Professional Documents

Culture Documents

Job Ad 14730

Uploaded by

Muhmmad AliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Job Ad 14730

Uploaded by

Muhmmad AliCopyright:

Available Formats

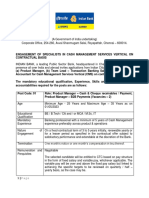

CAREER OPPORTUNITIES IN BANKING

The Bank of Punjab is one of the fastest growing Banks in Pakistan with its profound existence of over 33 years. It operates

through a network of 780+ real-time online branches and 706+ ATMs across the country. The Bank has established a strong

foundation while offering premium banking services with major focus on unsurpassed value added services for its customers

through advanced solutions.

In line with the Bank’s progression strategy, we invite applications from experienced, dedicated and performance-driven

professionals for the following position(s) in our SME Division. The following job profile offers excellent opportunity for the right

candidates desirous of building a long term career in a dynamic organization:

Position Job Summary / Major Responsibilities Eligibility Criteria

Ensure all assigned hub/team business targets are achieved. A balanced

growth is achieved in financing to all segments under SME Division i.e.

SME, Commercial/Corporate and in particular financing against SBP

schemes.

Ensure on-boarding of new to bank customers. Establishing new Qualification: Minimum Bachelor’s

relationships and strengthening & deepening relationships with existing Degree from a HEC recognized Local/

customers. Foreign University. Preference will be

Build up a healthy asset portfolio of the SME business Hub of the respective given to Master Degree holders.

area with prime emphasis on Shariah Complied assets and trade business.

Team Leader SME

Networking to develop business relations, promote Islamic financing Experience: Minimum 05 Years of

(Grade: AVP/VP)

products and other banking services. Attract corporate & individual Banking experience with 03 years of

(Location: Lahore)

customers and ensured high degree of customer loyalty relevant experience.

Positions: 01

Identify business opportunities to grow funded & non-funded Business,

structure proposals, negotiate terms and determine security Age: Up to 55 Years as of Dec 04, 2023.

arrangements.

Providing financial advice & solutions to existing and prospective clients.

Ensure achievement of financial and non-financial objectives of the division

Liaising with other business units for business leads. Ensure cross-sell with

other business groups. Divisions through marketing of Deposit, RFD/ACD

products, Cash Management Mandates etc.

The job requires conduct of client need analysis and conclude what type of

facilities the borrower requires keeping in view the terms of trade of that

particular industry.

The ideal candidate complete a thorough, in-depth analysis of new credit

requests, credit change requests, renewals and annual relationship

reviews. Recommend risk rating changes when analysis merits.

Ensure that eligibility criteria is met before offering a product to the Qualification: Minimum Bachelor’s

customer. Degree from a HEC recognized Local/

Report findings that may have an adverse effect on loan collateral or a Foreign University. Preference will be

borrower’s ability to repay the loan. given to Master Degree holders.

Senior Credit Analyst

Detailed cash flow analysis, since the bank would get repaid from free cash

(Grade: AVP/ VP-I)

flows of the business Experience: Minimum 05 Years of

(Location: Lahore)

The ideal resource to conduct comprehensive security analysis since the Banking experience preference will be

Positions:01

primary source of repayment is the cash flow while the secondary source given to candidates having credit related

is liquidation of security. experience.

Finalize credit proposals from all concerned quarters within shortest

possible time to maintain TAT. Age: Up to 55 Years as of Dec 04, 2023.

Evaluation & processing of credit proposals with respect to compliance of

internal (CPM) and external (SBP PRs) regulations as well as risk evaluation

criteria.

The job needs to analyze the risks of credit proposal and make

recommendations on risk mitigation measures, limit structures, tenor,

security, covenants, Term Sheets and conditions precedent.

Important Note:

a) Only shortlisted candidates shall be called for interview. No TA/DA will be admissible.

b) The Bank of Punjab reserves the right to accept or reject any application(s) without assigning any reason(s) thereof.

c) The Bank is an equal opportunity employer. Females, minorities and PWDs and transgender are encouraged to apply.

d) The above position(s) carry market based competitive remuneration.

e) Individuals fulfilling the above mentioned criteria are encouraged to apply online through BOP career portal

https://www.bop.com.pk/Available-Jobs Latest by Dec 04, 2023 .

