Professional Documents

Culture Documents

Faculty - Architecture, Planning, and Surveying - 2022 - Session 1 - Degree - Res619

Uploaded by

Nur AthirahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Faculty - Architecture, Planning, and Surveying - 2022 - Session 1 - Degree - Res619

Uploaded by

Nur AthirahCopyright:

Available Formats

CONFIDENTIAL 1 AP/FEB 2022/RES619

UNIVERSITI TEKNOLOGI MARA

FINAL ASSESSMENT

COURSE : REVENUE LAW

COURSE CODE : RES619

EXAMINATION : FEBRUARY 2022

TIME : 3 HOURS

INSTRUCTIONS TO CANDIDATES

1. This question paper consists of four (4) questions.

2. Answer ALL questions in the Answer Booklet. Start each answer on a new page.

3. Answer should be handwritten. Please save the submission in a PDF form.

4. Please submit the Final Assessment in the Google Classroom’s tray create by your

respective lecturer. Alternatively, please re-confirm with your lecturer the mode of

submission preferred. Any late submission will be penalized.

5. Answer ALL questions in English.

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This examination paper consists of 4 printed pages

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 2 AP/FEB 2022/RES619

QUESTION 1

a) Describe the formation and functions of the Inland Revenue Board Malaysia.

(10 marks)

b) Encik Nizam works as a property manager with Maju Properties Sdn. Bhd. since 2010.

In 2021, he received the following remuneration:

i) Salary RM10,000.00 per month.

ii) Bonus three (3) months’ salary.

iii) Travelling allowance RM600.00 per month.

Encik Nizam owns two condominium units in Petaling Jaya and he receives RM4,000.00

as a monthly rental. He has three (3) childrens; Sara (21 years old), Kamal (18 years old)

and Amani (6 years old). His wife, Suzana is a teacher. The eldest daughter is a disabled

child and studying at the University of Malaya. The second son is further education in

Malacca Matriculation College and the youngest daughter is going to private kindergarten

with a monthly fee of RM500.00 per month. According to Appendix 1, determine the

income tax payable by Encik Nizam for the Year Assessment (YA) 2021.

(15 marks)

QUESTION 2

a) Classify the differences between fixed duty and ad-valorem duty.

(10 marks)

b) Compute the following ad-valorem duties:

i) Mr. Khai Bahar recently purchased a three-storey shop lot located in Bandar Bukit

Raja at RM1,230,000.00. The purchasing date is 1st June 2021.

(5 marks)

ii) Siti Nordiana bought a single-storey terrace house in Petaling Jaya at RM550,000.00

for her second home. The purchasing date is 15th November 2021.

(5 marks)

iii) Mr. Aaron Aziz recently bought a bungalow house in Georgetown, Pulau Pinang at

RM2.3 million from the seller.

(5 marks)

QUESTION 3

a) Categorise the chargeable persons according to the Real Property Gains Tax 1976

(Amended).

(10 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 AP/FEB 2022/RES619

b) Encik Ismail disposed a piece of agricultural land located in Merlimau, Melaka at

RM300,000.00 on 25th October 2021. He acquired the land on 12th June 2012 with

purchasing price of RM180,000.00. Based on this information:

i) Justify whether he will impose the Real Property Gains Tax. If yes, how much is the

Real Property Gains Tax (RPGT) levy on him?

(9 marks)

ii) Determine the disposal that is not liable to Real Property Gains Tax (RPGT).

(6 marks)

QUESTION 4

a) Identify the five (5) differences between Annual Value and Improved Value.

(10 marks)

b) According to Local Government Act 1976 (Amended) (Act 171), classify with examples

the powers of the local authority in Malaysia.

(15 marks)

END OF QUESTION PAPER

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 4 AP/FEB 2022/RES619

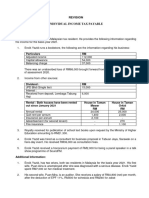

APPENDIX 1

Assessment Year 2021

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

You might also like

- Coaching Business Plan PDFDocument16 pagesCoaching Business Plan PDFdorelb76100% (2)

- Motion To DismissDocument27 pagesMotion To DismissAdam PoulisseNo ratings yet

- (Not So) Legendary Actions PDFDocument4 pages(Not So) Legendary Actions PDFEduardo0% (1)

