Professional Documents

Culture Documents

Tutorial 6 ITA

Uploaded by

adifaaharefeen0 ratings0% found this document useful (0 votes)

5 views2 pagesIta

Original Title

tutorial 6 ITA

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIta

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesTutorial 6 ITA

Uploaded by

adifaaharefeenIta

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Name: Adifaah Arefeen

Student ID: BIBM 2210-6754

Date Transactions Effect on Account to be Account to be

transactions debited credited

2022 Bought machinery with cash Increase in Machinery RM Cash RM

june RM machinery. 5000 5000

1 5,000 Decrease in cash

3 Started business with cash Increase in cash. Cash RM Capital RM

RM 20,000 and motor Increase in motor 20,000. Motor 35,000

vehicle RM 15,000 vehicle. Increase in vehicle RM

capital 15,000

7 Purchases land and building Increase in land and Land and AP RM

with loan from finance building. Increase building RM 120,000

house amounted RM in account payable 120,000

120,000

12 Owner withdraw cash Decrease in cash. Cash RM 100 Capital RM

for his own use amounted Increase in 100

RM 100 drawings

13 Paid creditor amount Decrease in bank. AP RM 520 Bank RM 520

due by cheque RM 520 Decease in AP

15 Debtor paid RM 1,030 Increase in cash. Cash RM 1,030 AR RM 1,030

amount owing by cash Decrease in AR

20 Bought motor van though a Increase in motor Motor van RM AP RM

bank loan RM 35,000 van. Increase in AP 35,000 35,000

23 Owner brought in Increase in Computer RM Cash RM

computer amounted RM computer. Decrease 3,400 3,400

3,400 for office use in cash

24 Bought extra furniture by Increase in Furniture RM Bank RM

cheque RM 2,000 furniture. Decrease 2,000 2,000

in bank

25 Owner brought in further Increase in cash. Cash RM Capital RM

cash into the business RM Increase in capital 10,000 10,000

10,000

26 Bought furniture by Increase in Furniture RM Bank RM

cheque RM 1,100 furniture. Decrease 1,100 1,100

in bank

27 M Finance lends the firm Increase in AP. Cash RM M Finance AP

loan paid by cash RM increase in cash 12,000 RM 12,000

12,000

29 Repaid by cash, loan Decrease in cash. M fiance AP Cash RM

owed to finance company Decrease in AP RM 2,200 2,200

RM 2,200

30 The owner deposited extra Increase in capital. Cash RM 8,000 Capital RM

cash to the business RM Increase in cash 8,000

8,000

You might also like

- Financial Accounting 1 - Solution 4Document3 pagesFinancial Accounting 1 - Solution 4mardhiahNo ratings yet

- Effects and Equation-Individual AssignmentDocument8 pagesEffects and Equation-Individual AssignmentAbduzzahir Bin Mohd SaidNo ratings yet

- BAABDocument8 pagesBAABaqilahNo ratings yet

- ACC 406 Intermediate Financial Accounting and Reporting Nbs3ADocument10 pagesACC 406 Intermediate Financial Accounting and Reporting Nbs3AKeyo BintajolNo ratings yet

- Group AssignmentDocument10 pagesGroup AssignmentKeyo BintajolNo ratings yet

- Practice Question and Answer On Preparing JournalDocument3 pagesPractice Question and Answer On Preparing JournalNaz JrNo ratings yet

- ACC106Document12 pagesACC106Aneesah RaziNo ratings yet

- Template Tutorial EFFECTDocument2 pagesTemplate Tutorial EFFECTkopayied 07No ratings yet

- Amalgamation - Example 1 To 4Document4 pagesAmalgamation - Example 1 To 4Zhong HanNo ratings yet

- BAAB1014 Quiz 1 (B) AnswersDocument4 pagesBAAB1014 Quiz 1 (B) AnswersHareen JuniorNo ratings yet

- Variation Proforma For Journal Entries: S.No Transactions Chart of Accounts Accounting Pillars Reasons Debit CreditDocument11 pagesVariation Proforma For Journal Entries: S.No Transactions Chart of Accounts Accounting Pillars Reasons Debit CreditZaheer Ahmed SwatiNo ratings yet

- Accounting For Mgt.Document3 pagesAccounting For Mgt.RNo ratings yet

- DATEDocument2 pagesDATEMUHAMMAD DANISH ANIQ ABDUL JALILNo ratings yet

- Journal EntryDocument15 pagesJournal EntryNajOh Marie D ENo ratings yet

- Contoh Tugasan AccountDocument20 pagesContoh Tugasan AccountMuhammad IddinNo ratings yet

- Journals Question 2 ProblemsDocument22 pagesJournals Question 2 ProblemsAzam YahyaNo ratings yet

- Solution Chapter 3Document3 pagesSolution Chapter 3arha_86867820No ratings yet

- Accounting Equation: Chapter TwoDocument8 pagesAccounting Equation: Chapter Twojohn adamNo ratings yet

