Professional Documents

Culture Documents

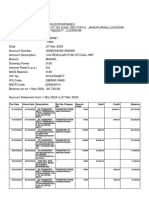

State Bank of India - Ramaipur

Uploaded by

ashutoshbbk786Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

State Bank of India - Ramaipur

Uploaded by

ashutoshbbk786Copyright:

Available Formats

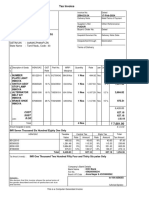

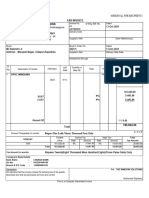

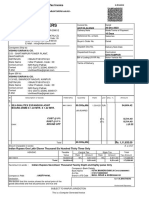

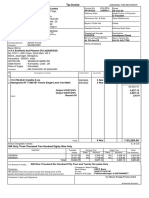

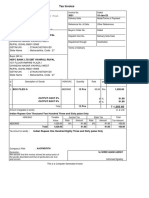

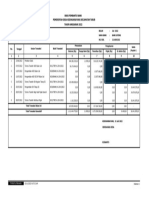

GST Invoice

Shiva Enterprises Invoice No. Dated

3/33, Patrakarpuram (Vinay Khand), SE/4549/2022-23 28-Feb-23

Gomti Nagar, Lucknow- 226010 Delivery Note Mode/Terms of Payment

GSTIN/UIN: 09ACUPY0267D1Z2

State Name : Uttar Pradesh, Code : 09

Reference No. & Date. Other References

Contact : +91-9076500731, +91-9076500748,+91-8127558888

E-Mail : shivaenterprises.head@gmail.com PC/FEB/02, JUTE/FEB/01 dt. 28-Feb-23

Buyer’s Order No. Dated

Consignee (Ship to)

State Bank of India - Ramaipur

Branch Manager Dispatch Doc No. Delivery Note Date

, House No. 1226, Hamirpur Road Ramaipur,

Dist. - Kanpur, Uttar Pradesh - 209214, Ph. No. :

09336069853 Dispatched through Destination

GSTIN/UIN : 09AAACS8577KAZE

State Name : Uttar Pradesh, Code : 09 Terms of Delivery

Buyer (Bill to)

State Bank of India - Ramaipur

Branch Manager

, House No. 1226, Hamirpur Road Ramaipur,

Dist. - Kanpur, Uttar Pradesh - 209214, Ph. No. :

09336069853

GSTIN/UIN : 09AAACS8577KAZE

State Name : Uttar Pradesh, Code : 09

Sl Description of Goods HSN/SAC GST Quantity Rate per Amount

No. Rate

1 Withdrawal Voucher 4802 12 % 1,500 Pcs 0.89 Pcs 1,339.28

2 24X18" Printed Sunboard 3921 18 % 1 Board 1,271.18 Board 1,271.18

2,610.46

Output CGST 6% 6 % 80.36

Output SGST 6% 6 % 80.36

Output CGST 9% 9 % 114.41

Output SGST 9% 9 % 114.41

Total 3,000.00

Amount Chargeable (in words) E. & O.E

Three Thousand Indian Rupees Only

HSN/SAC Taxable Central Tax State Tax Total

Value Rate Amount Rate Amount Tax Amount

4802 1,339.28 6% 80.36 6% 80.36 160.72

3921 1,271.18 9% 114.41 9% 114.41 228.82

Total 2,610.46 194.77 194.77 389.54

Tax Amount (in words) : Three Hundred Eighty Nine Indian Rupees and Fifty Four Only

Company’s PAN : ACUPY0267D

Declaration for Shiva Enterprises

We declare that this invoice shows the actual price of

the goods described and that all particulars are true

and correct. Authorised Signatory

This is a Computer Generated Invoice

You might also like

- Tax Invoice: Gstin/Uin: 24AABCD8132C1Z7 State Name: Gujarat, Code: 24 Place of Supply: GujaratDocument1 pageTax Invoice: Gstin/Uin: 24AABCD8132C1Z7 State Name: Gujarat, Code: 24 Place of Supply: GujaratGaurav ChaudharyNo ratings yet

