Professional Documents

Culture Documents

Silver Valley MexiCan Presentation 221118 w1

Uploaded by

M CCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Silver Valley MexiCan Presentation 221118 w1

Uploaded by

M CCopyright:

Available Formats

PAGE 1

INVE STOR PRE SENTATION NOVEMBER 2022

MexiCan Project

A potassium and lithium resource located on the Central

Mexican Plateau.

TSX.V SILV | QTCQB SVMFF

SILVERVALLEYMETALS.COM

TSX.V SILV | QTCQB SVMFF

PAGE 2

Forward Looking Statements

Certain statements in this presentation are forward-looking and involve a number of risks and uncertainties. Such forward looking statements are within the meaning of that term in Section

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, as well as within the meaning of the phrase ‘forward-looking information’

in the Canadian Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations. Forward-looking statements are not comprised of historical facts. Forward-looking

statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated

condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since

forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements

are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other

factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such

forward-looking information. Forward looking information in this presentation includes, the Company’s intentions regarding its objectives, goals or future plans and statements. Factors

that could cause actual results to differ materially from such forward-looking information include, but are not limited to: the ability to predict and counteract the effects of COVID-19 on the

business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply

chains; failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the inability to complete a feasibility study which recommends a production decision;

the preliminary nature of metallurgical test results; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; changes in equity

markets; uncertainties relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity in light of the failure to obtain

additional financing, including the ability of the Company to complete the payments pursuant to the terms of the option agreement to acquire 100% of the Ranger-Page Project; inflation;

changes in exchange rates; fluctuations in commodity prices; delays in the development of projects; capital, operating and reclamation costs varying significantly from estimates and the

other risks involved in the mineral exploration and development industry; and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the

assumptions and factors used in preparing the forward-looking information in this presentation are reasonable, undue reliance should not be placed on such information, which only applies as

of the date of this presentation, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update

or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. No stock exchange, securities commission or other

regulatory authority has approved or disapproved of the information contained herein.

Qualified Person

Timothy Mosey, B.Sc., M.Sc., SME is a Qualified Person as defined by NI 43-101 and has reviewed and approved the technical data and information contained in this presentation.

TSX.V SILV | QTCQB SVMFF

PAGE 3

SILVER VALLE Y METAL S

About Us

Silver Valley Metals (“Silver Valley” or the “Company”) is a brownfields exploration There is shared underground infrastructure connecting the larger Page mine with five

Company that has two projects, one located in the Silver Valley, Idaho (silver, zinc, shallow historical mines within the larger Project area. The Company has underground

lead) and the second project located in Zacatecas, Mexico (Lithium and SOP). mining data and surface geological data that supports high grade silver-zinc-lead

mineralization present within the shallow, undeveloped mines. These mines remain

Silver Valley’s primary focus is on its flagship Ranger-Page Project (“The Project”) open at depth, and laterally along strike. Exploration potential beyond the historical

located in the Silver Valley of Idaho, 60 kilometres east of Coeur d’Alene and 1 mines is considered significant due to no modern systematic exploration applied to

kilometre from the I-90 freeway. In 2020 Idaho was ranked the first in the world in the project.

policy perception and 9th best mining jurisdiction (Fraser Institute Annual Mining

Survey). The Project borders the famous Bunker Hill Mine to the west and for the first Silver Valley also has a 100%-owned interest in a lithium and potassium bearing salar

time consolidates the western extent of the prolific Silver Valley mining corridor by one complex comprising 4,059 hectares on three mineral concessions (the “Mexican

operator in the past 100+ years. Projects”) located on the Central Mexican Plateau in the states of Zacatecas, and

San Luis Potosi, Mexico. The NI 43-101 inferred mineral resource contains 12.3Mt

The Project is on patented claims, there are no royalties and comprise 6 historical of Sulfate of Potash (SOP) and 243,000 tonnes of lithium carbonate equivalent (LCE)

mines. The largest of these, the Page Mine, was a top ten producer in the Silver Valley and remains open in all directions for expansion. The Company is currently exploring

producing over 1 billion pounds of zinc and lead and 14.6 million ounces of silver. The strategic alternatives for the Project to enhance shareholder value. The Company

Page Mine has high grade silver-zinc-lead historic reserves and remains wide open at considers the asset valuable and important.

depth beyond what has been defined to date.

TSX.V SILV | QTCQB SVMFF

PAGE 4

100% OWNED P OTAS SIUM-LITHIUM PRO JE C T IN ME XIC O WITH NI 43-101 INFERRED RE S OURCE

Project Highlights

La Salada

» 100% ownership of three high priority primary Sulphate of Potash (SOP) sediment and brine salar targets.

Principal salars: Santa Clara, La Salada, Caliguey

Santa Clara,

Caliguey

» Contained 12.3 Mt of sulphate of potash (SOP) and 243,000 tonnes of lithium carbonate equivalent (LCE), Dual

high value commodities of SOP and Lithium as co-products

» Maiden Mineral Resource Estimate (NI 43-101 compliant) of 120Mt of Inferred Mineral Resources grading 4.6

potassium (K) and 380ppm lithium (Li) Mexico

» Santa Clara, the most prospective and largest salar in the District, possesses size and scale (5km x 2km) with State of State of San

grades from the first 5m in sediments averaging ~4.8% potassium over the entire salar Zacatecas Luis Potosi

» Deep basin large aquifer potential defined by a regional geophysics survey near Santa Clara, indicating that the

salar basin depth may be much greater than previously contemplated

» Large land position and first mover advantage in a new District within an emerging potassium-lithium province

in the Central Mexican Plateau

Mexico

City

» Mexico imports 100% of all potash – significant opportunity to fulfill supply needs

