Professional Documents

Culture Documents

Budget Worksheet

Budget Worksheet

Uploaded by

hayleerudy99Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budget Worksheet

Budget Worksheet

Uploaded by

hayleerudy99Copyright:

Available Formats

Budget Worksheet

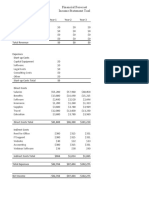

This worksheet contains suggested ranges for most expenses not directly addressed in the activity, based on common

amounts for a single person. Use them to estimate your own expenses or research the median values for your area.

Career _________________________________________

Income Gross Net

Total income from job or career $57600 $32742

for one year

Entertainment Yearly Cost

Movies and subscription service $200 Utilities Yearly Cost

($120–$400)

Phone and/or cell phone $480

Vacation ($1,000–$5,000) $300 ($900–$1,200)

Other ($500–$1,000) $0 Cable or satellite and internet $600

($1,000–$3,600)

Subtotal $500

Electric and gas ($1,000–$3,000) $1800

Other Credit Debt or Taxes Yearly Cost Water and sewer ($800–$1,500) $0

Student loan payment $0 Waste removal ($150–$300) $0

(10% of gross income per year)

Subtotal $2880

Credit card payment $0

(varies based on balance—$0 if Gifts and Donations Yearly Cost

no credit card debt)

Holidays and birthdays $400

Total estimated taxes besides $0 ($500 or more)

federal income tax (state and

local sales taxes, property taxes, Charity donations (varies) $250

state income taxes if applicable)

Other $250

Other $0

Subtotal $900

Subtotal $0

Unless Otherwise Noted All Content © 2022 Florida Virtual School.

FlexPoint Education Cloud™ is a trademark of Florida Virtual School.

Transportation Yearly Cost

Personal Care Yearly Cost Auto loan payment $0

Health insurance ($2,000–$4,000) $0 Bus and taxi fare (varies) $0

Other medical costs ($500 or $0 Auto insurance $1200

more)

Licensing and registration fees $45

Professional grooming, such as $200 ($30–$150)

hair or nails ($120–$1,500)

Gasoline (typical use) $1200

Clothing and laundry $480

($500 or more) Maintenance and repairs $500

Health club/gym membership $0 Other $0

($600–$1,200)

Subtotal $2945

Organization dues or fees (varies) $0

Other $0 Food Yearly Cost

Subtotal $680 Groceries ($1,500 or more) $9600

Dining out ($600 or more) $2000

Housing Yearly Cost

Subtotal $11600

Mortgage or rent $6000

Maintenance and repairs $250 Pets Yearly Cost

Supplies ($600 or more) $1200 Food ($300 or more) $0

Homeowner’s or renter’s insurance $0 Medical ($200 or more) $0

Furnishings and upkeep $500 Grooming $0

($500 or more)

Toys $0

Property tax $0

(if you own property) Other $0

varies—estimate 1% of home value

Subtotal $0

Subtotal $7950

Unless Otherwise Noted All Content © 2022 Florida Virtual School.

FlexPoint Education Cloud™ is a trademark of Florida Virtual School.

Savings and Investments Yearly Cost

Retirement account $2000

Investment account $1000

Emergency savings $1000

Subtotal $4000

Totals Year

Net income from job or career for one year $32742

(From top section of worksheet)

Total Yearly Expenses $31455

(Add all subtotals in worksheet)

Difference $1287

(net income minus total expenses)

Reflecting on this Activity

Answer the following questions in complete sentences.

1. Why is budgeting important to your life?

Budgeting is important because you wouldn't spend your money on anything dumb and waste the money. Which will

help with financial stability.

2. Describe your experience with this process. Was it easy, difficult, or somewhere in the middle? What factors

contributed to your feelings?

This assignment was quite easy because I already budget my weekly checks.

3. How might the use of credit for a large purchase affect your budget? Discuss which type of credit plan you would

use, and how your budget can help you protect your credit score.