- Ars International, Bill No. 880, DT., 17.12.2021Document1 pageArs International, Bill No. 880, DT., 17.12.2021Ars InternationalNo ratings yet

- Invoice SHADOWFAXDocument1 pageInvoice SHADOWFAXAinta GaurNo ratings yet

- CubicDocument1 pageCubicSurajmal TansukhraiNo ratings yet

- SV Roofing 2067Document1 pageSV Roofing 2067bikkumalla shivaprasadNo ratings yet

- INR Three Hundred and Seventy Nine Rupees and Five Paise Only Tax Is Payable On Reverse Charge Basis: No E. & O.EDocument1 pageINR Three Hundred and Seventy Nine Rupees and Five Paise Only Tax Is Payable On Reverse Charge Basis: No E. & O.EArnav KalraNo ratings yet

- Assemble 6-8Document1 pageAssemble 6-8ok okNo ratings yet

- B S Technologies - Sky-177-22-23 (30-6-22)Document3 pagesB S Technologies - Sky-177-22-23 (30-6-22)Srikanth GNPNo ratings yet

- 001305012941Document3 pages001305012941RAJEEV MAHESHWARINo ratings yet

- NISM-Series-I: Currency Derivatives Certification ExaminationDocument8 pagesNISM-Series-I: Currency Derivatives Certification Examinationshashank78% (9)

- Circular Flow Model WorksheetDocument2 pagesCircular Flow Model Worksheetapi-320972635No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Bill No. 001Document1 pageBill No. 001vishwajeetNo ratings yet

- GST Tally Invoice Format Final PDFDocument1 pageGST Tally Invoice Format Final PDFSyed Danish FayazNo ratings yet

- A Project On Analysing Lam Coke in MMTCDocument56 pagesA Project On Analysing Lam Coke in MMTCHriday PrasadNo ratings yet

- P4 Chapter 04 Risk Adjusted WACC and Adjusted Present Value PDFDocument45 pagesP4 Chapter 04 Risk Adjusted WACC and Adjusted Present Value PDFasim tariqNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAnjani KumariNo ratings yet

- Bill No - 312 PDFDocument1 pageBill No - 312 PDFas constructionNo ratings yet

- Accounting Voucher DisplayDocument1 pageAccounting Voucher DisplayShubhyansh SinghNo ratings yet

- Bes2022 23143Document1 pageBes2022 23143Yeswanth PaluriNo ratings yet

- S.M. EnterprisesDocument1 pageS.M. EnterprisesPrashanth VishwakarmaNo ratings yet

- Sharma 01Document1 pageSharma 01Surajmal TansukhraiNo ratings yet

- Tax Invoice: Genesco SvsDocument1 pageTax Invoice: Genesco Svsshakir tkNo ratings yet

- Tax Invoice: Tax Amount Amount Rate Amount Rate ValueDocument1 pageTax Invoice: Tax Amount Amount Rate Amount Rate ValueTula rashi videosNo ratings yet

- 2594 Ki Mobility MduDocument1 page2594 Ki Mobility Mduacsstores.maduraiNo ratings yet

- Sales 3742Document1 pageSales 3742momskitchen.storeNo ratings yet

- Tyagi Tyres0Document1 pageTyagi Tyres0ABHISHEK SHARMANo ratings yet

- GST Tally Invoice Format FinalDocument1 pageGST Tally Invoice Format FinalJugaadi BahmanNo ratings yet

- Accounting Voucher - 2019-05-25T131133.745Document1 pageAccounting Voucher - 2019-05-25T131133.745PRIYA G.No ratings yet

- Output CGST 14% Output SGST 14% Round Off Fright Charge: 1 Kit Front SuspensionDocument1 pageOutput CGST 14% Output SGST 14% Round Off Fright Charge: 1 Kit Front SuspensionmadhurNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceROHIT V SHAHNo ratings yet

- 10rajendra JiDocument1 page10rajendra JiBs RaoNo ratings yet

- Mar 16 BillDocument1 pageMar 16 BillanandNo ratings yet

- Accounting Voucher DisplayDocument1 pageAccounting Voucher DisplayAntara IndiaNo ratings yet

