Professional Documents

Culture Documents

Review Quiz AAA

Uploaded by

ashleymakwarimba1Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Review Quiz AAA

Uploaded by

ashleymakwarimba1Copyright:

Available Formats

UoPeople

My Courses Resources Links Faculty Contact English (en)

Time

us Ashley Makwarimba

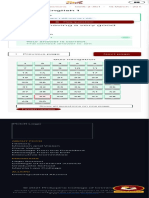

CBUS 2204-01 Personal Finance - AY2022-T3

Dashboard / My courses / CBUS 2204-01 - AY2022-T3 / Final Exam (Days 1 - 4) / Review Quiz

Question 1 Quiz navigation

If interest rates and inflation are low and there is liquidity in the credit markets, __________. Answer saved

Marked out of 1.00 Ashley Makwarimba

Flag question 1 2 3 4 5 6 7

Select one:

a. it will be easier for buyers to borrow. 8 9 10 11 12 13 14

b. the credit market will be illiquid.

15 16 17 18 19 20 21

c. the demand for housing will fall.

d. the supply of housing will fall. 22 23 24 25 26 27 28

e. it will be harder for buyers to borrow.

29 30 31 32 33 34 35

Clear my choice

36 37 38 39 40 41 42

43 44 45 46 47 48 49

Question 2 50 51 52 53 54 55 56

Mutual funds provide investors with __________. Answer saved

57 58 59 60

Marked out of 1.00

Flag question

Select one: Finish attempt ...

a. diversification.

b. security selection.

c. asset allocation.

d. a. and b.

e. a., b., and c.

Clear my choice

Question 3

Leveraged funds are riskier than funds that do not use leverage because they __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. use borrowing.

b. are unsecured.

c. depend on a target date.

d. increase in value when the market declines.

e. perform contrary to an index.

Question 4

Examples of recurring incomes are __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. wages or salary.

b. interest or dividends.

c. lottery winnings.

d. a. and b.

e. a., b., and c.

Question 5

Methods of investing in commodities include __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. commodity indexes.

b. exchange-traded open-end mutual funds.

c. closed-end lifestyle funds.

d. a. and b.

e. a., b., and c.

Question 6

Perfect Lawn Inc.’s stock price has fallen because it was not able to meet its production deadlines. Not yet answered

This is an example of __________. Marked out of 1.00

Flag question

Select one:

a. economic risk.

b. industry risk.

c. company risk.

d. asset class risk.

e. market risk.

Question 7

Categories for housing structures with different attributes include __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. multiple-unit dwelling.

b. mobile home.

c. condominium.

d. a. and b.

e. a., b., and c.

Question 8

Because of inflation, the school supplies you bought for $20 last year now cost __________. Answer saved

Marked out of 1.00

Flag question

Select one:

a. $19.95.

b. $10.

c. $15.

d. $30.

e. $12.95.

Clear my choice

Question 9

Funds structured to increase return through active management with the expectation of a down Not yet answered

market are called __________. Marked out of 1.00

Flag question

Select one:

a. lifestyle funds.

b. leveraged funds.

c. inverse funds.

d. open-end funds.

e. closed-end funds.

Question 10

An alternative to a promise of “satisfaction guaranteed” on a product is __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. small claims court.

b. a warranty.

c. a class-action suit.

d. caveat emptor.

e. consumer protection.

Question 11

All of the following assets or activities would be appropriate for developing a specialized budget Not yet answered

EXCEPT __________. Marked out of 1.00

Flag question

Select one:

a. tax consequences.

b. operating expenses.

c. an inheritance.

d. a new recreational activity.

e. cash flows.

Question 12

On a cash flow statement, each cash flow is shown as a percentage of total __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. net worth.

b. positive cash flow.

c. negative cash flow.

d. income after expenses.

e. income after taxes.

Question 13

The relationship between your financial statements and your budget is that together they allow you Not yet answered

to __________. Marked out of 1.00

Flag question

Select one:

a. project the effects of your financial choices.

b. protect your liquidity and asset base.

c. reduce your opportunity costs.

d. account for differences in rate spreads.

e. avoid budget variances and budget deficits.

