Professional Documents

Culture Documents

Mel Roe

Uploaded by

jesseCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mel Roe

Uploaded by

jesseCopyright:

Available Formats

THE GUIDE - HOW TO COMPLETE THE RECORD OF EMPLOYMENT,

PROVIDES DETAILED INSTRUCTIONS.

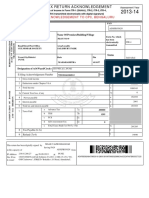

Protected when completed - B

RECORD OF EMPLOYMENT (ROE)

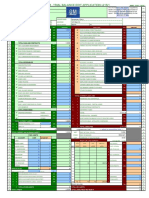

1 SERIAL NO. 2 SERIAL NO. OF ROE AMENDED OR REPLACED 3 EMPLOYER'S PAYROLL REFERENCE NO.

M02530269 BE.Y0013

4 EMPLOYER'S NAME AND ADDRESS 5 CRA PAYROLL ACCOUNT NUMBER

Be.YOU.tiful Inc. 735999310RP0001

A - 1853 PORTAGE AVE 6 PAY PERIOD TYPE

B - Bi-weekly

WINNIPEG MB 7 POSTAL CODE 8 SOCIAL INSURANCE NO.

Canada R3J0G8 671-113-561

9 EMPLOYEE'S NAME AND ADDRESS 10 FIRST DAY WORKED D M Y

IMELDA DE CASTRO 16 02 2021

138 DEXTER STREET 11 LAST DAY FOR WHICH PAID D M Y

WINNIPEG R2R2L8 19 08 2023

MB, CANADA 12 FINAL PAY PERIOD ENDING DATE D M Y

19 08 2023

13 OCCUPATION 14 EXPECTED DATE OF RECALL D M Y

X UNKNOWN NOT RETURNING

15A TOTAL INSURABLE HOURS 16 REASON FOR ISSUING THIS ROE

ACCORDING TO CHART ON PAGE 2 1226

Quit E

15B TOTAL INSURABLE EARNINGS FOR FURTHER INFORMATION, CONTACT

ACCORDING TO CHART ON PAGE 2 Joyce Angeles

$ 6,104.82

TELEPHONE NO. (204) 221-7046

15C THE FIRST ENTRY MUST RECORD THE INSURABLE EARNINGS FOR THE 17 ONLY COMPLETE IF PAYMENT OR BENEFITS (OTHER THAN REGULAR PAY) PAID IN OR IN

FINAL (MOST RECENT) INSURED PAY PERIOD. ENTER DETAILS BY PAY ANTICIPATION OF THE FINAL PAY PERIOD OR PAYABLE AT A LATER DATE.

PERIOD AS PER THE CHART ON PAGE 2. A - VACATION PAY

INSURABLE INSURABLE INSURABLE

Paid because no longer working $ 1.50

P.P. P.P. P.P.

EARNINGS EARNINGS EARNINGS

START DATE (D/M/Y): END DATE (D/M/Y):

1 37.40 2 442.00 3 306.00

B - STATUTORY HOLIDAY PAY FOR

4 344.11 5 361.25 6 400.86 D M Y D M Y

$ $

7 577.58 8 467.50 9 459.00

$ $

10 574.09 11 433.50 12 620.50 $ $

13 532.78 14 548.25 15 586.50 $ $

16 527.00 17 546.98 18 531.25 $ $

C - OTHER MONIES (SPECIFY)

19 548.25 20 459.00 21 306.00

22 544.00 23 550.51 24 545.36 $

25 655.86 26 454.75 27 536.86 START DATE (D/M/Y): END DATE (D/M/Y):

28 29 30

$

31 32 33

START DATE (D/M/Y): END DATE (D/M/Y):

34 35 36

$

37 38 39

START DATE (D/M/Y): END DATE (D/M/Y):

