Professional Documents

Culture Documents

AFAR 15 Job Order Costing

Uploaded by

Martin ManuelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AFAR 15 Job Order Costing

Uploaded by

Martin ManuelCopyright:

Available Formats

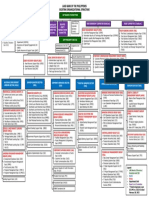

ReSA - THE REVIEW SCHOOL OF ACCOUNTANCY

CPA Review Batch 42 October 2021 CPA Licensure Exam Week No. 14

ADVANCED FINANCIAL ACCOUNTING & REPORTING A. Dayag G. Caiga M. Ngina

AFAR-15: JOB ORDER COSTING

Definition

Cost Accounting refers to recording, classifying, and reporting all cost aspects of company performance

during a particular period of time. It is therefore, a system that records, summarizes, analyzes, and interprets

the details of the cost of materials, labor and overhead necessary to produce and sell an article or a

product. Cost accounting is usually considered only as it applies to manufacturing and service

organizations as well.

System of Cost Accumulation

The basic objective of cost accounting is the determination or accumulation of a product’s cost for

inventory valuation and income determination. The following systems may be used in accumulating a

product’s cost:

1. Actual (Historical) Cost System. Under this system, direct materials, direct labor, and factory overhead

costs are determined as they occur simultaneously with the manufacturing operation but the total of

these costs is known only as the operation has been completed. An actual cost system collects the

actual amounts of direct materials, direct labor, and factory overhead that are incurred for each

product.

2. Standard (Predetermined) Cost System. Under this system, costs are determined in advance from

analysis and forecasts made before the actual production begins. In a standard cost system, standard

unit costs are computed for the direct materials, direct labor, and factory overhead; these amounts

rather than the actual costs are carried to Finished Goods.

3. Normal Cost System. This system is a combination of the actual cost system and the standard cost

system. It accumulates only the actual amounts of direct materials and direct labor costs. Factory

overhead costs are accumulated on the basis of predetermined overhead rate.

Cost Accumulation Procedures (Methods)

Job order and process costing are the two most widely used cost accumulation methods, and they have

several aspects in common. Although, the ultimate cost object in both of these methods is the unit of

product, the two methods differ fundamentally in their approach to cost tracing. In job order costing, cost

is traced to an individual batch, specific units, lot or contract. In process costing, cost is traced to a

department, operation, or some other subdivision within the factory as long a it involves a continuous flow

rather than a series of separate jobs.

The most common cost accumulation methods or procedures are:

1. Job Order Costing

2. Process Costing

The third method, is a combination of job order and process costing,

3. Operation Costing/Blended Method / Hybrid Method

The fourth method was introduced because of Just-In-Time (JIT) Philosophy in Production,

4. JIT - Backflush Costing

Job Order Costing. This method is used when:

1. products are manufactured within a department or cost center are heterogeneous or dissimilar

products.

2. they are manufactured individually or in distinct lots or batches,

3. each job requiring different amounts of materials, labor and overhead.

Costs should be recorded separately for every job produced. Keeping of individual records is possible only

if the various inputs to a job can be easily identified. Detailed cost record must be kept for each job and

updated as work progresses. Job-order costing is applicable to made-to-order work in factories,

manufacturers of expensive, one of kind items such as building contractors, shipbuilders, and motion

picture companies, workshops, repair shops, job printers, construction engineers, and service business such

as medical, legal, architectural, accounting and consulting firms.

Operation Costing/Blended Method/Hybrid Method/. In some manufacturing companies, different units

have significantly different materials costs, but all units undergo identical conversion in large quantities. In

these cases, direct materials costs are accumulated using job order costing, and conversion costs are

accumulated using process costing.

Page 1 of 11 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AFAR-15

Week 14: JOB ORDER COSTING

I – Actual and Normal Costing

For fiscal year 2021, Matz Solution it would incur total overhead costs of P1,200,000 and work

40,000 machine hours. During January 2021, the company works exclusively on one job, Job #458.

It incurred January costs as follows:

Direct materials usage………………………………… P 121,000

Direct labor (1,400 hours)……………………… 30,800

Manufacturing overhead:

Rent………………………………………………………………… P 11,200

Utilities…………………………………………………… 15,200

Insurance…………………………………………………… 32,100

Labor……………………………………………………………… 15,500

Depreciation…………………………………………… 23,700

Maintenance……………………………………………… 10,800

Total OH……………………………………………………… 108,500

Total Manufacturing Costs…………………………… P 260,300

Machine hours worked in January: 3,400.

1. Assuming the company uses an actual cost system, compute the January costs assigned to

Job#458.

A. P253,800 C. P260,300

B. P251,800 D. P265,000

2. Assuming the company uses a normal cost system, compute the January costs assigned to Job#458.

A. P253,800 C. P260,300

B. P251,800 D. P265,000

Disposition of Over-under applied Overhead Account

When factory overhead is over-under applied and a variance or difference results, either of the

following methods is acceptable to account for the difference in closing the account (this is

in accordance with the Cost Accounting Standards Board requirement):

1. If difference is insignificant (immaterial) to Cost of Goods Sold or Income Summary. The

over-or under applied factory overhead may be debited or credited to Cost of Goods Sold

(most common treatment or most convenient) or Income Summary. This has no effect on unit

cost and treats the entire variance as a PERIOD EXPENSE.

2. If difference is significant (material) to Cost of Goods Sold and Inventories. The over-

under applied factory overhead may be debited or credited to Cost of Goods Sold and Ending

Inventories (Work-in-Process and Finished Goods). This would change cost per unit.

II – Disposition of Over-under applied Overhead Account

The records of XYZ Co. revealed the following data for 2021:

Work in Process P 73,150

Finished Goods 115,000

Cost of Goods Sold 133,650

Direct Labor 111,600

Direct Material 84,200

1. Refer to XYZ Co. Assume, for this question only, actual overhead is P98,700 and applied

overhead is P93,250. Manufacturing Overhead is

a. Overapplied by P12,900.

b. underapplied by P18,350.

c. overapplied by P5,450.

d. underapplied by P5,450.

