Professional Documents

Culture Documents

Exxon Mobil PDF

Uploaded by

ivan.maldonadoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exxon Mobil PDF

Uploaded by

ivan.maldonadoCopyright:

Available Formats

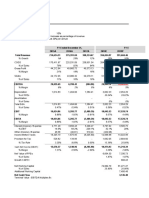

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

Destacados aj

Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual/Ú12M Estimación:2022 A Estimación:2023 A

Plazo termina 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-6-30 2022-12-31 2023-12-31

Capitalización de 323,960.20 374,398.48 354,549.96 288,921.03 295,448.52 174,484.26 259,384.41 451,917.64

mercado

- Efectivo y 3,705.00 3,657.00 3,177.00 3,042.00 3,089.00 4,364.00 6,802.00 18,861.00

equivalentes

+ Preferente y otros 5,999.00 6,505.00 6,812.00 6,734.00 7,288.00 6,980.00 7,106.00 7,192.00

+ Deuda total 38,687.00 42,762.00 42,336.00 37,796.00 52,628.00 72,806.00 52,898.00 46,883.00

Valor de empresa 364,941.20 420,008.48 400,520.96 330,409.03 352,275.52 249,906.26 312,586.41 487,131.64

Ingresos, aj 236,810.00 200,628.00 237,162.00 279,332.00 255,583.00 178,574.00 276,692.00 352,196.00 409,777.88 389,980.94

% Crec, YoY -35.08 -15.28 18.21 17.78 -8.50 -30.13 54.95 64.07 48.10 -4.83

Beneficio bruto, aj 25,907.00 13,202.00 26,258.00 35,070.00 25,433.00 -17,995.00 34,647.00 54,292.00 182,908.45 168,475.67

% Margen 10.94 6.58 11.07 12.55 9.95 -10.08 12.52 15.42 44.64 43.20

EBITDA, aj 30,931.00 26,668.62 33,488.00 40,073.00 27,336.42 42,714.06 45,031.37 70,350.76 102,211.44 88,187.10

% Margen 13.06 13.29 14.12 14.35 10.70 23.92 16.27 19.97 24.94 22.61

Beneficio neto, aj 16,410.00 10,066.00 15,289.00 21,038.00 10,685.00 -2,054.00 22,763.00 41,684.00 53,985.05 42,685.09

% Margen 6.93 5.02 6.45 7.53 4.18 -1.15 8.23 11.84 13.17 10.95

BPA, aj 3.91 2.41 3.59 4.93 2.50 -0.48 5.32 9.77 12.93 10.58

% Crec, YoY -48.07 -38.38 49.02 37.18 -49.21 557.92 142.83 -18.19

Efectivo de 30,344.00 22,082.00 30,066.00 36,014.00 29,716.00 14,668.00 48,129.00 63,966.00

operaciones

Gastos de capital -26,490.00 -16,163.00 -15,402.00 -19,574.00 -24,361.00 -17,282.00 -12,076.00 -14,677.00 -17,771.71 -19,745.24

Flujo de caja libre 3,854.00 5,919.00 14,664.00 16,440.00 5,355.00 -2,614.00 36,053.00 49,289.00 56,148.81 42,358.61

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 1

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

GAAP destacado

Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual/Ú12M Estimación:2022 A Estimación:2023 A

Plazo termina 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-6-30 2022-12-31 2023-12-31

Ingreso total 409,777.88 389,980.94

operacional

Ingresos totales 236,810.00 200,628.00 237,162.00 279,332.00 255,583.00 178,574.00 276,692.00 352,196.00 409,777.88 389,980.94

Ingreso operativo 12,883.00 936.00 12,074.00 20,839.00 11,531.00 -30,653.00 23,233.00 42,905.00 80,128.73 68,809.75

Ingreso neto a común 16,150.00 7,840.00 19,710.00 20,840.00 14,340.00 -22,440.00 23,040.00 38,950.00 53,943.50 42,827.32

BPA básico, GAAP 3.85 1.88 4.63 4.88 3.36 -5.25 5.39 9.13 12.93 10.61

BPA diluido, GAAP 3.85 1.88 4.63 4.88 3.36 -5.25 5.39 9.13 12.93 10.61

Acciones promedio 4,196.00 4,177.00 4,256.00 4,270.00 4,270.00 4,271.00 4,275.00 4,233.00

básicas pond

Acciones diluidas 4,196.00 4,177.00 4,256.00 4,270.00 4,270.00 4,271.00 4,275.00 4,233.00

promedio pond

Efectivo y equivalentes 3,705.00 3,657.00 3,177.00 3,042.00 3,089.00 4,364.00 6,802.00 18,861.00

Activos totales 42,623.00 41,416.00 47,134.00 47,973.00 50,052.00 44,893.00 59,154.00 93,163.00

actuales

Activos totales 336,758.00 330,314.00 348,691.00 346,196.00 362,597.00 332,750.00 338,923.00 367,774.00

Pasivos totales 53,976.00 47,638.00 57,771.00 57,138.00 63,989.00 56,363.00 56,643.00 80,110.00

corrientes

Pasivos totales 159,948.00 156,484.00 154,191.00 147,668.00 163,659.00 168,620.00 163,240.00 183,266.00

Capital total 176,810.00 173,830.00 194,500.00 198,528.00 198,938.00 164,130.00 175,683.00 184,508.00

Acciones pendientes 4,156.00 4,148.00 4,239.00 4,237.00 4,234.00 4,233.00 4,239.00 4,168.00

en hoja de balance

Acciones pendientes 4,152.76 4,146.51 4,237.46 4,234.80 4,232.19 4,233.48 4,233.59 4,167.64

en registro

Efectivo de 30,344.00 22,082.00 30,066.00 36,014.00 29,716.00 14,668.00 48,129.00 63,966.00

operaciones

Efectivo de inversiones -23,824.00 -12,403.00 -15,730.00 -16,446.00 -23,084.00 -18,459.00 -10,235.00 -12,173.00

Efectivo de -7,431.00 -9,727.00 -14,816.00 -19,703.00 -6,585.00 5,066.00 -35,456.00 -36,397.00

financiación

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 2

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

Valor de empresa

Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual Estimación:2022 A Estimación:2023 A

Plazo termina 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-10-27 2022-12-31 2023-12-31

Capitalización de 323,960.20 374,398.48 354,549.96 288,921.03 295,448.52 174,484.26 259,384.41 451,917.64

mercado

- Efectivo y 3,705.00 3,657.00 3,177.00 3,042.00 3,089.00 4,364.00 6,802.00 18,861.00

equivalentes

+ Acciones 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

preferentes

+ Interés minoritario 5,999.00 6,505.00 6,812.00 6,734.00 7,288.00 6,980.00 7,106.00 7,192.00

+ Deuda total 38,687.00 42,762.00 42,336.00 37,796.00 52,628.00 72,806.00 52,898.00 46,883.00

Valor de empresa 364,941.20 420,008.48 400,520.96 330,409.03 352,275.52 249,906.26 312,586.41 487,131.64

Capital 215,497.00 216,592.00 236,836.00 236,324.00 251,566.00 236,936.00 228,581.00 231,391.00

Deuda total/Capital 17.95 19.74 17.88 15.99 20.92 30.73 23.14 20.26

total

Deuda/Vlr emp 0.11 0.10 0.11 0.11 0.15 0.29 0.17 0.10

EV/Ventas 1.54 2.09 1.69 1.18 1.38 1.40 1.13 1.38 1.19 1.25

EV/EBITDA 11.80 18.07 12.53 8.35 11.02 14.78 6.89 7.28 4.77 5.52

EV/EBIT 28.33 448.73 33.17 15.86 30.08 13.39 11.35 6.08 7.08

VE/Flujo de caja a 11.93 9.04 11.16 6.24 7.54

empresa

VE/Flujo de caja libre a 89.26 19.47 48.81 8.23 9.76

empresa

Cap de mercado 327,078.20 377,016.02 355,971.84 291,171.30 297,960.60 176,050.62 261,587.25 459,005.34

diluido

Valor de empresa 364,941.20 420,008.48 400,520.96 330,409.03 352,275.52 251,472.62 312,586.41 487,171.07

diluido

VE por participación 87.81 101.26 94.48 77.98 83.20 59.04 73.74 94.09

Referencia

Valores últimos 12

meses para Ratios

IFRS 16/ASC 842 No No No No Sí Sí Sí Sí

Adoption

Ventas 236,810.00 200,628.00 237,162.00 279,332.00 255,583.00 178,574.00 276,692.00 352,196.00 409,777.88 389,980.94

EBITDA 30,931.00 23,244.00 31,967.00 39,584.00 31,963.00 16,909.00 45,382.00 66,890.00 102,211.44 88,187.10

EBIT 12,883.00 936.00 12,074.00 20,839.00 11,531.00 -30,653.00 23,233.00 42,905.00 80,128.73 68,809.75

Flujo de caja a 30,578.33 36,544.11 30,327.41 48,844.48 64,567.23

empresa

Flujo de caja libre a 4,088.33 16,970.11 5,966.41 36,768.48 49,890.23

empresa

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 3

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

Múltiplos

Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual Estimación:2022 A Estimación:2023 A

