Professional Documents

Culture Documents

Suggested Roadmap For Transforming Africa Into A Global Competitor Q & A

Uploaded by

nntambiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Suggested Roadmap For Transforming Africa Into A Global Competitor Q & A

Uploaded by

nntambiCopyright:

Available Formats

I salute you dear listeners and viewers.

It gives me great pleasure, when I am asked,

or get an opportunity to talk about Africa. Today I am going to briefly talk about:

Suggested roadmap for transforming Africa into a global competitor

I am Fellow Nathan, from Fenlina Management consultants, sharing my views on

Governance and Entrepreneurship initiatives that will make Africa sustainable and

globally competitive.

If you enjoy this video, kindly support our channel by subscribing, giving the

video a like, and giving your comments. You mean a lot to us and we

appreciate your time, participation and contribution.

Q1. We have heard a lot about Africa’s problems and achievements as well.

Africa wants to be globally competitive. What are some of the issues that in

your opinion would be quick-wins in this regard?

A1. internal

► EMPOWER THE AU:

☼ Give it decision making powers on behalf of Africa, bargaining power

on the international platform, e.g how to deal with the war in Ukraine,

Palestine. Sudan.

☼ Authority over matters that affect the continent as a whole,

☼ Oversee and liaise with the various blocks e.g. EAF, SADC, IGAD,

ECOWAS, in governing the continent especially honouring of

commitments.

► CREATE A FAMILY (CONTINENTAL ARMY, REMOVE BOARDERS, ONE

CURRENCY, ONE LANGUAGE, ONE PASSPORT, ETC.)

Q2. What do you envisage as the approach that Africa must use to address

these matters?

☼ Continental army as part of the solution: preventing foreign

aggression, invasion, assassinations, overthrow of governments,

☼ Remove boarders: smooth and faster flow of people and goods,

interaction of people, address crime syndicates and security issues in a

united manner. E.g. strengthening the already existing bodies, like

Interpol.

☼ One currency: minimise currency & exchange rate inconveniences.

☼ One language: Teaching Swahili in schools. Making it compulsory

at primary school level. It will make communication easy, bringing

Africans culturally closer.

► RESOLVE / PREVENT CONFLICTS

☼ Take the gun out of Internal conflict resolution completely,

☼ Use other peaceful means as a last resort to enforce compliance,

► INSTALL / PROMOTE GOOD GOVERNANCE

☼ Create credible governance structures

☼ Draft a constitution for Africa

☼ Ensure compliance to the constitution

► ACCELERATE ECONOMIC DEVELOPMENT

☼ Foreign Direct Investments,

☼ Implement and monitor the SDG Agenda 2063

☼ Implement and monitor the Agenda 2063, “The Africa we want”,

☼ Economic empowerment and sensitisation,

☼ Etc.

A2. External

☼ Get permanent seats in the G20

☼ Bargain for revisiting of the Financial Architecture to address the

borrowing and Debt burden for sovereign debt.

● Predatory approach to lending: High interest rated to African

countries because of perceiving Africa as highly risky borrowers,

Asset forfeiture, biased risk analysis,

● African public debts are mainly held by non-African lenders and in

foreign currencies (See article below):

● Private sector involvement in lending: (See article below)

☼ To promote peace in the whole world, through dialogue, and not

through the barrel of the gun.

☼ To support the countries that historically supported, and are still

supporting Africa in fighting against apartheid, colonisation and

recolonisation.

Q. What do all these mean to the common man?

A. All these talk to the SDG Agenda 2030. Having the ability of the masses to

have peace, justice, security, which are good catalysts for entrepreneurship

(creating employment, establishing projects and program for economic

benefits, protecting our ecosystem and tapping into continent-wide

opportunities, big and small.

Kindly support our channel by subscribing, giving the video a like, and giving

your comments. You mean a lot to us and we appreciate your time,

participation and contribution.