2. Refer to XYZ Co. Assume that XYZ has underapplied overhead of P37,200 for 2019 and that

this amount is material. What journal entry is needed to close the Overhead account? (Round

decimals to nearest whole percent.)

a. Debit Work in Process P8,456; Finished Goods P13,294; Cost of Goods Sold

P15,450 and credit Overhead P37,200

b. Debit Overhead P37,200 and credit Work in Process P8,456; Finished Goods

P13,294; Cost of Goods Sold P15,450

c. Debit Work in Process P37,200 and credit Overhead P37,200

d. Debit Cost of Goods Sold P37,200 and credit Overhead P37,200

3. Refer to XYZ Co. Assume that XYZ has underapplied overhead of P10,000 for 2019 and that

this amount is immaterial. What is the balance in Cost of Goods Sold after the underapplied

overhead is closed?

a. P133,650 c. P143,650

b. P123,650 d. P137,803

4. Refer to XYZ Co. Assume that XYZ has overapplied overhead of P25,000 for 2019 and that this

amount is material. What is the balance in Cost of Goods Sold after the overapplied

overhead is closed?

a. P123,267 c. P158,650

b. P144,033 d. P108,650

III – Job Order Costs Sheets

Page 2 of 11 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AFAR-15

Week 14: JOB ORDER COSTING

The Usry Company uses a job order costing system which is based on normal costs, and overhead

is applied on machine hours. The inventories on October 1: direct materials,P2,000, finished

goods, P5,000 (Job Order No. 1000), work-in-process, Job Order No. 1001, the job had been

assigned P130 for direct materials, P165 for direct labor cost with 100 machine hours. Purchases

of direct materials, 30,000 pieces @ P1.40 per piece. Following are the additional costs incurred

during the month.

Direct Direct Machine

Job Order Nos. Materials Labor Cost Hours

1001 P 4,100 P 1,375 1,300

1002 9,150 7,250 3,700

1003 11,275 14,325 8,200

1004 3,225 2,800 1,500

1005 6,500 6,100 3,200

1006 2,750 1,650 980

Manufacturing overhead costs are charged to jobs on the basis of P1.50 per machine hour used.

The actual manufacturing overhead cost for the month totaled P30,350. During October, Job Order

Nos. 1001, 1002, 1004, and 1005 were completed. Jobs 1001 and 1002 were shipped out and the

customers were billed for P9,000 for Job No. 1001 and P20,000 for 1002.

1. The cost of goods manufactured amounted to:

A. P55,495 B. P55,500 C. P56,495 D. P57,500

2. The work-in-process on October 31 amounted to:

A. P25,675 B. P29,820 C. P43,770 D. P69,445

3. The cost of goods available for sale amounted to:

A. P55,495 B. P60,495 C. P60,500 D. P61,495

4. The finished goods on October 31 amounted to:

A. P 8,275 B. P17,400 C. P 30,675 D. P43,770

5. The cost of goods of goods sold amounted to:

A. P29,820 B. P29,375 C. P21,950 D. P7,870

6. The gross margins on Jobs 1001 and 1002 amounted to:

Job 1001 Job 1002 Job 1001 Job 1002

A. P1,200 P 1,850 C. P1,150 P1,850

B. 1,130 ( 1,950) D. 1,130 (1,850)

7. The direct materials on October 31 amounted to:

A. P 5,000 B. P 7,000 C. P 30,675 D. P43,770

IV – Manufacturing Cost Computations

The following account balances and other information for Barfield Company pertain to November

operations:

Account Balances

November 1 November 30

Finished goods P 70,000 P 60,000

Work in process 50,000 ?

Raw materials inventory 10,000 25,000

Accounts payable ? 15,000

Accrued payroll 10,000 20,000

Accumulated depreciation – factory equipment 80,000 90,000

Other information:

a. The company’s Raw Materials Inventory account contains both direct and indirect

materials, materials purchased on account during November, P55,000.

b. Rebecca Company applies factory overhead at a predetermined rate of P3 per direct

labor hour.

c. During November, direct labor employees worked 25,000 hours at a rate of P4 per

hour.

d. Jobs 385, 386, and 387 were still in process at the end of November. A total of

P5,000 of direct materials has been charged to these three jobs. To date, 5,000

direct labor hours have been worked on these jobs.

e. The accrued payroll account is used for factory employees only. Assuming no payroll

deductions, payment to factory employees during the month totaled P140,000.

f. Factory overhead was underapplied by P5,000.

g. Payments on account totaled P55,000.

Required: Determine the following -

1. Direct materials charged to operations

2. Indirect materials

3. Factory overhead applied during the month

4. Ending inventory of work in process

5. Cost of goods manufactured

6. Cost of goods sold before over-under applied

7. Indirect labor

8. Miscellaneous factory overhead

9. Accounts payable, November 1

Page 3 of 11 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AFAR-15

Week 14: JOB ORDER COSTING

V

Adams Co. uses a job order costing system and the following information is available from its

records. The company has 3 jobs in process: #5, #8, and #12.

Raw material used P120,000

Direct labor per hour P8.50

Overhead applied based on direct labor cost 120%

Direct material was requisitioned as follows for each job respectively: 30 percent, 25 percent,

and 25 percent; the balance of the requisitions was considered indirect. Direct labor hours per

job are 2,500; 3,100; and 4,200; respectively. Indirect labor is P33,000. Other actual overhead

costs totaled P36,000.

1. Refer to Adams Co. What is the prime cost of Job #5?

A. P42,250 C. P73,250

B. P57,250 D. P82,750

2. Refer to Adams Co. What is the total amount of overhead applied to Job #8?

A. P18,250 C. P30,000

B. P26,350 D. P31,620

3. Refer to Adams Co. What is the total amount of actual overhead?

A. P36,000 C. P93,000

B. P69,000 D. P99,960

4. Refer to Adams Co. How much overhead is applied to Work in Process?

A. P69,000 C. P132,960

B. P99,960 D. P144,000

5. Refer to Adams Co. If Job #12 is completed and transferred, what is the balance in Work in

Process Inventory at the end of the period if overhead is applied at the end of the period?

A. P96,700 C. P170,720

B. P99,020 D. P139,540

6. Refer to Adams Co. Assume the balance in Work in Process Inventory was P18,500 on June 1 and

P25,297 on June 30. The balance on June 30 represents one job that contains direct material

of P11,250. How many direct labor hours have been worked on this job (rounded to the nearest

hour)?

A. 751 C. 1,653

B. 1,324 D. 2,976

VI

Brooke Corporation manufactures rattan furniture sets for export and uses job order cost system

in accounting for its costs. You obtained from the corporation’s books and records the following

information for the year ended December 31, 2021:

• The work-in-process inventory on January 1 was 20% less than the work-in-process inventory

on December 31.