» Excellent infrastructure in place, including abundance of skilled labour, an international airport, modern

highways, railways, and sufficient power

» Seasoned local management team based in-country in Zacatecas, Mexico

TSX.V SILV | QTCQB SVMFF

PAGE 5

Board of Directors

Brandon Rook, B.Sc, BA Timothy Mosey, B.Sc, M.Sc

PRESIDENT & CEO, DIRECTOR DIRECTOR

Mr. Rook has over 25 years of diversified business experience working as a geologist, advisor to Mr. Mosey has over 30 years of experience in the mining industry, previously in the private equity

numerous publicly listed companies as well as a CEO, President, and Director of several TSX-V listed investment space at Resource Capital Funds (RCF) and Traxys. As the managing director of the

companies. Currently he is a director of four public companies. Mr. Rook has been responsible in Traxys projects investment fund, Mr. Mosey was directly responsible for the investment and

raising over $100 million to date. As a geologist and executive, he has worked with and led teams management of projects around the globe. In a career focused on technical due diligence and

that have had significant discoveries in gold, copper, oil, natural gas, and diamonds. project finance, Mr. Mosey has reviewed projects from around the world, travelled extensively

to more than 60 countries on six continents and has gained experience across the commodity

spectrum, from precious, base and minor metals to ferro alloys, rare earths, industrial minerals,

coal and uranium. Mr. Mosey holds a Bachelor of Science degree in geological engineering from

Darrell Podowski, LLB, B.Sc South Dakota School of Mines and a Master of Science degree in mining engineering from the

Colorado School of Mines.

DIRECTOR

Mr. Podowski has over 28 years of international experience in the mining industry and is highly

regarded as one of the top mining lawyers globally. Darrell was previously in-house corporate

counsel to Teck Resources Limited, and is currently one of the key M&A lawyers for Antofagasta Clive Massey

Minerals SA and Freeport-McMoRan Inc. for each of their respective worldwide project acquisitions

and exploration projects. He currently is a partner with the national law firm Cassels Brock &

DIRECTOR

Blackwell LLP, and previous to that, he was a lawyer at a number of other major law firms, including Mr. Massey is President, CEO & Director of Universal Copper. Mr. Massey has held directorships and

one off-shore. Darrell has acted for numerous junior, mid level and senior mining companies during senior management positions with numerous TSX Venture Exchange listed companies. Over the last

his legal career. Prior to his legal career, he was an oil and gas exploration geophysicist with Amoco 30 years he has been responsible for the raising of tens of millions in equity for those companies.

Canada Petroleum Company. He was previously CEO of Redhill Resources, Windfire Capital, Aldever Resources, Prescient

Mining and Universal Uranium. He has also acted in an Investor Relations and or Corporate Finance

capacity for Lumina Copper, Pacific Rim Mining, Marifil Mines, Sumo Minerals, Greystar Resources

and the North Air Group of Companies.

TSX.V SILV | QTCQB SVMFF

PAGE 6

Management Dong Shim, CPA, CA, CPA (ILLINOIS)

CHIEF FINANCIAL OFFICER

Mr. Shim has led a successful accounting and finance career in both the US and Canada. He brings

Brandon Rook, B.Sc, BA

a wealth of knowledge to the team with his expertise in auditing publicly- traded junior mining

companies and high-tech industries. He is a member of the Chartered Professional Accountants of

British Columbia and a Certified Public Accountant registered in the State of Illinois, United States.

PRESIDENT & CEO, DIRECTOR He is also an audit partner on numerous audit engagements for various publicly traded companies.

Mr. Rook has over 25 years of diversified business experience working as a geologist, advisor to Mr. Shim also assisted various start-up companies in achieving public listings on the TSX Venture

numerous publicly listed companies as well as a CEO, President, and Director of several TSX-V listed Exchange, Canadian Securities Exchange and the OTC Market.

companies. Currently he is a director of four public companies. Mr. Rook has been responsible in

raising over $100 million to date. As a geologist and executive, he has worked with and led teams

that have had significant discoveries in gold, copper, oil, natural gas, and diamonds. Gilberto Zapata Castaneda, MBA

COUNTRY MANAGER

Dale Moore, B.Sc, P.Geo Mr. Castaneda is an entrepreneur and mining executive from Zacatecas, Mexico. His work history

includes participation with numerous mining ventures throughout the district and ownership

EXPLORATION DIRECTOR of small businesses. Mr. Castaneda’s responsibilities at Silver Valley Metals include business

Mr. Moore has an impressive track record of success and ongoing successes over the past 15 development for the company. Mr. Castaneda has provided invaluable assistance and continues to

years. He has been involved in the planning and execution of Americas Gold and Silver’s Galena play a key role in the project development. Mr. Castaneda is a graduate of Tecnologico de Monterrey

GIP project (10 km’s from Ranger-Page), adding over 100 million ounces of silver equivalent over and the Thunderbird School of Global Management. Mr. Castaneda resides in Zacatecas, Mexico.

the last two years. Other recent successes, all located in the vicinity of the Ranger-Page include

developing the first Leapfrog model for Idaho Strategics’ Golden Chest deposit; developing the first

modern geologic models of the Gold Hunter Deposit, and the Galena Complex, all of which have Jose de Jesus Parga

led to near mine discoveries, some adding significant additional resources. Additional projects

in the Silver Valley include the Star, Coeur, Caladay, and Sunshine mines. Mr. Moore has assisted

TECHNICAL ADVISOR

Hecla’s corporate development team with technical due diligence related to M&A targets, and with Mr. Parga is a renowned Mexican geologist (National Award in Geology, 2005, by AIMMGM). For

negotiations related to the acquisition of Rock Creek and Montinor projects, a large silver-copper the past nine years, he has worked on potassium-lithium projects in central Mexico, including

resource in northwest Montana. Silver Valley’s concessions. In addition to exploration geology duties, he managed relations with

the government institutions and the rural communities. Mr. Parga has been very active with the

project, helping enormously with the Company’s due diligence work and continued evaluation of the

properties.

