Professional Documents

Culture Documents

Latihan ASDOS AKL P13-17 Dellya Utami Putri

Latihan ASDOS AKL P13-17 Dellya Utami Putri

Uploaded by

Dellya PutriCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Latihan ASDOS AKL P13-17 Dellya Utami Putri

Latihan ASDOS AKL P13-17 Dellya Utami Putri

Uploaded by

Dellya PutriCopyright:

Available Formats

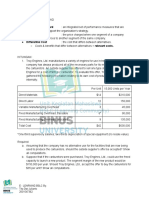

Evaluating Foreign Operations

For many years, Clark Company operated exclusively in the United States but recently

expanded its operations to the Pacific Rim countries of Indonesia, Singapore, and Australia.

After a modest beginning in these countries, recent successes have resulted in an increased

level of operation in each country. Operating information (in thousands of U.S. dollars) for the

company’s domestic and foreign operations follows.

New Zealand Indonesia Singapore Australia

Sales to $3,000 $520 $ 80 $220

unaffiliated

Interarea sales 200 30

Operating 2,520 300 90 60

expenses

Long-lived 3,200 380 240 100

assets

In addition, common costs of $150,000 are to be allocated to operations on the basis of the ratio

of an area’s sales to nonaffiliates to total company sales to nonaffiliates.

Required

a. Determine the profit or loss for each geographic segment.

b. Determine which, if any, of the three individual foreign geographic segments is separately

reportable using a 10 percent materiality threshold.

Answer

a. Profit or loss for each geographic area:

New Zealend Indonesia Singapore Australia

Sales to $3,000 $520 $80 $220

unaffiliated

Interarea sales 200 __ 30

Total revenues $3,200 $520 $110 $220

Operating 2,520 300 90 60

expenses

Allocated costs 117,8 a 20,41 3,14 8,63

Operating profit $ 562,2 $ 199,59 $ 16.86 $ 151.37

(loss)

a

$117.8 = ($3000 sales to unaffiliated / $3,820 total sales to unaffiliated) x $150

common costs to be allocated

b. The company must report the following, unless it is impracticable to do so:

a. Revenues from external customers attributed to (1) the company’s

home country of domicile and (2) the total revenue attributed to all foreign

countries in which the enterprise generates revenues. If revenues from

external customers generated in an individual country are material, then the

revenues for that country shall be separately disclosed.

b. Long-lived productive assets (1) located in the entity’s home country

of domicile and (2) the total assets located in all foreign countries in which the

entity holds assets. If assets in an individual foreign country are material, then

the amounts of assets held in that specific country shall be disclosed

separately.

Total foreign sales to unaffiliates = $ 820 = 31.46%

Consolidated sales to unaffiliates $3,820

Total foreign assets = $ 820 = 20.91%

Total long-lived assets $3.920

Revenues and long-lived assets for domestic and total foreign operations must be

disclosed.

You might also like

- Case Pet Well ClinicDocument16 pagesCase Pet Well Clinicv5jssftpwtNo ratings yet

- Jay Tesla: ExplanationDocument9 pagesJay Tesla: ExplanationJonathan Cheung100% (1)

- Solution Manual For Fundamental Financial Accounting Concepts 7th Edition by EdmondsDocument9 pagesSolution Manual For Fundamental Financial Accounting Concepts 7th Edition by EdmondsDiane Jones100% (27)

- Chapter 9. CH 09-10 Build A Model: Growth SalesDocument6 pagesChapter 9. CH 09-10 Build A Model: Growth SalesMatt SlowickNo ratings yet

- P4Document21 pagesP4nancy tomanda100% (2)

- More Sample Exam Questions-Midterm2Document6 pagesMore Sample Exam Questions-Midterm2mehdiNo ratings yet

- Responsibility Accounting ExcisesDocument7 pagesResponsibility Accounting ExcisesRoy Mitz Aggabao Bautista V100% (1)

- 10408065Document4 pages10408065Joel Christian MascariñaNo ratings yet

- ACCT4110 Advanced Accounting PRACTICE Exam 2 KEY v2Document14 pagesACCT4110 Advanced Accounting PRACTICE Exam 2 KEY v2accounts 3 lifeNo ratings yet

- Garlington Technologies IncDocument2 pagesGarlington Technologies IncRamarayo MotorNo ratings yet

- Foreclosure and Forcible Detainer Issues Brewer v. Bank of America, Fla. 17th Circuit 11004756Document55 pagesForeclosure and Forcible Detainer Issues Brewer v. Bank of America, Fla. 17th Circuit 11004756Roger Ross100% (6)

- Whatsapp Ar. DetailDocument15 pagesWhatsapp Ar. DetailSachin Kampani100% (1)

- Add Maths Sebenar SPM 2005Document26 pagesAdd Maths Sebenar SPM 2005zulkefliarof100% (13)

- IT448 - Mobile AppDocument31 pagesIT448 - Mobile AppKhulood AlhamedNo ratings yet

- Chapter 12 ProblemsDocument40 pagesChapter 12 ProblemsInciaNo ratings yet

- Lucky Carrot : Show Transcribed Image TextDocument2 pagesLucky Carrot : Show Transcribed Image TextAchmad RizalNo ratings yet

- Cases ChapterDocument15 pagesCases Chaptermariam.ahmed03No ratings yet

- Seminar 4 Set Work SolutionsDocument5 pagesSeminar 4 Set Work SolutionsStephanie XieNo ratings yet