• The total manufacturing costs added during 2019 was P900,000 based on actual direct

materials and direct labor but with manufacturing overhead applied on actual direct labor

pesos.

• The manufacturing overhead applied to process was 72% of the direct labor pesos, and it

was equal to 25% of the total manufacturing costs.

• The cost of goods manufactured, also based on actual direct materials, actual direct labor

and applied manufacturing overhead was P850,000.

The cost of direct materials used and the work-in-process inventory on December 31, 2021:

Direct Materials Work-In-Process

Used Inventory

A. P1,075,000 P200,000

B. P 362,500 P250,000

C. P 312,500 P250,000

D. P 312,500 P275,000

VII

Fusion Company has the following data on April 30, 2021:

April manufacturing overhead…………………………………………………… P30,101.80

Decrease in ending inventories:

Materials……………………………………………………………………………………………… 2,430.00

Goods in process…………………………………………………………………………… 590.00

Increase in ending inventory:

Finished goods………………………………………………………………………………… 1,320.40

The manufacturing overhead amounts to 50% of the direct labor and the direct labor and

manufacturing overhead combined equal 50% of the total costs of manufacturing. All materials are

purchased FOB shipping point. What is the costs of goods manufactured?

A. P180,610.80 C. P182,300.80

B. P181,200.80 D. P183,200.80

*The happiest persons don’t have the best of everything in life. Perhaps, they’re just good in making the best of everything that

life brings along their way.*

*The greatest use of life is to spend it for something that will outlast it.*

Page 4 of 11 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AFAR-15

Week 14: JOB ORDER COSTING

VIII – Normal Costing

Normal operating capacity of Warren, Inc. is 150,000 machine hours per month, the level used to

compute the predetermined factory overhead application rate. At this level of activity, fixed

factory overhead is estimated to be P300,000, and variable factory overhead is estimated to be

P150,000. During March, actual production required 140,000 machine hours, and the actual factory

overhead totaled P435,000.

Required:

1. Determine the fixed portion of the fixed factory overhead application rate.

2. Determine the variable portion of the factory overhead application rate.

3. Is factory overhead for March over- or underapplied and by how much?

4. How much is the spending variance, and is it favorable or unfavorable?

5. How much is the idle capacity variance, and is it favorable or unfavorable?

IX – Departmental Rates

Carter Marketing Corporation uses job order costing system. It has three production departments,

X, Y, and Z. The manufacturing budget cost for 2021 is as follows:

Dept. X Dept. Y Dept. Z

Direct materials P 600,000 P 400,000 P 200,000

Direct labor 200,000 500,000 400,000

Manufacturing overhead 600,000 100,000 200,000

For Job 01 completed in 2021, direct materials cost was P75,000; direct labor, Department X,

P40,000, Department Y, P100,000, and Department Z, P20,000. The corporation applies manufacturing

overhead to each job on the basis of direct labor cost using departmental rates predetermined

at the beginning of the year based on the manufacturing overhead budget cost. The total

manufacturing cost of Job 01 is:

A. P385,000 C. P235,000

B. 310,000 D. 150,000

X

Rizza Lyn Company uses job order costing. At the beginning of June 2021 two jobs were in

process:

Job 369 Job 372

Materials P 4,000 P 1,400

Direct labor 2,000 600

Applied factory overhead 3,000 900

Totals P 9,000 P 2,900

There were no inventory of finished goods on June 1. During the month, Jobs 373, 374, 376, 378,

and 379 were started. Materials requisitioned for June totaled P26,000, direct labor cost,

P20,000, and actual factory overhead of P32,000. Factory overhead is applied at the rate of 150%

of direct labor cost. The only job still in process at the end of June is Job 379, with costs

of P2,800 for materials and P1,800 for direct labor. Job 376, the only finished job on hand at

the end of June, has a total cost of P4,000. The cost of goods sold at normal amounted to:

A. P76,600 C. P80,600

B. 78,600 D. 82,600

XI

The following data were taken from the records of Sharron Company:

March 1, 2021 March 31, 2021

Inventories:

Direct Materials……………………………………… P ? P 100,000

Work-in-Process………………………………………… 160,000 190,000

Finished Goods…………………………………………… 120,000 156,000

Materials purchases, P92,000.

Factory overhead, 75% of direct labor cost, P126,000.

Operating expenses, 12.5% of sales, P50,000.

Net income for the month, P50,000.

1. The cost of goods sold for the month amounted to:

A. P300,000 C. P336,000

B. P366,000 D. P175,000

2. The direct materials inventory on March 1, 2021 amounted to:

A. P 80,000 C. P 92,000

B. P146,000 D. P116,000

***************

**Never take direction from a crowd for your personal life. And never choose to quit just because somebody else

disagrees with you.**

**Don’t just make a living, design a life.**

“The will to persevere is often the difference between failure and success.” - David Sarnoff

The most essential factor is persistence – the determination never to allow your energy or enthusiasm to be

dampened by the discouragement that must inevitably come – James Whitcomb Riley

Page 5 of 11 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AFAR-15

Week 14: JOB ORDER COSTING

Wages are payments made on an hourly, daily, or piecework basis, whereas salaries are fixed payments

for managerial services. Other terms necessary for any discussion of labor costs are best defined by

equations, as follows:

Gross Earnings = Regular wage + Overtime Premium

1. Regular Wage = Total hours worked (including overtime) x Regular hourly rate

2. Overtime Premium = Overtime hours worked x Extra hourly compensation for overtime

Other Additional Compensation chargeable to Factory Overhead Control:

1. Overtime premium

2. Shift premium or differential

3. Bonus. Theoretically, a bonus is a direct cost of production. However, because the purpose of cost

accumulation is the establishment of a standard unit cost, bonuses are charged to factory

overhead.

4. Vacation and Holiday Pay

5. Pensions

6. Fringe costs. Vacation and pension plans are only two of the most common employee benefits.

Other fringe costs are listed below:

Employer’s share in (not employees’ share):

a. Social Security System

b. PhilHealth Contribution

7. Incentive Plans

XII – Overtime Premiums and Shift Differentials

Reagan Company operates its factory on w two-shift basis and pays a late-shift

differential of 15%. Reagan also pays a premium of 50% for overtime work. Since Reagan

manufactures only for stock, the cost system provides for uniform direct-labor hourly

charges for production done without regard to shift worked or work done on an overtime

basis. Overtime and late-shift differentials are included in Reagan’s factory overhead

application rate. The May payroll for production workers is as follows:

Wages at basis direct-labor rates…………………………………………………………………P 325,000

Shift differentials……………………………………………………………………………………………………… 25,000

Overtime premiums…………………………………………………………………………………………………………… 10,000

For the month of May, what amount of direct labor should Reagan charge to work-in-

process?

