Professional Documents

Culture Documents

TCS

Uploaded by

peteno5623Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TCS

Uploaded by

peteno5623Copyright:

Available Formats

Rate

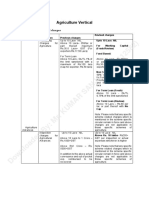

Payee (Seller)

(@ Actual Receipt) No TDS if

Section Nature of Payment (I/H if B T/O > 1 Cr. Payer (Buyer) NA Notes

No PAN/Aadhar - 5% Upto

P G/R > 50 L)

or 2(Rate)

Sale of

-Tendua Leaves 5% -If R buyer give declaration that goods purc. for mfr./ prodn of -Scrap means waste not usable as such

-Timber/Forest Produce 2.5% any article or generation of power (Case Law : By products of ship breaking

206C(1) Any Any -

-Alcohol for Human 1% -If buyer is Public Sector Co. (Govt. Co.) activities are usable as such, so its not

-Scrap 1% - If buyer buy for personal consumption scrap and hence no TCS)

-Minerals (Iron ore, Coal, Lignite) 1%

Licence/Lease/Tfr Rights in

-Parking Lot

-If buyer is Public Sector Co. (Govt. Co.)

206C(1C) -Toll Plaza Any Any 2% -

- If mine/Quarry of Mineral Oil/ Petrol/ Natural Gas

-Mine/Quarry

for business purpose

-See 10L limit per motor vehicle

-If buyer is Public Sector Co. (Govt. Co.) engaged in passenger -TCS only on retail sale {but wholesale

206C(1F) Sale of Motor Vehicle Any Any 1% 10L tpt. business maybe covered u/s 206C(1H)}

-Sale of vehicle at wholesale level -10L limit is including Luxury tax & GST but

excluding Road tax

Foreign Remittance of money under 7L * LRS out of educational loan (from

-If TDS under any sec

LRS (Liberalised Remittance Scheme) Authorised Dealer (TCS on Financial Institution)

5% -To Individual NR who's visiting India

206C(1G) of RBI Any Excess) -7L limit per dealer

0.5% (*) -Authorised dealer shall not collect TCS on any amt. wrt which

Sale of OTPP (Overseas Tour

Seller of OTPP - TCS has been collected by seller of OTPP

Program Package)

-If TDS/TCS under any sec

Any (except 50L

Any (except 0.1% -If buyer whole income exempt under I Tax

206C(1H) Sale of Goods > 50L in a PY exporter) if (TCS on -Related to 194Q

importer) 1% (No PAN) -Sale of fuel to NR airline co. at Indian airport

PY T/O > 10 Cr. Excess)

-If either payee/payer is NR

Note : If buyer is CG/SG/LA, Embassy, High Comm., Legation, Consulate, Trade Representation & Club, No TCS under any Section

(TCS always levy on amt inclusive of GST, unlike TDS which isn't levied on GST component)

You might also like

- Final Revision Notes DTDocument670 pagesFinal Revision Notes DTRaghavanNo ratings yet

- TDSDocument3 pagesTDSpeteno5623No ratings yet

- TDS & TCS - DT Nov 22Document4 pagesTDS & TCS - DT Nov 22bnanduriNo ratings yet

- GST Handout - Return Due DatesDocument1 pageGST Handout - Return Due DatesdebNo ratings yet

- Scheme Code AgriDocument14 pagesScheme Code AgriAnand KumarNo ratings yet

- TCS Rate Chart Under Income Tax For F.Y. 2Document3 pagesTCS Rate Chart Under Income Tax For F.Y. 2Unknown ManNo ratings yet

- Hindalco Wef 16.06.2018Document1 pageHindalco Wef 16.06.2018SanjayNo ratings yet

- Cir. JK Trade Offers - Mar 20Document21 pagesCir. JK Trade Offers - Mar 20MayankGoyalNo ratings yet

- H2 English OdishaDocument29 pagesH2 English OdishaB SubashNo ratings yet

- Ca Inter Noting Class 25Document9 pagesCa Inter Noting Class 25Raghav BangaNo ratings yet

- Future Quote For Hyundai I20 Normal - Niren PatelDocument1 pageFuture Quote For Hyundai I20 Normal - Niren Patelniren4u1567No ratings yet

- Transactions & Tax BaseDocument3 pagesTransactions & Tax BaseVero EntertainmentNo ratings yet

- Alfalah Auto Loan: Policy One PagerDocument1 pageAlfalah Auto Loan: Policy One PagerbilalasifNo ratings yet

- Binsooiiii Tax 7 PangitDocument1 pageBinsooiiii Tax 7 PangitLhorene Hope DueñasNo ratings yet

- Tax Collection at SourceDocument17 pagesTax Collection at SourceAARCHI JAINNo ratings yet

