Professional Documents

Culture Documents

21 Tax Rates

Uploaded by

rdaigle566Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

21 Tax Rates

Uploaded by

rdaigle566Copyright:

Available Formats

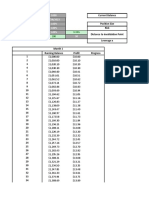

New Hampshire

Department of

Completed Public Tax Rates

Revenue Administration 2021

Total

Municipality Date Valuation Valuation w/ Utils Municipal County State Ed. Local Ed. Total Rate Commitment

Allenstown 10/21/21 $292,809,330 $300,374,630 $8.55 $2.85 $2.04 $18.06 $31.50 $9,341,868

Bedford 10/15/21 $4,687,462,606 $4,764,959,906 $3.76 $0.93 $1.66 $10.79 $17.14 $81,064,267

Boscawen 10/22/21 $288,487,187 $300,230,587 $9.27 $2.52 $1.87 $14.72 $28.38 $8,410,084

Dummer 10/21/21 $34,696,705 $101,455,205 $4.49 $3.65 $1.83 $6.10 $16.07 $1,500,867

Durham 10/21/21 $1,172,318,206 $1,252,334,006 $7.86 $2.79 $1.98 $15.28 $27.91 $34,671,711

Errol 10/19/21 $81,432,668 $90,585,368 $3.08 $4.49 $1.79 $4.50 $13.86 $1,236,829

Franklin 10/13/21 $620,187,623 $694,248,853 $12.00 $2.67 $1.92 $6.62 $23.21 $15,834,742

Lee 10/19/21 $713,908,251 $729,919,551 $4.56 $2.04 $1.52 $13.65 $21.77 $15,767,412

Lempster 10/20/21 $122,313,303 $127,944,603 $3.68 $3.07 $2.24 $14.77 $23.76 $3,001,950

Madbury 10/15/21 $277,889,505 $304,066,305 $4.27 $2.29 $1.81 $17.03 $25.40 $7,644,654

Marlow 10/19/21 $72,425,560 $74,319,260 $4.83 $3.42 $1.84 $14.62 $24.71 $1,819,045

Nelson 10/21/21 $160,843,822 $164,426,822 $4.29 $2.85 $1.44 $6.63 $15.21 $2,492,009

Newbury 10/13/21 $1,089,151,861 $1,096,047,061 $2.98 $2.04 $1.52 $4.84 $11.38 $12,390,248

Pittsburg 10/19/21 $286,437,943 $299,272,143 $3.68 $4.74 $2.01 $5.13 $15.56 $4,617,477

Plainfield 10/21/21 $301,289,373 $308,868,373 $5.34 $2.94 $1.87 $16.40 $26.55 $8,125,717

Surry 10/14/21 $82,299,523 $85,847,323 $2.76 $3.80 $1.94 $16.02 $24.52 $2,077,294

Sutton 10/19/21 $316,139,720 $320,805,720 $7.80 $2.40 $1.86 $12.10 $24.16 $7,670,488

Waterville Valley 10/18/21 $330,959,295 $333,664,595 $9.05 $1.61 $1.82 $3.18 $15.66 $5,212,864

Wilmot 10/21/21 $218,370,030 $223,749,930 $6.14 $2.34 $1.78 $10.88 $21.14 $4,689,148

Completed Public Tax Rates as of October 22, 2021 Page 1 of 1

You might also like

- Harus Tega Disiplin Anjingg: Starting Balance ($) Trade Profit % $ 100.00 80%Document32 pagesHarus Tega Disiplin Anjingg: Starting Balance ($) Trade Profit % $ 100.00 80%WyldanHafiezaNo ratings yet

- Precio Dolar $: Vibra Xyriana Mir4Document8 pagesPrecio Dolar $: Vibra Xyriana Mir4braulio sanchezNo ratings yet

- Date Description Amount BalanceDocument6 pagesDate Description Amount BalanceAli HassanNo ratings yet

- BOTTOMLEY Nov 2020 POST OFFDocument6 pagesBOTTOMLEY Nov 2020 POST OFFJim YehNo ratings yet