A. P325,000 C. P350,000

B. P335,000 D. P360,000

Notes on Scrap:

Scrap includes:

1. the filings or excessive trimmings of materials after the manufacturing operations.

2. defective materials that cannot be returned to vendor or not suitable for

manufacturing operations, and

3. broken parts as a result of an employee error or machine breakdowns that causes

the product in a poor quality condition.

Furthermore, scrap should be treated as:

1. If the scrap has a salvage value, it should be collected and placed in the storage

and available for sale to scrap dealers or anybody who are willing to buy.

2. If the scrap is the result if filings, excessive trimmings or materials residue,

and the costs of scrap cannot be determinable then, the scrap, notwithstanding

that they cannot be eliminated in the production, a record of quality of scrap

should be maintained. The purpose is to keep track and periodically analyze to

determine if some of the waste is due to inefficient use of materials and if not

eliminated, at least minimize.

Waste as distinguish to scrap materials refers to any amount of raw materials left-

over from a production process or production cycle for which there is no further use.

Waste is not usually salable at any price and must be discarded.

XIII – Accounting for Scrap

The KCO Metal Fabricators, Inc. accumulates a fairly large quantities of metal shavings and

trimmings from the products their produce. At least, once a month, the scrap metal is sold to a

local jobber for further processing. This month’s scrap sales on account total P10,000.

Required: Give the appropriate entry to record the sale of the scrap for each of the following

alternatives:

1. The scrap sales are viewed as additional revenue.

2. The scrap sales are viewed as a reduction of the cost of goods sold during the month.

3. The scrap sales are viewed as a reduction of factory overhead control.

4. The scrap sales are traceable to individual jobs and are recorded as a reduction of cost

of the materials on the jobs.

Page 6 of 11 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AFAR-15

Week 14: JOB ORDER COSTING

Notes on Spoiled Goods/Spoilage in Job-Order Costing:

Spoiled goods or spoilage differ from scrap, in the manner that they are either

partially or fully completed unit. For reason of being spoilage, they cannot be

corrected either because it is not technically possible to correct them or it is not

economical to correct them. For instance, a glass molded with different design cannot

be correctable since it will not be technically feasible because by changing it would

distort the original form or by changing the design to its original form would cost

more than the benefit to be derived.

XIV – Accounting for Spoilage or Spoiled Goods

Harper Company’s Job 501 for the manufacture of 2,200 units, which was completed during

August at the unit costs presented below:

Direct materials………………………………………………………………………………………................……P 20

Direct labor…………………………………………………………………………………………………................…… 18

Factory overhead (includes an allowance of P1 for spoiled work)………… 18

P 56

Final inspection of Job 501 disclosed 200 spoiled units which were sold to a local

jobber for P6,000.

1. Assume that spoilage loss is charged to all production or due to internal failure

during August. What would be the unit cost of the product produced on Job 501?

A. P53.00 C. P56.00

B. P55.00 D. P58.60

2. Assume that the spoilage loss is attributable to the exacting specifications of

Job 501 (or production run) and is charged to specific job. What would be the unit

cost of the product produced on Job 501?

A. P53.00 C. P57.50

B. P55.00 D. P58.60

XV - Accounting for Spoilage or Spoiled Goods

Grace Company manufactures picture frames of all sizes and shapes and uses a job-order

costing system. There is always some spoilage in each production run. The following

costs relate to the current run:

Estimated overhead (exclusive of spoilage) P160,000

Spoilage (estimated) P 25,000

Sales value of spoiled frames P 11,500

Labor hours 100,000

The actual cost of a spoiled picture frame is P7.00. During the year 170 frames are

considered spoiled. Each spoiled frame can be sold for P4. The spoilage is considered

a part of all jobs (factory overhead).

a. Labor hours are used to determine the predetermined overhead rate. What is the

predetermined overhead rate per direct labor hour

b. Prepare the journal entry needed to record the spoilage (factory overhead or to

all production.

c. Prepare the journal entry if the spoilage relates only to Job #12 (particular

job or exacting specifications) rather than being a part of all production

runs.

Answers:

a. Budgeted overhead………………………………………………………………………………………………………P 160,000

Budgeted labor……………………………………………………………………………………………………………… 25,000

Sales value of spoiled frames………………………………………………………………………( 11,500)

Budgeted costs………………………………………………………………………………………………………………P 173,500

Divided by: Budgeted labor hours……………………………………………………………… 100,000

Predetermined/Budgeted Direct Labor rate…………………………………………P 1.735/DLH

b. Spoiled Goods Inventory (P4 x 170)……………………………………………… 680

Factory Overhead Control (unrecoverable amount)…………… 510

Work-in-Process Inventory (P7 x 170)………………… 1,190

c. Spoiled Goods Inventory (P4 x 170)……………………………………………… 680

Work-in-Process Inventory……………………………………………… 680

Notes on Rework in Job Order Costing (Process of Reworking):

Rework is the process of correcting defective goods in order to bring them into a salable

condition. A defective unit normally arises when the product itself lacks materials, labor and

factory overhead.

Page 7 of 11 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AFAR-15

Week 14: JOB ORDER COSTING

XVI – Accounting for Defective Goods (Rework)

During March, Loryvi Company incurred the following costs on Job 109 for the manufacture of 200

motors:

Original cost accumulation:

Direct materials………………………………………………………………………P 660

Direct labor………………………………………………………………………………… 800

Factory overhead (150% of direct labor)………… 1,200

Total costs……………………………………………………………………………………P 2,660

Direct costs of reworking 10 motors:

Direct materials………………………………………………………………………P 100

Direct labor………………………………………………………………………………… 160

Total costs……………………………………………………………………………………P 260

1. The rework costs were attributable to internal failure (to all production) or charged to

factory overhead, what is the cost per finished unit of Job 109?

A. P15.80 C. P14.00

B. P14.60 D. P13.30

2. The rework costs were attributable to the exacting specifications of Job 109 (or production

run) and the full rework costs were charged to this specific job. What is the cost per

finished unit of Job 109?