40 41 42

19 PAID SICK/MATERNITY/PARENTAL/COMPASSIONATE CARE/FAMILY CAREGIVER LEAVE

43 44 45 OR GROUP WAGE LOSS INDEMNITY PAYMENT

START DATE END DATE AMOUNT PER PER

46 47 48 D M Y D M Y DAY WEEK

PSL $

49 50 51

WLI - Not ins. $

52 53

WLI - Ins. $

18 COMMENTS MAT/PAR/CC/FC $

20 COMMUNICATION PREFERRED IN 21 TELEPHONE NO.

X English French (416) 766-9704 221

22 I AM AWARE THAT IT IS AN OFFENSE TO KNOWINGLY MAKE FALSE ENTRIES AND

HEREBY CERTIFY THAT ALL STATEMENTS ON THIS FORM ARE TRUE.

Name of Issuer

Nazim D M Y

Zafor 21 09 2023

INS 5220 (12-17) E Service Canada delivers Employment and Social Development Canada programs and services for the Government of Canada.

Version 12.6.0

Service Canada has already received a copy of this electronic Record of Employment. Do not submit a paper copy of this Record of Employment to Service Canada.

Page 2 contains important information. Ce formulaire est également disponible en français

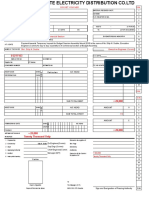

Important Information and Instructions for Employees

What is a Record of Employment?

The Record of Employment (ROE) is a form your employer must complete when you stop working. Your employer has to issue the ROE to you, even if

you do not intend to apply for EI benefits. On the ROE, you will find details about your work history with your employer. You do not need your ROEs to

apply for EI benefits. If you delay filing your EI claim for more than four weeks after you stop working, you may lose benefits.

How do I apply for EI benefits?

You can apply for EI benefits online at www.servicecanada.ca or by visiting your nearest Service Canada Centre.

To find the location of your nearest Centre, click on “Contact Us” on the Web site or call 1 800 O-Canada (1-800-622-6232).

What do I do with my ROEs?

After you submit your EI application online, you will need to provide us with any paper ROEs issued to you during the last 52 weeks. We cannot process

your application until we receive them. For this reason, you must submit your paper ROEs as soon as possible after you submit your EI application.

You can either mail us your paper ROEs (the address is provided when you apply for EI online - if you need the address, call us at 1-800-206-7218

(TTY: 1-800-529-3742)) or drop them off in person at a Service Canada Centre.

This ROE was submitted electronically by your employer to Service Canada. For this reason, you do not need to provide us with a copy of it. For copies

of all ROEs in your name that have been submitted electronically, visit My Service Canada Account on the Canada Web site at www.canada.ca.

What if I’m not planning to apply for EI benefits?

If you are not applying for EI benefits, keep this and all other ROEs in a safe place for two years after the date shown in Block 11.

What do I do if the information on the ROE is incorrect?

If any information on this form appears to be incorrect, talk with your employer right away to correct or clarify it. Do not make any changes yourself.

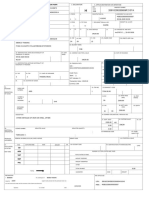

What does the information in Blocks 15A, 15B, and 15C mean?

· Block 15A, Total insurable hours: The number in Block 15A represents the total insurable hours you worked in a certain number of pay periods.

See the chart below for the number of pay periods your employer has included, based on your pay period type.

· Block 15B, Total insurable earnings: The amount in Block 15B represents the total insurable earnings you received over a certain number of pay

periods. See the chart below for the number of pay periods your employer has included, based on your pay period type.

· Block 15C, Breakdown of insurable earnings by pay period: In this block, your employer has broken down your insurable earnings by pay

period. Line PP1 in Block 15C shows the insurable earnings for your final (most recent) pay period. For pay periods with no insurable earnings,

your employer will have entered “0” (zero).

