Professional Documents

Culture Documents

Projections 4

Uploaded by

GAJJA SURENDRAOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Projections 4

Uploaded by

GAJJA SURENDRACopyright:

Available Formats

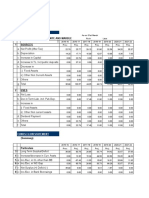

ANNEXURE- II

ANJANEYA CEMENT WORKS , VEMPALLI.

RS. IN LAKHS

ESTIMATE OF COST OF PRODUCTION & PROFITABILITY STATEMENT

YEAR F.Y.2022-2023F.Y.2023-2024

F.Y.2024-2025

F.Y.2025-2026

F.Y2026-2027

F.Y.2027-2028

INSTALLED CAPACITY (Nos) 4000 4000 4000 4000 4000 4000

LICENCED CAPACITY (Nos) 2800 3200 3200 3200 3200 3200

CAPACITY UTILIESD (%) 70 80 80 80 80 80

MANUFACTURING EXPENSES

RAWMATERIAL 13.65 15.60 15.60 15.60 15.60 15.60

CONSUMABULS 0.48 0.55 0.55 0.55 0.55 0.55

POWER & FUEL 0.85 0.97 0.97 0.97 0.97 0.97

WAGES 16.00 17.60 17.60 17.60 17.60 17.60

REPAIRS AND MAINTENANCE 0.36 0.40 0.44 0.48 0.53 0.53

RENTS, RATES,TAXES AND INSURANCE 0.30 0.33 0.36 0.40 0.44 0.44

OTHER FACTORY EXPENSES 0.00 0.00 0.00 0.00 0.00 0.00

TOTAL : A 31.64 35.45 35.52 35.60 35.69 35.69

ADMINISTRATIVE EXPENSES

SALARIES 1.62 1.78 1.96 2.16 2.37 2.37

OTHER ADMINISTRATIVE EXPENSES 0.00 0.00 0.00 0.00 0.00 0.00

TOTAL : B 1.62 1.78 1.96 2.16 2.37 2.37

TOTAL COST OF PRODUCTION (A+B) : D 33.26 37.23 37.48 37.75 38.06 38.06

SALES : E 37.50 42.86 42.86 42.86 42.86 42.86

GROSS PROFIT BEFORE INTEREST AND

DEPRECIATION (E-D) : F 4.24 5.63 5.38 5.10 4.80 4.80

FINANCIAL EXPENSES

INTEREST ON TERM LOANS 0.00 0.00 0.00 0.00 0.00 0.00

INTEREST ON BORROWINGS FOR W.C 1.35 1.35 1.35 1.35 1.35 1.35

TOTAL : G 1.35 1.35 1.35 1.35 1.35 1.35

DEPRECIATION : H 2.25 1.91 1.63 1.38 1.17 1.00

OPERATING PROFIT ( F-G-H) : I 0.64 2.37 2.40 2.37 2.27 2.45

PROVISION FOR TAXATION : J 0.00 0.00 0.00 0.00 0.00 0.00

PROFIT AFTER TAX (I-J) : K 0.64 2.37 2.40 2.37 2.27 2.45

NET ROFIT BEFORE TAXES INT ADDED

BACK BUT AFTER DEPRECIATION

OR EBIT (F-H) 1.99 3.72 3.75 3.72 3.62 3.80

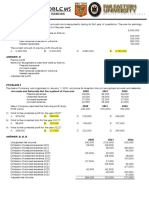

ANNEXURE-III

ANJANEYA CEMENT WORKS , VEMPALLI.

