Professional Documents

Culture Documents

Borrower Eligibility Criteria Updated Oct'23 PDF

Uploaded by

Vishal BawaneOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Borrower Eligibility Criteria Updated Oct'23 PDF

Uploaded by

Vishal BawaneCopyright:

Available Formats

Faircent.

com October 2023

Borrower Eligibility Criteria

Salaried Profile-

1) Age should be between 25-55 years.

2) Salary– Above 25K per month (Net Take Home)

3) Eligible Cities-PAN India (Except all Pin codes of Ghaziabad City)

4) Minimum 3 Month Current Job Experience.

5) Minimum 6 Months current residence stability.

6) Credit Score>=550 (Except Borrower with Score between 775 to 800)

7) No Default ever.

8) No Delay in any loan in last 12 Months.

9) Customers should have at least 1 year credit history.

10) Customer should not have made more than 10 enquiries in last 3 months.

11) Customers who have availed any of these HL/AL/Used Car, CC, PL, CL in their credit history

shall only be considered.

12) Mandatory PF Deduction – PF deduction from Salary of the borrower is Mandatory.

Self-employed Profile –

1) Age should be between 25-55 years. (Except customer with age of 41-45 years)

2) Minimum ITR – Above 3 Lakhs (Gross Income)

3) Eligible Cities- Pan India

4) Credit Score>=550

5) No Default ever.

6) Minimum 6 Months current residence stability.

7) Minimum Business Vintage should be 2 years.

8) Customer should have at least 36 Months credit history.

9) Customer should not have made more than 12 enquiries in last 3 months.

10) No Delay in any loan/CC in last 12 Months.

11) Customer Should have at least one of these products in their credit history- HL, AL/Used Car, CC, PL, CL, CVL, CEL, TL, BL, OD, GL,

Agriculture Loan

12) Any lead which qualifies all the PQ rules except CRIF score, will be qualified if Experian score is greater than 700.

13) Customer can also be eligible with 18 Months of Credit history if satisfied the below conditions:

- If Bureau Vintage is less than 36 Months and greater than 18 Months then lead must pass the following conditions.

A). Minimum Credit Score >= 650

B). Remove customers with only Consumer loan, Gold Loan & Two-wheeler Loan.

14) If loan Amount is upto 1.5 Lacs then Credit score should be greater than 700.

Faircent.com October 2023

Documents

Salaried:

1. KYC documents (ID Proof, Current Address Proof & PAN Card)

2. Last 3 Months Salary Slip.

3. Last 3 Months Bank Statement (Till Current Date)

4. Residence ownership Proof (On Loan requirement of 2 Lac & Above)

Self- Employed:

1. KYC documents (ID Proof, Current Address Proof & PAN Card)

2. Last 2 Year ITR

3. Last 6 Months Bank Statement (Till current Date)

4. Business Registration& Address Proof.

5. Residence Ownership Proof (On Loan requirement of 2 Lac & Above)

Note:

1. Metro (Delhi NCR*, Mumbai**, Kolkata, Chennai) *Delhi NCR includes- Delhi, New Delhi,

Ghaziabad, Faridabad, Gurgaon, Noida, Gautam Budh Nagar / **Mumbai includes - Mumbai,

Navi Mumbai, Thane, Vashi

2.

Abbreviation Details

HL Housing Loan

AL Auto Loan

PL Personal Loan

BL Business Loan

LAP Loan Against Property

CL Consumer Loan

GL Gold Loan

CVL Commercial vehicle loan

CEL Commercial Equipment Loan

CC Credit card

OD Overdraft

TL Tractor Loan

Prop. Loan Property Loan

Agri. Loan Agriculture Loan

3. In case borrower do not have ITR or have 1-year ITR then 12 months bank statement will

be required.

