Professional Documents

Culture Documents

Adriatic PFS Update - RB2

Uploaded by

ilfadhOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adriatic PFS Update - RB2

Uploaded by

ilfadhCopyright:

Available Formats

Adriatic Metals | Equity Research

15th October 2020

Adriatic Metals GICS Sector Materials

Ticker LON: ADT1

PFS released for the Vares silver project Market cap 14-Oct-20 (£m) 249

Share price 14-Oct-20 (GBp) 127

Positive PFS released

Target price (GBp) 153

Adriatic Metals (ADT) has released solid PFS study results for its polymetallic

Vares project in Bosnia, with an NPV8% of US$1,040m and an exceptional

IRR of 113%1. The PFS highlights numerous other attractive metrics for the

US$1.04

project, with a low upfront capex of US$173m for a 14-year mine life, and short

1.2-year payback period. The expected mine-plan entails throughput of bn

800ktpa, removing a total of 11.1Mt of ore over the project’s life. The Sep’20 PFS NPV for Sector

Vares project

...0.0.0GICS Materials

Resource estimate update and metallurgical domaining of the orebody have

1.2 years

allowed Adriatic to better constrain the technical and cost assumptions for Ticker LN:SOLG

Vares, compared to the 2019 scoping study. Market cap 16-May-18

591.2

(US$m)

Silver now the most valuable metal at Vares Share price 16-May-18

26.52

Expected payback period on US$173m

(GBp)

In our initiation report on Adriatic, published 12 months ago, we described

upfront capex;

Target price 113% IRR

30-Jun-19

Vares as a polymetallic asset, with zinc being the primary metal. However, (GBp)

xx.xx

with the 2020 rally in silver and gold prices, the project is now presented by '000s

AUD

the Company as the Vares Silver Project. In our initiation, silver and gold 3 12

revenue made up respectively 25% and 12% of our total life of mine Vares

revenues. However, with updated spot prices, and the PFS, they now

2.5 10

contribute 31% and 14% respectively, with silver now the most valuable metal

in the Vares commodity mix. In our view, this is a positive, as the market tends

2 8

to give precious metals juniors higher multiples compared to base metal peers.

Other metal products will be zinc, lead, barite, copper and antimony.

1.5 6

Minimal environmental impact with very favourable margin

The PFS results indicate an AgEq production for the life of mine of 137Moz, at 1 4

an average of 15.3Moz AgEq produced per year. On a US$/t milled basis,

revenue is US$296/t, with AISC at US$120/t, implying a revenue-to-cost ratio 0.5 2

of nearly 2.5x. The average annual EBITDA for years 1-5 is US$251m. The

project has minimal environmental impact, with most of the ore sourced from 0 0

the underground Rupice deposit, and about 1/5 sourced via open pit from the

Apr-20

Dec-18

Dec-19

May-19

Mar-19

Feb-20

Jul-20

Oct-18

Jul-19

Oct-19

Sep-20

Veovaca deposit. Adriatic will also make use of partial tailings backfill to lower

their footprint, and will build the majority of plant infrastructure on a

brownfield site. Volume (000's,RHS)

ADT AU Equity

New JORC Reserves supported by Sep’20 Resource upgrade

A larger indicated resource (albeit with slightly lower grades) announced in S&P/ASX300 Met & Min

(rebased)

September underpins the updated Rupice mine plan in the pre-feasibility

study. The new JORC reserve, defined by the economic parameters of today’s H&P Advisory Ltd is a Retained Advisor

PFS is a Probable Reserve of 11.1Mt, comprising 8.4Mt from Rupice and 2.7Mt to Adriatic Metals. The cost of producing

this material has been covered by Adriatic

from Veovaca, with average contained metal grades of 150g/t Ag, 1.28 g/t Au, Metals as part of a contractual

4.22% Zn, 2.67% Pb, 0.43% Cu and 0.19% Sb. The Barite grade (BaSO4) is engagement with H&P; this report should

26.4%. The 8.4Mt reserve at Rupice represents an 88.5% conversion rate from therefore be considered an “acceptable

minor non-monetary benefit” under the

the Sep’20 indicated resource, while the conversion rate on the lower-grade, MiFID II Directive

open-pit resource at Veovaca is ~51%.

