Professional Documents

Culture Documents

11.solutions Amalgamation 2022 (Page 255-263) PDF

Uploaded by

rodagab903Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

11.solutions Amalgamation 2022 (Page 255-263) PDF

Uploaded by

rodagab903Copyright:

Available Formats

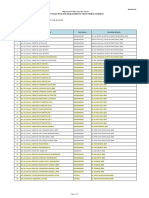

Solutions to Exercises on Amalgamation

Solution 1.

Ledger Accounts in the books of A Ltd.

Realization Account

Date Particulars Rs. Date Particulars Rs.

1.4.2020 To Goodwill A/c 1,30,000 1.4.2020 By Loan from A A/c 1,60,000

1.4.2020 To Machinery A/c 6,40,000 1.4.2020 By Sundry creditors a/c 3,20,000

1.4.2020 To Building A/c 3,40,000 1.4.2020 By 10 % Debentures A/c 4,00,000

1.4.2020 To Stock A/c 2,20,000 1.4.2020 By B Ltd. A/c 12,10,000

1.4.2020 To Debtors A/c 2,60,000 1.4.2020 By Equity Shareholders A/c

1.4.2020 To Bank A/c (debentures) 4,00,000 (Loss on realization) 76,000

1.4.2020 To Bank A/c (Loan of A) 1,60,000

1.4.2020 To Bank A/c(Expenses) 16,000

Total 21,66,000 Total 21,66,000

Bank Account

Date Particulars Rs. Date Particulars Rs.

1.4.2020 To Balance b/d 1,36,000 1.4.2020 By Realization A/c (Loan of A) 1,60,000

1.4.2020 To B Ltd. A/c 6,00,000 1.4.2020 By Realization A/c (Debentures) 4,00,000

1.4.2020 By Realization A/c (Expenses) 16,000

1.4.2020 Equity shareholders’ A/c 1,60,000

Total 7,36,000 Total 7,36,000

Equity Shareholders Account

Date Particulars Rs. Date Particulars Rs.

1.4.2020 To Miscellaneous Expenses A/c 34,000 1.4.2020 By Equity share capital A/c 8,00,000

1.4.2020 To Realization A/c 76,000 1.4.2020 By General Reserve A/c 80,000

1.4.2020 To Equity Shares in B Ltd. A/c 6,10,000

1.4.2020 To Bank A/c 1,60,000

Total 8,80,000 Total 8,80,000

Balance sheet as at 1st April, 2020

Particulars Note No. Rs.

I EQUITY AND LIABILITIES

(1) Shareholders’ funds

(a)Share capital (4,880 equity shares of Rs. 100 each, other than cash) 4,88,000

(b)Reserves and surplus (Securities premium Account = 4,880 X Rs. 25) 1,22,000

Sub-total 6,10,000

(2) Current liabilities

(a)Trade payables (Trade creditors for Rs.3,20,000-Rs. 40,000) 2,80,000

(b)Other current liabilities (Bank overdraft) 6,00,000

Sub-total 8,80,000

Total 14,90,000

II ASSETS

(1) Non-current assets

(a)Fixed assets (Machinery Rs. 5,76,000+Building Rs.3,06,000) 8,82,000

(b)Intangible assets(Goodwill-Rs. 2,16,000+15,000) 2,31,000

Sub-total 11,13,000

(2) Current assets

(a)Inventories (Rs. 2,20,000-Rs. 22,000-Rs. 15,000) 1,83,000

(b)Trade receivables (Trade debtors Rs. 2,60,000-Rs. -26,000-Rs. 40,000) 1,94,000

Sub-total 3,77,000

Total 14,90,000

Note: It is assumed that the company B Ltd. has issued cheque for Rs. 6,00,000 which is in excess of the bank balance

available in the bank account of the company.

Ranker’s Classes Page 255

Working Notes

(i) Computation of consideration for the amalgamation (Net assets basis)

Particulars Rs. Rs.

A. Assets taken over at agreed values

(i)Machinery (Rs.6,40,000-Rs. Rs. 64,000) 5,76,000

(ii)Building (Rs. 3,40,000-Rs. 34,000) 3,06,000

(iii)Stock (Rs. 2,20,000-Rs. 22,000) 1,98,000

(iv)Debtors (Rs. 2,60,000-Rs. 26,000) 2,34,000

(v)Goodwill 2,16,000

Total of assets at agreed values 15,30,000

B. Total liabilities taken over at agreed amount

Trade creditors taken over at carrying amount 3,20,000

C.Net assets being consideration for the amalgamation(A-B) 12,10,000

(ii) Calculation of the form and respective amounts of discharge of consideration for the amalgamation

Particulars From Rs.

