Professional Documents

Culture Documents

Depreciation Expense: Straight Line

Uploaded by

ekoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Depreciation Expense: Straight Line

Uploaded by

ekoCopyright:

Available Formats

Purchased 1 jan 2010 (Full Year)

Straight Line

Depreciation Base 150,000 - 24,000

= = 25,200

Useful Life 5

Book Value Depreciation Acc. Book Value

Year

(Beg.) Expense Depreciation (End)

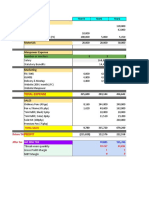

2010 150,000 25,200 25,200 124,800

2011 124,800 25,200 50,400 99,600

2012 99,600 25,200 75,600 74,400

2013 74,400 25,200 100,800 49,200

2014 49,200 25,200 126,000 24,000

Unit of Activity

Depreciation Base 150,000 - 24,000

= = 6

Useful Life 21,000

Book Value Depreciation Acc. Book Value

Year Hours

(Beg.) Expense Depreciation (End)

2010 1,500 150,000 9,000 9,000 141,000

2011 4,000 141,000 24,000 33,000 117,000

2012 7,000 117,000 42,000 75,000 75,000

2013 6,000 75,000 36,000 111,000 39,000

2014 2,500 39,000 15,000 126,000 24,000

21,000

Declining Method

1

Rate = x 2= 40%

5

Book Value Depreciation Acc. Book Value

Year Rate

(Beg.) Expense Depreciation (End)

2010 40% 150,000 60,000 60,000 90,000

2011 40% 90,000 36,000 96,000 54,000

2012 40% 54,000 21,600 117,600 32,400

2013 40% 32,400 8,400 126,000 24,000

2014 40% 24,000 - 126,000 24,000

Sum of the year

Denominator

1+2+3+4+5= 15

(n(n+1))/2 = (5(5+1))/2= 15

Depreciation base = 126,000

Book Value Depreciation Acc. Book Value

Year Dep. Fraction

(Beg.) Expense Depreciation (End)

2010 150,000 5/15 42,000 42,000 108,000

2011 108,000 4/15 33,600 75,600 74,400

2012 74,400 3/15 25,200 100,800 49,200

2013 49,200 2/15 16,800 117,600 32,400

2014 32,400 1/15 8,400 126,000 24,000

Purchased 1 August 2010 (Partial Year)

Straight Line

Depreciation Base 150,000 - 24,000

= = 25,200

Useful Life 5

Book Value Depreciation Current Year Acc. Book Value

Year Partial Year

(Beg.) Expense Dep. Expense Depreciation (End)

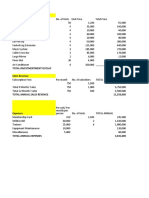

2010 150,000 25,200 5/12 10,500 10,500 139,500

2011 139,500 25,200 25,200 35,700 114,300

2012 114,300 25,200 25,200 60,900 89,100

2013 89,100 25,200 25,200 86,100 63,900

2014 63,900 25,200 25,200 111,300 38,700

2015 38,700 25,200 7/12 14,700 136,500 24,000

Unit of Activity

Depreciation Base 150,000 - 24,000

= = 6

Useful Life 21,000

Book Value Depreciation Acc. Book Value

Year Hours

(Beg.) Expense Depreciation (End)

2010 800 150,000 4,800 4,800 145,200

2011 4,000 145,200 24,000 28,800 121,200

2012 7,000 121,200 42,000 70,800 79,200

2013 6,000 79,200 36,000 106,800 43,200

2014 2,500 43,200 15,000 121,800 28,200

2015 700 28,200 4,200 126,000 24,000

21,000

Declining Method

1

Rate = x 2= 40%

5

Book Value Depreciation Current Year Acc. Book Value

Year Rate Partial Year

(Beg.) Expense Dep. Expense Depreciation (End)

2010 40% 150,000 60,000 5/12 25,000 25,000 125,000

2011 40% 125,000 50,000 50,000 75,000 75,000

2012 40% 75,000 30,000 30,000 105,000 45,000

2013 40% 45,000 18,000 18,000 123,000 27,000

2014 40% 27,000 3,000 3,000 126,000 24,000

2015 40% 24,000 - 7/12 - 126,000 24,000

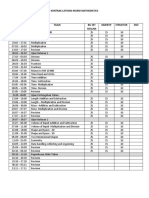

Sum of the year

Denominator

1+2+3+4+5= 15

(n(n+1))/2 = (5(5+1))/2= 15

Depreciation base = 126,000

Book Value Depreciation Current Year Acc. Book Value

Year Dep. Fraction Partial Year

(Beg.) Expense Dep. Expense Depreciation (End)

