Professional Documents

Culture Documents

5 Company ITRs

5 Company ITRs

Uploaded by

Ashwani Kumar0 ratings0% found this document useful (0 votes)

32 views9 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views9 pages5 Company ITRs

5 Company ITRs

Uploaded by

Ashwani KumarCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 9

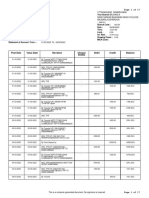

INDIAN INCOME TAX RE”

URN ACKNOWLEDGEMENT

[Where he data ofthe Returo of income in Fora FTR-l (FAHA, ITR-2,ITR3, ITRe4(SUGAM),ITR-S, ITR-6, (TR-7

filed ahd verified)

(Please see Rule 12 of he Income-tax Rules, 1962)

PAN AACCNI4S 1B.

Name NAVRATAN PIPE AND PROFILE LIMITED

Ades OTF , COMMUNITY CENTER , Néw Delhi 094DeIhi, 9T-tndia, 110064

Seas Private Company Form Number

Filed ws 139(4) Belated- Return filed after due dat

(Current Year business loss,

Total Income

Book Profit under MAT, where applicable

3

Adjusted Total Income under AMT, where applicable

Neves pe

intrest and Fee Payable

4 rnin and Fe pyabe

. Taxes Paid

(4)Tax Payable (-)Refundatle (6-7)

«Pine ox Pyle

Tom Denton nin re

3 toxesPaid

(+WT x Payable -)Refundable (11-12)

-Acersted Income as pee section 11STD

Adgitional Tax payable wls 11STD.

Interest payable ufs 11STE.

Additional Tox and interest payable

Tas aa interest pid

(23Tax Payable (Refundable (17-18)

‘his reten hasbeen digitally signed by Suresh Bhardwal

fon 29-03-2022 13:29:09

DSC SI. No, & Issuer 3638675. &

J

‘System Genera

Barcode/QR Code

108369842697011CN.

i

cee |

\CKNOWLEDGEMENT TO CPC, BENGALURU,

e ‘Filing Acknowledgement Number

Vernsys CA 2014,0U=Cenifying Authority,O=Verasys Technologies Pvt Lid,C-

Assessment Yeer

2021-22

ITRS

465713310290322

2,57,60,115

°

°

°

°

1,000

1,000

3,06,300

(9 3,05,900

‘AACCNT451D4646571931029002263S800BES7ED7ESS306F9F269D ASESAEABECCD?

°

o

nthe capacity of Director having PAN DLMPB2413Q fiom IP address 106.215.88.193

Name of Assessee NAVRATAN PIPE AND PROFILE LIMITED

Address 10TIF,COMMUNITY CENTER,New Delhi, DELHI,110064

Status Company|Domestic) Assessment Year 2021-2022

Ward OCIT CIRCLE 16(1) DELHI Year Ended 31,3.2021

PAN AACCN14518 Incorporation Date 19/07/2005

Residential Status Resident

Nature of Business MANUFACTURING-Manufacture of steel products(04056)

AO. Code DEL-C-36+1

GSTIN No. OBAACCN145181Z0

Filing Status Original

Last Year Retum Filed u/s Normal

Computation of Total Income [As per Normal Provisions!

Income from Business or Profession (Chapter IV D) -3923674

Profit as per Profit and Loss a/c 24974814

Add:

Depreciation Debited in P&L A/c 24051140

Total -3923674

Allowable depreciation is Rs. 2183644 /- but resiricted to

Rs, Ol- available profits.

Gross Total Income -3923674

Gross Total Income as -ve figure is nol allowed in return 0

form

Total Income 0

Round off vis 288 A 0

Calculation for Mat -24974814

Profit as per part Il and Ill of Schedule \/I -25217472

‘Add:

Deferred Tax Liability 242658

Total 24974814

Tax calculated @ 15.0% on Book Profil is Rs. 0

Tax Due @ 26% (Tumover for Fin. Year 2018-19 °

is less than 400 Crore)

T.D.S/T.C.S 306900

-306900

Fee for default in furnishing return of inome u/s. 1000

234F cee i

-305900

Refundable (Round off u/s 2888) 305900

T.D.8. T.C.S. From ils

Non-Salary(as per Annexure) 306900

Interest calculated upto March,2022, Que Date for filing of Return October $1, 2021

Due date extended to 15/03/2022 Circular No, 01/2022 in F.No:226/49/2024/TA-lI Dt 11-Jan-2022

NAME OF ASSESSEE : NAVRATAN PIPE AND PROFILE LIMITED _A.Y. 2021-2022 PAN : AACCN1451B.