- Practice Questions On AEDocument21 pagesPractice Questions On AERahul ManglaNo ratings yet

- Analysis of Common Business TransactionsDocument18 pagesAnalysis of Common Business TransactionsClarisse RosalNo ratings yet

- Diaz - Journal EntriesDocument4 pagesDiaz - Journal EntriesPangitkaNo ratings yet

- Topic 3 TutorialDocument10 pagesTopic 3 TutorialMimi ArniNo ratings yet

- Question: Ledger, TB: Dr cash 变多5000Document2 pagesQuestion: Ledger, TB: Dr cash 变多5000S1X 32 許詠棋 KohYongKeeNo ratings yet

- Effects of Transactions and Double Entry Question 2 Page 65Document2 pagesEffects of Transactions and Double Entry Question 2 Page 65azra balqisNo ratings yet

- A221 - Self-Study Chapter 3Document8 pagesA221 - Self-Study Chapter 3Shairah SaifullNo ratings yet

- Basics of Accounting - Theory and Questions Handout # 2Document6 pagesBasics of Accounting - Theory and Questions Handout # 2Kaali CANo ratings yet

- Accounting Cycle. FAR1Document12 pagesAccounting Cycle. FAR1Gajulin, April JoyNo ratings yet

- Tally Assignment: Question Create A Company Using Tally SoftwareDocument11 pagesTally Assignment: Question Create A Company Using Tally SoftwaregsaNo ratings yet

- Acc117 Group ProjectDocument9 pagesAcc117 Group ProjectKHAIRUL AQIL THAQIF100% (1)

- Acc Assignment FinalDocument17 pagesAcc Assignment FinalKavesh KumarNo ratings yet

- BAAB1014 Accounting - (Group 1 Assignment)Document10 pagesBAAB1014 Accounting - (Group 1 Assignment)Hareen Junior100% (1)

- Tutorial Chapter 4 (TRIAL BALANCE)Document2 pagesTutorial Chapter 4 (TRIAL BALANCE)azra balqisNo ratings yet

- XI AccountancyDocument5 pagesXI Accountancytechnical hackerNo ratings yet

- Accts Project For Class Xi 2015 16-1Document2 pagesAccts Project For Class Xi 2015 16-1Narsingh Das AgarwalNo ratings yet

- Acc Group AssignmentDocument19 pagesAcc Group AssignmentNabihan SofianNo ratings yet

- Home Assignment - Financial Accounting PGPM 2019-20Document3 pagesHome Assignment - Financial Accounting PGPM 2019-20SidharthNo ratings yet

- School of Business (SBC) : Module's InformationDocument3 pagesSchool of Business (SBC) : Module's InformationEinNo ratings yet

- Detail RM RM Consideration PaidDocument3 pagesDetail RM RM Consideration PaidMuhammad Syamil Zikri IsmayuddinNo ratings yet

- Vijayam Junior College:: Chittoor: Iii Answer The Following. 1X10 10Document1 pageVijayam Junior College:: Chittoor: Iii Answer The Following. 1X10 10M JEEVARATHNAM NAIDUNo ratings yet

- Test 2Document1 pageTest 2Saranya DeviNo ratings yet

- MGT101 GDB No.1 2020Document1 pageMGT101 GDB No.1 2020Khuzaima HanifNo ratings yet

- PaperDocument4 pagesPaperamirNo ratings yet

- Accounting EquationDocument36 pagesAccounting EquationHadi HarizNo ratings yet

- IGCSE & OL Accounting Worksheets AnswersDocument53 pagesIGCSE & OL Accounting Worksheets Answerssana.ibrahimNo ratings yet

- Problems Accounting Variation Proforma 1 5 SolvedDocument5 pagesProblems Accounting Variation Proforma 1 5 SolvedSHORT VIDZNo ratings yet

- Bafna Suggested Answers CDocument18 pagesBafna Suggested Answers Csizantu100% (1)

- Financial and Cost Accounting (MAC 2073) 7 JANUARY 2021Document20 pagesFinancial and Cost Accounting (MAC 2073) 7 JANUARY 2021Alif AnuarNo ratings yet

- Practical Questions With HintsDocument4 pagesPractical Questions With HintsMff DeadsparkNo ratings yet

- Acc 106 Ebook Answer Topic 4Document13 pagesAcc 106 Ebook Answer Topic 4syifa azhari 3BaNo ratings yet

- FA - Excercises & Answers PDFDocument17 pagesFA - Excercises & Answers PDFRasanjaliGunasekeraNo ratings yet

- Business Studies Chapter 6 - Grade 10Document4 pagesBusiness Studies Chapter 6 - Grade 10Maneesha DulanjaliNo ratings yet

- Abm11a Assignment (Journal)Document13 pagesAbm11a Assignment (Journal)Clarisse RosalNo ratings yet