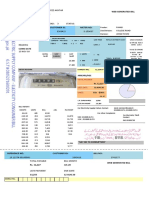

Information included in Blocks 15A, 15B, and 15C

Pay period type Number of consecutive pay periods Number of consecutive pay periods Number of consecutive pay periods

(Block 6) to report for total insurable hours to report for insurable earnings to report for insurable earnings

(Block 15A) (Block 15B) (Block 15C)

Weekly Last 53 pay periods* Last 27 pay periods* Last 53 pay periods*

Bi-weekly Last 27 pay periods* Last 14 pay periods* Last 27 pay periods*

Semi-monthly Last 25 pay periods* Last 13 pay periods* Last 25 pay periods*

Monthly Last 13 pay periods* Last 7 pay periods* Last 13 pay periods*

13 pay periods per year Last 14 pay periods* Last 7 pay periods* Last 14 pay periods*

*Or fewer, if the period of employment was shorter.

What does the code in Block 16 mean?

The following chart explains the codes that may appear in Block 16:

A – Shortage of work / End of contract or season B – Strike or lockout D – Illness or injury

E – Quit F – Maternity G – Mandatory retirement

H – Work-Sharing J – Apprentice training M – Dismissal or suspension

N – Leave of absence P – Parental Z – Compassionate care/Family caregiver

K – Other (see Block 18, Comments)

What happens if I receive benefits to which I am not entitled?

If for any reason you receive EI benefits to which you are not entitled, you will have to repay those benefits. Knowingly making false or misleading

statements is an offence under the law that can result in an administrative penalty or prosecution.

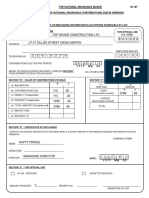

Note

Service Canada collects the information on this form for the purposes of administering and enforcing the Employment Insurance Act. The information is kept in Personal Information Banks ESDC PPU

150, 180, and 385, and will be used and disclosed in accordance with the conditions that apply to the Personal Information Banks. Service Canada may also use the information for policy analysis,

research, and/or evaluation purposes. To conduct these activities, Service Canada may link information under its custody and control. Any information Service Canada collects will be administered in

accordance with the Privacy Act. Under the provisions of the Privacy Act, individuals have the right to have their personal information protected, and to have full access to it. For instructions on how to

obtain your personal information, as well as a detailed description of the Personal Information Banks, see InfoSource, a publication available at Service Canada Centres or online at

www.canada.ca/infosource-ESDC.

You might also like

- Record of Employment (Roe) : Payroll DepartmentDocument2 pagesRecord of Employment (Roe) : Payroll Departmentcaadani5005No ratings yet

- ROE Feb 3, 2022Document2 pagesROE Feb 3, 2022mdhillonNo ratings yet

- Record of Employment (Roe) : Office Copy OnlyDocument1 pageRecord of Employment (Roe) : Office Copy OnlyRyanNo ratings yet

- FORM 1932 Jan 10 ReportDocument16 pagesFORM 1932 Jan 10 Reportmbyedith100% (1)

- D 19 L8 0012Document24 pagesD 19 L8 0012Justin RohrlichNo ratings yet

- Kamna BuildtehDocument59 pagesKamna BuildtehMakardhwaj MishraNo ratings yet

- Jaelon Trice - 6222841244 2Document1 pageJaelon Trice - 6222841244 2Jaelon TriceNo ratings yet

- Mack Blower Motor Repair Harness PigtailsDocument1 pageMack Blower Motor Repair Harness PigtailsMeadows TruckNo ratings yet

- NC 17-651732-000 - 20231215 - 27339162 - 12205685112Document1 pageNC 17-651732-000 - 20231215 - 27339162 - 12205685112angel.vinacNo ratings yet

- 2022 46-1240832 XXX-XX-8976 1410.00: CORRECTED (If Checked)Document2 pages2022 46-1240832 XXX-XX-8976 1410.00: CORRECTED (If Checked)Minerva BetancourtNo ratings yet

- Form 1120 2022Document6 pagesForm 1120 2022DjibzlaeNo ratings yet

- Connery 2021Document22 pagesConnery 2021ytprem agu100% (1)

- Mcgraw Hills Taxation of Individuals and Business Entities 2019 Edition 10th Edition Spilker Solutions ManualDocument19 pagesMcgraw Hills Taxation of Individuals and Business Entities 2019 Edition 10th Edition Spilker Solutions Manualairpoiseanalyzernt5t100% (24)

