Professional Documents

Culture Documents

FnO RiskReward Calc

FnO RiskReward Calc

Uploaded by

Pooja Gupta0 ratings0% found this document useful (0 votes)

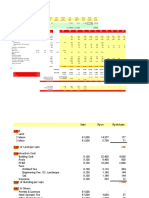

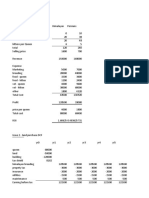

6 views3 pagesThe document outlines various hedging strategies using options and futures contracts across different scenarios with varying underlying prices. It provides details like lot sizes, strike rates, premiums, margins, profits/losses for each strategy under each scenario. The maximum potential loss is Rs. 19,000 in the most unfavorable scenarios. Liquidity is noted as an important factor to consider for options nearing expiry when looking to exit positions. Cash returns ranging from 21% to -19% are shown depending on the underlying price at expiry.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines various hedging strategies using options and futures contracts across different scenarios with varying underlying prices. It provides details like lot sizes, strike rates, premiums, margins, profits/losses for each strategy under each scenario. The maximum potential loss is Rs. 19,000 in the most unfavorable scenarios. Liquidity is noted as an important factor to consider for options nearing expiry when looking to exit positions. Cash returns ranging from 21% to -19% are shown depending on the underlying price at expiry.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesFnO RiskReward Calc

FnO RiskReward Calc

Uploaded by

Pooja GuptaThe document outlines various hedging strategies using options and futures contracts across different scenarios with varying underlying prices. It provides details like lot sizes, strike rates, premiums, margins, profits/losses for each strategy under each scenario. The maximum potential loss is Rs. 19,000 in the most unfavorable scenarios. Liquidity is noted as an important factor to consider for options nearing expiry when looking to exit positions. Cash returns ranging from 21% to -19% are shown depending on the underlying price at expiry.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

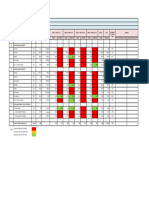

SBI YES FEB OPTIN

OW Hedge Future Hedge

Sell CE BUY CE Buy FutureBUY PE

Lot Size Lot Size 3000 3000

Strike rate Strike rate 284 295

Premium Premium 16

Margin Margin 78000

Net Profit Net Profit

Final Final

Expiry Expiry Scenario 1

284

Scenario 2

290

Scenario 3

295

Scenario 4

300

Scenario 5

310

Scenario 6

280

Scenario 7

275

Scenario 8

270

Scenario 9

260

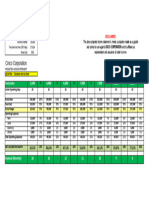

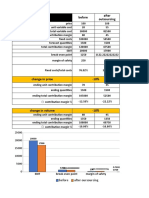

LIQUIDITY MATTERS SAIL NO FEB SAIL option

Future Hedge

Buy FutureBUY PE Hawa CASH

Lot Size 19000 19000

Strike rate 74.2 79

Premium 5.8 1

Total Prem 1409800 110200

Margin 123939

Net Profit

Final

Max Loss -19000 FnO Return

Expiry Scenario 1

90 300200 -167200 133000 107%

Scenario 2

85 205200 -167200 38000 31%

Scenario 3

82 148200 -167200 -19000 -15%

Scenario 4

80 110200 -129200 -19000 -15%

Scenario 5

77 53200 34200 87400 71%

Scenario 6

75 15200 -34200 -19000 -15%

Scenario 7

70 -79800 60800 -19000 -15%

Scenario 8

65 -174800 155800 -19000 -15%

Scenario 9

60 -269800 250800 -19000 -15%

HOW TO SOLVE THIS

Problem in selling in illiquid ones for expiry?

Cash Returns

21%

15%

11%

8%

4%

1%

-6%

-12%

-19%

You might also like

- All I Need To Know. Step by StepDocument93 pagesAll I Need To Know. Step by Stepjamal93% (81)

- PROJECT: Joining The Market: Required ResourcesDocument5 pagesPROJECT: Joining The Market: Required ResourcesAngel Enamorado0% (1)

- Payroll Operation Manual (SOP) - Tricor Business Services v1.7Document9 pagesPayroll Operation Manual (SOP) - Tricor Business Services v1.7Puvaneswary BalachandrenNo ratings yet

- Compiled ReportDocument24 pagesCompiled ReportkartikNo ratings yet

- Year 0 - 8000 - 8800 1 7600 6800 2 7800 7600 3 8400 7800 4 9600 7950 5 9800 8300 6 8450 7 8900 8 9300 Project Rose Project LilyDocument2 pagesYear 0 - 8000 - 8800 1 7600 6800 2 7800 7600 3 8400 7800 4 9600 7950 5 9800 8300 6 8450 7 8900 8 9300 Project Rose Project LilySourav SinghNo ratings yet