A. P15.80 C. P14.00

B. P14.60 D. P13.30

XVII – with Answers

Carver Test Systems manufactures automated testing equipment. The company uses a job-order costing

system and applies overhead on the basis of machine-hours. At the beginning of the year, estimated

manufacturing overhead was P1,960,000 and the estimated machine-hours was 98,000. Data regarding

several jobs at Carver are presented below.

Beginning Direct Direct Machine

Job Number Balance Materials Labor Hours

XJ-107 ...................... P118,600 P 4,000 P 8,400 P 150

ST-211 ....................... 121,450 2,500 12,160 300

XD-108 ..................... 21,800 86,400 36,650 3,100

SL-205....................... 34,350 71,800 32,175 2,700

RX-115 ...................... 0 18,990 21,845 1,400

By the end of the first month (January), all jobs but RX-115 were completed, and all completed jobs had

been delivered to customers except for SL-205.

Required: What was the balance in Finished Goods inventory at the end of January?

Ans: The Finished Goods inventory consists only of Job SL-205. The balance in the account is computed as

follows:

Beginning balance, Job SL-205................... P 34,350

November charges to Job SL-205:

Direct materials ......................................... 71,800

Direct labor ................................................ 32,175

Manufacturing overhead applied* ........ 54,000

Ending balance, Job SL-205 ........................ P192,325

* Predetermined overhead rate = P1,960,000 ÷ 98,000 MHs = P20 per MH

Overhead applied = 2,700 MHs × P20 per MH = P54,000

**If your determination is fixed, I do not counsel you to despair. Few things are impossible

to diligence and skill. Great works are performed not by strength, but

perseverance.**

**The difference between the impossible and the possible lies in a person’s determination**

**The greatest mistake you can make is to continually fear making mistakes.**

**We are never given guarantees in life. We are only given the opportunities and it is up to

us to make the BEST out of it.**

**When all else is lost, the future still remains.**

Page 8 of 11 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AFAR-15

Week 14: JOB ORDER COSTING

Costs Flow

Accounting for Materials:

Upon Purchase: (Direct materials and Indirect materials)

Materials (or Stores Control)…………………………………………….. xxx

Accounts payable………………………………………………… xxx

Issued to production/Requisitioned/Materials used/Applied to Production:

Work-in-process (Direct materials)……………………………………. xxx

Factory Overhead Control or Actual FOH (Indirect materials).. xxx

Materials (or Stores Control)………………………………… xxx

Upon Payment:

Accounts payable……………………………………………………………. xxx

Cash………………………………………………………………….. xxx

Accounting for Labor: (ignore employer’s share in payroll taxes)

Labor Incurrence: (Factory Labor: Direct and Indirect Labor, Sales and admin. Salaries):

Payroll…………………………………………………………………………… xxx

Withholding tax payable……………………………………… xxx

SSS Premiums payable……………………………………….. xxx

PhilHealth Premiums payable………………………………. xxx

Accrued payroll…………………………………………………..

Labor Distribution/Labor applied to production:

Work-in-process – Direct labor………………………………………... xxx

Factory Overhead Control or Actual FOH (Indirect labor)……. xxx

Sales salaries………………………………………………………………… xxx

General and administrative expenses………………………………. xxx

Payroll……………………………………………………………… xxx

Payment of Payroll:

Accrued payroll……………………………………………………………… xxx

Cash…………………………………………………………………. xxx

Accounting for Factory Overhead:

Incurrence of FOH:

Factory Overhead Control or Actual FOH………………………….. xxx

Cash, Accounts payable, Accum. dep., Prep. Exp. … xxx

FOH Applied to production:

Work-in-Process……………………………………………………………. xxx

Applied Factory Overhead (FOH Rate* x Activity).... xxx

*Budgeted Factory Overhead Rates:

Budgeted FOH

----------------- = % x Actual DM

Budgeted DM

Budgeted FOH

----------------- = % x Actual DL Cost

Budgeted DL Cost

Budgeted FOH

----------------- = P / DLH x Actual DLH

Budgeted DLH/

Normal or Standard Capacity - DLH

Budgeted FOH

----------------- = P / MH x Actual MH

Budgeted MH/

Normal or Standard Capacity – MH

Budgeted FOH

----------------- = P /Actual Unit Produced x Actual Unit Produced

Budgeted Units

of production or Normal/Standard Capacity - Units

Page 9 of 11 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AFAR-15

Week 14: JOB ORDER COSTING

Disposition of Overapplied/Underapplied OH (entries may vary depending on the practice of

the company):

Applied Factor Overhead………………………………………………….. xxx

Overhead* Applied FOH (CGS/IS, WP, FG)……………… xxx

Factory Overhead Control……………………………………… xxx

*debit if underapplied FO

Problem IV: Barfield Company

Direct Materials, beg…………………………….…………………………………………….P

Add: Net Purchases……………………………………………………………………………_________

Direct Materials available for use………………………………………………………...P

Less: Direct Materials, ending……………………………………………………………._________

Direct materials used……………………….……………………………………………….. P

Direct labor……………………………………………………………………………………….

Applied factory overhead…………………………………………………………………….. ________

Manufacturing Costs…………………………………………………………………………..P

Add: Work-in-process, beginning..………………………………………………………._________

Total work placed in process……………………………………………………………….P

Less: Work-in-process, ending…………………….………………………………………_________

Cost of goods manufactured………………………………………………………………..P

Add: Finished Goods, beginning……………………………………………………………________

Cost of goods available for sale……………………………………………………………P

Less: Finished Goods, ending………….…………………………………………………… ________

Cost of Goods Sold, normal costing ……………………………………………………..P…………..

Solution to Problem VIII: Warren, Inc.

Predetermined OH Rate = Budgeted Factory Overhead

Normal Capacity / Budgeted Capacity / Standard Capacity

1. Predetermined Fixed OH Rate= Budgeted Fixed Overhead = P 300,000 = P 2.00 per MH

NCap or BCap. Or Stad. Cap. 150,000 hrs.

2. Predetermined Variable OH Rate= Budgeted Variable Overhead = P 150,000 = P 1.00 per MH

NCap or BCap. Or Stad. Cap. 150,000 hrs.

3. Over/Under Applied Factory Overhead:

Actual Factory Overhead………………………………………………………..P 435,000

Less: Applied Factory Overhead (P1 + P2) x 140,000 Actual MH.. 420,000

Underapplied Factory Overhead……………………………………………..P 15,000

4 and 5 –

AFOH (Actual Factory Overhead)…………………………………………………..P 435,000

BABOCU (Budgeted Allowed Based on Capacity Utilized Spending

/ Actual MH): 140,000 machine hours P(5,000) Fav

Fixed as Budgeted…………………………………………..P 300,000

Variable: P1 x 140,000 MH………………………………. 140,000 P 440,000 Idle Cap.