- Dec 16 BillDocument1 pageDec 16 BillanandNo ratings yet

- 61 AglinDocument1 page61 AglinShobhna ReddyNo ratings yet

- Tax Invoice: BHAKTI ENTERPRISES - (From 1-Apr-2018Document1 pageTax Invoice: BHAKTI ENTERPRISES - (From 1-Apr-2018Parth DamaNo ratings yet

- DataDocument1 pageDataTimepass MungfuliNo ratings yet

- SRK Drug (CN Feb-24)Document1 pageSRK Drug (CN Feb-24)cyber pointNo ratings yet

- Vishnu Saran & Co. Bill No 5045Document1 pageVishnu Saran & Co. Bill No 5045gopukrishna37No ratings yet

- Bill 2Document1 pageBill 2Naveen SelvaraajuNo ratings yet

- Si Ap 130Document4 pagesSi Ap 130Aman AhlawatNo ratings yet

- Shree Chenaramjee Fancy Electric & Hardware Store: CGST SGSTDocument1 pageShree Chenaramjee Fancy Electric & Hardware Store: CGST SGSTDr. Shashank RkNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoicesce mduNo ratings yet

- Monitor BillDocument1 pageMonitor BillGulf JobsNo ratings yet

- Ae 4197Document1 pageAe 4197omkar sawantNo ratings yet

- Bill P2 872Document3 pagesBill P2 872DATTANA INTERNATIONALNo ratings yet

- Sai Lubricants: BuyerDocument1 pageSai Lubricants: Buyerstamboli9No ratings yet

- TaskDocument1 pageTaskPawan KeswaniNo ratings yet

- Main Chowk Bhilwadi Dist-Sangli State Name:Maharashtra, Code: 27 Place of Supply:MaharashtraDocument1 pageMain Chowk Bhilwadi Dist-Sangli State Name:Maharashtra, Code: 27 Place of Supply:Maharashtrastamboli9No ratings yet

- Tax InvoiceDocument1 pageTax InvoiceᴘᴇᴀᴄᴏᴄᴋNo ratings yet

- 8863 PDFDocument1 page8863 PDFmalar studioNo ratings yet

- KamageriDocument1 pageKamageriashutoshbbk786No ratings yet

- Resume ZubDocument1 pageResume ZubZubair SyedNo ratings yet

- GB TradersDocument1 pageGB TradersgvsairamchennaiNo ratings yet

- Indian Tyres SreDocument1 pageIndian Tyres SreABHISHEK SHARMANo ratings yet

- (Original For Recipient) : INR One Thousand and Seventy Six and Twenty Four Paise OnlyDocument2 pages(Original For Recipient) : INR One Thousand and Seventy Six and Twenty Four Paise OnlyElakya muniNo ratings yet

- RzMrc3RPZUpmeGVUZUU5NnJyaUZTUT09 Seller Tax InvoiceDocument1 pageRzMrc3RPZUpmeGVUZUU5NnJyaUZTUT09 Seller Tax InvoicePratyush kumar NayakNo ratings yet

- 3051 Revised DateDocument1 page3051 Revised DateElla and MiraNo ratings yet

- SV Roofing-13Document1 pageSV Roofing-13bikkumalla shivaprasadNo ratings yet

- GH - 0872Document1 pageGH - 0872ruchiscreation ruchiscreationNo ratings yet

- 600 Food For Thought-PuneDocument1 page600 Food For Thought-PuneRohit Singh RajputNo ratings yet

- GsusDocument1 pageGsusgvsairamchennaiNo ratings yet

- Buyer CPP Angul MO-9437492597 Gstin/Uin: 21AAACN7449M1Z9 State Name: Odisha, Code: 21 Terms of DeliveryDocument1 pageBuyer CPP Angul MO-9437492597 Gstin/Uin: 21AAACN7449M1Z9 State Name: Odisha, Code: 21 Terms of DeliverySanjay GuptaNo ratings yet

- Tax Invoice (Credit)Document3 pagesTax Invoice (Credit)Surajmal TansukhraiNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument78 pagesMobile Services: Your Account Summary This Month'S Chargesashutoshbbk786No ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument14 pagesMobile Services: Your Account Summary This Month'S Chargesashutoshbbk786No ratings yet

- WWGa 7 YANIoejf 6 CHDocument5 pagesWWGa 7 YANIoejf 6 CHashutoshbbk786No ratings yet