Plazo termina 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-10-27 2022-12-31 2023-12-31

PER 19.93 37.45 23.29 13.84 27.89 11.49 11.09 8.39 10.25

Media 11.04 22.10 33.92 22.24 15.02 17.80 11.49

Máx 19.93 37.45 37.72 24.80 27.89 28.33 11.49

Mín. 9.12 18.71 23.29 13.84 13.54 12.57 11.49

P/Libro 1.90 2.24 1.89 1.51 1.54 1.11 1.54 2.55 2.40 2.17

Media 2.00 2.10 2.03 1.81 1.63 0.98 1.56

Máx 2.25 2.31 2.25 2.01 1.84 1.57 1.79

Mín. 1.66 1.78 1.89 1.48 1.47 0.69 1.12

P/libro tangible 1.90 2.24 1.89 1.51 1.54 1.11 1.54 2.55

Media 2.00 2.10 2.03 1.81 1.63 0.98 1.56

Máx 2.25 2.31 2.25 2.01 1.84 1.57 1.79

Mín. 1.66 1.78 1.89 1.48 1.47 0.69 1.12

P/Ventas 1.38 1.88 1.50 1.04 1.17 0.99 0.95 1.31 1.10 1.16

Media 0.97 1.53 1.70 1.43 1.13 0.75 1.38

Máx 1.39 1.89 1.90 1.60 1.28 1.19 1.59

Mín. 0.78 1.27 1.50 1.03 1.01 0.50 0.94

P/Flujo de caja 10.78 17.07 11.84 8.08 10.03 12.00 5.44 7.22 6.12 7.06

Media 7.87 11.94 15.47 11.31 8.75 6.42 16.83

Máx 10.78 17.07 17.19 12.61 10.03 12.00 19.32

Mín. 6.52 10.12 11.84 8.08 7.91 4.52 5.44

P/Flujo libre caja 84.87 63.70 24.28 17.71 55.64 7.26 9.37

Media 29.39 93.73 57.63 23.20 19.30 35.51 7.26

Máx 84.87 103.56 64.14 25.85 55.64 56.53 7.26

Mín. 24.19 63.70 24.28 17.71 17.32 25.08 7.26

EV/Ventas 1.54 2.09 1.69 1.18 1.38 1.40 1.13 1.38 1.19 1.25

Media 1.04 1.69 1.94 1.62 1.27 0.96 1.79

Máx 1.54 2.09 2.11 1.79 1.41 1.40 2.00

Mín. 0.87 1.46 1.69 1.18 1.16 0.74 1.13

EV/EBITDA 11.80 18.07 12.53 8.35 11.02 14.78 6.89 7.28 4.77 5.52

Media 7.37 12.91 16.78 12.02 8.94 7.70 18.92

Máx 11.82 18.06 18.18 13.24 11.02 14.77 21.08

Mín. 6.18 11.17 12.52 8.34 8.18 5.94 6.88

EV/EBIT 28.33 448.73 33.17 15.86 30.08 13.39 11.35 6.08 7.08

Media 11.16 32.61 415.50 31.80 17.02 20.93 13.37

Máx 28.37 448.60 451.39 35.06 30.06 30.46 13.37

Mín. 9.32 26.83 33.16 15.84 15.53 16.22 13.37

Precio/Acc 77.95 90.26 83.64 68.19 69.78 41.22 61.19 108.43

Máx 93.45 95.55 91.34 89.30 83.49 71.37 66.38 109.58

Mín. 66.55 71.55 76.05 64.65 66.31 30.11 41.00 107.60

Valor de empresa 364,941.20 420,008.48 400,520.96 330,409.03 352,275.52 249,906.26 312,586.41 487,131.64

Media 377,958.75 398,785.28 390,375.78 384,555.27 353,603.49 245,215.75 320,672.75

Máx 426,547.95 435,406.67 422,502.96 423,370.04 394,444.29 356,812.42 356,361.50

Mín. 317,652.82 345,624.84 368,053.75 323,327.71 323,702.79 189,929.40 250,893.72

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 4

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

Ajustado

Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual/Ú12M Estimación:2022 A Estimación:2023 A

Plazo termina 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-6-30 2022-12-31 2023-12-31

Ingreso 236,810.00 200,628.00 237,162.00 279,332.00 255,583.00 178,574.00 276,692.00 352,196.00 409,777.88 389,980.94

+ Ingresos de 236,810.00 200,628.00 237,162.00 279,332.00 255,583.00 178,574.00 276,692.00 352,196.00

servicios y ventas

- Coste de ingreso 210,903.00 187,426.00 210,904.00 244,262.00 230,150.00 196,569.00 242,045.00 297,904.00

+ Coste de bienes y 192,855.00 165,118.00 191,011.00 225,517.00 211,152.00 150,560.00 221,438.00 273,919.00

servicios

+ Depreciación + 18,048.00 22,308.00 19,893.00 18,745.00 18,998.00 46,009.00 20,607.00 23,985.00

amortización

Beneficio bruto 25,907.00 13,202.00 26,258.00 35,070.00 25,433.00 -17,995.00 34,647.00 54,292.00 182,908.45 168,475.67

+ Otros ingresos 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

operacionales

- Gastos 13,024.00 8,841.38 12,663.00 13,742.00 18,528.58 -13,147.06 11,764.63 7,926.24

operacionales

+ Ventas, generales 10,493.00 9,741.00 9,586.00 10,364.00 10,184.00 9,152.00 8,731.00 9,740.00

y admin

+ Investigación y 1,008.00 1,058.00 1,063.00 1,116.00 1,214.00 1,016.00 843.00

desarrollo

+ Otro gasto 1,523.00 -1,957.62 2,014.00 2,262.00 7,130.58 -23,315.06 2,190.63 -1,813.76

operativo

Ingreso operacional 12,883.00 4,360.62 13,595.00 21,328.00 6,904.42 -4,847.94 22,882.37 46,365.76 80,128.73 68,809.75

(pérdida)

- Ingreso (pérdida) no -9,083.00 -7,033.00 -6,600.00 -10,114.00 -8,525.00 -1,770.00 -8,001.00 -11,919.00

operacional

+ Gasto de 265.00 423.00 565.00 702.00 746.00 1,109.00 914.00

intereses, neto

+ Gastos de 311.00 453.00 601.00 766.00 830.00 1,158.00 947.00 817.00

intereses

- Ingreso de 46.00 30.00 36.00 64.00 84.00 49.00 33.00

intereses

+ (Plusvalía) pérdida 119.00 -29.00 -6.00 -138.00 -104.00 -24.00 -18.00

del tipo de cambio

+ Beneficio (pérdida) -7,644.00 -4,806.00 -5,380.00 -7,355.00 -5,441.00 -1,732.00 -6,657.00 -9,974.00

de filiales

+ Otro (ingreso) -1,823.00 -2,621.00 -1,779.00 -3,323.00 -3,726.00 -1,123.00 -2,240.00 -2,762.00

pérdida no op

Beneficios (pérdidas) 21,966.00 11,393.62 20,195.00 31,442.00 15,429.42 -3,077.94 30,883.37 58,284.76 80,734.69 67,643.07

antes de impuestos,

ajustados

- Pérdida anormal 0.00 3,424.62 1,521.00 489.00 -4,626.58 25,805.06 -350.63 3,460.76

+ Despojo de activos -4,626.58 -1,368.35 -1,746.84

+ Cancelación de 3,424.62 1,521.00 489.00 25,392.41 951.90

activos

+ Beneficio/pérdida

en la venta/adquisición

de empresas

+ Resolución jurídica

+ Restructura 65.82

+ Otros elementos 412.66

atípicos

Beneficios (pérdidas) 21,966.00 7,969.00 18,674.00 30,953.00 20,056.00 -28,883.00 31,234.00 54,824.00 80,734.69 67,643.07

antes de impuestos,

GAAP

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 5

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual/Ú12M Estimación:2022 A Estimación:2023 A

Plazo termina 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-6-30 2022-12-31 2023-12-31

- Gasto de impuesto a 5,415.00 -406.00 -1,174.00 9,532.00 5,282.00 -5,632.00 7,636.00 14,479.00

la renta (Beneficio)

+ Impuesto sobre la 7,152.00 3,817.00 7,147.00 9,628.00 5,957.00 2,420.00 7,680.00

renta actual

+ Impuesto sobre la -1,737.00 -4,223.00 -8,321.00 -96.00 -675.00 -8,052.00 -44.00

renta diferido

Beneficios (pérdidas) 16,551.00 8,375.00 19,848.00 21,421.00 14,774.00 -23,251.00 23,598.00 40,345.00 53,943.50 42,827.32

de operaciones

continuas

- Pérdidas 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

(ganancias)

extraordinarias netas

+ Operaciones 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

discontinuas

+ PE y cambios 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

contables

Ingreso (pérdida) incl 16,551.00 8,375.00 19,848.00 21,421.00 14,774.00 -23,251.00 23,598.00 40,345.00