(a)Payment by cash Cheque 6,00,000

(b)Payment by issue of shares 4,880 Equity shares in B Ltd.@ of Rs. 100 each at Rs. 125 each 6,10,000

Total 12,10,000

Notes:

(i) The entry to be passed in the books of B Ltd. to reduce the value of stock will be to debit ‘Goodwill A/c’ and credit

‘Stock A/c’ by Rs. 15,000 [i.e. Rs. 25,000-Rs. 10,000 (10 % of Rs. 1,00,000)]. Since the figures for the items related to

B Ltd. are not given in the problem, the Balance Sheet in the books of B Ltd. can be prepared only on the basis of the

assets and liabilities taken over from B Ltd. and other transactions with B Ltd.

(ii) It may be noted that the consideration for the amalgamation as per AS 14is the amount payable only to the

shareholders of the company. As per the instant problem, consideration for the amalgamation is Rs. 12,10,000 which

should be meant for the shareholders only. However, the amount paid to the shareholders is 7,70,000 only (i.e. Rs.

6,10,000 being the equity shares issued by B Ltd. and Rs. 1,60,000 being cash paid to the shareholders out of total

cash Rs. 6,00,000 paid by B Ltd. Thus, the provision of AS 14 in respect of the meaning of consideration for the

amalgamation is violated meaning thereby that the payment made by B Ltd. includes not only the payment made to

the shareholders of A Ltd. but also for other purposes which should never form part of consideration for the

amalgamation. This situation has arisen because of the error in drafting of the problem.

It is possible that the payment made by B Ltd. may not be sufficient for the payment to shareholders of A Ltd. and

hence the balance payment may be made by A Ltd. itself to its shareholders but vice versa as the one in the instant

problem is not possible.

(iii)B Ltd. is paying cash amounting to Rs.6,00,000 to A Ltd. Since it is not given in the problem whether B Ltd. has

cash or not, it is assumed that B Ltd. has overdrawn its bank A/c resulting into Bank overdraft. It can otherwise also

be assumed, e.g. B Ltd. has taken any long-term loan. If it is so assumed that Rs. 6,00,000 (Bank overdraft) will not

appear under ‘Other current liabilities. Rather, it will appear under ‘Long term borrowings’ under ‘Non-current

liabilities’. Another assumption that may be made is that B Ltd. has the share capital of Rs. 6,00,000 and

corresponding cash balance of Rs. 6,00,000 before merger and this cash has been paid by B Ltd. to liquidator of A

Ltd. If this assumption is made then share capital amount will be Rs.10,88,000 (i.e. Rs.4,88,000+Rs.6,00,000).

Ranker’s Classes Page 256

Solution 2.

Journal entries in the books of B Ltd.

Date Particulars L.F. Dr. (Rs.) Cr.(Rs.)

Business Merger A/c Dr. 8,00,000

To Liquidator of B Ltd. A/c 8,00,000

(Being consideration for the amalgamation made due to the

liquidator of B Ltd.)

Building A/c Dr. 4,50,000

Machinery A/c Dr. 3,10,000

Furniture A/c Dr. 1,15,000

Stock A/c Dr. 2,25,000

Trade Debtors A/c Dr. 1,60,000

Bank A/c Dr. 80,000

Capital Loss A/c Dr. 1,00,000

To 10 % Debentures A/c 2,00,000

To Trade Creditors A/c 1,00,000

To Business Merger A/c 8,00,000

To General Reserve A/c 1,80,000

To Statutory Reserve A/c 90,000

To P&L A/c 70,000

(Being the assets and liabilities and all items of reserves and

surplus of B Ltd. recorded at book values and the difference

between consideration and share capital Loss A/c)

General Reserve A/c Dr. 1,00,000

To Capital Loss A/c 1,00,000

(Being capital set off against general reserve)

Liquidator of B Ltd. A/c Dr. 8,00,000

To Equity Share Capital A/c 5,00,000

To 10 % Preference share Capital A/c 2,00,000

To Securities Premium A/c 1,00,000

(Being consideration for the amalgamation paid to the liquidator

of B Ltd. by the issue of 50,000 equity shares of Rs. 10 each at Rs.

12 each and 2,000 10 % preference shares of Rs. 100 each at par)

10 % Debentures A/c Dr. 2,00,000

To 12 % Debentures A/c 2,00,000

(Being 10 % debentures of B ltd. discharged by the issue of 2,000

12 % debentures of Rs. 100 each at par)

General Reserve A/c/P&L A/c Dr. 20,000

To Bank A/c 20,000

(Being winding up expenses of B Ltd. paid)

Working Notes

Computation of consideration for the amalgamation

Payable to Form Calculation Rs.