It would affect my budget because I'd have to put money towards paying back the money which will mess it all up.

Instead of using credit to buy it I can save up for this large purchase and pay in cash.

4. What adjustments did you have to make to your budget? How did you decide where to make changes?

I spent less on eating out and ended up putting that money on doing other things that will help me or help make more

money.

Unless Otherwise Noted All Content © 2022 Florida Virtual School.

FlexPoint Education Cloud™ is a trademark of Florida Virtual School.

5. Will you begin using a budget regularly now? Why or why not?

Yes,because I have been around budgeting my whole life and I am now using a budget with my own money.

Unless Otherwise Noted All Content © 2022 Florida Virtual School.

FlexPoint Education Cloud™ is a trademark of Florida Virtual School.

You might also like

- Shivani Carriers Session 5 Case Study SummaryDocument3 pagesShivani Carriers Session 5 Case Study SummaryPheko P (PK)No ratings yet

- Lab ExerciseDocument5 pagesLab ExerciseJohan Nazran100% (1)

- BUSINESS PROJECT Bubble Car WashDocument62 pagesBUSINESS PROJECT Bubble Car WashNur Husna100% (1)

- Afar 01 Partnership Formation OperationsDocument7 pagesAfar 01 Partnership Formation OperationsMikael James VillanuevaNo ratings yet

- Chapter 31 - Substantive Test of Income Statement AccountsDocument8 pagesChapter 31 - Substantive Test of Income Statement AccountsDeeNo ratings yet

- Importance of Quality Control in Textile and Apparel IndustryDocument6 pagesImportance of Quality Control in Textile and Apparel IndustryMasudul Alam SajibNo ratings yet

- 1.09 - Jackson Combass 09.22.2023Document5 pages1.09 - Jackson Combass 09.22.2023jackson combassNo ratings yet

- Manage Your Money Chart: Budget WorksheetDocument4 pagesManage Your Money Chart: Budget WorksheetRyan GreenbergNo ratings yet

- Budget WorksheetDocument4 pagesBudget Worksheetsenuli WithanachchiNo ratings yet

- Budget Worksheet: Career Graphic DesignerDocument5 pagesBudget Worksheet: Career Graphic DesignerArkoNo ratings yet

- Budget WorksheetDocument4 pagesBudget WorksheetskyNo ratings yet

- Manage Your Money Chart: Budget WorksheetDocument4 pagesManage Your Money Chart: Budget WorksheetAlfia ThahaNo ratings yet

- 2023 Fees & Budget Form FINALDocument1 page2023 Fees & Budget Form FINALnelkon7No ratings yet

- 17 Mfa Intl - GradcostsDocument4 pages17 Mfa Intl - GradcostsabxyNo ratings yet

- Income and Expense Statement For: Amount Income Time PeriodDocument1 pageIncome and Expense Statement For: Amount Income Time PeriodKelli StudentNo ratings yet

- 2.08 Why BudgetDocument5 pages2.08 Why BudgetJakeFromStateFarmNo ratings yet

- 6 Budget WorksheetDocument3 pages6 Budget Worksheetmerxedes xoNo ratings yet

- Best of Refference On Develop Save Spend PlanDocument5 pagesBest of Refference On Develop Save Spend PlanJemal SeidNo ratings yet

- 02.04 Why BudgetDocument17 pages02.04 Why BudgetmeaNo ratings yet

- 2011 Sworn Financial StatementDocument7 pages2011 Sworn Financial StatementKendra KoehlerNo ratings yet

- Budgeting Template: Amount Monthly Equivalent Income (After Taxes & Deductions) Frequency ReceivedDocument3 pagesBudgeting Template: Amount Monthly Equivalent Income (After Taxes & Deductions) Frequency ReceivedjituniNo ratings yet

- Monthly Budget Worksheet-2Document4 pagesMonthly Budget Worksheet-2Yuyao QuNo ratings yet