CASH FLOW STATEMENT RS. IN LAKHS

YEARS

PARTICUALRS CONS F.Y.2022-2023F.Y.2023-2024

F.Y.2024-2025

F.Y.2025-2026

F.Y.2026-2027

F.Y.2027-2028

PERIOD

A. SOURCES OF FUNDS

a. NET PROFIT BEFORE TAXES WITH

INTEREST ADDED BACK BUT AFTER

DEPRECIATION 1.99 3.72 3.75 3.72 3.62 3.80

b. INCREASE IN SHARE CAPITAL

EQUITY 17.50

c. DEPRECIATION 2.25 1.91 1.63 1.38 1.17 1.00

d. INC. IN LONG TERM LOANS 0.00

e. INC IN UNSECURED LOANS 0.00

f. INC. IN BANK BORROWING FOR W/c 7.50

g. MARGIN MONEY FROM PMEGP 0.00 0.00 0

h. OTHERS 0.00

TOTAL : A 17.50 11.74 5.63 5.38 5.10 4.80 4.80

B. APPLICATION OF FUNDS

a. PREL.& PRE.OP EXPENSES 0.00

b. INC. IN CAPITAL EXPENDITURE 15.00

c. INC. IN CURRENT ASSETS 7.50 1.07 0.00 0.00 0.00 0.00

d. DEC. IN LONG TERM LOANS 0.00 0.00 8.57 0.00 0.00 0.00

e. BANK DEPOSITS 0.00 0.00 0.00 0.00 0.00 0.00

f. INTEREST 1.35 1.35 1.35 1.35 1.35 1.35

g. TAXES 0.00 0.00 0.00 0.00 0.00 0.00

h. WITHDRAWALS 2.10 4.20 6.30 6.30 6.30 6.30

TOTAL : B 15.00 10.95 6.62 16.22 7.65 7.65 7.65

C. OPENING BALANCE 0.00 2.50 3.29 2.30 -8.54 -11.09 -13.94

D. NET SURPLUS ( A-B) 2.50 0.79 -0.99 -10.84 -2.55 -2.85 -2.85

E. CLOSING BALANCE 2.50 3.29 2.30 -8.54 -11.09 -13.94 -16.79

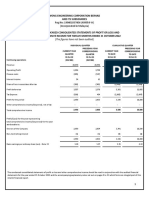

ANJANEYA CEMENT WORKS , VEMPALLI.

ANNEXURE - V

D.S.C.R. STATEMENT

RS. IN LAKHS

YEARS

PARTICUALRS

1ST 2ND 3RD 4TH 5TH 6TH

A. COVER

a. NET PROFIT AFTER TAX 0.64 2.37 2.40 2.37 2.27 2.45

b. DEPRECIATION 2.25 1.91 1.63 1.38 1.17 1.00

c. INT. ON LONG TERM LOAN 0.00 0.00 0.00 0.00 0.00 0.00

d. INT. ON SOFT LOANS

e. INT. ON FUNDED INT

TOTAL COVER 2.89 4.28 4.03 3.75 3.45 3.45

B. SERVICE

a. REPAYMENT OF L.T. LOANS 0.00 0.00 0.00 0.00 0.00 0.00

b. REPAYMENT OF SOFT LOANS

c. INT. ON L.T. LOANS 0.00 0.00 0.00 0.00 0.00 0.00

d. INT. ON SOFT LOANS 1.35 1.35 1.35 1.35 1.35 1.35

e. INT. ON FUNDED INT

TOTAL SERVICE 1.35 1.35 1.35 1.35 1.35 1.35

D.S.C.R. RATIO 2.14 3.17 2.98 2.78 2.55 2.55

D.S.C.R. IS EQUAL TO 1: 2.70

ANJANEYA CEMENT WORKS , VEMPALLI.

ANNEXURE-IV

BREAK EVEN POINT

RS. IN LAKHS

VARIABLE COSTS: Rs.

RAW MATERIALS 15.60

POWER & FUEL 0.97

WAGES 17.60

CONSUMABLES 0.55

SELLING EXENSES 0.00

INT. ON BANK BORROWINGS 1.35

EXCISE DUTY 0.00

OTHER FACTORY EXPENSES 0.00

TOTAL VARIABLE COSTS 36.07

SEMI VARIABLE & FIXED COSTS

SALARIES 1.96

REAIRS & MAINTANANCE 0.44

INT. ON TERM LOAN & U/s LOANS 0.00

DEPRECIATION 1.63

RENT, TAXES ETC., 0.36

OTHER ADMN. EXPENSES 0.00

TOTAL FIXED COSTS 4.38

CONTRIBUTION= SALES - VARIABLE COSTS) 6.79

BREAK EVEN POINT (%)= 51.68

CASH BREAKEVEN POINT (%)= 32.52

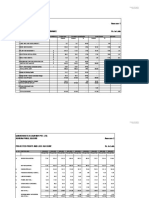

ANJANEYA CEMENT WORKS , VEMPALLI.