Until next time, God bless you

Part 2

Q2. African public debts are mainly held by non-African lenders and in foreign

currencies. What does this mean and what are the financial implications?

African countries' public debts are uniquely burdensome, in part because ((Mo

Ibrahim report 24 Aug 2023):

☼ They are mainly owed to international rather than domestic lenders,

making debt harder to refinance or restructure. Of the 10 African

countries with data on creditor residency, seven owe more than half of

public debt to overseas creditors. By contrast, over 70% of public debt

in Canada, China, the UK and US is owed to domestic creditors.

☼ External lenders prefer to lend to developing countries in their own

currency or international ‘hard currencies’ (e.g. US dollar or Euro).

Foreign currency debt carries an exchange rate risk. Industrialised

countries usually borrow in their own currencies e.g. In the UK (£),

China (CN¥), Canada (C$), and the US (US$) over 98% of central

government debt is denominated in the local currency. By contrast,

over 70% of Africa’s total public external debt is US dollar

denominated.

Q3. Under private sector involvement, can you please explain more about what

you really mean?

Private sector involvement in lending African Countries

A4.Credit rating adjustments (Mo Ibrahim report 24 Aug 2023)

Africa: currency of public external debt (2021)

Most debt is owed to private sector creditors, who charge African

countries higher interest rates

☼ In 2021, more than one third (40.4%) of Africa’s public external debt was

owed to the private sector. Post-2008 private sector lenders made more credit

available to Africa in order to obtain higher returns than the low rates on offer

in the Global North following the financial crisis.

☼ Private sector lenders, primarily motivated by financial considerations, lend at

market rates considerably more expensive than rates offered by official

creditors. Many African governments for their part were keen on private credit,

motivated by the desire to reduce dependence on aid or policy-conditioned

loans from official creditors.

Other challenges

☼ The amount African countries must pay to borrow from the private sector is

largely determined by Western rating agencies. The ‘big 3’ rating agencies -

Fitch, Moody's and Standard & Poor's (S&P) - are all headquartered in

London or New York and only have two offices in Africa between them, both

in Johannesburg. They have faced accusations of overstating the risk of

lending to African countries.

Solutions:

☼ The African Union (AU) is moving forward through the African Peer Review

Mechanism (APRM) with a plan to establish an African Credit Rating

Agency as an independent entity to provide alternative and complementary

rating opinions for the continent.

Q. What does all this mean to the common man?

A.

Kindly support our channel by subscribing, giving the video a like, and giving

your comments. You mean a lot to us and we appreciate your time,

participation and contribution.

Until next time, God bless you

You might also like

- 12-International Institutions and Role in International BusinessDocument13 pages12-International Institutions and Role in International Businessfrediz7971% (7)

- The Arguments Against Foreign AidDocument13 pagesThe Arguments Against Foreign AidOliver KadyataNo ratings yet

- Diaspora Financing For Development and Peacebuilding Lessons From Sub-Saharan AfricaDocument8 pagesDiaspora Financing For Development and Peacebuilding Lessons From Sub-Saharan AfricaThe Wilson CenterNo ratings yet

- Financial Inclusion in AfricaDocument148 pagesFinancial Inclusion in AfricakimringineNo ratings yet

- African Debt RestructuringDocument24 pagesAfrican Debt RestructuringMateus RabeloNo ratings yet

- Iit Maths - Trigonometry, Functions, Graphs, Differentiation EtcDocument20 pagesIit Maths - Trigonometry, Functions, Graphs, Differentiation EtcParas Thakur67% (3)

- Project Proposal BADAC 2022Document2 pagesProject Proposal BADAC 2022San Vicente West Calapan CityNo ratings yet

- Foreign Aid Debt Relief and Africa S Development Problems and ProspectsDocument17 pagesForeign Aid Debt Relief and Africa S Development Problems and Prospectsapi-328636801No ratings yet