MI

- Minoritarios 401.00 535.00 138.00 581.00 434.00 -811.00 558.00 1,395.00

Beneficio neto, GAAP 16,150.00 7,840.00 19,710.00 20,840.00 14,340.00 -22,440.00 23,040.00 38,950.00 53,943.50 42,827.32

- Dividendos 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

preferentes

- Otros ajustes 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

beneficio neto 16,150.00 7,840.00 19,710.00 20,840.00 14,340.00 -22,440.00 23,040.00 38,950.00 53,943.50 42,827.32

disponible a

accionistas comunes,

GAAP

Beneficio neto 16,410.00 10,066.00 15,289.00 21,038.00 10,685.00 -2,054.00 22,763.00 41,684.00 53,985.05 42,685.09

disponible a cap

común, aj

Pérdidas atípicas 260.00 2,226.00 -4,421.00 198.00 -3,655.00 20,386.00 -277.00 2,734.00

netas (ganancias)

Pérdidas (ganancias) 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

extraordinarias netas

Acciones promedio 4,196.00 4,177.00 4,256.00 4,270.00 4,270.00 4,271.00 4,275.00 4,233.00

básicas pond

BPA básicos, GAAP 3.85 1.88 4.63 4.88 3.36 -5.25 5.39 9.13 12.93 10.61

Basic EPS from Cont 3.85 1.88 4.63 4.88 3.36 -5.25 5.39 9.13 12.93 10.61

Ops, GAAP

BPA básicos de ops 3.91 2.41 3.59 4.93 2.50 -0.48 5.32 9.79 12.93 10.58

cont, ajustados

Acciones diluidas 4,196.00 4,177.00 4,256.00 4,270.00 4,270.00 4,271.00 4,275.00 4,233.00

promedio pond

BPA diluidos, GAAP 3.85 1.88 4.63 4.88 3.36 -5.25 5.39 9.13 12.93 10.61

Diluted EPS from Cont 3.85 1.88 4.63 4.88 3.36 -5.25 5.39 9.13 12.93 10.61

Ops, GAAP

BPA diluidos de ops 3.91 2.41 3.59 4.93 2.50 -0.48 5.32 9.77 12.93 10.58

cont, ajustados

Referencia

Norma de contabilidad US GAAP US GAAP US GAAP US GAAP US GAAP US GAAP US GAAP

EBITDA 30,931.00 26,668.62 33,488.00 40,073.00 27,336.42 42,714.06 45,031.37 70,350.76 102,211.44 88,187.10

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 6

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual/Ú12M Estimación:2022 A Estimación:2023 A

Plazo termina 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-6-30 2022-12-31 2023-12-31

Margen EBITDA 13.06 13.29 14.12 14.35 10.70 23.92 16.27 19.97 24.94 22.61

(U12M)

EBITA 12,883.00 4,360.62 13,595.00 21,328.00 8,338.42 -3,294.94 24,424.37 46,365.76

EBIT 12,883.00 4,360.62 13,595.00 21,328.00 6,904.42 -4,847.94 22,882.37 46,365.76 80,128.73 68,809.75

Margen bruto 10.94 6.58 11.07 12.55 9.95 -10.08 12.52 15.42 44.64 43.20

Margen operacional 5.44 2.17 5.73 7.64 2.70 -2.71 8.27 13.16 19.55 17.64

Margen de beneficio 6.93 5.02 6.45 7.53 4.18 -1.15 8.23 11.84 13.17 10.95

Ventas por empleado 3,221,904.76 2,821,772.15 3,407,500.00 3,934,253.52 3,412,323.10 2,480,194.44 4,391,936.51

Dividendos por acción 2.88 2.98 3.06 3.23 3.43 3.48 3.49 3.51 3.58 3.72

Dividendos ordinarios 12,090.00 12,453.00 13,001.00 13,798.00 14,844.00 15,053.00 15,148.00 15,194.00

totales en efectivo

Gasto de interés 482.00 708.00 749.00 652.00 731.00 665.00 844.00

capitalizado

Gasto de depreciación 18,048.00 22,308.00 19,893.00 18,745.00 18,998.00 46,009.00 20,607.00 23,985.00

Gasto de renta 3,929.00 3,091.00 2,618.00 2,715.00 3,476.00 3,166.00 2,893.00

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 7

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

GAAP

Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual/Ú12M Estimación:2022 A Estimación:2023 A

Plazo termina 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-6-30 2022-12-31 2023-12-31

Ingreso 236,810.00 200,628.00 237,162.00 279,332.00 255,583.00 178,574.00 276,692.00 352,196.00 409,777.88 389,980.94

+ Ingresos de 236,810.00 200,628.00 237,162.00 279,332.00 255,583.00 178,574.00 276,692.00 352,196.00

servicios y ventas

- Coste de ingreso 210,903.00 187,426.00 210,904.00 244,262.00 230,150.00 196,569.00 242,045.00 297,904.00

+ Coste de bienes y 192,855.00 165,118.00 191,011.00 225,517.00 211,152.00 150,560.00 221,438.00 273,919.00

servicios

+ Depreciación + 18,048.00 22,308.00 19,893.00 18,745.00 18,998.00 46,009.00 20,607.00 23,985.00

amortización

Beneficio bruto 25,907.00 13,202.00 26,258.00 35,070.00 25,433.00 -17,995.00 34,647.00 54,292.00 182,908.45 168,475.67

+ Otros ingresos 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

operacionales

- Gastos 13,024.00 12,266.00 14,184.00 14,231.00 13,902.00 12,658.00 11,414.00 11,387.00

operacionales

+ Ventas, generales 10,493.00 9,741.00 9,586.00 10,364.00 10,184.00 9,152.00 8,731.00 9,740.00

y admin

+ Investigación y 1,008.00 1,058.00 1,063.00 1,116.00 1,214.00 1,016.00 843.00

desarrollo

+ Otro gasto 1,523.00 1,467.00 3,535.00 2,751.00 2,504.00 2,490.00 1,840.00 1,647.00

operativo

Ingreso operacional 12,883.00 936.00 12,074.00 20,839.00 11,531.00 -30,653.00 23,233.00 42,905.00 80,128.73 68,809.75

(pérdida)

- Ingreso (pérdida) no -9,083.00 -7,033.00 -6,600.00 -10,114.00 -8,525.00 -1,770.00 -8,001.00 -11,919.00

operacional

+ Gasto de 265.00 423.00 565.00 702.00 746.00 1,109.00 914.00

intereses, neto

+ Gastos de 311.00 453.00 601.00 766.00 830.00 1,158.00 947.00 817.00

intereses

- Ingreso de 46.00 30.00 36.00 64.00 84.00 49.00 33.00

intereses

+ (Plusvalía) pérdida 119.00 -29.00 -6.00 -138.00 -104.00 -24.00 -18.00

del tipo de cambio

+ Beneficio (pérdida) -7,644.00 -4,806.00 -5,380.00 -7,355.00 -5,441.00 -1,732.00 -6,657.00 -9,974.00

de filiales

+ Otro (ingreso) -1,823.00 -2,621.00 -1,779.00 -3,323.00 -3,726.00 -1,123.00 -2,240.00 -2,762.00

pérdida no op

Ingreso antes de 21,966.00 7,969.00 18,674.00 30,953.00 20,056.00 -28,883.00 31,234.00 54,824.00 80,734.69 67,643.07

impuestos

- Gasto de impuesto a 5,415.00 -406.00 -1,174.00 9,532.00 5,282.00 -5,632.00 7,636.00 14,479.00

la renta (Beneficio)

+ Impuesto sobre la 7,152.00 3,817.00 7,147.00 9,628.00 5,957.00 2,420.00 7,680.00

renta actual

+ Impuesto sobre la -1,737.00 -4,223.00 -8,321.00 -96.00 -675.00 -8,052.00 -44.00

renta diferido

Beneficios (pérdidas) 16,551.00 8,375.00 19,848.00 21,421.00 14,774.00 -23,251.00 23,598.00 40,345.00 53,943.50 42,827.32

de operaciones

continuas

- Pérdidas 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

(ganancias)

extraordinarias netas

+ Operaciones 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

discontinuas

+ PE y cambios 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

contables

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 8

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual/Ú12M Estimación:2022 A Estimación:2023 A

Plazo termina 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-6-30 2022-12-31 2023-12-31

Ingreso (pérdida) incl 16,551.00 8,375.00 19,848.00 21,421.00 14,774.00 -23,251.00 23,598.00 40,345.00

