Professional Documents

Culture Documents

20230626160920

20230626160920

Uploaded by

Ashwani Kumar0 ratings0% found this document useful (0 votes)

11 views13 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views13 pages20230626160920

20230626160920

Uploaded by

Ashwani KumarCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 13

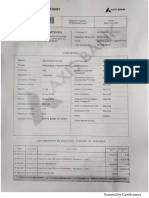

Nay Ltd,

hee

‘As at Mazeh 31, 2023

nore no, [aaa —|

a +492,24,000, 4492,24000

\ Reseres and Surplus a 5392,51,018 779,474

sfrton-currnt Uabuites

Jd cong Term Borrowings ‘ 9.,02,560 83.35.32,560

[Deseret Tx Lib Net 5 (23,06,450] 900,207

fourrent uabiiten

fe Shore Term Borcowings ‘ ‘

Tate Pabies 7 28,90,500 28,90,500,

on omer curren Haiies s 39,95,500

le) shorc-term provisions o é

rorat| TIESTO, I EEIEEO]

nfassers:

sfom-ourrent aasts

a sed Assets 10 1593.02.75 18,0827,520

(9 Tangible Assets

| Deters tax Asses ey

lc) ore Non current meets

Jourrentaseots

a tovenories| a 5 :

rade receives 2 2316,88,576 2.52,4,458

cs cans and cash equivalents 13 123,726 190,500

Ja) snort Term Loans and Advances Ps 1,14,805566 1974072

rorat| {=a srex0] ——a ars]

lieniteane Accounting policies 1

For and on behalf of the Board of Director of

Navratan Pipe & Profile Ud

No

hardwaj

(Dikgeter)

Date: 91.03.2023

uu Place: Now Delht

Navratan Pipe & Profile Ltd.

Statement of Profit and Loss Account

for the year ending 31st March 2023,

ML

vm

vu,

xi

xa

[amount(s] —]

expenses:

Jrotal Expenses

JPrott before exceptional and extraordinary items and tax

any)

exceptional items & Extraordinary items

Prost Before tax (V-VI)

jrax expense

1) income Tax-current year

2) Detered Tax Income Expense)

JPrott Lose) for the period from continuing operations

Prost /ioss rom discontinuing operations

Tax expense of discontinuing operations

Pront/{lss) from Discontinuing operations (after tax) (X-X1)

Profit (Loss) for the period (IX+XI)

learning Per Share

Basie Earning per Share

Ditutive Earning per Share

|steniscant Accounting policies

hs per our report of even date

aoe

Partoalars Tee Sioa a00s-| neat aT

evenue fom operations 18 : 9.96;758

other income 16 07391 90,8531

rota Revenue (1)

cor of materials consumed 1" : agsear

Purchase of stocsin-trade :

JCnanges in invectonae of finished stock 18 : :

Jrployes benettaexpente » 800 11,19,000

nance ents 20 288 12830

other Sepenaes a 57461 399.000

Depreciation and amortization expense io 2,10 96,565 aw aas®

(“er

(2,16,49,430)

29,18,706 (49,84,790)

33.778]

157 33.725)

o2n] 12.68

(sn 12.64

Date: 31.03.2023

Place: New Delhi

For and on behalf of the Board of Directors of

Navratan Pipe & Profile Ltd,

1 Ra

Navratan Pipe & Profile Ltd.

Notes to Accounts

[Rsthorised Share Cantal

[0,00,000 squiy Shares of Rs. 10 each 6,00,00,000 6,00,00,000|

Previous Year 60,00,000 Equity shares of Rs 10 each) 6,00,00,000 6,00,00,000

"49,2200 iquity shares of Rs. 10 each fully paid up 4,92,24,000 4,92,24,000,

[rcvicus Year 49,22;400 Bqulty Shares of Rs 10 each fly pald up) 392.24 000 3.92.28 000

Note He. 201

Reconeilintion of the' otanding at the and at the end of

TORTS a:

[Stores camanding ate Depaning of tho Tea aA Taz OOO] aw AEA] —— 4 9,28,000

shares Issued and subseribed during the year %

snares ought back During the year g a :

[Snares outstanding et the ond of the your BIRO 9zB OOO] — aE OT| — AITO.