- Amortization Schedule: Loan Parameters Loan Summary InformationDocument9 pagesAmortization Schedule: Loan Parameters Loan Summary InformationMintNo ratings yet

- Travana Nelson Project 2Document11 pagesTravana Nelson Project 2api-711530818No ratings yet

- Simple Loan Calculator: Loan Values Loan SummaryDocument11 pagesSimple Loan Calculator: Loan Values Loan SummarymerrwonNo ratings yet

- Loan Amortization 1Document28 pagesLoan Amortization 1Beboy EvardoNo ratings yet

- Loan Amortization 1Document28 pagesLoan Amortization 1Beboy EvardoNo ratings yet

- Principal and InterestDocument2 pagesPrincipal and InterestArmand BoumdaNo ratings yet

- Simple Loan Calculator: Loan Values Loan SummaryDocument11 pagesSimple Loan Calculator: Loan Values Loan Summarypile raftNo ratings yet

- Tabla de AmortizacionDocument2 pagesTabla de AmortizacionCarlos ColmenaresNo ratings yet

- Interest vs. Principal: Rate Period Interest Principal Periods Present Value $ 350,000.00 Future Value TypeDocument1 pageInterest vs. Principal: Rate Period Interest Principal Periods Present Value $ 350,000.00 Future Value TypeArmand BoumdaNo ratings yet

- Cindy Rono Project 2Document15 pagesCindy Rono Project 2api-741772217No ratings yet

- Faith Ing Project 2 2Document11 pagesFaith Ing Project 2 2api-711721240No ratings yet

- Cartola Completa 209 (15!02!2024 20 - 49) (Comunidad Edificio Linea)Document10 pagesCartola Completa 209 (15!02!2024 20 - 49) (Comunidad Edificio Linea)Orlando BohorquezNo ratings yet

- Jeep Wrangler Unlimited Rubicon 4x4 3.6LDocument4 pagesJeep Wrangler Unlimited Rubicon 4x4 3.6LkarlaNo ratings yet

- Master Data Week 9Document68 pagesMaster Data Week 9HARDEEP KAURNo ratings yet

- Mariana Galarza Project 2 1Document11 pagesMariana Galarza Project 2 1api-739835250No ratings yet

- Tabla de AmortizacionDocument4 pagesTabla de AmortizacionkarlaNo ratings yet

- Simple Loan Calculator: Loan Values Loan SummaryDocument11 pagesSimple Loan Calculator: Loan Values Loan Summarysanju sanjuNo ratings yet

- Loan Amortization Schedule3Document9 pagesLoan Amortization Schedule3devanand bhawNo ratings yet

- Loan Amortization Schedule2Document9 pagesLoan Amortization Schedule2devanand bhawNo ratings yet

- Loan Amortization Schedule5Document9 pagesLoan Amortization Schedule5devanand bhawNo ratings yet

- Loan Amortization Schedule6Document9 pagesLoan Amortization Schedule6devanand bhawNo ratings yet

- Loan Amortization Schedule4Document9 pagesLoan Amortization Schedule4devanand bhawNo ratings yet

- Mini Data SetDocument4 pagesMini Data SetT ReyNo ratings yet

- Mortgage CalculatorDocument9 pagesMortgage CalculatorJSONo ratings yet

- Cuentas Victor CruzDocument277 pagesCuentas Victor CruzCarlos CruzNo ratings yet

- Sistema Aleman y FrancesDocument9 pagesSistema Aleman y FrancesPaola TovarNo ratings yet

- Simple Loan Calculator: Loan Values Loan SummaryDocument11 pagesSimple Loan Calculator: Loan Values Loan SummaryMuhammad Ridhwan MahboobNo ratings yet

- 100 Year Financial PlanDocument24 pages100 Year Financial PlanAbel YagoNo ratings yet

- Excel Loan CalculatorDocument12 pagesExcel Loan CalculatorCare Medical AcademyNo ratings yet

- Kadena USD Historical Data CoinGeckoDocument1 pageKadena USD Historical Data CoinGeckoTapmeonce TapmeNo ratings yet