Question 14

If an asset is worth more when you re-sell it than when you bought it, then you have __________. Answer saved

Marked out of 1.00

Flag question

Select one:

a. a capital loss.

b. a capital gain.

c. a store of wealth.

d. a reduction in expenses.

e. excess capital.

Clear my choice

Question 15

In January you made your final payment on your car loan and in July you got a small home equity Answer saved

loan to replace windows and add a deck. How would you classify these activities in your cash flow Marked out of 1.00

statement? Flag question

Select one:

a. Operating

b. Financing

c. Investing

d. Buying and selling

e. Recurring

Clear my choice

Question 16

Serena wants to see how her money from all sources came in and went out for all uses during each Not yet answered

month of the past year. Which kind of financial statement does she need? Marked out of 1.00

Flag question

Select one:

a. Balance sheet

b. Income statement

c. Net worth statement

d. Cash flow statement

e. Budget

Question 17

Sources of information about your recurring incomes and expenditures include __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. your income statement.

b. your cash flow statement.

c. your pro forma statements.

d. a. and b.

e. a., b., and c.

Question 18

You should read a fund’s prospectus to __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. analyze risk and return.

b. ensure a good match with your investment goals.

c. compare costs.

d. a. and b.

e. a., b., and c.

Question 19

Advantages of renting a home include all the following EXCEPT __________. Answer saved

Marked out of 1.00

Flag question

Select one:

a. creating a store of value.

b. limited financial obligation.

c. more liquidity.

d. more mobility.

e. limited maintenance expenses.

Clear my choice

Question 20

Mutual funds that own shares in other mutual funds rather than in securities per se, are called Not yet answered

__________. Marked out of 1.00

Flag question

Select one:

a. index funds.

b. funds of funds.

c. closed-end funds.

d. open-end funds.

e. exchange-traded funds.

Question 21

A factor to consider in calculating your mortgage affordability includes __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. the mortgage factor.

b. your gross monthly income.

c. the monthly net of your PITI.

d. a. and b.

e. a., b., and c.

Question 22

A mortgage in which you borrow a monthly income via a loan against your home equity that you Not yet answered

don’t have to pay back for as long as you live there is called a/an __________. Marked out of 1.00

Flag question

Select one:

a. reverse mortgage.

b. balloon mortgage.

c. home equity loan.

d. adjustable rate mortgage.

e. fixed rate mortgage.

Question 23

When you invest in stocks you __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. pay dividends.

b. sell equity for liquidity.

c. buy a share of a corporation.

d. a. and b.

e. a., b., and c.

Question 24

Real estate prices fell across the board because the market was glutted with surplus pre-owned Not yet answered

homes for sale. This is an example of __________. Marked out of 1.00

Flag question

Select one:

a. economic risk.

b. industry risk.

c. company risk.

d. asset class risk.

e. market risk.

Question 25

An investment policy statement is __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. an investor’s return objectives, risk preferences, and constraints.

b. an investment advisor’s approach to applying portfolio theory.

c. an institution’s goals and investment decisions.

d. an investment firm’s disclosures to clients.

e. a company’s disclosures to investors.

Question 26

Individual factors may affect all the following financial situations EXCEPT __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. inflation.

b. income.

c. income needs.

d. risk tolerance.

e. wealth.

Question 27

Characteristics of financial advisors to look for include __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. manner of compensation.

b. ability to give subjective advice.

c. professional training.

d. a. and c.

e. a., b., and c.

Question 28

The risk that actual returns will not match or exceed expected returns is called __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. opportunity cost.

b. investment risk.

c. default risk.

d. asset class risk.

e. market risk.

Question 29

Storing wealth, creating income, and reducing future expenses are all uses of __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. income.

b. assets.

c. capital.

d. markets.

e. possessions.

Question 30

An effect of deflation is that your money __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. is worth more and buys more.

b. is worth less and buys less.

c. has less purchasing power.

d. is less useful as a medium of exchange.

e. is more stable.

Question 31

Recession and inflation have decreased the value of your investments. This is an example of Not yet answered

__________. Marked out of 1.00

Flag question

Select one:

a. economic risk.

b. industry risk.

c. company risk.

d. asset class risk.

e. market risk.

