Professional Documents

Culture Documents

Accounting Information System

Uploaded by

Imtiaz SultanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Information System

Uploaded by

Imtiaz SultanCopyright:

Available Formats

Chapter # 1

Accounting Information System.

An accounting information system (AIS) focuses on financial data, recording transactions,

and producing financial statements. It supports accounting and finance functions.

Management Information System

A management information system (MIS) collects and processes both financial and non-

financial data, providing information to support decision-making across various departments and

management levels.

INTERNAL AND EXTERNAL FLOW OF INFORMATION

Internal flow of information refers to the exchange and circulation of information within an

organization, typically among employees, departments, and management levels.

External flow of information involves the exchange of information between an organization

and external parties, such as customers, suppliers, regulatory bodies, and the general public.

Difference between transaction, financial transaction and non-financial transaction

Transaction: A transaction is a process of exchanging goods, services, or information between

parties for mutual benefit.

Financial Transaction: A financial transaction is the transfer or exchange of money or financial

assets between individuals, businesses, or institutions.

Non-Financial Transaction: A non-financial transaction involves the exchange of goods, services, or

information without monetary transactions or financial assets.

Chapter # 3

ETHICAL ISSUES IN BUSINESS

Ethical issues in business are situations that involve moral concerns, such as fairness,

honesty, discrimination, environmental impact, and consumer protection.

Business Ethics

Business ethics is about doing the right thing in business, treating people fairly, being

honest and trustworthy, and considering the impact of actions on others and society.

Computer Ethics in Business:

1. Responsible Technology Use: Utilizing computer technology in a responsible and ethical

manner within business operations.

2. Data Privacy and Security: Safeguarding sensitive data and protecting the privacy rights of

customers, employees, and stakeholders.

3. Intellectual Property: Respecting and upholding copyright laws and intellectual property

rights in digital content and software.

4. Cybersecurity: Implementing measures to prevent unauthorized access, data breaches, and

cyber-attacks.

5. Fair and Ethical Use of Information: Ensuring ethical practices when collecting, storing, and

using digital information.

6. Digital Accessibility: Making digital resources and technology accessible to individuals with

disabilities.

FRAUD

Fraud is an intentional act of deception or deceit, often involving false information or

misrepresentation, for the purpose of obtaining personal or financial gain at the expense of others.

According to common law, the conditions for establishing fraud typically include the following

elements:

Misrepresentation or False Statement

Knowledge of Falsity

Intent to Deceive

Reliance

Damages

DIFFERENCE BETWEEN EMPLOYEE AND MANAGEMENT FRAUD?

Employee Fraud: Employee fraud refers to fraudulent activities committed by individual

employees within an organization. It involves deceptive actions, such as theft, embezzlement, or

manipulation of company resources for personal gain.

Management Fraud: Management fraud, on the other hand, involves fraudulent activities

perpetrated by higher-level executives or managers within an organization. It typically includes

schemes such as financial statement manipulation, insider trading, or misrepresentation of

company performance for personal or organizational benefit.

THE FRAUD TRIANGLE

The fraud triangle is a concept that explains the factors contributing to fraud. It consists of three

elements:

1. Opportunity: The presence of circumstances or conditions that allow someone to commit

fraud without getting caught.

2. Rationalization: The individual's ability to justify or rationalize their fraudulent behavior,

often by convincing themselves that it is justified or necessary.

3. Pressure or Incentive: Financial, personal, or situational pressures that drive individuals to

engage in fraudulent activities, such as financial difficulties or the desire for personal gain.

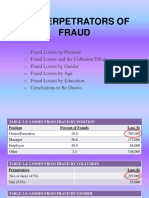

THE PERPETRATOR OF FRAUDS

The ACFE study examined a number of factors that profile the perpetrator of the frauds, including

position within the organization, collusion with others, gender, age and education.

