Professional Documents

Culture Documents

Global Systemically Important Banks Indicators 2022

Uploaded by

Alina PapazarcadaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Global Systemically Important Banks Indicators 2022

Uploaded by

Alina PapazarcadaCopyright:

Available Formats

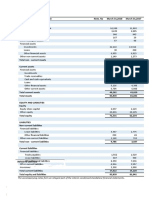

Global systemically important banks indicators

The Basel Committee on Banking Supervision (Basel Committee) has established a number

of indicators that help determine whether a bank can be classified as a Global Systemically

Important Bank, or G-SIB. Banks that meet the criteria are subject to additional supervisory

requirements aimed at mitigating systemic risk in the financial system. ING reports these

indicators every year to the Basel Committee (through DNB). We are also required to

publish the main indicators on our external website. These are published in the Investor

Relations section.

The table below displays the 13 size indicators for ING Groep N.V. as at 31 December 2022.

These size indicators are unaudited and based on the definitions included in the instructions

of the Basel Committee.

Category Individual indictator 2022 value (in € mln)

Total exposure as defined for use in the

Size 1,067,532

Basel III leverage ratio

Interconnectedness Intra-financial system assets 145,822

Intra-financial system liabilities 126,626

Securities outstanding 168,735

Substitutability/Financial Institution

Payments activity 33,650,731

Infrastructure

Assets under custody 243,508

Underwritten transactions in debt and

36,792

equity markets

Trading volume fixed income 816,503

Trading volume equities and other

72,232

securities

Notional amount of over-the-counter

Complexity 4,614,247

(OTC) derivatives

Investment securities 24,045

Level 3 assets 7,526

Cross-Jurisdictional Activity Cross jurisdictional claims 940,712

Cross jurisdictional liabilities 797,068

You might also like

- Chapter 3 - MCQ SolDocument3 pagesChapter 3 - MCQ SolinasNo ratings yet

- RPL Ind AS Consol Dec-23Document19 pagesRPL Ind AS Consol Dec-23venkyniyerNo ratings yet

- 1.2 Maliyye Hesabatlari Eng III Rub 2022Document2 pages1.2 Maliyye Hesabatlari Eng III Rub 2022Zakir KhalilovNo ratings yet

- DTCC Annual Financial Statements 2020 and 2019Document51 pagesDTCC Annual Financial Statements 2020 and 2019EvgeniyNo ratings yet

- Invested Capital Formula Excel TemplateDocument24 pagesInvested Capital Formula Excel TemplateMichael OdiemboNo ratings yet

- DASH Q3 23 Earnings FinancialsDocument6 pagesDASH Q3 23 Earnings Financialsalpha.square.betaNo ratings yet

- Consolidated Balance Sheet: December 31, 2022 2021 (In Millions, Except Per Share Data)Document2 pagesConsolidated Balance Sheet: December 31, 2022 2021 (In Millions, Except Per Share Data)Maanvee JaiswalNo ratings yet

- Quarterly Report 20120331Document25 pagesQuarterly Report 20120331TshegofatsoTaunyaneNo ratings yet

- Basel II Capital Disclosure Q4 2009/10Document3 pagesBasel II Capital Disclosure Q4 2009/10aNo ratings yet

- Balance Sheet (All Numbers in Thousands) : Break Down 7/30/2020Document16 pagesBalance Sheet (All Numbers in Thousands) : Break Down 7/30/2020Shubham ThakurNo ratings yet

- Chapter 3 108-117Document10 pagesChapter 3 108-117Leony SantikaNo ratings yet

- Annual Report of INFOSYS LimitedDocument16 pagesAnnual Report of INFOSYS LimitedAman SinghNo ratings yet

- 001 Apple-Quarterly-Balance-Sheet-1Document1 page001 Apple-Quarterly-Balance-Sheet-1hullegulkadNo ratings yet

- Choose The Best Answer Out of The Available Options For Each QuestionDocument2 pagesChoose The Best Answer Out of The Available Options For Each QuestionSambhav TripathiNo ratings yet

- F45 AssetsDocument7 pagesF45 AssetsDawood Adel DhakallahNo ratings yet

- Financial Report 30 09 2019 ENDocument38 pagesFinancial Report 30 09 2019 ENVenture ConsultancyNo ratings yet

- Rashtriya Chemicals standalone financial ratiosDocument18 pagesRashtriya Chemicals standalone financial ratiosritikNo ratings yet

- Five Below 2018 Financial StatementsDocument4 pagesFive Below 2018 Financial StatementsElie GergesNo ratings yet

- Final Cia SubmissionDocument44 pagesFinal Cia SubmissionGarvit GuptaNo ratings yet

- Balance SheetDocument1 pageBalance Sheet227230No ratings yet

- General Tyre Financial Statement AnalysisDocument29 pagesGeneral Tyre Financial Statement AnalysisasifNo ratings yet