IRR STATEMENT

YEARS

CASH INFLOWS 1ST 2ND 3RD 4TH 5TH 6TH

E.B.I.T 1.99 3.72 3.75 3.72 3.62 3.80

DEPRECIATION 2.25 1.91 1.63 1.38 1.17 1.00

TOTAL: 4.24 5.63 5.38 5.10 4.80 4.80

YEAR CAPITAL BENEFITS NET DISCOUNTED

OUTLAY BENEFITS BENEFITS

CONSTRUCTION PERIOD 15.00 0.00 -15.00 -15.00

1ST YEAR 7.50 4.24 -3.26 3.47

2ST YEAR 1.07 5.63 4.56 3.76

3RD YEAR 0.00 5.38 5.38 2.94

4TH YEAR 0.00 5.10 5.10 2.28

5TH YEAR 0.00 4.80 4.80 1.76

6TH YEAR 0.00 4.80 4.80 1.44

7TH YEAR 0.00 0.00 0.00 0.00

8TH YEAR 0.00 0.00 0.00 0.00

9TH YEAR 0.00 0.00 0.00 0.00

10TH YEAR 0.00 0.00 0.00 0.00

11TH YEAR 0.00 0.00 0.00 0.00

12TH YEAR 0.00 0.00 0.00 0.00

13TH YEAR 0.00 0.00 0.00 0.00

14TH YEAR 0.00 0.00 0.00 0.00

15TH YEAR 0.00 0.00 0.00 0.00

TOTAL DISCOUNTED BENEFITS 0.65

IRR (%) = 22.28

ANNEXURE

ANJANEYA CEMENT WORKS , VEMPALLI.

COST BENEFIT INDICATORS RS. IN LAKHS

PARTICULARS YEARS

1ST 2ND 3RD

INSTALLED CAPACITY 4000

PRODUCTION CAPACITY 2800 3200 3200

CAPACITY UTILISATION (%) 70 80 80

CAPITAL EMPLOYED 15.00

EMLOYMENT 17.00

VALUE OF OUT PUT 37.50 42.86 42.86

VAL.OF OUTPUT/CAP.EMPLOYED (%) 250.00 285.71 285.71

RAW MATERIAL COST 13.65 15.60 15.60

RAW MATERIALS/VALUE OF OUTPUT (%) 36.40 36.40 36.40

INTEREST/VALUE OF OUTPUT (%) 3.60 3.15 3.15

OPERATING PROFIT 0.64 2.37 2.40

NET PROFIT 0.64 2.37 2.40

OP.PROFIT/VALUE OF OUTPUT (%) 1.71 5.52 5.61

NET PROFIT/EQUITY (%) 3.66 13.52 13.73

INVESTMENT PER WORKER 0.03

CONTRIBUTION TO EXCHEQUER OVER

6 YEARS OF INCOME TAX 0.00

ANNEXURE-VI

ANJANEYA CEMENT WORKS , VEMPALLI.

