Professional Documents

Culture Documents

Digitally Signed by Poleboina Bhogishwarlu Municipal Commissioner Date: 22-08-2023 15:56:45 Approved

Uploaded by

niharxerox180Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Digitally Signed by Poleboina Bhogishwarlu Municipal Commissioner Date: 22-08-2023 15:56:45 Approved

Uploaded by

niharxerox180Copyright:

Available Formats

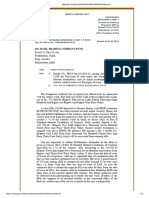

GOVERNMENT OF TELANGANA

MUNICIPAL ADMINISTRATION DEPARTMENT

SHAMSHABAD MUNICIPALITY,

RANGAREDDY DISTRICT.

App No. 9119902421 / 2023

PROPERTYTAX ASSESSMENTNOTICE Date: 22-08-2023

In exercise of the powers conferred on Municipal Commissioner under Sections 58 and 92 of Telangana Municipalities Act, 2019, assessment of Property Tax is

made as follows as per the information furnished by the applicant/available information:

Name of the Assessee K SATHYANARAYANA RAO

S/o, W/o, D/o K RAMA CHANDRA RAO

Address & Location of the Property AIRPORT COLONY

Zone No./ Village Name SHAMSHABAD, SHAMSHABAD MUNICIPALITY

Door No. allotted 432/P

PTIN Number

(Property Tax identification Number)

1199301427

Reason for Assessment

Property Tax effect Period 2023-2024-1

Plinth Area and Usage of the Building

Floor No. Total Plinth Area Usage Total Total Capital Value Tax levied per Half year.

ARV

0 375 Residential 0 314250 1359

1 432 Residential 0 237600 1026

2 432 Residential 0 237600 1026

Total Yearly Property Tax 6822 Total Half year Tax 3411

TERMS AND CONDITIONS

1. This assessment order does not amount to regularisation of un-authorised constructions if any or made against sanctioned plan.

2. This assessment will be deemed to be cancelled, if it comes to notice that it has been obtained by fraud / deceit or mistake of fact.

3. This assessment doesn’t confer any right on the site

4. The assessment order does not amount to regularisation of occupation of Government lands or objectionable lands.

5. The assessee if not satisfied with this assessment, she/he can file a revision petition before the Municipal Commissioner wit hin 30 days from the date of

receipt of this notice.

6. The Assessee shall pay Property Tax every year before 30th June, for 1st half year and 31st December for 2nd half year tax to avoid payment of

penalty.

7. If the Assessee fails to pay in above specify time is liable to pay simple interest of 2% per Month.

8. The Assessee can pay advance tax for complete year in advance i.e before 30th April of every year to avail 5% Rebate on Property Tax.

9. If the tax payer defaults to pay the tax in the prescribed period, theCommissioner after giving a notice to the defaulter owner or occupier disconnect the

services of the premises. 10. The Municipality is empowered to recover any arrears due towards any amount towards Municipal Revenue by

following the procedure as contemplated for the recovery of land revenue under the provisions of sec 87 of the Telangana Municipalities Act, 2019.

Digitally Signed By

POLEBOINA BHOGISHWARLU

Municipal Commissioner

Date : 22-08-2023 15:56:45

Approved

You might also like

- SafariDocument1 pageSafariKoteswara RaoNo ratings yet

- Probir KMC Tax Bill OldDocument1 pageProbir KMC Tax Bill OldLawrence JowittNo ratings yet

- PDFenDocument6 pagesPDFenSachin SharmaNo ratings yet

- Notice DelinquencyDocument1 pageNotice DelinquencyJoyce BalanaNo ratings yet

- Challan 2Document1 pageChallan 2Learning with EshallNo ratings yet

- House TaxDocument4 pagesHouse TaxHarish NanduriNo ratings yet

- Ramapuram Village Panchayat, Cuddalore Block, Cuddalore District Receipt of Property TaxDocument1 pageRamapuram Village Panchayat, Cuddalore Block, Cuddalore District Receipt of Property TaxbrightfuturecudNo ratings yet