2010 150,000 5/15 42,000 5/12 17,500 17,500 132,500

2011 132,500 4/15 33,600 38,500 56,000 94,000

2012 94,000 3/15 25,200 30,100 86,100 63,900

2013 63,900 2/15 16,800 21,700 107,800 42,200

2014 42,200 1/15 8,400 13,300 121,100 28,900

2015 28,900 0/15 8,400 7/12 4,900 126,000 24,000

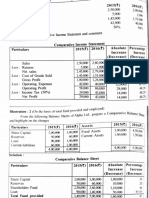

2010 2011 2012 2013 2014 2015

42,000 17,500 24,500 42,000

33,600 14,000 19,600 33,600

25,200 10,500 14,700 25,200

16,800 7,000 9,800 16,800

8,400 3,500 4,900 8,400

17,500 38,500 30,100 21,700 13,300 4,900

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Investment CriteriaDocument15 pagesInvestment CriteriaGOWTHAM K KNo ratings yet

- Chapter 28Document6 pagesChapter 28Shane Ivory ClaudioNo ratings yet

- Unit-2 SUM Comparative, Commonsize, Trend examplesDocument14 pagesUnit-2 SUM Comparative, Commonsize, Trend examplesbhargav.bhut112007No ratings yet

- Trial 1 - DominionDocument17 pagesTrial 1 - Dominionelenasalvazia9No ratings yet

- Measures of Leverage: Abhishek SinhaDocument30 pagesMeasures of Leverage: Abhishek Sinhadev guptaNo ratings yet

- AF Ch. 4 - Analysis FS - ExcelDocument9 pagesAF Ch. 4 - Analysis FS - ExcelAlfiandriAdinNo ratings yet

- T 4Document3 pagesT 4Muntasir AhmmedNo ratings yet

- Paki Check BiDocument5 pagesPaki Check BiAusan AbdullahNo ratings yet

- Oyo Ar 0706Document58 pagesOyo Ar 0706Neema chandokNo ratings yet

- Võ Thành Thắng - 31211024016 - NFGDocument28 pagesVõ Thành Thắng - 31211024016 - NFGtungphan.31211023431No ratings yet

- X Corporation's comparative balance sheet and income statement analysisDocument2 pagesX Corporation's comparative balance sheet and income statement analysisjustineNo ratings yet

- Financial Management Capital Budgeting Practice Questions SolutionsDocument5 pagesFinancial Management Capital Budgeting Practice Questions SolutionsAnchit JassalNo ratings yet

- essayFIN202Document5 pagesessayFIN202thaindnds180468No ratings yet

- Thornado Partnership Statement of Liquidation August 1, 2016 To October 31, 2016Document3 pagesThornado Partnership Statement of Liquidation August 1, 2016 To October 31, 2016Joannah maeNo ratings yet

- Quick Depreciation Calculator: Straight-Line MethodDocument3 pagesQuick Depreciation Calculator: Straight-Line MethodBobbyNicholsNo ratings yet

- ANSWER KEY - FM - Mcom Sem 4 - June 2023Document5 pagesANSWER KEY - FM - Mcom Sem 4 - June 2023Faheem KwtNo ratings yet

- ZafaDocument3 pagesZafaDayavantiNo ratings yet

- Financial ProjectionDocument55 pagesFinancial ProjectionVinayak SilverlineswapNo ratings yet

- 26 LPDocument18 pages26 LPYen YenNo ratings yet

- Cercado April Rose M. 100 Problem 2 To 6 (Elijah Mae)Document4 pagesCercado April Rose M. 100 Problem 2 To 6 (Elijah Mae)Jerome MorenoNo ratings yet

- DVM Enterprises Financial Statements AnalysisDocument6 pagesDVM Enterprises Financial Statements AnalysisNicole AlexandraNo ratings yet

- Silvia Caffe - SolutionDocument1 pageSilvia Caffe - SolutionMurtaza BadriNo ratings yet

- Funding Proj. For StartupsDocument5 pagesFunding Proj. For StartupsBiki BhaiNo ratings yet

- FINANCIAL MANAGEMENT Assignment 2Document14 pagesFINANCIAL MANAGEMENT Assignment 2dangerous saifNo ratings yet

- Cost Residual Value Dapriciable Amount Useful Life Building Machinery EquipmentDocument14 pagesCost Residual Value Dapriciable Amount Useful Life Building Machinery EquipmentcharlottevinsmokeNo ratings yet

- Cost Residual Value Dapriciable Amount Useful Life Building Machinery EquipmentDocument9 pagesCost Residual Value Dapriciable Amount Useful Life Building Machinery EquipmentcharlottevinsmokeNo ratings yet

