Professional Documents

Culture Documents

Schedule of Rates and Charges

Schedule of Rates and Charges

Uploaded by

Subham UpadhayayOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Schedule of Rates and Charges

Schedule of Rates and Charges

Uploaded by

Subham UpadhayayCopyright:

Available Formats

Schedule of Rates and Charges

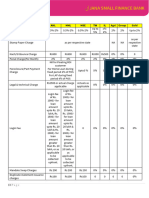

Rate of Interest

Product ROI

Hypothecation Loan (HL) Up to 32% per annum

Quasi Mortgage Loan (QML) Up to 27% per annum

Mortgage Loan (ML) Up to 26% per annum

Effective rate on individual loans would vary based on product, loan amount and facilities like emergency loan

reserve. Applicable effective rate on individual loans is communicated through sanction letter.

Charges

Parameter HL QML ML

Application Fees ₹500 + applicable govt. taxes

Processing Fee (PF) Up to 2.5% of Loan amount + applicable govt. taxes

Franking Charges As per state act

Loan Amount up

Mortgage - Up to ₹ 1,250*

to ₹ 2.0 lacs Up to ₹ 2,700 +

legal & technical NA

Loan Amount Up to ₹ 2,700 + applicable govt. taxes

valuation

above ₹ 2.0 lacs applicable govt. taxes

PDC/ACH bounce charges ₹500 (Inclusive of taxes)

Nil for first 7 Days

Late Payment Charges

Beyond 7 Days: ₹200 (Inclusive of taxes) i.e., on 15th of due month

Pre-closure Charges 7% of OSP 7% of OSP 5% of OSP

* Applicable only to Andhra Pradesh, Karnataka, Tamil Nadu and Telangana.

You might also like

- Axis Offer Latter For SalariedDocument4 pagesAxis Offer Latter For Salariedyoursmanish8312No ratings yet

- Schedule of Charges Version 21.0.0 Dated 1st June 19Document1 pageSchedule of Charges Version 21.0.0 Dated 1st June 19RajivNo ratings yet

- Schedule of Charges - Master - 27 10 23 1Document10 pagesSchedule of Charges - Master - 27 10 23 1shuvam0016No ratings yet

- RI AnnexureDocument6 pagesRI Annexurekaizen.hameshaNo ratings yet

- Schedule-Of-charges Master 27-10-23Document142 pagesSchedule-Of-charges Master 27-10-23xtreameairtelNo ratings yet

- Aadhar Tariff Schedule092021-2 PDFDocument2 pagesAadhar Tariff Schedule092021-2 PDFSamNo ratings yet

- Advances Related Service Charges W.E.F. 01.04.2019 A PDFDocument11 pagesAdvances Related Service Charges W.E.F. 01.04.2019 A PDFSudhakar BataNo ratings yet

- National Housing Finance and Investments Limited: SL No Type of Service/Product Nature of Charges Rate/ ChargesDocument1 pageNational Housing Finance and Investments Limited: SL No Type of Service/Product Nature of Charges Rate/ ChargesrajibazamNo ratings yet

- Txrus 2019 Dec QDocument15 pagesTxrus 2019 Dec QKAH MENG KAMNo ratings yet

- ICICI Housing LoansDocument3 pagesICICI Housing LoansAdv Sheetal SaylekarNo ratings yet

- Schedule of Charges - Master - 16.3.23Document6 pagesSchedule of Charges - Master - 16.3.23mk9778225No ratings yet

- Msme Loan - Upto 2lakhs: NF-546 NF-998 NF-588 NF-855 NF-803 NF-482 NF-373 NF-368Document4 pagesMsme Loan - Upto 2lakhs: NF-546 NF-998 NF-588 NF-855 NF-803 NF-482 NF-373 NF-368Santosh KumarNo ratings yet

- In Schedule of Charges June 17 GSTDocument1 pageIn Schedule of Charges June 17 GSTmanihar veeramalluNo ratings yet

- Personal Loan: Why Avail A Personal Loan From HDFC Bank?Document6 pagesPersonal Loan: Why Avail A Personal Loan From HDFC Bank?Ramana GNo ratings yet

- Applicable Schedule of Charges and Penal Interest For Farmer Funding (B2C) Businesses of Bharat Enterprises (W.e.f 1st April 2023)Document4 pagesApplicable Schedule of Charges and Penal Interest For Farmer Funding (B2C) Businesses of Bharat Enterprises (W.e.f 1st April 2023)Raj kumarNo ratings yet

- Home Loan: TCHFL HL MITC Version 17Document4 pagesHome Loan: TCHFL HL MITC Version 17Ali Khan AKNo ratings yet

- Most Important Terms and Conditions (Mitc) Loan Reference No.Document6 pagesMost Important Terms and Conditions (Mitc) Loan Reference No.prashant gargNo ratings yet

- Electric BillDocument2 pagesElectric BillJagannath PanigrahiNo ratings yet

- MITC - Scapia Credit Card - 15-June-2023Document5 pagesMITC - Scapia Credit Card - 15-June-2023BhushanNo ratings yet

- Loanagainstproperty PDFDocument4 pagesLoanagainstproperty PDFsameer ahmadNo ratings yet

- LoanDocument1 pageLoanPrateek SoniNo ratings yet

- Schedule of Charges and Interest Rates PDFDocument5 pagesSchedule of Charges and Interest Rates PDFAjju PodilaNo ratings yet