- Avatar Legends RPG - Starter Set - Pregens - Aang EraDocument10 pagesAvatar Legends RPG - Starter Set - Pregens - Aang Eraguilherme.souza.bkpNo ratings yet

- Legal Ethics Q and ADocument185 pagesLegal Ethics Q and Aknicky FranciscoNo ratings yet

- Donation Inter Vivos - SampleDocument3 pagesDonation Inter Vivos - SampleLen Tao100% (1)

- Woodward Camp Lawsuit 2021Document23 pagesWoodward Camp Lawsuit 2021Ryan GraffiusNo ratings yet

- Gap Analysis - 17025 2017 PDFDocument20 pagesGap Analysis - 17025 2017 PDFmanojvattavilaNo ratings yet

- CIR Vs TOLEDO POWER COMPANY - (08.10.2015) - BayogDocument3 pagesCIR Vs TOLEDO POWER COMPANY - (08.10.2015) - BayogDanica DepazNo ratings yet

- FAR570 Jul 2020 Set 1 (Sesi 1) - QDocument4 pagesFAR570 Jul 2020 Set 1 (Sesi 1) - QNURUL NAZAHANNIE MOHAMAD NAJIBNo ratings yet

- Commercial LawDocument12 pagesCommercial LawKatrina Petil100% (1)

- Equipment Rental Agreement TemplateDocument3 pagesEquipment Rental Agreement Templatemohamed hussien100% (1)

- Second Motion For Extension of Time-Court of Appeals (Sarion) Petition For ReviewDocument3 pagesSecond Motion For Extension of Time-Court of Appeals (Sarion) Petition For ReviewattyleoimperialNo ratings yet

- Le Monde en Français - WorkbookDocument138 pagesLe Monde en Français - WorkbookMayl DelauNo ratings yet

- Mid-Term Test Tax517 June 2022Document8 pagesMid-Term Test Tax517 June 2022FeahRafeah KikiNo ratings yet

- TAX517 2023 Feb QDocument15 pagesTAX517 2023 Feb QNik Fatehah NajwaNo ratings yet

- Tax 467 Common Test July 2022 PDFDocument5 pagesTax 467 Common Test July 2022 PDFkhaiNo ratings yet

- Tax317 Quiz Jan 2023 QDocument4 pagesTax317 Quiz Jan 2023 Q2021830296No ratings yet

- Tax517 Test June 2022Document5 pagesTax517 Test June 2022Marlina RashidNo ratings yet

- Mat112 Feb 2021Document5 pagesMat112 Feb 2021nadine emilyNo ratings yet

- TAX517 - July 2022Document14 pagesTAX517 - July 2022IZZAH FAQIHAH AHMAD HARRISNo ratings yet

- Faculty Accountancy 2022 Session 1 - Degree Far510Document13 pagesFaculty Accountancy 2022 Session 1 - Degree Far510Wahida AmalinNo ratings yet

- Universiti Teknologi Mara Final Assessment: Confidential 1 CS/FEB 2022/MAT112Document6 pagesUniversiti Teknologi Mara Final Assessment: Confidential 1 CS/FEB 2022/MAT112MARLINDAH RAHIMNo ratings yet

- TAX517 - Feb 2022Document14 pagesTAX517 - Feb 2022IZZAH FAQIHAH AHMAD HARRISNo ratings yet

- Week 6Document3 pagesWeek 6xinghe666No ratings yet

- Group Assignment Mat112 PDFDocument3 pagesGroup Assignment Mat112 PDFIts RealNo ratings yet

- Universiti Teknologi MaraDocument2 pagesUniversiti Teknologi MaraAZRIL HAIRIE CHAIRIL ASYRAFNo ratings yet

- T6Q RCA22020 Business IncomeDocument2 pagesT6Q RCA22020 Business IncomeHaananth SubramaniamNo ratings yet

- 2020 Mar - 2020 July - QDocument11 pages2020 Mar - 2020 July - Qnur hazirahNo ratings yet

- Universiti Teknologi Mara Common Test: Confidential 1 AC/MAY 2021/FAR270Document4 pagesUniversiti Teknologi Mara Common Test: Confidential 1 AC/MAY 2021/FAR270Lampard AimanNo ratings yet

- Tax267 February 22 FaDocument13 pagesTax267 February 22 FarumaisyaNo ratings yet