- Foreign Aid Debt Relief and Africa S Development Problems and ProspectsDocument17 pagesForeign Aid Debt Relief and Africa S Development Problems and Prospectsgoberezi71No ratings yet

- Foreign Aid: Professor Carolino A. Gamlanga JR., MbaDocument28 pagesForeign Aid: Professor Carolino A. Gamlanga JR., MbaJose PanganibanNo ratings yet

- 4 Were Debttrap 2018Document14 pages4 Were Debttrap 2018luanadiasfrancoNo ratings yet

- ADB ReportDocument3 pagesADB ReportKawtar AallamNo ratings yet

- 04 OlanDocument30 pages04 OlanRose SammyNo ratings yet

- IdaDocument23 pagesIdaarun_choudhary_9No ratings yet

- Will money alone solve Africa’s development problemsDocument14 pagesWill money alone solve Africa’s development problemsrNo ratings yet

- Welcome To AfricaDocument16 pagesWelcome To AfricanametraNo ratings yet

- Module 3 PDFDocument21 pagesModule 3 PDFRAJASAHEB DUTTANo ratings yet

- Aldcafrica2020 en PDFDocument248 pagesAldcafrica2020 en PDFrukwavuNo ratings yet

- International Development AssociationDocument11 pagesInternational Development AssociationSurbhiNo ratings yet

- African Perspectives On Aid: Foreign Assistance Will Not Pull Africa Out of Poverty, Cato Economic Development Bulletin No. 2Document4 pagesAfrican Perspectives On Aid: Foreign Assistance Will Not Pull Africa Out of Poverty, Cato Economic Development Bulletin No. 2Cato InstituteNo ratings yet

- Nass Revision-1Document8 pagesNass Revision-1masamvumichael05No ratings yet

- Is Foreign Debt A Problem For Bangladesh PDFDocument13 pagesIs Foreign Debt A Problem For Bangladesh PDFAshiqur RahmanNo ratings yet

- Development 6Document32 pagesDevelopment 6Awetahegn HagosNo ratings yet

- The World BankDocument7 pagesThe World BankambaNo ratings yet

- TH THDocument7 pagesTH THapi-290145140No ratings yet

- 4.6 The Role of Foreign Aid and Multilateral Development AssistanceDocument14 pages4.6 The Role of Foreign Aid and Multilateral Development AssistancechristinaNo ratings yet

- Foreign AidDocument28 pagesForeign AidCarol CordilhaNo ratings yet

- Democracy and Economic Reforms in the Middle East and AfricaDocument13 pagesDemocracy and Economic Reforms in the Middle East and AfricaEarvin Gared Hernandez BermudoNo ratings yet

- Chapter 2: Global EconomyDocument12 pagesChapter 2: Global EconomyAlphine DalgoNo ratings yet

- Report of The High Level Panel On Illicit Financial Flows From AfricaDocument126 pagesReport of The High Level Panel On Illicit Financial Flows From AfricaCityPressNo ratings yet

- Position Paper - Delegate of CambodiaDocument3 pagesPosition Paper - Delegate of Cambodiasehaj mNo ratings yet

- Capital Budgeting and Economic Development in The Third World: The Case of NigeriaDocument26 pagesCapital Budgeting and Economic Development in The Third World: The Case of NigeriaAdeyeye davidNo ratings yet

- Practice Note - Introduction To Practitioners: Using Aid Effectiveness To Improve Domestic AccountabilityDocument26 pagesPractice Note - Introduction To Practitioners: Using Aid Effectiveness To Improve Domestic AccountabilityBOYAKAANo ratings yet

- International Development AssociationDocument8 pagesInternational Development AssociationvmktptNo ratings yet

- MacleanDocument5 pagesMacleanCory StephensonNo ratings yet

- Finance in Africa: Uncertain times, resilient banks: African finance at a crossroadsFrom EverandFinance in Africa: Uncertain times, resilient banks: African finance at a crossroadsNo ratings yet