- P13Document21 pagesP13Saeful AzizNo ratings yet

- FM09-CH 29 PDFDocument2 pagesFM09-CH 29 PDFNaveen RaiNo ratings yet

- Determining Cash Flows for Investment AnalysisDocument19 pagesDetermining Cash Flows for Investment AnalysisJack mazeNo ratings yet

- ABC Corporation's 2019 Financial Statement AnalysisDocument15 pagesABC Corporation's 2019 Financial Statement AnalysisHallasgo, Elymar SorianoNo ratings yet

- Initial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsDocument5 pagesInitial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsPrince JoshiNo ratings yet

- 5.ratio Analysis SumsDocument9 pages5.ratio Analysis Sumsvinay kumar nuwalNo ratings yet

- Solution of Tutorial 6Document4 pagesSolution of Tutorial 6Richard MidgleyNo ratings yet

- Financial Stuff (SME)Document14 pagesFinancial Stuff (SME)Sana KhanNo ratings yet

- Corporate Finance: Class Notes 8Document18 pagesCorporate Finance: Class Notes 8Sakshi VermaNo ratings yet

- Data JioDocument18 pagesData JioAnkit VermaNo ratings yet

- Project Evaluation Techniques Non-Discounted Cash FlowDocument3 pagesProject Evaluation Techniques Non-Discounted Cash FlowYameteKudasaiNo ratings yet

- Study Guide For Brigham Houston Fundamentas of Financial Management-13th Edition - 2012Document1 pageStudy Guide For Brigham Houston Fundamentas of Financial Management-13th Edition - 2012Rajib Dahal50% (2)

- Financial Model For Check SMEDocument6 pagesFinancial Model For Check SMEDhanunjai IitbNo ratings yet

- Financing Daycare CenterDocument3 pagesFinancing Daycare CenterAngel CastilloNo ratings yet

- Magsino Hannah Florence Activity 5 Discounted Cash FlowsDocument36 pagesMagsino Hannah Florence Activity 5 Discounted Cash FlowsKathyrine Claire Edrolin100% (1)

- Account Titles Unadjusted Trial Adjustments Balance Dr. Cr. DRDocument6 pagesAccount Titles Unadjusted Trial Adjustments Balance Dr. Cr. DRJohn Gabriel BondoyNo ratings yet

- Prelim - Case Study (Answer Sheet)Document5 pagesPrelim - Case Study (Answer Sheet)Rona P. AguirreNo ratings yet

- Logical DepreciationDocument2 pagesLogical DepreciationAnto RaharNo ratings yet

- Acquisition Cash FlowDocument3 pagesAcquisition Cash Flowkaeya alberichNo ratings yet

- DepreciationDocument5 pagesDepreciationsofyan samNo ratings yet

- Project Implementation Cost BreakdownDocument9 pagesProject Implementation Cost BreakdownAmzar SaniNo ratings yet

- Auditing Problem 2 To 6Document5 pagesAuditing Problem 2 To 6April Rose CercadoNo ratings yet

- Chapter 23Document8 pagesChapter 23Matahari PagiNo ratings yet

- MAC Mile CyclesDocument10 pagesMAC Mile CyclesEhtisham AkhtarNo ratings yet

- Operation Expenses and Sales Analysis for Stationery Business Over 5 YearsDocument31 pagesOperation Expenses and Sales Analysis for Stationery Business Over 5 YearsJanine PadillaNo ratings yet

- Accounts - FIFO and WA For FinalDocument11 pagesAccounts - FIFO and WA For FinalRohan SinghNo ratings yet

- Negocio de Palomitas de JasonDocument11 pagesNegocio de Palomitas de JasonElizabeth Sanabria AriasNo ratings yet

- AFAR2 CH. 3 - Problem Quiz 1Document19 pagesAFAR2 CH. 3 - Problem Quiz 1Von Andrei MedinaNo ratings yet

- 5110WA7 FinancialsDocument1 page5110WA7 FinancialsAhmed EzzNo ratings yet

- Financial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions ManualDocument36 pagesFinancial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions Manualandrewnealobrayfksqe100% (23)

- AaasDocument4 pagesAaasMurgi kun :3No ratings yet

- Total Receipts 100,400 132,400 153,000Document3 pagesTotal Receipts 100,400 132,400 153,000Marissa Jem ClaveriaNo ratings yet

- WACC & PaybackDocument9 pagesWACC & PaybackBelle Dela CruzNo ratings yet

- Lab3 Group10 TolentinoDocument28 pagesLab3 Group10 Tolentinoodrhey hernandezNo ratings yet