- Rate Chart of Tcs For Financial Year 2021-22 or FOR ASSESSMENT YEAR 2022-23Document2 pagesRate Chart of Tcs For Financial Year 2021-22 or FOR ASSESSMENT YEAR 2022-23INFO ACCNo ratings yet

- Tax RatesDocument7 pagesTax Ratesmadhusudan2005No ratings yet

- Cannot Be Used by Nra-Etb & Taxpayers Mandated To Use Itemized DeductionsDocument3 pagesCannot Be Used by Nra-Etb & Taxpayers Mandated To Use Itemized DeductionsAreel GalvanNo ratings yet

- 30%, 70% PLP Payment PlanDocument1 page30%, 70% PLP Payment PlanDhruv SainiNo ratings yet

- GST at A GlanceDocument10 pagesGST at A Glancestr690No ratings yet

- 56 Tds Tcs Rate Chart W e F 01 10 09Document1 page56 Tds Tcs Rate Chart W e F 01 10 09Shankar BidadiNo ratings yet

- TDS Chart Nov 23Document1 pageTDS Chart Nov 23Flashcap693No ratings yet

- Price List - Ford New Endeavour - ICA Bhavna Ford: VariantsDocument1 pagePrice List - Ford New Endeavour - ICA Bhavna Ford: VariantsTanmay KhanolkarNo ratings yet

- Zakat CalculationDocument4 pagesZakat Calculationapi-19755136No ratings yet

- Day 3Document9 pagesDay 3Dipesh MagratiNo ratings yet

- Composition SchemeDocument2 pagesComposition SchemeMadhur MadnaniNo ratings yet

- TDS CIRCULAR-compressedDocument24 pagesTDS CIRCULAR-compressedNitin VermaNo ratings yet

- Structured Products: (Market Linked Debentures)Document1 pageStructured Products: (Market Linked Debentures)ghodababuNo ratings yet

- Grid For The Month of August 2021 - East (WB, BR, Or, JH, As, NL, ML, MZ, TR, An, SK)Document5 pagesGrid For The Month of August 2021 - East (WB, BR, Or, JH, As, NL, ML, MZ, TR, An, SK)Rony KumarNo ratings yet

- Credit Processing For CVDocument5 pagesCredit Processing For CVBhaskar GarimellaNo ratings yet

- MSOP Part A Item 39 (D) PDFDocument2 pagesMSOP Part A Item 39 (D) PDFHARESH JANINo ratings yet

- VAT Mnemonics - Sir KDocument3 pagesVAT Mnemonics - Sir Kcairoden radiamodaNo ratings yet

- 1 Cellestial E-Tractor Application Part ADocument4 pages1 Cellestial E-Tractor Application Part AvickymechoNo ratings yet

- Tata Motors: DVR - Waiting For AcceptanceDocument7 pagesTata Motors: DVR - Waiting For AcceptanceOmkar BibikarNo ratings yet

- TDS Rates Smart Notes (Nov 22) - Yash KhandelwalDocument12 pagesTDS Rates Smart Notes (Nov 22) - Yash KhandelwalUmang BansalNo ratings yet

- Persons Liable To VAT: Value Added Tax (Vat)Document2 pagesPersons Liable To VAT: Value Added Tax (Vat)aaron filoteoNo ratings yet

- Charts DTDocument57 pagesCharts DTAayushi AayushiNo ratings yet

- UBI BrochureDocument2 pagesUBI BrochureDEEPAKNo ratings yet

- Indices SpecsDocument9 pagesIndices Specssami ghazouaniNo ratings yet

- RHB Equity 360° - 14 September 2010 (MREITS Technical: IJM)Document2 pagesRHB Equity 360° - 14 September 2010 (MREITS Technical: IJM)Rhb InvestNo ratings yet

- DARF Format Revised On 28 09 2020Document4 pagesDARF Format Revised On 28 09 2020Kuvam BansalNo ratings yet

- TDS & TCS Rates - Yash KhandelwalDocument15 pagesTDS & TCS Rates - Yash KhandelwalSahoo PrabhasNo ratings yet

- 194 Q and 206C (1H)Document4 pages194 Q and 206C (1H)harshNo ratings yet

- Zakat Calculator For MuslimDocument10 pagesZakat Calculator For MuslimKhayaal100% (3)

- RA Document RA Details: - Thank YouDocument1 pageRA Document RA Details: - Thank YouRakesh YadavNo ratings yet

- English Gold GuineaDocument2 pagesEnglish Gold Guineapgk242003No ratings yet

- Del PrepaidDocument1 pageDel PrepaidSwati SrivastavaNo ratings yet

- Union Budget FY 12Document36 pagesUnion Budget FY 12Yahya AzharNo ratings yet

- OPT, Excise, DST, Tax RemediesDocument11 pagesOPT, Excise, DST, Tax RemediesLou Brad Nazareno IgnacioNo ratings yet

- Asset Product Purpose Margin Limit Repayment Other FeaturesDocument4 pagesAsset Product Purpose Margin Limit Repayment Other FeaturesjyottsnaNo ratings yet