P20,000 Unf.

Applied Factory Overhead (AH x SR): 140,000 x P3……………………….. P 420,000 _______

Underapplied Factory Overhead P15,000 Unf

Solution to Problem IX: Carter Marketing Corporation

Direct Materials……………………………………………………………… P 75,000

Direct Labor:

Department X……………………………………………………….. P 40,000

Department Y……………………………………………………….. 100,000

Department Z……………………………………………………….. 20,000 160,000

Applied Factory Overhead:

Department X: P40,000 x 6/2………………………………… P120,000

Department Y: P100,000 x 1/5…………………............... 20,000

Department Z: P20,000 x 2/4………………………………… 10,000 150,000

Manufacturing Costs P 385,000 (c)

Solution to Problem X: Rizza Lyn Company.

Direct Materials…………………………………………………………………………………. P 26,000

Direct Labor……………………………………………………………………………………… 20,000

Applied Factory Overhead…………………………………………………………………. 30,000

Manufacturing Costs………………………………………………………………………….. P 76,000

Add: Work-in-process, beginning of June……………………………………………. 11,900

Total Work Placed in Process……………………………………………………………… P 87,900

Less: Work-in-process, ending of June [P2,800+(P1,800x150%)]…………… 7,300

Cost of goods manufactured…………………………………………………………………P 80,600

Page 10 of 11 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AFAR-15

Week 14: JOB ORDER COSTING

Cost of goods manufactured…………………………………………………………………P 80,600

Add: Finished goods, beginning of June……………………………………………….. –0-

Cost of Goods Available for Sale……………………………………………………………P 80,600

Less: Finished Goods, ending of June…………………………………………………… 4,000

Cost of Goods Sold………………………………………………………………………….….P 76,600 (b)

Solution to Problem XI: Sharron Company.

Direct materials, 3/1/2019…………………………………………………….. P 80,000

Add: Net purchases……………………………………………………………. 92,000

Direct materials available for use…………………………………………….. P 172,000

Less: Direct materials, 3/31/2019……………………………………………. 100,000

Direct materials used…………………………………………………………. P 72,000

Direct labor……………………………………………………………………. 168,000

Applied factory overhead…………………………………………………….. 126,000 / 75%

Manufacturing Costs………………………………………………………….. P 366,000

Add: Work-in-process, 3/1/2019……………………………………………. 160,000

Total work placed in process…………………………………………………. P 526,000

Less: Work-in-process, 3/31/2019…………………………………………… 190,000

Cost of goods manufactured…………………………………………………. P 336,000

Add: Finished Goods, 3/1/2019……………………………………………… 120,000

Cost of goods available for sale…………………………………………….. P 456,000

Less: Finished Goods, 3/31/2019…………………………………………… 156,000

Cost of Goods Sold…………………………………………………………… P 300,000

Sales…………………………………………………………………………….. P 400,000

Less: Cost of goods sold……………………………………………………… 300,000

Gross profit……………………………………………………………………… P 100,000

Less: Operating expenses……………………………………………………. 50,000 / 12.5%

Net income……………………………………………………………………… P 50,000

Problem XIV: Harper Company – Spoiled Goods

1. Spoiled Loss is Charged to FOHC/Internal 2. Spoiled Loss is Charged to Particular

Failure Job/Exacting Specs./Production Run

Total Cost of 2,200 units: Total Cost of 2,200 units:

Work-in-process Work-in-process

(P56 x 2,200)…… 123,200 (P56-P1=P55 x 2,200) 121,000

Materials, P20…. 44,000 Materials, P20…. 44,000

Payroll, P18……. 39,600 Payroll, P18……. 39,600

App. FOH, P18.. 39,600 App. FOH, P18-P1=P17 37,400

Spoiled Goods Inventory: 200 units. Spoiled Goods Inventory: 200 units.

Cash at SV……………. 6,000 Cash at SV……………. 6,000

FOHC(P11,200 – P6,000) 5,200 WP………………….. 6,000

WP, (P56 x 200)… 11,200

Transfer to Finished Goods: Transfer to Finished Goods:

Finished Goods……… 112,000 Finished Goods……… 115,000

WP (123,200–11,200) 112,000 WP (121,000–6,000) 115,000

UC = P112,000/2,000 = P56/u UC = P115,000/2,000 = P57.5/u

Problem XVI: Loryvi Co. – Defective Units

1. Rework Cost is charged to FOHC 2. Rework Cost is charged to Particular Job

Total Cost of 200 motors: Total Cost of 200 motors:

Work-in-process…….…….. 2,660 Work-in-process…….…….. 2,660

Materials, ………………. 660 Materials, ………………. 660

Payroll, ……………….… 800 Payroll, ……………….… 800

App. FOH, 150% x P160 1,200 App. FOH, 150% x P160 1,200

Rework Cost of 10 motors: Rework Cost of 10 motors:

FOHC………………………. 500 WIP………………………. 500

Materials………..……… 100 Materials………..……… 100

Payroll……….…..…… 160 Payroll……….…..…… 160

App. FOH, 150% x P160 240 App. FOH, 150% x P160 240

Transfer to Finished Goods: Transfer to Finished Goods:

Finished Goods………… 2,660 Finished Goods………….. 3,160

Work-in-process…… 2,660 Work-in-process……… 3,160

UC = P2,660/200 = P13.3/u UC = P3,160/200 = P15.8/u

Page 11 of 11 0915-2303213/0908-6567516 www.resacpareview.com

You might also like

- Functional Budget Solution - CompressDocument11 pagesFunctional Budget Solution - CompressRochelle HullezaNo ratings yet

- Additional Data For The Period Were ProvidedDocument3 pagesAdditional Data For The Period Were Providedmoncarla lagon100% (1)

- Auditing and Assurance Principles Final Exam Set ADocument11 pagesAuditing and Assurance Principles Final Exam Set APotato CommissionerNo ratings yet

- CH 8Document63 pagesCH 8Rico, Jalaica B.No ratings yet

- Chapter 6 Fundamentals of Assurance ServicesDocument28 pagesChapter 6 Fundamentals of Assurance ServicesJoyce Anne Garduque100% (1)

