Professional Documents

Culture Documents

Heidi Memo

Uploaded by

loralee0512Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Heidi Memo

Uploaded by

loralee0512Copyright:

Available Formats

Heidi memo

Part A

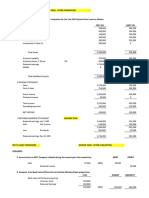

Goodwill at acquisition 1 January 2012

Fair value of investment 1,500,000 0.5

Value of NCI 450,000 0.5

Less: Fair value of net assets -1,500,000 0.5 P

Goodwill 450,000 0.5 P

Net Assets

Share Capital 1,000,000 0.5

Retained Earnings 500,000 0.5

Fair value of net asset at acquisition 1,500,000

3

Part B

Analysis of owners equity Heidi

Since

Total At Acquisition Acquisition NCI

At Acquisition

Share Capital 1,000,000 700,000 300,000

Retained Earnings 500,000 350,000 150,000 Award marks if this approached

was followed to calculate

Non-controlling interest 1,500,000 1,050,000 450,000

goodwill in part A

Fair value of investment 1,500,000

Goodwill -450,000

Since Acquisition

Share Capital -

Retained Earnings (800 000 - 500 000) 300,000 210,000 90,000

Other reserves 200,000 140,000 60,000

Current year

Profit for the year 45,000 31,500 13,500

Total 381,500 613,500

Pro-forma consolidation journals for the year ended 31 December 2014

Dr Share Capital (SCE) 1,000,000 0.5

Dr Retained earnings (SCE) 500,000 0.5

Dr Goodwill (SoFP) 450,000 0.5 P

Cr Investment in Peter (SoFP) 1,500,000 0.5

Cr Non-controlling interest (SoFP) 450,000 0.5

Dr Retained earnings (SCE) 0.5 90,000 1.5

Cr Non-controlling interest (SoFP) 0.5 90,000 0.5

(800 000 - 500 000) x 30%

Dr Other reserves (SCE) 0.5 60,000 1

Cr Non-controlling interest (SoFP) 0.5 60,000 0.5

(200 000 x 30%)

Dr Non-controlling share in profit (P/l) 0.5 13,500 1

Cr Non-controlling interest (SoFP) 0.5 13,500 0.5

(45 000 x 30%)

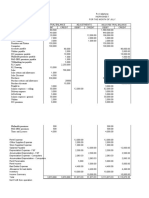

Part C 10.5

Heidi Peter Heidi Group

R R Adj

Revenue 520,000 450,000 970,000 1

Costs of sales -320,000 -300,000 -620,000 1.5

Gross Profit 200,000 150,000 350,000

Distribution costs -30,000 -42,000 -72,000 1

Administrative expenses -45,000 -45,000 -90,000 1

Profit before tax 125,000 63,000 188,000

Income tax expense -20,000 -18,000 -38,000 1

Profit for the year 105,000 45,000 150,000

Profit attributable to:

Shareholders of the parent (150 000 - 13 500) 136,500 1P

Non-controlling interest 13,500 0.5 P

Total 7

Part D

Retained earnings of Heidi at the beginning of the year 1,200,000 0.5

Since acquisition retained earnings of Peter Ltd (800 000 - 500 000) x 70% 210,000 1.5