- Finance AccountsDocument2 pagesFinance AccountsBalumahendran. P Balumahendran. PNo ratings yet

- Transaction Analysis (2424)Document17 pagesTransaction Analysis (2424)AirForce ManNo ratings yet

- Taxation NotesDocument33 pagesTaxation NotesNaina AgarwalNo ratings yet

- 高一簿记模拟试卷Document6 pages高一簿记模拟试卷Carpenters ForeverNo ratings yet

- Homework 1Document2 pagesHomework 1Hasmieza AlieyaNo ratings yet

- AFH Important QuestionDocument6 pagesAFH Important Questionmanassadashiv013No ratings yet

- Accounting For Managers - Practical ProblemsDocument33 pagesAccounting For Managers - Practical ProblemsdeepeshmahajanNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Pas 8811 2017Document42 pagesPas 8811 2017Mohammed HafizNo ratings yet

- Corsaf™ 16D: Corrosion InhibitorDocument1 pageCorsaf™ 16D: Corrosion Inhibitorsmithyry2014No ratings yet

- Constitution of India - SyllabusDocument1 pageConstitution of India - SyllabusDavidNo ratings yet

- Colleges and Universities 2023 1Document8 pagesColleges and Universities 2023 1gods2169No ratings yet

- Components of A Balance Sheet AssetsDocument3 pagesComponents of A Balance Sheet AssetsAhmed Nawaz KhanNo ratings yet

- Benefits BookletDocument59 pagesBenefits BookletThe QuadfatherNo ratings yet

- Operations TXT PLUS CLAIREDocument513 pagesOperations TXT PLUS CLAIRElimetta09No ratings yet

- Microsoft Dynamics AX Lean AccountingDocument26 pagesMicrosoft Dynamics AX Lean AccountingYaowalak Sriburadej100% (2)

- 1 Ptot07awDocument40 pages1 Ptot07awSanket RoutNo ratings yet

- Green v. Speedy InterrogatoriesDocument5 pagesGreen v. Speedy Interrogatoriessamijiries100% (2)

- Readings in Philippine HistoryDocument11 pagesReadings in Philippine HistoryWilliam DC RiveraNo ratings yet

- Peoria County Inmates 12/20/12Document6 pagesPeoria County Inmates 12/20/12Journal Star police documentsNo ratings yet

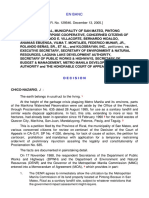

- Case No. 83-3Document3 pagesCase No. 83-3angelo macatangayNo ratings yet

- Upland's 2015 California Public Records RequestsDocument70 pagesUpland's 2015 California Public Records RequestsBeau YarbroughNo ratings yet

- Book Review - An Undocumented Wonder - The Great Indian ElectionsDocument18 pagesBook Review - An Undocumented Wonder - The Great Indian Electionsvanshika.22bap9539No ratings yet

- Muhannad Evidence 1 Contemporary PresentationDocument24 pagesMuhannad Evidence 1 Contemporary PresentationMuhannad LallmahamoodNo ratings yet

- Bus Math Grade 11 q2 m2 w2Document7 pagesBus Math Grade 11 q2 m2 w2Ronald AlmagroNo ratings yet

- 000.000pd 451Document6 pages000.000pd 451remy vegim tevesNo ratings yet

- Diamond Service SoftwareDocument42 pagesDiamond Service Softwareqweqwe50% (2)

- Province of Rizal v. Executive SecretaryDocument23 pagesProvince of Rizal v. Executive SecretaryKim MontanoNo ratings yet

- Notice of Appeal Criminal Case MTC To RTCDocument3 pagesNotice of Appeal Criminal Case MTC To RTCLex Dagdag100% (1)

- WS QHSE Std23 3313701 07Document24 pagesWS QHSE Std23 3313701 07ralph100% (1)

- British Collectors Banknotes 1 PDFDocument104 pagesBritish Collectors Banknotes 1 PDFRafael VegaNo ratings yet

- Stock Investing Mastermind - Zebra Learn-171Document2 pagesStock Investing Mastermind - Zebra Learn-171RGNitinDevaNo ratings yet

- Civil Procedure CaseDocument3 pagesCivil Procedure CaseEarl Ian DebalucosNo ratings yet

- PHILO 3rd ModuleDocument15 pagesPHILO 3rd ModuleAngelyn LingatongNo ratings yet

- Conjugal Dictatorship Chapter 2Document2 pagesConjugal Dictatorship Chapter 2Nicole Anne Santiago SibuloNo ratings yet

- Civil Docket - Larson v. Perry (Dorland) ("Bad Art Friend")Document20 pagesCivil Docket - Larson v. Perry (Dorland) ("Bad Art Friend")x2478No ratings yet

- Limited ContractDocument2 pagesLimited ContractMajid ImranNo ratings yet

- General Request Letter For Police ClearanceDocument1 pageGeneral Request Letter For Police ClearanceMazh FathNo ratings yet