Professional Documents

Culture Documents

9 6

Uploaded by

celson carel0 ratings0% found this document useful (0 votes)

5 views1 pageOriginal Title

9-6

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 page9 6

Uploaded by

celson carelCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

0

0

Statement of Business Operations

For the Year Ended December 31, ____

Notes and Instructions:

1) Premiums Collected During the Year - the consideration received by the brokers from the insured (policy holders) as payments for the insurance afforded by the insurers.

2) Premiums Remitted During the Year - the consideration transmitted by the brokers to the insurers as payments made for the insurance afforded to the insured.

3) Commissions Received During the Year - the consideration given for the direct business solicited by the brokers

4) Premiums Collected during the year should equal to Premiums Remitted during the year + Commissions received during the year

5) Premiums Receivables at the end of the year should equal to Premiums Payable at the end of the year + Commissions Receivables at the end of the year.

6) For purposes of Statement of Business Operations: Premiums Receivable is equal to Premiums Payable per Audited Finance Statements.

7) Premiums Receivables reported in the Audited Financial Statements are receivables from clients and were not yet reported in this statement.

8) Premiums Reported should be Gross of Tax

9) Premums and/or Commissions earned during the year should tally per Audited Financial Statement, reconcilliation will be provided in case of discrepancies (page 4)

10) * Includes Fidelity and Surety

11) ** If Miscellaneous is more than 5% of the total business, please indicate breakdown on the Miscellaneous section

12) ***Business offered by Health Maintenance Organizations only

Premiums Remittances Commissions

Lines of Business

Collected During the Year Receivables, End Receivables, Beg Produced for the Year Remitted During the Year Payables, End Payables, Beg Remittances For the Year Received During the Year Receivables, End Receivables, Beg Earned For the Year

1. Life - - -

2. Fire - - -

3. Marine Cargo - - -

4. Marine Hull - - -

5. Aviation - - -

6. Motor Car - - -

7. Health - - -

8. Accident - - -

9. Engineering - - -

10. Insurance for Migrant Workers - - -

11. Micro-Insurance - - -

12. Bonds * - - -

13. General Liability - - -

14. Prof. Indemnity - - -

15. Crime Insurance - - -

16. Special Risks - - -

17. Miscellaneous ** - - -

18. HMO*** - - -

TOTAL - - - - - - - - - - - -

Breakdown of Miscellaneous Lines

Premiums Remittances Commissions

Lines of Business

Collected During the Year Receivables, End Receivables, Beg Produced for the Year Remitted During the Year Payables, End Payables, Beg Remittances For the Year Received During the Year Receivables, End Receivables, Beg Earned For the Year

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

TOTAL MISCELLANEOUS - - - - - - - - - - - -

You might also like

- URC-Branded Consumer Foods Group Expense ReportDocument2 pagesURC-Branded Consumer Foods Group Expense ReportNics GozunNo ratings yet

- Next You Fill in Expense Category and The Totals For Each Category To Complete Your BudgetDocument11 pagesNext You Fill in Expense Category and The Totals For Each Category To Complete Your BudgetAhaisibwe GeofreyNo ratings yet

- Company Profile. ThinkBIG 2021 - CompressedDocument20 pagesCompany Profile. ThinkBIG 2021 - CompressedCarmen IbrahimNo ratings yet

- Notice GPL Gpu VeluxDocument16 pagesNotice GPL Gpu VeluxrobineausylNo ratings yet

- PT Sicamindo Balaraja Indonesia: Earthwire Tension Set For Earthwire As 55Document1 pagePT Sicamindo Balaraja Indonesia: Earthwire Tension Set For Earthwire As 55Oktovianus TeguhNo ratings yet

- Bain Wet Shave CoDocument13 pagesBain Wet Shave CoJohn ChaoNo ratings yet

- Flea Market Site MapDocument1 pageFlea Market Site MapwapellofleamarketNo ratings yet