- FreezytemplateDocument1 pageFreezytemplateFyxdNo ratings yet

- PeroduaGlenmarieSales ATIVA PriceListDocument1 pagePeroduaGlenmarieSales ATIVA PriceListhusna hadiNo ratings yet

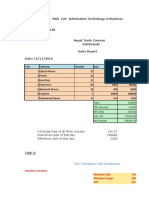

- MAS 120-Information Technology in Business: Month:October Minimum Calls: 150 Minimum Charge: 200 Vat: 13%Document10 pagesMAS 120-Information Technology in Business: Month:October Minimum Calls: 150 Minimum Charge: 200 Vat: 13%Anuska JayswalNo ratings yet

- 2 RLK Even FloorDocument2 pages2 RLK Even FloorShashank WaghmareNo ratings yet

- Test Resistencia A La Fza Rapida Especial 2021Document1 pageTest Resistencia A La Fza Rapida Especial 2021Lucha CoahuilaNo ratings yet

- Power-Hypertrophy-Program13 Week Power - Hypertrophy Program With Upper - Lower Body SplitDocument39 pagesPower-Hypertrophy-Program13 Week Power - Hypertrophy Program With Upper - Lower Body SplitJose Eduardo BacciNo ratings yet

- Quantum of The Seas: Price in SGDDocument3 pagesQuantum of The Seas: Price in SGDRahadian Lintang ALNo ratings yet

- Project Ffeasibility Report 5 Star Hotel in The Mumbai Suburban AreaDocument4 pagesProject Ffeasibility Report 5 Star Hotel in The Mumbai Suburban AreaKiranNo ratings yet

- PHUL Workout Template (13 Weeks)Document40 pagesPHUL Workout Template (13 Weeks)Tuteraipuni POTHIERNo ratings yet

- Loan Schedule: Comparable CompaniesDocument30 pagesLoan Schedule: Comparable CompaniesIrene Mae GuerraNo ratings yet

- Capitulo 7Document19 pagesCapitulo 7thalibritNo ratings yet

- Sensitivity AnalysisDocument27 pagesSensitivity AnalysisVipin UniyalNo ratings yet

- OPTION STRATAGY VVVVDocument18 pagesOPTION STRATAGY VVVVRTG Mechanical EnggNo ratings yet

- Bags of Cash - X15002-XXLP - Par - 01Document4 pagesBags of Cash - X15002-XXLP - Par - 01Queen likeNo ratings yet

- Drilling Rig POWDocument32 pagesDrilling Rig POWPrince Owoko Attiki KiébéNo ratings yet

- Cash Flow Projection of MCV: SQM SQM RP.M/SQM RP.M/SQM SQM SQM RP.M US$. Tho Rp. MDocument26 pagesCash Flow Projection of MCV: SQM SQM RP.M/SQM RP.M/SQM SQM SQM RP.M US$. Tho Rp. Mangg4interNo ratings yet

- OEE (Overall Equipment Efectiveness) Enhancement Analysis Using The SMED (Single Minute Exchange Die) Method at Extruder Departement Tire ManufactureDocument25 pagesOEE (Overall Equipment Efectiveness) Enhancement Analysis Using The SMED (Single Minute Exchange Die) Method at Extruder Departement Tire ManufactureBudy AriyantoNo ratings yet

- 10% To 30% Error - May Be Acceptable Based Upon Importance of ApplicationDocument3 pages10% To 30% Error - May Be Acceptable Based Upon Importance of ApplicationktyeoNo ratings yet

- 7.cash Flow UnsolvedDocument16 pages7.cash Flow UnsolvedEvita Faith LeongNo ratings yet

- Free CashflowDocument4 pagesFree CashflowMainali GautamNo ratings yet

- Import Tariff Quotas For Cereal Products: All Origins UkraineDocument2 pagesImport Tariff Quotas For Cereal Products: All Origins UkraineAlex's PrestigeNo ratings yet

- Rent 1,000,000: S/N Particular UOM Rate Loading Value EMI CostDocument7 pagesRent 1,000,000: S/N Particular UOM Rate Loading Value EMI CostAbhimanyu ArjunNo ratings yet

- Potato Corner Sample BreakevenDocument1 pagePotato Corner Sample Breakevenphuri.siaNo ratings yet

