Professional Documents

Culture Documents

Notice Delinquency

Uploaded by

Joyce BalanaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notice Delinquency

Uploaded by

Joyce BalanaCopyright:

Available Formats

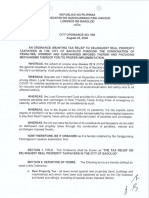

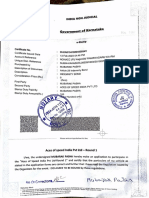

REPUBLIC OF THE PHILIPPINES

PROVINCE OF ALBAY

MUNICIPALITY OF DARAGA

OFFICE OF THE MUNICIPAL TREASURER

NOTICE OF DELINQUENCY

Owner : TIONGSON, PERFECTO Date Printed: April 14, 2023

PARANAQUE CITY, M.M. Date Computed: April 14, 2023

Administrator : TOLEDO, SILVENO

ANISLAG,DARAGA,ALBAY

SIR / MADAME:

NOTICE is hereby served pursuant to the provision of Section 254, Republic Act No. 7160 (The Local Government Code) due

for the Calendar year 2023 and previous years, has been delinquent with respect to the following:

CLASS / Area AV DELINQUENT AMOUNT

TD NO. PIN BARANGAY

LOT NO. (Sq. M) . PERIOD DUE

2017-04-0005-00562 031-04-005-03-025 A / 13848 ANISLAG 74,858.0000 89,140 2000-2022 43,097.60

*** TOTAL AMOUNT DUE *** 43,097.60

This computation is valid until: April 30, 2023

Pursuant to Section 256, 258, 260 of the Local Government Code of 1991, as amended, failure of real property owners to pay their

delinquent taxes empowers the Municipal Treasurer to avail of administrative action by Levy through Public Auction. Within thirty (30)

days after service of warrant, the local treasurer shall proceed to publicly advertise for sale or auction the property to satisfy the tax

delinquency and expenses of sale.

Simultaneously, failure to pay real property taxes and the said real property becomes delinquent, an interest of two percent (2%) per

month shall be charged on the unpaid amount until the taxes have been fully paid, as provided for in Section 255 of the Local Government

Code of 1991.

Delinquent taxpayers are therefore enjoined to settle delinquent taxes to avoid their real property be seized and sold through public

auction.

RECEIVED ORIGINAL :__________________DATE RECEIVED:______________

Note:

MICHELLE MAY MANAGO

1. Kindly inform this office of any error or ommission that you may have

discovered in this Bill. ACTING MUNICIPAL TREASURER

2. Please present this Bill to this of when payment is made.

3._______Payment of the said Taxes/Discounts/Interest is up to

4. Failure to pay the aforemntioned real property taxes within twenty (20) days from receipt hereof will force to apply the remedial

measures provided under Sec. 256 of RA 7160 to enforce collection of the same.

5. In case payment has been made, please briing the neccessary official receipts.

GENERATED BY : ETRACS System 2.5 PRINTED BY : NEVEL B. TEVES PRINT DATE : 2023-04-14 04:31:49 Page 1 of

You might also like

- Official Receipt: Land Transportation OfficeDocument2 pagesOfficial Receipt: Land Transportation Officelorilyn batallerNo ratings yet

- Efs Master Clinical Trial Agreement 2019 V2Document30 pagesEfs Master Clinical Trial Agreement 2019 V2Krystal SantiagoNo ratings yet

- Barangay Ordinance Re Barangay Clearance AuthorizationDocument3 pagesBarangay Ordinance Re Barangay Clearance AuthorizationDilg Concepcion100% (1)

- 2020 - 07 - 04 UE College of Law Course Syllabus On Labor Law ReviewDocument10 pages2020 - 07 - 04 UE College of Law Course Syllabus On Labor Law ReviewpaescorpisoNo ratings yet

- Renovation ContractDocument3 pagesRenovation ContractStevenAronNo ratings yet

- Certificate of RegistrationDocument2 pagesCertificate of RegistrationEnrry SebastianNo ratings yet