- Annual Budget Forecast TemplateDocument2 pagesAnnual Budget Forecast Templaterowena balaguerNo ratings yet

- UN Forklift Diesel SpecDocument12 pagesUN Forklift Diesel SpecОлег Складремонт100% (1)

- Cashflow Analysis BreakdownDocument5 pagesCashflow Analysis BreakdownRommel A. RosalesNo ratings yet

- Daily Cash Position and Sales ReportDocument53 pagesDaily Cash Position and Sales ReportDiana Rose OrlinaNo ratings yet

- TPP of HEP PDFDocument39 pagesTPP of HEP PDFNayeem HossainNo ratings yet

- TotalDocument1 pageTotalRa ChelNo ratings yet

- Cost Tracker for Project ABCDocument13 pagesCost Tracker for Project ABCpratik ghavateNo ratings yet

- Corporation TaxesDocument64 pagesCorporation Taxesf7vertexlearningsolutionsNo ratings yet

- 18 6 Complete Tech ManualsDocument71 pages18 6 Complete Tech ManualsIgor BelchiorNo ratings yet

- Ecuf HelpDocument26 pagesEcuf HelpКостя РудаковNo ratings yet

- Pro Forma Invoice: A. Kodir SaputraDocument1 pagePro Forma Invoice: A. Kodir SaputraMuhammad HaryadiNo ratings yet

- Is 8422-8 - 1977 - 4Document1 pageIs 8422-8 - 1977 - 4Svapnesh ParikhNo ratings yet

- Form Klaim Biaya - StandardDocument10 pagesForm Klaim Biaya - Standardabi habudinNo ratings yet

- UntitledDocument6 pagesUntitledDÉBORA CARDOSONo ratings yet

- Ecuf HelpDocument22 pagesEcuf HelpАндрей МихайловичNo ratings yet

- Schematic Circuits: Section C - ElectricsDocument1 pageSchematic Circuits: Section C - ElectricsIonut GrozaNo ratings yet

- Schematic Circuits: Section C - ElectricsDocument1 pageSchematic Circuits: Section C - ElectricsIonut GrozaNo ratings yet

- DateDocument14 pagesDateerik0007No ratings yet

- Raise Our Glasses: 1 Decoration 2 StrikeDocument1 pageRaise Our Glasses: 1 Decoration 2 StrikeBobin SouledNo ratings yet

- Daily Transaction Agustus ' 2019Document65 pagesDaily Transaction Agustus ' 20191heatNo ratings yet

- At Grade PrintDocument1 pageAt Grade Printwatertightness filesNo ratings yet

- Dahua Intro & ProductsDocument68 pagesDahua Intro & ProductsSarah AliNo ratings yet

- 1kW Smps Project (Based On MicrosiM Design) pg1 1kw Smps Ir2153 PDFDocument1 page1kW Smps Project (Based On MicrosiM Design) pg1 1kw Smps Ir2153 PDFAshok Patel100% (1)

- Let's Start With The PRIMA: A Solution That Only A Pioneer Can OfferDocument3 pagesLet's Start With The PRIMA: A Solution That Only A Pioneer Can Offerduc vinhNo ratings yet

- C2 C3 Inch Metric Conversion Table MFP EGv2Document1 pageC2 C3 Inch Metric Conversion Table MFP EGv2John RussellNo ratings yet

- 9 - Bhattiacademy - Com - Chemistry - 5. Scholar Series (Obj)Document13 pages9 - Bhattiacademy - Com - Chemistry - 5. Scholar Series (Obj)Amir FarooqNo ratings yet

- Characteristics Standard Pagina: 1/10 DataDocument14 pagesCharacteristics Standard Pagina: 1/10 Dataerik0007No ratings yet

- Project Report & CMA Data: S.A.CoconutsDocument15 pagesProject Report & CMA Data: S.A.CoconutsMichael AdonikarNo ratings yet

- Expense Report: Purpose: From: Statement #: To: Name: Department: Employee ID: ManagerDocument2 pagesExpense Report: Purpose: From: Statement #: To: Name: Department: Employee ID: ManagerCV. Mora Karya PerkasaNo ratings yet

