volvo Car AB 99 18.64 7 49.18 8 40 33.33% 0.83 9.78M

Guangzhou Automobile Group Co 40 32.37 1 60.07 2 36.36 0.00% 6.17 592.01k

Geely Automobile Holdings Ltd 78 17.84 7 74.14 0 36.36 27.27% 16.92 4.64M

Renault SA 71 22.34 6 -- 7 50 31.25% 2.5 4.76M

Isuzu Motors Ltd 51 26.77 8 -- 6 38.46 15.38% 7.83 1.66M

Mazda Motor Corp 84 31.48 7 -- 6 40 13.33% 4.83 846.38k

Polestar Automotive Holding UK -- 0 -- 35.95 -- 55.56 22.22% 0.75 1.62M

Mitsubishi Motors Corp 60 30.58 2 -- 6 38.46 15.38% 3.83 983.80k

FAW Jiefang Group Co Ltd 14 33.16 10 43.64 0 33.33 0.00% 1.33 289.20k

Zhejiang Leapmotor Technologie -- 0 -- 49.62 -- 42.86 14.29% 8 8.38M

Dongfeng Motor Group Co Ltd 34 26.6 7 53.19 0 42.86 0.00% 1.92 214.44k

Yulon Motor Co Ltd 45 0 -- -- 0 33.33 11.11% 9.42 378.87k

Aston Martin Lagonda Global Ho 66 32.09 10 -- 2 46.15 23.08% 0.67 1.43M

Brilliance China Automotive Ho 23 0 8 50.41 0 50 12.50% 1.42 0

BAIC Motor Corp Ltd 33 0 5 58.85 0 35.71 7.14% 2.08 279.13k

Energy InteGHG Emis/VWaste IntenWater IntenLost Time Incident Rate

1.97 0.57 0.17 4.64 0.34

-- 0.46 0.29 2.56 --

-- -- -- -- --

5.57 4.31 0.65 27.35 --

2.54 0.3 0.07 4.67 --

-- 0.69 0.25 2.97 --

2.62 -- 0.34 2.02 0.32

2.54 0.8 0.38 4.76 --

2.68 0.6 0.05 4.61 --

5.05 -- 0.6 -- 0.13

33.2 7.26 0.64 55.81 0.52

2.97 0.89 0.27 3.78 0.39

2.37 0.75 0.25 4.6 0.39

0.72 0.22 0.09 2.96 0

1.73 0.57 0.18 -- --

1.9 -- 0.14 5.06 0.39

-- -- -- -- --

1.94 0.4 -- -- --

1.8 0.99 0.03 5.47 --

1.52 1 -- -- --

0.73 0 0.15 2.86 --

1.14 0.39 0.13 -- --

-- -- -- -- --

2.94 0.86 0.06 -- --

-- -- 0.08 -- --

-- -- -- -- --

1.11 0.84 0.21 -- 0.1

-- -- -- -- --

-- -- -- -- --

2.05 0.18 0.44 3.21 0.07

1.12 0.55 0.17 3.77 --

1.17 0.42 0.11 6.68 --

1.99 0.3 0.3 5.05 0.34

-- -- -- -- --

-- -- -- -- --

-- 0.16 -- -- --

-- 0.36 0.14 -- --

-- -- -- -- --

0.1 0.14 0.12 8.13 --

1.11 0.68 0.02 5.34 --

-- -- -- -- --

11.81 2.37 0.37 -- 0.36

0.05 0.03 -- -- --

2.14 0.82 0.16 -- --

Mercedes- Bayerische

Volkswagen

Name Median Benz Group Motoren Kia Corp

AG

RobecoSAM Total Sustainability Rank 65 AG

68 Werke

81 AG 88 90

Sustainalytics ESG Rank 25.97 20.88 24.75 25.97 24.55

ISS Governance Quickscore 7 3 7 10 3

ESG Disclosure Score 51.18 73.23 69.46 66.21 51.18

CDP Integrated Performance Score 6 8 7 7 7

% Indep Dir on Board 45.8 50 40 20 55.56

% Women on Board 18.18% 35.00% 30.00% 40.00% 22.22%

CEO Tenure as of FYE 3.5 3.67 3.42 0.33 4.5

Total Comp Awarded to CEO 1.43M 7.47M 7.50M 16.10M 2.90M

Energy Intens/Vehicle Sold 1.97 -- 2.62 2.54 1.94

GHG Emis/Vehicle Sold 0.57 0.69 -- 0.8 0.4

Waste Intens/Vehicle Sold 0.17 0.25 0.34 0.38 --

Water Intens/Vehicle Sold 4.64 2.97 2.02 4.76 --

Lost Time Incident Rate 0.34 -- 0.32 -- --

You might also like

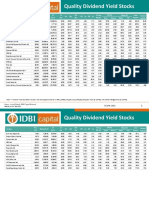

- DIVIDEND YIELD REPORT - JUNE 2023-05-June-2023-1938561564Document5 pagesDIVIDEND YIELD REPORT - JUNE 2023-05-June-2023-1938561564uma AgrawalNo ratings yet