- DocumentDocument4 pagesDocumentMichele PadillaNo ratings yet

- Maria Bellucci 5165471196Document2 pagesMaria Bellucci 5165471196chde795No ratings yet

- Mcgraw Hills Essentials of Federal Taxation 2019 10th Edition Spilker Solutions ManualDocument19 pagesMcgraw Hills Essentials of Federal Taxation 2019 10th Edition Spilker Solutions Manualairpoiseanalyzernt5t100% (21)

- JL PDFDocument1 pageJL PDFJuegos DebeNo ratings yet

- 0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDocument2 pages0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDeepika RajasekarNo ratings yet

- Richard Feeney w2's 2018 2Document3 pagesRichard Feeney w2's 2018 2Richy FeeneyNo ratings yet

- Solution Manual For Mcgraw Hills Taxation of Individuals and Business Entities 2020 Edition 11th by SpilkerDocument14 pagesSolution Manual For Mcgraw Hills Taxation of Individuals and Business Entities 2020 Edition 11th by Spilkerlouisdienek3100% (19)

- RENGGALI NeoDocument3 pagesRENGGALI NeoMuhamad SofyanNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDiazNo ratings yet

- Work PaystubDocument1 pageWork Paystubjoelryan2019No ratings yet

- W2 - 2316 (1) - UnlockedDocument1 pageW2 - 2316 (1) - UnlockedEnrico Torres Jr. JrNo ratings yet

- For Solicitation Information Call:: Offeror To Complete Blocks 12, 17, 23, 24, & 30Document12 pagesFor Solicitation Information Call:: Offeror To Complete Blocks 12, 17, 23, 24, & 30LinaceroNo ratings yet

- GIRO CIT Appln FormDocument2 pagesGIRO CIT Appln FormHarith IskandarNo ratings yet

- Vp°Ffiv 'Phf Lh° Hpμvπka°' 'F: Your DetailsDocument2 pagesVp°Ffiv 'Phf Lh° Hpμvπka°' 'F: Your DetailsDeviben MehtaNo ratings yet

- 723254EFB162Document1 page723254EFB162Gio MirandaNo ratings yet

- Tax Ritan18-19 PDFDocument4 pagesTax Ritan18-19 PDFRishabh SharmaNo ratings yet

- PLA Intiff'S Exhibit 73Document13 pagesPLA Intiff'S Exhibit 73Jessie SmithNo ratings yet

- 1099 HsuxixfkrDocument1 page1099 HsuxixfkrhayyandaiNo ratings yet

- 722256EA01B9 Sept2022Document1 page722256EA01B9 Sept2022Lanie CalvezNo ratings yet

- 723039EBAEAFDocument1 page723039EBAEAFMarina LayugNo ratings yet

- Cost Center Order Date Sales No Sales Vendor Date Required: PhoneDocument1 pageCost Center Order Date Sales No Sales Vendor Date Required: PhoneShaneigha NoelleNo ratings yet

- KH - Imran Hafeez S/O KH - Hafeez Akhtar 365-B-I M.A.Johar Town LHRDocument1 pageKH - Imran Hafeez S/O KH - Hafeez Akhtar 365-B-I M.A.Johar Town LHRNaeem MalikNo ratings yet

- Vp°Ffiv 'Phf Lh° Hpµvπka°' 'F: Your DetailsDocument2 pagesVp°Ffiv 'Phf Lh° Hpµvπka°' 'F: Your Detailspateldrash2498No ratings yet

- GM OEM Financials Dgi9ja-2Document1 pageGM OEM Financials Dgi9ja-2Dananjaya GokhaleNo ratings yet

- Quess Corp Limited: A U G 2 7 2 0 2 2 3: 1 9 P MDocument1 pageQuess Corp Limited: A U G 2 7 2 0 2 2 3: 1 9 P Msagar janiNo ratings yet