Note No. 2.02

Details of Shares hold by sharoholders holding more than S% of the aggregate shares inthe Company

[Rame at Sharohold

oof Sharer hold | Woof Shares FT

Sareah Ohana WO DT

Paramject Singh 6.00%)

am Naresh (7%)

T5515

2.95344

3.84568

315,000

‘eserves and Surplus

Particulars

[raat aT]

Tawra 320%

Opening Batnace wornasn) — (14,30,13,260]

Jcurrene Year Prost (ater appropriations) (0.879.724 6,22,42,023

[Short Term Capital Gain

Protar Ss oRsEN|——eORTAEN

Opening ba 15,87,56,000| _18,87,56,000

[Fear TERT SE DOO | TEBE 0OO

[rotat Reserve & Surplus & Profit & Lose 5,928,019 7,79,04.749.

‘ons Term Borrowings

lunsecured Loan

From norc's :

From Friends &Relatwes 8,35,32,560 35 32,560,

3.35,32,560 335.32560

‘Amount al] ——Resoat eT]

Partioalare Heat 31.05.2025| Ke wt 31-8202

= _ WW}

saat Toast RT]

Partioulars Tarai oaa0m| —aear shades}

[Sunday Creators hr Goode 726,90,500, 75,9050

JSundsy Creditors for Expenses :

[roar EDO EO ZEDOEOO]

sites

et] rey

i 31.05-2075| — A at 913-2007

[Raat Toor papa x

salary Payable 2,80,500

éwance fons Customers 37,00,000 37,00,000,

aout

Pertioalare Beat 31,08:2025

Particulars [arm sivoaa030

tosing stock of inventories

Note No.12

eee ome

uistanding for Less than six months

Others

1 Balances with

‘In Fixed Deposit.

‘In Current Account

ies & aves Recanabies

securty Deposits with Govt. Boies

cst

lessr

lsesr

|:avance to Customers

32,55,670

30,97,733

38,28.355

10,26,758,

270,888

stock converted ite Pant & Machinery

Ciosing Stock

i 2s

Revaluation of Plant fe Machine 5 9.50,15.646

ota Tw 3x0 i851]

Mote Ho. 17,

Partioulre Brae 31.05.2025

Opening stock ot raw materia

Jada: Purenases

tes: losing stock of aw Material :

[Fear i 5 BESEEST

Hote Ho. 18

Fasust Ra]] ——Rmoust (Ray

Particulars Tse 51:05:20 | — he at 31:5.207

er

oteo12

Partiot

mat

Teak a108 3020

stat weltare

350,000

25,360

AD

Bank interest

‘Bank charges 245 12,830]

enaly :

on eo

Hote No.2

Toa Fees

‘Advertsing & Publity

Car ake Running & Maintenance

Conveyance Bxpenses 2.800

Business Promotion Expenses 75,700

Fatiory Bpenses 720,900.

Freight 78,400)

Medial ox 2.150

‘Membership Tee 70,500

‘Office xp 72,500)

Forking Emenee 9.500

Rent Lease Rent Tass 734,500.

Tour & Traveling 7.150

Printing & Stationery 23 3.890

Repair & Maintenance 72,800.

secutive. = 725,000

“Telephone Expenses 5450 3.580

Water Expenses 7.689 9,800

‘Computer Expense 340) 7,800

Power &electieity xpenses 70560) 752,900

Postage And Courier 7,956. 3.250

Toga & Professional Charges 2500] 710,500

Recruitment expenses zi 9,800

ROC Fling Fees 5 72,900

Latour Charges T3560) 20,500.

al BTacsr

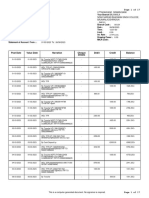

[eeeueaoer Tar [rarariees Teorecore

r Boer —_{o, SOSTTT bares soycssazy

eeeeT ‘ecret'oc | aivtz o0c'se Uz corer

eos 9% Tes ese su5 SeaTac boes'sc somos

eoresrs —[oavarly —[ecvesvre — z190r7 SeLeOCTE

poorer sywoudino3 3uns

ISTO _feeereee [aver veee | aT eTTTT OT TSO wae Tae [Ore corer

‘o0'00'0s% —foovn0s'2 —f = 00,0005 coo.