MI

- Minoritarios 401.00 535.00 138.00 581.00 434.00 -811.00 558.00 1,395.00

Beneficio neto, GAAP 16,150.00 7,840.00 19,710.00 20,840.00 14,340.00 -22,440.00 23,040.00 38,950.00 53,943.50 42,827.32

- Dividendos 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

preferentes

- Otros ajustes 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

beneficio neto 16,150.00 7,840.00 19,710.00 20,840.00 14,340.00 -22,440.00 23,040.00 38,950.00 53,943.50 42,827.32

disponible a

accionistas comunes,

GAAP

Beneficio neto 16,410.00 10,066.00 15,289.00 21,038.00 10,685.00 -2,054.00 22,763.00 41,684.00 53,985.05 42,685.09

disponible a cap

común, aj

Pérdidas atípicas 260.00 2,226.00 -4,421.00 198.00 -3,655.00 20,386.00 -277.00 2,734.00

netas (ganancias)

Pérdidas (ganancias) 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

extraordinarias netas

Acciones promedio 4,196.00 4,177.00 4,256.00 4,270.00 4,270.00 4,271.00 4,275.00 4,233.00

básicas pond

BPA básicos, GAAP 3.85 1.88 4.63 4.88 3.36 -5.25 5.39 9.13 12.93 10.61

Basic EPS from Cont 3.85 1.88 4.63 4.88 3.36 -5.25 5.39 9.13 12.93 10.61

Ops, GAAP

BPA básicos de ops 3.91 2.41 3.59 4.93 2.50 -0.48 5.32 9.79 12.93 10.58

cont, ajustados

Acciones diluidas 4,196.00 4,177.00 4,256.00 4,270.00 4,270.00 4,271.00 4,275.00 4,233.00

promedio pond

BPA diluidos, GAAP 3.85 1.88 4.63 4.88 3.36 -5.25 5.39 9.13 12.93 10.61

Diluted EPS from Cont 3.85 1.88 4.63 4.88 3.36 -5.25 5.39 9.13 12.93 10.61

Ops, GAAP

BPA diluidos de ops 3.91 2.41 3.59 4.93 2.50 -0.48 5.32 9.77 12.93 10.58

cont, ajustados

Referencia

Norma de contabilidad US GAAP US GAAP US GAAP US GAAP US GAAP US GAAP US GAAP

EBITDA 30,931.00 23,244.00 31,967.00 39,584.00 31,963.00 16,909.00 45,382.00 66,890.00 102,211.44 88,187.10

Margen EBITDA 13.06 11.59 13.48 14.17 12.51 9.47 16.40 18.99 24.94 22.61

(U12M)

EBITA 12,883.00 936.00 12,074.00 20,839.00 12,965.00 -29,100.00 24,775.00 42,905.00

EBIT 12,883.00 936.00 12,074.00 20,839.00 11,531.00 -30,653.00 23,233.00 42,905.00 80,128.73 68,809.75

Margen bruto 10.94 6.58 11.07 12.55 9.95 -10.08 12.52 15.42

Margen operacional 5.44 0.47 5.09 7.46 4.51 -17.17 8.40 12.18 19.55 17.64

Margen de beneficio 6.82 3.91 8.31 7.46 5.61 -12.57 8.33 11.06 13.17 10.95

Ventas por empleado 3,221,904.76 2,821,772.15 3,407,500.00 3,934,253.52 3,412,323.10 2,480,194.44 4,391,936.51

Dividendos por acción 2.88 2.98 3.06 3.23 3.43 3.48 3.49 3.51 3.58 3.72

Dividendos ordinarios 12,090.00 12,453.00 13,001.00 13,798.00 14,844.00 15,053.00 15,148.00 15,194.00

totales en efectivo

Gasto de interés 482.00 708.00 749.00 652.00 731.00 665.00 844.00

capitalizado

Gasto de depreciación 18,048.00 22,308.00 19,893.00 18,745.00 18,998.00 46,009.00 20,607.00 23,985.00

Gasto de renta 3,929.00 3,091.00 2,618.00 2,715.00 3,476.00 3,166.00 2,893.00

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 9

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

COVID-19

Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual/Ú12M Estimación:2022 A Estimación:2023 A

Plazo termina 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-6-30 2022-12-31 2023-12-31

Impacto operacional

Impacto operacional 2.00 5.00 5.00

COVID-19

Cargos relacionados

con COVID-19

Reconciliación de

ingreso

Ingreso 236,810.00 200,628.00 237,162.00 279,332.00 255,583.00 178,574.00 276,692.00 352,196.00 409,777.88 389,980.94

Ingresos, ex impacto 236,810.00 200,628.00 237,162.00 279,332.00 255,583.00 178,574.00 276,692.00 352,196.00

de COVID-19

Reconciliación EBIT

EBIT 12,883.00 936.00 12,074.00 20,839.00 11,531.00 -30,653.00 23,233.00 42,905.00 80,128.73 68,809.75

EBIT, ex impacto de 12,883.00 936.00 12,074.00 20,839.00 11,531.00 -30,653.00 23,233.00 42,905.00

COVID-19

Reconciliación ingreso

antes de impuestos

Ingreso antes de 21,966.00 7,969.00 18,674.00 30,953.00 20,056.00 -28,883.00 31,234.00 54,824.00 80,734.69 67,643.07

impuestos

Ingreso bruto de 21,966.00 7,969.00 18,674.00 30,953.00 20,056.00 -28,883.00 31,234.00 54,824.00

impuestos, ex impacto

de COVID-19

Reconciliación de

beneficio neto

Beneficio neto/Margen 16,150.00 7,840.00 19,710.00 20,840.00 14,340.00 -22,440.00 23,040.00 38,950.00 53,943.50 42,827.32

neto (pérdidas)

Ingreso neto, ex 16,150.00 7,840.00 19,710.00 20,840.00 14,340.00 -22,440.00 23,040.00 38,950.00

impacto de COVID-19

Reconciliación de

beneficios por acción

BPA diluidos 3.85 1.88 4.63 4.88 3.36 -5.25 5.39 9.13 12.93 10.61

BPA diluidos, ex 3.85 1.88 4.63 4.88 3.36 -5.25 5.39 9.13

impacto de COVID-19

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 10

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

Estandarizado

Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual Estimación:2022 A Estimación:2023 A

Plazo termina 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-10-27 2022-12-31 2023-12-31

Activo total

+ Efectivo, 3,705.00 3,657.00 3,177.00 3,042.00 3,089.00 4,364.00 6,802.00 18,861.00

equivalentes y STI

+ Efectivo y 3,705.00 3,657.00 3,177.00 3,042.00 3,089.00 4,364.00 6,802.00 18,861.00

equivalentes

+ Inversiones a corto 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

plazo

+ Cuentas y notas por 19,875.00 21,394.00 25,597.00 24,701.00 26,966.00 20,581.00 32,383.00 48,063.00

cobrar

+ Cuentas por 13,243.00 16,033.00 21,274.00 19,638.00 21,100.00 16,339.00 26,883.00

cobrar, neto

+ Notas por cobrar, 6,632.00 5,361.00 4,323.00 5,063.00 5,866.00 4,242.00 5,500.00

netas

+ Inventarios 16,245.00 15,080.00 16,992.00 18,958.00 18,528.00 18,850.00 18,780.00 23,585.00

+ Mat primas 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

+ Trabajo en 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

proceso

+ Bienes de 12,037.00 10,877.00 12,871.00 14,803.00 14,010.00 14,169.00 14,519.00 19,580.00

consumo

+ Otro inventario 4,208.00 4,203.00 4,121.00 4,155.00 4,518.00 4,681.00 4,261.00 4,005.00

+ Otros activos a CP 2,798.00 1,285.00 1,368.00 1,272.00 1,469.00 1,098.00 1,189.00 2,654.00

+ Activos derivados 25.00 0.00 0.00 0.00 0.00

y de cobertura

+ Activos varios a 2,798.00 1,285.00 1,343.00 1,272.00 1,469.00 1,098.00 1,189.00 2,654.00

CP

Activos totales 42,623.00 41,416.00 47,134.00 47,973.00 50,052.00 44,893.00 59,154.00 93,163.00

actuales

+ Propiedad, planta y 251,605.00 244,224.00 252,630.00 247,101.00 259,651.00 233,631.00 222,634.00 209,159.00

equipo; neto

+ Propiedad, planta 447,337.00 453,915.00 477,185.00 477,190.00 493,335.00 511,400.00 501,144.00

y equipo

- Depreciación 195,732.00 209,691.00 224,555.00 230,089.00 233,684.00 277,769.00 278,510.00

acumulada

+ Inversiones y 4,798.00 4,849.00 5,694.00 5,800.00 5,331.00 4,931.00 5,644.00

cuentas por cobrar a

LP

+ Inversiones a largo 274.00 154.00 174.00 210.00 190.00 143.00 138.00

plazo

+ Cuentas por 4,524.00 4,695.00 5,520.00 5,590.00 5,141.00 4,788.00 5,506.00

cobrar LP

+ Otros activos a LP 37,732.00 39,825.00 43,233.00 45,322.00 47,563.00 49,295.00 51,491.00 65,452.00