BOP Phone Banking: 111-267-200 www.bop.com.pk

You might also like

- JobAd14036 BankDocument1 pageJobAd14036 BankKay PeeNo ratings yet

- Jo Bad 14967Document1 pageJo Bad 14967abdul mateenNo ratings yet

- Job Ad 14712Document1 pageJob Ad 14712palmw8007No ratings yet

- Understanding The Credit Department of A BankDocument6 pagesUnderstanding The Credit Department of A Bankzubair07077371No ratings yet

- Abhyudaya Bank Recruitment for Managerial PostsDocument2 pagesAbhyudaya Bank Recruitment for Managerial PostsShewale HemantNo ratings yet

- Job Ad - CSODocument1 pageJob Ad - CSOMuhammad AdnanNo ratings yet

- CCRA Final Brochure PDFDocument4 pagesCCRA Final Brochure PDFYogesh LassiNo ratings yet

- ICICI Bank Relationship Manager Business Loans GroupDocument2 pagesICICI Bank Relationship Manager Business Loans GroupSuraj DoshiNo ratings yet

- Jo Bad 14793Document1 pageJo Bad 14793Belal MuhamadNo ratings yet

- SCFS Cooperative Bank LTDDocument64 pagesSCFS Cooperative Bank LTDLïkïth RäjNo ratings yet

- Fahana Najnin Rajib SirDocument24 pagesFahana Najnin Rajib Sirmrs solutionNo ratings yet

- Notification For Asst. Manager 2023-24Document10 pagesNotification For Asst. Manager 2023-24umesh bhagatNo ratings yet

- Handbook On CreditDocument185 pagesHandbook On CreditPanna100% (1)

- JoB AprilDocument1 pageJoB AprilAnonymous FnM14a0No ratings yet

- NMB Careers New JuneDocument4 pagesNMB Careers New JuneKambi OfficialNo ratings yet

- Ratio AnalysisDocument8 pagesRatio AnalysisAbdul RehmanNo ratings yet

- Abhishek Kamble, ABH, MumbaiDocument2 pagesAbhishek Kamble, ABH, MumbaiSuneel BhatiaNo ratings yet

- B.V.V. Satya Narayana: Capital and Investment Banking OperationsDocument3 pagesB.V.V. Satya Narayana: Capital and Investment Banking OperationsAnonymous afNbVVPp4No ratings yet

- Research Paper On Credit Appraisal ProcessDocument6 pagesResearch Paper On Credit Appraisal Processgatewivojez3100% (1)

- Certified Credit Research Analyst (CCRA)Document4 pagesCertified Credit Research Analyst (CCRA)Suksham SoodNo ratings yet

- Sanction, Documentation and Disbursement of CreditDocument32 pagesSanction, Documentation and Disbursement of Creditrajin_rammstein100% (1)

- JD - Credit ManagerDocument2 pagesJD - Credit Managersanket patilNo ratings yet

- Internal Control and Compliance Risk and To Compare The Existing Credit Policy of Dhaka Bank LimitedDocument22 pagesInternal Control and Compliance Risk and To Compare The Existing Credit Policy of Dhaka Bank LimitedHafiz IslamNo ratings yet

- Sanaul - CECM 4th - Assignment 1Document6 pagesSanaul - CECM 4th - Assignment 1Sanaul Faisal100% (1)

- Application Format and Notification For Asst. ManagerDocument11 pagesApplication Format and Notification For Asst. Managerumesh bhagatNo ratings yet

- Assistant Manager Manager Small Enterprises Group (SEG) SalesDocument2 pagesAssistant Manager Manager Small Enterprises Group (SEG) Salesmurudkaraditya110No ratings yet

- C R O Notification - ADV3Document9 pagesC R O Notification - ADV3sipuns827No ratings yet

- Join India's International Bank For A Challenging & Progressive CareerDocument4 pagesJoin India's International Bank For A Challenging & Progressive CareerNILANCHALNo ratings yet

- Chapter 5 Credit Management Policy of JBLDocument20 pagesChapter 5 Credit Management Policy of JBLMd. Saiful IslamNo ratings yet

- Credit AppraisalDocument6 pagesCredit AppraisalAnjali Angel ThakurNo ratings yet

- Credit Appraisal For Term Loan And: Working Capital FinancingDocument93 pagesCredit Appraisal For Term Loan And: Working Capital FinancingRohit AggarwalNo ratings yet

- Naukri SandeepNishad (4y 5m)Document2 pagesNaukri SandeepNishad (4y 5m)sandeep nishadNo ratings yet

- Senior Banking Professional With Over 15 Years ExperienceDocument2 pagesSenior Banking Professional With Over 15 Years ExperienceMohannad MagabiNo ratings yet