Profit for the year attributable to shareholders of the parent 136,500 0.5 P

Consolidated retained earnings at the end of the year. 1,546,500 0.5 P

Total 3

Or Heidi Peter Total

Retained earnings at beginning of the year 1,200,000 1,200,000 0.5

Since acquisition retained earnings 210,000 210,000 1.5

Profit for the year 105,000 31,500 136,500 0.5

1,546,500 0.5

Heidi memo

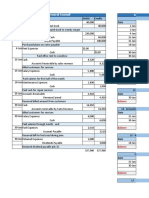

Deel A

Klandisiewaarde met verkryging op 1 Janaurie 2012

Billike waarde van die belegging 1,500,000 0.5

Waarde van NBB 450,000 0.5

Min: Billike waarde van netto bates -1,500,000 0.5 P

Klandisiewaarde 450,000 0.5 P

Netto Bates

Aandele kapitaal 1,000,000 0.5

Behoue verdienste 500,000 0.5

Billike waarde van netto bates met vekryging 1,500,000

3

Deel B

Ontdeling van ekwiteit Heidi

Sedert

Totaal Met vekryging verkryging NBB

Met verkryging

Aandele kapitaal 1,000,000 700,000 300,000

Behoue verdienste 500,000 350,000 150,000 Gee punte as hierdie

benadering gevolg is om

Nie beheredned belang 1,500,000 1,050,000 450,000

klandisiewaarde te bereken

Billike waarde van belegging 1,500,000

Klandisiewaarde -450,000

Sedert Verkryging

Aandele Kapitaal -

Behoue verdienste (800 000 - 500 000) 300,000 210,000 90,000

Ander reserwes 200,000 140,000 60,000

Huidige jaar

Wins vir die jaar 45,000 31,500 13,500

Totaal 381,500 613,500

Pro-forma konsolidasie joernale vir die jaar geëindig 31 Desember 2014

Dr Aandelekapitaal (SvVE) 1,000,000 0.5

Dr Behoue verdienste (SvVE) 500,000 0.5

Dr Klandsiewaarde (SvFP) 450,000 0.5 P

Cr Belegging in in Peter (SvFP) 1,500,000 0.5

Cr Non-beherende belang (SvFP) 450,000 0.5

Dr Behoue verdienste (SvVE)) 0.5 90,000 1.5

Cr Nie-beherende belang (SvFP) 0.5 90,000 0.5

(800 000 - 500 000) x 30%

Dr Ander reserwes (SvVE) 0.5 60,000 1

Cr Nie-beherende belang (SvFP) 0.5 60,000 0.5

(200 000 x 30%)

Dr Nie-beherende belang se deel in winste

(w/l) 0.5 13,500 1

Cr Nie-beherende belang (SvFP) 0.5 13,500 0.5

(45 000 x 30%)

Deel C 10.5

Heidi Peter Heidi Group

R R Adj

Inkomste 520,000 450,000 970,000 1

Koste van verkope -320,000 -300,000 -620,000 1.5

Bruto Wins 200,000 150,000 350,000

Verspreidingskoste -30,000 -42,000 -72,000 1

Administratiewe uitgawes -45,000 -45,000 -90,000 1

Wins voor belasting 125,000 63,000 188,000

Inkomstebelasting uitgawe -20,000 -18,000 -38,000 1

Wins vir die jaar 105,000 45,000 150,000

Wins toeskryfbaar aan:

Aandeelhouers van die moeder (150 000 - 13 500) 136,500 1P

Nie-beherende belang 13,500 0.5 P

Total 7

Deel D

Behoue verdienste van Heidi aan die begin van die jaar 1,200,000 0.5

Sedert verkryging behoue verdienste van Peter Ltd (800 000 - 500 000) x 70% 210,000 1.5

Wins vir die jaar toeskryfbaar aan aandeelhouers van die moeider 136,500 0.5 P

Consolidated retained earnings at the end of the year. 1,546,500 0.5 P

Total 3

Of Heidi Peter Total

Behoue verdienste aan die begin van die jaar 1,200,000 1,200,000 0.5

Seder verkrgings behoue verdienste 210,000 210,000 1.5

Wins vir die jaar 105,000 31,500 136,500 0.5

1,546,500 0.5

You might also like

- Exercises On DividendsDocument16 pagesExercises On DividendsGrace RoqueNo ratings yet

- PaladinDocument4 pagesPaladinZumrud AlizadaNo ratings yet

- Session 7 and 7a SupplemenDocument10 pagesSession 7 and 7a Supplemenkhadija arifNo ratings yet