Losses from fraud by positions Losses from fraud by collusion

Positions Percentage of fraud Perpetrators Percentage

Owner/Executive 23% Two or more 36%

Manager 37% One 64%

Employees 40%

Losses from fraud by Gender Losses from fraud by educational level

Gender Percentage of fraud Educational level Loss ($)

Male 59% High School 100 000

Female 41% College 210 000

Postgraduate 550 000

Losses from fraud by age

Age Range Loss ($)

<26 25 000

26 – 30 50 000

31 – 35 113 000

36 – 40 145 000

41 – 50 250 000

51 – 60 500 000

>60 435 000

FRAUD SCHEMES

Fraud schemes involve deceptive methods or techniques used to gain personal or financial

benefits through dishonest or illegal means. Three broad categories of fraud schemes.

Losses from fraud by scheme types

Scheme type Percentage of loss

Fraudulent statement 10%

Corruption 27%

Asset misappropriation 89%

Fraudulent statement: A fraudulent statement is a false or misleading statement made with the

intention to deceive others for personal gain or advantage.

Corruption: Corruption is the abuse of entrusted power or position for personal gain or advantage,

typically involving bribery, fraud, or dishonest practices.

Assets Misappropriation: Asset misappropriation refers to the unauthorized or improper use,

theft, or manipulation of an organization's assets by an individual for personal gain.

Subcategories of assets misappropriation with fraud percentage according to ACFE.

Skimming (17%) Payroll (9%)

Cash Larceny (10%) Expense reimbursement (13%)

Billing (24%) Theft of cash (15%)

Check Tampering (15%) Non-cash misappropriation (16%)

INTERNAL CONTROL CONCEPT AND TECHNIQUES

Internal control refers to the measures and practices implemented within an organization to

ensure the reliability of financial reporting, safeguard assets, and promote operational efficiency.

Here are some headings that can help you understand internal control concepts and techniques

better:

Environment control

Risk assessment

Control activities

Information and communication

Monitoring

INTERNAL CONTROL AND THEIR STAGES

Internal controls are policies, procedures, and technical safeguards that protect an organization’s

assets by preventing errors and inappropriate actions. Internal controls fall into three broad

categories: detective, preventative, and corrective.

Preventive controls are implemented before any specific adverse event happens, and their

objective is to prevent errors and fraud from happening in the first place. For example, multi-

factor authentication restricts user access to confidential data.

Detective controls are activated to identify errors that have occurred before they cause significant

problems. For example, audit trails can be used to track changes made to financial records.

Corrective controls are implemented after an error has occurred. Their objective is to correct the

error and prevent it from happening again. For example, a company might implement a new policy

or procedure after discovering an error.

HOW TO CONTROL INTERNAL CONTROL ACTIVITIES.

Internal control activities refer to the specific actions and procedures implemented within an

organization to ensure the effectiveness of internal controls. These activities are designed to

safeguard assets, prevent fraud, ensure accuracy in financial reporting, and promote operational

efficiency. Here are some common internal control activities.

1. Segregation of Duties: Separation of duties between different employees

2. Authorization and Approval: Approval of transaction and activities

3. Reconciliation and Review: Comparing records to ensure accuracy.

4. Documentation and Recordkeeping: Recording transaction and activities.

5. Monitoring and Supervision

6. Physical Controls

7. IT Controls

8. Training and Education

9. Internal Audit

10. Management Review and Oversight

Chapter # 4

SALES ORDER PROCEDURE

The sales order procedure in the revenue cycle management is a sequence of actions that a

business follows to fulfill a customer purchase. It includes the tasks involved in:

1. Receiving and processing a customer order

2. Filling the order and shipping the products to the customer

3. Billing the customer at the proper time

4. Accounting for the transaction

SALES RETURN PROCEDURE

The sales return procedure is an important part of the revenue cycle. It is used to handle sales

returns from customers. The procedure involves several steps that are designed to ensure that the

return is handled properly and that the customer is satisfied with the outcome. Here are some of

the steps involved in the sales return procedure:

1. List the return and record the return type.

2. Determine how the customer initially paid and how the company returns funds.

3. Record whether the customer paid in cash or on store credit.

4. Record where this money comes from to balance the books.

5. Reflect a decrease in the cash account for cash refunds.

6. Decrease accounts receivable for a return for an item purchased on credit.

7. Place returned items back in inventory.

CASH RECEIPTS PROCEDURE

Cash receipts procedures are related to the basic concepts of accounting. It involves

receiving cash directly from customers, making cash receipt vouchers, depositing cash at the bank,

keeping records of cash and bank books or cash and bank transfer reports, and making daily cash

stock-taking. They are described in detail in the following section

Open mail and prepare remittance advice: Process of receiving and sorting incoming mail,

extracting payments, and preparing corresponding remittance advice documents.

