Professional Documents

Culture Documents

THR Analysis

Uploaded by

Bill Clinton SimanjuntakOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

THR Analysis

Uploaded by

Bill Clinton SimanjuntakCopyright:

Available Formats

Bogor, 17 Juli 2023

REGULATORY COMPLIANCE

In connection with Religious Allowance, as a non-salary income that must be paid by business actors to workers/laborers or their families prior to Religious Holiday. We found a number of things that need to be a concern, this

is important in order to avoid legal problems that can cause losses to the company in the future.

Currently, the rules for Religious Allowance or Tunjangan Hari Raya (“THR”) refer to the Regulation of the Minister of Manpower 6/2016. Meanwhile, regulations in the form of laws such as Law 13/2003 and Perppu

2/2022 which has been passed into law on March 21, 2023, do not specifically regulate Religious Allowance for employees.

Therefore our company should comply to the provisions Regulation of Minister of Manpower 6/2016. Herewith we provide the compliance analysis in the following table that contain provision of the Minister Regulation, our

Company Regulation and actual realization in our company.

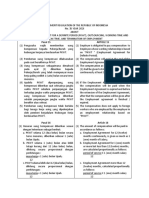

No. Content Regulation of the Minister of Manpower Company Regulation Actual Realization

6/2016

1. Calculation Of Holiday Allowance Article 3 Article 18 Paragraph 1 Different

Workers/laborers who have a service term of 12 1 month of fixed salary for the Employee who has

(twelve) months consecutively or more, shall be reach 1 year service period or more.

granted in the amount of 1 (one) monthly salary;

Article 4 Article 18 Paraghraph 2

Workers/laborers who have service term 1 (one) If the lenght of service is 1 month or more but less

month consecutively, but less than 12 (twelve) than 12 months, will receive THR based on the

months, shall be granted proportionally in following calculation:

accordance with the service term by using the

following calculation:

(service term)/12 x 1 (one) monthly salary. Length of Service (Month) / 12 x Fixed Salary

2. Monthly Salary Defenition Article 3 Paragraph 2 Article 1 Paragraph 16 The calculation is only done based on the amount of base

salary.

Salary which is the clean salary; Fixed Salary is Basic Salary plus Fixed Allowances.

Or basic salary, including fixed allowance.

3.

Sanctions for Entrepreneurs If They Do Not Pay Full THR

Permenaker 6/2016 stipulates provisions for sanctions if the entrepreneur does not pay THR 1 time in 1 year and if the THR payment is not in accordance with the provisions. The sanctions in question are administrative

sanctions.

Regarding further administrative sanctions, sanctions that can be imposed include:[6]

- Written warning;

- Restrictions on business activities;

- Temporary suspension of part or all of the means of production; And

- Suspension of business.

You might also like

- Employment Contract: (Wide Range Digital Services) (The "Company")Document10 pagesEmployment Contract: (Wide Range Digital Services) (The "Company")Saifal Ahmed MughalNo ratings yet

- Human Resource Management Final ExamDocument24 pagesHuman Resource Management Final ExamKayezel Kriss100% (1)

- Cebu Oxygen Acetylene Co., vs. Drilon, G.R. No. 82849Document1 pageCebu Oxygen Acetylene Co., vs. Drilon, G.R. No. 82849Bug Rancher100% (1)

- MCQs On OSHC-2020 Part 1&2Document96 pagesMCQs On OSHC-2020 Part 1&2AMLAN PANDA100% (10)

- Talent Management Handbook PreviewDocument14 pagesTalent Management Handbook PreviewMuhammad Bahmansyah0% (3)

- Training Requirements TemplateDocument6 pagesTraining Requirements Templateriko.adi.sunaryoNo ratings yet

- SMBR - Offering Letter (Rizal Yon Aulia)Document3 pagesSMBR - Offering Letter (Rizal Yon Aulia)RaffaIlhamNo ratings yet

- Lecture Notes Labor LawDocument3 pagesLecture Notes Labor LawMaphile Mae CanenciaNo ratings yet

- Standard Employment ContractDocument3 pagesStandard Employment ContractchellyNo ratings yet

- Week 3-Slm 3 - Safety in The WorkplaceDocument27 pagesWeek 3-Slm 3 - Safety in The WorkplaceRachelle Anne MendozaNo ratings yet

- Sample of Assignment Profeesional EthicsDocument10 pagesSample of Assignment Profeesional EthicsLavanya Thevi100% (1)