Equity shareholders Equity shares in A Ltd. 50,000 x Rs.12 6,00,000

Preference shareholders 10 % preference shares in A Ltd. 2,000 x Rs.100 2,00,000

Total 8,00,000

Ranker’s Classes Page 257

Solution 3.

Journal entries in the books of Y Ltd.

Date Particulars L.F. Dr. (Rs.) Cr. (Rs.)

Business Merger A/c Dr. 2,23,000

To Liquidator of X Ltd. A/c 2,23,000

(Being consideration for the amalgamation made due to the

liquidator of X Ltd.)

Building A/c Dr. 1,25,000

Furniture A/c Dr. 67,500

Trademarks A/c Dr. 35,000

Current Investments A/c Dr. 1,00,000

Trade Debtors A/c Dr. 90,000

Bank A/c Dr. 25,000

Capital Loss A/c Dr. 20,500

To 15 % Debentures A/c 1,00,000

To Bank Loan A/c 50,000

To Trade Creditors A/c 75,000

To Accrued Interest on Debentures A/c 15,000

To Business Merger A/c 2,23,000

(Being assets and liabilities of X Ltd. recorded at the carrying

amounts in the books of X Ltd.)

General Reserve A/c Dr. 20,500

To Capital Loss A/c 20,500

(Being capital loss set off against general reserve)

Liquidator of X Ltd. A/c Dr. 2,23,000

To Bank A/c 4,000

To Equity Share Capital A/c 69,000

To 15 % Preference Share Capital A/c 1,00,000

To Securities Premium A/c 50,000

(Being the consideration for the amalgamation discharged)

15 % Debentures A/c Dr. 1,00,000

Accrued Interest on Debentures A/c Dr. 15,000

To Equity Share Capital A/c 1,15,000

(Being the 15 % Debentures and accrued interest thereon

discharged by the issue of equity shares of Rs. 10 each)

Trade Creditors A/c Dr. 75,000

To Bank A/c 37,500

To Equity Share Capital A/c 18,750

To Capital Reserve A/c 18,750

(Being trade creditors discharged by the payment of cash and

issue of equity shares of Rs. 10 each)

Incorporation Cost A/c * Dr. 2,500

To Bank A/c 2,500

(Being the incorporation of Y Ltd. accounted for)

*This will be transferred to Profit and Loss A/c at the end of the year of incorporation.

Ranker’s Classes Page 258

Working Notes

Calculation of consideration for the amalgamation (as per Payment to Shareholders method*)

Payment to Form Calculation Rs.

Equity shareholders (approving) Equity shares in Y Ltd. (23,000/2) x 6 69,000

Equity shareholders (Dissenting) Cash 2,000 x 2 4,000

Preference shareholders 15 % preference shares in Y Ltd. 10,000 x 15 1,50,000

Total 2,23,000

*Since all the forms of payment to shareholders along with their respective amounts are given in the problem, the

consideration is calculated as per this method and not as per Net Assets method.

Solutions to exercises on Internal Reconstruction

Solution 1.

Journal entries in the books of X Ltd.

Date Particulars L.F. Dr. (Rs.) Cr.(Rs.)

Equity Share Final Call A/c Dr. 8,00,000

To Equity Share Capital A/c 8,00,000

(Being final call made due on 20,000 equity shares @ Rs.40 each)

Bank A/c Dr. 8,00,000

To Equity Share Final Call A/c 8,00,000

(Being final call money received on 20,000 equity shares)

Equity Share Capital (Rs. 100 each) A/c Dr. 20,00,000

To Equity Share Capital (Rs. 20 each) A/c 4,00,000

To Reconstruction A/c 16,00,000

(Being 20,000 equity shares of Rs. 100 each converted into the same number of

equity shares of Rs. 20 each)

10 % first Debentures A/c Dr. 4,00,000

To 13.5 % Debentures A/c 4,00,000

(Being the debenture holders holding 4,000, 10 % debentures of Rs. 100 each

discharged by the issue of 4,000, 13.5% debentures of Rs. 100 each)

12 % Second Debentures A/c Dr. 10,00,000

To 15 % Debentures A/c 8,00,000

To Reconstruction A/c 2,00,000

(Being the debenture holders holding 10,000, 12 % second debentures of Rs. 100

each discharged by the issue of 8000, 15 % debentures of Rs. 100 each)

Trade Creditors A/c Dr.