TSX.V SILV | QTCQB SVMFF

PAGE 7

A C ONTAINED 12.3MT OF SULFATE OF P OTASH (S OP ) AND 243,000 TONNE S OF LITHIUM CARB ONATE E QUIVALENT (LCE )

Maiden Mineral Resource Estimate

MAIDEN MIN E R A L R E S O UR C E E S TIMATE L A S AL ADA S AL AR M I NE R AL R E S O U R C E E ST I M AT E

S ALAR MINERA L TONNE S K ( %) L I (PPM) SALAR MINERAL TO N N E S K (%) LI ( PPM)

RE S OURC E (MT ) RESOURCE (MT )

CATE G ORY CAT E G O RY

LA S ALADA 20 4.1 880 P OTA S SIUM 11 5.3 518

S ANTA CLARA 85 4.8 264 HIGH LITHIUM 7 2.5 1,488

Inferred Inferred

CALIG UE Y 15 4.3 373 LOW LITHIUM 2 2.3 782

TOTAL 120 4.6 380 TOTAL 20 4.1 880

• 120 million tonnes (Mt) of Inferred Mineral Resources grading 4.6% potassium La Salada separate statement is provided to demonstrate the different grades within

(K) and 380 ppm lithium (Li) the three modelled domains (high-potassium, high-lithium and low-lithium) to

highlight the potential to mine a higher-lithium product at La Salada.

• A continuous high-lithium portion of La Salada salar containing 7Mt grading

1,490 ppm within a total 20Mt grading 4.1% potassium (K) and 880 ppm lithium

(Li)

NOTES: Mr. Martin Pittuck, CEng, MIMMM, FGS, is responsible for this Mineral Resource statement and is an “independent qualified

• A contained 12.3Mt of Sulfate of Potash (SOP) and 243,000 tonnes of lithium

person” as such term is defined in NI 43-101. Mineral Resource is reported above breakeven value of USD 37/t; calculated using

carbonate equivalent (LCE) potassium and lithium grades, recoveries, operating costs and selling prices on a block-by-block basis. Mineral Resource is

considered to have reasonable prospects for eventual economic extraction by open pit surface mining. Mining Resources are not

• Sediment sampling is restricted to 5 metre depths in most areas; excellent

Mineral Reserves and do not have demonstrated economic viability. The statement uses the terminology, definitions and guidelines

exploration potential to increase the Mineral Resource at depth and by extending given in the CIM Standards on Mineral Resources and Mineral Reserves (May 2014) as required by NI 43-101. Effective date 17

the sampling to the edge of the salar basins where sampling has not taken place December 2018. MRE is reported on 100%basis. Tonnes are reported in metric units.

TSX.V SILV | QTCQB SVMFF

PAGE 8

E XCELLENT INFRASTRUC TURE IN T HE RE GION

Location & Infrastructure

I NF RAS T RUC TU R E

• Strategic land position in an emerging potassium-lithium province in the Central Zacatecas & San Luis Potosi

Mexican Plateau.

# SA L AR

• Located near Zacatecas, Mexico the company benefits from the presence of 1 La Salada

Fresnillo Plc, the top producer of silver in Mexico. There is an abundance of skilled 2 Santa Clara

Caliguey

labour, service suppliers, and equipment vendors available meaning no need to

construct camps or any other residential infrastructure as the workforce is local to

the Project.

• Zacatecas has an international airport, modern highways transecting the project

areas, railway is located nearby, power is sufficient, there is an abundance of

water, and easy access to ports on both the Gulf of Mexico and Pacific Ocean.

TSX.V SILV | QTCQB SVMFF

PAGE 9

AN EMERG ING LITHIUM-P OTAS SIUM PROVINCE

Central Mexican Plateau

• An emerging potassium-lithium province

• Mineral rich brines from salty lagoons require intense volcanic activity, post volcanic activity

that contributes to the mineralizing fluids, a hot dry climate with low humidity that allows a strong

evaporation and consequent mineral concentration. These conditions are also seen in Nevada,

South America (Chile, Argentina, Bolivia) and Tibet

• Historically the nearest resources outside the US were South America, and the “Lithium Triangle” of

Chile, Argentina, and Bolivia

• The Central Mexican Plateau satisfies these conditions and is emerging as a new potassium-lithium

province, with demand for both growing rapidly. Demand for potash fertilizer in Mexico has become

a national priority as Mexico is 100% dependent on imports for these commodities

VIEW OF LA SALADA SALAR

• Salar - a natural salt pan or salt lake formed by evaporation

Work Timeline of the Salars of the Central Mexican Plateau

1652 1837 1912 1989 1992 2010–2012 2016 2017 2019

Colonial Spanish Began salt Salt production Mexican MGS found Prior owner collected Lab studies completed Weak acid leach tests First resource estimate

produced salt production by 50 tons per day Geologic Survey Lithium in over 3,500 sediment by Alset suggests reveal up to 97% recovery published defining 12.3

from the brines pumping brines with capacity (MGS) found evaporation samples from surface that the majority of of lithium from salar Mt sulphate of potash

in the region to surface for “for double that” Lithium in lagoons at to 5m depths with up Lithium is not held as sediments. Drilling and 243,000 tons of

evaporative sediments up to Caliguey Salar to 2,590 ppm Lithium smectite/hectorite program at La Salada lithium carbonate and

concentration 300 mg/L ranging from & 11% Potassium salar confirms sediment wide open for expansion