- Dividend Yield Report June 2022 - Idbi CapDocument5 pagesDividend Yield Report June 2022 - Idbi CapcitisunNo ratings yet

- Lab 110509Document6 pagesLab 110509Andre SetiawanNo ratings yet

- Market Statistics - Friday, October 30 2009: Japan - Nikkei 225Document7 pagesMarket Statistics - Friday, October 30 2009: Japan - Nikkei 225Andre SetiawanNo ratings yet

- Share ProjectionsDocument4 pagesShare ProjectionsPuducherryNo ratings yet

- Nifty 500 COMPANY WITH ANALYSISDocument3 pagesNifty 500 COMPANY WITH ANALYSISVILAS KORKENo ratings yet

- Dividend Yield StocksDocument3 pagesDividend Yield StocksSushilNo ratings yet

- Performance of Select Stocks Over Last 20 Years (2000-2020)Document12 pagesPerformance of Select Stocks Over Last 20 Years (2000-2020)GANESHNo ratings yet

- Rising Net Cash Flow and Cash From Operating Activity Aug 10Document3 pagesRising Net Cash Flow and Cash From Operating Activity Aug 10KabirNo ratings yet

- CFD - November 5th 2009Document3 pagesCFD - November 5th 2009Andre SetiawanNo ratings yet

- Waverly Advisors ScreenersDocument28 pagesWaverly Advisors Screenershecha82No ratings yet

- Quality Dividend Yield Stocks Jan 22 03 January 2022 478756522Document4 pagesQuality Dividend Yield Stocks Jan 22 03 January 2022 478756522Jaikanth MuthukumaraswamyNo ratings yet

- Dividend Yield Stocks 210922Document3 pagesDividend Yield Stocks 210922Aaron KaleesNo ratings yet

- Stock Screens 080217Document50 pagesStock Screens 080217sarav10No ratings yet

- Segment Wise Report Upto March 2020 - RevisedDocument6 pagesSegment Wise Report Upto March 2020 - RevisedJayalakshmi RajendranNo ratings yet

- Stock Screener172818Document6 pagesStock Screener172818Rafiq ShaikhNo ratings yet

- Particulars CMP Purchase Price Purchase Value Current Value Return (%) Purchase Weightage (%) Current No of Shares Current Weightage (%)Document31 pagesParticulars CMP Purchase Price Purchase Value Current Value Return (%) Purchase Weightage (%) Current No of Shares Current Weightage (%)gurudev21No ratings yet

- Automobile Industry: Presented by Josh Jit Singh BaliDocument15 pagesAutomobile Industry: Presented by Josh Jit Singh BalivjsbaliNo ratings yet

- Market 11 Aug 2014 3.30 PMDocument2 pagesMarket 11 Aug 2014 3.30 PMasifNo ratings yet

- Dividend Yield Stocks: Retail ResearchDocument3 pagesDividend Yield Stocks: Retail ResearchAmeerHamsaNo ratings yet

- ReportDocument50 pagesReportPratik VermaNo ratings yet

- Lab 110609Document6 pagesLab 110609Andre SetiawanNo ratings yet

- Dividend Yield StocksDocument3 pagesDividend Yield StocksDilip KumarNo ratings yet

- IndustryDocument20 pagesIndustry121prashantNo ratings yet

- Stocks Inside Feb 2024Document3 pagesStocks Inside Feb 2024dwk6q9zq25No ratings yet

- CFD - November 6th 2009Document3 pagesCFD - November 6th 2009Andre SetiawanNo ratings yet

- Nifty 50Document3 pagesNifty 50Arjun BhatnagarNo ratings yet

- Ethics of Business Turnaround Mangement: Global Trade War (Us - China)Document12 pagesEthics of Business Turnaround Mangement: Global Trade War (Us - China)Ashlesh MangrulkarNo ratings yet