- Afar BuscombDocument22 pagesAfar BuscombMo Mindalano MandanganNo ratings yet

- Afar 2 Module CH 2Document22 pagesAfar 2 Module CH 2Razmen Ramirez PintoNo ratings yet

- Governtment AccountingDocument2 pagesGoverntment Accountingjessica amorosoNo ratings yet

- Zurita - Summary Table For PSAsDocument2 pagesZurita - Summary Table For PSAsNove Jane ZuritaNo ratings yet

- Ford Motor Company A Case Study Presentation With TransitionsDocument22 pagesFord Motor Company A Case Study Presentation With TransitionsMelissa FabillarNo ratings yet

- 4a Standard Costs and Analysis of VariancesDocument3 pages4a Standard Costs and Analysis of VariancesGina TingdayNo ratings yet

- Accounting Information System ReviewerDocument16 pagesAccounting Information System RevieweralabwalaNo ratings yet

- Cash Budget FMDocument16 pagesCash Budget FMLysss EpssssNo ratings yet

- I. True/False: Quiz-Job Order CostingDocument17 pagesI. True/False: Quiz-Job Order CostingDan RyanNo ratings yet

- Proof of Cash+2-1Document35 pagesProof of Cash+2-1Eunice FulgencioNo ratings yet

- Chapter 7 Conversion CycleDocument20 pagesChapter 7 Conversion CycleHassanNo ratings yet

- Problem 14-5: Kayla Cruz & Gabriel TekikoDocument7 pagesProblem 14-5: Kayla Cruz & Gabriel TekikoNURHAM SUMLAYNo ratings yet

- Short Problem#1: No Lost Units, Pure EUPDocument3 pagesShort Problem#1: No Lost Units, Pure EUPDerick FigueroaNo ratings yet

- Direct Costing and Cost-Volume-Profit Analysis: Multiple ChoiceDocument25 pagesDirect Costing and Cost-Volume-Profit Analysis: Multiple ChoiceQueeny Mae Cantre ReutaNo ratings yet

- Lesson H - 1 Ch10 Exp. Cycle Act. Tech.Document57 pagesLesson H - 1 Ch10 Exp. Cycle Act. Tech.Blacky PinkyNo ratings yet

- MAS Midterm Exam PDFDocument12 pagesMAS Midterm Exam PDFZyrelle DelgadoNo ratings yet

- Assignment On SC and VADocument12 pagesAssignment On SC and VAVixen Aaron EnriquezNo ratings yet

- TBCH19 Professional Ethics PDFDocument8 pagesTBCH19 Professional Ethics PDFjembot dawaton0% (1)

- Job Order Costing SolutionDocument9 pagesJob Order Costing SolutionMariah VillanNo ratings yet

- Straight ProblemsDocument1 pageStraight ProblemsMaybelle100% (1)

- Job Order CostingDocument8 pagesJob Order CostingAndrea Nicole MASANGKAYNo ratings yet

- MAS.05 Drill Variable and Absorption CostingDocument5 pagesMAS.05 Drill Variable and Absorption Costingace ender zeroNo ratings yet

- IA2 02 - Handout - 1 PDFDocument10 pagesIA2 02 - Handout - 1 PDFMelchie RepospoloNo ratings yet

- 03 Gross Profit AnalysisDocument5 pages03 Gross Profit AnalysisJunZon VelascoNo ratings yet

- QE - Cost & FMDocument10 pagesQE - Cost & FMJykx SiaoNo ratings yet

- PUP Review Handout 1 OfficialDocument3 pagesPUP Review Handout 1 OfficialDonalyn CalipusNo ratings yet

- Buscom 2ND Sem Prelims and Midterms Reviewer 1Document13 pagesBuscom 2ND Sem Prelims and Midterms Reviewer 1Accounting MaterialsNo ratings yet

- Cost Accounting Activity - Answer KeyDocument3 pagesCost Accounting Activity - Answer KeyJanen Redondo TumangdayNo ratings yet

- Ref 1 Prelim Quiz 1Document7 pagesRef 1 Prelim Quiz 1Melanie MinaNo ratings yet

- Cost 2 - Quiz5 PDFDocument7 pagesCost 2 - Quiz5 PDFshengNo ratings yet

- Instructions:: University of San Jose-Recoletos Online Class For The School Year 2020-2021 2 Semester ACTIVITY 03 (A03)Document7 pagesInstructions:: University of San Jose-Recoletos Online Class For The School Year 2020-2021 2 Semester ACTIVITY 03 (A03)Leila OuanoNo ratings yet

- Management Science Chapter 10Document44 pagesManagement Science Chapter 10Myuran SivarajahNo ratings yet

- Quiz On Auditing For 1 To 2Document10 pagesQuiz On Auditing For 1 To 2Vanjo MuñozNo ratings yet

- Psa 600Document9 pagesPsa 600Bhebi Dela CruzNo ratings yet

- At.3213 - Application of Audit Process To Transaction Cycles Part 1Document9 pagesAt.3213 - Application of Audit Process To Transaction Cycles Part 1Denny June CraususNo ratings yet

- Job Order CostingDocument3 pagesJob Order CostingKrizia Mae FloresNo ratings yet

- Activity Based Costing PDFDocument59 pagesActivity Based Costing PDFSiddharthNo ratings yet

- Solman Cost Accounting 1 Guerrero 2015 Chapters 1-16 PDFDocument46 pagesSolman Cost Accounting 1 Guerrero 2015 Chapters 1-16 PDFMarylorieanne CorpuzNo ratings yet

- Responsibility Accounting and TP Transfer PricingDocument8 pagesResponsibility Accounting and TP Transfer PricingAmdcNo ratings yet

- Afar NotesDocument20 pagesAfar NotesChristian James Umali BrionesNo ratings yet

- Or He/She Should Be On Leave of Absence With Pay On The Day Immediately Preceding The Regular HolidayDocument3 pagesOr He/She Should Be On Leave of Absence With Pay On The Day Immediately Preceding The Regular HolidayDANIELA VASALLONo ratings yet

- 361 Chapter 6 MC SolutionsDocument46 pages361 Chapter 6 MC SolutionsNick Guidry33% (3)

- AFAR 2303 Cost Accounting-1Document30 pagesAFAR 2303 Cost Accounting-1Dzulija TalipanNo ratings yet

- Strat Cost Drop or ContinueDocument1 pageStrat Cost Drop or ContinueStephannieArreolaNo ratings yet