To Equity Share Capital A/c 23,00,000

To Bank A/c 6,00,000

To Reconstruction A/c 6,00,000

(Being Mr. Y, one of the trade creditors, paid 6,00,000 in full settlement of Rs. 11,00,000

17,00,000 and the balance trade creditors discharged by the issue of 30,000

equity shares of Rs. 20 each)

Outstanding Interest on Debentures A/c* Dr. 1,60,000

To Reconstruction A/c 1,60,000

(Being the balance in Outstanding Interest on Debentures A/c transferred to

Reconstruction A/c)

Reconstruction A/c Dr. 30,60,000

To Profit and Loss A/c 20,00,000

To Underwriting Commission A/c 40,000

To Property, Plant and Equipment A/c 10,20,000

(Being the fictitious assets fully written off and by the balance in Reconstruction

A/c, fixed assets amount brought down)

*Outstanding Interest on debentures after discharge of debenture holders fully is a liability not required to be paid

and hence is transferred to Reconstruction A/c.

**Market value of investment being Rs. 40,000 is not to be accounted for. It is simply for the sake of disclosure of

additional information as per schedule III.

Ranker’s Classes Page 259

Working Notes:

(i) Since the balance sheet of the company has not been given in a complete form, the same as at 31st March, 2020

may be prepared as under:

Particulars Note No. Rs.

I EQUITY AND LIABILITIES

(1) Shareholders ‘funds

(a)Share capital

Equity Share Capital (60 % Paid up) 12,00,000

(b)Reserves and surplus

Surplus i.e. Balance in Statement of Profit and Loss (20,00,000)

Sub-total (8,00,000)

(2) Non-current liabilities

Long term borrowings

(i)10 % first debentures 4,00,000

(ii)12 % second debentures 10,00,000

Sub-total 14,00,000

(3) Current liabilities

(a)Trade payables

Trade creditors (including Y for Rs. 17,00,000) 23,00,000

(b)Other current liabilities 1,00,000

(i) Bank overdraft

(ii) Outstanding interest on debentures for one year 1,60,000

Sub-total 25,60,000

Total 31,60,000

II ASSETS

(1) Non-current assets

(a)Fixed assets 14,00,000

(b)Non-current investments

Investments (Market value Rs. 40,000) 20,000

(c)Other non-current assets (Underwriting commission) 40,000

Sub-total 14,60,000

(2) Current assets

(a)Inventories(Stock) 7,80,000

(b)Trade receivables (Trade debtors) 9,20,000

Sub-total 17,00,000

Total 31,60,000

(ii) Reconstruction Account

Particulars (Rs.) Particulars (Rs.)

To Profit and Loss A/c 20,00,000 By Equity Share Capital A/c 16,00,000

To Preliminary Expenditure A/c 40,000 By 12 % Second Debentures A/c 2,00,000

To Fixed Assets A/c (Bal. fig.) 10,20,000 By Trade Creditors A/c 11,00,000

By Outstanding Interest on Debentures A/c 1,60,000

Total 30,60,000 Total 30,60,000

Solution 2.

Journal entries in the books of Downhill Ltd.

Date Particulars L.F. Dr.(Rs.) Cr.(Rs.)

Equity Share capital (Rs. 100 each) A/c Dr. 20,00,000

To Equity share capital (Rs. 5 each) A/c 1,00,000

To Reconstruction A/c 19,00,000

(Being 20,000 equity shares of Rs. 100 each reduced to Rs. 5 each)

Equity Share Capital (Rs. 5 each) A/c Dr. 1,00,000

To Equity Share Capital (Rs. 10 each) A/c 1,00,000

(Being 20,000 equity shares of Rs.5 each consolidated into 10,000

equity shares of Rs.10 each)

Outstanding Debenture Interest A/c Dr. 1,20,000

To Reconstruction A/c 1,20,000

(Being outstanding debenture interest waived by the debenture

Ranker’s Classes Page 260

holders)

12 % Debentures A/c Dr. 5,00,000

To 14 % Debentures A/c 5,00,000

(Being 12 % debentures converted into 14 % debentures)

Bank A/c Dr. 5,00,000

To Equity Share Application A/c 5,00,000

(Being application money received for 50,000 equity shares @ Rs.

10 each)

Equity share Application A/c Dr. 5,00,000

To Equity Share Capital A/c 5,00,000

(Being 50,000 equity shares of Rs. 10 each allotted at par)

Trade Creditors A/c Dr. 3,00,000

To Equity Share Capital A/c 2,00,000

To Bank A/c 50,000

To Reconstruction A/c 50,000

(Being creditors of Rs. 2,00,000 issued 20,000 equity shares of Rs.