Comparision of Income if Company|Opts for Section 1145BAA (Tax @22%)

4Total income as pet Normal provisions 0

2. Adjustments according to section 1158/1 }SBAB

(i) Deduction under Ch VIA & Section 10AA as por Normal

Provisions.

Gross Total Income as per Normal provisions a 0

(ii) Disallowed Deductions under secton 11§BAA/ 115BAB

No Deduction exists

(i) Disallowed Brought Forward Loss relatdd to Above Deductions,

NA 0

3. Gross Total Income (142) 0

Deduction under Chapter VIA under heading Clother than 80NJAA 0

Total Income after Adjustments undor section 11SBAAM11SBAB = Q

Sta urrent Year Loss Adjustm

Head!Source of Income Current Year | House Property Business Loss of _ Other Sources _ Current Year Income

Income Loss ofthe the Current Year Loss ofthe Remaining after Set

Current Year Set Set off Current Year Set off

off off

Loss to be adjusted 25760118

House Property NIL Ni NL NIL

Business NIL NIL Ni NIL

Speculation Business NIL NIL NIL Nit NIL

Shor term Capital Gain NIL NIL NIL NIL NIL

Long term Capital Gain NIL NIL NIL NIL NIL

Other Sources NIL Nit NIL NIL

Tolal Loss Set off Nit NIL Nit

Loss Remaining aftor NIL 25760115 NIL

sot off ee

Statement of Unabsorbed Depreciation Brought/Carried Forward _

Assessment Year___ Brought Forward _ Set off Carried Forward __

Current Year Loss 21836441

Total 0 0 21836441

Details of Depreciation

Particulars Rate Opening Mord Loss Total Solos Sales Balance Depreciation WDV

Than *po Than 180 tess Than (Short Gain) Closing

Days Days 430 days,

‘land Not Used 250000 ° 250000 ° 0280000 © 280000

PLANT AND 15% 033483 ° 0 14039403 ° 0 14o3a483 210802268 119284612

MACHINARY 3 8 8

PLANT AND, 30% 2380809 ° 02380699 ° 0 29e0se9 © 7142101686489

MACHINARY

Furiture to% 120010 ° © 120010 ° © 120010 ya001 108008

Motor Vehicle 18% 398273, ° 0 396273 ° 0 396273 sore) 3385

putor and Data 40% 687 ° 0 887 ° oo OST 283, 304

Processing Unis aL

Total asa8a7 ° 0 aaaeaeT ° 0 taaabia7 —2ieauei 12648036

z 7 1

Bank Account Detail

8. No Bank ress ‘AccountNo_MIGRNO IFSC Code Type

Page 2

NAME OF ASSESSEE,

NAVRATAN PIP!

AND PROFILE LIMITED AY. 2021-2022 PAN: AACCN1451B

1 Canara Bank MAYAPURH ovzaros009912 ‘eNRBG002017 _Curreni(Primary)

PHASE-1,COMMUNITY

CENTER.NEW DELHI-110064,

2 -HDFC BANK 8612050000059 HOFCO0005S1

3 SYNDICATE BANK MAYAPURI) 90281010008912 SYNeDo0So28 current

PHASE-1,COMMUNITY

CENTER.NEW DELHI-110084

1 In Schedule SH-1, Disclosure requ

shares in.

the name of 38 shareholders which ar

shares were allotted to them 10-12 yeni

percentage of each shareholder not di

provided details of Shareholders with

2- In Schedule AL-1, Disclosure requi

are not available and software does nj

a, Shamsher Singh Sandhu- Openi

‘Amount F

Amount P

Closing 8

b.Preet Pal Singh- Opening

Amount Ri

‘Amount P;

Closing 8

c. Gupta and Sons- Openin,

Amount Rj

‘Amount

Closing 8

3- TDS Of Amount Rs. 3,06,900 for A)

now claimed as Unclaimed TDS in A

ifement of Year End Shareholding there are 1593232 number of

not disclosed because their PAN are not available with us as the

rs before and software does not accept details without PAN. Holding

closed is below 10% of Total Pald-up Capital, while we have

jolding percentage of more than 10% of Total Paid-up Capital.