H&Pe model to be updated upon in depth review of PFS

Using the PFS metal price assumptions in our model, and an 8% WACC to

match Adriatic’s, we would have reached an NPV of US$1.09bn, marginally

more than the US$1.04bn announced today. The slightly lower PFS NPV

appears to be due to lower reserve grades, which were already apparent from

Roger Bell

Director of Mining Research

the September resource update; other key parameters appear to be broadly in-

line with or better than our expectations. We will now review Adriatic’s PFS in T +44-207-907-8534

E rb@hannam.partners

depth and update our model accordingly. This will allow us to release a full

model update and updated price target in due course. We see scope for

valuation lift following the closure of the acquisition of the Tethyan Serbian Andrei Kroupnik

assets, the final grant of the exploitation permit for Rupice, and from potential Research Analyst

increases in our metal price inputs. T +44-207-907-8534

E Andrei.Kroupnik@hannam.partners

H&P Advisory Ltd

2 Park Street, Mayfair

1 PFS metal price assumptions: Silver: US$24/oz, Gold: US$1,900/oz, Zinc: US$2,500/t, London W1K 2HX

Lead: US$2,000/t, Copper: US$6,500/t, Barites: US$150/t, Antimony: US$6,500/t

Adriatic Metals | Equity Research

15th October 2020

Disclaimer

This Document has been prepared by H&P Advisory Limited (“H&P”). It is protected by international copyright laws and is for the recipient’s use in

connection with considering a potential business relationship with H&P only. This Document and any related materials are confidential and may not be

distributed or reproduced (in whole or in part) in any form without H&P’s prior written permission.

By accepting or accessing this Document or any related materials you agree to be bound by the limitations and conditions set out herein and, in particular, will

be taken to have represented, warranted and undertaken that you have read and agree to comply with the contents of this disclaimer including, without

limitation, the obligation to keep information contained in this Document and any related materials confidential.

This Document does not represent investment research for the purposes of the rules of the Financial Conduct Authority (“FCA Rules”). To the extent it

constitutes a research recommendation, it takes the form of NON-INDEPENDENT research for the purposes of the FCA Rules. As such it constitutes a

MARKETING COMMUNICATION, has not been prepared in accordance with legal requirements designed to promote the independence of investment

research and is not subject to any prohibition on dealing ahead of dissemination of investment research.

The information contained herein does not constitute an offer or solicitation to sell or acquire any security or fund the acquisition of any security by anyone in

any jurisdiction, nor should it be regarded as a contractual document. Under no circumstances should the information provided in this Document or any

other written or oral information made available in connection with it be considered as investment advice, or as a sufficient basis on which to make investment

decisions. This Document is being provided to you for information purposes only.

The distribution of this Document or any information contained in it and any related materials may be restricted by law in certain jurisdictions, and any

person into whose possession this Document or any part of it comes should inform themselves about, and observe, any such restrictions.

The information in this Document does not purport to be comprehensive and has been provided by H&P (and, in certain cases, third party sources) and has

not been independently verified. No reliance may be placed for any purposes whatsoever on the information contained in this Document or related materials

or in the completeness of such information.

The information set out herein and in any related materials reflects prevailing conditions and our views as at this date and is subject to updating, completion,

revision, verification and amendment, and such information may change materially. H&P is under no obligation to provide the recipient with access to any

additional information or to update this Document or any related materials or to correct any inaccuracies in it which may become apparent.

Whilst this Document has been prepared in good faith, neither H&P nor any of its group undertakings, nor any of its or their respective directors, members,

advisers, representatives, officers, agents, consultants or employees makes, or is authorised to make any representation, warranty or undertaking, express or

implied, with respect to the information or opinions contained in it and no responsibility or liability is accepted by any of them as to the accuracy,

completeness or reasonableness of such information or opinions or any other written or oral information made available to any party or its advisers. Without

prejudice to the foregoing, neither H&P nor any of its group undertakings, nor any of its or their respective directors, members, advisers, representatives,

officers, agents, consultants or employees accepts any liability whatsoever for any loss howsoever arising, directly or indirectly, from use of this Document

and/or related materials or their contents or otherwise arising in connection therewith. This Document shall not exclude any liability for, or remedy in respect

of, fraudulent misrepresentation.