- C C P S: Lalit KumarDocument3 pagesC C P S: Lalit KumarAbhishek aby5No ratings yet

- Piramal Finance - Job DescriptionDocument9 pagesPiramal Finance - Job DescriptionMAYANKNo ratings yet

- Credit Risk Management - Reading Material For E Learning-FinalDocument19 pagesCredit Risk Management - Reading Material For E Learning-FinalMatthew ButlerNo ratings yet

- Research Paper On Credit Risk ManagementDocument8 pagesResearch Paper On Credit Risk Managementmpymspvkg100% (1)

- Arul Selvam Sanjay CVDocument2 pagesArul Selvam Sanjay CVSathishNo ratings yet

- Mortgage Underwriter Resume Cover LetterDocument5 pagesMortgage Underwriter Resume Cover Letterafdmmavid100% (1)

- Mohannad Ahmed CV 2020ADocument2 pagesMohannad Ahmed CV 2020AMohannad MagabiNo ratings yet

- Credit MonitoringDocument166 pagesCredit Monitoringjananidhanasekaran26No ratings yet

- Harkesh Garg: Assistant ManagerDocument3 pagesHarkesh Garg: Assistant ManagerPriya Rahul KalraNo ratings yet

- Md. Imtiaz Ahmed Nayeem: Contact Work ExperienceDocument3 pagesMd. Imtiaz Ahmed Nayeem: Contact Work ExperienceImtiazNo ratings yet

- Moodys Prodegree EbrochureDocument6 pagesMoodys Prodegree EbrochureJayakumarNo ratings yet

- SeamEx - Guidelines - Jod Description - Credit Manager Sr. Credit ManagerDocument6 pagesSeamEx - Guidelines - Jod Description - Credit Manager Sr. Credit ManagershivamNo ratings yet

- How To Succeed at Bank Financing: Lon TaylorDocument4 pagesHow To Succeed at Bank Financing: Lon TaylorKu Yoon LianNo ratings yet

- Manual SmeDocument636 pagesManual SmeSiddhesh SatputeNo ratings yet

- E-Handbook For CCCsDocument42 pagesE-Handbook For CCCsRahul KumarNo ratings yet

- Credit Appraisal IBDocument48 pagesCredit Appraisal IBHenok mekuriaNo ratings yet

- Mohannad A. Y. Ahmed: S - L C R MDocument2 pagesMohannad A. Y. Ahmed: S - L C R MMohannad MagabiNo ratings yet

- Credit Risk Management and Profitability ThesisDocument6 pagesCredit Risk Management and Profitability ThesisCanIPaySomeoneToWriteMyPaperSingapore100% (2)

- Certified Credit Counsellors For Msmes: A HandbookDocument43 pagesCertified Credit Counsellors For Msmes: A HandbookSekar ThangavelNo ratings yet

- Notification For Appointment As Chief Risk Officer On Contractual BasisDocument8 pagesNotification For Appointment As Chief Risk Officer On Contractual BasisGuda KosalendraNo ratings yet

- Subrato ChakrabortyDocument2 pagesSubrato ChakrabortyJerryd Peter Marian DannyNo ratings yet

- Credit Risk and Underwriting ProdegreeDocument6 pagesCredit Risk and Underwriting ProdegreeDEBABRATA BHUNIANo ratings yet

- Chapter 5 - Credit Evaluation: Content OutlineDocument9 pagesChapter 5 - Credit Evaluation: Content OutlineroseNo ratings yet

- Chuck Nwokocha: Presented byDocument41 pagesChuck Nwokocha: Presented byJan Dave OgatisNo ratings yet

- Detailed Advertisement For Engagement of Product Manager Team LeadDocument11 pagesDetailed Advertisement For Engagement of Product Manager Team LeadMohit PacharNo ratings yet

- SBDC Counselor Certification Manual MODULE 9 - Sources & Requirements For FinancingDocument24 pagesSBDC Counselor Certification Manual MODULE 9 - Sources & Requirements For FinancingHeidiNo ratings yet

- Business Culture of ChineseDocument24 pagesBusiness Culture of ChineseEcaNo ratings yet

- 9 Neuromarketing Examples and StudiesDocument16 pages9 Neuromarketing Examples and StudiesRitika RituNo ratings yet

- Informality and Development: Rafael La Porta and Andrei ShleiferDocument31 pagesInformality and Development: Rafael La Porta and Andrei ShleiferMIRANDA LAURIDO CORDOBANo ratings yet