- SPE8EC-21-D-0086 (Basic) Advanced Matl Handling (MFR Hyundai and Manitou)Document17 pagesSPE8EC-21-D-0086 (Basic) Advanced Matl Handling (MFR Hyundai and Manitou)Afshin GhafooriNo ratings yet

- Capital Gains Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document2 pagesCapital Gains Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"GSAFINNo ratings yet

- State Mobile Ward Status Preparedate Email-Id: Computation Total IncomeDocument4 pagesState Mobile Ward Status Preparedate Email-Id: Computation Total IncomejayminNo ratings yet

- WEEK 2 - OJT Weekly Report Template TERM 2Document1 pageWEEK 2 - OJT Weekly Report Template TERM 2Zoram AbreraNo ratings yet

- Aug 2022Document2 pagesAug 2022fazreina 99No ratings yet

- Vp°Ffiv 'Phf Lh° Hpμvπka°' 'F: Your DetailsDocument2 pagesVp°Ffiv 'Phf Lh° Hpμvπka°' 'F: Your Detailspateldrash2498No ratings yet

- Zafar Ahmad S/O Abdul Hameed H No 130 Block B Audit & Accounts LHRDocument1 pageZafar Ahmad S/O Abdul Hameed H No 130 Block B Audit & Accounts LHRNoman ZafarNo ratings yet

- MBBcurrent 564548147990 2022-12-31 PDFDocument10 pagesMBBcurrent 564548147990 2022-12-31 PDFAdeela fazlinNo ratings yet

- Rma100726 Bol PDFDocument1 pageRma100726 Bol PDFHammad AneesNo ratings yet

- CD ADV VAT RAF FUL: Ebenezer Ebenco Trading AgentDocument2 pagesCD ADV VAT RAF FUL: Ebenezer Ebenco Trading AgentMoholi LithebeNo ratings yet

- File 4Document3 pagesFile 4Kimberly NugentNo ratings yet

- Audted Form: DC Annual X1Document19 pagesAudted Form: DC Annual X1hari reddyNo ratings yet

- Mercedes CA Exempt Registration CardDocument1 pageMercedes CA Exempt Registration Cardabe lincolnNo ratings yet

- 2014 DV IMPREST PermanentDocument147 pages2014 DV IMPREST Permanentchief engineer CommercialNo ratings yet

- Ni 189Document2 pagesNi 189AkidaNo ratings yet

- 9YWwhh55h5384810244629010109102 PDFDocument2 pages9YWwhh55h5384810244629010109102 PDFDave Yerznkyan100% (1)

- 9 Keland Cossia 2019 Form 1099-MISCDocument1 page9 Keland Cossia 2019 Form 1099-MISCpeter parkinsonNo ratings yet

- District Account Office Gujrat: Danish Javed 34202-5564986-7 Junior ClerkDocument6 pagesDistrict Account Office Gujrat: Danish Javed 34202-5564986-7 Junior ClerkPub G0% (1)

- Potestio Brothers Equipment: Quantities Part Number DescriptionDocument1 pagePotestio Brothers Equipment: Quantities Part Number DescriptionAnonymous H63fNpNo ratings yet

- Statement Summury SheetDocument2 pagesStatement Summury SheetCedrick KatempaNo ratings yet

- How To Pay Zero Estate Taxes: Your Guide to Every Estate Tax Break the IRS AllowsFrom EverandHow To Pay Zero Estate Taxes: Your Guide to Every Estate Tax Break the IRS AllowsNo ratings yet

- Conditional SentenceDocument4 pagesConditional SentenceAbdul Azis ElnuryNo ratings yet

- Introduction To Macroeconomics: © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray FairDocument27 pagesIntroduction To Macroeconomics: © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray FairAyu Dyah PitalokaNo ratings yet

- Nickelodeon Internship Cover LetterDocument8 pagesNickelodeon Internship Cover Letterydzkmgajd100% (2)

- Organizational Behavior: Chapter 9 - Foundations of Group BehaviorDocument10 pagesOrganizational Behavior: Chapter 9 - Foundations of Group BehaviorRicardo VilledaNo ratings yet