- 2008 Domestic Water SurveyDocument1 page2008 Domestic Water SurveyCaroline Nordahl BrosioNo ratings yet

- Simple Loan Calculator: Loan Values Loan SummaryDocument11 pagesSimple Loan Calculator: Loan Values Loan SummarydalalroshanNo ratings yet

- Simple Loan Calculator: Loan Values Loan SummaryDocument11 pagesSimple Loan Calculator: Loan Values Loan SummarydalalroshanNo ratings yet

- 1 Trades v6Document6 pages1 Trades v6Huub SNo ratings yet

- Loan Shark CalculatorDocument18 pagesLoan Shark CalculatorTony MartinNo ratings yet

- Loan Amortization ScheduleDocument30 pagesLoan Amortization ScheduleMarc QuinamotNo ratings yet

- Aplicacion de Formulas para PrestamosDocument4 pagesAplicacion de Formulas para PrestamosMONTSERRAT GARCIA RODRIGUEZNo ratings yet

- SNAP Nov 2022 Numbers by CountyDocument1 pageSNAP Nov 2022 Numbers by CountyMarcus FlowersNo ratings yet

- Tarea#6 Allan ParralesDocument2 pagesTarea#6 Allan ParralesMARJORIE DOMENICA JUNA VARGASNo ratings yet

- IPCA - Brasil IndicadoresDocument6 pagesIPCA - Brasil IndicadoresThiago MouraNo ratings yet

- Sharon Chagala Project 2 1 1 1Document11 pagesSharon Chagala Project 2 1 1 1api-710559327No ratings yet

- Práctica 9 - GonzaloDocument1 pagePráctica 9 - GonzaloJehu SantiagoNo ratings yet

- Cooperativa 16 de Julio PrestamoDocument4 pagesCooperativa 16 de Julio PrestamoGeovanny GabrielNo ratings yet

- Cuent AsDocument2 pagesCuent AsBrian Adrian Saucedo GómezNo ratings yet

- Simple Loan Calculator: Loan Values Loan SummaryDocument11 pagesSimple Loan Calculator: Loan Values Loan Summaryaswath ventraNo ratings yet

- Con BancariasDocument47 pagesCon BancariasMauricio PachecoNo ratings yet

- Amortización NANCY ACOSTADocument1 pageAmortización NANCY ACOSTAMichael JimenezNo ratings yet

- Summary ZW005Document1 pageSummary ZW005ckudzwaisheNo ratings yet

- TablaAmortizacion 122101520285Document1 pageTablaAmortizacion 122101520285deancarreonnNo ratings yet

- Plazo (Mesesaldo Insoluto Pago Mensual Totalcapital Intereses IvaDocument2 pagesPlazo (Mesesaldo Insoluto Pago Mensual Totalcapital Intereses IvaonamiNo ratings yet

- Loan AmmortisationDocument4 pagesLoan AmmortisationIVANNo ratings yet

- JAN Avenge ReportDocument4 pagesJAN Avenge ReportSiva Durga Prasad yaNTRapragadaNo ratings yet

- Repayment Schedule PuternicDocument60 pagesRepayment Schedule PuternicandreiciboNo ratings yet

- ESA Estimated Fiscal ImpactDocument1 pageESA Estimated Fiscal ImpactDan LehrNo ratings yet

- Louis Castigliano - 2540128902 - JAWABAN GSLC - Chapter 9 - ForecastDocument24 pagesLouis Castigliano - 2540128902 - JAWABAN GSLC - Chapter 9 - ForecastLouis CastiglianoNo ratings yet

- Resort Operations ManagementDocument15 pagesResort Operations Managementasif2022coursesNo ratings yet

- Civil 20procedure 20final PalsDocument185 pagesCivil 20procedure 20final PalsPaul EspinosaNo ratings yet

- Session 1 Introduction To Operations Management 3.0Document48 pagesSession 1 Introduction To Operations Management 3.0Aryan DwivediNo ratings yet