Question 32

If you had a budget surplus, which of the following choices would best increase that surplus? Not yet answered

Marked out of 1.00

Flag question

Select one:

a. Increase spending

b. Save and invest

c. Work fewer hours

d. Borrow more

e. Change jobs

Question 33

Creating a budget involves __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. projecting realistic behavior.

b. questioning your assumptions.

c. reviewing your financial records.

d. a. and b.

e. a., b., and c.

Question 34

A group created to buy and manage commercial property is called a __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. syndicate.

b. limited partnership.

c. real estate investment trust

d. direct investment fund.

e. mortgage-backed fund.

Question 35

Your prime directive as a consumer is to __________. Answer saved

Marked out of 1.00

Flag question

Select one:

a. live within your means.

b. avoid buyer’s remorse.

c. shop for bargains.

d. a. and b.

e. a., b., and c.

Clear my choice

Question 36

A fund of real estate holdings that can be privately held or publicly traded on an exchange is a Not yet answered

__________. Marked out of 1.00

Flag question

Select one:

a. syndicate.

b. limited partnership.

c. real estate investment trust.

d. direct investment fund.

e. mortgage-backed fund.

Question 37

A budget for long-term goals involving non-recurring items is called a/an __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. operating budget.

b. comprehensive budget.

c. capital budget.

d. a. and b.

e. a., b., and c.

Question 38

The costs of operating a car include all the following EXCEPT __________. Answer saved

Marked out of 1.00

Flag question

Select one:

a. price.

b. fuel.

c. maintenance and repair.

d. property taxes.

e. insurance and registration.

Clear my choice

Question 39

Thebudget process begins with a thorough understanding of your __________. Answer saved

Marked out of 1.00

Flag question

Select one:

a. current financial condition.

b. financial statements.

c. desires and choices.

d. a. and b.

e. a., b., and c.

Clear my choice

Question 40

Investments in gold, silver, and other precious metals __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. threaten the value of currency.

b. lose their value during times of turmoil.

c. serve as a hedge against inflation.

d. have low transaction costs.

e. are more liquid than cash.

Question 41

The Joneses believe it is important to try to reduce poverty and hunger globally by aiding local Not yet answered

communities. They invest internationally in local businesses and nonprofit organizations that are Marked out of 1.00

effectively addressing the problem. Their strategy is an example of __________. Flag question

Select one:

a. divestment.

b. social investment.

c. unique circumstances.

d. risk tolerance.

e. legal constraints.

Question 42

In financial planning, effective goals are __________. Answer saved

Marked out of 1.00

Flag question

Select one:

a. timely.

b. specific and measurable.

c. realistic and attainable.

d. b. and c.

e. a., b., and c.

Clear my choice

Question 43

Dylan earns $24,500 a year as an office worker. He pays $1,000 a month for rent, $300 a month Answer saved

toward his car, and his other expenses come to around $1,200 a month. Dylan __________. Marked out of 1.00

Flag question

Select one:

a. has a budget deficit.

b. has a budget surplus.

c. should reduce expenses.

d. a. and c.

e. b. and c.

Clear my choice

Question 44

Financial advisors may assist through all the following services EXCEPT __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. tax planning.

b. career planning.

c. estate planning.

d. investment planning.

e. business financial planning.

Question 45

Passively managed funds designed to mirror the performance of an representative asset class are Answer saved

called __________. Marked out of 1.00

Flag question

Select one:

a. index funds.

b. funds of funds.

c. closed-end funds.

d. open-end funds.

e. exchange-traded funds.

Clear my choice

Question 46

Recurring incomes and expenses __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. address long-term goals.

b. satisfy lifestyle goals.

c. reduce free cash flow.

d. limit capital expenditures.

e. decrease liquidity.

Question 47

When you identify the product you want to buy, you should first identify __________. Answer saved

Marked out of 1.00

Flag question

Select one:

a. your opportunity cost.

b. the cheapest alternative.

c. what need the product will satisfy.

d. what attributes are most important.

e. the availability of the product.

Clear my choice

Question 48

Your financial planning should reflect the realities of your career choice because your choice of Answer saved

career affects your __________. Marked out of 1.00

Flag question

Select one:

a. health and safety risks.

b. salary and benefits.

c. career duration.

d. b. and c.

e. a., b., and c.