4. ITR & Bank Statement should for latest year & Month.

You might also like

- O'Neil William J. - .Article - How To Make Money in Stocks. A Winning System in Good Times or Bad (Third Edition Summary)Document16 pagesO'Neil William J. - .Article - How To Make Money in Stocks. A Winning System in Good Times or Bad (Third Edition Summary)Ioana Ionescu85% (13)

- Vehicle Loans: List of Documents Required To Be Submitted For Hire Purchase LoanDocument17 pagesVehicle Loans: List of Documents Required To Be Submitted For Hire Purchase LoanDr.K.PadmanabhanNo ratings yet

- Business LoanDocument6 pagesBusiness Loansandeep Kumar Dubey100% (1)

- Marketing Strategies For Mortgage Lenders and BrokersDocument2 pagesMarketing Strategies For Mortgage Lenders and BrokersTodd Lake100% (7)

- Budgeting & Budgetary ControlDocument28 pagesBudgeting & Budgetary ControlIeymarh FatimahNo ratings yet

- Petrol Pump Business Plan - How To Start Petrol Pump Business in IndiaDocument1 pagePetrol Pump Business Plan - How To Start Petrol Pump Business in IndiaMalik MuzafferNo ratings yet

- Dsa Handbook2018Document19 pagesDsa Handbook2018Dayalan A100% (3)

- Application Reference Number: Emudra/032300/476529: Signature Not VerifiedDocument8 pagesApplication Reference Number: Emudra/032300/476529: Signature Not VerifiedMeditation IndiaNo ratings yet

- General Guidelines On Loans & Advance: Sachin Katiyar-Chief ManagerDocument53 pagesGeneral Guidelines On Loans & Advance: Sachin Katiyar-Chief Managersaurabh_shrutiNo ratings yet

- Etoro Forex Trading Course - First LessonDocument19 pagesEtoro Forex Trading Course - First LessonTrading Guru100% (4)

- Welcome LetterDocument4 pagesWelcome LetterChetan ChoudharyNo ratings yet

- ICICI Bank Car Loans Primary DetailsDocument11 pagesICICI Bank Car Loans Primary DetailsAastha PandeyNo ratings yet

- Midterm Quiz in ACCTG2215Document17 pagesMidterm Quiz in ACCTG2215guess who100% (1)

- Welcome Letter PDFDocument4 pagesWelcome Letter PDFVinay KumarNo ratings yet

- Icici Car LoanDocument11 pagesIcici Car LoanmaniNo ratings yet

- Project On HDFC Car LoanDocument12 pagesProject On HDFC Car Loansoniparmar80% (5)

- DHFL Sanction LetterDocument6 pagesDHFL Sanction LetterRamesh Kulkarni75% (4)

- Sap Asset Depreciation: Author - Gobi SuppiahDocument7 pagesSap Asset Depreciation: Author - Gobi SuppiahAbdullahNo ratings yet

- Faircent PL&BL PolicyDocument2 pagesFaircent PL&BL Policymanoj.sharma110045No ratings yet

- HDFC Gold Loan CSC PDFDocument5 pagesHDFC Gold Loan CSC PDFhari1433No ratings yet

- Gold Loan CSC PDFDocument5 pagesGold Loan CSC PDFhari1433No ratings yet

- Policy Update - Verified Income May'21Document3 pagesPolicy Update - Verified Income May'21debprosaddalalNo ratings yet

- JLR Special Scheme For Salaried CustomersDocument5 pagesJLR Special Scheme For Salaried CustomersJay ShahNo ratings yet

- Banking & InsuranceDocument44 pagesBanking & InsuranceBhurabhai MaliNo ratings yet

- Car Loan WEBSITEDocument57 pagesCar Loan WEBSITENAVEEN ROYNo ratings yet

- Ftcash's Product Sheet For DSAs & Connectors (As On 13th Oct'23)Document10 pagesFtcash's Product Sheet For DSAs & Connectors (As On 13th Oct'23)rohinidhebe1No ratings yet

- Target Segment: Employed/ SalariedDocument21 pagesTarget Segment: Employed/ SalariedSandeep KumarNo ratings yet

- All Bank Policy HL & LapDocument25 pagesAll Bank Policy HL & LapmadirajunaveenNo ratings yet

