Professional Documents

Culture Documents

Latihan Management Accounting

Uploaded by

Adeulfa InsaniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Latihan Management Accounting

Uploaded by

Adeulfa InsaniCopyright:

Available Formats

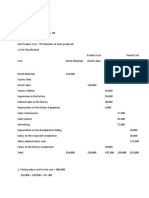

1 Identify types of cost

Product Costs

Manufacturing Period

a Cost Item Direct Materials Direct Labor Overhead Costs

Bicycle components $100,000

Depreciation on plant 60,000

Property taxes on store 7,500

Labor costs of assembly-line workers 110,000

Factory supplies used 13,000

Advertising expense 45,000

Property taxes on plant 14,000

Delivery expense 21,000

Sales commissions 35,000

Salaries paid to sales clerks 50,000

Product Costs

Manufacturing Period

b Cost Item Direct Materials Direct Labor Overhead Costs

Factory utilities $15,500

Depreciation on factory equipment 12,650

Depreciation on delivery trucks 3,800

Indirect factory labor 48,900

Indirect materials 80,800

Direct materials used 137,600

Factory manager’s salary 8,000

Direct labor $69,100

Sales salaries 46,400

Property taxes on factory building 2,500

Repairs to offi ce equipment 1,300

Factory repairs 2,000

Advertising 15,000

Office supplies used 2,640

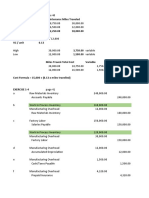

2 Compute cost of goods manufactured and cost of goods sold

Materials used in product $120,000

Depreciation on plant 60,000

Property taxes on store 7,500

Labor costs of assembly-line workers 110,000

Factory supplies used 23,000

Advertising expense 45,000

Property taxes on plant 14,000

Delivery expense 21,000

Sales commissions 35,000

Salaries paid to sales clerks 50,000

Work in process inventory was $12,000 at January 1 and $15,500 at December 31.

Finished goods inventory was $60,000 at January 1 and $45,600 at December 31.

You might also like

- Make It! The Engineering Manufacturing Solution: Engineering the Manufacturing SolutionFrom EverandMake It! The Engineering Manufacturing Solution: Engineering the Manufacturing SolutionNo ratings yet

- Varnish Company Cost AnalysisDocument4 pagesVarnish Company Cost AnalysisAmiee Laa PulokNo ratings yet

- Test 1 ProblemsDocument48 pagesTest 1 ProblemsKaira Arora50% (2)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- 2011 Manufacturing Budget vs Actual ResultsDocument31 pages2011 Manufacturing Budget vs Actual Resultsგიორგი კაციაშვილიNo ratings yet

- Costcon 1Document3 pagesCostcon 1Frances Clayne GonzalvoNo ratings yet

- CH-1 Cost SheetDocument6 pagesCH-1 Cost SheetIftekhar Uddin M.D EisaNo ratings yet

- Cost of goods manufactured schedule and product costsDocument3 pagesCost of goods manufactured schedule and product costsshivnilNo ratings yet

- Execise2 31-34Document5 pagesExecise2 31-34richel sanchezNo ratings yet

- Job Order Costing QuizbowlDocument27 pagesJob Order Costing QuizbowlsarahbeeNo ratings yet

- Cost Accounting Chapter5 Exercise1 7Document16 pagesCost Accounting Chapter5 Exercise1 7Baby MushroomNo ratings yet

- Task 1: Cost Classfication Task 1 Has 3 Questions in TotalDocument3 pagesTask 1: Cost Classfication Task 1 Has 3 Questions in TotalNgọc Trâm TrầnNo ratings yet

- ManAc Quiz 1Document12 pagesManAc Quiz 1random122No ratings yet

- Job and Batch CostingDocument4 pagesJob and Batch CostingAmber Kelly0% (1)

- Cost Calculation Snowball ManufacturingDocument13 pagesCost Calculation Snowball ManufacturingBisma ShahabNo ratings yet

- Accounting for Manufacturing Concerns: Calculating CostsDocument3 pagesAccounting for Manufacturing Concerns: Calculating CostsAhsan MemonNo ratings yet

- Chap 002Document7 pagesChap 002api-27091131No ratings yet

- Assignment 01Document3 pagesAssignment 01LUCILENE ROSITNo ratings yet

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- Assignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR MohsinDocument11 pagesAssignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR Mohsinjgfjhf arwtr100% (1)

- MFG - PL QuestionDocument3 pagesMFG - PL Questionane9sdNo ratings yet

- COST ACCOUNTING ASSIGNMENTDocument6 pagesCOST ACCOUNTING ASSIGNMENTSugata SNo ratings yet