Clear my choice

Question 49

Once you have selected a good, your purchase options may include any of the following EXCEPT Answer saved

__________. Marked out of 1.00

Flag question

Select one:

a. price.

b. discount.

c. place of manufacture.

d. free delivery and/or installation.

e. a financing deal.

Clear my choice

Question 50

Your time horizon for financial planning is __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. the time it takes to set goals.

b. the five-year plan.

c. the time it takes to realize goals.

d. life long.

e. approximately 65 years.

Question 51

The financial decision making process is complicated by all of the following factors EXCEPT Not yet answered

__________. Marked out of 1.00

Flag question

Select one:

a. uncertainty and risk.

b. the number of factors to consider.

c. the use of information in planning.

d. the complexity of relationships among factors.

e. the relative importance of consequences.

Question 52

Commodities include all the following EXCEPT __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. stocks and bonds.

b. currencies.

c. precious metals.

d. energy resources.

e. agricultural products.

Question 53

Periods of contraction in the economy often lead to __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. reduced returns on investment.

b. an increase in the employment rate.

c. growth in job creation.

d. greater consumption.

e. greater participation in the capital markets.

Question 54

Investment risks include all the following EXCEPT __________. Answer saved

Marked out of 1.00

Flag question

Select one:

a. default risks.

b. economic risks.

c. industry and company risks.

d. asset class risks

e. market risks.

Clear my choice

Question 55

Seeing the effect of each financial transaction or event on your current situation is the purpose of Not yet answered

__________. Marked out of 1.00

Flag question

Select one:

a. balancing your books.

b. identifying your cash flows.

c. paying your bills.

d. recording your incomes.

e. having a checking account.

Question 56

Your risk tolerance represents __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. your wealth or net worth.

b. the amount of money you stand to lose.

c. your ability or willingness to take chances.

d. the amount of time separating you from your money.

e. your return objective.

Question 57

A summary of income and expenses over a period of time is called __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. a balance sheet.

b. an income statement.

c. net worth.

d. a cash flow statement.

e. a budget.

Question 58

The value of assets is equal to the value of liabilities plus the value of __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. equity.

b. debt.

c. cash.

d. a. and b.

e. a., b., and c

Question 59

Examples of non-recurring expenditures are __________. Not yet answered

Marked out of 1.00

Flag question

Select one:

a. windfalls.

b. loan repayments.

c. automatic deposits.

d. taxes.

e. window replacements.

Question 60

Budgets can be prepared conservatively by __________. Answer saved

Marked out of 1.00

Flag question

Select one:

a. underestimating costs.

b. underestimating earnings.

c. overestimating goals.

d. overestimating results.

e. reconciling behaviors and goals.

Clear my choice

Finish attempt ...

◄ Learning Guide Unit 9 Jump to... Final Exam ►

Disclaimer Regarding Use of Course Material - Terms of Use www.uopeople.edu

University of the People is a 501(c)(3) not for profit organization. Contributions are tax deductible to the extent permitted by

law.

Copyright © University of the People 2021. All rights reserved.

You are logged in as Ashley Makwarimba (Log out)

Data retention summary

Get the mobile app

You might also like

- Program Enrollment Test Quiz WorldQuant UniversityDocument23 pagesProgram Enrollment Test Quiz WorldQuant UniversityKEVIN JESUS APARI100% (1)

- Weekly Quiz 1 Machine Learning Great Learning PDFDocument7 pagesWeekly Quiz 1 Machine Learning Great Learning PDFRobertKimtai100% (2)

- College Success - Certificate Final Exam - Attempt Review (Page 1 of 15) - Saylor AcademyDocument1 pageCollege Success - Certificate Final Exam - Attempt Review (Page 1 of 15) - Saylor AcademyJeffrey WittyNo ratings yet

- NAV-225-FINALS ReviewerDocument1 pageNAV-225-FINALS ReviewerJhun Clyde Dabasol100% (2)

- PedhDocument3 pagesPedhJohn Dexter Lanot83% (6)

- Program Enrollment Test Quiz - WorldQuant UniversityDocument24 pagesProgram Enrollment Test Quiz - WorldQuant UniversityIKECHUKWU SOLOMON ELILINo ratings yet