12,000 -21,000 resources and significant including brine potential

mg/L potassium in near- to be tested

surface brines

TSX.V SILV | QTCQB SVMFF

PAGE 10

MO ST PRO SPE C TIVE SALAR IN THE P ORTF OLIO

Santa Clara Salar

• High priority for sediment exploration and future deep basin target drilling for SOP and Lithium

brine. Size: 1,660 hectares, Scale: ~5 km x 2 km

• Artesian brine wells noted in the vicinity of the salar by local community

• Strong potassium grades reported in 848 sediment samples at Santa Clara ranging in grade

from 1.25% - 6.61%, averaging ~4.80%

• Sediment sampling is restricted to 5 metre depths in most areas; excellent exploration

potential to increase the Mineral Resource at depth and by extending the sampling to the edge

of the salar basins where sampling has not taken place

L E GEND

Sediment Sample

Silver Valley Claim

Salar Outline

TSX.V SILV | QTCQB SVMFF

PAGE 11

DEEP BASIN BRINE AQUIFER P OTENTIAL

Santa Clara Salar

• Geophysics completed by Zenith Minerals on neighboring salars from Santa Clara

(within 10km) indicates strongly conductive anomalies with the potential to host

a deep basin aquifer

• Santa Clara salar is the largest salar in the district and hypothesized that it may

be the centre point of a regional basin

• Geophysics results indicate basin depths of 100m to 1,000m which is analogous MAGNETOTELLURICS PROFILE, SAN VICENTE-SAN JUAN SALAR (EAST OF SANTA CLARA)

to similar producing brine aquifers at Clayton Valley, Nevada

2017 DRILL RIG FOR DIAMOND AND AUGER DRILLING

MAGNETOTELLURICS PROFILE, ILLESCAS SALAR (SOUTH OF SANTA CLARA)

TSX.V SILV | QTCQB SVMFF

PAGE 12

E XPLORATION P OTENTIAL IN THE SEDIMENT S – C ONTINUOUS HIGH-GRADE LITHIUM

La Salada Salar

• Continuous high lithium portion at La Salada salar containing 7Mt @ 1,490 ppm; remains wide open at depth

beyond the 5 metres tested to date

• 20Mt averaging 4.10% potassium (K) and 880ppm lithium (Li)

• Historic sediment sampling in 2011 on 100m x 100m grid, 151 excavated pits to 5m with each meter channel

sampled (711 samples)

3D VIEW (LOOKING NE) OF

LA SALADA GEOLOGICAL

MODEL OF HIGH AND LOW-LI

WIREFRAMES. VERTICAL

EXAGGERATION X5 SEDIMENTS AT 1 METER

TSX.V SILV | QTCQB SVMFF

PAGE 13

E XPLORATION P OTENTIAL IN THE SEDIMENT S – C ONTINUOUS HIGH LITHIUM

La Salada Salar

• 2017 drill program of 40 auger holes ranging in depth from 4.5m – 25.5m for sediment and near-surface brine

sampling

• Potassium in water peaked at 27,000 mg/l with an avg. of 13,000 mg/l and sulfate (SO4) peaked at 40,000mg/l

with an avg. of 17,000 mg/l

• 2017 diamond drill hole ended at 50m - salar basement not confirmed

NEAR-SURFACE BRINES

TSX.V SILV | QTCQB SVMFF

PAGE 14

SEDIMENT S AND BRINE

Caliguey Salar

• 300 Hectares

• Historic sampling by the Mexican Geological Survey

(MGS) in 1992

• Brine from 20m wells pumped to the surface and

concentrated by evaporation yielded lithium results

of 1.2 – 2.1% (12,000 – 21,000 mg/l)

• Sediment samples ranged from 200 – 1,500 ppm

lithium

• Historic sediment sampling in 2010 on 100m x

100m grid, 300 excavated pits to 5m with each

meter channel sampled (1,512 samples)

• Potassium average of 4.30%, lithium average of

373ppm

• Historic RC drill program of 5 holes in 2010 ranging

in depths of 34 to 60 meters, salar basement was

not intersected

RC DRILLING AT CALIGUEY CALIGUEY – 2010 POTASSIUM IN SEDIMENTS (%)

TSX.V SILV | QTCQB SVMFF

PAGE 15

S OP IS AN E S SENTIAL FERTILIZER F OR HIGH VALUE CROP S

About SOP

Sulphate of Potash (SOP) Muriate of Potash (MOP)

• SOP is a fertilizer product used in the production of high-value, chloride intolerant • Standard source of potassium

sensitive crops (fruits, vegetables and tree nuts)

• Also known as KCl

• Also known as K2SO4

• Contains chloride (no nutrient value), which can be harmful to the point of killing

• Increases yields, fights disease, and significantly improves the flavor, colour and crops through toxicity. Chloride can leach into groundwater or build up in arid soil

longevity of the crop conditions, impacting yields and crop quality

• Contains abundant sulfur, a beneficial secondary nutrient for healthy plant growth • MOP is applied to low-value, chloride-tolerant crops (rice, corn, maize, wheat,

etc.)

• Soluble SOP can be delivered directly to plants and sells at a significant premium

to standard and granular SOP • Price averages less than half of SOP

SOURCE: PUBLIC DISCLOSURE, CRU GROUP, ARGUS MEDIA GROUP.

(1) SOURCE: CRU GROUP.

(2) SOURCE: 2020 SUPPLY AGREEMENT BETWEEN BPC AND CHINA CONSORTIUM.