All statements of opinion and/or belief contained in this Document and all views expressed and all projections, forecasts or statements regarding future

events or possible future performance represent H&P’s own assessment and interpretation of information available to it as at the date of this Document. This

Document and any related materials may include certain forward-looking statements, beliefs or opinions. By their nature, forward-looking statements involve

risk and uncertainty because they relate to events and depend on circumstances that will occur in the future. There can be no assurance that any of the results

and events contemplated by the forward-looking statements contained in the information can be achieved or will, in fact, occur. No representation is made or

any assurance, undertaking or indemnity given to you that such forward looking statements are correct or that they can be achieved. Past performance cannot

be relied on as a guide to future performance.

This Document is directed at persons having professional experience in matters relating to investments to whom Article 19 of the Financial Services and

Markets Act 2000 (Financial Promotion) Order 2005 ("FPO") applies, or high net worth organisations to whom Article 49 of the FPO applies. The investment

or investment activity to which this communication relates is available only to such persons and other persons to whom this communication may lawfully be

made (“relevant persons”) and will be engaged in only with such persons. This Document must not be acted upon or relied upon by persons who are not

relevant persons.

This Document is not intended for distribution to, or use by any person or entity in any jurisdiction or country where such distribution or use would be

contrary to local law or regulation. In particular, the information contained in this Document is not for publication, release or distribution, and may not be

taken or transmitted into: (i) the United States or its territories or possessions, or distributed, directly or indirectly, in the United States, its territories or

possessions or to any U.S. person as such term is defined in Regulation S of the Securities Act; or (ii) Australia, Canada, Japan, New Zealand or the Republic of

South Africa. Any failure to comply with this restriction may constitute a violation of United States, Canadian, Japanese, New Zealand or South African

securities law. Further, the distribution of this document in other jurisdictions may be restricted by law, and persons into whose possession this Document

comes are required to inform themselves about, and observe, any such restrictions.

H&P may from time to time have a broking, corporate finance advisory or other relationship with a company which is the subject of or referred to in the

Document.

This Document may contain information obtained from third parties, including ratings from credit ratings agencies such as Standard & Poor’s. Reproduction

and distribution of third party content in any form is prohibited except with the prior written permission of the related third party. Third party content

providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are not responsible for any errors

or omission (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. Third party content providers give no

express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use. Third party content

providers shall not be liable for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal

fees or losses (including lost income or profits and opportunity costs or losses caused by negligence) in connection with any use of their content including

ratings. Credit ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address

the suitability of securities or the suitability of securities for investment purposes, and should not be relied on as investment advice.

In H&P’s view this material is considered as “acceptable minor non-monetary benefit” under MiFID II as it is either: (i) “non-substantive short-term market

commentary”; and/or (ii) making a brief reference to existing H&P research and, as such, is in-and-of-itself non-substantive; and/or (iii) paid for by a

corporate issuer or potential corporate issuer as part of a contractual engagement with H&P.

H&P Advisory Ltd is registered in England No.11120795. Registered Office: 2 Park Street, London W1K 2HX. H&P Advisory Ltd is authorised and regulated by

the Financial Conduct Authority (Firm Reference Number 805667).

You might also like

- PayslipDocument1 pagePayslipmallikarjunamargam100% (3)

- Ernie ZerennerDocument261 pagesErnie Zerennerjbiddy789No ratings yet

- The Budget: Roberto A. Biato, Mpa Jail Chief Inspector Deputy Chief, FSO-NHQDocument58 pagesThe Budget: Roberto A. Biato, Mpa Jail Chief Inspector Deputy Chief, FSO-NHQEnrico ReyesNo ratings yet

- 7) Fusion Accounting Hub For Insurance Premium - External SourceDocument18 pages7) Fusion Accounting Hub For Insurance Premium - External Sourcekeerthi_fcmaNo ratings yet

- Ben & JerryDocument4 pagesBen & Jerrydaniel85jungNo ratings yet

- Employee Provident Fund: Presentation OnDocument19 pagesEmployee Provident Fund: Presentation OnTracey MorinNo ratings yet

- Gold enDocument25 pagesGold enjovanny echeverriaNo ratings yet

- Portfolio TheoryDocument78 pagesPortfolio TheoryAmit PrakashNo ratings yet

- Uranium Sector Gets Four Catalysts Are "ESG" Investors Gaining Interest, and Is It Time To Buy?Document7 pagesUranium Sector Gets Four Catalysts Are "ESG" Investors Gaining Interest, and Is It Time To Buy?ZerohedgeNo ratings yet