Toma rN

eoveote sev | eeoveote ey | ecacvore way | amcom | eeorsotennaa | ecoveote wey | tov ome Saar ee

ae ono SST

= ———————

iE or 3600 rd rd 0

wee owe crests [esc wut sist

OE U6 TSR 13 06C2 B06 90006 sor

e997 LOO sozaveae —Pers'a9' tr ers 99TT 08

oeerseror[rorsvors _ferarrasert [eraser [Tore xa

oooooas'e —[oovevoss | ooo oo08'e = or

Taree weaecore | —weaecare | —eeoe OTe Teer BOETOTD

A “wie | sxvaontwvna [oes ava suom

Sear TERT Soon sooan [ae aE

£200'€0°TE NO SV 49¥ X¥L NOON! INGaHIOS NOLLWIORNATA

“py ongora ® oda wesezaey|

Navratan Pipe & Profile Ltd.

Note No.5

snded on 31.03.2023

Statement showing cs ion of Deferred tax for

lOpening Balance (Deferred Tax Liability)

[Timing Difference for the year

Depreciation as per Companies Act

Depreciation as per Income Tax Act

Timing Difference for the year

Doferred Tax Assets for the year

iClosing Balance (Deferred Tax Liability)

6,09,247

2,10,96,565

1,16,60,624

194,35,941

29,15,706

Navratan Pipe & Profile Ltd.

‘STATEMENT OF INCOME & INCOME TAX FOR THE A,¥.2019-20

PAN :AACCNT@S1B Prev, Year: 2019-20

JAdd:10, COMMUNITY CENTER 3 RD FLOOR MAYAPURI Asst. Year: 2020-21

INDUSTRIAL AREA,

NEW DELHI-110064

IDor: 19.05.2005

[Particulars ‘Amount(Rs.) | Amount{Rs.

INCOME FROM BUSINESS & PROFESSION

INet profit as per Profit & Loss Account (2,16,49,430)]

(Profit before Income Tax)

|Add: Depreciation Considered separately 2,10,96,565

Less: Depreciation as per IT Act 1,16,60,624

lINCOME UNDER THE HEAD BUSINESS & PROFESSION (1,22,18,489)

lGross Total Income (1,22,13,489)

lLess: Loss of Previous Year

For the FY 2013-14 (96,73,502)

lFor the FY 2014-15 (2,99,29,110)

lFor the FY 2018-19 (2,74,53,670)|

lLess: Deduction under Chapter VI :

lTotal Income (7,92,69,771)|

|rax Thereon @ 20% (1,58,53,954)]

[Surcharge(10% E

[Education Cess (4%) (6,34,158)

‘Tax Liability (1,64,88,113)|

Less: Advance Tax 2

Less: Tax Deducted at Source 21,51,000

|Tax Payable /(Refund Due) (1,86,39,112)

|Setoff unabsorbed depreciation S

|ADD: Interest u/s 234B

|ADD: Interest u/s 234C -

lTotal Tax & Interest payable (1,86,39,112)

lLess: Self Assessment Tax Paid :

[Balance Tax Payable (1,86,39,113)|

Navratan Pipe & Profile Ltd.

Bi Annexure - 1

ACCOUNTING YEAR 2019-20

Calculation of Book Profit as per section 115 JB:

et Profit as per Prof Loss A/c alter tax

Jada: Positive adjustments as per section 1158

current income tae

Deferred Tax Expense

Adjusted profit for section 115JB (1,87,33,724)

Less: Negative adjustments as per section 115JB

Deferred Tax income / (Expenses) 29,158,706 29,15,706

IBook Profit as per section 115JB

income tax under section 115JB @ 19.055% of Book Profit,

Since the tax as per other provision of the Income Tax Act is higher

than as computed under section 115 JB, the provisions of this section are

Jnot applicable

‘As per our report under section 115JB of even date,

[Statement showing computation of Long Term Capital Gain on sale of Scrap Plant & Machinery

‘as on 31/03/2020

Full Value of Consideration F28,201.00

‘Less: Cost of acquisiton "25,670.00.