Record and deposit checks: Documenting check receipts accurately and promptly and depositing

them into the designated bank accounts securely.

Update accounts receivable: Updating accounts receivable involves recording and tracking cash

receipts received from customers to reflect accurate outstanding balances.

Update General Ledger: Record cash receipts accurately in the General Ledger to reflect the

increase in cash balances and corresponding revenue accounts.

Reconcile cash receipts and deposits: Compare recorded cash receipts with actual cash deposits

to ensure accuracy and identify discrepancies.

REVENUE CYCLE CONTROL

Internal control activities that guide us in designing and evaluating transaction processing

controls. They are transaction authorization, segregation of duties, supervision, accounting

records, access control, and independent verification. These control activities as they apply in the

revenue cycle.

Transaction Authorization: Establishing approval processes to authorize and validate transactions

within the revenue cycle process.

Segregation of Duties: Segregating duties ensures that no single individual or department

processes a transaction in its entirety.

1. Transaction authorization should be separate from transaction processing.

2. Asset custody should be separate from the task of asset record keeping.

3. The organization should be structured so that the perpetration of a fraud requires collusion

between two or more individuals.

Supervision: Supervision can also provide control in systems that are properly segregated.

Accounting Records: Accurate and complete documentation of financial transactions and events

within the revenue cycle process to support transparency, compliance, and financial reporting.

Access Controls: Access controls prevent and detect unauthorized and illegal access to the firm’s

assets. The physical assets at risk in the revenue cycle are inventories and cash.

Independent Verification: The objective of independent verification is to verify the accuracy and

completeness of tasks that other functions in the process perform.

You might also like

- The Underlying ProblemsDocument3 pagesThe Underlying ProblemsjeffveracruzNo ratings yet

- Chapter 12Document5 pagesChapter 12Anonymous fBY2wwTcNo ratings yet

- BCS PPT1Document67 pagesBCS PPT1Lea Samantha GallardoNo ratings yet

- Forensic Audit: Shaheed Sukhdev College of Business Studies, University of DelhiDocument45 pagesForensic Audit: Shaheed Sukhdev College of Business Studies, University of Delhisarthakahuja67% (3)

- Ethics, Fraud, and Internal ControlDocument91 pagesEthics, Fraud, and Internal ControlJoelyn MirandaNo ratings yet

- FRAUD - 3rd GroupDocument18 pagesFRAUD - 3rd GroupDwi NovianaNo ratings yet

- CEB A Collection of Fraud SchemesDocument54 pagesCEB A Collection of Fraud Schemespunith1989No ratings yet

- Asset MisappropriationDocument16 pagesAsset Misappropriationdelhi delhi100% (1)

- Fafd Research PaperDocument9 pagesFafd Research Paperharshita patniNo ratings yet

- What Is FraudDocument8 pagesWhat Is FraudVeneranda AtriaNo ratings yet

- Research - Paper On Asset MisappropriationDocument17 pagesResearch - Paper On Asset Misappropriationdelhi delhi100% (1)

- Ethics, Fraud, and Internal Control: Presented byDocument40 pagesEthics, Fraud, and Internal Control: Presented byALMA MORENANo ratings yet

- FraudDocument10 pagesFraudHershey ReyesNo ratings yet

- What Is FraudDocument17 pagesWhat Is FraudKarthikNo ratings yet

- Manatad - Corporate Governance - Fraud and ErrorDocument3 pagesManatad - Corporate Governance - Fraud and ErrorPring PringNo ratings yet

- Pindi Yulinar Rosita - 008201905023 - Session 5Document7 pagesPindi Yulinar Rosita - 008201905023 - Session 5Pindi YulinarNo ratings yet