10 each at par and the balance of creditors paid 50 % cash)

Land and Building A/c Dr. 75,000

To Reconstruction A/c 75,000

(Being land and building revalued upwardly)

Profit Prior to Incorporation A/c Dr. 25,000

To Reconstruction A/c 25,000

(Being the balance in Profit Prior to Reconstruction A/c transferred

to Reconstruction A/c)

Reconstruction A/c Dr. 21,70,000

To Discount on issue of Debentures A/c 20,000

To Profit and Loss A/c 19,80,000

To Plant and Machinery A/c 1,15,000

To Provision for Doubtful Debts A/c 5,000

To Goodwill A/c 50,000

(Being the balance in Reconstruction A/c collected from various

sources used to eliminate losses and assets and the remaining

amount transferred to Capital Reserve A/c)

Balance Sheet after Reconstruction as at 31.3.2020

Particulars Note No. Rs.

I EQUITY AND LIABILITIES

(1) Shareholders’ funds

Share capital(including 20000 for non-cash consideration) 8,00,000

(2) Non-current liabilities

Long term borrowings(Debentures 5,00,000 + Bank Loan 55,000) 5,55,000

Total 13,55,000

II ASSETS

(1) Non-current assets

Fixed assets

Tangible assets 1 4,90,000

(2) Current assets

(a)Inventories (Stock) 3,50,000

(b) Trade receivables (Trade debtors) 60,000-5000 55,000

(c)Cash and cash equivalents 2 4,60,000

Sub-total 8,65,000

Total 13,55,000

Notes to Accounts (Amount in Rs.)

1. Tangible assets

Land and building 2,25,000

Plant and machinery 1,85,000

Furniture 80,000

Total 4,90,000

Ranker’s Classes Page 261

2. Cash and cash equivalents

Opening bank balance 10,000

Add: Receipt from issue of 50,000 equity shares to directors 5,00,000

Less: payment to creditors (50,000)

Balance 4,60,000

Working Notes

Reconstruction A/c

Particulars Rs. Particulars Rs.

To Discount on Issue of Debentures A/c 20,000 By Equity share capital A/c 19,00,000

To Profit and Loss A/c 19,80,000 By Outstanding Debenture Interest A/c 1,20,000

To Plant and Machinery A/c 1,15,000 By Trade Creditors A/c 50,000

To Provision for Doubtful Debts A/c 5,000 By Land and Building A/c 75,000

To Goodwill A/c 50,000

Total 21,45,000 Total 21,45,000

Solution: 3.

Journal entries in the books of X Ltd.

Date Particulars L.F. Dr.(Rs.) Cr.(Rs.)

(a)(i) 7 % Cum. Pref. Share Capital (Rs. 100 each) A/c Dr. 5,00,000

To 7 % Cum. Preference share Capital (Rs. 80 each) A/c 4,00,000

To Reconstruction A/c 1,00,000

(Being 5,000 7 % pref shares of Rs. 100 each fully paid reduced

to 5,000 7 % preference shares of Rs. 80 each fully paid)

(a)(ii) Equity Share Capital (Rs. 10 each) A/c Dr. 10,00,00

To Equity Share Capital (Rs. 2.50 each) A/c 0 2,50,000

To Reconstruction A/c 7,50,000

(Being 1,00,000 equity shares of Rs. 10 each fully paid reduced

to 1,00,000 equity shares of Rs. 2.50 each)

(b) Reconstruction A/c Dr.

To Goodwill A/c 1,25,000 75,000

To Patents A/c 50,000

(Being intangible assets written off)

(c) Reconstruction A/c Dr.

To Stock A/c 80,000 50,000

To Debtors A/c 30,000

(Being the value of stock reduced and debtors considered

doubtful written off)

(d) Reconstruction A/c Dr.

To Equity Share Capital A/c 7,000 7,000

(Being 2,800 equity shares of Rs. 2.50 each issued as fully paid

up for the half of the arrears of pref. dividend)

(e)(i) Land and Buildings A/c Dr.

To Reconstruction A/c 70,000 70,000

(Being the increase in the value of land and building accounted

for)

(e)(ii) 7 % Debentures A/c Dr.

To Debenture holders A/c 2,50,000 2,50,000

(Being 7 % debentures made due to the debenture holders)

(e)(iii) Debenture holders A/c Dr.

To Land and Building A/c 2,50,000 2,50,000

(Being debenture holders discharged by handing over land and

building)

(e)(iv) Interest Payable to Debenture holders A/c Dr.

To 7 % Debentures A/c 17,500 17,500

Ranker’s Classes Page 262

(Being 7 % debentures issued for the interest payable to

debenture holders)

(e) (v) Bank A/c Dr.

To Debenture Application A/c 1,50,000 1,50,000

(Being application money received for the issue of 7 %

debentures)

(e)(vi) Debenture Application A/c Dr.