- Scul BudgetDocument1 pageScul Budgetmarianghinea2006No ratings yet

- Monthly Budget Worksheet - Fillable PDF 2022Document3 pagesMonthly Budget Worksheet - Fillable PDF 2022Glaze BoncalesNo ratings yet

- Kimberley Hoff PAR711 JDF 1111 Sworn Financial StatementDocument7 pagesKimberley Hoff PAR711 JDF 1111 Sworn Financial StatementlegalparaeagleNo ratings yet

- Monthly Budget Worksheet: (804) 323-6800 (800) 285-6609 Visit A Branch MobileDocument1 pageMonthly Budget Worksheet: (804) 323-6800 (800) 285-6609 Visit A Branch MobileMikaila BurnettNo ratings yet

- My Budget: Your Total IncomeDocument3 pagesMy Budget: Your Total Incomeyun3No ratings yet

- Budgeting-Worksheet GP PDFDocument2 pagesBudgeting-Worksheet GP PDFSamantha ForeNo ratings yet

- Cash Flow Template 42Document8 pagesCash Flow Template 42ianachieviciNo ratings yet

- 2021 Team Member Support GuideDocument7 pages2021 Team Member Support GuideKhazid HaronNo ratings yet

- Monthly Family Budget: $1,203 $1,317 Income 1 Income 2 Extra Income Total Monthly IncomeDocument1 pageMonthly Family Budget: $1,203 $1,317 Income 1 Income 2 Extra Income Total Monthly IncomejammykhanNo ratings yet

- Student Budget WorksheetDocument5 pagesStudent Budget WorksheetCatarcyNo ratings yet

- Igrad Daily Income and Expense DiaryDocument17 pagesIgrad Daily Income and Expense DiaryPallavi DhingraNo ratings yet

- PDF 1020 Make Budget Worksheet PDFDocument2 pagesPDF 1020 Make Budget Worksheet PDFawefawefawe100% (3)

- Money With Jess My Annual BudgetDocument8 pagesMoney With Jess My Annual BudgetTony MannNo ratings yet

- Personal FinanceDocument5 pagesPersonal Finance11222084No ratings yet

- Sworn Financial StatementDocument6 pagesSworn Financial Statementbatousai1900No ratings yet

- Adult Weekly ExpensesDocument2 pagesAdult Weekly ExpensesnonhumsubNo ratings yet

- Income and Expenditure Form 23-24Document2 pagesIncome and Expenditure Form 23-24Tate SpiersNo ratings yet

- Inancial Lanning Orksheet: Statement of Net WorthDocument8 pagesInancial Lanning Orksheet: Statement of Net WorthDu Baladad Andrew MichaelNo ratings yet

- Make A Budget: My Income This MonthDocument2 pagesMake A Budget: My Income This MonthjuanNo ratings yet

- Budgetworksheet 2013Document4 pagesBudgetworksheet 2013api-256636603No ratings yet

- Budget BlankDocument1 pageBudget Blankwflemister1No ratings yet

- IRS Rates Limits 2019Document1 pageIRS Rates Limits 2019claokerNo ratings yet

- Business BudgetDocument5 pagesBusiness BudgetCarolNo ratings yet

- Sept Budget EconDocument3 pagesSept Budget Econapi-293330747No ratings yet

- Budget WorksheetDocument16 pagesBudget WorksheetMarx DelmoNo ratings yet

- After College Budget 2017Document10 pagesAfter College Budget 2017api-358027640No ratings yet

- CoaDocument6 pagesCoaCarlo CariasoNo ratings yet

- Personal Cash-Flow Statement: Monthly AmountDocument2 pagesPersonal Cash-Flow Statement: Monthly AmountDũng HoàngNo ratings yet

- Lesson 15-Budget Planning WorksheetDocument3 pagesLesson 15-Budget Planning Worksheetapi-284302646No ratings yet

- 2023 Individual ChecklistDocument1 page2023 Individual Checklistapi-648671766No ratings yet