- Application Letter: By: Annisa Putri Ruliandi Ni Nengah Ayu Laksmi Sri DeviDocument6 pagesApplication Letter: By: Annisa Putri Ruliandi Ni Nengah Ayu Laksmi Sri DeviAnnisa0% (1)

- A Study On "Performance Appraisal" at KirloskarDocument6 pagesA Study On "Performance Appraisal" at KirloskarappachuNo ratings yet

- Autism Speaks - A Tool Kit From Adolescense To AdulthoodDocument118 pagesAutism Speaks - A Tool Kit From Adolescense To AdulthoodΜάνος ΜπανούσηςNo ratings yet

- Job Profile Logistic Assistant 2019Document8 pagesJob Profile Logistic Assistant 2019Mas ZalieNo ratings yet

- Writ Petition of Mandamus To High Court Under Article 226 of Constitution To Quash Termination Order, Reinstate Petitioner and Pay Back WagesDocument3 pagesWrit Petition of Mandamus To High Court Under Article 226 of Constitution To Quash Termination Order, Reinstate Petitioner and Pay Back Wagessaurabh singhNo ratings yet

- Juridical Persons: Prescriptions in GeneralDocument4 pagesJuridical Persons: Prescriptions in Generaldidi chenNo ratings yet

- Gender, School, Society and Inclusive School PDFDocument168 pagesGender, School, Society and Inclusive School PDFShane Watson PatraNo ratings yet

- ApplicationForm - 2578478 - EditDocument5 pagesApplicationForm - 2578478 - EditRaj BnNo ratings yet

- Curriculum Vitae: Joko Wibowo Santoso, S.TDocument4 pagesCurriculum Vitae: Joko Wibowo Santoso, S.Tlambe congorNo ratings yet

- Sample Call Center Cover LetterDocument2 pagesSample Call Center Cover LetterKristine RiojaNo ratings yet

- CAAT (Computer Assisted Auditing Technique) TestsDocument78 pagesCAAT (Computer Assisted Auditing Technique) TestsVanessaDulayAbejay100% (3)

- OB Assignment - 3Document23 pagesOB Assignment - 3Muhammad Salman AhmedNo ratings yet

- LabRev-Digests Jan23Document37 pagesLabRev-Digests Jan23BenBulacNo ratings yet

- TNL 201712145194201801254Document2 pagesTNL 201712145194201801254Harshit Suri100% (1)

- ContractTypes PDFDocument2 pagesContractTypes PDFHaider ShahNo ratings yet

- Regional Sales Development Manager in Calgary Canada Resume Bruce TurnerDocument3 pagesRegional Sales Development Manager in Calgary Canada Resume Bruce TurnerBruceTurner3No ratings yet

- Sumit ResumeDocument3 pagesSumit ResumeSumit PareekNo ratings yet

- In House Management Versus Management OutsourcedDocument38 pagesIn House Management Versus Management OutsourcedSid KharbandaNo ratings yet

- 11-14-16 Docket PDFDocument389 pages11-14-16 Docket PDFAli GhaniNo ratings yet

- The Economic Effects of Designn PDFDocument35 pagesThe Economic Effects of Designn PDFLou Cy BorgNo ratings yet

- HRM ProjectDocument63 pagesHRM ProjectAvinash67% (3)

- How To Compute Night Shift DifferentialDocument3 pagesHow To Compute Night Shift DifferentialLuckbay TruckingNo ratings yet

- CH 1 Intro To StatsDocument13 pagesCH 1 Intro To StatsRohit KumarNo ratings yet

- Case Study DownsizingDocument13 pagesCase Study DownsizingManisha GuptaNo ratings yet

- Final Research MR KadangoDocument30 pagesFinal Research MR KadangoJAPHET NKUNIKANo ratings yet

- Australian Public Service: Information and Communications Technology StrategyDocument40 pagesAustralian Public Service: Information and Communications Technology StrategyFarraz Sarmento SalimNo ratings yet