- Barangay Ordinance - Barangay Clearance Issuance - SampleDocument3 pagesBarangay Ordinance - Barangay Clearance Issuance - SampleSusan Carbajal88% (8)

- Business PermitDocument1 pageBusiness PermitVELOX MABUHAYNo ratings yet

- Pax 23 X 0030252543Document1 pagePax 23 X 0030252543Kurt Pruna100% (1)

- Barangay Ordinance No 435-001 S 2021 Issuing Business ClearanceDocument3 pagesBarangay Ordinance No 435-001 S 2021 Issuing Business Clearancealex v. agbanglo100% (2)

- Customer Service Point ("CSP") - Retailer AgreementDocument41 pagesCustomer Service Point ("CSP") - Retailer AgreementAMAN SHARMANo ratings yet

- A Notice of Delinquency LetterDocument1 pageA Notice of Delinquency LetterShena Bianca FailmaNo ratings yet

- SafariDocument1 pageSafariKoteswara RaoNo ratings yet

- Application Form For Business Permit 2023Document1 pageApplication Form For Business Permit 2023Pop MovesNo ratings yet

- List of LesseeDocument5 pagesList of LesseeJennielyn MedesNo ratings yet

- 3187e232-4902-401c-935f-2ddc1cb32107Document1 page3187e232-4902-401c-935f-2ddc1cb32107rukhshiconsultantNo ratings yet

- Contract New Jul To Dec - Page-0001 (8 Files Merged)Document8 pagesContract New Jul To Dec - Page-0001 (8 Files Merged)Dadz CoraldeNo ratings yet

- Republic of The PhilippinesDocument1 pageRepublic of The Philippinescristine gomobarNo ratings yet

- Tax Collector Correspondence4210107211917Document2 pagesTax Collector Correspondence4210107211917Amsal Asif Kasbati0% (1)

- Digitally Signed by Poleboina Bhogishwarlu Municipal Commissioner Date: 22-08-2023 15:56:45 ApprovedDocument2 pagesDigitally Signed by Poleboina Bhogishwarlu Municipal Commissioner Date: 22-08-2023 15:56:45 Approvedniharxerox180No ratings yet

- Warrant of Levy On Real Property TaxDocument1 pageWarrant of Levy On Real Property TaxRhestie IlaganNo ratings yet

- Lessee Information StatementDocument1 pageLessee Information Statementmja.carilloNo ratings yet

- Assesment BPL 2019Document86 pagesAssesment BPL 2019Mylene M.PanganibanNo ratings yet

- Affidavit of ConsolidationDocument3 pagesAffidavit of ConsolidationmarygracecatungalNo ratings yet

- DOF Order 007-02Document3 pagesDOF Order 007-02Peggy SalazarNo ratings yet

- PG 1Document1 pagePG 1Highvalue RdcNo ratings yet

- 2023721217646921CircularNo 1of2023-2024Document4 pages2023721217646921CircularNo 1of2023-2024krebs38No ratings yet

- Launch Jasper ReportDocument1 pageLaunch Jasper ReportElias Abubeker AhmedNo ratings yet

- Ramesh GPF Old StatementDocument2 pagesRamesh GPF Old StatementSHARANUNo ratings yet

- Memorandum of AgreementDocument4 pagesMemorandum of AgreementBarangayZone XI TalisayNo ratings yet

- 05.25.23 Citizens CharterDocument1 page05.25.23 Citizens Charterjhzc6tmhg8No ratings yet

- CharterDocument46 pagesChartersameergoaNo ratings yet

- Registration of Plots in Unauthorized Layout - Furnishing of Prohibited Property ListDocument2 pagesRegistration of Plots in Unauthorized Layout - Furnishing of Prohibited Property ListRaghuNo ratings yet

- Alcantara V RepublicDocument15 pagesAlcantara V RepublicEzer SccatsNo ratings yet

- Notice of Payment 2020Document1 pageNotice of Payment 2020Carlo CaguimbalNo ratings yet