- Assignment2 CostACC VanessaDocument7 pagesAssignment2 CostACC VanessaVanessa vnssNo ratings yet

- Cost AccDocument27 pagesCost AccAngel PulvinarNo ratings yet

- Chap 1 Problems Cost SheetDocument5 pagesChap 1 Problems Cost SheetRositaNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Knight Company costs totalsDocument1 pageKnight Company costs totalsMoad NasserNo ratings yet

- Set9 P3Document5 pagesSet9 P3Geriq Joeden PerillaNo ratings yet

- KJ TGL 28 COst AcctDocument4 pagesKJ TGL 28 COst Acctirene fionaliaNo ratings yet

- Cost of Goods Manufactured StatementDocument3 pagesCost of Goods Manufactured Statementnur athirahNo ratings yet

- Chapter 2: Cost Management Concepts: Jayadevm@iimb - Ernet.inDocument20 pagesChapter 2: Cost Management Concepts: Jayadevm@iimb - Ernet.inPratyush GoelNo ratings yet

- Chapters 1 To 3 (Answers)Document8 pagesChapters 1 To 3 (Answers)Cho AndreaNo ratings yet

- Drill12 Drill13 Manufacturing BusinesDocument6 pagesDrill12 Drill13 Manufacturing BusinesAngelo FelizardoNo ratings yet

- MGT Accounting, Intermideiate-SolutionsDocument31 pagesMGT Accounting, Intermideiate-SolutionsRONALD SSEKYANZINo ratings yet

- Revision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Document5 pagesRevision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Sujib BarmanNo ratings yet

- Cost ProblemsDocument7 pagesCost ProblemsMadanNo ratings yet

- MANAGEMENT ACCOUNTING ASSIGNMENTDocument7 pagesMANAGEMENT ACCOUNTING ASSIGNMENTmuhammad Ammar Shamshad100% (2)

- Managerial Accounting - ExercisesDocument60 pagesManagerial Accounting - ExercisesNúmero CuatroNo ratings yet

- BUSI2083Document2 pagesBUSI2083Amandeep GillNo ratings yet

- Cost Accounting Prelims Practice Solving 1 50 1Document24 pagesCost Accounting Prelims Practice Solving 1 50 1Marjorie PalmaNo ratings yet

- Assignment 3 Accounting PDFDocument11 pagesAssignment 3 Accounting PDFjgfjhf arwtr100% (1)

- Cost Activity 1Document12 pagesCost Activity 1Dark Ninja100% (1)

- Exercises: Job Order Costing: Q1: Lamonda Corp. Uses A Job Order Cost System. On April 1, The Accounts Had The FollowingDocument4 pagesExercises: Job Order Costing: Q1: Lamonda Corp. Uses A Job Order Cost System. On April 1, The Accounts Had The FollowingCynthia WongNo ratings yet

- Chapter 1 - Manufacturing Account (I)Document16 pagesChapter 1 - Manufacturing Account (I)NG JIA LUNGNo ratings yet

- AccountsDocument14 pagesAccountsgokulamaromal2001No ratings yet

- Ch2 - Cost Accounting - Horngren'sDocument16 pagesCh2 - Cost Accounting - Horngren'svipinkala1No ratings yet

- Cost Sheet ProblemsDocument10 pagesCost Sheet Problemsprapulla sureshNo ratings yet

- Cost SheetDocument10 pagesCost Sheetchukku2803No ratings yet

- Baya - Exercise 4 Job Order Costing, Accounting For MaterialDocument12 pagesBaya - Exercise 4 Job Order Costing, Accounting For MaterialAngelica BayaNo ratings yet

- Vicenzo Bernard Leandro Tioriman - 01011182025009Document6 pagesVicenzo Bernard Leandro Tioriman - 01011182025009ImVicNo ratings yet

- Introduction to Manufacturing Costs and Financial StatementsDocument4 pagesIntroduction to Manufacturing Costs and Financial StatementsAshitero YoNo ratings yet

- Notes On Process Costing System - PDF - ProtectedDocument14 pagesNotes On Process Costing System - PDF - Protectedhildamezmur9No ratings yet

- ACT202 - Assignment 2 - 18204001 - Mohammed RashedDocument6 pagesACT202 - Assignment 2 - 18204001 - Mohammed RashedAnkur SahaNo ratings yet

- Determine total costs and prepare partial financial statementsDocument7 pagesDetermine total costs and prepare partial financial statementsNgọc KhánhNo ratings yet

- CostConExercise - COGM & COGSDocument3 pagesCostConExercise - COGM & COGSLee Tarroza100% (1)

- Direct Material CostDocument29 pagesDirect Material CostRaj DharodNo ratings yet