- Paper-2 (PRMO) 2-6-2019 - With Ans PDFDocument5 pagesPaper-2 (PRMO) 2-6-2019 - With Ans PDFAnonymous FckLmgFy100% (1)

- CBSE Class 2 Counters MCQsDocument20 pagesCBSE Class 2 Counters MCQsutpal sahaNo ratings yet

- 23-24 MMW Module 2d - Binary OperationsDocument7 pages23-24 MMW Module 2d - Binary Operations2023-201655No ratings yet

- OceanofPDF.com Essential Prealgebra Skills Practice Workbook - Chris McMullenDocument350 pagesOceanofPDF.com Essential Prealgebra Skills Practice Workbook - Chris McMullen6yjf8gmxhsNo ratings yet

- Long TestDocument2 pagesLong TestLevi Corral100% (1)

- The number you get when you add 1 to 999,999 is 1,000,000. 1,000,000 is one millionDocument80 pagesThe number you get when you add 1 to 999,999 is 1,000,000. 1,000,000 is one millionTa Bin KaNo ratings yet

- Decimals ExamplesDocument2 pagesDecimals ExamplesKazel GutierrezNo ratings yet

- Rational Expressions and Equations GuideDocument12 pagesRational Expressions and Equations GuideIRIS JEAN BRIAGASNo ratings yet

- Kontrak Latihan Murid Math Tahun 3Document1 pageKontrak Latihan Murid Math Tahun 3Sali KANo ratings yet

- Chpater 4 Complex NumbersDocument19 pagesChpater 4 Complex NumbersChandramouli GuptaNo ratings yet

- Fermat's Theorem - PRMODocument4 pagesFermat's Theorem - PRMOapocalypticNo ratings yet

- Weighted Partitioning For Fast MultiplierlessDocument5 pagesWeighted Partitioning For Fast MultiplierlessDr. Ruqaiya KhanamNo ratings yet

- Leyes de Exponentes:: B B B ZDocument5 pagesLeyes de Exponentes:: B B B ZRonald Vizcardo GrupoAepuNo ratings yet

- Computer Arithmetic: ALU, Integer Representation, Floating PointDocument37 pagesComputer Arithmetic: ALU, Integer Representation, Floating PointreinaldoopusNo ratings yet

- Right shift (x >> n): fill in 0 or repeat MSB (arithmeticDocument6 pagesRight shift (x >> n): fill in 0 or repeat MSB (arithmeticJeremy JohnNo ratings yet

- 0123 Final DLP MathDocument6 pages0123 Final DLP MathAna Alicia Medallada ArimadoNo ratings yet

- MATH UNIT 2 GRADE 3 LESSON 29 Sinugbuanong BinisayaDocument74 pagesMATH UNIT 2 GRADE 3 LESSON 29 Sinugbuanong BinisayaLucrecia Tanoy100% (6)

- Edexcel AS and A Level Further Mathematics Further Pure Mathematics 2Document273 pagesEdexcel AS and A Level Further Mathematics Further Pure Mathematics 2mgmfcf7m6yNo ratings yet

- Math G5-Q1-WK4Document25 pagesMath G5-Q1-WK4MuhammadIshahaqBinBenjaminNo ratings yet

- 16 Preparation For AlgebraDocument3 pages16 Preparation For AlgebraJINESH KOTHARINo ratings yet

- 3 Introduction To Arithmetic SequenceDocument1 page3 Introduction To Arithmetic SequenceAshly DeniseNo ratings yet

- Form 5 ModuleDocument7 pagesForm 5 ModuleKaiswan GanNo ratings yet

- M1 Maths Common Fraction OperationsDocument6 pagesM1 Maths Common Fraction OperationsLala JafarovaNo ratings yet

- Our Lady of Grace Academy Weekly Learning Plan for Grade 10 MathematicsDocument16 pagesOur Lady of Grace Academy Weekly Learning Plan for Grade 10 MathematicsJean DelaNo ratings yet

- IGCSE MATHEMATICS Algebraic FractionsindicesDocument10 pagesIGCSE MATHEMATICS Algebraic FractionsindicesshahulNo ratings yet

- Integers Multiplication - 1212 - 1212!0!002Document2 pagesIntegers Multiplication - 1212 - 1212!0!002Abdul Basit KaliaNo ratings yet

- First Form Mathematics Module 6Document34 pagesFirst Form Mathematics Module 6Chet AckNo ratings yet

- Using Basic Formulas in ExcelDocument14 pagesUsing Basic Formulas in ExcelJesiah PascualNo ratings yet

- LESSON: "Four Operations."Document5 pagesLESSON: "Four Operations."Mai Trà MyNo ratings yet