- Travel Expense ReportDocument3 pagesTravel Expense ReportFelicia GhicaNo ratings yet

- Expense Sheet TestDocument3 pagesExpense Sheet TestM NadeemNo ratings yet

- Eagle Eye Equities May 10 Index Looks at Day Trading TrendsDocument7 pagesEagle Eye Equities May 10 Index Looks at Day Trading TrendsAnshuman GuptaNo ratings yet

- Travel Expense ReportDocument1 pageTravel Expense ReporttaqasubbuniNo ratings yet

- Revised Collection Template V2 07-18-2023Document9 pagesRevised Collection Template V2 07-18-2023Leizl RangasaNo ratings yet

- Alteraciones de La HemostasiaDocument3 pagesAlteraciones de La HemostasiaJENNIFER DIANA MORENO PRECIADONo ratings yet

- ISO 27001.2022 Info Security MGMT Systems - RequirementsDocument26 pagesISO 27001.2022 Info Security MGMT Systems - RequirementsmariyanaNo ratings yet

- CIRCUITSDocument17 pagesCIRCUITSSteven WassaakaNo ratings yet

- Proposed Budget and TimetableDocument13 pagesProposed Budget and TimetableAria Atyanto SatwikoNo ratings yet

- TRAMO II - KM 32 - KM 33Document6 pagesTRAMO II - KM 32 - KM 33Diego Pimentel AparicioNo ratings yet

- PLANTA PARCIAL EL. +1703.300 (T.A.) : CertificadoDocument1 pagePLANTA PARCIAL EL. +1703.300 (T.A.) : CertificadoRicardo Alejandro Oyarce ArmijoNo ratings yet

- Sample Invoice TemplateDocument2 pagesSample Invoice TemplateLutherNo ratings yet

- Sonata 1Document2 pagesSonata 1api-3740041No ratings yet

- Expense Claim Form: March 2018-Feb 2019Document1 pageExpense Claim Form: March 2018-Feb 2019Varun SirohiNo ratings yet

- Polity RevisionDocument6 pagesPolity RevisionupscnavigatorNo ratings yet

- 03.1 The Case of The Unidentified Industries-2018Document2 pages03.1 The Case of The Unidentified Industries-2018maryam rizwanNo ratings yet

- Fixed Asset RegisterDocument12 pagesFixed Asset RegisterBrijgopal YadavNo ratings yet

- Schematic Circuits: Section C - ElectricsDocument1 pageSchematic Circuits: Section C - ElectricsIonut GrozaNo ratings yet

- Cold Start ECU TroubleshootingDocument1 pageCold Start ECU TroubleshootingIonut GrozaNo ratings yet

- G21LAHL1377 - A - ICA Fluor Ethenol GADocument2 pagesG21LAHL1377 - A - ICA Fluor Ethenol GAYadir SánchezNo ratings yet

- Cur Culum Phase 18: Card The Sound - Match Artjculated The CardsDocument2 pagesCur Culum Phase 18: Card The Sound - Match Artjculated The CardsSayfull An WarNo ratings yet

- SAFe Scrum Master Digital Workbook (5.1.1)Document161 pagesSAFe Scrum Master Digital Workbook (5.1.1)Hariharan ANo ratings yet

- Expense Claim FormDocument13 pagesExpense Claim Formye min aungNo ratings yet

- Complete Guide To PhilhealthDocument8 pagesComplete Guide To PhilhealthJoenas TunguiaNo ratings yet

- Letter From Past Student Body Presidents in Support of Prop 1Document2 pagesLetter From Past Student Body Presidents in Support of Prop 1The Texas ExesNo ratings yet

- Gonzales Cannon September 19 IssueDocument30 pagesGonzales Cannon September 19 IssueGonzales CannonNo ratings yet