To 7 % Debentures A/c 1,50,000 1,50,000

(Being 7 % debentures issued to the debenture holders in lieu

of additional cash received)

(f) (i) Bank A/c Dr.

To Reconstruction A/c 40,000 40,000

(Being Rs. 40,000 recovered from the person responsible for

damage as a result of conversion of dispute for damages into

actual liability)

(f) (ii) Reconstruction A/c Dr.

To Bank 50,000 40,000

To Equity Share Capital A/c 10,000

(Being the materialization of contingent liability into actual

liability for damages settled by partial cash and the balance by

the issue of 4,000 equity shares of Rs. 2.50 each)

(g) Loan from Director A/c Dr.

To Equity Share Capital A/c 1,00,000 1,00,000

(Being the directors ’loan converted into 40,000 equity shares

of Rs. 2.50 each)

Reconstruction A/c Dr.

To Profit and Loss A/c 6,98,000 5,70,000

To Capital Reserve A/c 1,28,000

(Being the balance in Reconstruction A/c after all uses thereof

transferred to Capital Reserve A/c)

Reconstruction Account

Date Particulars Rs. Date Particulars Rs.

To Goodwill A/c 75,000 By 7 % Pref. Share Capital A/c 1,00,000

To Patents A/c 50,000 By Equity Share Capital A/c 7,50,000

To Stock A/c 50,000 By Land and Buildings A/c 70,000

To Debtors A/c 30,000 By Bank A/c 40,000

To Equity Share Capital A/c 7,000

To Bank A/c 40,000

To Equity Share Capital A/c 10,000

To Profit and Loss A/c 5,70,000

To Capital Reserve A/c 1,28,000

Total 9,60,000 Total 9,60,000

Working Notes: Computation of the number and amount of equity shares to be issued for the arrears of

preference dividend

Particulars Calculation No. of equity Rs.

shares

Arrears of preference dividend - - 14,000

Half of the arrears of dividend waived off Rs. 14,000/2 7,000

Balance of arrears of pref. dividend Rs. 14,000-Rs. 7,000 - 7,000

Nominal value per equity share - - 2.50

Number of equity shares to be issued Rs. 7,000/Rs.2.50 2,800 -

Ranker’s Classes Page 263

You might also like

- Cash Flow Statement Problems PDFDocument32 pagesCash Flow Statement Problems PDFnsrivastav180% (30)

- Accounting For Managers Acf1200 Extensive Notes HDDocument70 pagesAccounting For Managers Acf1200 Extensive Notes HDIshan MalakarNo ratings yet

- Securities-Regulations-Code Activity QuizDocument3 pagesSecurities-Regulations-Code Activity QuizCarl Joshua MontenegroNo ratings yet

- Accounting AssignmentDocument2 pagesAccounting Assignmentsadif sayeed100% (2)

- AccorDocument11 pagesAccorPooja Kumari Deo50% (2)

- Accountancy Assignment Grade 12Document4 pagesAccountancy Assignment Grade 12sharu SKNo ratings yet

- Case28notes 000Document6 pagesCase28notes 000Refger RgwseNo ratings yet

- Assigned CasesDocument12 pagesAssigned CasesRyan Anthony100% (1)

- Cash Flow Statement - 2Document9 pagesCash Flow Statement - 2Midhun PerozhiNo ratings yet

- IPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDocument6 pagesIPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDrShailesh Singh ThakurNo ratings yet

- 232 FM AssignmentDocument17 pages232 FM Assignmentbhupesh joshiNo ratings yet

- EXERCISE Cashflow of The CompanyDocument41 pagesEXERCISE Cashflow of The CompanyDev lakhaniNo ratings yet

- 12 DRT AccDocument2 pages12 DRT AccDeeran DhayanithiRPNo ratings yet

- Incomplete RecordsDocument32 pagesIncomplete RecordsSunil KumarNo ratings yet

- First Model Test Paper Part - B Time: 40 Minutes Accountancy M.M. 20Document2 pagesFirst Model Test Paper Part - B Time: 40 Minutes Accountancy M.M. 20surbhi singhalNo ratings yet

- Particulars Note No. 31 Mar, 2020 31 Mar, 2019: ST STDocument5 pagesParticulars Note No. 31 Mar, 2020 31 Mar, 2019: ST STAmit sinhaNo ratings yet

- Accounts AIP FINALDocument14 pagesAccounts AIP FINALManthanNo ratings yet

- Class 12 Accountancy CBSE Cash Flow StatementDocument7 pagesClass 12 Accountancy CBSE Cash Flow StatementSarvesh SreedharNo ratings yet