- Educative Series LAPDocument2 pagesEducative Series LAPRohith RaoNo ratings yet

- Car LoanDocument16 pagesCar LoanRajkot academyNo ratings yet

- Types of LoanDocument20 pagesTypes of LoanTariqul IslamNo ratings yet

- First Time BorrowersDocument4 pagesFirst Time BorrowersMuskan RaoNo ratings yet

- Infrastructure Finance Group (IFG) : East - WB, JHK, Orissa, NEDocument22 pagesInfrastructure Finance Group (IFG) : East - WB, JHK, Orissa, NEAnindya ChampatiNo ratings yet

- Business Loan PolicyDocument7 pagesBusiness Loan Policyniteshparewa372No ratings yet

- 3045TW0057673Document2 pages3045TW0057673Amit KumarNo ratings yet

- Whitehat Webinar PDFDocument21 pagesWhitehat Webinar PDFRishabh TripathiNo ratings yet

- CC Two-Wheeler-LoansDocument29 pagesCC Two-Wheeler-LoansRight ClickNo ratings yet

- Business Installment Loan: FeaturesDocument6 pagesBusiness Installment Loan: FeaturesMd.Azam KhanNo ratings yet

- HDFC Bank: Innovative Institution and A Market Leader in The Housing Finance Sector in IndiaDocument40 pagesHDFC Bank: Innovative Institution and A Market Leader in The Housing Finance Sector in IndialavsamirNo ratings yet

- 2.4 Personal LoanDocument13 pages2.4 Personal LoanRadadiya JenilNo ratings yet

- Tractor LoansProductDocument10 pagesTractor LoansProductkakali mondalNo ratings yet

- Group Project: Consumer Runing FinanceDocument27 pagesGroup Project: Consumer Runing FinanceDanish HassanNo ratings yet

- Introduction To MSME ProductSDocument24 pagesIntroduction To MSME ProductSPraveen TiwariNo ratings yet

- Link and List of Documents Eligibility Check and Link For Apply LoanDocument3 pagesLink and List of Documents Eligibility Check and Link For Apply LoanValecia G Wolf-RodriguezNo ratings yet

- Credit FAQ and PolicyDocument31 pagesCredit FAQ and PolicyManish JoshiNo ratings yet

- 03600-2022 New SchemeDocument9 pages03600-2022 New Schemeరాజశేఖర్ రెడ్డి కందికొండNo ratings yet

- Chapter 1 IntroDocument10 pagesChapter 1 IntrosanyakathuriaNo ratings yet

- Annexure Circular 241 ADV-59-2022-23 ANNEXURE 1Document49 pagesAnnexure Circular 241 ADV-59-2022-23 ANNEXURE 1sandeepNo ratings yet

- Bank of Baroda (BOB) Car Loan Interest Rates 2019: Sona Copy HereDocument81 pagesBank of Baroda (BOB) Car Loan Interest Rates 2019: Sona Copy Heresavita kailas kadamNo ratings yet

- MM Catalogue-FA05-Magna Automotive India PVT LTD 07 Sep 23 - 122295 - 1.00Document10 pagesMM Catalogue-FA05-Magna Automotive India PVT LTD 07 Sep 23 - 122295 - 1.00engagement teamNo ratings yet

- 32642892-PL WelcomeLetterDocument4 pages32642892-PL WelcomeLetterMohan ChandraNo ratings yet

- Salary One Pager 2Document1 pageSalary One Pager 2toxicgamimg639No ratings yet

- TENDER NO: WRCC/2020-21/PT/148 (Tender Id: 2020 - WRO - 126176 - 1) TitleDocument18 pagesTENDER NO: WRCC/2020-21/PT/148 (Tender Id: 2020 - WRO - 126176 - 1) Titleravi yemmadiNo ratings yet

- Contact Point Verification - Business (Credit Approver & BM)Document4 pagesContact Point Verification - Business (Credit Approver & BM)Srikanth KolkundaNo ratings yet