- Dambisa Moyo's book draws attention to foreign aid debate in AfricaDocument11 pagesDambisa Moyo's book draws attention to foreign aid debate in AfricadadplatinumNo ratings yet

- Chapter 18-Foreign Sources of FinanceDocument23 pagesChapter 18-Foreign Sources of FinanceAtashi ChakrabortyNo ratings yet

- MGNM578 ImfDocument36 pagesMGNM578 ImfDevanshi Rajpal SxmqwuljSxNo ratings yet

- TpodeDocument17 pagesTpoderllandres01No ratings yet

- LECTURE 2 Dev FinanceDocument5 pagesLECTURE 2 Dev FinanceMark KinotiNo ratings yet

- International Monetary Fund: Introduction by Faiza AzizDocument34 pagesInternational Monetary Fund: Introduction by Faiza AzizTaha Khan LodhiNo ratings yet

- Foreign AidDocument8 pagesForeign AidChristabel DedeNo ratings yet

- African Debt Isn't The Problem - The Global Financial System Is - African Business MagazineDocument5 pagesAfrican Debt Isn't The Problem - The Global Financial System Is - African Business MagazineYourick Evans Pouga MbockNo ratings yet

- Africa's Future and the World Bank's RoleDocument18 pagesAfrica's Future and the World Bank's RoleGoutham Kumar ReddyNo ratings yet

- World Bank and ImfDocument10 pagesWorld Bank and ImfMriganka DasNo ratings yet

- Banking On ForgivenessDocument3 pagesBanking On ForgivenessFirma ChicaOlshopNo ratings yet

- World Bank, IMF, and It's ImpactsDocument24 pagesWorld Bank, IMF, and It's ImpactsAli JumaniNo ratings yet

- Financing Africa'S Development: Can Aid - Dependence Be Avoided?Document15 pagesFinancing Africa'S Development: Can Aid - Dependence Be Avoided?Poqo Aviwe Bulalabathakathi TyumreNo ratings yet

- The NehaDocument11 pagesThe Neha777priyankaNo ratings yet

- Bilateral AidDocument10 pagesBilateral Aidbengaly.mohamed455No ratings yet

- Chapter 2: The Global Economy: at The End of The Lesson The Students Will Be Able ToDocument12 pagesChapter 2: The Global Economy: at The End of The Lesson The Students Will Be Able ToClaire ManzanoNo ratings yet

- The Plight of The Poor: The US Must Increase Development AidDocument6 pagesThe Plight of The Poor: The US Must Increase Development AidMelissa NewNo ratings yet

- Foreign Aid Debt Relief and Africa S Development Problems and ProspectsDocument17 pagesForeign Aid Debt Relief and Africa S Development Problems and Prospectsdilia wanelaNo ratings yet

- Kulvir SinghDocument46 pagesKulvir SinghlalitsoniaNo ratings yet

- GE9 - Mod1Les3Document4 pagesGE9 - Mod1Les3Loveszkie KittyNo ratings yet

- International Development Law and The World Bank GroupDocument3 pagesInternational Development Law and The World Bank GroupRaza AliNo ratings yet

- Building Inclusive Financial Sectors The Blue BookDocument195 pagesBuilding Inclusive Financial Sectors The Blue BookHoang Thi ChuongNo ratings yet

- Foreign Aid Explained: Types, Motives, and EvaluationDocument11 pagesForeign Aid Explained: Types, Motives, and Evaluationnitha telkar nitaNo ratings yet

- Bussines and International Relations Topical IssuesDocument11 pagesBussines and International Relations Topical Issuesnoerfaizi faiziNo ratings yet

- M TaruffoDocument20 pagesM Taruffoinefable007No ratings yet

- Hegemony: A Conceptual and Theoretical Analysis: Download This Expert Comment in PDFDocument12 pagesHegemony: A Conceptual and Theoretical Analysis: Download This Expert Comment in PDFГлеб ПрыймакNo ratings yet