PROJECTED BALANCE SHEET RS. IN LAKHS

YEARS

CONS 1ST 2ND 3RD 4TH 5TH 6TH

PERIOD

A. SOURCES OF FUNDS

a. PROMOTERS CAPITAL 17.50 17.50 17.50 17.50 17.50 17.50 17.50

b. RESERVS & SURPLUS -1.46 -3.29 -7.19 -11.12 -15.15 -18.99

c. LOAN FUNDS

1. SECURED LOANS

TERM LOAN FROM BANK 0.00 0.00 0.00 0.00 0.00 0.00 0.00

w/c LOAN FROM BANK 7.50 7.50 7.50 7.50 7.50 7.50

MARGIN MONEY - PMGEP 0.00 0.00 0.00 0.00 0.00 0.00

TOTAL : A 17.50 23.54 21.71 17.81 13.88 9.85 6.01

B. APPLICATION OF FUNDS

a. FIXED ASSETS

GROSS BLOCK 15.00 15.00 12.75 10.84 9.21 7.83 6.66

LESS: DEPRECIATION 0.00 2.25 1.91 1.63 1.38 1.17 1.00

NET BLOCK 15.00 12.75 10.84 9.21 7.83 6.66 5.66

b. Bank Deposits 0.00 0.00 0.00 0.00 0.00 0.00

c. NET CURRENT ASSETS 2.50 10.79 10.87 8.60 6.05 3.20 0.35

TOTAL 17.50 23.54 21.71 17.81 13.88 9.85 6.01

You might also like

- RAJGHARANADocument20 pagesRAJGHARANAPriyanshu tripathiNo ratings yet

- Beckwith Crossing Homeowners Association Inc: 1/31/2022 Balance Sheet ForDocument5 pagesBeckwith Crossing Homeowners Association Inc: 1/31/2022 Balance Sheet ForKsk sidkdNo ratings yet

- Cma-Krishnaveni Upvc Profiles PDFDocument22 pagesCma-Krishnaveni Upvc Profiles PDFtechnopreneurvizagNo ratings yet

- 6.certified Summary of WorkDocument1 page6.certified Summary of WorkRachelle Ann NotoNo ratings yet

- Finanical Statement ofDocument41 pagesFinanical Statement ofanujNo ratings yet

- Data JioDocument18 pagesData JioAnkit VermaNo ratings yet

- Sadguru Construction Cma 16-17 To 2020-21Document8 pagesSadguru Construction Cma 16-17 To 2020-21vdtaudit 1No ratings yet

- City of Fort St. John - 2023-2027 Operating BudgetDocument30 pagesCity of Fort St. John - 2023-2027 Operating BudgetAlaskaHighwayNewsNo ratings yet

- CMA - BlankDocument84 pagesCMA - Blankeakwalansari4No ratings yet

- Price EscalationDocument1 pagePrice EscalationsaptaraqsNo ratings yet

- Project Report Printin PressDocument5 pagesProject Report Printin Pressmanohar michaelNo ratings yet

- Reviewer Quiz 4Document21 pagesReviewer Quiz 4Jessica Mikah Lim AgbayaniNo ratings yet

- (In Lakhs) : © The Institute of Chartered Accountants of IndiaDocument17 pages(In Lakhs) : © The Institute of Chartered Accountants of Indiaarihant bokdiaNo ratings yet

- Technocrat Consultancy-Rs Engineering Consultancy JVDocument9 pagesTechnocrat Consultancy-Rs Engineering Consultancy JVBright Tone Music InstituteNo ratings yet

- Q1fy22 FR AtlDocument7 pagesQ1fy22 FR AtlbandhulNo ratings yet

- Project Report Final 1Document11 pagesProject Report Final 1ManiyarSant & Co., Chartered AccountantsNo ratings yet

- Sumida JP - BP - 2021-23Document27 pagesSumida JP - BP - 2021-23Akash PhogatNo ratings yet

- Case Study Invetment DecisionDocument8 pagesCase Study Invetment DecisionKelsy NguyenNo ratings yet

- Technocrat Consultancy-Rs Engineering Consultancy JVDocument8 pagesTechnocrat Consultancy-Rs Engineering Consultancy JVBright Tone Music InstituteNo ratings yet

- Shree Shyam Granite Cma Data - Xls FINALDocument45 pagesShree Shyam Granite Cma Data - Xls FINALSURANA1973100% (1)

- Financial Result 30.06.2022Document3 pagesFinancial Result 30.06.2022SachinNo ratings yet

- FinmanDocument4 pagesFinmanAngel ToribioNo ratings yet

- Auditing Problems: Ap - 01: Correction of ErrorsDocument15 pagesAuditing Problems: Ap - 01: Correction of ErrorsPrinces100% (2)

- PRDocument10 pagesPRPradeep SenNo ratings yet

- Cma & DSCRDocument10 pagesCma & DSCRSaranNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- RP Infra Cma ReportDocument12 pagesRP Infra Cma ReportJitendra NikhareNo ratings yet

- Assessment For Working Capital Requirements: Actual Provisional Projected Projected ProjectedDocument11 pagesAssessment For Working Capital Requirements: Actual Provisional Projected Projected ProjectedVivek SharmaNo ratings yet