- IB LLC 2022 UnAud FinlsDocument21 pagesIB LLC 2022 UnAud FinlsMark MarksonNo ratings yet

- ADIB Consalidated Condensed Dec 2022Document109 pagesADIB Consalidated Condensed Dec 2022Youssef NabilNo ratings yet

- Financial Reporting Case: What Is It Worth?: Property of STIDocument2 pagesFinancial Reporting Case: What Is It Worth?: Property of STIJoannie Cercado RabiaNo ratings yet

- University of Central Punjab: Project Appraisal & Credit ManagementDocument6 pagesUniversity of Central Punjab: Project Appraisal & Credit ManagementMisha ButtNo ratings yet

- Financial RatiosDocument13 pagesFinancial RatiosAaron Coutinho0% (1)

- MKT1713 Group-AssignmentDocument11 pagesMKT1713 Group-AssignmentLe Tran Duy Khanh (K17 HCM)No ratings yet

- Week 1 IntroductionDocument28 pagesWeek 1 IntroductionAbhijit ChokshiNo ratings yet

- 2 NGCI BalanceSheet 07032022 8Document2 pages2 NGCI BalanceSheet 07032022 8Hussna Al-Habsi حُسنى الحبسيNo ratings yet

- Dialog Finance PLC: ConfidentialDocument12 pagesDialog Finance PLC: ConfidentialgirihellNo ratings yet

- American Airlines Group IncDocument5 pagesAmerican Airlines Group IncMyka Mabs MagbanuaNo ratings yet

- 01 ELMS Activity 1Document2 pages01 ELMS Activity 1Emperor SavageNo ratings yet

- INTRODUCED PAGE - Merged ArpitDocument13 pagesINTRODUCED PAGE - Merged ArpitArpit Mayank ChaurasiaNo ratings yet

- Consolidated Balance SheetDocument1 pageConsolidated Balance SheetSukhmanNo ratings yet

- Balance Sheet - The Coca-Cola Company (KO)Document1 pageBalance Sheet - The Coca-Cola Company (KO)vijayNo ratings yet

- Ilovepdf MergedDocument3 pagesIlovepdf MergedvijayNo ratings yet

- PT Matahari Department Store TBK Dan Entitas Anak/And Subsidiaries Laporan Keuangan KonsolidasianDocument103 pagesPT Matahari Department Store TBK Dan Entitas Anak/And Subsidiaries Laporan Keuangan KonsolidasianStevi MujonoNo ratings yet

- 01 ELMS Activity 1Document2 pages01 ELMS Activity 1Gonzaga FamNo ratings yet

- Cashflow DDocument6 pagesCashflow DJatin JainNo ratings yet

- Basic Q&A Balance SheetDocument6 pagesBasic Q&A Balance SheetKunal Khaparkar patilNo ratings yet

- AR Financial Statements ExtractedDocument4 pagesAR Financial Statements ExtractedISHA AGGARWALNo ratings yet

- Financial Analysis Hewlett Packard Corporation 2007Document24 pagesFinancial Analysis Hewlett Packard Corporation 2007SAMNo ratings yet

- Assets: PAYNET, Inc. Consolidated Balance SheetsDocument3 pagesAssets: PAYNET, Inc. Consolidated Balance Sheetschemicalchouhan9303No ratings yet

- KRR FS Q1 2023 15-May-2023Document19 pagesKRR FS Q1 2023 15-May-2023prenges prengesNo ratings yet

- Disclosure Under Basel III - 2nd Quarter Poush 2074 of FY 2074-75 PDFDocument5 pagesDisclosure Under Basel III - 2nd Quarter Poush 2074 of FY 2074-75 PDFAjit ThapaNo ratings yet

- Particulars 2Document2 pagesParticulars 2AshwinNo ratings yet

- Consolidated Balance Sheet: in Millions, Except Per Share Amounts, at December 31Document1 pageConsolidated Balance Sheet: in Millions, Except Per Share Amounts, at December 31Juan Jeronimo Marin ArevaloNo ratings yet

- BS 2018Document1 pageBS 2018Maanvee JaiswalNo ratings yet

- Ratio AnalysisDocument15 pagesRatio AnalysisNSTJ HouseNo ratings yet

- Q1 2014 Financial ResultsDocument12 pagesQ1 2014 Financial ResultsJha YaNo ratings yet

- Fy 17Document33 pagesFy 17vivekgandhi7k7No ratings yet

- Otc Fcob 2017Document40 pagesOtc Fcob 2017gaja babaNo ratings yet

- Pepsico Inc 2019 Annual ReportDocument1 pagePepsico Inc 2019 Annual ReportToodley DooNo ratings yet

- 2022 - Consolidated Financial StatementsDocument7 pages2022 - Consolidated Financial StatementscaarunjiNo ratings yet

- Garcia's Health Care Financial StatementsDocument3 pagesGarcia's Health Care Financial StatementsPamela PerezNo ratings yet