- Product ListDocument6 pagesProduct Listashutoshbbk786No ratings yet

- Indian Post Cod FormatDocument1 pageIndian Post Cod Formatashutoshbbk786No ratings yet

- KamageriDocument1 pageKamageriashutoshbbk786No ratings yet

- NC城投转型战略分析 石胜男Document53 pagesNC城投转型战略分析 石胜男zl972098576No ratings yet

- Swot Analysis of AssetsDocument8 pagesSwot Analysis of Assetsshinjan bhattacharyaNo ratings yet

- ProposalDocument14 pagesProposalAMADI EBERECHI CHINYERENo ratings yet

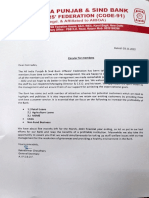

- AIBOA Circular For MembersDocument1 pageAIBOA Circular For Memberskgaurav001No ratings yet

- Buku Pembantu Bank Tahun Anggaran 2022 Pemerintah Desa Kedokansayang Kecamatan TarubDocument1 pageBuku Pembantu Bank Tahun Anggaran 2022 Pemerintah Desa Kedokansayang Kecamatan TarubDanyep IdrisNo ratings yet

- 121 - Stat - 16 Emp PDFDocument4 pages121 - Stat - 16 Emp PDFFarhan AliNo ratings yet

- CV Ips, 2021Document4 pagesCV Ips, 2021अहा मधुमक्खीपालनNo ratings yet

- Aeromexico AMXEES 2022 11 07 HUX-YVR ALLDocument4 pagesAeromexico AMXEES 2022 11 07 HUX-YVR ALLlina perezNo ratings yet

- Giro/Duitnow Transfer Giro/Duitnow Transfer: Successful SuccessfulDocument3 pagesGiro/Duitnow Transfer Giro/Duitnow Transfer: Successful SuccessfulNur IsmiNo ratings yet

- HS1340Document2 pagesHS1340Prarabdha SharmaNo ratings yet

- Indonesia Industrial Nickel StrategyDocument4 pagesIndonesia Industrial Nickel StrategykalenjiindonesiaNo ratings yet

- Price Controls: Hugh RockoffDocument4 pagesPrice Controls: Hugh Rockoffjoseph YattaNo ratings yet

- Chapter 1: Meaning, Characteristics and Rationales of Public EnterprisesDocument80 pagesChapter 1: Meaning, Characteristics and Rationales of Public EnterprisesHabteweld EdluNo ratings yet

- Lecture 8.2 (Capm and Apt)Document30 pagesLecture 8.2 (Capm and Apt)Devyansh GuptaNo ratings yet

- Chap 1 - Portfolio Risk and Return Part1Document91 pagesChap 1 - Portfolio Risk and Return Part1eya feguiriNo ratings yet

- Registration-List-03 07 2023Document44 pagesRegistration-List-03 07 2023Mr.ShalbyNo ratings yet

- Release Position of Public Sector Development Programme Including District Adp and Federal Grants 2022-23Document594 pagesRelease Position of Public Sector Development Programme Including District Adp and Federal Grants 2022-23Atif HidayatullahNo ratings yet

- WBG Form Export Collection Document Covering ScheduleDocument2 pagesWBG Form Export Collection Document Covering Schedulevetrivelrajaselvi100% (1)

- MARCH 23bills TALLY OUTSTANDING RECEIVABLE LIST 06.03.2023Document12 pagesMARCH 23bills TALLY OUTSTANDING RECEIVABLE LIST 06.03.2023radha gNo ratings yet

- Catalogue New Arteor LegrandDocument1 pageCatalogue New Arteor LegrandManh Ha NgoNo ratings yet

- Stock Table WorksheetsDocument3 pagesStock Table WorksheetsKaren MartinezNo ratings yet

- Business CycleDocument26 pagesBusiness CycleNalin08100% (7)

- Accounting Cycle ProblemsDocument3 pagesAccounting Cycle ProblemsCHRISHA PARAGASNo ratings yet

- Africa Worksheet PDFDocument3 pagesAfrica Worksheet PDFSamarthNo ratings yet

- Masonry Level 3 - Learning GuideDocument642 pagesMasonry Level 3 - Learning Guideweston chege100% (1)