P

jement of ‘Loans and Advances’ there are three parties whose PAN

3t accept detalls without PAN. They are-

|g Balance- NIL

‘eceived during the year- Rs. 10,00,000

id during the year= NIL

lance- Rs. 10,00,000

Salance- NIL

ieceived during the year- Rs. 27,00,000

id during the year- NIL

lance- Rs, 27,00,000

Balanoe- NIL

jeceived during the year- NIL

aid during the year- Rs. 2,75,000

lance- Rs. 2,75,000

2013-14 was not claimed in that year or years after AY 2013-14 is

2021-22.

GST Turnover Detail

S.NO. GSTIN Turnover

1 O8AACCN1451B1Z0 51060

TOTAL 51060

Dotails of Turnover as por GSTR-38 (Imported From Form 26AS)

‘Sno. cSTiN ant oats Sedans Teaver Total Tuva

1 inncenest6i2SAAtwOEROGHT;O—BodunaB0 wy 2020 o 7

2 cemcanasterz] — Aacenzossaeda Zt lun0@) Apa 3 Q

3 ceancevasteran aaceoorbsraaba — au2020 sane 020 Q 0

1 Gharcevtectntz0 anosoransoosgix — 20.Sopane0 yeaa ° Q

$ conccentastorZ® —anowsueosgsadr2 20rt2%0 opin. 2020 1080 080

fb GaARCONtas@1Z0 —AAOBUEZIOOTORSK —0Sop2"00 —_ Anqu 2020 ° °

7 GGAAcentastBrZo —ADBLOzOoHSHTS 254-2020 Crab 2020 ° °

3 paoatto0oraise 080002020 Novrbor.220 0 3

$ feouranoeeefou —rvenatei —Docwmber 2020 a i

* eoucseeeoia —ZoMey2021—Mwch2a2t Q Q

Hae ae

Dota of 70,8. on Non-Salery26 AS Impelt Dte:26 Mar 2022)

“Sno Name ofthe Doductor See dawtan NONG, Yul Tax deduced Aout oF) Boston

Soa debee en ahi ar

TaN OF BARODA — DELBOEOSE Tae ar WR

2 ECAP UMTED beuo¥es00 wma rreaTe 1848

Page 3

NAME OF ASSESSEE : NAVRATAN PIPE AND PROFILE LIMITED

3 SYNDICATE BANK

beLso1076F

AY. 2021-2022 PAN : AACCN1451B

273 aera t94a

4 APURVIOYUT VITRAN NIGAM LIMITED JPRLOGA46E 4081 4801199

JINN IRRIGATION SYSTEMS LIMITED nyskJ000660 2018 30151940.

JALGAON

TOTAL 308000

Head wise Summary on Income and TOS thereon

Head Section Amount: As per Location of Income for TOS

Paid/Credited As | Computation Comparison

a a per 26AS,

Other Sources 193 48811 4881

Other Sources 194A 2989938 as above as above 299004

Other Sources 1946 150758 as above as above 3015

Total 3189507 306900

Signature

(Suresh Bhardwaj)

For NAVRATAN PIPE AND PROFILE

LIMITED

Date-29.03.2022

CompuTax: [NAVRATAN PIPE AND PROFILE LIMITED]

Page 4

URN ACKNOWLEDGEMRNSE

Assessment Year

‘Neeeae cin of eRe tae Por IR (AHA. Te. TR,

FTRAISUGAM ITS, 176, TR Me and verified) 2020-21

(Pes se 2 fe acy Rl

Haw JAACCNT4SIB |

| a ne

“ane __[MAVRATAN PE AND PROFLE UnaTED

| 10, COMMUNITY CENTRE 3D FLOOR, MNAPORT PHASE 1, MAYAPURI PHASE 1, DELHI. 110068

1 sauress |

| i

I

tats Ple Company Form Number TRG |

Hiled us —139%4)-Belated [Fling Ackwowledgement Number | 324186471310321

Curren Var busines To

i Prani

Netty payable

‘Tere Pad . eT = ~ 2151000]

© eras PasbleiRetimable GT ™ 7 53 1656780 |

Piven Tax Payable an To

Tal Divito tae and interes

(FF PavableMRetundable (Ia)

|r Payable eetandabte

“one'Tas Ret submited electronically on 3-83-2021 O2-2:13 fom address 1SSERAELAD

SURESH MIEPs

PAN pumppes fiom IP address 1838321340

sil Signature Certificate (DSC),

*SIRSSSSAASTONECHSaNScryp Rub Tar RCA Cas 2 2014OU™SuhCA Only Technologie mttese-1N