- Business Loan: Normal Current AccountDocument16 pagesBusiness Loan: Normal Current AccountUthaiah CmNo ratings yet

- Iob EngineerDocument2 pagesIob EngineerManishNo ratings yet

- IBA Customer Segmentation RequestDocument12 pagesIBA Customer Segmentation Requestrabd.pnbNo ratings yet

- Green Veh OnepagerDocument2 pagesGreen Veh OnepagerRohith RaoNo ratings yet

- MBA (Comparison of Retail Loan of J&K Banks With Other Banks and Deposit SchemesDocument68 pagesMBA (Comparison of Retail Loan of J&K Banks With Other Banks and Deposit Schemeszargar100% (1)

- LXS-H09023-242564415 - Terms & ConditionsDocument23 pagesLXS-H09023-242564415 - Terms & Conditionsdewic29037No ratings yet

- Entrepreneurship Loan and SchemesDocument10 pagesEntrepreneurship Loan and SchemesSriniketh SridharNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyNo ratings yet

- List of Active Channel Partners As On June 30 2018Document56 pagesList of Active Channel Partners As On June 30 2018Vishal BawaneNo ratings yet

- Prefr Pincode ListDocument476 pagesPrefr Pincode ListVishal BawaneNo ratings yet

- Abante Integrated Management Services Private LimitedDocument1 pageAbante Integrated Management Services Private LimitedVishal BawaneNo ratings yet

- TermsDocument9 pagesTermsVishal BawaneNo ratings yet

- Updated One Pager SPL - Dsa-1Document1 pageUpdated One Pager SPL - Dsa-1Vishal BawaneNo ratings yet

- As TRW4I3 CpyLssKGyO Bank Statement 1Document54 pagesAs TRW4I3 CpyLssKGyO Bank Statement 1Vishal BawaneNo ratings yet

- Prefr Pincode ListDocument23 pagesPrefr Pincode ListVishal BawaneNo ratings yet

- Fast Credit GT All Bank PL Policy - One PagerDocument20 pagesFast Credit GT All Bank PL Policy - One PagerVishal BawaneNo ratings yet

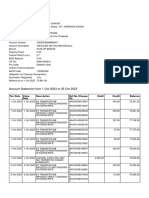

- Account Statement From 1 Oct 2023 To 25 Oct 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument12 pagesAccount Statement From 1 Oct 2023 To 25 Oct 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceVishal BawaneNo ratings yet

- StatementDocument15 pagesStatementVishal BawaneNo ratings yet

- Secured PayoutDocument2 pagesSecured PayoutVishal BawaneNo ratings yet

- API PanDocument2 pagesAPI PanVishal BawaneNo ratings yet

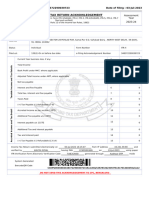

- Print - Udyam Registration CertificateDocument2 pagesPrint - Udyam Registration CertificateVishal BawaneNo ratings yet

- Udyam Registration Certificate: ServicesDocument2 pagesUdyam Registration Certificate: ServicesVishal BawaneNo ratings yet

- Null 7Document6 pagesNull 7Vishal BawaneNo ratings yet

- MSME CompleteDocument5 pagesMSME CompleteVishal BawaneNo ratings yet

- Ack 348372290030723Document1 pageAck 348372290030723Vishal BawaneNo ratings yet

- DGAadhaarDocument2 pagesDGAadhaarVishal BawaneNo ratings yet

- महारा दुकाने व आ थापना (नोकर चे व सेवाशत चे व नयमन) नयम, २०१८ Form - ‘F'Document3 pagesमहारा दुकाने व आ थापना (नोकर चे व सेवाशत चे व नयमन) नयम, २०१८ Form - ‘F'Vishal BawaneNo ratings yet

- SL5094277 Additional Docs 3Document1 pageSL5094277 Additional Docs 3Vishal BawaneNo ratings yet

- Proposed PL Online Pin CodeDocument945 pagesProposed PL Online Pin CodeVishal BawaneNo ratings yet