- 64a4b619ad83deb05ec54ad7 - Tax Return Checklist 2023 - Platinum AccountingDocument3 pages64a4b619ad83deb05ec54ad7 - Tax Return Checklist 2023 - Platinum AccountingMalathi accountsNo ratings yet

- Household Budget SpreadsheetDocument1 pageHousehold Budget SpreadsheetnangaayissiNo ratings yet

- 2020 Redistricting Data ReportDocument8 pages2020 Redistricting Data Reportsandra hollinsNo ratings yet

- Sample BudgetDocument3 pagesSample Budgetwbfuller16641No ratings yet

- The Cost of Living Project (50 Points) : Income Source of IncomeDocument4 pagesThe Cost of Living Project (50 Points) : Income Source of IncomeMukesh Kumar100% (1)

- Budget&expenses WorksheetDocument4 pagesBudget&expenses WorksheetMarj BaquialNo ratings yet

- Cash Flow Statement SampleDocument8 pagesCash Flow Statement SampleHeatman RobertNo ratings yet

- Fin Outlook Forecast ToolDocument8 pagesFin Outlook Forecast ToolMohamed SururrNo ratings yet

- Financial Statement and Ratio Analysis PowerpointDocument86 pagesFinancial Statement and Ratio Analysis PowerpointRadhi MajmudarNo ratings yet

- CS204 Unit 8 AssignmentDocument2 pagesCS204 Unit 8 AssignmentBonifaceNo ratings yet

- Your Customized Benefits Plan at HCL America IncDocument2 pagesYour Customized Benefits Plan at HCL America IncShiv RanjanNo ratings yet

- Propose Budget RR Gia ArdjeDocument16 pagesPropose Budget RR Gia Ardjeriario2487No ratings yet

- Make A Budget: My Income This MonthDocument2 pagesMake A Budget: My Income This MonthjuanNo ratings yet

- Fire Your Over-Priced Financial Advisor and Retire SoonerFrom EverandFire Your Over-Priced Financial Advisor and Retire SoonerRating: 5 out of 5 stars5/5 (1)

- Text Note Guide Module 2Document2 pagesText Note Guide Module 2hayleerudy99No ratings yet

- 02 01 Literature 101Document2 pages02 01 Literature 101hayleerudy99No ratings yet

- We The People Note GuideDocument11 pagesWe The People Note Guidehayleerudy99No ratings yet

- The Legislative Branch Assignment TemplateDocument1 pageThe Legislative Branch Assignment Templatehayleerudy99No ratings yet

- The Constitution TemplateDocument3 pagesThe Constitution Templatehayleerudy99No ratings yet

- 06 05 02 TemplateDocument1 page06 05 02 Templatehayleerudy99No ratings yet

- Investment Honors Data Sheet TemplateDocument2 pagesInvestment Honors Data Sheet Templatehayleerudy99No ratings yet

- 01 04 Effective Presentations RubricDocument1 page01 04 Effective Presentations Rubrichayleerudy99No ratings yet

- 06 05 02 TemplateDocument1 page06 05 02 Templatehayleerudy99No ratings yet

- 05 05 02 ChecklistDocument2 pages05 05 02 Checklisthayleerudy99No ratings yet

- 1.05 The Market PriceDocument4 pages1.05 The Market Pricehayleerudy99No ratings yet

- 2.02 The Legislative BranchDocument2 pages2.02 The Legislative Branchhayleerudy99No ratings yet

- 1.04 Effective PresentationDocument5 pages1.04 Effective Presentationhayleerudy99No ratings yet

- The Constitution TemplateDocument2 pagesThe Constitution Templatehayleerudy99No ratings yet

- 01 03 Purposeful WritingDocument4 pages01 03 Purposeful Writinghayleerudy99No ratings yet

- GTX 3XX Part 23 AML STC IM 190-00734-10 Rev. 15 PDFDocument370 pagesGTX 3XX Part 23 AML STC IM 190-00734-10 Rev. 15 PDFIngeniero Analista Aeroclub de ColombiaNo ratings yet