- Fire Alarm Loa PraygrajDocument5 pagesFire Alarm Loa PraygrajDHN CUGNo ratings yet

- Claims Report by Claim No#1858Document3 pagesClaims Report by Claim No#1858Sanjeet KumarNo ratings yet

- Work Commencement TurkayamjalDocument4 pagesWork Commencement Turkayamjalbrr21818No ratings yet

- GST 12 To 18Document34 pagesGST 12 To 18Rajesh ChandelNo ratings yet

- WorkCommencement SC 28635 MANC 0160 2021Document4 pagesWorkCommencement SC 28635 MANC 0160 2021Honey Singh ThamNo ratings yet

- WorkCommencement SC 295807 JAGI 0528 2023Document4 pagesWorkCommencement SC 295807 JAGI 0528 2023prashanth.financialpanditNo ratings yet

- WorkCommencement SC 43964 MANC 0329 2021Document5 pagesWorkCommencement SC 43964 MANC 0329 2021Honey Singh ThamNo ratings yet

- 1-4848974423267 216663802 88269XXXXX 8 2023Document4 pages1-4848974423267 216663802 88269XXXXX 8 2023ranjeetdrdoNo ratings yet

- E20 CVL Work OrderDocument151 pagesE20 CVL Work OrderEr. TK SahuNo ratings yet

- Trident C, DDocument1 pageTrident C, Dsarup140509No ratings yet

- Construction ApprovalDocument4 pagesConstruction ApprovalMAHENDAR SOMSHETTY0% (1)

- RT 2021-22 01078Document1 pageRT 2021-22 01078M A InteriorsNo ratings yet

- Ulhasnagar Municipal Corporation Dist - Thane (Maharashtra) : Public Works DepartmentDocument2 pagesUlhasnagar Municipal Corporation Dist - Thane (Maharashtra) : Public Works Departmentdivya jhamtaniNo ratings yet

- Wa0010.Document2 pagesWa0010.gauttam gowlikarNo ratings yet

- No Due Certificate - MCG Property TaxDocument1 pageNo Due Certificate - MCG Property Taxabhinav007_007No ratings yet

- Rajamahendravaram Municipal Corporation: OriginalDocument4 pagesRajamahendravaram Municipal Corporation: OriginalAbhishek saiNo ratings yet

- Tendernotice 1Document1 pageTendernotice 1ASHIK AHAMED.SNo ratings yet

- Fixedline and Broadband Services: Your Account Summary This Month'S ChargesDocument2 pagesFixedline and Broadband Services: Your Account Summary This Month'S ChargesSuraj SinghNo ratings yet

- Egov - View Property DetailsDocument4 pagesEgov - View Property DetailsvanapallimadhumscNo ratings yet

- Scrutiny Base Signed 1666847523582Document2 pagesScrutiny Base Signed 1666847523582NANP VITALNo ratings yet

- Current PDDocument1 pageCurrent PDAvijit ChakrabortyNo ratings yet

- Friday Re-Gravelling of Damaged Roads in Nkomazi East Villages in Nkomazi Municipality Nko 22-2023Document170 pagesFriday Re-Gravelling of Damaged Roads in Nkomazi East Villages in Nkomazi Municipality Nko 22-2023Zimkhitha GugusheNo ratings yet

- Fire Alarm LOA NGPDocument6 pagesFire Alarm LOA NGPDHN CUGNo ratings yet

- 3187e232-4902-401c-935f-2ddc1cb32107Document1 page3187e232-4902-401c-935f-2ddc1cb32107rukhshiconsultantNo ratings yet

- PB NOC TTO TARNT 88505 Sanctioned SIG 230517 101747Document2 pagesPB NOC TTO TARNT 88505 Sanctioned SIG 230517 101747SMLD Nursing SchoolNo ratings yet