- Tax267 July22 QQDocument9 pagesTax267 July22 QQSYAZWINA SUHAILINo ratings yet

- Acd10303 Sem II 20212022 Intangible Asset PgeDocument3 pagesAcd10303 Sem II 20212022 Intangible Asset Pgechillbonhi0820No ratings yet

- Dqs 359 Final Assessment - August 2022Document7 pagesDqs 359 Final Assessment - August 2022Tony ANo ratings yet

- Faculty - Law - 2022 - Session 1 - Degree - Law549Document5 pagesFaculty - Law - 2022 - Session 1 - Degree - Law549RyNo ratings yet

- A221 MC 3 - StudentDocument5 pagesA221 MC 3 - StudentNajihah RazakNo ratings yet

- Faculty of Management and MuamalahDocument8 pagesFaculty of Management and MuamalahZati TyNo ratings yet

- Tax267 Jul2022 QQDocument9 pagesTax267 Jul2022 QQLENNY GRACE JOHNNIENo ratings yet

- Faculty Architecture, Planning, and Surveying 2022 Session 1 DegreeDocument7 pagesFaculty Architecture, Planning, and Surveying 2022 Session 1 DegreeHUDA SYAZWANI MOHAMAD HUZAININo ratings yet

- 2019 December - 231030 - 155131Document6 pages2019 December - 231030 - 155131masnurzuaniNo ratings yet

- Feb2022 Tax267Document9 pagesFeb2022 Tax267Ayu MaisarahNo ratings yet

- Exam CD FEB 2023 MAT112Document5 pagesExam CD FEB 2023 MAT112mustardNo ratings yet

- Faculty - Accountancy - 2022 - Session 1 - Degree - Tax667 PDFDocument10 pagesFaculty - Accountancy - 2022 - Session 1 - Degree - Tax667 PDFNur Athirah Binti MahdirNo ratings yet

- Far570 Q Test December 2022Document4 pagesFar570 Q Test December 2022fareen faridNo ratings yet

- Dec 2021Document83 pagesDec 2021刘宝英No ratings yet

- UntitledDocument3 pagesUntitledCarylChooNo ratings yet

- Faculty - Architecture, Planning, and Surveying - 2022 - Session 1 - Degree - bqs609Document5 pagesFaculty - Architecture, Planning, and Surveying - 2022 - Session 1 - Degree - bqs609mohdsyazrul28No ratings yet

- Q - Test Far270 Nov 2022 PDFDocument5 pagesQ - Test Far270 Nov 2022 PDFNUR QAMARINANo ratings yet

- BPM109 Jan 2022 Toa 1660812347923Document5 pagesBPM109 Jan 2022 Toa 1660812347923beyyijingNo ratings yet

- CT Far160 Dec2022 QDocument4 pagesCT Far160 Dec2022 QSiti Nurul AtiqahNo ratings yet

- Far570 Q Set 1Document8 pagesFar570 Q Set 1NURUL NAZAHANNIE MOHAMAD NAJIBNo ratings yet

- Pyq - Mat112 - Jun 2019Document5 pagesPyq - Mat112 - Jun 2019isya.ceknua05No ratings yet

- 2007 S1Document8 pages2007 S1Balquish AmnaNo ratings yet

- TUTORIAL Withholding Tax 2023 PDFDocument4 pagesTUTORIAL Withholding Tax 2023 PDFfarhan edhamNo ratings yet

- Mat112 Business Mathematics PDFDocument6 pagesMat112 Business Mathematics PDFRosliNo ratings yet

- Far270 - Q Test May 2023Document5 pagesFar270 - Q Test May 20232022896776No ratings yet

- Tutorial 3 - RPGT-2022Document4 pagesTutorial 3 - RPGT-2022Keat 98No ratings yet

- Revision 1Document4 pagesRevision 1carazamanNo ratings yet

- Soalan Tugasan Individu Am025 Ambilan 2021Document3 pagesSoalan Tugasan Individu Am025 Ambilan 2021Nur SuziliyanaNo ratings yet

- Tax467 Dec 2019Document13 pagesTax467 Dec 2019Szasza teppeiNo ratings yet

- SAMPLE - FINAL EXAM-ilahDocument9 pagesSAMPLE - FINAL EXAM-ilahpsfarisha2023No ratings yet