U See ciwe a

ste Aveare\ Peano nor ures

CIN: © U27tDL2005PLCTaB—86 wr oe ¥ -

‘Address(O): 10 COMMUNITY CENTRE, 32D FLOOR, MAYAPURI PHASE. +4, MAYAPURIPHASE «4,

aot Belin oes oce

- TO esisoortenen

Node Ra aang

Date-otlassips

ee

© Asbossma

Paninmsgeiiise

a e Computation‘of Total Ineoniau a. 2

ss i See ea aR Bigg a © Si-daansater

so Daforeseton ‘Sot off

Income front House Prépaerty Spe bag eee ’

Incéme From Budhness or Profession, ‘

Income from Capital Galas 210801

Ineonve from Othor Soureos Hi 9 °

Grové Tetil Income)

RTE = 7

mm

Toles ps oboRprovstons of

Toepnysu e048 ‘

‘Add : Surcharga(it applicable) 0

Total Saal M 455980

‘Nd; Heath and Eaveaion Coss 18239

Tost eres

Higher orto atisveo g ae rans

lass: TosTeg ft ri aM Sn ce 2151000,

Astontad Tox es aera

Ad inor0st Ang Fo bgt 7 tbo

Feeusaue es ‘

Armount Reliable - o 3 Tian

‘Amount Rafdable Rounvod OfflistaeOB * PT 1066700

>

MTReé, ITR+S, ITR-GITR-T filed and verifiad eloctronically)

| INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT Assessment Year

| {Where the data of the Retura of Income in Form Ret (SAHA), TR-2,ITR, 2019-20

|

taupe neem

Name

PAN

AACGNIASIB

| iaibooviack No Hh

NAVRATAN FIFE AND PROFILE LINTTED

Neme Or PremisssMutding/Viage

10, COMMUNITY CENTRE, 3RD

FLOOR

HoudiSteeeiPoxt Office

MAVAFURT PHASE. mill

Form Number. {{iTR-¢

[Area/Localty

MAVAPURTPRASE-1

Status Ple Company

State

Pin/ZipCade | Filed wis Pr r

cera 110064 139(1)-On or before due date

‘Assessing Officer Details (Ward/Cirele) [CHECT ET 7(2), DELAY ear

fling Acknowledgement Number }240768491311019 -

[7 eran oatineome a T oF

| | sree a

Teacher wr ChopeeEA gy 7 @

7 E ' 7

Total tacome (ay [3| 8

Desned Tota Ticome under AMTIMAT Sy," ay ES Om

ree :

Corr Yeartssitany god Yop ate oo vig sy ae

5 ‘Net tax payable Bs ponte 4 Q

g Interest and Pee Payable YT cit

| © = [6 [Tota tx, terest and Fee payable

Sia | 7 a Advanei Ta 0

21 1 | roesvaa os

a | bo TDS 7 o

| 3 Tes 7e 2

Wee al 7 Sat Aisiimnent Far Ta re

| © Tat Tage Pa Ca TDNTE Ta) i

[TE parame

7 [Retina esp

| aviutre ia

10 | Exempt income Assit a] lh

| Income Tax Return submitted electronically on 31-10-2019 18:46:10 from IP address 182.68.129.199 and verified by

svRESH BTIARDWAL having PAN DLMPO24130_ on 31-10-2019 18:

129,199.

from IP address

sing Digital Signature Certhiieate (DSC)

18L069CNme-Muthra Sub CA for Class?

vidual 2014,0U=Certilying AuthorityO~eMudhra Consurver Services Lnlss,C-IN

DSC details

BO. NOT SEND THIS ACKNOWLEDGEMENT TO CPG, BENGALURU

tan Pipe & Profile Ltd,

‘SEATEMENT OF iicome INCOME TAX FOR TUB AY.A0I-20

PANTAACCNTaS18

|Add:10, COMMUNITY CENTER $ RD FLOOR MAYAPURI

INDUSTRIAL AREA

NEW DELHI-110064

DOE: 19.08.2005

|Parcoutars

Prev. Wear 2018-19

Asst. Year: 2019-20

[amountiitey)

Amountimey |

NCoM® FROM BUSINESS & PROFESSION

Net profit as per Profit & Loss Account

\Profit efore Income Tax)

|Add: Depreciation Considered seperately

less: Depreciation as per IT Act

INCOME UNDER THE HEAD BUSINESS & PROFESSION

(Gross Total Income

Less: Deduction under Chapter VI

[Total Income

I7ax Thereon @ 30%

Surcharge(10%)

Education Cess (3%)

(Tax Liability.