- Latur Municipal Corporation: Page 1/2Document2 pagesLatur Municipal Corporation: Page 1/2INo ratings yet

- LOA Issued 124Document10 pagesLOA Issued 124Siddharth vaibhavNo ratings yet

- Government of Andhra Pradesh Municipal Administration DepartmentDocument3 pagesGovernment of Andhra Pradesh Municipal Administration DepartmentDISPLAY DEVICESNo ratings yet

- Guntur Municipal Corporation: OriginalDocument4 pagesGuntur Municipal Corporation: OriginalSubbu BudduNo ratings yet

- Acknowledgement BUILDING SC 53764 DUND 0994 2021Document5 pagesAcknowledgement BUILDING SC 53764 DUND 0994 2021Cma Mahendar RaoNo ratings yet

- Project BrochureDocument1 pageProject BrochureBhavin PatelNo ratings yet

- AllotmentLetter 136 151306Document7 pagesAllotmentLetter 136 151306Ekam KaurNo ratings yet

- Volume-I Tecnical Bid Tender For MicrosurfacingDocument76 pagesVolume-I Tecnical Bid Tender For MicrosurfacingSaurabh KushwahaNo ratings yet

- Demand ChallanDocument2 pagesDemand ChallanMountAloneNo ratings yet

- WORK ORDER - Local Job Work ReceiptDocument2 pagesWORK ORDER - Local Job Work ReceiptprakashNo ratings yet

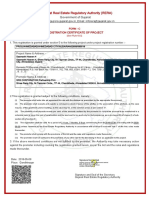

- Maharashtra Real Estate Regulatory Authority: Certificate For Extension of Registration of Project Form 'F'Document1 pageMaharashtra Real Estate Regulatory Authority: Certificate For Extension of Registration of Project Form 'F'SWARAJ WAVDEKARNo ratings yet

- PDF FileDocument2 pagesPDF Filesuhas umeshNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument3 pagesMobile Services: Your Account Summary This Month'S ChargessubaNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument3 pagesMobile Services: Your Account Summary This Month'S ChargesRejin Surendran0% (1)

- 2023-15 LOA NetworkDocument10 pages2023-15 LOA Networksr.vijay.pandeyNo ratings yet

- 68 00lDocument3 pages68 00lCulture CommissionNo ratings yet

- 1014017423-Special NoticeDocument4 pages1014017423-Special NoticeMohammadNo ratings yet

- List of LesseeDocument5 pagesList of LesseeJennielyn MedesNo ratings yet

- Rakesh KumarDocument3 pagesRakesh Kumarkumarrakesh34185No ratings yet

- Bolpur Ocsc Lease Rent Sep 2023Document1 pageBolpur Ocsc Lease Rent Sep 2023Firoz ShaikhNo ratings yet

- New Workflow EncryptedDocument2 pagesNew Workflow EncryptedCv krishna reddyNo ratings yet

- IDFCFIRSTBankstatement 10130563584 082912603Document13 pagesIDFCFIRSTBankstatement 10130563584 08291260307499255309axisNo ratings yet

- FAQ Property Tax 10 02 2017Document7 pagesFAQ Property Tax 10 02 2017Diya PandeNo ratings yet

- Ramesh GPFDocument2 pagesRamesh GPFSHARANUNo ratings yet

- 1 AugustDocument1 page1 AugustKshitij NagraleNo ratings yet

- Robiul Hoque PDFDocument2 pagesRobiul Hoque PDFAMIRUL HAQUENo ratings yet

- Sukkur Municipal Corporation: (Notice For Inviting Tender)Document1 pageSukkur Municipal Corporation: (Notice For Inviting Tender)alibuxjatoiNo ratings yet

- OPCR IPCR Treasury Jan Dec. 2022Document14 pagesOPCR IPCR Treasury Jan Dec. 2022Gelyn Rabanes100% (1)

- 64.-Angeles University Foundation v. City of Angeles, G.R No. 189999Document12 pages64.-Angeles University Foundation v. City of Angeles, G.R No. 189999Christine Rose Bonilla LikiganNo ratings yet