- Do 174 Presentation BLRDocument43 pagesDo 174 Presentation BLRJoseph CabreraNo ratings yet

- Feather BeddingDocument8 pagesFeather BeddingPearl Angeli Quisido CanadaNo ratings yet

- Director Vs Manager Vs SupervisorDocument2 pagesDirector Vs Manager Vs Supervisor1105195794No ratings yet

- The Payment of Gratuity Act, 1972Document6 pagesThe Payment of Gratuity Act, 1972abd VascoNo ratings yet

- Changes in Bonus Act AlertDocument4 pagesChanges in Bonus Act AlertJagan MohanNo ratings yet

- K49 - NHÓM H - POWERPOINT THUYẾT TRÌNHDocument40 pagesK49 - NHÓM H - POWERPOINT THUYẾT TRÌNHthengsam2404No ratings yet

- Recent Amendments in Labour LawDocument8 pagesRecent Amendments in Labour Lawsandeepambure143No ratings yet

- ESIC On Bonus, Overtime, Leave EncashmentDocument3 pagesESIC On Bonus, Overtime, Leave Encashmentharshil.rmlNo ratings yet

- CA Inter - GST AmendmentsDocument23 pagesCA Inter - GST AmendmentsOm Sai EnterprisesNo ratings yet

- Key Amendments in Payment of Gratuity Act: Roopa Somasundaran Garima MehraDocument2 pagesKey Amendments in Payment of Gratuity Act: Roopa Somasundaran Garima MehraASHWINI PATADENo ratings yet

- Provision of PF ActDocument4 pagesProvision of PF ActSachin ThakkarNo ratings yet

- CONTRACT WORKER COMPENSATION - MetaDocument1 pageCONTRACT WORKER COMPENSATION - MetaTeam UpNo ratings yet

- Gratuity Trust - BenefitsDocument10 pagesGratuity Trust - BenefitsManoj Kumar KoyalkarNo ratings yet

- RanjitDocument5 pagesRanjitjawedaman123No ratings yet

- Translation Article 15 - 16 - 17 - PPNo 35 Year 2021Document2 pagesTranslation Article 15 - 16 - 17 - PPNo 35 Year 2021oggy SatyaNo ratings yet

- Payment of GratuityDocument11 pagesPayment of GratuityHari NaamNo ratings yet

- Saudi EOSB Policy v5Document8 pagesSaudi EOSB Policy v5Bahaa AbusaqerNo ratings yet

- Taxation of SalaryDocument27 pagesTaxation of SalaryAshish RanjanNo ratings yet

- Salient Features of The Payment of Bonus ActDocument5 pagesSalient Features of The Payment of Bonus ActbudhnabamNo ratings yet

- Recent Amendments in Labour LawDocument4 pagesRecent Amendments in Labour LawAMIYA BISWARANJAN NayakNo ratings yet

- 12bf7 Budget 2020 UpdatesDocument22 pages12bf7 Budget 2020 UpdatesrajendraNo ratings yet

- Bonus Act AmendmentDocument2 pagesBonus Act AmendmentgopalakrishnanNo ratings yet

- Offer Letter - DraftDocument5 pagesOffer Letter - DraftyzhpgoofdNo ratings yet

- Sarfaraj JoiningDocument5 pagesSarfaraj Joiningjawedaman123No ratings yet

- Proctor & GambleDocument8 pagesProctor & GambleSaad SaleemNo ratings yet

- Wages For ESICDocument10 pagesWages For ESICvai8havNo ratings yet

- SUMMARY of Goverment Regulation No 35 - 2021Document5 pagesSUMMARY of Goverment Regulation No 35 - 2021De Aris DerismanNo ratings yet

- LELB51Document8 pagesLELB51NvghNo ratings yet

- ISA Agreement SharpenerDocument7 pagesISA Agreement SharpenerGurjeet kaur RanaNo ratings yet

- The Payment of Bonus ActDocument10 pagesThe Payment of Bonus Actshanky631No ratings yet

- SalaryDocument2 pagesSalarythanhnguyen.31231020164No ratings yet

- Client Note - Labor Law - Eng - v1 - 20211029Document13 pagesClient Note - Labor Law - Eng - v1 - 20211029maronzo17No ratings yet

- The Glocal Law School: SaharanpurDocument9 pagesThe Glocal Law School: SaharanpurSajid KhanNo ratings yet