- AFAR2 CH. 3 - Problem Quiz 1Document19 pagesAFAR2 CH. 3 - Problem Quiz 1Von Andrei MedinaNo ratings yet

- Chapter 14Document10 pagesChapter 14Nikki GarciaNo ratings yet

- BSA 315 Accounting For Business CombinationDocument5 pagesBSA 315 Accounting For Business CombinationJeth MahusayNo ratings yet

- Business Combination Subsequent To Date of Acquisition SolutionDocument3 pagesBusiness Combination Subsequent To Date of Acquisition SolutionGelliza Mae MontallaNo ratings yet

- Stock Acquisition Quiz 100% AnswerDocument2 pagesStock Acquisition Quiz 100% AnswerJohn BalanquitNo ratings yet

- Problem 5-1Document7 pagesProblem 5-1Tammy AckleyNo ratings yet

- Adv Acc 2 Sol Man 2008 BaysaDocument8 pagesAdv Acc 2 Sol Man 2008 BaysaNorman DelirioNo ratings yet

- PARTNERSHIP AND CORPORATION Answers For pp.226-227 Exercises 1,2, 3 and 8Document5 pagesPARTNERSHIP AND CORPORATION Answers For pp.226-227 Exercises 1,2, 3 and 8MALICDEM, CharizNo ratings yet

- Investment in Equity Securities (Prob 28-31)Document4 pagesInvestment in Equity Securities (Prob 28-31)Lorence Patrick LapidezNo ratings yet

- KL Business Finance Nov Dec 2013Document2 pagesKL Business Finance Nov Dec 2013Towhidul IslamNo ratings yet

- Purchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalanceDocument14 pagesPurchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalancesallyNo ratings yet

- Consolidation - Cost vs. Equity MethodDocument8 pagesConsolidation - Cost vs. Equity MethodzaounxosakubNo ratings yet

- Entry For The AcquisitionDocument5 pagesEntry For The AcquisitionEnalem OtsuepmeNo ratings yet

- WEEK 6-7 ULO A, B, C Answer KeyDocument4 pagesWEEK 6-7 ULO A, B, C Answer Keyzee abadilla100% (1)

- Investments in Financial Instruments CompleteDocument34 pagesInvestments in Financial Instruments CompleteDenise CruzNo ratings yet

- Intercorporate InvestmentsDocument14 pagesIntercorporate InvestmentsYisbel CarrascoNo ratings yet

- Accum DepDocument13 pagesAccum Depconrad valixNo ratings yet

- 5110WA7 FinancialsDocument1 page5110WA7 FinancialsAhmed EzzNo ratings yet

- ASS 1 2021 Part A SolutionDocument4 pagesASS 1 2021 Part A SolutionOdzulaho DemanaNo ratings yet

- 5.ratio Analysis SumsDocument9 pages5.ratio Analysis Sumsvinay kumar nuwalNo ratings yet

- LX20210603 100Document21 pagesLX20210603 100Joshua PelegrinoNo ratings yet

- Co Operative HSG Soc. 2Document48 pagesCo Operative HSG Soc. 2ishan.patel.310No ratings yet

- FM Eco AnswerDocument12 pagesFM Eco AnswersriramakrishnajayamNo ratings yet

- Shareholders EquityDocument11 pagesShareholders EquityJasmine ActaNo ratings yet

- ConsolidationDocument25 pagesConsolidationAEDRIAN LEE DERECHONo ratings yet

- Materi Accounting AdvancedDocument12 pagesMateri Accounting AdvancedRianty AstaniaNo ratings yet

- 3 - Answer Key Exercise 3 CLOYDocument10 pages3 - Answer Key Exercise 3 CLOYNikko Bowie PascualNo ratings yet

- Lape - ACP312 - ULOa - Let's Analyze Week6Document3 pagesLape - ACP312 - ULOa - Let's Analyze Week6Bryle Jay LapeNo ratings yet