- The Perpetrators of FraudDocument20 pagesThe Perpetrators of FraudArianeMaeT.RicaboNo ratings yet

- Disney LandDocument8 pagesDisney LandBik LyNo ratings yet

- Financial Statement Fraud in An Organization: Instructor: Mr. Pierre Kmeid Student Name: Rebecca HajjDocument14 pagesFinancial Statement Fraud in An Organization: Instructor: Mr. Pierre Kmeid Student Name: Rebecca HajjRebecca Fady El-hajjNo ratings yet

- Chapter 3 - Ethics, Fraud and Internal ControlDocument8 pagesChapter 3 - Ethics, Fraud and Internal ControlHads LunaNo ratings yet

- Accounting Information SystemDocument39 pagesAccounting Information SystemTAETAENo ratings yet

- What Is Financial Crime?Document6 pagesWhat Is Financial Crime?Rizza Mae EudNo ratings yet

- Dafd Unit-1Document33 pagesDafd Unit-1NIKHIL kUMARNo ratings yet

- Fraud Awareness Week Lesson Plan - Rita Crundwell: VideoDocument3 pagesFraud Awareness Week Lesson Plan - Rita Crundwell: VideoChess NutsNo ratings yet

- Chapter 3 Joseph Chan Acc 3202Document7 pagesChapter 3 Joseph Chan Acc 3202Noushin ChowdhuryNo ratings yet

- Audit 09 JournalDocument6 pagesAudit 09 Journalkris salacNo ratings yet

- AIS6e ch03Document50 pagesAIS6e ch03Jecca JamonNo ratings yet

- 1 Simone BewryDocument30 pages1 Simone BewryTan DizzleNo ratings yet

- Chapter 3 - Ethics, Fraud, and Internal ControlDocument5 pagesChapter 3 - Ethics, Fraud, and Internal ControlAShley NIcoleNo ratings yet

- CH 03Document5 pagesCH 03goerginamarquezNo ratings yet

- Management FraudsDocument21 pagesManagement Fraudsksmann88100% (7)

- White Collar SessionalDocument20 pagesWhite Collar SessionalBinit PandeyNo ratings yet

- Ethics, Fraud, and Internal ControlDocument22 pagesEthics, Fraud, and Internal ControlsariNo ratings yet

- Rodriguez Zyra-Denelle 09 JournalDocument9 pagesRodriguez Zyra-Denelle 09 JournalDaena NicodemusNo ratings yet

- FAFP Backgroud PDFDocument165 pagesFAFP Backgroud PDFRahul KhannaNo ratings yet

- Ais - Fraud Ethics and Internal ControlDocument4 pagesAis - Fraud Ethics and Internal ControlMERRY CHRIS CERBITONo ratings yet

- Staff Fraud and Dishonesty Managing and Mitigating The Risks 2012Document48 pagesStaff Fraud and Dishonesty Managing and Mitigating The Risks 2012Andrew Richard ThompsonNo ratings yet

- Fraud Indicators AuditorsDocument35 pagesFraud Indicators AuditorsMutabarKhanNo ratings yet

- Govbusman Module 9.1 (11) - Chapter 14Document7 pagesGovbusman Module 9.1 (11) - Chapter 14Rohanne Garcia AbrigoNo ratings yet

- Red Flags FraudDocument15 pagesRed Flags FraudRizael Jrs100% (1)

- AIS Module 8Document5 pagesAIS Module 8Kim Maxene GarciaNo ratings yet

- Real - Fraud and ErrorDocument5 pagesReal - Fraud and ErrorRhea May BaluteNo ratings yet

- Fraud Taxonomies and ModelsDocument14 pagesFraud Taxonomies and ModelsVaibhav Banjan100% (1)

- Corporate Accounting Fraud: A Case Study of Satyam Computers LimitedDocument17 pagesCorporate Accounting Fraud: A Case Study of Satyam Computers LimitedAAFurqanNo ratings yet

- All About Forensic AuditDocument8 pagesAll About Forensic AuditDinesh ChoudharyNo ratings yet