TSX.V SILV | QTCQB SVMFF

PAGE 16

SULPHATE OF P OTASH: LOWE ST C O ST PRODUCER

SOP Production Processes & Costs

• The Company is targeting the deep brine aquifers for the potential of future PRIMARY SOP production.

This represents the lowest cost SOP production worldwide if successful in discovery

• SOP is produced by three main processes:

1. Salt lake brine processing through evaporation and purification - organic

2. Secondary process of reacting MOP with sulfate salts

3. Mannheim process of reacting MOP with sulfuric acid

SOURCE: CRU GROUP JANUARY 2020 MARKET OUTLOOK. INDUSTRY COST CURVE SHOWS TOTAL CASH COST OF EXISTING SOP MINES THAT ARE CURRENTLY IN PRODUCTION.

GLOBAL SOP CASH COST I CURVE (US$/T FOB)

400

Existing Brine Producers have a competitive cost of

production advantage as evaporation is the lowest cost

SOP production method worldwide.

300

200

SECONDARY/ MANHEIM

PRODUCTION

SECONDARY/ MANHEIM

BRINE PRODUCTION

HIGH

100

BRINE LOW

2019 CUMULATIVE ANNUAL PRODUCTION: 6.5MTPA

TSX.V SILV | QTCQB SVMFF

PAGE 17

LITHIUM AND SULPHATE OF P OTAS H SEDIMENT PRO JE C T S

Peer Comparisons NOTE: (1) MARKET CAPITALIZATION FIGURES IN US$ AS AT 14 APRIL 2022

2) GANFENG PURCHASED BACANORA IN 2021 FOR US$391M

C O MPANY LOCAT ION DE P O S IT DESCRIPTION - GRADE TO N N E S M AR KET

CAP ( $) ( 1 )

BACANORA (GANFENG LITHIUM) Mexico Sonora deposit Lithium: 3,250 ppm Li / 1.4% K -M&I 5Mt LCE & 4Mt SOP $20B (2)

LITHIUM AMERICA S – T SX :LAC Nevada Thacker Pass deposit Lithium: 3,283 ppm Li – Proven & Probable 3.14 Mt LCE $4B

IONEER LTD – A SX :INR Nevada Rhyolite Ridge deposit Lithium: 1,600 ppm Li / 14,200 ppm B – M&I+Inferred 1.25 Mt LCE & 12 Mt $1.1B

Boric Acid

AMERICAN LITHIUM - T SX .LI Nevada Tonopah deposit Lithium: 912 ppm M&I 5.37Mt LCE $604M

VERDE AGRITE CH – T SX :NPK Brazil Cerrado Verde deposit SOP: 9.28% K2O – M&I 296 Mt K2O $376M

ARIZONA LITHIUM - A SX . AZL Arizona Big Sandy deposit Lithium : 1850 ppm Indicated/Inferred 321kt LCE $283M

CYPRE S S DEV.- T SXV:CYP Nevada Clayton Valley deposit Lithium : 905 ppm Li - Indicated 6.28Mt LCE $225M

JINDALEE RE S OURCE S - A SX : JRL Oregon McDermitt deposit Lithium : 1320 ppm Li - Indicated/Inferred 10.1Mt LCE $204M

BRADDA HEAD LITHIUM - LON:BHL Arizona Wikieup/Basin deposits Lithium : 818 ppm Li / 3.3% K - Inferred 185kt LCE $59M

NORAM LITHIUM - T SXV:NRM Nevada Zeus deposit Lithium : 923 ppm Li - M&I 1.78Mt LCE $57M

S OPERIOR FERTILIZER Utah Blawn Mountain SOP : 3.51% K2O - M&I 5.5Mt K2O $11.5M

SILVER VALLE Y METAL S Mexico MexiCan Deposit Lithium : 3 deposits: 880/373/264 ppm Li - Inferred 243kt LCE $7M

SILVER VALLE Y METAL S Mexico MexiCan Deposit SOP : 3 deposits: 4.1%K/4.3%K/4.8%K - Inferred 12.3Mt SOP $7M

TSX.V SILV | QTCQB SVMFF

PAGE 18

THE C OMPANY ’ S HIGH GRADE BRINE TRADE S AT A SIGNIFICANT DIS C OUNT TO PEER S

Peer Comparisons

C O MPANY SYM B OL LOCAT ION S TAGE MARKET K BR I N E

CA P ($) G R AD E

( 1)

(M G/L )

C OMPA S S MINERAL S CMP.NYSE Utah, Ontario, Brazil, Integrated Producer US$2.25B 6,000

INTERNATIONAL UK

AGRIMIN AMN.ASX W. Australia DFS in 2020, EIS in mid-2022, FID in H2 2022, 70% of production under offtake A$121M 3,349 (3)

KALIUM LAKE S KLL.ASX W. Australia Commissioning, H2 2022 for initial commercial production. A$80M 5,897 (2)

AUSTRALIAN P OTA SH APC.ASX W. Australia In development, final equity financing. 90% of production under offtake A$50M 3,402 (4)

REWARD MINERAL S AWD.ASX W. Australia Pre-Feasibility A$19M 4,750

SILVER VALLE Y METAL S SILV.V Mexico Preliminary Sampling $7M 12,720

NOTES: (1) MARKET CAPITALIZATION FIGURES AS AT 14 APRIL 2022

(2) KALIUM LAKES BRINE GRADE (MG/ BASED ON COMBINED MEASURED, INDICATED, INFERRED RESOURCE

(3) AGRIMIN BRINE GRADE (MG/ BASED ON TOTAL MINERAL RESOURCE (TOTAL POROSITY) ORE RESERVE GRADE 2 815 K (MG/ AS PER JANUARY 20 2020 ASX RELEASE FOR MINERAL RESOURCE AND AS PER JULY 21 2020 ASX RELEASE FOR ORE RESERVE