+ Activos intangibles 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

totales

+ Fondo de 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

comercio

+ Otros activos 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

intangibles

+ Activos de 0.00 0.00 0.00 0.00 0.00

derivados y de

cobertura

+ Costes de 454.00 1,035.00 1,403.00 1,174.00 1,151.00 1,931.00 2,544.00

pensiones prepagados

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 11

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual Estimación:2022 A Estimación:2023 A

Plazo termina 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-10-27 2022-12-31 2023-12-31

+ Inversiones en 29,447.00 30,253.00 39,160.00 40,790.00 43,164.00 43,515.00 45,195.00 46,820.00

filiales

+ Activos varios a 7,831.00 8,537.00 2,670.00 3,358.00 3,248.00 3,849.00 3,752.00 18,632.00

LP

Activos totales no 294,135.00 288,898.00 301,557.00 298,223.00 312,545.00 287,857.00 279,769.00 274,611.00

corrientes

Activos totales 336,758.00 330,314.00 348,691.00 346,196.00 362,597.00 332,750.00 338,923.00 367,774.00

Pasivo y capital social

+ Cuentas por pagar 35,214.00 33,808.00 39,841.00 39,880.00 42,185.00 34,733.00 50,996.00 72,743.00

y devengos

+ Cuentas por pagar 18,074.00 17,801.00 21,701.00 21,063.00 24,694.00 17,499.00 26,623.00 67,958.00

+ Impuestos 5,739.00 5,268.00 6,356.00 5,892.00 4,881.00 4,092.00 5,497.00 4,785.00

incurridos

+ Interés y

dividendos por pagar

+ Otras cuentas por 11,401.00 10,739.00 11,784.00 12,925.00 12,610.00 13,142.00 18,876.00

pagar y en devengo

+ Deuda CP 18,762.00 13,830.00 17,930.00 17,258.00 21,804.00 21,630.00 5,647.00 7,367.00

+ Préstamos CP 18,204.00 10,870.00 13,164.00 13,188.00 18,877.00 17,528.00 4,165.00 7,367.00

+ ST Lease 1,310.00 1,274.00 1,482.00

Liabilities

+ Arrendamientos 99.00 106.00 115.00

de finanzas a CP

+ Arrendamientos 1,211.00 1,168.00 1,367.00

de operación a CP

+ Porción corriente 558.00 2,960.00 4,766.00 4,070.00 1,617.00 2,828.00

de deuda a LP

+ Otros pasivos a 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

corto plazo

+ Ingreso diferido 0.00 0.00 0.00 0.00 0.00 0.00 0.00

+ Derivados y 0.00 0.00 0.00 0.00 0.00 0.00

cobertura

+ Pasivos varios a 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

CP

Pasivos totales 53,976.00 47,638.00 57,771.00 57,138.00 63,989.00 56,363.00 56,643.00 80,110.00

corrientes

+ Deuda LP 19,925.00 28,932.00 24,406.00 20,538.00 30,824.00 51,176.00 47,251.00 39,516.00

+ Préstamos a largo 18,687.00 27,707.00 23,079.00 19,235.00 24,533.00 45,367.00 41,536.00 39,516.00

plazo

+ LT Lease 1,238.00 1,225.00 1,327.00 1,303.00 6,291.00 5,809.00 5,715.00

Liabilities

+ Arrendamientos de 1,238.00 1,225.00 1,327.00 1,303.00 1,809.00 1,815.00 1,892.00

finanzas a LP

+ Arrendamientos de 4,482.00 3,994.00 3,823.00

operación a LP

+ Otros pasivos a LP 86,047.00 79,914.00 72,014.00 69,992.00 68,846.00 61,081.00 59,346.00 63,640.00

+ Pasivos acum 0.00 0.00 0.00 0.00 0.00 0.00 0.00

+ Pasivos de 22,647.00 20,680.00 21,132.00 20,272.00 22,304.00 22,415.00 18,430.00 17,408.00

pensiones

+ Ingreso diferido 0.00 0.00 0.00 0.00 0.00 0.00 0.00

+ Pasivo de 36,818.00 34,041.00 26,893.00 27,244.00 25,620.00 18,165.00 20,165.00 20,807.00

impuesto diferido

+ Derivados y 63.00 0.00 0.00 0.00 0.00

cobertura

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 12

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual Estimación:2022 A Estimación:2023 A

Plazo termina 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-10-27 2022-12-31 2023-12-31

+ Pasivos varios a 26,582.00 25,193.00 23,926.00 22,476.00 20,922.00 20,501.00 20,751.00 25,425.00

LP

Pasivos totales no 105,972.00 108,846.00 96,420.00 90,530.00 99,670.00 112,257.00 106,597.00 103,156.00

corrientes

Pasivos totales 159,948.00 156,484.00 154,191.00 147,668.00 163,659.00 168,620.00 163,240.00 183,266.00

+ Acciones 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

preferentes y capital

híbrido

+ Capital en acciones 11,612.00 12,157.00 14,656.00 15,258.00 15,637.00 15,688.00 15,746.00 16,018.00

y APIC

- Acciones de 229,734.00 230,424.00 225,246.00 225,553.00 225,835.00 225,776.00 225,464.00 231,587.00

Tesorería

+ Beneficios retenidos 412,444.00 407,831.00 414,540.00 421,653.00 421,341.00 383,943.00 392,059.00 407,902.00

+ Otro capital -23,511.00 -22,239.00 -16,262.00 -19,564.00 -19,493.00 -16,705.00 -13,764.00 -15,017.00

Capital antes de 170,811.00 167,325.00 187,688.00 191,794.00 191,650.00 157,150.00 168,577.00 177,316.00

interés minoritario

+ Participación 5,999.00 6,505.00 6,812.00 6,734.00 7,288.00 6,980.00 7,106.00 7,192.00

minoritaria/no

dominante

Patrimonio total 176,810.00 173,830.00 194,500.00 198,528.00 198,938.00 164,130.00 175,683.00 184,508.00

Pasivo y capital totales 336,758.00 330,314.00 348,691.00 346,196.00 362,597.00 332,750.00 338,923.00 367,774.00

Referencia

Norma de contabilidad US GAAP US GAAP US GAAP US GAAP US GAAP US GAAP US GAAP

Publication Date n/a n/a n/a n/a n/a n/a n/a 02/23/2022

Acciones en 4,156.00 4,148.00 4,239.00 4,237.00 4,234.00 4,233.00 4,239.00 4,168.00

circulación:

Núm de acciones de 3,863.00 3,871.00 3,780.00 3,782.00 3,785.00 3,786.00 3,780.00 3,851.00

Tesorería

Obligaciones de 22,647.00 20,680.00 21,132.00 20,272.00 22,304.00 22,415.00 18,430.00 17,408.00

pensión

Arriendos futuros 4,845.00 3,811.00 4,290.00 6,112.00 6,800.00 6,094.00 5,970.00

mínimos de

operaciones

Arrend capital - Total 1,238.00 1,225.00 1,327.00 1,303.00 1,908.00 1,921.00 2,007.00

Opciones en

circulación al fin del

periodo

Deuda neta 34,982.00 39,105.00 39,159.00 34,754.00 49,539.00 68,442.00 46,096.00 28,022.00 13,601.08 2,010.72

Deuda neta a capital 19.79 22.50 20.13 17.51 24.90 41.70 26.24 15.19

Ratio de capital 50.72 50.66 53.83 55.40 52.85 47.23 49.74 48.21

ordinario tangible

Ratio corriente 0.79 0.87 0.82 0.84 0.78 0.80 1.04 1.16

Ciclo de conversión de 27.79 32.98 30.04 28.03 30.27 44.31 30.03

efectivo

Número de empleados 73,500.00 71,100.00 69,600.00 71,000.00 74,900.00 72,000.00 63,000.00

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 13

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

Estandarizado

Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual/Ú12M Estimación:2022 A Estimación:2023 A

Plazo termina 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-6-30 2022-12-31 2023-12-31

Efectivo de actividades

operacionales

+ Ingreso neto 16,150.00 7,840.00 19,710.00 20,840.00 14,340.00 -22,440.00 23,040.00 38,950.00