- CUST105: Customer Service: Quiz NavigationDocument1 pageCUST105: Customer Service: Quiz NavigationJeffrey Witty100% (2)

- 1 Pesan BaruDocument4 pages1 Pesan Barusteam2021No ratings yet

- Quarterly Exam & Answer Key TemplateDocument2 pagesQuarterly Exam & Answer Key Templatecherrie ann50% (2)

- UGRD-ECON6150 Microeconomics: Quiz NavigationDocument1 pageUGRD-ECON6150 Microeconomics: Quiz NavigationCamae Lamigo100% (2)

- Summative Assessment Written (Page 3 of 9)Document1 pageSummative Assessment Written (Page 3 of 9)Kara hemaNo ratings yet

- SECOND QUARTER EXAM - Attempt ReviewDocument1 pageSECOND QUARTER EXAM - Attempt ReviewShelvie Morata (Bebeng)No ratings yet

- Geography P1Document8 pagesGeography P1ngalonkulukNo ratings yet

- Moodle Test For Teachers PDFDocument2 pagesMoodle Test For Teachers PDFNaveen KumarNo ratings yet

- 11.1.GPA. TOEIC Reading Practice Quiz - Attempt ReviewDocument22 pages11.1.GPA. TOEIC Reading Practice Quiz - Attempt ReviewOscar Eduardo Mart�n JassoNo ratings yet

- Formative Test I (Plus Feedback) NBSS 2020-2021 - Attempt ReviewDocument1 pageFormative Test I (Plus Feedback) NBSS 2020-2021 - Attempt ReviewAlif YusufNo ratings yet

- Quiz 4 - Attempt ReviewDocument3 pagesQuiz 4 - Attempt ReviewYosua Petra HattuNo ratings yet

- Student's Feed BackDocument2 pagesStudent's Feed BackkarthikinvestaNo ratings yet

- Preliminary Questions (Page 5 of 50)Document1 pagePreliminary Questions (Page 5 of 50)rf4ng2q8syNo ratings yet

- Graduation Exam For 2014 Batch Overseas Students: Hebei North UniversityDocument18 pagesGraduation Exam For 2014 Batch Overseas Students: Hebei North UniversityAlfredNo ratings yet

- 30.06 Preliminary For Schools Trainer 2 - Test 3 - Listening Attempt ReviewDocument1 page30.06 Preliminary For Schools Trainer 2 - Test 3 - Listening Attempt ReviewluciacanalsanfelizNo ratings yet

- 1st Year JEE-Mains Weekly Test-11 13-09-2021 Attempt ReviewDocument1 page1st Year JEE-Mains Weekly Test-11 13-09-2021 Attempt ReviewKolli BavithaNo ratings yet

- Msbte w22 22103Document21 pagesMsbte w22 22103pranaymhaskar399No ratings yet

- 30.04 Preliminary For Schools Trainer 2 - Exam 2 - Listening Attempt ReviewDocument1 page30.04 Preliminary For Schools Trainer 2 - Exam 2 - Listening Attempt ReviewluciacanalsanfelizNo ratings yet

- BAHASA INGGRIS XII PAS T.A. 20212022 (Page 3 of 50)Document1 pageBAHASA INGGRIS XII PAS T.A. 20212022 (Page 3 of 50)Mufida NugraheniNo ratings yet

- 45.topicwise Transportation Engg. and Geomatics Engg.-4 CEDocument17 pages45.topicwise Transportation Engg. and Geomatics Engg.-4 CEsamuelNo ratings yet

- 30.05 Preliminary For Schools Trainer 2 - Exam 3 - Reading Attempt ReviewDocument1 page30.05 Preliminary For Schools Trainer 2 - Exam 3 - Reading Attempt ReviewluciacanalsanfelizNo ratings yet

- DESCRIPTIVE STATISTICS - Doc BuffeDocument2 pagesDESCRIPTIVE STATISTICS - Doc BuffeMarjorie Buiza OmbaoNo ratings yet

- 5 6161280922852262162 PDFDocument14 pages5 6161280922852262162 PDFshubham sahuNo ratings yet

- Review Test Submission - Quiz-08 - ELEC8900-30-R-2022S ..Document5 pagesReview Test Submission - Quiz-08 - ELEC8900-30-R-2022S ..SarlaNo ratings yet