(4) AUSTRALIAN POTASH BRINE GRADE (MG/ BASED ON MEASURED RESOURCE AS AT JUNE 30 2020

TSX.V SILV | QTCQB SVMFF

PAGE 19

100%-OWNED LITHIUM-P OTAS SIUM PRO JE C T IN ME XIC O WITH NI 43-101 INFERRED RE S OURCE

Snapshot

Exploration Potential Experienced Local Size & Scale Potential Current NI 43-101 Resource Dual High Value Commodities

Management Team As Co-Products

Deep Basin Aquifier Potential 100% Ownership Mining-Friendly State in Large Land Position Exposure to SOP & Lithium

Mexico

TSX.V SILV | QTCQB SVMFF

PAGE 20

Capital Structure

S H A RE STRUC TURE S H A R E PR IC E PE R F O R M A N C E ( 1-Y E A R ) (2)

Common Shares (Basic) 45.1M

Options 2.9M

Warrants @ $0.15 (Nov-24) 9.3M

Warrants @ $0.30 (Mar-23) 2.75M

Common Shares (FD) 60.1M

FINANCIAL

Cash (1)

$525,000

Share Price (2)

$0.095

Market Cap (C$) (Basic) $4.3M

SOURCE: TMX GROUP, SEDAR, YAHOO FINANCE.

(1) AS AT NOVEMBER 14, 2022.

Average Daily Volume (90-day) 37,000

(2) AS AT NOVEMBER 14, 2022.

TSX.V SILV | QTCQB SVMFF

PAGE 21

CONTACT

US

BRANDON ROOK

PRESIDENT & CEO

E: brandon@silvervalleymetals.com

M: 604-800-4710

HEAD OFFICE

750 - 1095 WEST PENDER STREET

VANCOUVER, B.C. V6E 2M6

silvervalleymetals.com TSX.V SILV | QTCQB SVMFF

You might also like

- Recent Advances in Mining and Processing of Low-Grade and Submarginal Mineral Deposits: Centre for Natural Resources, Energy and Transport, United Nations, New YorkFrom EverandRecent Advances in Mining and Processing of Low-Grade and Submarginal Mineral Deposits: Centre for Natural Resources, Energy and Transport, United Nations, New YorkRating: 5 out of 5 stars5/5 (1)

- AGMRacquireslandDocument3 pagesAGMRacquireslandEtsonNo ratings yet

- Litio en Arcillas MarronesDocument5 pagesLitio en Arcillas MarronesWilber Manrique ValdiviaNo ratings yet

- Everest Gold Inc Presentation Dec 2012Document25 pagesEverest Gold Inc Presentation Dec 2012richardharris841188No ratings yet

- HCH5Productora Delivers PFS Resource Reserve Upgrade02032016 1Document78 pagesHCH5Productora Delivers PFS Resource Reserve Upgrade02032016 1Ezequiel Guillermo Trejo NavasNo ratings yet

- Choice Gold Corporate PresentationDocument20 pagesChoice Gold Corporate PresentationMohamed KhamisNo ratings yet

- Lms Lacsha Project 97 PDFDocument14 pagesLms Lacsha Project 97 PDFRicardo CesarNo ratings yet

- (NAK) Northern Dynasty Presentation 2017-06-05Document39 pages(NAK) Northern Dynasty Presentation 2017-06-05Ken Storey100% (1)

- KPG Research Report On Nova Minerals LimitedDocument24 pagesKPG Research Report On Nova Minerals LimitedEli BernsteinNo ratings yet

- Pressed PDFDocument19 pagesPressed PDFHenry OkoyeNo ratings yet

- C SEDAR FILINGS Annual-ReportDocument36 pagesC SEDAR FILINGS Annual-Reportcarlos arroyo huaracaNo ratings yet

- Lion One Metals - Tuvatu Gold Project - Dec 2011 PresentatnDocument19 pagesLion One Metals - Tuvatu Gold Project - Dec 2011 PresentatnIntelligentsiya HqNo ratings yet

- Characteristics of High Sulphidation Epithermal Gold Deposits in Chile and ArgentinaDocument18 pagesCharacteristics of High Sulphidation Epithermal Gold Deposits in Chile and ArgentinaCarlos Manuel Changanaqui PlasenciaNo ratings yet

- Calcatreu 7Document237 pagesCalcatreu 7ricar20100% (1)

- AlicantoDocument22 pagesAlicantoSantiagoCuartasNo ratings yet

- KM66 CRD Project PDFDocument12 pagesKM66 CRD Project PDFHector Felix Gonzalez RamirezNo ratings yet

- Discovering Mineral Resources Annual Report 2006Document56 pagesDiscovering Mineral Resources Annual Report 2006Luis Jordan LoboNo ratings yet

- MCoal Coal July Investor SlidesDocument26 pagesMCoal Coal July Investor SlidesMCoaldataNo ratings yet

- PLMC Investor Presentation September 17 2014 - v001 - l8949n PDFDocument22 pagesPLMC Investor Presentation September 17 2014 - v001 - l8949n PDFguanatosNo ratings yet

- Gold by CarubeDocument25 pagesGold by CarubeTony GaryNo ratings yet

- Caña Brava PCDDocument5 pagesCaña Brava PCDJoseph Felipe Bazan ChavezNo ratings yet

- Other Mexico Mine PropertiesDocument12 pagesOther Mexico Mine PropertiesgechectorglzNo ratings yet

- New Pacific Announces Expanded Discovery Drill Program at The Carangas Silver ProjectDocument5 pagesNew Pacific Announces Expanded Discovery Drill Program at The Carangas Silver ProjectLuis VeraNo ratings yet