+ Depreciación + 18,048.00 22,308.00 19,893.00 18,745.00 18,998.00 46,009.00 20,607.00 23,985.00

amortización

+ Partidas no -741.00 -6,674.00 -8,888.00 -2,215.00 -4,545.00 -7,248.00 320.00 103.00

monetarias

+ Impuestos al -1,832.00 -4,386.00 -8,577.00 -60.00 -944.00 -8,856.00 303.00

ingreso diferidos

+ Otros ajustes no 1,091.00 -2,288.00 -311.00 -2,155.00 -3,601.00 1,608.00 17.00 103.00

en efectivo

+ Var en fondo -3,113.00 -1,392.00 -649.00 -1,356.00 923.00 -1,653.00 4,162.00 928.00

de maniobra no en

efectivo

+ (Inc) dec en -2,640.00 5,384.00 -12,098.00

cuentas por cobrar

+ (Aum) baja en -379.00 -388.00 -1,682.00 -3,107.00 72.00 -315.00 -489.00

inventarios

+ Aum (baja) de -2,734.00 -1,004.00 1,033.00 1,751.00 3,491.00 -6,722.00 16,749.00 928.00

otros

+ Efectivo neto de 0.00 0.00 0.00 0.00 0.00 0.00 0.00

ops disc

Efectivo de actividades 30,344.00 22,082.00 30,066.00 36,014.00 29,716.00 14,668.00 48,129.00 63,966.00

operacionales

Efectivo de actividades

de inversión

+ Cambio en fijos e -24,101.00 -11,888.00 -12,299.00 -15,451.00 -20,669.00 -16,283.00 -8,900.00 -10,826.00

intangibles

+ Desp en fijos e 2,389.00 4,275.00 3,103.00 4,123.00 3,692.00 999.00 3,176.00 3,851.00

intangibles

+ Desp de activos 2,389.00 4,275.00 3,103.00 4,123.00 3,692.00 999.00 3,176.00 3,851.00

fijos prod

+ Desp de activos 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

intangibles

+ Adq de fijos e -26,490.00 -16,163.00 -15,402.00 -19,574.00 -24,361.00 -17,282.00 -12,076.00 -14,677.00

intangibles

+ Adq de activos -26,490.00 -16,163.00 -15,402.00 -19,574.00 -24,361.00 -17,282.00 -12,076.00 -14,677.00

fijos prod

+ Adq de activos 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

intangibles

+ Cambio neto en 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

inversiones LP

+ Dec en 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

inversiones LP

+ Inc en inversiones 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

LP

+ Efectivo neto de 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

adq y div

+ Efectivo por 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

despojos

+ Efectivo para adq 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

de subs

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 14

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual/Ú12M Estimación:2022 A Estimación:2023 A

Plazo termina 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-6-30 2022-12-31 2023-12-31

+ Efectivo para JVs 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

+ Otras actividades 277.00 -515.00 -3,431.00 -995.00 -2,415.00 -2,176.00 -1,335.00 -1,347.00

de inversión

+ Efectivo neto de 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

ops disc

Efectivo de actividades -23,824.00 -12,403.00 -15,730.00 -16,446.00 -23,084.00 -18,459.00 -10,235.00 -12,173.00

de inversión

Efectivo de actividades

de financiación

+ Dividendos -12,090.00 -12,453.00 -13,001.00 -13,798.00 -14,652.00 -14,865.00 -14,924.00 -14,970.00

pagados

+ Efectivo de (pagos) 9,255.00 4,293.00 -1,048.00 -4,925.00 8,662.00 20,141.00 -19,654.00 -13,669.00

deuda

+ Efectivo de 1,253.00 -7,773.00 -1,108.00 -4,971.00 1,611.00 -3,037.00 -19,692.00 -13,707.00

(pagos) deuda CP

+ Efectivo de deuda 8,028.00 12,066.00 60.00 46.00 7,052.00 23,186.00 46.00 46.00

a LP

+ Pagos de -26.00 0.00 -1.00 -8.00 -8.00 -8.00

préstamos a LP

+ Efectivo (recompra) -4,032.00 -971.00 -747.00 -626.00 -594.00 -405.00 -155.00 -6,140.00

de acciones

+ Aumento en 7.00 6.00 0.00 0.00 0.00 0.00 0.00 0.00

capital

+ Baja en capital -4,039.00 -977.00 -747.00 -626.00 -594.00 -405.00 -155.00 -6,140.00

+ Otras actividades -170.00 -162.00 -334.00 -97.00 -34.00 414.00 -690.00 -1,221.00

de financiación

+ Efectivo neto de 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

ops disc

Efectivo de actividades -7,037.00 -9,293.00 -15,130.00 -19,446.00 -6,618.00 5,285.00 -35,423.00 -36,000.00

de financiación

Efecto de los tipos de -394.00 -434.00 314.00 -257.00 33.00 -219.00 -33.00 -397.00

cambio

Cambios netos en el -911.00 -48.00 -480.00 -135.00 47.00 1,275.00 2,438.00 15,396.00

efectivo

Efectivo pagado por 7,269.00 4,214.00 7,510.00 9,294.00 7,018.00 2,428.00 5,341.00 8,807.00

impuestos

Efectivo pagado en 586.00 818.00 1,132.00 955.00 1,291.00 1,451.00 1,474.00 1,435.00

intereses

Referencia

EBITDA 30,931.00 23,244.00 31,967.00 39,584.00 31,963.00 16,909.00 45,382.00 66,890.00 102,211.44 88,187.10

Margen EBITDA 13.06 11.59 13.48 14.17 12.51 9.47 16.40 18.99 24.94 22.61

últimos 12M

Efectivo neto 0.00 0.00 0.00 0.00 0.00 0.00 0.00

desembolsado por

adquisiciones

Beneficio de impuesto 2.00 0.00

de opciones de

acciones

Flujo de caja libre 3,854.00 5,919.00 14,664.00 16,440.00 5,355.00 -2,614.00 36,053.00 49,289.00 56,148.81 42,358.61

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 15

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual/Ú12M Estimación:2022 A Estimación:2023 A

Plazo termina 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-6-30 2022-12-31 2023-12-31

Flujo de caja libre a 4,088.33 16,970.11 5,966.41 36,768.48 49,885.59

empresa

Flujo libre de caja a 15,498.00 14,487.00 16,719.00 15,638.00 17,709.00 18,526.00 19,575.00 39,471.00

capital

Flujo libre de caja por 0.92 1.42 3.45 3.85 1.25 -0.61 8.43 11.57

acción

Precio a flujo de caja 84.87 63.70 24.28 17.71 55.64 7.26 9.37

libre

Flujo de caja a 1.88 2.82 1.53 1.73 2.07 2.09 1.12

beneficio neto

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 16

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

Rentabilidad

Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual/Ú12M Estimación:2022 A Estimación:2023 A

Plazo termina 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-6-30 2022-12-31 2023-12-31

Renta

Retorno sobre el 9.36 4.64 11.10 10.98 7.48 -12.87 14.15 23.19 29.05 20.42

capital común

Retorno en activos 4.71 2.35 5.81 6.00 4.05 -6.45 6.86 11.05 15.14 10.38

Retorno de capital: 7.89 4.01 8.93 9.28 6.31 -9.14 10.45 17.90

Retorno de capital 4.38 2.02 6.44 5.69 3.41 -8.78 7.05 13.75

invertido

Márgenes

Margen bruto 10.94 6.58 11.07 12.55 9.95 -10.08 12.52 15.42

Margen EBITDA 13.06 11.59 13.48 14.17 12.51 9.47 16.40 18.99

Margen operacional 5.44 0.47 5.09 7.46 4.51 -17.17 8.40 12.18 19.55 17.64

Margen operacional -16.57 -33.02 30.49 20.78 -39.19 -54.78 54.92 35.19

gradual

Margen antes de 9.28 3.97 7.87 11.08 7.85 -16.17 11.29 22.41

impuestos

Margen ingreso antes 6.99 4.17 8.37 7.67 5.78 -13.02 8.53 16.69

de PE

Margen beneficio neto 6.82 3.91 8.31 7.46 5.61 -12.57 8.33 11.06 13.17 10.95

Beneficio neto a 6.82 3.91 8.31 7.46 5.61 -12.57 8.33 16.04

margen común

Adicional

Tasa impositiva 24.65 30.80 26.34 24.45 25.50

efectiva

Ratio de pago de 74.86 158.84 65.96 66.21 103.51 65.75 20.88 27.71 35.21

dividendos

Tasa de crecimiento 2.35 -2.73 3.78 3.71 -0.26 4.85 18.35

sostenible

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 17

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

Crec

Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual Estimación:2022 A Estimación:2023 A

Plazo termina 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-10-27 2022-12-31 2023-12-31