- Chapter Two Audit of Receivables and Sales: Page - 1Document20 pagesChapter Two Audit of Receivables and Sales: Page - 1mubarek oumer100% (1)

- Finished Goods Inventory: Exercise 1-1 (True or False)Document16 pagesFinished Goods Inventory: Exercise 1-1 (True or False)Isaiah BatucanNo ratings yet

- Chapter 26Document8 pagesChapter 26Mae Ciarie YangcoNo ratings yet

- Introduction To AFAR Simple NotesDocument10 pagesIntroduction To AFAR Simple NotesCheese Butter100% (1)

- Direct Method or Cost of Goods Sold MethodDocument2 pagesDirect Method or Cost of Goods Sold MethodNa Dem DolotallasNo ratings yet

- "The Conversion Cycle": Two Subsystems: - Ends With Completed Product Sent To The Finished Goods WarehouseDocument2 pages"The Conversion Cycle": Two Subsystems: - Ends With Completed Product Sent To The Finished Goods WarehouseKaren CaelNo ratings yet

- AFAR-18 (JIT, ABC, FOH - Service Cost Allocation)Document7 pagesAFAR-18 (JIT, ABC, FOH - Service Cost Allocation)Flores Renato Jr. S.No ratings yet

- Chap 019Document62 pagesChap 019Husein GraphicNo ratings yet

- JOBCOSTINGDocument4 pagesJOBCOSTINGkakaoNo ratings yet

- Acctg201 Exercises2Document18 pagesAcctg201 Exercises2sarahbeeNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Absa Multi Managed Preserver Fund of Funds PDFDocument2 pagesAbsa Multi Managed Preserver Fund of Funds PDFmarko joosteNo ratings yet

- An Evaluation of The Services Quality of Standard Bank Limited, Pabna BranchDocument59 pagesAn Evaluation of The Services Quality of Standard Bank Limited, Pabna BranchNafiz FahimNo ratings yet

- A Study On Credit Appraisal System On SME of Union Bank of IndiaDocument56 pagesA Study On Credit Appraisal System On SME of Union Bank of IndiaSarva ShivaNo ratings yet

- LBP Organizational StructureDocument1 pageLBP Organizational StructureJeish KimNo ratings yet

- Determinants of Capital Adequacy Ratio of Commercial Banks in NepalDocument15 pagesDeterminants of Capital Adequacy Ratio of Commercial Banks in NepalSabinaNo ratings yet

- Iapm PDFDocument25 pagesIapm PDFtejas malokarNo ratings yet

- Basking AnswerDocument2 pagesBasking AnswerAjith GeorgeNo ratings yet

- International Trade Lecture 8 2022Document7 pagesInternational Trade Lecture 8 2022latyshovllad2011No ratings yet

- Fauci DocumentsDocument96 pagesFauci DocumentsVirutron ResearchNo ratings yet

- Final Ass. 2 Malinao Kathleen S. BSBAHRM 2 3DDocument4 pagesFinal Ass. 2 Malinao Kathleen S. BSBAHRM 2 3DHanna Ruth FloreceNo ratings yet

- ACC10007 Sample Exam 2Document9 pagesACC10007 Sample Exam 2dannielNo ratings yet

- Comparative Study of Retail Banking Strategies Adopted by Various Private Sector Banks Such As HDFC Bank, Icici Bank and Axix Bank.Document31 pagesComparative Study of Retail Banking Strategies Adopted by Various Private Sector Banks Such As HDFC Bank, Icici Bank and Axix Bank.asutoshNo ratings yet

- Lembar JawabanDocument28 pagesLembar Jawabansusi mamaNo ratings yet

- Seminar 6.1Document2 pagesSeminar 6.1Đạt PhạmNo ratings yet

- Journal EntriesDocument7 pagesJournal Entriesb20cs099No ratings yet

- Sureseats - SeatmapDocument2 pagesSureseats - SeatmapNorberto Sinsona Jr.No ratings yet

- Intermediate Accounting 2 Week 3 Lecture AY 2020-2021Document6 pagesIntermediate Accounting 2 Week 3 Lecture AY 2020-2021deeznutsNo ratings yet

- 8.0money Demand & Money MKT EquilibriumDocument16 pages8.0money Demand & Money MKT EquilibriumJacquelyn ChungNo ratings yet

- Unit 10 Financial MarketsDocument9 pagesUnit 10 Financial MarketsDURGESH MANI MISHRA PNo ratings yet

- Corporate Financial Accounting Project Roll No KSPMCAA012 Dev Shah Mcom Part 2 Sem 4 2022-2023 CARO 2016Document5 pagesCorporate Financial Accounting Project Roll No KSPMCAA012 Dev Shah Mcom Part 2 Sem 4 2022-2023 CARO 2016Dev ShahNo ratings yet

- Gov. Bruce Rauner's 2018 Statement of Economic InterestDocument11 pagesGov. Bruce Rauner's 2018 Statement of Economic InterestMitch ArmentroutNo ratings yet

- Basic Finance Final Q2Document13 pagesBasic Finance Final Q2Michelle EsperalNo ratings yet

- Practical Guide To Issue, Forfeiture and Reissue of Shares: Topic I: Full SubscriptionDocument24 pagesPractical Guide To Issue, Forfeiture and Reissue of Shares: Topic I: Full SubscriptionGANDHI DHRUVINNo ratings yet

- Application 6150Document9 pagesApplication 6150Dmitriy PevzovNo ratings yet

- Sydney Olympic Park 2000 To 2010: History and LegacyDocument2 pagesSydney Olympic Park 2000 To 2010: History and Legacyapi-98108692No ratings yet

- Priority of Mortgages Over Registered Land - Priority of MortgagesDocument3 pagesPriority of Mortgages Over Registered Land - Priority of MortgagesschoolemailsdumpNo ratings yet

- MPS 21062023 135432Document2 pagesMPS 21062023 135432Kartik saxenaNo ratings yet

- Car Buying Project XLS 95 Excel (Version 1)Document17 pagesCar Buying Project XLS 95 Excel (Version 1)rolfwillNo ratings yet

- Name: Kimberly Anne P. Caballes Year and CourseDocument12 pagesName: Kimberly Anne P. Caballes Year and CourseKimberly Anne CaballesNo ratings yet

- JGS-List of The Top100 Stockholders and PDTC Participants As of September 30, 2020Document6 pagesJGS-List of The Top100 Stockholders and PDTC Participants As of September 30, 2020ADFAfsNo ratings yet