- Built Up Box PlatesDocument16 pagesBuilt Up Box Platesvrajan1988No ratings yet

- Duct Static SheetDocument6 pagesDuct Static SheetSENTRA ADABNo ratings yet

- Finm Ca 1Document44 pagesFinm Ca 1Muskan ChawlaNo ratings yet

- First Half: Budget (BE Year) Actual (BE Year)Document7 pagesFirst Half: Budget (BE Year) Actual (BE Year)Michael AzerNo ratings yet

- NH Corporate Presentation 9m 2017Document42 pagesNH Corporate Presentation 9m 2017Nicu ClaudiuNo ratings yet

- Project Name Received Enagement Fee / Month Engagement Duration (Months) Engagement Fee (Total)Document2 pagesProject Name Received Enagement Fee / Month Engagement Duration (Months) Engagement Fee (Total)IvaNo ratings yet

- Time Schedule TRANSMART Jambi 25 Mei 2018Document16 pagesTime Schedule TRANSMART Jambi 25 Mei 2018SupriatnaNo ratings yet

- Total Recoveries: Anurag Prakash Mob.: 9410390436Document1 pageTotal Recoveries: Anurag Prakash Mob.: 9410390436Kalpesh PrassannaNo ratings yet

- Faisal Town Phase 2 Payment PlanDocument1 pageFaisal Town Phase 2 Payment PlanRoy Estate (Sajila Roy)No ratings yet

- Session 11Document5 pagesSession 11samay gargNo ratings yet

- LiuMeihan PC#4Document4 pagesLiuMeihan PC#4MeihanNo ratings yet

- Ro007e30 2023 08Document85 pagesRo007e30 2023 08Alina Georgiana BarbuNo ratings yet

- Capsim Summary ReportDocument54 pagesCapsim Summary ReportyjchoNo ratings yet

- Cost Volume Profit and Outsourcing Correction Calculations With Drop-Down ListDocument7 pagesCost Volume Profit and Outsourcing Correction Calculations With Drop-Down ListaviruddhjainNo ratings yet

- Data JioDocument18 pagesData JioAnkit VermaNo ratings yet

- Review WeekDocument5 pagesReview WeekRiantoNo ratings yet

- CrionDocument6 pagesCrionPreticia ChristianNo ratings yet

- Ball Screw Accuracy-2Document1 pageBall Screw Accuracy-2Mohit SharmaNo ratings yet

- WPR T7 Week 4 of September - 22Document1 pageWPR T7 Week 4 of September - 22satpuraNo ratings yet

- Working Paper CH 7 - Sheet1Document2 pagesWorking Paper CH 7 - Sheet1azkahilmii12No ratings yet

- Capstone 1Document16 pagesCapstone 1bacardiblastwineNo ratings yet

- SolvingDocument15 pagesSolvingManoo ValievNo ratings yet

- Ro007601 2020 16Document169 pagesRo007601 2020 16Alina Georgiana BarbuNo ratings yet

- P05 - Stock ValuationDocument8 pagesP05 - Stock ValuationL1588AshishNo ratings yet

- Shrimpprocessing ModelDocument31 pagesShrimpprocessing ModelKoduri Sri HarshaNo ratings yet

- CS For CAP IIMsDocument3 pagesCS For CAP IIMsGomishChawlaNo ratings yet

- Integra - Business Case GeneratorDocument27 pagesIntegra - Business Case GeneratorAmigo SecretoNo ratings yet

- Elan Case - PEVC - Group 09Document4 pagesElan Case - PEVC - Group 09BHAVYA MISHRANo ratings yet

- Case 1: Less: Reinvestment at 20%Document4 pagesCase 1: Less: Reinvestment at 20%Vinay JajuNo ratings yet

- PHUL Workout Template (13 Weeks)Document39 pagesPHUL Workout Template (13 Weeks)enes canNo ratings yet

- Daily Calculations: Payoff CalculationDocument13 pagesDaily Calculations: Payoff CalculationShravanRigNo ratings yet

- Jam-Minit Peratusperpuluhan Juta-R/Ribu KG-G Jam-Minit Peratusperpuluhan Juta-R/Ribu KG - G L-ML L-ML KM-M KM-MDocument1 pageJam-Minit Peratusperpuluhan Juta-R/Ribu KG-G Jam-Minit Peratusperpuluhan Juta-R/Ribu KG - G L-ML L-ML KM-M KM-MAIRINNo ratings yet

- Accounting: AssignmentDocument4 pagesAccounting: Assignmentiza khanNo ratings yet