- HK IRD Tax GuideDocument34 pagesHK IRD Tax GuideAlex LimNo ratings yet

- PT3 EnglishDocument3 pagesPT3 Englishkevin todlerNo ratings yet

- FYI Memo Feb. 27, 2023 - CPS Revenue and AbatementsDocument3 pagesFYI Memo Feb. 27, 2023 - CPS Revenue and AbatementsWVXU NewsNo ratings yet

- StatCon Case Digests PDFDocument19 pagesStatCon Case Digests PDFallen joyce malazarte100% (5)

- 1.3registering Property Mumbai EoDBDocument16 pages1.3registering Property Mumbai EoDBgaaneshmujumdarNo ratings yet

- CRES2015 Module1 Mocknov302015Document29 pagesCRES2015 Module1 Mocknov302015Law_PortalNo ratings yet

- 2.2. Province of Nueva Ecija vs. Imperial Mining Co., IncDocument4 pages2.2. Province of Nueva Ecija vs. Imperial Mining Co., IncAaron CariñoNo ratings yet

- Written Submission 23.3.2018Document25 pagesWritten Submission 23.3.2018Vir PatelNo ratings yet

- ITOC AnalysisDocument15 pagesITOC AnalysisVoldNo ratings yet

- Part LLDocument50 pagesPart LLRuiz, CherryjaneNo ratings yet

- 53 PNGDocument2 pages53 PNGReymond IgayaNo ratings yet

- Tax 2 Outline (Consolidated)Document24 pagesTax 2 Outline (Consolidated)MRNo ratings yet

- Law Case Digest G.R. No. 191109Document2 pagesLaw Case Digest G.R. No. 191109Kielle Castelle0% (2)

- Audit, Represented by Its Chairperson Commissioner Ma. Gracia M. Pulido Tan, Respondent. The FactsDocument5 pagesAudit, Represented by Its Chairperson Commissioner Ma. Gracia M. Pulido Tan, Respondent. The FactsHarold EstacioNo ratings yet

- An Introduction To Tax: 2021 EditionDocument24 pagesAn Introduction To Tax: 2021 EditionKarina NoellNo ratings yet

- Real Estate InvestingDocument6 pagesReal Estate Investingkrossi9183No ratings yet

- Direct & Indirect TaxesDocument33 pagesDirect & Indirect Taxesdinanikarim50% (2)

- Energy Africa LiquidationDocument328 pagesEnergy Africa LiquidationTiso Blackstar GroupNo ratings yet

- Attributes or Essential Characteristics (SLEP)Document11 pagesAttributes or Essential Characteristics (SLEP)Carina Amor ClaveriaNo ratings yet

- Chapter 4 Updated SlidesDocument66 pagesChapter 4 Updated SlidesYonatan WadlerNo ratings yet

- 1 Property Rating and Property TaxationDocument10 pages1 Property Rating and Property TaxationAyodele Kehinde RotimiNo ratings yet

- The New Revenue Code of Taguig (PDF Format)Document217 pagesThe New Revenue Code of Taguig (PDF Format)Anonymous cvFhSo67% (3)

- Lladoc V CommissionerDocument3 pagesLladoc V CommissionerGale Calaycay LaenoNo ratings yet

- Mock Professional PracticeDocument23 pagesMock Professional PracticePrince EG DltgNo ratings yet

- Government FundDocument23 pagesGovernment Fund20211211017 SKOLASTIKA ANABELNo ratings yet

- Province of Nueva Ecija vs. Imperial Mining Co. IncDocument2 pagesProvince of Nueva Ecija vs. Imperial Mining Co. IncHinata ShoyoNo ratings yet

- Punjab Finance Act 2019Document14 pagesPunjab Finance Act 2019DETDGKHANNo ratings yet

- Revenue Code 2019Document110 pagesRevenue Code 2019Mica Ellah GasconNo ratings yet