Tong term capital gain ,02,531.00]

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Unlocked 3 Months Statement - OCT2023 - 148346525 (1) - UnlockedDocument6 pagesUnlocked 3 Months Statement - OCT2023 - 148346525 (1) - UnlockedAshwani KumarNo ratings yet

- Vikas Bhawan Dehradun Contacts 2Document4 pagesVikas Bhawan Dehradun Contacts 2Ashwani KumarNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- NPPL Project Report 50Cr 2022Document76 pagesNPPL Project Report 50Cr 2022Ashwani KumarNo ratings yet

- NPPL Catalog ScaffoldingDocument12 pagesNPPL Catalog ScaffoldingAshwani KumarNo ratings yet

- 17 Cat Log Steel PipeDocument8 pages17 Cat Log Steel PipeAshwani KumarNo ratings yet

- 16 Land Allotment RIICODocument10 pages16 Land Allotment RIICOAshwani KumarNo ratings yet

- Dehradun MultibrandsDocument132 pagesDehradun MultibrandsAshwani KumarNo ratings yet

- 20230109130925Document10 pages20230109130925Ashwani KumarNo ratings yet

- DBS PL LatestDocument160 pagesDBS PL LatestAshwani KumarNo ratings yet

- 5 Company ITRsDocument9 pages5 Company ITRsAshwani KumarNo ratings yet

- 20230109130503Document6 pages20230109130503Ashwani KumarNo ratings yet

- 7 Audit Report 2020-21Document18 pages7 Audit Report 2020-21Ashwani KumarNo ratings yet

- NPPLR Balance Sheet 31 March 2022-1Document19 pagesNPPLR Balance Sheet 31 March 2022-1Ashwani KumarNo ratings yet

- Vikas Bhawan Dehradun ContactsDocument2 pagesVikas Bhawan Dehradun ContactsAshwani KumarNo ratings yet

- सद्स्य सम्पर्क - उत्तराखण्ड विधान सभाDocument3 pagesसद्स्य सम्पर्क - उत्तराखण्ड विधान सभाAshwani KumarNo ratings yet

- NTB (New TO Bank) PL Policy - Aug 22Document16 pagesNTB (New TO Bank) PL Policy - Aug 22Ashwani KumarNo ratings yet

- Loans LendersDocument4 pagesLoans LendersAshwani KumarNo ratings yet

- Central Bank Branch List Pan IndiaDocument549 pagesCentral Bank Branch List Pan IndiaAshwani KumarNo ratings yet

- Products ListDocument2 pagesProducts ListAshwani KumarNo ratings yet

- Ubl PolicyDocument28 pagesUbl PolicyAshwani KumarNo ratings yet

- Aditya Birla Udyog New Pdated Pin Code ListDocument459 pagesAditya Birla Udyog New Pdated Pin Code ListAshwani KumarNo ratings yet

- Commector Payout Claim DataDocument3 pagesCommector Payout Claim DataAshwani KumarNo ratings yet

- CASHe LoansDocument7 pagesCASHe LoansAshwani KumarNo ratings yet

- Naukri SrinivasAnumala (12y 0m)Document3 pagesNaukri SrinivasAnumala (12y 0m)Ashwani KumarNo ratings yet

- Axis Repayment ScheduleDocument4 pagesAxis Repayment ScheduleAshwani KumarNo ratings yet

- All Serviceable Pincodes nonGL-Version20 BL&PLDocument717 pagesAll Serviceable Pincodes nonGL-Version20 BL&PLAshwani KumarNo ratings yet

- Bank Ac SBIDocument7 pagesBank Ac SBIAshwani KumarNo ratings yet

- Post Date Value Date Narration Cheque Details Debit Credit BalanceDocument17 pagesPost Date Value Date Narration Cheque Details Debit Credit BalanceAshwani KumarNo ratings yet

- Banking ...Document8 pagesBanking ...Ashwani KumarNo ratings yet

- Aadhar CardDocument2 pagesAadhar CardAshwani KumarNo ratings yet