- Module 2 Handout 2 Business ComDocument3 pagesModule 2 Handout 2 Business ComRosemarie AlcantaraNo ratings yet

- Module 2 Handout 2 Business ComDocument3 pagesModule 2 Handout 2 Business ComPara Sa PictureNo ratings yet

- Chapter 7 Up StreamDocument14 pagesChapter 7 Up StreamAditya Agung SatrioNo ratings yet

- Consolidation PartBDocument29 pagesConsolidation PartBHuzaifa AhmedNo ratings yet

- Homework Answer (Quiz 1-2 Revision)Document7 pagesHomework Answer (Quiz 1-2 Revision)Kccc siniNo ratings yet

- Conso FS Sdoa - DiscussionDocument10 pagesConso FS Sdoa - DiscussionShaz NagaNo ratings yet

- Chapter17 BuenaventuraDocument8 pagesChapter17 BuenaventuraAnonnNo ratings yet

- Financial Accounting and Reporting Assignment 1 - Lesson 16 ExercisesDocument5 pagesFinancial Accounting and Reporting Assignment 1 - Lesson 16 ExercisesShilla Mae BalanceNo ratings yet

- Less: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaDocument16 pagesLess: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaGao YungNo ratings yet

- Par CorDocument11 pagesPar CorIts meh Sushi100% (1)

- Single QuestionsDocument5 pagesSingle QuestionsEduskill Learning CentreNo ratings yet

- Advanced Accounting Vol 2 2014 Edition Baysa-LupisanDocument110 pagesAdvanced Accounting Vol 2 2014 Edition Baysa-LupisanIzzy B100% (4)

- Chapter 9 ExerciseDocument4 pagesChapter 9 ExerciseKaila Clarisse CortezNo ratings yet

- Techniques of Financial Analysis by ERICH A HELFERTDocument62 pagesTechniques of Financial Analysis by ERICH A HELFERTRupee Rudolf Lucy Ha100% (3)

- ABC MIDTERMS PROJECT Sene Di Pa TaposDocument11 pagesABC MIDTERMS PROJECT Sene Di Pa TaposJanesene SolNo ratings yet

- A4 PalacioDocument3 pagesA4 PalacioPinky DaisiesNo ratings yet

- Step 5: Compute Net Income or Net LossDocument29 pagesStep 5: Compute Net Income or Net LossTanvir Islam100% (1)

- 2016 FR PDFDocument6 pages2016 FR PDFSomeone 4780No ratings yet

- The Remaining Percent of The Sea-Breeze Shares Traded Near A Total Value of 200,000Document5 pagesThe Remaining Percent of The Sea-Breeze Shares Traded Near A Total Value of 200,000RomerNo ratings yet

- Far460 Group Project 1Document3 pagesFar460 Group Project 1NURAMIRA AQILANo ratings yet

- Advance AccountingDocument6 pagesAdvance AccountingRatna SariNo ratings yet

- BAb X Buku Bu IInDocument16 pagesBAb X Buku Bu IInAditya Agung SatrioNo ratings yet

- Practice Problem SolutionDocument15 pagesPractice Problem SolutionTherese Noelle R. ARMADA100% (1)

- Transfer Pricng SolutionDocument3 pagesTransfer Pricng SolutionchandraprakashNo ratings yet

- Akl P4.7Document12 pagesAkl P4.7ApriancaesarioNo ratings yet

- Chapter+3+Consolidation+at+aquisition+date+ PART+2Document16 pagesChapter+3+Consolidation+at+aquisition+date+ PART+2Christi ClarkNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Docsity Fundamentals of Accounting 1 3Document5 pagesDocsity Fundamentals of Accounting 1 3Timothy Arbues ReyesNo ratings yet

- Pce Part B Set CDocument13 pagesPce Part B Set Czara100% (1)