- The Mining Metallurgical Industry of Greece. Commodity Review For Years 2013 2014Document29 pagesThe Mining Metallurgical Industry of Greece. Commodity Review For Years 2013 2014PETROS TZEFERISNo ratings yet

- RjgoldDocument26 pagesRjgoldSahaj Goel 576643No ratings yet

- 2019-09-16-EOG.v-hannam Partners-Second Discovery De-Risks Development and Further ... - 86211411Document5 pages2019-09-16-EOG.v-hannam Partners-Second Discovery De-Risks Development and Further ... - 86211411Anonymous xAIKZFSomNo ratings yet

- AfriTin 20220426 p2 PEA.02Document4 pagesAfriTin 20220426 p2 PEA.02Rodrigo RodrigoNo ratings yet

- Noble Mining Newsletter Q22018Document22 pagesNoble Mining Newsletter Q22018sNo ratings yet

- AKD Detailed Sep 21 2022Document8 pagesAKD Detailed Sep 21 2022shahjahanabdulrehmanNo ratings yet

- Myb1 2018 Rare EarthsDocument18 pagesMyb1 2018 Rare Earths10evenwoodcloseNo ratings yet

- European Aniline ProductionDocument2 pagesEuropean Aniline ProductionheliselyayNo ratings yet

- The Second Split: Basrah Medium and The Challenge of Iraqi Crude QualityDocument11 pagesThe Second Split: Basrah Medium and The Challenge of Iraqi Crude QualitymghiffariNo ratings yet

- 2018-07-24-Wells Fargo Securiti-The Basin Book Supply vs. Takeaway-82461766 PDFDocument5 pages2018-07-24-Wells Fargo Securiti-The Basin Book Supply vs. Takeaway-82461766 PDFDavid SpilkinNo ratings yet

- Myb3 2017 18 KazakhstanDocument17 pagesMyb3 2017 18 Kazakhstan498104054No ratings yet

- Getting Graphite Prices RightDocument5 pagesGetting Graphite Prices RightMochammad AdamNo ratings yet

- Doc4.Global Emerald Ruby Supply Analysing Market DataDocument23 pagesDoc4.Global Emerald Ruby Supply Analysing Market DataFredy Rios ChaparroNo ratings yet

- Focus ON Catalysts: July 2020Document1 pageFocus ON Catalysts: July 2020Zohaib AhmedNo ratings yet

- MMG Ar 2021 MrorDocument11 pagesMMG Ar 2021 MrorSerginho KabuloNo ratings yet

- Intermodal Report Week 07 2021Document8 pagesIntermodal Report Week 07 2021Akın AKNo ratings yet

- Ponto Corporate-PresentationDocument18 pagesPonto Corporate-PresentationJoshLeighNo ratings yet

- KISI PT Aneka Tambang TBK (ANTM) Steady Gold PricesDocument13 pagesKISI PT Aneka Tambang TBK (ANTM) Steady Gold PricesKacang GorengNo ratings yet

- Copper Market Analysis RFC Ambrian May 2022Document30 pagesCopper Market Analysis RFC Ambrian May 2022qleapNo ratings yet

- GMC Research Aug 2019Document31 pagesGMC Research Aug 2019BUMI ManilapaiNo ratings yet

- Base Metals: Q4 Base Metal Producer PreviewDocument16 pagesBase Metals: Q4 Base Metal Producer PreviewTokkiNo ratings yet

- CormarkResearch - Unlocking Significant Value in The Portfolio - Jul - 13 - 2020 - $1.20Document11 pagesCormarkResearch - Unlocking Significant Value in The Portfolio - Jul - 13 - 2020 - $1.20TFMetalsNo ratings yet

- Report Goldman Sachs PDFDocument31 pagesReport Goldman Sachs PDFJose Luis Puma VenturaNo ratings yet

- BayerDocument29 pagesBayerPrabu KusumaNo ratings yet

- Specialty Minerals and Metals: A Flake's Chance in Cell: Quantifying Graphite DemandDocument68 pagesSpecialty Minerals and Metals: A Flake's Chance in Cell: Quantifying Graphite Demandadam_723172810No ratings yet

- Sociedad Minera Cerro Verde S.A.A.: Verde) Valuation Recommending To Maintain Its Shares Within ADocument12 pagesSociedad Minera Cerro Verde S.A.A.: Verde) Valuation Recommending To Maintain Its Shares Within ABisto MasiloNo ratings yet