- Docktown's Fate in The Balance: Second Jack's Prime Restaurant Set To OpenDocument33 pagesDocktown's Fate in The Balance: Second Jack's Prime Restaurant Set To OpenSan Mateo Daily JournalNo ratings yet

- OPD Claim FormDocument2 pagesOPD Claim FormvishalrastogiNo ratings yet

- Template Letter Post DoctoralDocument3 pagesTemplate Letter Post DoctoralPamela Grace AnzuresNo ratings yet

- OPT EP Kimber Student Insurance BrochureDocument20 pagesOPT EP Kimber Student Insurance BrochureKanakamedala Sai Rithvik ee18b051No ratings yet

- Pub 4491 PDFDocument364 pagesPub 4491 PDFJay PatelNo ratings yet

- Health Financing Overview: Resource Mobilization, Risk Pooling and AllocationDocument15 pagesHealth Financing Overview: Resource Mobilization, Risk Pooling and AllocationLydia ladislausNo ratings yet

- Rogerian ArgumentDocument8 pagesRogerian Argumentapi-232536315100% (1)

- Confirmation Statement: Nisar H Baig 18474 ORCHID DR LEESBURG, VA 20176 CTRL: 1Document5 pagesConfirmation Statement: Nisar H Baig 18474 ORCHID DR LEESBURG, VA 20176 CTRL: 1abaig76No ratings yet

- Bangladesh's Healthcare Delivery ExplainedDocument50 pagesBangladesh's Healthcare Delivery ExplainedDip Ayan MNo ratings yet

- Thesis On Insurance Sector in IndiaDocument6 pagesThesis On Insurance Sector in Indiaaprilchesserspringfield100% (2)

- Understanding Actuarial Practice - KlugmanDocument54 pagesUnderstanding Actuarial Practice - Klugmanjoe malor0% (1)

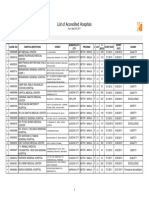

- PhilHealth Accredited HospitalsDocument3 pagesPhilHealth Accredited HospitalsCalypso BrielleNo ratings yet

- LN01 Rejda99500X 12 Principles LN11Document29 pagesLN01 Rejda99500X 12 Principles LN11Mahbubur RahmanNo ratings yet

- RA 11223 (UHC Act) For Stakeholders - 1 PDFDocument50 pagesRA 11223 (UHC Act) For Stakeholders - 1 PDFju MBNo ratings yet

- Mother Theresa's Care For The DyingDocument2 pagesMother Theresa's Care For The Dyingjroeuk100% (1)

- DC Motor Speed ControllerDocument30 pagesDC Motor Speed ControllerLaurentiu IacobNo ratings yet

- Recognize APRNsDocument3 pagesRecognize APRNsLaceyNo ratings yet

- Sistem Pembiayaan Kesehatan Di ArgentinaDocument12 pagesSistem Pembiayaan Kesehatan Di ArgentinaAswar100% (1)

- Shivani Lab ReportDocument2 pagesShivani Lab ReportJames MooreNo ratings yet

- Medical Coding&BillingDocument3 pagesMedical Coding&BillingDilip AeidenNo ratings yet

- Kathleen Sebelius Letter To Hospital OfficialsDocument2 pagesKathleen Sebelius Letter To Hospital OfficialsHLMeditNo ratings yet

- Individual Health Insurance CoveragesDocument25 pagesIndividual Health Insurance Coveragesmannajoe70% (1)

- File Health Claim Form Blue Cross PlanDocument1 pageFile Health Claim Form Blue Cross PlanManoj GuptaNo ratings yet

- Insurance Awareness Survey Report PDFDocument148 pagesInsurance Awareness Survey Report PDFharshNo ratings yet

- India's Economic Growth and Challenges at 2030Document33 pagesIndia's Economic Growth and Challenges at 2030mannugupta123No ratings yet

- C - Hmo Cy2019 Confirmation FormDocument2 pagesC - Hmo Cy2019 Confirmation FormAl MarvinNo ratings yet