- Audit and AssuranceDocument222 pagesAudit and AssuranceQudsia ZulfiqarNo ratings yet

- Assignment 3 - AccountingDocument5 pagesAssignment 3 - AccountingGulzar JamalNo ratings yet

- Company Profile HDFC BankDocument7 pagesCompany Profile HDFC Bankdominic wurdaNo ratings yet

- 20012ipcc Paper5 Vol2 Cp5Document28 pages20012ipcc Paper5 Vol2 Cp5Muthu RamanNo ratings yet

- BFI 220 CAT AnswersDocument2 pagesBFI 220 CAT Answerssamkimari5No ratings yet

- T3TAAC - Arrangement Architecture - Core - R11.1Document163 pagesT3TAAC - Arrangement Architecture - Core - R11.1Sojanya KatareNo ratings yet

- Mini Quiz BowlDocument28 pagesMini Quiz BowlErma CaseñasNo ratings yet

- On December 31 2011 Information Inc Completed Its Third YearDocument1 pageOn December 31 2011 Information Inc Completed Its Third YearFreelance WorkerNo ratings yet

- Q1 - Q4 - Prelim Exam ACC5112 - Auditing and Assurance - Concepts and Applications 1 v2Document72 pagesQ1 - Q4 - Prelim Exam ACC5112 - Auditing and Assurance - Concepts and Applications 1 v2artemisNo ratings yet

- Amarakosha Knowledge StructureDocument5 pagesAmarakosha Knowledge Structureaarpee78No ratings yet

- Savings Account Statement: Capitec B AnkDocument6 pagesSavings Account Statement: Capitec B Anksipho gumbiNo ratings yet

- Universal BankDocument1 pageUniversal Bankhailene lorenaNo ratings yet

- Reserve Bank of IndiaDocument84 pagesReserve Bank of IndiaSunil ColacoNo ratings yet

- Goodwill Glob Accounting For Decision Making 5.54 & 5.55 AnswerDocument4 pagesGoodwill Glob Accounting For Decision Making 5.54 & 5.55 AnswerJay ShaunNo ratings yet

- Exam NoDocument17 pagesExam NoAzzia Morante LopezNo ratings yet

- Epolicy - 1022684495Document61 pagesEpolicy - 1022684495Kurt MarfilNo ratings yet

- Tutorial 3 MFRS 116 QDocument15 pagesTutorial 3 MFRS 116 QN FrzanahNo ratings yet

- DR Manfred Knof: Curriculum VitaeDocument2 pagesDR Manfred Knof: Curriculum VitaeFernandoNo ratings yet

- Contact List 2020Document14 pagesContact List 2020Crawford BoydNo ratings yet

- CSEC POA June 2014 P1 PDFDocument12 pagesCSEC POA June 2014 P1 PDFjunior subhanNo ratings yet

- Key Investor Information: Objectives and Investment PolicyDocument2 pagesKey Investor Information: Objectives and Investment PolicyGeorgio RomaniNo ratings yet

- Pengantar Akuntansi Pertemuan Ke 3Document85 pagesPengantar Akuntansi Pertemuan Ke 3Denny ramadhanNo ratings yet

- Full Download Corporate Finance 4th Edition Berk Solutions ManualDocument13 pagesFull Download Corporate Finance 4th Edition Berk Solutions Manualetalibelmi2100% (41)

- SPX 3m SkewDocument2 pagesSPX 3m SkewahmadnaminiNo ratings yet

- TRẮC NGHIỆM TTQTDocument39 pagesTRẮC NGHIỆM TTQTHuyền MaiNo ratings yet

- International Planned Parenthood Federation - Western Hemisphere Region, IncDocument23 pagesInternational Planned Parenthood Federation - Western Hemisphere Region, IncIngrid RieraNo ratings yet

- Transaction-Dispute-Form NAVEENDocument7 pagesTransaction-Dispute-Form NAVEENSPG CAMPUSNo ratings yet