- Insight - Cement Sector Update - 07-Apr-22Document4 pagesInsight - Cement Sector Update - 07-Apr-22ShujaatAhmedNo ratings yet

- Metals Despatch No 27Document6 pagesMetals Despatch No 27toppfartNo ratings yet

- Nexa - PR Aripuanã UpdateDocument13 pagesNexa - PR Aripuanã UpdatezparNo ratings yet

- The Beauty of GR LogDocument24 pagesThe Beauty of GR Logmoncef.amine.tamNo ratings yet

- The Beauty of GR LogDocument24 pagesThe Beauty of GR LogArpan BiswasNo ratings yet

- Dri Update May - 2021Document31 pagesDri Update May - 2021Vivek RanganathanNo ratings yet

- Long Term Outlook For Exploration - Richard Schodde - Minex Consulting, July 2013.Document53 pagesLong Term Outlook For Exploration - Richard Schodde - Minex Consulting, July 2013.Glenn ViklundNo ratings yet

- MDKA - 2022 09 05 - JPM Conference PDFDocument40 pagesMDKA - 2022 09 05 - JPM Conference PDFJovi TobingNo ratings yet

- 2014 The Commodity SeesawDocument3 pages2014 The Commodity SeesawzeebsbeezNo ratings yet

- PT Merdeka Copper Gold TBK: Q3 2021 UpdateDocument37 pagesPT Merdeka Copper Gold TBK: Q3 2021 UpdateRichard nicoNo ratings yet

- TH ND: Copper Producer Silver ProducerDocument2 pagesTH ND: Copper Producer Silver ProducerHarold LopezNo ratings yet

- Metals & Mining: Earnings Marred by Weak Domestic Volumes and Higher Share of ExportsDocument11 pagesMetals & Mining: Earnings Marred by Weak Domestic Volumes and Higher Share of ExportswhitenagarNo ratings yet

- BAIINFO Rare Gas Weekly Report On Apr. 13, 2023Document7 pagesBAIINFO Rare Gas Weekly Report On Apr. 13, 2023Nitin KumarNo ratings yet

- Korean Investment & Sekuritas MDKA - Gold Opens All LocksDocument7 pagesKorean Investment & Sekuritas MDKA - Gold Opens All LocksGumilang PrakarsaNo ratings yet

- FCR T P R S: Oral Roject Esource TatementDocument11 pagesFCR T P R S: Oral Roject Esource TatementMutlu ZenginNo ratings yet

- ARCI - The New PlayerDocument4 pagesARCI - The New PlayerjohnNo ratings yet

- Result Review: Marketing Losses Sink EarningsDocument12 pagesResult Review: Marketing Losses Sink EarningsAnuragNo ratings yet

- Exploration For PGE in IndiaDocument22 pagesExploration For PGE in IndiaAravind KumaraveluNo ratings yet

- Consolidated Mineral Resources and Ore Reserves Statement As of 31 December 2021Document19 pagesConsolidated Mineral Resources and Ore Reserves Statement As of 31 December 2021rifqi bambangNo ratings yet

- TotalEnergies 2022 Strategy and Outlook LNG Focus PresentationDocument12 pagesTotalEnergies 2022 Strategy and Outlook LNG Focus Presentationgasra.meetingNo ratings yet

- Freeport Res. 11121 Final CorpDocument29 pagesFreeport Res. 11121 Final CorpResearchtimeNo ratings yet

- Nighthawk Fact Sheet Jan 2017Document2 pagesNighthawk Fact Sheet Jan 2017kaiselkNo ratings yet

- ESS Research ReportDocument21 pagesESS Research ReportHoward QinNo ratings yet

- Gold & Silver Mining Projects in EcuadorDocument25 pagesGold & Silver Mining Projects in EcuadorArthur OppitzNo ratings yet

- All About Pakistan's Oil & Gas Exploration CompaniesDocument13 pagesAll About Pakistan's Oil & Gas Exploration CompaniesFahad HussainNo ratings yet

- Capex - Loma Larga - INV MetalsDocument2 pagesCapex - Loma Larga - INV MetalsEzequiel Guillermo Trejo NavasNo ratings yet

- 01112023125908production 2021Document8 pages01112023125908production 2021Alfred V ChurchillNo ratings yet