- Osler - Emerging Technologies in Energy - LithiumDocument17 pagesOsler - Emerging Technologies in Energy - LithiumetsimoNo ratings yet

- Eldora Gold Resources News - Willow Creek Signs LOI To Acquire Historic Gold Property in Prestigious Walker Lane, NevadaDocument4 pagesEldora Gold Resources News - Willow Creek Signs LOI To Acquire Historic Gold Property in Prestigious Walker Lane, NevadaeldoragoldresourcesNo ratings yet

- Corporate Presentation Highlights Brixton's Thorn Project PotentialDocument23 pagesCorporate Presentation Highlights Brixton's Thorn Project PotentialarzoorathiNo ratings yet

- Colibri Fact Sheet-ProofDocument2 pagesColibri Fact Sheet-ProofkaiselkNo ratings yet

- YNG Presentation Feb 2012Document36 pagesYNG Presentation Feb 2012MariuszSkoniecznyNo ratings yet

- Trans Canada Gold Corp.: News ReleaseDocument4 pagesTrans Canada Gold Corp.: News ReleaseTrans Canada Gold Corp. (TSX-V: TTG)No ratings yet

- Goliath Resources Wealth Letter Analyst Report February 25, 2021Document7 pagesGoliath Resources Wealth Letter Analyst Report February 25, 2021Chester Yukon GoldNo ratings yet

- Trans Canada Gold Corp.: News ReleaseDocument4 pagesTrans Canada Gold Corp.: News ReleaseTrans Canada Gold Corp. (TSX-V: TTG)No ratings yet

- El Oro Tailings Opportunity Oct 2020Document10 pagesEl Oro Tailings Opportunity Oct 2020betoNo ratings yet

- December 2023 Corporate PresentationDocument26 pagesDecember 2023 Corporate Presentationwagah22600No ratings yet

- Canadian Zinc Corp Media Release - 19 May 2009 - Option Agreement On Tuvatu Gold ProjDocument4 pagesCanadian Zinc Corp Media Release - 19 May 2009 - Option Agreement On Tuvatu Gold ProjIntelligentsiya HqNo ratings yet

- Presentation February 2017Document23 pagesPresentation February 2017kaiselkNo ratings yet

- Update on Weda Bay Nickel/Cobalt Laterite Project Resource DefinitionDocument17 pagesUpdate on Weda Bay Nickel/Cobalt Laterite Project Resource DefinitionSulistya Tangkaari WaodeNo ratings yet

- Las Cristinas Gold Project Feasibility StudyDocument35 pagesLas Cristinas Gold Project Feasibility StudyJos BenNo ratings yet

- Viscount Mining (VML.V) in Bull & Bear's Financial ReportDocument1 pageViscount Mining (VML.V) in Bull & Bear's Financial Reportblast firstNo ratings yet

- Trans Canada Gold Corp. Prepares Gold Targets and Drill Program For The Crippleback Lake Gold Project in The Corridor of Gold in Central NewfoundlandDocument4 pagesTrans Canada Gold Corp. Prepares Gold Targets and Drill Program For The Crippleback Lake Gold Project in The Corridor of Gold in Central NewfoundlandTrans Canada Gold Corp. (TSX-V: TTG)No ratings yet

- Manica Gold Project Mozambique Offers Significant Exploration UpsideDocument21 pagesManica Gold Project Mozambique Offers Significant Exploration UpsidedclayjutaNo ratings yet

- Aldershot Resources Uranium Vanadium Mining PropertyDocument2 pagesAldershot Resources Uranium Vanadium Mining PropertyRichard J MowatNo ratings yet

- Hope Bay 2011Document2 pagesHope Bay 2011Mi Mina CorruptaNo ratings yet

- Cliffs Chromite Booklet - Feb4 E - WebDocument25 pagesCliffs Chromite Booklet - Feb4 E - WebNetNewsLedger.comNo ratings yet

- Resolution Copper Project to Meet 25% of US Copper DemandDocument2 pagesResolution Copper Project to Meet 25% of US Copper DemandJacob Corral MagallanesNo ratings yet

- Wealth Letter: West Mining Corp Analyst Report - March 2021Document9 pagesWealth Letter: West Mining Corp Analyst Report - March 2021James HudsonNo ratings yet

- Sunset Cove Mining Discovers 13 New Silver Veins To Be Drilled ShortlyDocument5 pagesSunset Cove Mining Discovers 13 New Silver Veins To Be Drilled Shortlyapi-167940199No ratings yet

- NAP RIO JV Resource SummaryDocument6 pagesNAP RIO JV Resource SummaryReginaLeaderPostNo ratings yet

- Lion One Metals - Tuvatu Gold Project - Fiji - Exploratn Confirmtn - 23 Nov 2011Document2 pagesLion One Metals - Tuvatu Gold Project - Fiji - Exploratn Confirmtn - 23 Nov 2011Intelligentsiya HqNo ratings yet

- Trans Canada Gold Corp.: News ReleaseDocument4 pagesTrans Canada Gold Corp.: News ReleaseTrans Canada Gold Corp. (TSX-V: TTG)No ratings yet

- Tocvan Ventures Provides Phase II Drill Program UpdateDocument3 pagesTocvan Ventures Provides Phase II Drill Program UpdateLaura Lizette Ramirez DiazNo ratings yet

- Orporate ResentationDocument25 pagesOrporate ResentationRayanNo ratings yet

- New Pacific Commences Initial Discovery Drilling at The Carangas Silver ProjectDocument5 pagesNew Pacific Commences Initial Discovery Drilling at The Carangas Silver ProjectLuis VeraNo ratings yet