- Model Portfolio Performance - 03rd July 2020Document4 pagesModel Portfolio Performance - 03rd July 2020Sandipan DasNo ratings yet

- NYSE & NASDAQ New 52 Week Highs and Lows - 20220506Document30 pagesNYSE & NASDAQ New 52 Week Highs and Lows - 20220506matrixitNo ratings yet

- 2-Gaikindo Brand Data Janaug2022-RevDocument2 pages2-Gaikindo Brand Data Janaug2022-RevfahranyNo ratings yet

- NSE Nifty 50 Quarterly Financial Analysis With EPSDocument1 pageNSE Nifty 50 Quarterly Financial Analysis With EPSRajeev NaikNo ratings yet

- Dalal Street - Top 1000 Companies Financial ReviewDocument19 pagesDalal Street - Top 1000 Companies Financial ReviewRoyden DSouzaNo ratings yet

- Lab 110309Document6 pagesLab 110309Andre SetiawanNo ratings yet

- Model Portfolio Performance - 15th May 2020Document4 pagesModel Portfolio Performance - 15th May 2020FACTS- WORLDNo ratings yet

- L Name Price PAT Dividend (5YA) Div - Pay DY.5A DY.CDocument5 pagesL Name Price PAT Dividend (5YA) Div - Pay DY.5A DY.CdineshNo ratings yet

- 3264 PDFDocument1 page3264 PDFGanesh DasaraNo ratings yet

- Stock DetailsDocument2 pagesStock DetailsNilesh DhandeNo ratings yet

- GAWARVALADocument31 pagesGAWARVALAgurudev21No ratings yet

- Book 6Document3 pagesBook 6salvi_2079No ratings yet

- Korba: For Any Feedback Please Contact SH Ajay Sharma, GM (COS-Boiler), Mob: 9650992042Document1 pageKorba: For Any Feedback Please Contact SH Ajay Sharma, GM (COS-Boiler), Mob: 9650992042anil peralaNo ratings yet

- August New Car Sales FiguresDocument1 pageAugust New Car Sales Figuresdanielharrison1No ratings yet

- Telangana State Power Generation Corporation LimitedDocument1 pageTelangana State Power Generation Corporation LimitedSuresh DoosaNo ratings yet

- CFD - November 3rd 2009Document3 pagesCFD - November 3rd 2009Andre SetiawanNo ratings yet

- Ind Nifty50listDocument4 pagesInd Nifty50listSubrata PaulNo ratings yet

- Stock MarketDocument11 pagesStock MarketMufaddal DaginawalaNo ratings yet

- Caution Stock WatchlistDocument47 pagesCaution Stock WatchlistSatyasundar PanigrahiNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument8 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- Next 50Document631 pagesNext 50Kasthuri CoimbatoreNo ratings yet

- Weightage of Deffrent Co.'s in Nifty: Switch To NSE Switch To BSEDocument2 pagesWeightage of Deffrent Co.'s in Nifty: Switch To NSE Switch To BSEShakti ShuklaNo ratings yet

- The Watch List: Being Near-Monopolies, These Companies Have High Chances of Delivering Consistent ReturnsDocument2 pagesThe Watch List: Being Near-Monopolies, These Companies Have High Chances of Delivering Consistent Returnsmaheshtech76No ratings yet

- 03 - Marzo - PatentamientoDocument5 pages03 - Marzo - PatentamientoLeonardo PeirettiNo ratings yet

- RelianceTaxSaver (ELSS) Fund 2017jul25Document4 pagesRelianceTaxSaver (ELSS) Fund 2017jul25Krishnan ChockalingamNo ratings yet

- Kingston Educational Institute: Ratio AnalysisDocument1 pageKingston Educational Institute: Ratio Analysisdhimanbasu1975No ratings yet

- Year 2013 2014 2015 2016 2017 Latest: CompetitionDocument3 pagesYear 2013 2014 2015 2016 2017 Latest: CompetitionDahagam SaumithNo ratings yet

- Ejercicio Clase 04-09-2023Document8 pagesEjercicio Clase 04-09-2023Jose CariasNo ratings yet

- ER ProjectDocument25 pagesER ProjectGunjan AhujaNo ratings yet

- Dividend Yield StocksDocument2 pagesDividend Yield Stocksunu_uncNo ratings yet

- GT Range BrochureDocument8 pagesGT Range BrochureEric OukoNo ratings yet

- Electric Vehicle PPT - FinalDocument15 pagesElectric Vehicle PPT - Finalspam mail100% (4)