- Corporate Accounting ProblemDocument6 pagesCorporate Accounting ProblemparameshwaraNo ratings yet

- RTP Dec 18 AnsDocument36 pagesRTP Dec 18 AnsbinuNo ratings yet

- Previous Year Question Paper (FSA)Document16 pagesPrevious Year Question Paper (FSA)Alisha ShawNo ratings yet

- Financial AccountingDocument19 pagesFinancial AccountingObed AsamoahNo ratings yet

- F M ADocument11 pagesF M AAjay SahooNo ratings yet

- Assignment For AccountancyDocument3 pagesAssignment For AccountancyKamlesh PandeyNo ratings yet

- Management Accouting Assignment4 Manish Chauhan (09-1128) .Document17 pagesManagement Accouting Assignment4 Manish Chauhan (09-1128) .manishNo ratings yet

- PT 06 (Partnership) (5 Dec)Document8 pagesPT 06 (Partnership) (5 Dec)Rajesh Kumar100% (2)

- Cash Flow Statement Activity Wise 05-02-24Document7 pagesCash Flow Statement Activity Wise 05-02-24navyabindra28No ratings yet

- Admission of A Partner PDFDocument8 pagesAdmission of A Partner PDFSpandan DasNo ratings yet

- Accounts DDocument13 pagesAccounts DRahit MitraNo ratings yet

- Accounts CH 6 Cash FlowDocument11 pagesAccounts CH 6 Cash Flowapsonline8585No ratings yet

- Proposed DividebdDocument34 pagesProposed DividebdPiyush SrivastavaNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced AccountingDocument97 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced AccountingSujit DasNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- CA Foundation MTP 2020 Paper 1 AnsDocument9 pagesCA Foundation MTP 2020 Paper 1 AnsSaurabh Kumar MauryaNo ratings yet

- 12 Accounts Imp ch10 PDFDocument14 pages12 Accounts Imp ch10 PDFmukesh kumarNo ratings yet

- Adobe Scan 05 Mar 2022Document5 pagesAdobe Scan 05 Mar 2022Titiksha Joshi100% (1)

- MTP May20 ADocument9 pagesMTP May20 Aomkar sawantNo ratings yet

- Partnership - Admission of Partner - DPP 05 (Of Lecture 07) - (Kautilya)Document8 pagesPartnership - Admission of Partner - DPP 05 (Of Lecture 07) - (Kautilya)DevanshuNo ratings yet

- PART-B Analysis Test YtDocument8 pagesPART-B Analysis Test YtRiddhi GuptaNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghNo ratings yet

- WORKSHEET - 5 On CFSDocument6 pagesWORKSHEET - 5 On CFSNavya KhemkaNo ratings yet

- Practice Paper SET A1Document3 pagesPractice Paper SET A1Aaditi VNo ratings yet

- Test 5 Solutions AccountsDocument9 pagesTest 5 Solutions AccountsVijayasri KumaravelNo ratings yet

- FINMAN MIDTERMS FinalDocument5 pagesFINMAN MIDTERMS FinalJennifer RasonabeNo ratings yet

- DocumentDocument4 pagesDocumentTûshar ThakúrNo ratings yet

- Acc Practical QuestionsDocument6 pagesAcc Practical QuestionsyogochkeNo ratings yet

- Accountancy Board Practical Paper - 2020-2021 Class - Xii Time: 1 Hour Max. Marks: 12Document3 pagesAccountancy Board Practical Paper - 2020-2021 Class - Xii Time: 1 Hour Max. Marks: 12Kairav KhuranaNo ratings yet

- Introduction To Accounting: Page 1 of 6Document6 pagesIntroduction To Accounting: Page 1 of 6Hareem AbbasiNo ratings yet

- Vertical Financial StatementsDocument3 pagesVertical Financial StatementsMANAN MEHTANo ratings yet

- Partner Ship - IIDocument6 pagesPartner Ship - IIM JEEVARATHNAM NAIDUNo ratings yet

- Accounting For Holding Co. (Lecture 3) : Total 12,00,000 6,00,000Document6 pagesAccounting For Holding Co. (Lecture 3) : Total 12,00,000 6,00,000Michael JimNo ratings yet

- P6 June 2023 SY23Document5 pagesP6 June 2023 SY23Shivam GuptaNo ratings yet

- Decemeber 2020 Examinations: Suggested Answers ToDocument41 pagesDecemeber 2020 Examinations: Suggested Answers ToDipen AdhikariNo ratings yet

- Cash Flow Statement Numericals QDocument3 pagesCash Flow Statement Numericals QDheeraj BholaNo ratings yet