- Data TablesDocument12 pagesData TablesmayankNo ratings yet

- The Complete Rigger's Apprentice: Tools and Techniques for Modern and Traditional RiggingFrom EverandThe Complete Rigger's Apprentice: Tools and Techniques for Modern and Traditional RiggingNo ratings yet

- Cyber Risk Communication To Executives Board Members 1617280324Document10 pagesCyber Risk Communication To Executives Board Members 1617280324ferNo ratings yet

- ShopRite Refund PolicyDocument1 pageShopRite Refund PolicysyontechNo ratings yet

- Net Zero Standard CriteriaDocument16 pagesNet Zero Standard CriteriaQ LauNo ratings yet

- Credit Creation: Primary Deposits: Primary Deposits Arise or Formed When Cash or Cheque Is Deposited byDocument7 pagesCredit Creation: Primary Deposits: Primary Deposits Arise or Formed When Cash or Cheque Is Deposited byMaisha AnzumNo ratings yet

- Chapter 14 Quantitative Analysis in Budgeting: 1. ObjectivesDocument27 pagesChapter 14 Quantitative Analysis in Budgeting: 1. ObjectivesIssa AdiemaNo ratings yet

- Quiz 1.01 Financial Statements To Interim ReportingDocument22 pagesQuiz 1.01 Financial Statements To Interim ReportingJohn Lexter MacalberNo ratings yet

- CV Tabussam - Contract - CommercialDocument3 pagesCV Tabussam - Contract - CommercialGokulNo ratings yet

- DIMINISHING-MUSHARIKA-14112021-072718pmDocument24 pagesDIMINISHING-MUSHARIKA-14112021-072718pmAwn AqdasNo ratings yet

- Jamnalal Bajaj: Institute of Management StudiesDocument10 pagesJamnalal Bajaj: Institute of Management StudiesRandom FakeNo ratings yet

- Sale of GoodsDocument8 pagesSale of GoodsmahamamaNo ratings yet

- Pile Driving Analyzer ManualDocument3 pagesPile Driving Analyzer ManualElmo Frianata Zetha0% (1)

- Artificial Intelligence Argumentative EssayDocument3 pagesArtificial Intelligence Argumentative EssayPrincess DelimaNo ratings yet

- TCO Status ReportDocument39 pagesTCO Status ReportjoaoNo ratings yet

- Introduction To Pfrs 9Document36 pagesIntroduction To Pfrs 9Natalie SerranoNo ratings yet

- Summer Training Project On Attrition and RetentionDocument57 pagesSummer Training Project On Attrition and Retentioniweweyuwerfgherguj100% (3)

- Full Test Bank For Introduction To Information Systems 5Th Edition R Kelly Rainer Download PDF Docx Full Chapter ChapterDocument36 pagesFull Test Bank For Introduction To Information Systems 5Th Edition R Kelly Rainer Download PDF Docx Full Chapter Chaptersanityenhanceqould1100% (13)

- Chapter 3 - Consumer BehaviorDocument88 pagesChapter 3 - Consumer BehaviorRoshan BhattaNo ratings yet

- JW 14302 Construction of 20ml Carlswald Reservoir Tender DocumentDocument188 pagesJW 14302 Construction of 20ml Carlswald Reservoir Tender Documentdavid selekaNo ratings yet

- Orlando Manufacturing Company Makes Camping Equipment Selected Account Balances ListedDocument1 pageOrlando Manufacturing Company Makes Camping Equipment Selected Account Balances ListedMiroslav GegoskiNo ratings yet

- Test Bank For Management Accounting 6th Canadian Edition HorngrenDocument18 pagesTest Bank For Management Accounting 6th Canadian Edition Horngrenalicefidelia8cloNo ratings yet

- Hydroponics Business Plan ExampleDocument53 pagesHydroponics Business Plan ExampleJoseph QuillNo ratings yet

- GST-K07-Goods - FMCG and RetailDocument12 pagesGST-K07-Goods - FMCG and RetailNitinNo ratings yet

- 15 How To Compare Price For Different Quotation - SAP ME49Document5 pages15 How To Compare Price For Different Quotation - SAP ME49manjuNo ratings yet

- 11 Types of ProcessessDocument9 pages11 Types of ProcessessavmrNo ratings yet

- Taxation ReviewerDocument11 pagesTaxation Reviewerjerdelynvillegas7No ratings yet

- FABM2 - Q1 - Module 2 Statement of Comprehensive Income EditedDocument23 pagesFABM2 - Q1 - Module 2 Statement of Comprehensive Income EditedJayson MejiaNo ratings yet

- Master Thesis Big Data PDFDocument5 pagesMaster Thesis Big Data PDFfjfcww51100% (2)