- 08 Risiko FraudDocument57 pages08 Risiko Frauddowney_tengengNo ratings yet

- Forensic Accounting Week 4 NotesDocument7 pagesForensic Accounting Week 4 Noteswambualucas74No ratings yet

- Group 4 - Fraud, Computer Fraud, and Abuse TechniquesDocument13 pagesGroup 4 - Fraud, Computer Fraud, and Abuse Techniquesamelya puspitaNo ratings yet

- Ethics, Fraud, and Internal ControlDocument32 pagesEthics, Fraud, and Internal ControlMonica Ferrer100% (2)

- Objectives and Scope of Financial Statement AuditDocument54 pagesObjectives and Scope of Financial Statement AuditKogilavani a/p ApadoreNo ratings yet

- 2 - Fraud in BankingDocument14 pages2 - Fraud in BankingMuhammad GulfamNo ratings yet

- Module 03 Accounting and Information SystemsDocument8 pagesModule 03 Accounting and Information SystemsYolly DiazNo ratings yet

- Corporate Fraud Refers To Activities Committed byDocument4 pagesCorporate Fraud Refers To Activities Committed bysahil singhNo ratings yet

- Asset Misappropriation Fraud - Article 2 - Units 17Document13 pagesAsset Misappropriation Fraud - Article 2 - Units 17ishanvi tripathiNo ratings yet

- Chapter 2 Forensic Auditing and Fraud InvestigationDocument92 pagesChapter 2 Forensic Auditing and Fraud Investigationabel habtamuNo ratings yet

- Corporate Accounting Fraud: A Case Study of Satyam Computers LimitedDocument13 pagesCorporate Accounting Fraud: A Case Study of Satyam Computers Limitedcartoon anime انميNo ratings yet

- Financial Statements Fraud Cases and TheoryDocument25 pagesFinancial Statements Fraud Cases and TheoryCoster Itayi MukushaNo ratings yet

- 41 Types of Fraud and How To Detect and Prevent ThemDocument14 pages41 Types of Fraud and How To Detect and Prevent Themحمود المريتعNo ratings yet

- Scholar's Daily Dose........Document1 pageScholar's Daily Dose........Imtiaz SultanNo ratings yet

- Business SociologyDocument4 pagesBusiness SociologyImtiaz SultanNo ratings yet

- Daily Dose..Document1 pageDaily Dose..Imtiaz SultanNo ratings yet

- Chapter 3 Mid SlybusDocument15 pagesChapter 3 Mid SlybusImtiaz SultanNo ratings yet

- IBF Chapter 2 Mid TermDocument2 pagesIBF Chapter 2 Mid TermImtiaz SultanNo ratings yet

- Ethics NotesDocument12 pagesEthics NotesImtiaz SultanNo ratings yet

- Final IBF (Numerical) Chapter 2, 5 & 15Document13 pagesFinal IBF (Numerical) Chapter 2, 5 & 15Imtiaz SultanNo ratings yet

- CG Mid 2 ChapterDocument5 pagesCG Mid 2 ChapterImtiaz SultanNo ratings yet

- Reference in Journal and BookDocument1 pageReference in Journal and BookImtiaz SultanNo ratings yet

- E Commerce Self Study 2Document2 pagesE Commerce Self Study 2Imtiaz SultanNo ratings yet

- CG Mid CompleteDocument8 pagesCG Mid CompleteImtiaz SultanNo ratings yet

- E Commerce Chapter 2Document3 pagesE Commerce Chapter 2Imtiaz SultanNo ratings yet

- AIS Chapter 12Document6 pagesAIS Chapter 12Imtiaz SultanNo ratings yet

- ASC 2020-21 Questionnaire PDFDocument11 pagesASC 2020-21 Questionnaire PDFShama PhotoNo ratings yet

- Using The Words in The Box, Fill in All The GapsDocument23 pagesUsing The Words in The Box, Fill in All The GapsMo NoNo ratings yet

- Operations Management Stevenson 11th Edition Test BankDocument10 pagesOperations Management Stevenson 11th Edition Test BankAries Gonzales Caragan50% (2)