- Welfare Measures: Extension of Date of Utilisation For Donations Received For Gujarat Earthquake ReliefDocument7 pagesWelfare Measures: Extension of Date of Utilisation For Donations Received For Gujarat Earthquake ReliefAnji NaniNo ratings yet

- The Payment of Bonus Act, 1965Document36 pagesThe Payment of Bonus Act, 1965NiveditaSharmaNo ratings yet

- Payrollintroduction 202206031248PMDocument16 pagesPayrollintroduction 202206031248PMsandeep kohapareNo ratings yet

- Debajyoti BBSRDocument5 pagesDebajyoti BBSRjawedaman123No ratings yet

- Debajyoti JoiningDocument5 pagesDebajyoti Joiningjawedaman123No ratings yet

- Unit 5 EmployeeDocument7 pagesUnit 5 Employeemohammadfaisal4021No ratings yet

- Circular No. 12 of 2023 Ex Gratia To DPS NWNPDocument2 pagesCircular No. 12 of 2023 Ex Gratia To DPS NWNPpiyush jainNo ratings yet

- Meaning of Salary': Condition For Charging Income U/H "Salaries"Document21 pagesMeaning of Salary': Condition For Charging Income U/H "Salaries"kiranshingoteNo ratings yet

- A Note On Amendment To The Payment of Bonus ActDocument3 pagesA Note On Amendment To The Payment of Bonus Actjaskaran singhNo ratings yet

- Salary Income-Pg DTDocument11 pagesSalary Income-Pg DTOnkar BandichhodeNo ratings yet

- Amendments To The Labour Law Introduced in 2017Document2 pagesAmendments To The Labour Law Introduced in 2017842janxNo ratings yet

- Analyse The Recent Labour Law Reform & Its Impact On BusinessesDocument4 pagesAnalyse The Recent Labour Law Reform & Its Impact On BusinessesAnshul KachhapNo ratings yet

- Guide To Malaysian Employment Law - Donovan & Ho PDFDocument6 pagesGuide To Malaysian Employment Law - Donovan & Ho PDFRaph TNo ratings yet

- Dhruv Rajput NewDocument13 pagesDhruv Rajput NewAbhay SharmaNo ratings yet

- Wage Revision Clarification PDFDocument4 pagesWage Revision Clarification PDFbraghavNo ratings yet

- JD Form IiDocument2 pagesJD Form Iiredminote7s098No ratings yet

- ConceptDocument2 pagesConceptNicolas RiosNo ratings yet

- HLK 13Document8 pagesHLK 13Jne Raya MenurNo ratings yet

- Tax Implications For Employers Amidst Covid-19Document4 pagesTax Implications For Employers Amidst Covid-19Bryan JosephNo ratings yet

- RR 3-2015 (Other Benefits 82000)Document2 pagesRR 3-2015 (Other Benefits 82000)Judith De los ReyesNo ratings yet

- October 2020 Consolidated Pay ScalesDocument91 pagesOctober 2020 Consolidated Pay ScalesdoodrillNo ratings yet

- Payment of Gratuity As Per UAE Labour Law: Konkan TimesDocument4 pagesPayment of Gratuity As Per UAE Labour Law: Konkan TimesAdarsh SvNo ratings yet

- Gratuity Law in PakistanDocument6 pagesGratuity Law in PakistanDanish Nawaz100% (1)

- Employees' Provident Fund and Miscellaneous Provisions Act, 1952 Sneha Gedam (09-716)Document17 pagesEmployees' Provident Fund and Miscellaneous Provisions Act, 1952 Sneha Gedam (09-716)smit2512No ratings yet

- ESICDocument8 pagesESICVenkataraman KarthikeyanNo ratings yet

- Textbook of Urgent Care Management: Chapter 21, Employment Contracts and CompensationFrom EverandTextbook of Urgent Care Management: Chapter 21, Employment Contracts and CompensationNo ratings yet

- TR_ADeepDiveIntoCyberResilienceDocument1 pageTR_ADeepDiveIntoCyberResilienceBill Clinton SimanjuntakNo ratings yet

- Negotiation for Auditor TrainingDocument1 pageNegotiation for Auditor TrainingBill Clinton SimanjuntakNo ratings yet

- MoM_KJPPSentraland2024Document1 pageMoM_KJPPSentraland2024Bill Clinton SimanjuntakNo ratings yet