Crec 1año

Ingreso -35.08 -15.28 18.21 17.78 -8.50 -30.13 54.95 68.73 43.46 -4.83

EBITDA -39.80 -24.85 37.53 23.83 -19.25 -47.10 168.39 159.03

Ingreso operativo -62.20 -92.73 1,189.96 72.59 -44.67 334.92

Ingreso neto a común -50.34 -51.46 151.40 5.73 -31.19 280.60

BPA diluidos -49.34 -51.17 146.28 5.40 -31.15 282.73

BPA diluidos antes de -49.34 -51.17 146.28 5.40 -31.15 282.73

PE

BPA diluidos antes de -48.07 -38.38 49.02 37.18 -49.21 276.43

anormales

Dividendo por acción 6.67 3.47 2.68 5.56 6.19 1.46 0.29 1.15

Cuentas por cobrar -29.04 7.64 19.65 -3.50 9.17 -23.68 57.34 68.41

Inventario -2.60 -7.17 12.68 11.57 -2.27 1.74 -0.37 22.36

Activos fijos -0.42 -2.93 3.44 -2.19 5.08 -10.02 -4.71 -6.21

Activo total -3.64 -1.91 5.56 -0.72 4.74 -8.23 1.86 9.04

Fondo de maniobra -6.98 3.47 11.86 8.18 -7.95 5.44 11.89 -92.28

modificado

Fondo de maniobra 3.16 45.20 -70.96 13.84 -52.07 17.70

Empleados -2.39 -3.27 -2.11 2.01 5.49 -3.87 -12.50

Cuentas por pagar -28.52 -1.51 21.91 -2.94 17.24 -29.14 52.14

Deuda a corto plazo 7.41 -26.29 29.65 -3.75 26.34 -0.80 -73.89 -51.83

Deuda total 32.85 10.53 -1.00 -10.72 39.24 38.34 -27.34 -22.65

Patrimonio total -2.35 -1.69 11.89 2.07 0.21 -17.50 7.04 11.45

Capital 2.53 0.51 9.35 -0.22 6.45 -5.82 -3.53 2.31

Valor contable por -1.00 -1.85 9.76 2.24 0.00 -17.98 7.12 13.59

acción

Efectivo de -32.74 -27.23 36.16 19.78 -17.49 -50.64 228.12 106.87

operaciones

Gastos de capital -19.61 -38.98 -4.71 27.09 24.46 -29.06 -30.12 39.68

Cambio neto en -3,153.57 94.73 -900.00 71.88 2,612.77 91.22

efectivo

Flujo de caja libre -68.32 53.58 147.74 12.11 -67.43 133.61

Flujo de caja a la -32.50 -17.01 104.29

empresa

Flujo de caja libre a la -66.90 -64.84 129.31

empresa

Crec 5años

Ingreso -7.06 -14.28 -10.76 -6.47 -6.87 -5.49 6.64 14.71

EBITDA -10.84 -19.72 -13.44 -7.19 -9.06 -11.38 14.32 29.48

Ingreso operativo -20.32 -55.58 -24.70 -12.36 -19.49 90.09 55.71

Ingreso neto a común -11.92 -28.19 -15.17 -8.55 -15.11 24.06 39.74

BPA diluidos -9.15 -25.91 -13.75 -7.91 -15.06 23.45 40.10

BPA diluidos antes de -9.15 -25.91 -13.75 -7.91 -15.06 23.45 40.10

PE

BPA diluidos antes de -8.99 -22.14 -14.91 -7.74 -19.78 17.18 39.63

anormales

Dividendo por acción 10.60 10.00 7.02 5.60 4.90 3.86 3.21 2.71

Cuentas por cobrar -9.25 -11.15 -6.06 -5.72 -0.76 0.70 8.64 17.69

Inventario 4.60 0.07 3.16 3.28 2.13 3.02 4.49 9.03

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 18

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual Estimación:2022 A Estimación:2023 A

Plazo termina 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-10-27 2022-12-31 2023-12-31

Activos fijos 4.75 2.61 2.17 0.28 0.55 -1.47 -1.83 -3.73

Activo total 2.17 -0.04 0.88 -0.04 0.74 -0.24 0.52 1.40

Fondo de maniobra 4.50 -1.06 5.82 4.23 1.40 3.98 5.62 -36.80

modificado

Empleados -2.54 -2.84 -1.98 -1.09 -0.11 -0.41 -2.39

Cuentas por pagar -10.10 -12.12 -8.47 -7.39 -0.47 -0.64 8.38

Deuda a corto plazo 46.43 12.39 37.46 1.77 4.53 2.89 -16.40 -15.58

Deuda total 20.84 20.21 29.60 10.74 12.56 13.48 4.35 2.26

Patrimonio total 2.98 1.58 2.53 1.92 1.90 -1.48 0.21 -0.14

Fondo de maniobra 5.14 4.03 5.27 3.07 3.66 1.91 1.08 0.32

crecimiento 5 años

Valor contable por 6.86 4.34 3.74 2.43 1.75 -2.01 -0.28 0.12

acción

Efectivo de -8.92 -16.79 -11.75 -4.32 -8.01 -13.53 16.86 23.51

operaciones

Flujo de caja libre -29.12 -24.65 -7.71 7.89 -15.13 43.53

Flujo de caja a la -8.84 23.25

empresa

Flujo de caja libre a la -28.38

empresa

Crec secuencial

Ingreso -35.08 -15.28 18.21 17.78 -8.50 -30.13 54.95 26.82

EBITDA -39.80 -24.85 37.53 23.83 -19.25 -47.10 168.39 69.32

Ingreso operativo -62.20 -92.73 1,189.96 72.59 -44.67 -365.83 246.45

Ingreso neto a común -50.34 -51.46 151.40 5.73 -31.19 -256.49 225.73

BPA diluidos -49.34 -51.17 146.28 5.40 -31.15 -256.25 228.91

BPA diluidos antes de -49.34 -51.17 146.28 5.40 -31.15 -256.25 228.91

PE

BPA diluidos antes de -48.07 -38.38 49.02 37.18 -49.21 -119.22 100.36

anormales

Dividendo por acción 6.67 3.47 2.68 5.56 6.19 1.46 0.29 0.00

Cuentas por cobrar -29.04 7.64 19.65 -3.50 9.17 -23.68 57.34 14.05

Inventario -2.60 -7.17 12.68 11.57 -2.27 1.74 -0.37 6.35

Activos fijos -0.42 -2.93 3.44 -2.19 5.08 -10.02 -4.71 -1.70

Activo total -3.64 -1.91 5.56 -0.72 4.74 -8.23 1.86 3.67

Fondo de maniobra -6.98 3.47 11.86 8.18 -7.95 5.44 11.89 -94.26

modificado

Fondo de maniobra 151.21

Empleados -2.39 -3.27 -2.11 2.01 5.49 -3.87 -12.50

Cuentas por pagar -28.52 -1.51 21.91 -2.94 17.24 -29.14 52.14

Deuda a corto plazo 7.41 -26.29 29.65 -3.75 26.34 -0.80 -73.89 50.78

Deuda total 32.85 10.53 -1.00 -10.72 39.24 38.34 -27.34 -1.38

Patrimonio total -2.35 -1.69 11.89 2.07 0.21 -17.50 7.04 4.52

Capital 2.53 0.51 9.35 -0.22 6.45 -5.82 -3.53 3.27

Valor contable por -1.00 -1.85 9.76 2.24 0.00 -17.98 7.12 5.92

acción

Efectivo de -32.74 -27.23 36.16 19.78 -17.49 -50.64 228.12 34.99

operaciones

Gastos de capital -19.61 -38.98 -4.71 27.09 24.46 -29.06 -30.12 -1.89

Cambio neto en 2,612.77 91.22 82.28

efectivo

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 19

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual Estimación:2022 A Estimación:2023 A

Plazo termina 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-10-27 2022-12-31 2023-12-31

Flujo de caja libre -68.32 53.58 147.74 12.11 -67.43 -148.81 48.26

Flujo de caja a la -32.50 -17.01 34.82

empresa

Flujo de caja libre a la -66.90 -64.84 47.87

empresa

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 20

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

Crédito

Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual/Ú12M Estimación:2022 A Estimación:2023 A

Plazo termina 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-6-30 2022-12-31 2023-12-31

IFRS 16/ASC 842 No No No No Sí Sí Sí Sí

Adoption

Deuda total 38,687.00 42,762.00 42,336.00 37,796.00 52,628.00 72,806.00 52,898.00 46,883.00

Deuda a corto plazo 18,762.00 13,830.00 17,930.00 17,258.00 21,804.00 21,630.00 5,647.00 7,367.00

Largo plazo 19,925.00 28,932.00 24,406.00 20,538.00 30,824.00 51,176.00 47,251.00 39,516.00