- Profile Category Frequency PercentageDocument4 pagesProfile Category Frequency PercentageChristian Lumactod EmbolodeNo ratings yet

- Select Question Out of 30: Online Test Review ForDocument2 pagesSelect Question Out of 30: Online Test Review ForRanjith Kumar GoudNo ratings yet

- Select Question Out of 30: Online Test Review ForDocument2 pagesSelect Question Out of 30: Online Test Review ForRanjith Kumar GoudNo ratings yet

- Test 2: Attempt ReviewDocument1 pageTest 2: Attempt ReviewJoy RoyalNo ratings yet

- Remi Stats WRK - 2Document8 pagesRemi Stats WRK - 2herwins.stocksNo ratings yet

- Ethics PrelimsDocument4 pagesEthics PrelimsDanrev dela CruzNo ratings yet

- Laurette SET ScoresDocument2 pagesLaurette SET ScoresDeanna LauretteNo ratings yet

- 48.topicwise General Aptitude-4 CEDocument19 pages48.topicwise General Aptitude-4 CEsamuelNo ratings yet

- My Practice Exam ScoreDocument3 pagesMy Practice Exam ScoreFer FloresNo ratings yet

- Computer OrganizationDocument5 pagesComputer Organizationali.urgot123No ratings yet

- Prelim Examination - Math in The Modern WorldDocument2 pagesPrelim Examination - Math in The Modern WorldKyledana Francisco100% (1)

- PRELIM EXAMINATION - Math in The Modern WorldDocument2 pagesPRELIM EXAMINATION - Math in The Modern WorldKyledana FranciscoNo ratings yet

- 0580 Mathematics: MARK SCHEME For The May/June 2010 Question Paper For The Guidance of TeachersDocument3 pages0580 Mathematics: MARK SCHEME For The May/June 2010 Question Paper For The Guidance of TeachersNaveen KumarNo ratings yet

- Answer Sheet Speaking-2Document1 pageAnswer Sheet Speaking-2Andrew AlexanderNo ratings yet

- TOS Link Test Item Analysis More Than 40 ItemsDocument11 pagesTOS Link Test Item Analysis More Than 40 ItemsleogarybonNo ratings yet

- LT 2023 Oct-Nov P1 MSDocument9 pagesLT 2023 Oct-Nov P1 MSrqb7704No ratings yet

- Graded Quiz Unit 3fffDocument5 pagesGraded Quiz Unit 3fffZ MO4s ZNo ratings yet

- LT 2023 Oct-Nov p1 MsDocument9 pagesLT 2023 Oct-Nov p1 Msrqb7704No ratings yet

- Psychology (210005)Document5 pagesPsychology (210005)Jeslin JosephNo ratings yet

- Unit 5 - WEEK 04: Assignment 04Document3 pagesUnit 5 - WEEK 04: Assignment 04DURLAB DASNo ratings yet

- ICL WeightedMean Math10Document2 pagesICL WeightedMean Math10SOFIA YASMIN VENTURANo ratings yet

- Prelim Exam Attempt Review (Page 46 of 50)Document1 pagePrelim Exam Attempt Review (Page 46 of 50)Nicholas CamilonNo ratings yet

- Review Test Submission - Quiz - 09 - ELEC8900-30-R-2022S ..Document6 pagesReview Test Submission - Quiz - 09 - ELEC8900-30-R-2022S ..SarlaNo ratings yet

- REVIEW 1 2 Page 1 of 2Document65 pagesREVIEW 1 2 Page 1 of 2sangnhtse184333No ratings yet

- Cambridge Assessment International Education: Mathematics (Syllabus D) 4024/22 May/June 2019Document7 pagesCambridge Assessment International Education: Mathematics (Syllabus D) 4024/22 May/June 2019Danny DrinkwaterNo ratings yet

- Cambridge O Level: Mathematics (Syllabus D) 4024/21 October/November 2021Document9 pagesCambridge O Level: Mathematics (Syllabus D) 4024/21 October/November 2021m.owaisulhaqNo ratings yet

- Self-Quiz Unit 3 - Attempt Review 2Document4 pagesSelf-Quiz Unit 3 - Attempt Review 2Tjaantjies NkuNo ratings yet