- COST OF GOODS MANUFACTURED AND SOLD BarrosDocument8 pagesCOST OF GOODS MANUFACTURED AND SOLD BarrosJINKY TOLENTINONo ratings yet

- Activity - 1 - MTDocument3 pagesActivity - 1 - MTKezNo ratings yet

- Document 9Document2 pagesDocument 9mohammedbudul18No ratings yet

- Gopi M. Patel: Summary of QualificationsDocument2 pagesGopi M. Patel: Summary of QualificationsAshwani kumarNo ratings yet

- HSBC Settles Fraud Case Against Singer After Regulator PressureDocument3 pagesHSBC Settles Fraud Case Against Singer After Regulator PressureSaumyadeep BardhanNo ratings yet

- How The CIA Made Google (Google Did Not Start in Susan Wojcicki's Garage)Document9 pagesHow The CIA Made Google (Google Did Not Start in Susan Wojcicki's Garage)karen hudesNo ratings yet

- Microfabrication Technologies: Microsystem Products Microfabrication ProcessesDocument47 pagesMicrofabrication Technologies: Microsystem Products Microfabrication ProcessesSaAhRaNo ratings yet

- AUD689 2019 June SolutionDocument9 pagesAUD689 2019 June SolutionRossa HohoNo ratings yet

- Pcic VS Central CollegesDocument2 pagesPcic VS Central CollegesannlaurenweillNo ratings yet

- Demand Forecasting of Cement IndustryDocument20 pagesDemand Forecasting of Cement IndustryShraddhaNaikNo ratings yet

- Statement Summary: Run24.mx Sapi de CV Statement Date: Statement Period: Billing MethodDocument6 pagesStatement Summary: Run24.mx Sapi de CV Statement Date: Statement Period: Billing MethodnovelNo ratings yet

- Excel Merchandising CompanyDocument1 pageExcel Merchandising Companygolemwitch01No ratings yet

- Reddy - Prathap - Web TranscriptDocument26 pagesReddy - Prathap - Web TranscriptSridhar KrishnamurthiNo ratings yet

- Eatigo - Group 10Document4 pagesEatigo - Group 10satyam mishraNo ratings yet

- GDP Assignment FinalDocument5 pagesGDP Assignment FinalZakia Jalil17% (6)

- Casting PDFDocument14 pagesCasting PDFArun kumar rouniyarNo ratings yet

- Extraction of Nonferrous Metals by H S Ray PDFDocument2 pagesExtraction of Nonferrous Metals by H S Ray PDFMichael22% (23)

- Ebrd ContractDocument18 pagesEbrd ContractAna GogoladzeNo ratings yet

- FY-7.4 Lesson Guide - Google DocsDocument4 pagesFY-7.4 Lesson Guide - Google Docstarikhero755No ratings yet

- BUS 1101 Principles of Business Management Written Assignment Unit 2Document4 pagesBUS 1101 Principles of Business Management Written Assignment Unit 2Azalia Delgado Vera100% (1)

- C11 Social EntrepreneurshipDocument28 pagesC11 Social Entrepreneurshiphuzailinsyawana100% (1)

- Chalet Sports Sells Hunting and Fishing Equipment and Provides Guided HuntingDocument1 pageChalet Sports Sells Hunting and Fishing Equipment and Provides Guided Huntingtrilocksp SinghNo ratings yet

- sGAN INTERNSHIP REPORTDocument16 pagessGAN INTERNSHIP REPORTShubham GuptaNo ratings yet

- Master the Art of Persuasion and Influence with these 15 Must-Read BooksDocument9 pagesMaster the Art of Persuasion and Influence with these 15 Must-Read BooksJuan Luis JuncosNo ratings yet

- JRD Tata Biography PDFDocument5 pagesJRD Tata Biography PDFGangadhar BituNo ratings yet

- Internal Control ReviewDocument3 pagesInternal Control ReviewPatrick KariukiNo ratings yet

- McKinsey Case StudyDocument7 pagesMcKinsey Case StudyAmol AndhaleNo ratings yet

- Unit4 - 488 - Assignment 1 Frontsheet (Group)Document40 pagesUnit4 - 488 - Assignment 1 Frontsheet (Group)Minh Thi TrầnNo ratings yet

- Weeks 4,5,6 - PDFDocument191 pagesWeeks 4,5,6 - PDFMehul Kumar MukulNo ratings yet

- Payment NotificationDocument1 pagePayment NotificationbengunindwandweNo ratings yet

- Ap 5906 ReceivablesDocument14 pagesAp 5906 ReceivablesMa. Lou Erika BALITENo ratings yet

- Advance Chaper 7 & 8Document27 pagesAdvance Chaper 7 & 8abel habtamuNo ratings yet

- Stock TradingDocument31 pagesStock TradingSunil ChoudharyNo ratings yet