- Mis For Construction CoDocument1 pageMis For Construction CoShubham ChaudhariNo ratings yet

- 7050 Wong QR 2022-10-31 Wecfrq4fy2022 - 2122247081Document13 pages7050 Wong QR 2022-10-31 Wecfrq4fy2022 - 2122247081Quint WongNo ratings yet

- Error and Corrections Solutionpa CheckDocument5 pagesError and Corrections Solutionpa Checkmartinfaith958No ratings yet

- PC-1 Savuz - MergedDocument7 pagesPC-1 Savuz - MergedMahesh RNo ratings yet

- Manipur Budget 2022-23 - Demand-No.7-PoliceDocument11 pagesManipur Budget 2022-23 - Demand-No.7-PoliceChirag singh MehtaNo ratings yet

- Marathon Tea Company Pvt. Ltd. Ashram Para, Siliguri Annexure-1Document18 pagesMarathon Tea Company Pvt. Ltd. Ashram Para, Siliguri Annexure-1RajibDebNo ratings yet

- AuditorDocument2 pagesAuditorSum WhosinNo ratings yet

- Aditya: ForgeDocument17 pagesAditya: ForgeanupNo ratings yet

- Less: Deduction@30%: © The Institute of Chartered Accountants of IndiaDocument12 pagesLess: Deduction@30%: © The Institute of Chartered Accountants of IndiaAashish soniNo ratings yet

- Sigachi Quaterly and Annual ResultsDocument18 pagesSigachi Quaterly and Annual Resultsknowme73No ratings yet

- Project Report Va Tika ProjectionsDocument37 pagesProject Report Va Tika Projectionsprateek goyalNo ratings yet

- 2.office of The AdministratorDocument7 pages2.office of The AdministratorVIRGILIO OCOY IIINo ratings yet

- 1663274292-Tax Cals-1Document1 page1663274292-Tax Cals-1Kriti GandhiNo ratings yet

- Cma FormatDocument14 pagesCma FormatBISHNU PADA DASNo ratings yet

- MpsDocument2 pagesMpsSum WhosinNo ratings yet

- Figure in Lakh Prepared by - Ca. Shivam GuptaDocument11 pagesFigure in Lakh Prepared by - Ca. Shivam GuptaAayush LohanaNo ratings yet

- Smom Store Renovation 2Document9 pagesSmom Store Renovation 2AndroNo ratings yet

- Statement of Income PDFDocument1 pageStatement of Income PDFIconic PointNo ratings yet

- SGMEDICOSEDocument12 pagesSGMEDICOSEVijay HemwaniNo ratings yet

- Shail End RaDocument24 pagesShail End Rabharat khandelwalNo ratings yet

- Sip 3Document5 pagesSip 3mohit sharmaNo ratings yet

- Afm Final1Document9 pagesAfm Final1madhav.agarwal23hNo ratings yet

- Salma Saifi May SlipDocument2 pagesSalma Saifi May Slipsalma saifiNo ratings yet

- 20200731-0100001646-SMCC-Mall North Wing-TECHNOMARINE ENTERPRISES PHILS INC PDFDocument6 pages20200731-0100001646-SMCC-Mall North Wing-TECHNOMARINE ENTERPRISES PHILS INC PDFEdjon AndalNo ratings yet

- Form 1621032023 201318 PDFDocument3 pagesForm 1621032023 201318 PDFManvendraNo ratings yet

- Pangibitan, Geojanni R. - Activity 3 - A5Document4 pagesPangibitan, Geojanni R. - Activity 3 - A5Geojanni PangibitanNo ratings yet

- MTP II AnswersDocument14 pagesMTP II AnswersEediko ConsultingNo ratings yet

- Hind Adhesives BBG AdjustedDocument2 pagesHind Adhesives BBG Adjustedgraheeth26No ratings yet

- Depreciation Allowance (Parts 1 & 2) Tutorial Questions 1Document4 pagesDepreciation Allowance (Parts 1 & 2) Tutorial Questions 1ting ting shihNo ratings yet

- Standalone Profit LossDocument1 pageStandalone Profit LossrahulNo ratings yet

- Statemnt of Profit and LossDocument1 pageStatemnt of Profit and LossRutuja shindeNo ratings yet