- Unlocking The Potential in Madagascar's Natural ResourcesDocument1 pageUnlocking The Potential in Madagascar's Natural Resourcesjulianme77No ratings yet

- Reteam Tracker: A Publication of Oreteam ResearchDocument6 pagesReteam Tracker: A Publication of Oreteam ResearchPrakash DuvvuriNo ratings yet

- Turning A Corner: Investment ArgumentsDocument13 pagesTurning A Corner: Investment ArgumentsDinesh ChoudharyNo ratings yet

- FPX PresentationDocument32 pagesFPX PresentationivokodzNo ratings yet

- Market Research, Global Market for Germanium and Germanium ProductsFrom EverandMarket Research, Global Market for Germanium and Germanium ProductsNo ratings yet

- IRR and NPV Conflict - IllustartionDocument27 pagesIRR and NPV Conflict - IllustartionVaidyanathan RavichandranNo ratings yet

- Blockchain & Crypto Regulation PDFDocument505 pagesBlockchain & Crypto Regulation PDFblueiconus100% (1)

- IL&FS Letter To LIC Chairman 1 Oct 2018Document3 pagesIL&FS Letter To LIC Chairman 1 Oct 2018Moneylife FoundationNo ratings yet

- 1572864484901DgW4fJ7Tpzy3Bqd2 PDFDocument2 pages1572864484901DgW4fJ7Tpzy3Bqd2 PDFVIPIN THAPLIYALNo ratings yet

- Accounting Online Test With AnswersDocument10 pagesAccounting Online Test With AnswersAuroraNo ratings yet

- Deflation DefinitionDocument5 pagesDeflation DefinitionVarshitha K.S.BNo ratings yet

- Implementationworks, IncDocument5 pagesImplementationworks, IncSeanKeithNeriNo ratings yet

- ESENECO 2 Interest Money Time Relationship Rev1Document49 pagesESENECO 2 Interest Money Time Relationship Rev1Irah BonifacioNo ratings yet

- Arm - MF - Final - Sample (From 2016)Document27 pagesArm - MF - Final - Sample (From 2016)甜瓜No ratings yet

- Forex Simle Best Manual Trading System: Nick HolmzDocument4 pagesForex Simle Best Manual Trading System: Nick HolmznickholmzNo ratings yet

- Risk Tolerance and Behavioural FinanceDocument7 pagesRisk Tolerance and Behavioural FinanceSudhanshu RanjanNo ratings yet

- Plagiarism: Issues Found in This Text Score: Unoriginal Text: Matching SourcesDocument6 pagesPlagiarism: Issues Found in This Text Score: Unoriginal Text: Matching SourcesAbhijeet TalwarNo ratings yet

- Unit-1 Cost Accounting and Cost Sheet Choose The Best AnswerDocument14 pagesUnit-1 Cost Accounting and Cost Sheet Choose The Best AnswerDhanu ShriNo ratings yet

- Chapter 5Document20 pagesChapter 5cedNo ratings yet

- Impact of Foreign Direct Investment On Living StandardDocument13 pagesImpact of Foreign Direct Investment On Living StandardNwigwe Promise ChukwuebukaNo ratings yet

- Financial BrochureDocument2 pagesFinancial Brochurefelipe vinces jamaNo ratings yet

- Financial RiskDocument14 pagesFinancial RiskKritikaGuptaNo ratings yet

- Chapter 13: Investing Fundamentals - DONEDocument2 pagesChapter 13: Investing Fundamentals - DONEMichael Fox SerraNo ratings yet

- SBI ProductsDocument6 pagesSBI Productsvinay mouryaNo ratings yet

- Almario Bsa2d At4 Fin2Document4 pagesAlmario Bsa2d At4 Fin2Tracy CamilleNo ratings yet

- FINA01052383 - Tutorial 3 Problem SetDocument5 pagesFINA01052383 - Tutorial 3 Problem SetJunaid Arshad50% (2)

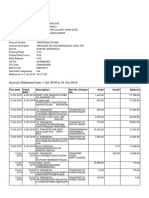

- Laporan Rekening Koran (Account Statement Report) : Balance Remark Debit Reference No Credit Posting DateDocument6 pagesLaporan Rekening Koran (Account Statement Report) : Balance Remark Debit Reference No Credit Posting Datedok wahab siddikNo ratings yet

- 731 Audit IssuesDocument4 pages731 Audit IssuesLCNo ratings yet