- Mat112 Sept - 2014Document7 pagesMat112 Sept - 2014Nara SakuraNo ratings yet

- July21 QQ PDFDocument4 pagesJuly21 QQ PDFSYAZWINA SUHAILINo ratings yet

- Tax July 2021Document4 pagesTax July 2021MUHAMMAD FARIS NAIMNo ratings yet

- Faculty - Accountancy - 2022 - Session 1 - Degree - Tax467Document9 pagesFaculty - Accountancy - 2022 - Session 1 - Degree - Tax467HAZIQ HASNOLNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AP/JUN2012/EMT511Document6 pagesUniversiti Teknologi Mara Final Examination: Confidential AP/JUN2012/EMT511nur_afiqah_74No ratings yet

- Tutorial 2Document4 pagesTutorial 2CHUNG SIAU SWEAN ALICENo ratings yet

- Far270 CT - Q - April2022 PDFDocument5 pagesFar270 CT - Q - April2022 PDFNUR QAMARINANo ratings yet

- CT Far270 Dec21Document5 pagesCT Far270 Dec212022624622No ratings yet

- Maf253 Fa Q Aug 2020Document12 pagesMaf253 Fa Q Aug 2020alisatasnimNo ratings yet

- Jan22 QQ PDFDocument5 pagesJan22 QQ PDFSYAZWINA SUHAILINo ratings yet

- Far160 Pyq Feb2023Document8 pagesFar160 Pyq Feb2023nazzyusoffNo ratings yet

- Transforming Borneo: From Land Exploitation to Sustainable DevelopmentFrom EverandTransforming Borneo: From Land Exploitation to Sustainable DevelopmentNo ratings yet

- NOTES ON RA No. 11032 Ease of Doing Business and Efficient Government Service Delivery Act of 2018Document22 pagesNOTES ON RA No. 11032 Ease of Doing Business and Efficient Government Service Delivery Act of 2018Cirele Sofia Dela LunaNo ratings yet

- 09 Albania v. TalladoDocument2 pages09 Albania v. TalladoChelle BelenzoNo ratings yet

- Gem Service Proposal From WWW - Thetenders.com (Priyanka Devghare - 9898340926) M - S - Kahale Trading CorporationDocument2 pagesGem Service Proposal From WWW - Thetenders.com (Priyanka Devghare - 9898340926) M - S - Kahale Trading CorporationKrupam Thetenders.comNo ratings yet

- Instant Download Systems Architecture 7th Edition Burd Test Bank PDF Full ChapterDocument25 pagesInstant Download Systems Architecture 7th Edition Burd Test Bank PDF Full ChapterDianaFloresfowc100% (8)

- NPC V CADocument2 pagesNPC V CAAllen Windel BernabeNo ratings yet

- Law ProjectDocument17 pagesLaw Projecthardik anandNo ratings yet

- Corliss v. Manila Railroad Co., G.R. No. L-21291, March 28, 1969Document9 pagesCorliss v. Manila Railroad Co., G.R. No. L-21291, March 28, 1969Lex LawNo ratings yet

- Kopaonik Tom IV 2020 Web NovoDocument218 pagesKopaonik Tom IV 2020 Web NovoNikola TadicNo ratings yet

- Group Screening Test FormDocument8 pagesGroup Screening Test FormArchessNo ratings yet

- Weekly Report - Operation Support and Compliance Team As of 25 August 2023Document79 pagesWeekly Report - Operation Support and Compliance Team As of 25 August 2023Dea SaskiaNo ratings yet

- Business Law SyllabusDocument24 pagesBusiness Law SyllabusMK GrospeNo ratings yet

- Pdf-Burlington-1-10-Test-Key 999Document3 pagesPdf-Burlington-1-10-Test-Key 999Alin NguyenNo ratings yet

- Bermuda Immigration and Protection Amendment Act 2020Document10 pagesBermuda Immigration and Protection Amendment Act 2020BernewsAdminNo ratings yet

- PRC 2 ST ApqDocument253 pagesPRC 2 ST Apqmeki ustadNo ratings yet

- Unfair PrejudiceDocument9 pagesUnfair PrejudiceRyan KatibuNo ratings yet

- Asignment Work On Service Law in IndiaDocument1 pageAsignment Work On Service Law in IndiaDilawar SinghNo ratings yet

- Me 421 Module 1Document32 pagesMe 421 Module 1I AM CHESCA (IamChesca)No ratings yet