- Additional Questions 5Document13 pagesAdditional Questions 5Sanjay SiddharthNo ratings yet

- Master of Business Administration (M.B.A.) Semester-I (C.B.C.S.) Examination Accounting For Managers Compulsory Paper-3Document4 pagesMaster of Business Administration (M.B.A.) Semester-I (C.B.C.S.) Examination Accounting For Managers Compulsory Paper-3Namrata RamgadeNo ratings yet

- Screenshot 2023-09-20 at 11.30.51 AMDocument1 pageScreenshot 2023-09-20 at 11.30.51 AMprince bhatiaNo ratings yet

- Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Document4 pagesAnswer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Harish KapoorNo ratings yet

- Financial Mangement-Midterm ExamDocument12 pagesFinancial Mangement-Midterm ExamChaeminNo ratings yet

- Answers To NavneetDocument12 pagesAnswers To NavneetPawan TalrejaNo ratings yet

- Practice Question Paper - Financial AccountingDocument6 pagesPractice Question Paper - Financial AccountingNaomi SaldanhaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Ramco Cement Limited: Insight Into Their Marketing AnalyticsDocument14 pagesRamco Cement Limited: Insight Into Their Marketing Analyticsnishant1984No ratings yet

- 11 Accountancy English 2020 21Document376 pages11 Accountancy English 2020 21Tanishq Bindal100% (1)

- Stellarleack Business PlanDocument14 pagesStellarleack Business Planleackyotieno4No ratings yet

- Nedbank Case StudyDocument14 pagesNedbank Case Studyambuj joshiNo ratings yet

- Waste Management in PDO Ahmed Al-Sabahi - CSM/25 Corporate Environmental AdvisorDocument22 pagesWaste Management in PDO Ahmed Al-Sabahi - CSM/25 Corporate Environmental AdvisorMojtaba TahaNo ratings yet

- Course Summary: Sales To Customers Via Internet Requirements Planning and Warehouse Deliveries Warehouse ReturnsDocument7 pagesCourse Summary: Sales To Customers Via Internet Requirements Planning and Warehouse Deliveries Warehouse ReturnsMario Alberto Garcia AlcazarNo ratings yet

- CH - 02 7-5-11Document42 pagesCH - 02 7-5-11Myla GellicaNo ratings yet

- List of Vacant Posts (Civil Wing) Available For Choice Filling by CandidatesDocument5 pagesList of Vacant Posts (Civil Wing) Available For Choice Filling by CandidatesPreetam SundarayNo ratings yet

- SAP WMS User Requirements Gathering Questionnaire 3Document3 pagesSAP WMS User Requirements Gathering Questionnaire 3Anil Kumar100% (1)

- 2 Sales of Goods and ServicesDocument37 pages2 Sales of Goods and ServicesMobile LegendsNo ratings yet

- Guru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GDocument6 pagesGuru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GSAURABH JAINNo ratings yet

- Succession Assignment CompleteDocument5 pagesSuccession Assignment Completechan marxNo ratings yet

- Topic 3 - Tutorial Question - Contract - Part - ADocument2 pagesTopic 3 - Tutorial Question - Contract - Part - AYuenNo ratings yet

- Video Scripts Unit 1-4Document8 pagesVideo Scripts Unit 1-4rikuto dokkyoNo ratings yet

- PAS 40 - Investment Property-1Document13 pagesPAS 40 - Investment Property-1Krizzia DizonNo ratings yet

- Prestige Private LimitedDocument28 pagesPrestige Private Limitedlery.aryNo ratings yet

- De Boer-Hekkert-and-Woolthuis PDFDocument40 pagesDe Boer-Hekkert-and-Woolthuis PDFAdriana BernalNo ratings yet

- Case IDocument3 pagesCase IYatharth Shukla100% (1)

- Club of Rome Sustainable DevelopmentDocument8 pagesClub of Rome Sustainable Developmentnortherndisclosure100% (1)

- ?return & Exchanges - 7eleven-ShopDocument5 pages?return & Exchanges - 7eleven-ShopVikas GuptaNo ratings yet

- 2 Cadbury Ratio AnalysisDocument7 pages2 Cadbury Ratio AnalysisMiconNo ratings yet

- trắc nghiệm quản trị kênh phân phốiDocument14 pagestrắc nghiệm quản trị kênh phân phốiVinh HuỳnhNo ratings yet

- Process View of Supply ChainDocument4 pagesProcess View of Supply ChainArchana Tiwari100% (1)

- Buscom Midterm PDF FreeDocument29 pagesBuscom Midterm PDF FreeheyNo ratings yet

- Amul Ice CreamDocument48 pagesAmul Ice CreamNitin Keniya100% (1)