- PultzDocument2 pagesPultzChamain MarreroNo ratings yet

- Application For Sand Gravel Gratuitous PermitDocument3 pagesApplication For Sand Gravel Gratuitous PermitALFONSO JEZIEL M DE LOS REYESNo ratings yet

- FAQ Property Tax 10 02 2017Document7 pagesFAQ Property Tax 10 02 2017Diya PandeNo ratings yet

- 723254EFB162Document1 page723254EFB162Gio MirandaNo ratings yet

- 12a Aabtm0174ge20046 SignedDocument3 pages12a Aabtm0174ge20046 SignedPrashant MujumdarNo ratings yet

- DocumentDocument1 pageDocumentDagnachew TsegayeNo ratings yet

- ResearchDocument5 pagesResearchEjhay OniaNo ratings yet

- Bid Notice Abstract: Invitation To Bid (ITB)Document3 pagesBid Notice Abstract: Invitation To Bid (ITB)kurokochijangskieNo ratings yet

- Website: Agkar - Cag.gov - in E - Mail ID - Agpf - Kar@nic - inDocument2 pagesWebsite: Agkar - Cag.gov - in E - Mail ID - Agpf - Kar@nic - inJumki SNo ratings yet

- BLGF Opinion Dated June 6 2017Document10 pagesBLGF Opinion Dated June 6 2017Taxation LawNo ratings yet

- Ramesh GPFDocument2 pagesRamesh GPFSHARANUNo ratings yet

- Sworn Application For Tax Clearance For Bidding Purposes - EdrDocument2 pagesSworn Application For Tax Clearance For Bidding Purposes - Edranabua0% (1)

- Quarterly Business Tax ReminderDocument11 pagesQuarterly Business Tax ReminderPaolo IcangNo ratings yet

- Evaluation Sheet: (Abatement or Cancellation of Taxes, Penalties And/Or Interest)Document5 pagesEvaluation Sheet: (Abatement or Cancellation of Taxes, Penalties And/Or Interest)Hanabishi RekkaNo ratings yet

- CORTES, Hrs. of Ceferina Notice-Cancellation-of-assessmentDocument2 pagesCORTES, Hrs. of Ceferina Notice-Cancellation-of-assessmenterwintangNo ratings yet

- Appeal FinalDocument1 pageAppeal FinalJeruel San GabrielNo ratings yet

- Authority To PrintDocument5 pagesAuthority To PrintKyungsoo PenguinNo ratings yet

- Tax Collector Correspondence3840409752263Document2 pagesTax Collector Correspondence3840409752263Muzaffar AliNo ratings yet

- 2.) Annex F - LTO - Dealer - FNL (DOE APPLICANT)Document2 pages2.) Annex F - LTO - Dealer - FNL (DOE APPLICANT)Mark Anthony CarigNo ratings yet

- SAT - Formato RTU GuatemalaDocument2 pagesSAT - Formato RTU GuatemalaAxel Omar Gil MarroquinNo ratings yet

- Kano State of Nigeria 12 ChairmanDocument2 pagesKano State of Nigeria 12 ChairmanHuzaifa HamzaNo ratings yet

- Pak Telecom Mobile Limited: 6,094.05 Six Thousand Ninety-Four Rupees Five PaisasDocument1 pagePak Telecom Mobile Limited: 6,094.05 Six Thousand Ninety-Four Rupees Five PaisasAsharf AliNo ratings yet

- Paf# 20230908 8575518Document1 pagePaf# 20230908 8575518Monica Royo DigmanNo ratings yet

- Null 4Document1 pageNull 4Alvin AduNo ratings yet

- C.O. 936, S. 2020 - Tax Relief On Delinquent Real Property Taxpayers in The City of BacolodDocument4 pagesC.O. 936, S. 2020 - Tax Relief On Delinquent Real Property Taxpayers in The City of BacolodCity Legal OfficeNo ratings yet

- Circular-ITR of Salaried Employees-Suspicious Claims..Document9 pagesCircular-ITR of Salaried Employees-Suspicious Claims..Damodar SurisettyNo ratings yet