- A3 6Document3 pagesA3 6David Rolando García OpazoNo ratings yet

- Finance Report enDocument1 pageFinance Report enPhương Linh VũNo ratings yet

- Ilovepdf Merged OrganizedDocument16 pagesIlovepdf Merged OrganizedArpit Mayank ChaurasiaNo ratings yet

- (In Millions) : Consolidated Statements of Cash FlowsDocument1 page(In Millions) : Consolidated Statements of Cash FlowsrocíoNo ratings yet

- Form 16 ADocument23 pagesForm 16 Amlkhantwal8404No ratings yet

- The Effect of Financial Innovation and Bank Competition On Firm Value - A Comparative Study of Malaysian and Nigerian BanksDocument9 pagesThe Effect of Financial Innovation and Bank Competition On Firm Value - A Comparative Study of Malaysian and Nigerian BanksMayowa AriyibiNo ratings yet

- Payment Medium WorkbenchDocument27 pagesPayment Medium Workbenchanon_78372217250% (2)

- Bank Marketing - 2020 S 3Document21 pagesBank Marketing - 2020 S 3SuvajitLaikNo ratings yet

- Oracle R12 Suppliers and CustomersDocument44 pagesOracle R12 Suppliers and CustomersTina Floyd100% (1)

- Sap FicoDocument119 pagesSap FicoVijay PatoleNo ratings yet

- Business Finance PrelimDocument2 pagesBusiness Finance PrelimYna PangilinanNo ratings yet

- Curriculum Vitae: Muhammad ZeeshanDocument4 pagesCurriculum Vitae: Muhammad ZeeshanholoNo ratings yet

- BNK211 Banking LawDocument2 pagesBNK211 Banking LawdhitalkhushiNo ratings yet

- Expected Interview Questions - Bank ExamsDocument8 pagesExpected Interview Questions - Bank ExamsParag DahiyaNo ratings yet

- Gullas V Philippine National BankDocument3 pagesGullas V Philippine National BankCharmila SiplonNo ratings yet

- National Bank of Ethiopia Risk-Based Supervision FrameworkDocument203 pagesNational Bank of Ethiopia Risk-Based Supervision Frameworkyemisrach fikiru0% (1)

- Dashen Bank Annual Report 2019 2020Document110 pagesDashen Bank Annual Report 2019 2020SakariyeNo ratings yet

- Legalisation of Documents by The Ministry For Foreign AffairsDocument2 pagesLegalisation of Documents by The Ministry For Foreign AffairsHaja SheriefNo ratings yet

- Bank Income Statement ProblemsDocument7 pagesBank Income Statement Problemsياسين البيرنسNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument3 pagesMobile Services: Your Account Summary This Month'S ChargesAanindya ChoudhuryNo ratings yet

- T3TSCO - Securities Back Office - R15Document462 pagesT3TSCO - Securities Back Office - R15PRAVIN JOSHUANo ratings yet

- Swift Cat7 mt798 Faqs 20181026Document23 pagesSwift Cat7 mt798 Faqs 20181026musman0075No ratings yet

- Alternate Revenue Sources for BanksDocument37 pagesAlternate Revenue Sources for BanksMustafa S TajaniNo ratings yet

- Module 1 - Cash and Cash EquivalentsDocument4 pagesModule 1 - Cash and Cash Equivalentsvh28qjw8ghNo ratings yet

- Arceo, Jr. Vs People of The PHDocument2 pagesArceo, Jr. Vs People of The PHToni CalsadoNo ratings yet

- BPI Ordered to Pay Account Despite WithdrawalDocument2 pagesBPI Ordered to Pay Account Despite WithdrawalJemNo ratings yet

- Impact of Rightsizing On Shareholders Value in Micro Finance Banks in Lagos State, NigeriaDocument10 pagesImpact of Rightsizing On Shareholders Value in Micro Finance Banks in Lagos State, NigeriaIjahss JournalNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument22 pagesInstructions / Checklist For Filling KYC FormAshok KumarNo ratings yet

- Raymond WC MGMTDocument66 pagesRaymond WC MGMTshwetakhamarNo ratings yet

- 21st Year Banking Publication Registration DetailsDocument20 pages21st Year Banking Publication Registration DetailsRajasekhar ChaduvulaNo ratings yet

- Sep2015Document2 pagesSep2015Sidhantha JainNo ratings yet

- Business Report Pradeep Chauhan 11june'23Document25 pagesBusiness Report Pradeep Chauhan 11june'23Pradeep ChauhanNo ratings yet

- Kindergarten Sort Colors Shape LPDocument21 pagesKindergarten Sort Colors Shape LPKathlen Aiyanna Salvan BuhatNo ratings yet

- Indiabuls Final PresentationDocument39 pagesIndiabuls Final PresentationVanraj PandeyNo ratings yet