- Business Integrity Digest: Compliance in The Agricultural SectorDocument27 pagesBusiness Integrity Digest: Compliance in The Agricultural SectorHaval A.MamarNo ratings yet

- Cities and Their Brands Lessons From Corporate BraDocument13 pagesCities and Their Brands Lessons From Corporate BraAleksandar MihajlovićNo ratings yet

- Fed Rate Rise Is Biggest Since 2000: Ukrainians Reclaim Villages, Easing Pressure On KharkivDocument40 pagesFed Rate Rise Is Biggest Since 2000: Ukrainians Reclaim Villages, Easing Pressure On KharkivAgung SumargoNo ratings yet

- Ratio, Proportion and Variation-CAT-Previous Year QuestionsDocument6 pagesRatio, Proportion and Variation-CAT-Previous Year Questionsrohitshukla0543No ratings yet

- 2 SK 170Document6 pages2 SK 170nishatiwari82No ratings yet

- Royal Bank of Canada: BUS 419 - Advanced Derivatives Securities Heng I (Miki) Pun Jeff Chan Macau Chan Nathan YauDocument90 pagesRoyal Bank of Canada: BUS 419 - Advanced Derivatives Securities Heng I (Miki) Pun Jeff Chan Macau Chan Nathan YauAbhijeet PatilNo ratings yet

- Importance of Cooperative Movement For Indian Agriculture SectorDocument5 pagesImportance of Cooperative Movement For Indian Agriculture SectormovinNo ratings yet

- The Starkey Test Revisited Rev19 - Private - DistributionDocument19 pagesThe Starkey Test Revisited Rev19 - Private - DistributionCarlos Cjuno BustamanteNo ratings yet

- Suresh Thevar: AchievementsDocument2 pagesSuresh Thevar: Achievementssuresh thevarNo ratings yet

- Chap 1 OverviewDocument57 pagesChap 1 OverviewThùy Linh Lê ThịNo ratings yet

- CV - Ilman Arief in English1Document1 pageCV - Ilman Arief in English1muhammad ilman ariefNo ratings yet

- Motivation Letter - CorrectionDocument2 pagesMotivation Letter - CorrectionAbner PlNo ratings yet

- Pink Blooming Bridal Bouquets Sales PresentationDocument25 pagesPink Blooming Bridal Bouquets Sales PresentationElif TahmisciogluNo ratings yet

- Sample SOP For Masters in Professional Accounting: La Trobe UniversityDocument3 pagesSample SOP For Masters in Professional Accounting: La Trobe UniversityNancyNo ratings yet

- Maslash Burn Out Inventory MBIDocument23 pagesMaslash Burn Out Inventory MBIInes NouriNo ratings yet

- Solution Pricing DecisionDocument2 pagesSolution Pricing DecisionAnn SalazarNo ratings yet

- Chris Garments Corporation v. Hon. Patricia A. Sto. Tomas and Chris Garments Workers Union-PTGWODocument1 pageChris Garments Corporation v. Hon. Patricia A. Sto. Tomas and Chris Garments Workers Union-PTGWOJoanne MacabagdalNo ratings yet

- Indonesia APEC Card Issuance Requirement 2022Document2 pagesIndonesia APEC Card Issuance Requirement 2022TGL Indonesia LogisticsNo ratings yet

- Checklist For Goods/Services: RequirementsDocument2 pagesChecklist For Goods/Services: RequirementsMich PradoNo ratings yet

- Intangible Assets: IA 1 - J. TamayaoDocument39 pagesIntangible Assets: IA 1 - J. TamayaoAterg MooseNo ratings yet

- Tax TermsDocument3 pagesTax TermsRAJINIKNTH REDDYNo ratings yet

- Self-Learning Management SeriesDocument10 pagesSelf-Learning Management SeriesAbhinav SinghNo ratings yet

- NC Mechanical Engineering Modules For Semester 1 2023aDocument4 pagesNC Mechanical Engineering Modules For Semester 1 2023aAnesu Chimbwanda Jr.No ratings yet