- Learning Theories Behaviourism, Cognitivism, Social ConstructivismDocument39 pagesLearning Theories Behaviourism, Cognitivism, Social ConstructivismJuan Miguel100% (3)

- Module 11 Activity Based CostingDocument13 pagesModule 11 Activity Based CostingMarjorie NepomucenoNo ratings yet

- Technology For Duck - Fish Integrated Farming System in GoaDocument4 pagesTechnology For Duck - Fish Integrated Farming System in GoagavinilaaNo ratings yet

- Structural Engineering Formulas Second EditionDocument224 pagesStructural Engineering Formulas Second Editionahmed_60709595194% (33)

- The English We SpeakDocument2 pagesThe English We Speakcaeronmustai100% (1)

- Accenture MockDocument1 pageAccenture Mockrajyogesh487No ratings yet

- Ielts Reading Actual Tests With Suggested Answers Oct 2021 JDocument508 pagesIelts Reading Actual Tests With Suggested Answers Oct 2021 JHarpreet Singh JohalNo ratings yet

- Lab 6 Data VisualizationDocument8 pagesLab 6 Data VisualizationRoaster GuruNo ratings yet

- 12.3 What Is The Nomenclature System For CFCS/HCFCS/HFCS? (Chemistry)Document3 pages12.3 What Is The Nomenclature System For CFCS/HCFCS/HFCS? (Chemistry)Riska IndriyaniNo ratings yet

- Test Iii Cultural Social and Political OrganizationDocument2 pagesTest Iii Cultural Social and Political OrganizationTin NatayNo ratings yet

- Pediatric Infectious DiseasesDocument3 pagesPediatric Infectious DiseasesAiri FirdausiaNo ratings yet

- Cross CultureDocument134 pagesCross CulturePhương AnnhNo ratings yet

- Bo Sanchez-Turtle Always Wins Bo SanchezDocument31 pagesBo Sanchez-Turtle Always Wins Bo SanchezCristy Louela Pagapular88% (8)

- TRUMPF Marking Laser BrochureDocument48 pagesTRUMPF Marking Laser BrochureKKM SBNo ratings yet

- This Study Resource Was: MCV4U Exam ReviewDocument9 pagesThis Study Resource Was: MCV4U Exam ReviewNathan WaltonNo ratings yet

- Serie10 User Man ProgDocument1,042 pagesSerie10 User Man Progfahmi derbel100% (1)

- California Academy For Lilminius (Cal) : Lesson PlanDocument4 pagesCalifornia Academy For Lilminius (Cal) : Lesson Plandarryl franciscoNo ratings yet

- Digital Control Engineering 2nd Edition Fadali Solutions Manual PDFDocument3 pagesDigital Control Engineering 2nd Edition Fadali Solutions Manual PDFMohammed SalahNo ratings yet

- Asian RegionalismDocument15 pagesAsian RegionalismLiezel AalaNo ratings yet

- Cyanocobalamin Injection Clinical Pharmacology Drug MonographDocument36 pagesCyanocobalamin Injection Clinical Pharmacology Drug MonographLaureyNo ratings yet

- Citadel Securities Australia Pty LTD - Company DetailsDocument5 pagesCitadel Securities Australia Pty LTD - Company DetailsBrendan OswaldNo ratings yet

- Gita Ananda SDocument10 pagesGita Ananda Srosaanggita76No ratings yet

- Solution Manual-Statistical Physics of Particles by Meheran KardarDocument165 pagesSolution Manual-Statistical Physics of Particles by Meheran KardarDanielle Nguyen7% (14)

- Important Points in SurveyingDocument4 pagesImportant Points in SurveyingAnand BossNo ratings yet

- TML IML DefinitionDocument2 pagesTML IML DefinitionFicticious UserNo ratings yet

- 14 Days of Prayer and FastingDocument40 pages14 Days of Prayer and FastingntsakoramphagoNo ratings yet

- Happiest Refugee Coursework 2013Document10 pagesHappiest Refugee Coursework 2013malcrowe100% (2)