Less: Advance Tex

Less: Tax Deducted at Source

[Tax Payable /(Refund Due}

JADD: Interest u/s 2948

|ADD; Interest u/s 234C

[Total Tax & Interest payable

Less: Self Assi

wament Tax Paid.

Balance Tax Payable

(27,748,709)

30,090,978

29,795,939

(27,453,670)

(27,485,570)

(27,453,670)!

Fe NAVRRTAN PIPE & PROFILE UNITED

eae

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- NPPL Project Report 50Cr 2022Document76 pagesNPPL Project Report 50Cr 2022Ashwani KumarNo ratings yet

- NPPL Catalog ScaffoldingDocument12 pagesNPPL Catalog ScaffoldingAshwani KumarNo ratings yet

- 17 Cat Log Steel PipeDocument8 pages17 Cat Log Steel PipeAshwani KumarNo ratings yet

- 16 Land Allotment RIICODocument10 pages16 Land Allotment RIICOAshwani KumarNo ratings yet

- Dehradun MultibrandsDocument132 pagesDehradun MultibrandsAshwani KumarNo ratings yet

- 20230626160920Document13 pages20230626160920Ashwani KumarNo ratings yet

- DBS PL LatestDocument160 pagesDBS PL LatestAshwani KumarNo ratings yet

- 7 Audit Report 2020-21Document18 pages7 Audit Report 2020-21Ashwani KumarNo ratings yet

- 20230109130925Document10 pages20230109130925Ashwani KumarNo ratings yet

- 20230109130503Document6 pages20230109130503Ashwani KumarNo ratings yet

- NPPLR Balance Sheet 31 March 2022-1Document19 pagesNPPLR Balance Sheet 31 March 2022-1Ashwani KumarNo ratings yet

- Vikas Bhawan Dehradun ContactsDocument2 pagesVikas Bhawan Dehradun ContactsAshwani KumarNo ratings yet

- सद्स्य सम्पर्क - उत्तराखण्ड विधान सभाDocument3 pagesसद्स्य सम्पर्क - उत्तराखण्ड विधान सभाAshwani KumarNo ratings yet

- NTB (New TO Bank) PL Policy - Aug 22Document16 pagesNTB (New TO Bank) PL Policy - Aug 22Ashwani KumarNo ratings yet

- Vikas Bhawan Dehradun Contacts 2Document4 pagesVikas Bhawan Dehradun Contacts 2Ashwani KumarNo ratings yet

- Loans LendersDocument4 pagesLoans LendersAshwani KumarNo ratings yet

- Central Bank Branch List Pan IndiaDocument549 pagesCentral Bank Branch List Pan IndiaAshwani KumarNo ratings yet

- Products ListDocument2 pagesProducts ListAshwani KumarNo ratings yet

- Ubl PolicyDocument28 pagesUbl PolicyAshwani KumarNo ratings yet

- Aditya Birla Udyog New Pdated Pin Code ListDocument459 pagesAditya Birla Udyog New Pdated Pin Code ListAshwani KumarNo ratings yet

- Commector Payout Claim DataDocument3 pagesCommector Payout Claim DataAshwani KumarNo ratings yet

- CASHe LoansDocument7 pagesCASHe LoansAshwani KumarNo ratings yet

- Naukri SrinivasAnumala (12y 0m)Document3 pagesNaukri SrinivasAnumala (12y 0m)Ashwani KumarNo ratings yet

- Axis Repayment ScheduleDocument4 pagesAxis Repayment ScheduleAshwani KumarNo ratings yet

- All Serviceable Pincodes nonGL-Version20 BL&PLDocument717 pagesAll Serviceable Pincodes nonGL-Version20 BL&PLAshwani KumarNo ratings yet

- Bank Ac SBIDocument7 pagesBank Ac SBIAshwani KumarNo ratings yet

- Post Date Value Date Narration Cheque Details Debit Credit BalanceDocument17 pagesPost Date Value Date Narration Cheque Details Debit Credit BalanceAshwani KumarNo ratings yet

- Unlocked 3 Months Statement - OCT2023 - 148346525 (1) - UnlockedDocument6 pagesUnlocked 3 Months Statement - OCT2023 - 148346525 (1) - UnlockedAshwani KumarNo ratings yet

- Banking ...Document8 pagesBanking ...Ashwani KumarNo ratings yet

- Aadhar CardDocument2 pagesAadhar CardAshwani KumarNo ratings yet