- Compliance Law No. 5 of 1960Document2 pagesCompliance Law No. 5 of 1960Bill Clinton SimanjuntakNo ratings yet

- Regulation of PMN SummaryDocument3 pagesRegulation of PMN SummaryBill Clinton SimanjuntakNo ratings yet

- Compliance of Government Regulation in Lieu of Law (Perppu) No.2 of 2022Document5 pagesCompliance of Government Regulation in Lieu of Law (Perppu) No.2 of 2022Bill Clinton SimanjuntakNo ratings yet

- Summary Regarding Foreclosure (Latest)Document3 pagesSummary Regarding Foreclosure (Latest)Bill Clinton SimanjuntakNo ratings yet

- Compliance Regulatory Law No.5 of 1960Document2 pagesCompliance Regulatory Law No.5 of 1960Bill Clinton SimanjuntakNo ratings yet

- Compliance Regulation ListDocument1 pageCompliance Regulation ListBill Clinton SimanjuntakNo ratings yet

- en Land Acquisition Strategy of PT KrakatauDocument15 pagesen Land Acquisition Strategy of PT KrakatauBill Clinton SimanjuntakNo ratings yet

- en Land Acquisition Strategy of PT KrakatauDocument14 pagesen Land Acquisition Strategy of PT KrakatauBill Clinton SimanjuntakNo ratings yet

- Indonesian Company LawDocument2 pagesIndonesian Company LawBill Clinton SimanjuntakNo ratings yet

- EnglishDocument2 pagesEnglishPınar SarmanNo ratings yet

- TASK ONE.3.LINE GRAPH - Men and Women Employment in Australia Between 1973 and 1993Document3 pagesTASK ONE.3.LINE GRAPH - Men and Women Employment in Australia Between 1973 and 1993Mir NaimNo ratings yet

- Krugman'S: EconomicsDocument15 pagesKrugman'S: EconomicsscNo ratings yet

- Chapter 6Document16 pagesChapter 6mohammad younasNo ratings yet

- UNIT - 5 Alagappa UniversityDocument39 pagesUNIT - 5 Alagappa UniversitySe SathyaNo ratings yet

- اصدار تصريح عمل جديدDocument28 pagesاصدار تصريح عمل جديدabukibnakahmedNo ratings yet

- Job Safety Analysis: Tahapanpekerjaan Bahaya Akibat TindakanpengendalianDocument2 pagesJob Safety Analysis: Tahapanpekerjaan Bahaya Akibat TindakanpengendalianGanubio KhottobNo ratings yet

- Letter of Concern Attendance TemplateDocument1 pageLetter of Concern Attendance TemplateIt's VerielNo ratings yet

- Chapter 05 - Planning For and Recruiting Human ResourcesDocument29 pagesChapter 05 - Planning For and Recruiting Human ResourcesAmy SyahidaNo ratings yet

- San Miguel Corporation vs. LaguesmaDocument3 pagesSan Miguel Corporation vs. LaguesmaKornessa ParasNo ratings yet

- TP - Employment Standards in Ontario - 2019Document1 pageTP - Employment Standards in Ontario - 2019Mohamadreza JafaryNo ratings yet

- Apprenticeship - Vacancy - Session 2019-2020Document1 pageApprenticeship - Vacancy - Session 2019-2020karan patelNo ratings yet

- Human Resources PDFDocument38 pagesHuman Resources PDFSoweirdNo ratings yet

- Resume ITDocument3 pagesResume ITSupriya ShindeNo ratings yet

- Labor Law - 13th Month Pay and Service ChargeDocument9 pagesLabor Law - 13th Month Pay and Service ChargeApple LavarezNo ratings yet

- HR Management Assignment # 1 Submitted By: Adeen Ahmad Khan Section: (A) Reference No: L1S20BSSY0021 Submitted To: MAM Ayesha MugheesDocument3 pagesHR Management Assignment # 1 Submitted By: Adeen Ahmad Khan Section: (A) Reference No: L1S20BSSY0021 Submitted To: MAM Ayesha MugheesKhizieNo ratings yet

- Turnover Intention Influencing Factors of EmployeeDocument5 pagesTurnover Intention Influencing Factors of EmployeeAnonymous CR8v7xb0No ratings yet

- HR Practices in Local Companies of Bangladesh: A Study On EskayefDocument24 pagesHR Practices in Local Companies of Bangladesh: A Study On EskayefSinhaj NoorNo ratings yet