Deuda/EBITDA 1.25 1.84 1.32 0.95 1.65 4.31 1.17 0.70 0.52 0.60

Deuda neta/EBITDA 1.13 1.68 1.22 0.88 1.55 4.05 1.02 0.42 0.13 0.02

Deuda total/EBIT 3.00 45.69 3.51 1.81 4.49 2.27 1.09

Deuda neta/EBIT 2.72 41.78 3.24 1.67 4.23 1.97 0.65

EBITDA a gasto de 99.46 51.31 53.19 51.68 38.51 14.60 47.92 129.70

interés

EBITDA-CapEx/ 5.60 6.10 12.27 14.11 4.87 -0.20 18.60 109.92

Intereses

EBIT a intereses 41.42 2.07 20.09 27.20 13.89 -26.47 24.53 106.76

EBITDA/Interés 52.78 28.42 28.24 41.45 24.76 11.65 30.79 107.53

pagado

EBITDA-CapEx/Interés 7.58 8.66 14.63 20.95 5.89 -0.26 22.60 91.13

pagado

EBIT/Interés pagado 21.98 1.14 10.67 21.82 8.93 -21.13 15.76 88.51

Interés pagado en 586.00 818.00 1,132.00 955.00 1,291.00 1,451.00 1,474.00 1,435.00

efectivo

Gastos de intereses 311.00 453.00 601.00 766.00 830.00 1,158.00 947.00 817.00

Capital social/Activos 50.72 50.66 53.83 55.40 52.85 47.23 49.74 48.21

totales

Deuda a largo plazo/ 11.27 16.64 12.55 10.35 15.49 31.18 26.90 21.42

Capital

Deuda a largo plazo/ 9.25 13.36 10.31 8.69 12.25 21.60 20.67 17.85

Capital

Deuda a largo plazo/ 5.92 8.76 7.00 5.93 8.50 15.38 13.94 12.04

activos totales

Deuda/Capital 21.88 24.60 21.77 19.04 26.45 44.36 30.11 25.41

Deuda/Capital 17.95 19.74 17.88 15.99 20.92 30.73 23.14 20.26

Deuda total/Activos 11.49 12.95 12.14 10.92 14.51 21.88 15.61 12.75

totales

Deuda neta/acción 19.79 22.50 20.13 17.51 24.90 41.70 26.24 15.19

Deuda neta/capital 16.52 18.36 16.76 14.90 19.94 29.43 20.78 13.18

EBITDA 30,931.00 23,244.00 31,967.00 39,584.00 31,963.00 16,909.00 45,382.00 66,890.00 102,211.44 88,187.10

EBITDA-CapEx 4,441.00 7,081.00 16,565.00 20,010.00 7,602.00 -373.00 33,306.00 52,213.00

EBIT 12,883.00 936.00 12,074.00 20,839.00 11,531.00 -30,653.00 23,233.00 42,905.00 80,128.73 68,809.75

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 21

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

Crédito ex arrend oper

Original:2013 A Original:2014 A Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual/Ú12M

Plazo termina 2013-12-31 2014-12-31 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-6-30

IFRS 16/ASC 842 No No No No No No Sí Sí Sí Sí

Adoption

Deuda total 22,699.00 29,121.00 38,687.00 42,762.00 42,336.00 37,796.00 46,935.00 67,644.00 47,708.00 46,883.00

Deuda a corto plazo 15,808.00 17,468.00 18,762.00 13,830.00 17,930.00 17,258.00 20,593.00 20,462.00 4,280.00 7,367.00

Largo plazo 6,891.00 11,653.00 19,925.00 28,932.00 24,406.00 20,538.00 26,342.00 47,182.00 43,428.00 39,516.00

Deuda/EBITDA 0.39 0.57 1.25 1.84 1.32 0.95 1.54 4.41 1.09 0.70

Deuda neta/EBITDA 0.31 0.48 1.13 1.68 1.22 0.88 1.44 4.12 0.93 0.42

Deuda total/EBIT 0.56 0.85 3.00 45.69 3.51 1.81 4.07 2.05 1.09

Deuda neta/EBIT 0.45 0.72 2.72 41.78 3.24 1.67 3.80 1.76 0.65

EBITDA a gasto de 6,387.00 179.65 99.46 51.31 53.19 51.68 36.78 13.26 46.29 129.70

intereses

EBITDA-CapEx/ 74.89 29.25 5.60 6.10 12.27 14.11 4.12 -0.90 17.90 109.92

Intereses

EBIT a intereses 4,477.89 119.17 41.42 2.07 20.09 27.20 13.89 -26.47 24.53 106.76

EBITDA/Interés 134.94 135.21 52.78 28.42 28.24 41.45 23.65 10.58 29.74 107.53

pagado

EBITDA-CapEx/Interés 55.90 48.49 7.58 8.66 14.63 20.95 4.98 -1.13 21.75 91.13

pagado

EBIT/Interés pagado 94.60 89.69 21.98 1.14 10.67 21.82 8.93 -21.13 15.76 88.51

Interés pagado en 426.00 380.00 586.00 818.00 1,132.00 955.00 1,291.00 1,451.00 1,474.00 1,435.00

efectivo

Gastos de intereses 9.00 286.00 311.00 453.00 601.00 766.00 830.00 1,158.00 947.00 817.00

Capital social/Activos 50.17 49.90 50.72 50.66 53.83 55.40 53.84 48.11 50.65 48.21

totales

Deuda a largo plazo/ 3.82 6.44 11.27 16.64 12.55 10.35 13.24 28.75 24.72 21.42

Capital

Deuda a largo plazo/ 3.39 5.54 9.25 13.36 10.31 8.69 10.71 20.36 19.44 17.08

Capital

Deuda a largo plazo/ 1.99 3.33 5.92 8.76 7.00 5.93 7.40 14.44 13.05 10.74

activos totales

Deuda/Capital 12.58 16.08 21.88 24.60 21.77 19.04 23.59 41.21 27.16 25.41

Deuda/Capital 11.17 13.85 17.95 19.74 17.88 15.99 19.09 29.19 21.36 20.26

Deuda total/Activos 6.55 8.33 11.49 12.95 12.14 10.92 13.19 20.71 14.33 12.75

totales

Deuda neta/acción 10.00 13.53 19.79 22.50 20.13 17.51 22.04 38.55 23.28 15.19

Deuda neta/capital 9.09 11.92 16.52 18.36 16.76 14.90 18.06 27.83 18.89 13.18

EBITDA 57,483.00 51,379.00 30,931.00 23,244.00 31,967.00 39,584.00 30,529.00 15,356.00 43,840.00 66,890.00

EBITDA-CapEx 23,814.00 18,427.00 4,441.00 7,081.00 16,565.00 20,010.00 6,426.00 -1,643.00 32,055.00 52,213.00

EBIT 40,301.00 34,082.00 12,883.00 936.00 12,074.00 20,839.00 11,531.00 -30,653.00 23,233.00 42,905.00

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 10/27/2022 13:57:13 22

Análisis de informe financiero

Ticker: XOM US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Exxon Mobil Corp

Registro: Más reciente

Liquidez

Original:2013 A Original:2014 A Original:2015 A Restated:2016 A Restated:2017 A Original:2018 A Original:2019 A Original:2020 A Original:2021 A Actual

Plazo termina 2013-12-31 2014-12-31 2015-12-31 2016-12-31 2017-12-31 2018-12-31 2019-12-31 2020-12-31 2021-12-31 2022-10-27

Ratio de efectivo 0.06 0.07 0.07 0.08 0.05 0.05 0.05 0.08 0.12 0.24

Ratio corriente 0.83 0.82 0.79 0.87 0.82 0.84 0.78 0.80 1.04 1.16

Ratio rápido 0.53 0.50 0.44 0.53 0.50 0.49 0.47 0.44 0.69 0.84

CFO/Pas corr prom 0.66 0.66 0.51 0.43 0.57 0.63 0.49 0.24 0.85 0.90

Capital social/Activos 50.17 49.90 50.72 50.66 53.83 55.40 52.85 47.23 49.74 48.21

totales

Deuda a largo plazo/ 3.82 6.44 11.27 16.64 12.55 10.35 15.49 31.18 26.90 21.42

Capital

Deuda a largo plazo/ 3.39 5.54 9.25 13.36 10.31 8.69 12.25 21.60 20.67 17.85

Capital

Deuda a largo plazo/ 1.99 3.33 5.92 8.76 7.00 5.93 8.50 15.38 13.94 12.04

activos totales

Deuda/Capital 12.58 16.08 21.88 24.60 21.77 19.04 26.45 44.36 30.11 25.41

Deuda/Capital 11.17 13.85 17.95 19.74 17.88 15.99 20.92 30.73 23.14 20.26

Deuda total/Activos 6.55 8.33 11.49 12.95 12.14 10.92 14.51 21.88 15.61 12.75

totales

CFO/Pasivo 27.01 26.79 18.97 14.11 19.50 24.39 18.16 8.70 29.48 34.90

CFO/CapEx 1.33 1.37 1.15 1.37 1.95 1.84 1.22 0.85 3.99 5.20

Puntuación Z de 4.62 4.36 3.72 3.76 3.80 3.85 3.47 2.43 3.62 4.12

Altman

Línea de crédito total 5,900.00 6,300.00 6,000.00 5,500.00 5,400.00 5,300.00 7,900.00 11,300.00 10,700.00

Línea de crédito 5,400.00 5,800.00 6,000.00 5,500.00 5,400.00 5,300.00 7,900.00 11,300.00 10,700.00

disponible total

Líneas de crédito 500.00 500.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

retirado

Papel comercial 14,051.00 16,225.00 17,973.00 10,727.00 13,049.00 12,863.00 18,561.00 17,306.00 1,608.00