- Eastern District of PennsylvaniaDocument6 pagesEastern District of PennsylvaniaScribd Government DocsNo ratings yet

- Political ThoughtDocument47 pagesPolitical Thoughtdebraktastan2No ratings yet

- Gov94CM: International Law and International Organizations: Fall 2018, Tuesdays 3-5 P.M., CGIS Knafel K450Document10 pagesGov94CM: International Law and International Organizations: Fall 2018, Tuesdays 3-5 P.M., CGIS Knafel K450Alexandra Jima GonzálezNo ratings yet

- Violence Against Women in Naga CityDocument12 pagesViolence Against Women in Naga CityEco IsaiahNo ratings yet

- (16-009292) Ulio A. Mocega & Associates, Inc.Document1 page(16-009292) Ulio A. Mocega & Associates, Inc.larry-612445No ratings yet

- Between Exclusion and InclusioDocument328 pagesBetween Exclusion and InclusioMirna BrođanacNo ratings yet

- Lecture Special Parental AuthorityDocument3 pagesLecture Special Parental AuthorityLiza MelgarNo ratings yet

- Toyota Auris Hybrid 2015 2017 Electrical Wiring DiagramDocument7 pagesToyota Auris Hybrid 2015 2017 Electrical Wiring Diagramjacquelinemartin271095pwz100% (62)

- PHirst Documentation 101Document48 pagesPHirst Documentation 101Paulo OrtegaNo ratings yet

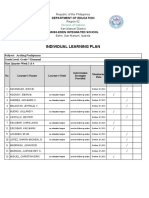

- ILP-week 3 & 4Document13 pagesILP-week 3 & 4Jamielor GN BalmedianoNo ratings yet

- EXPORT SALES AGREEMENTDocument7 pagesEXPORT SALES AGREEMENTRajvi ChatwaniNo ratings yet

- INTELLECTUAL PROPERTYaDocument16 pagesINTELLECTUAL PROPERTYarohitnanwaniNo ratings yet

- 45 Hernandez vs. PascualDocument2 pages45 Hernandez vs. PascualGoodyNo ratings yet

- Law Between Normativity and Pragmatism: The 2 Annual TAU Workshop For Junior ScholarsDocument1 pageLaw Between Normativity and Pragmatism: The 2 Annual TAU Workshop For Junior ScholarsandrewjjonesNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- Ipil, Zamboanga - Sibugay Voters List - PDFDocument2 pagesIpil, Zamboanga - Sibugay Voters List - PDFCelso MaalatNo ratings yet

- Extra Grammar Exercises (Unit 8, Page 89) : Top Notch 3, Third EditionDocument2 pagesExtra Grammar Exercises (Unit 8, Page 89) : Top Notch 3, Third EditionVirginia PachariNo ratings yet

- Guest FormDocument1 pageGuest FormCoco MondejarNo ratings yet

- Reconnaissance Survey For Proposed Jammu Srinagar Natural Gas PipelineDocument3 pagesReconnaissance Survey For Proposed Jammu Srinagar Natural Gas PipelineS R SINGHNo ratings yet

- Ass. CAC Chapter 9Document3 pagesAss. CAC Chapter 9Jea Ann CariñozaNo ratings yet

- Instrument of Accession Zafar KamiliDocument8 pagesInstrument of Accession Zafar Kamilimdbr2666No ratings yet

- Personal Meaning MappingDocument6 pagesPersonal Meaning MappingPriscila WilkerNo ratings yet

- Radio Philippines Network vs. YapDocument9 pagesRadio Philippines Network vs. YapRomy Ian LimNo ratings yet

- Financial Model For BrandsDocument60 pagesFinancial Model For BrandsAnjali SrivastavaNo ratings yet

- Aimcat 2203Document28 pagesAimcat 2203Anshul YadavNo ratings yet

- Jan 2021 1Document265 pagesJan 2021 1Dilip BigbossNo ratings yet