- Prop Tax A RPGT Illustrations (Tracked)Document39 pagesProp Tax A RPGT Illustrations (Tracked)celina kohNo ratings yet

- Ta HLMTDocument37 pagesTa HLMTAKMAL HELMINo ratings yet

- 2 BR - Tower 108 - Jumeirah Village - Inr 2.46 CR - ReadyDocument4 pages2 BR - Tower 108 - Jumeirah Village - Inr 2.46 CR - ReadyFahad Farooq FareedNo ratings yet

- Decennial Liability in The UAE - A CommentaryDocument3 pagesDecennial Liability in The UAE - A CommentaryanupjpNo ratings yet

- 05 Saudi Arabian Airlines (Saudia) v. Rebesencio (2015)Document28 pages05 Saudi Arabian Airlines (Saudia) v. Rebesencio (2015)enggNo ratings yet

- ATEX 2014 34 EU Butterfly Valve and Check ValveDocument3 pagesATEX 2014 34 EU Butterfly Valve and Check ValveABHISHEK DOLLENo ratings yet

- La Sicología Femenil en La Obra...Document18 pagesLa Sicología Femenil en La Obra...Leidy ZamaraNo ratings yet

- 霍姆斯:普通法(THE COMMON LAW)Document171 pages霍姆斯:普通法(THE COMMON LAW)Benedito ZepNo ratings yet

- Form 51Document2 pagesForm 51Shobhna0% (1)

- Lecture 3 Torts LawDocument17 pagesLecture 3 Torts LawHasnain HaiderNo ratings yet

- Tax Guide On Philippine Taxation - Bureau of Internal RevenueDocument11 pagesTax Guide On Philippine Taxation - Bureau of Internal RevenueRadh KamalNo ratings yet

- New Imprest FormDocument2 pagesNew Imprest Formchola100% (1)

- Lecture Note On Managent and LawDocument54 pagesLecture Note On Managent and LawVictoryNo ratings yet

- Alonzo Q Ancheta Vs Candelaria Guersey-DalaygonDocument9 pagesAlonzo Q Ancheta Vs Candelaria Guersey-DalaygonCleophilKayeGripoYontingNo ratings yet

- Appeal: MeaningDocument5 pagesAppeal: MeaningSlim ShadyNo ratings yet

- ADR ConsolidatedDocument13 pagesADR ConsolidatedJamiah HulipasNo ratings yet

- Guagua National Colleges VS Guagua National Colleges Faculty Labor UnionDocument41 pagesGuagua National Colleges VS Guagua National Colleges Faculty Labor UnionViolet BlueNo ratings yet

- 0071 0155 EMA Application Form V3 25th May 2018Document12 pages0071 0155 EMA Application Form V3 25th May 2018kceoredNo ratings yet

- Deficiency of Services Under Consumer Protection Act, 2019 - Lexology PDFDocument4 pagesDeficiency of Services Under Consumer Protection Act, 2019 - Lexology PDFVarun RoyNo ratings yet

- Conflict 1 NotesDocument23 pagesConflict 1 NotesSelwyn Spencer SackeyNo ratings yet

- Kidnap and Ransom Proposal Form-1Document3 pagesKidnap and Ransom Proposal Form-1gargramNo ratings yet

- SBI 8 Saving Taxable Bond 2003 Application Form SIAPL PDFDocument3 pagesSBI 8 Saving Taxable Bond 2003 Application Form SIAPL PDFSagarika BeraNo ratings yet

- TESDA Circular No. 038-2019Document12 pagesTESDA Circular No. 038-2019Leonicia MarquinezNo ratings yet

- Contract Law For IP Lawyers: Mark Anderson, Lisa Allebone and Mario SubramaniamDocument14 pagesContract Law For IP Lawyers: Mark Anderson, Lisa Allebone and Mario SubramaniamJahn MehtaNo ratings yet

- Mubarak IndemintyDocument2 pagesMubarak IndemintyJeevan Gowda RNo ratings yet

- Application Form: Professional Regulation CommissionDocument1 pageApplication Form: Professional Regulation CommissionKhyshen WuNo ratings yet