- Zpinp 5 AlDocument12 pagesZpinp 5 AlVishal BawaneNo ratings yet

- Signed SL4777028Document22 pagesSigned SL4777028Vishal BawaneNo ratings yet

- Print - Udyam Registration CertificateDocument2 pagesPrint - Udyam Registration CertificateVishal BawaneNo ratings yet

- Agreement 1039626Document9 pagesAgreement 1039626Vishal BawaneNo ratings yet

- Print - Udyam Registration Certificate LANDSCAPEDocument5 pagesPrint - Udyam Registration Certificate LANDSCAPEVishal BawaneNo ratings yet

- Grade 7 EMS Mid Year Examination 2021Document7 pagesGrade 7 EMS Mid Year Examination 2021nkatekodawn72No ratings yet

- Franchise AccountingDocument17 pagesFranchise AccountingCha EsguerraNo ratings yet

- Credit Eda Case Study: Aparna Trivedi Ashish Nipane DS C29Document13 pagesCredit Eda Case Study: Aparna Trivedi Ashish Nipane DS C29aparnaNo ratings yet

- Akibat Hukum Terhadap Debitur Atas Terjadinya: Force Majeure (Keadaan Memaksa)Document5 pagesAkibat Hukum Terhadap Debitur Atas Terjadinya: Force Majeure (Keadaan Memaksa)dea eka rahmawatiNo ratings yet

- Assignemnt 1 Muhammad Awais (NUML-S20-11149)Document40 pagesAssignemnt 1 Muhammad Awais (NUML-S20-11149)Muhammad AwaisNo ratings yet

- Komitmen Fee 3% Serang BantenDocument2 pagesKomitmen Fee 3% Serang BantenHardi HendratmoNo ratings yet

- Jaguar Land Rover PLC LX000000002046407490Document409 pagesJaguar Land Rover PLC LX000000002046407490mehulssheth50% (2)

- Inancial Arkets: Learning ObjectivesDocument24 pagesInancial Arkets: Learning Objectivessourav goyalNo ratings yet

- Mock Test Paper 2Document7 pagesMock Test Paper 2FarrukhsgNo ratings yet

- Sachin Tyagi Insurance PDFDocument4 pagesSachin Tyagi Insurance PDFsachin tyagiNo ratings yet

- Escott v. BarChris ConstructionDocument4 pagesEscott v. BarChris ConstructionLynne SanchezNo ratings yet

- Pfrs For Smes - Acpapp WebsiteDocument56 pagesPfrs For Smes - Acpapp WebsiteThessaloe B. Fernandez100% (2)

- Beams11 - PPT 16Document49 pagesBeams11 - PPT 16naufal bimoNo ratings yet

- BelizeDocument8 pagesBelizeroger_roland_1No ratings yet

- Evidencia 8 Actividad 15Document10 pagesEvidencia 8 Actividad 15Angela Maria Galan NavasNo ratings yet

- QutotionDocument1 pageQutotionmanishsngh24No ratings yet

- University of Kota - Kota: Day Date Time Subject PaperDocument3 pagesUniversity of Kota - Kota: Day Date Time Subject PaperDinesh LalwaniNo ratings yet

- Buyback: What Is A Buyback?Document3 pagesBuyback: What Is A Buyback?Niño Rey LopezNo ratings yet

- Cost of CapitalDocument16 pagesCost of CapitalReiner NuludNo ratings yet

- AnDocument5 pagesAnPritesh ChaudhariNo ratings yet

- Tips On Preparation A Report On A Video or DocumentaryDocument3 pagesTips On Preparation A Report On A Video or DocumentaryZiha RusdiNo ratings yet

- R13-Brand ValuationDocument3 pagesR13-Brand ValuationYashi GuptaNo ratings yet

- Jose Maria College College of Business Education: Audit TheoryDocument10 pagesJose Maria College College of Business Education: Audit TheoryMendoza Ron NixonNo ratings yet

- BookDocument98 pagesBookmuthulakshmiNo ratings yet