- Volkswagen Golf Manual PDF Mk6 WordpresscomDocument2 pagesVolkswagen Golf Manual PDF Mk6 WordpresscomSergio Pereira60% (5)

- Onzo Price List-LithiumDocument1 pageOnzo Price List-Lithiumrohitkushwaha325No ratings yet

- 3 GAIKINDO Wholesales Data Jan2024Document3 pages3 GAIKINDO Wholesales Data Jan2024Trick UnikNo ratings yet

- 2024 Volvo XC90Document2 pages2024 Volvo XC90luxury life wishesNo ratings yet

- File 2 NewDocument3,345 pagesFile 2 Newrajesh thapaNo ratings yet

- Davinci DPF Egr DTC Maf New Version 1.0.26 Full ListeDocument21 pagesDavinci DPF Egr DTC Maf New Version 1.0.26 Full ListeCega Servic100% (1)

- Ford and Toyota JVDocument2 pagesFord and Toyota JVSonam GurungNo ratings yet

- SDG Goal 7 Article For ReflectionDocument2 pagesSDG Goal 7 Article For ReflectionRoy :DNo ratings yet

- Lilium Jet Aircraft: Electric AviationDocument3 pagesLilium Jet Aircraft: Electric AviationGabriel MellaNo ratings yet

- Electric Vehicle Industry in SwitzerlandDocument4 pagesElectric Vehicle Industry in SwitzerlandFrantz AugustinNo ratings yet

- Automotive - Pitch 3 (VDL Bus & Coach) PDFDocument16 pagesAutomotive - Pitch 3 (VDL Bus & Coach) PDFManoj DashNo ratings yet

- Golf Variant EditionDocument3 pagesGolf Variant EditionAnonymous vQewJPfVXaNo ratings yet

- "Business Plan On Electric Vehicle Charging Station": A Micro Project OnDocument12 pages"Business Plan On Electric Vehicle Charging Station": A Micro Project OnZenith SandilNo ratings yet

- AFESDocument7 pagesAFESjhdfjhfnNo ratings yet

- Ev To Evse CommunicationDocument4 pagesEv To Evse CommunicationnaveenNo ratings yet

- Regulasi Teknis Sem Asia 2020 PDFDocument47 pagesRegulasi Teknis Sem Asia 2020 PDFmuhamad yakubNo ratings yet

- Nissan: N. Codice Bieffe Ref. Cil. Cyl. MM Modello Model N. Originale O.E. NumberDocument7 pagesNissan: N. Codice Bieffe Ref. Cil. Cyl. MM Modello Model N. Originale O.E. Numberchristopher Huaman SanchezNo ratings yet

- Model yDocument2 pagesModel ysaadshahab622No ratings yet

- Electric Rickshaw & Battery Rickshaw in DelhiDocument14 pagesElectric Rickshaw & Battery Rickshaw in DelhiNanyaNo ratings yet

- Toyota TSB - Hard Start or Poor Idle After 12V Power InterruptionDocument2 pagesToyota TSB - Hard Start or Poor Idle After 12V Power InterruptionMaster XeotoNo ratings yet

- SSPB4343: (In United States)Document19 pagesSSPB4343: (In United States)SIVASANGKARY MUNIANDYNo ratings yet

- Metalcaucho 2012Document1,652 pagesMetalcaucho 2012Adi SdrancăNo ratings yet

- EV Home Charger GuideDocument17 pagesEV Home Charger Guideprakash barikNo ratings yet

- AUTOMOBILE Micro Project of Automobile Engineering 22656 MSBTE I SCHEME - MSBTE MICRO PROJECTSDocument10 pagesAUTOMOBILE Micro Project of Automobile Engineering 22656 MSBTE I SCHEME - MSBTE MICRO PROJECTS30-Sakharam JadhavNo ratings yet

- Ecu List X Auto y UbicDocument11 pagesEcu List X Auto y UbicLindsey Bruce100% (2)

- FILTROSACEITEDocument8 pagesFILTROSACEITEFranberts BenitesNo ratings yet

- caja-festiva-F3A-3 Velocidades PDFDocument4 pagescaja-festiva-F3A-3 Velocidades PDFAnna Nelson50% (2)

- Corporate DataDocument12 pagesCorporate DataAbdullah Banab0% (1)

- PH - English - ASC - Q1429 - Electric Vehicle Service Technician - V4.0Document325 pagesPH - English - ASC - Q1429 - Electric Vehicle Service Technician - V4.0संजीव कुमार झाNo ratings yet