- New Pacific Commences A 38,000 Metre Exploration and Resource Expansion Drill Program at Its Flagship Silver Sand ProjectDocument8 pagesNew Pacific Commences A 38,000 Metre Exploration and Resource Expansion Drill Program at Its Flagship Silver Sand ProjectLuis VeraNo ratings yet

- Trans Canada Gold Corp.: News ReleaseDocument4 pagesTrans Canada Gold Corp.: News ReleaseTrans Canada Gold Corp. (TSX-V: TTG)No ratings yet

- Trans Canada Gold Corp.: News ReleaseDocument4 pagesTrans Canada Gold Corp.: News ReleaseTrans Canada Gold Corp. (TSX-V: TTG)No ratings yet

- Old Harry 8 Apr 2011Document46 pagesOld Harry 8 Apr 2011Stan HollandNo ratings yet

- 6a1135503 DevDocument16 pages6a1135503 DevSteve MarkzNo ratings yet

- Business Plan MagnetiteDocument45 pagesBusiness Plan MagnetiteJuliano ConstanteNo ratings yet

- Trans Canada Gold Corp.: News ReleaseDocument4 pagesTrans Canada Gold Corp.: News ReleaseTrans Canada Gold Corp. (TSX-V: TTG)No ratings yet

- LARA Investor PresentationDocument17 pagesLARA Investor PresentationEdgard DiazNo ratings yet

- حليوات و شهيوات - E - قائمة الحلال والحرام من المجموعة... - فيسبوكDocument2 pagesحليوات و شهيوات - E - قائمة الحلال والحرام من المجموعة... - فيسبوكaymanNo ratings yet

- LiteraturDocument94 pagesLiteraturMuhammad Iqbal MaulanaNo ratings yet

- Preparation of PotassiumSulphateDocument5 pagesPreparation of PotassiumSulphatenithansaNo ratings yet

- Valve Material Selection GuideDocument5 pagesValve Material Selection GuidekamiloktayNo ratings yet

- Moc ChartDocument8 pagesMoc ChartRSNo ratings yet

- Potassium SulfateDocument19 pagesPotassium SulfateLaila AteyatNo ratings yet

- Modern Ammonia Production PlantDocument58 pagesModern Ammonia Production PlantPrabal Kahar100% (1)

- Pears Pears Pears Pears Pears: Nitrogen (N)Document4 pagesPears Pears Pears Pears Pears: Nitrogen (N)Zineil BlackwoodNo ratings yet

- AlumxxxDocument4 pagesAlumxxxDjugian GebhardNo ratings yet

- Ferrous SulphateDocument62 pagesFerrous Sulphatekhushboo pNo ratings yet

- Chemical formulas and empirical formulas listDocument12 pagesChemical formulas and empirical formulas listadlhaNo ratings yet

- Alchemists ConcordanceDocument108 pagesAlchemists Concordanceroger santosNo ratings yet

- IGCSE ChemistryDocument32 pagesIGCSE ChemistryTysonNo ratings yet

- Honors Chemistry WKSHT Solution Stoichiometry With Some ANSWERSDocument5 pagesHonors Chemistry WKSHT Solution Stoichiometry With Some ANSWERSAlbert LinNo ratings yet

- European Patent Specification C01D 5/08, C01D 5/18: Printed by Jouve, 75001 PARIS (FR)Document9 pagesEuropean Patent Specification C01D 5/08, C01D 5/18: Printed by Jouve, 75001 PARIS (FR)enriqueramoscNo ratings yet

- Module 6 ActivitesDocument5 pagesModule 6 ActivitesOxygn XX100% (1)

- CH 3 Chemical Reaction WorksheetDocument19 pagesCH 3 Chemical Reaction Worksheetgert16100% (1)

- Summer Chemestry ProjectDocument8 pagesSummer Chemestry Projectshukla duttaNo ratings yet

- CT-L11 (Potash)Document13 pagesCT-L11 (Potash)Lahari LahariNo ratings yet

- Potassium SulfateDocument1 pagePotassium SulfateGreg BillNo ratings yet

- E NumberDocument30 pagesE Numberisy12073No ratings yet

- Mole Calculation Worksheet Answer KeyDocument5 pagesMole Calculation Worksheet Answer KeyNurul NadiaNo ratings yet

- Single-Stage Process for Manufacturing Potassium Sulphate from Sodium SulphateDocument5 pagesSingle-Stage Process for Manufacturing Potassium Sulphate from Sodium SulphateazharNo ratings yet

- Danielle N. - Making-Salts-differentiated-worksheetDocument2 pagesDanielle N. - Making-Salts-differentiated-worksheetdanielle njorogeNo ratings yet

- KOH From K2SO4 and NaOHDocument3 pagesKOH From K2SO4 and NaOHamirNo ratings yet

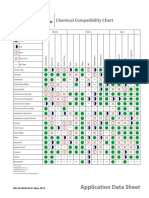

- IND-AS-00899-EN - Chemical Compatibility ChartDocument8 pagesIND-AS-00899-EN - Chemical Compatibility ChartlorenzoNo ratings yet

- Is 1047 1965Document28 pagesIs 1047 1965Kumud PathakNo ratings yet

- Z - Chemical Process Industries - K, N IndustriesDocument68 pagesZ - Chemical Process Industries - K, N IndustriesZVSNo ratings yet

- Sojitz to Invest in Indian SOP Fertilizer ProjectDocument2 pagesSojitz to Invest in Indian SOP Fertilizer ProjectBibaswan DuttaNo ratings yet

- Potassium in PlantsDocument13 pagesPotassium in PlantsTantoh RowlandNo ratings yet