- CDS - Schedule of Fees Deposits Updated July 2016Document4 pagesCDS - Schedule of Fees Deposits Updated July 2016fpaimranNo ratings yet

- MSOP Part A Item 38 (E) PDFDocument2 pagesMSOP Part A Item 38 (E) PDFHARESH JANINo ratings yet

- Composition SchemeDocument2 pagesComposition SchemeMadhur MadnaniNo ratings yet

- OPT Summary RatesDocument2 pagesOPT Summary RatesDISEREE AMOR ATIENZANo ratings yet

- DX-790-960-65-17.5i-M: Electrical PropertiesDocument2 pagesDX-790-960-65-17.5i-M: Electrical PropertiesАлександрNo ratings yet

- Scenario - Taxation 2019 UNISA - Level 1 Test 4Document7 pagesScenario - Taxation 2019 UNISA - Level 1 Test 4Tyson RuvengoNo ratings yet

- Dual Shield 7100 Ultra: Typical Tensile PropertiesDocument3 pagesDual Shield 7100 Ultra: Typical Tensile PropertiesDino Paul Castro HidalgoNo ratings yet

- SAP On ASE Development UpdateDocument16 pagesSAP On ASE Development Updatebetoy castroNo ratings yet

- Packing Lists AbroadDocument9 pagesPacking Lists AbroadAdit PinheiroNo ratings yet

- TransmissionDocument3 pagesTransmissionamitsaharulzNo ratings yet

- 777rsec3 PDFDocument36 pages777rsec3 PDFAlexander Ponce VelardeNo ratings yet

- COT RPMS Rating Sheet For T I III For SY 2021 2022 JhanzDocument2 pagesCOT RPMS Rating Sheet For T I III For SY 2021 2022 Jhanzjhancelle golosindaNo ratings yet

- Questão 13: Technology Anticipates Fast-Food Customers' OrdersDocument3 pagesQuestão 13: Technology Anticipates Fast-Food Customers' OrdersOziel LeiteNo ratings yet

- M.S Engineering (Aerospace) Application Form: For Office UseDocument4 pagesM.S Engineering (Aerospace) Application Form: For Office Useshashasha123No ratings yet

- Pseudomonas AeruginosaDocument26 pagesPseudomonas AeruginosaNur AzizahNo ratings yet

- Shunt Reactor ConstructionDocument9 pagesShunt Reactor ConstructionIrfan AhmedNo ratings yet

- Server Preparation Details LinuxDocument9 pagesServer Preparation Details Linuxbharatreddy9No ratings yet

- 430D Backhoe LoaderDocument8 pages430D Backhoe LoaderRaul GuaninNo ratings yet

- Design and Analysis Aircraft Nose and Nose Landing Gear PDFDocument8 pagesDesign and Analysis Aircraft Nose and Nose Landing Gear PDFTarik Hassan ElsonniNo ratings yet

- 2 - ARM Cotex-M3 - IntroductionDocument124 pages2 - ARM Cotex-M3 - IntroductionNghĩa VũNo ratings yet

- Passive Voice PDFDocument5 pagesPassive Voice PDFJohan FloresNo ratings yet

- Certificate of Software AcceptanceDocument6 pagesCertificate of Software AcceptanceVince PepañaNo ratings yet

- Gr4 Reading InterventionDocument2 pagesGr4 Reading InterventionEvelyn Del RosarioNo ratings yet

- Voting BehaviorDocument23 pagesVoting BehaviorWela Paing FallitangNo ratings yet

- Ready. Set. IELTS. Idioms.Document45 pagesReady. Set. IELTS. Idioms.Renatochka BakirovaNo ratings yet

- Gamla Stan PDFDocument4 pagesGamla Stan PDFAlexandra FricosuNo ratings yet

- Bottom-Up Cost Evaluation of SOEC Systems (10-100MW)Document14 pagesBottom-Up Cost Evaluation of SOEC Systems (10-100MW)Roy JudeNo ratings yet

- XDM-100 IOM SDH A00 4-5 enDocument334 pagesXDM-100 IOM SDH A00 4-5 endilipgulatiNo ratings yet

- Sika Hi Mod Gel Msds B-1Document5 pagesSika Hi Mod Gel Msds B-1Katherine Dilas Edward CarhuaninaNo ratings yet

- m5q3w2 Las 4Document5 pagesm5q3w2 Las 4ronaldNo ratings yet

- Scib RC PipesDocument4 pagesScib RC PipesterrylimNo ratings yet

- NEBULIZATIONDocument2 pagesNEBULIZATIONMae ValenzuelaNo ratings yet

- NDC Format For Billing PADDocument3 pagesNDC Format For Billing PADShantkumar ShingnalliNo ratings yet

- CN Mod1 Ppt-FinalDocument56 pagesCN Mod1 Ppt-FinalkkNo ratings yet