- Human Resource Management Project Topics, Ideas and Abstracts, Thesis, DissertationDocument4 pagesHuman Resource Management Project Topics, Ideas and Abstracts, Thesis, DissertationArcot Ellender Santhoshi PriyaNo ratings yet

- Senate Bill No. 982Document3 pagesSenate Bill No. 982Rappler100% (1)

- DefaultDocument2 pagesDefaultBADER AlnassriNo ratings yet

- The Rise of Big Data Policing - Surveillance, Race, and The Future of Law Enforcement On JSTORDocument11 pagesThe Rise of Big Data Policing - Surveillance, Race, and The Future of Law Enforcement On JSTORFeroze KareemNo ratings yet

- Critical Analysis of The Concept of Plea Bargaining in IndiaDocument8 pagesCritical Analysis of The Concept of Plea Bargaining in IndiaSRUTHI KANNAN 2257024No ratings yet

- Eating According To Our Needs With ChrononutritionDocument6 pagesEating According To Our Needs With ChrononutritionTatjana VindišNo ratings yet

- Testimonies and PioneersDocument4 pagesTestimonies and Pioneerswally ziembickiNo ratings yet

- T Proc Notices Notices 035 K Notice Doc 30556 921021241Document14 pagesT Proc Notices Notices 035 K Notice Doc 30556 921021241Bwanika MarkNo ratings yet

- United States v. Stephen Rosenberg, 4th Cir. (2011)Document5 pagesUnited States v. Stephen Rosenberg, 4th Cir. (2011)Scribd Government DocsNo ratings yet

- Gerund Infinitive ParticipleDocument4 pagesGerund Infinitive ParticiplemertNo ratings yet

- NO. Three (3) Instances Justify The Declaration of Failure of Election, To Wit: (A) TheDocument2 pagesNO. Three (3) Instances Justify The Declaration of Failure of Election, To Wit: (A) TheMaria GarciaNo ratings yet

- Chris Heathwood, - Faring Well and Getting What You WantDocument12 pagesChris Heathwood, - Faring Well and Getting What You WantStefan BaroneNo ratings yet

- Blockchain PaperDocument33 pagesBlockchain PaperAyeshas KhanNo ratings yet

- The Economic Burden of ObesityDocument13 pagesThe Economic Burden of ObesityNasir Ali100% (1)

- Key Area IIIDocument26 pagesKey Area IIIRobert M. MaluyaNo ratings yet

- Abarientos PR1Document33 pagesAbarientos PR1Angelika AbarientosNo ratings yet

- Judicial Affidavit - Arselita AngayDocument6 pagesJudicial Affidavit - Arselita AngayJay-ArhNo ratings yet

- Blockchain in ConstructionDocument4 pagesBlockchain in ConstructionHasibullah AhmadzaiNo ratings yet

- Tes Sharing Agreement 1Document2 pagesTes Sharing Agreement 1Chesca UrietaNo ratings yet

- Bajrang Lal Sharma SCCDocument15 pagesBajrang Lal Sharma SCCdevanshi jainNo ratings yet

- Madhu Limaye Vs The State of Maharashtra On 31 October, 1977Document13 pagesMadhu Limaye Vs The State of Maharashtra On 31 October, 1977Nishant RanjanNo ratings yet

- Texas City, TX: Amanda EnglerDocument27 pagesTexas City, TX: Amanda EnglerPrajay ShahNo ratings yet

- JhdsjkduijhsbsgdDocument3 pagesJhdsjkduijhsbsgdRanvidsNo ratings yet

- Natural Resources LawDocument6 pagesNatural Resources LawAubrey BalindanNo ratings yet

- Order Confirmation 318155149Document3 pagesOrder Confirmation 318155149charisse mae rillortaNo ratings yet

- PDHONLINE - Google SearchDocument2 pagesPDHONLINE - Google SearchThanga PandiNo ratings yet

- Material Cost 01 - Class Notes - Udesh Regular - Group 1Document8 pagesMaterial Cost 01 - Class Notes - Udesh Regular - Group 1Shubham KumarNo ratings yet