- HRM Assignment 02Document13 pagesHRM Assignment 02meketedeguale12No ratings yet

- M05 Gitman50803X 14 MF C05Document61 pagesM05 Gitman50803X 14 MF C05layan123456No ratings yet

- Operations & Supply Chain ManagementDocument35 pagesOperations & Supply Chain ManagementAnimesh kumarNo ratings yet

- BS 476-24-1987Document25 pagesBS 476-24-1987Hadi Iz'aanNo ratings yet

- (Sem.-VI) Examination Oct - Nov.-2019 Indian Economy - (NEW)Document2 pages(Sem.-VI) Examination Oct - Nov.-2019 Indian Economy - (NEW)Manoj ValaNo ratings yet

- Spiceland SM 7ech06Document35 pagesSpiceland SM 7ech06mas azizNo ratings yet

- C E G M:: Redit Valuation Rids FOR IcrolendersDocument28 pagesC E G M:: Redit Valuation Rids FOR IcrolendersJoseph AbalosNo ratings yet

- Etextbook 978-1305574793 Cengage Advantage Books: Business Law Today, The Essentials: Text and Summarized CasesDocument62 pagesEtextbook 978-1305574793 Cengage Advantage Books: Business Law Today, The Essentials: Text and Summarized Casesnancy.gravely120100% (35)

- 2015 National Economics Challenge, Semi-Finals Adam Smith, InternationalCurrent Events (Round III) - TestDocument9 pages2015 National Economics Challenge, Semi-Finals Adam Smith, InternationalCurrent Events (Round III) - Test李IRISNo ratings yet

- Calculus A Complete Course Canadian 8th Edition Adams Test BankDocument21 pagesCalculus A Complete Course Canadian 8th Edition Adams Test Banksubbaseweasy0n3r100% (21)

- Kadapa 1Document12 pagesKadapa 1Turumella VasuNo ratings yet

- FILE - 20200312 - 133948 - CESA®antimicro-PPA0425100 - Ver2-Technical Product InformationDocument1 pageFILE - 20200312 - 133948 - CESA®antimicro-PPA0425100 - Ver2-Technical Product InformationPhuong ThaiNo ratings yet

- Accounting ScandalsDocument4 pagesAccounting Scandalsyatz24No ratings yet

- Front Page On Challenges and Prospects of Hotel Industries in IlaroDocument4 pagesFront Page On Challenges and Prospects of Hotel Industries in IlaropeterNo ratings yet

- Bill of Quantity (BOQ) : General Contractor and TradingDocument2 pagesBill of Quantity (BOQ) : General Contractor and TradingApriliaNo ratings yet

- Final Reviewer in TechnopreneurshipDocument18 pagesFinal Reviewer in TechnopreneurshipJanezah Joyce MendozaNo ratings yet

- Monetary Policy Statement October 2020Document2 pagesMonetary Policy Statement October 2020African Centre for Media ExcellenceNo ratings yet

- Swot Analysis of LuxDocument7 pagesSwot Analysis of LuxSourin MukherjeeNo ratings yet

- Banana Chips Customer ServiceDocument3 pagesBanana Chips Customer ServiceJecelmae MacapepeNo ratings yet

- R Transport Corp. vs. PanteDocument3 pagesR Transport Corp. vs. PanteRhea CalabinesNo ratings yet

- Cryptocurrency Project Shreya Maheshwari PDFDocument7 pagesCryptocurrency Project Shreya Maheshwari PDFshreya maheshwariNo ratings yet

- Annex I Contract of Service Between The Dole Regional Office and Tupad WorkersDocument4 pagesAnnex I Contract of Service Between The Dole Regional Office and Tupad WorkersArcelin LabuguinNo ratings yet

- Sales QuotationDocument1 pageSales QuotationTekbahadur SinghNo ratings yet

- Wheel Loader Forklift Thorough Exam ReportDocument2 pagesWheel Loader Forklift Thorough Exam ReportRanjithNo ratings yet

- Analysis of Balancesheet ItlDocument78 pagesAnalysis of Balancesheet Itlnational coursesNo ratings yet

- MIS Report (Shrey Doshi)Document19 pagesMIS Report (Shrey Doshi)Thanks DoshiNo ratings yet

- Corporate Finance Ross 10th Edition Test BankDocument24 pagesCorporate Finance Ross 10th Edition Test BankJonathanThomasobgc100% (25)