- EducationLoan Conv PDS ENGDocument4 pagesEducationLoan Conv PDS ENGWan NurdyanaNo ratings yet

- Khushi Home LoansDocument2 pagesKhushi Home LoansGovind JhaNo ratings yet

- Service Charges Final - 03.06.2017for Circular IssuingDocument39 pagesService Charges Final - 03.06.2017for Circular IssuingshivaNo ratings yet

- User Agreement SummaryDocument9 pagesUser Agreement Summarysai yadavNo ratings yet

- Auxilo EIL Schedule of ChargesDocument2 pagesAuxilo EIL Schedule of ChargesArun KumarNo ratings yet

- RetailServiceCharges Adv EnglishDocument4 pagesRetailServiceCharges Adv EnglishYogesh PangareNo ratings yet

- Schedule of Charges Lending Products, SME BankingDocument4 pagesSchedule of Charges Lending Products, SME BankingAbu Syeed Md. Aurangzeb Al MasumNo ratings yet

- Fees and Charges CompensiveDocument1 pageFees and Charges CompensiveGSAINTSSANo ratings yet

- 03.01.2024 Consolidated Ser. ChargesDocument63 pages03.01.2024 Consolidated Ser. ChargesNadeem KhanNo ratings yet

- Updated Key Fact SatementDocument4 pagesUpdated Key Fact SatementYashodhan RajwadeNo ratings yet

- Educative Series LAPDocument2 pagesEducative Series LAPRohith RaoNo ratings yet

- Mitc For Amazon Pay Credit CardDocument7 pagesMitc For Amazon Pay Credit CardBlain Santhosh FernandesNo ratings yet

- PDS Equity Home Financing IDocument10 pagesPDS Equity Home Financing IsyahnooraimanNo ratings yet

- IOB9540Foot Service Charges 01.07.2017 PDFDocument39 pagesIOB9540Foot Service Charges 01.07.2017 PDFHarishPratabhccNo ratings yet

- 8 Fees and Charges Revised On 04 08 2016Document2 pages8 Fees and Charges Revised On 04 08 2016M ADITYA REDDYNo ratings yet

- Kfs 3000Document1 pageKfs 3000PAVAN GHOLAPNo ratings yet

- Kfs LTFDocument1 pageKfs LTFsamarth guptaNo ratings yet

- Schedule of Charges: Upfront Charges (Charges Before/During Disbursement)Document2 pagesSchedule of Charges: Upfront Charges (Charges Before/During Disbursement)BharatSharmaNo ratings yet

- Investment Proof Submission Form23 24Document6 pagesInvestment Proof Submission Form23 24Bindu madhaviNo ratings yet

- Navi Finserv Private Limited - HL - Fee and Schedule - 20202312 - 1000Document2 pagesNavi Finserv Private Limited - HL - Fee and Schedule - 20202312 - 1000sachin BhartiNo ratings yet

- Cost PDFDocument2 pagesCost PDFsiddharthchoksiNo ratings yet

- Cost PDFDocument2 pagesCost PDFbusuuuNo ratings yet

- Hi-STREET PL & PPDocument4 pagesHi-STREET PL & PPGaurav SinghNo ratings yet

- W WWWWWWWW WWWWWWW W WWWWWWW WWW WWWWWWWW W ! W"W# WW$"%WWWWWWW W & W ' W WW" "W (" W W") %W W (W WW) W W + WW W$ W$, W W - .WW WWW W/WWWWWDocument4 pagesW WWWWWWWW WWWWWWW W WWWWWWW WWW WWWWWWWW W ! W"W# WW$"%WWWWWWW W & W ' W WW" "W (" W W") %W W (W WW) W W + WW W$ W$, W W - .WW WWW W/WWWWWRAJPAL77No ratings yet

- Mitc For Amazon Pay Credit CardDocument7 pagesMitc For Amazon Pay Credit Cardsomeonestupid19690% (1)

- Individual Car Loan Agreement SampleDocument32 pagesIndividual Car Loan Agreement Sampleey019.aaNo ratings yet

- Application FormDocument12 pagesApplication FormAarti ThdfcNo ratings yet

- HL Onepager Revised 05042024Document2 pagesHL Onepager Revised 05042024abhista varmaNo ratings yet

- SOC AssetsDocument2 pagesSOC AssetsptsmithrafoundationNo ratings yet

- Housing Loan DetailsDocument9 pagesHousing Loan DetailsPandurangbaligaNo ratings yet

- Interest Concession of Available On The Above Card Rates Upto 31.10.2011 For All Types of New Home LoansDocument19 pagesInterest Concession of Available On The Above Card Rates Upto 31.10.2011 For All Types of New Home LoansapsagarNo ratings yet

- Business Transport LoanDocument8 pagesBusiness Transport LoanJan RootsNo ratings yet

- Campaign Processing Fees WaiverDocument1 pageCampaign Processing Fees Waiverjayeshahmhlc01406No ratings yet

- Schedule of Charges - Protium ProtiumDocument1 pageSchedule of Charges - Protium Protiummufcrufc12345No ratings yet

- Premium Banking: Schedule of ChargesDocument6 pagesPremium Banking: Schedule of Chargestanvir kabirNo ratings yet

- Fees and Charges W.E.F. 17th Mar, 2021Document3 pagesFees and Charges W.E.F. 17th Mar, 2021MANOJ PANSENo ratings yet

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeFrom EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeNo ratings yet

- A Haven on Earth: Singapore Economy Without Duties and TaxesFrom EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNo ratings yet