- Tut 05 SolnDocument4 pagesTut 05 Soln张婧姝No ratings yet

- Comprehensive Income Statement ExampleDocument1 pageComprehensive Income Statement ExampleAdil AliNo ratings yet

- XLSXDocument10 pagesXLSXezar zacharyNo ratings yet

- Question 1-1-1Document14 pagesQuestion 1-1-1Aqsa AnumNo ratings yet

- Febbinia Dwigna P - Week7 AKL 1Document5 pagesFebbinia Dwigna P - Week7 AKL 1febbiniaNo ratings yet

- Advanced AccountingDocument4 pagesAdvanced AccountingJulyaniNo ratings yet

- CH 4Document21 pagesCH 4JAPNo ratings yet

- MIDTERM EXAM - Mahardika Ayunda C1I019034 AKMDocument12 pagesMIDTERM EXAM - Mahardika Ayunda C1I019034 AKMMahardika AyundaNo ratings yet

- DokdokDocument10 pagesDokdokhadistiNo ratings yet

- Tutorial Chap 5Document2 pagesTutorial Chap 5lawjieyinNo ratings yet

- Fin2001 Pset2Document3 pagesFin2001 Pset2Valeria MartinezNo ratings yet

- Quiz 2 Am c1 - 20 FebDocument8 pagesQuiz 2 Am c1 - 20 FebJonathan ChandraNo ratings yet

- True FalseDocument2 pagesTrue FalseCarlo ParasNo ratings yet

- Strategic Cost Management Practical Applications DagpilanDocument6 pagesStrategic Cost Management Practical Applications Dagpilancarol indanganNo ratings yet

- Chapter 11Document8 pagesChapter 11yousufmeahNo ratings yet

- Solution Aassignments CH 12Document7 pagesSolution Aassignments CH 12RuturajPatilNo ratings yet

- Practice Exam 3Document7 pagesPractice Exam 3AndresNo ratings yet

- Manajemen Keuangan Kelompok CaiaDocument6 pagesManajemen Keuangan Kelompok CaiaintandewiNo ratings yet

- New Microsoft Office Word DocumentDocument3 pagesNew Microsoft Office Word DocumentrupokNo ratings yet

- Final RequirementDocument18 pagesFinal RequirementZandra GonzalesNo ratings yet

- Diskusi After UTS - 5I - Mutia Maulida - 2102015028 - Consolidation With Loss On Intercompany SaleDocument6 pagesDiskusi After UTS - 5I - Mutia Maulida - 2102015028 - Consolidation With Loss On Intercompany SaleNova AnggrainiNo ratings yet

- Chapter 8Document6 pagesChapter 8ديـنـا عادلNo ratings yet

- BCG Forage Core Strategy - Telco (Task 2 Additional Data)Document13 pagesBCG Forage Core Strategy - Telco (Task 2 Additional Data)Ramakrishna MaityNo ratings yet

- A. Calculate The Break-Even Dollar Sales For The MonthDocument25 pagesA. Calculate The Break-Even Dollar Sales For The MonthPriyankaNo ratings yet

- Exercises AllDocument9 pagesExercises AllLede Ann Calipus YapNo ratings yet

- E5-1B (Similar To E5-6) (LO 3) Preparing and Interpreting A Classified Balance Sheet With Discussion of Terminology (Challenging)Document4 pagesE5-1B (Similar To E5-6) (LO 3) Preparing and Interpreting A Classified Balance Sheet With Discussion of Terminology (Challenging)Muostapha FikryNo ratings yet

- 4 1 Question - 1Document7 pages4 1 Question - 1McAndah JoeNo ratings yet

- Pilihan Ganda Exercise: Use The Following Information in Answering Questions 2 and 3Document9 pagesPilihan Ganda Exercise: Use The Following Information in Answering Questions 2 and 3Desi AprilianiNo ratings yet

- Managerial Accounting - 1Document4 pagesManagerial Accounting - 1Layla AfidatiNo ratings yet

- Entry GDocument2 pagesEntry GMcKenzie WNo ratings yet

- Financial Statements, Cash Flow AnalysisDocument41 pagesFinancial Statements, Cash Flow AnalysisMinhaz Ahmed0% (1)

- BCG Forage Core Strategy - Telco (Task 2 Additional Data)Document11 pagesBCG Forage Core Strategy - Telco (Task 2 Additional Data)Akshay rajNo ratings yet

- Afrah Azzahira Wismono - 008202000053 - Assignment Week 14Document6 pagesAfrah Azzahira Wismono - 008202000053 - Assignment Week 14Afrah AzzahiraNo ratings yet

- Homework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Document3 pagesHomework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Caroline OktavianiNo ratings yet

- Heriot-Watt University Accounting - December 2016 Section II Case Studies Case Study 1Document6 pagesHeriot-Watt University Accounting - December 2016 Section II Case Studies Case Study 1sanosyNo ratings yet

- AKL 2 - Tugas 1Document14 pagesAKL 2 - Tugas 1Marselinus Aditya Hartanto TjungadiNo ratings yet

- Managerial Accounting PDFDocument8 pagesManagerial Accounting PDFMeryana DjapNo ratings yet

- Your Answers To 2 Decimal Places.) : Profit Margin Ratio Company Choose N/ Choose D / Barco / KyanDocument6 pagesYour Answers To 2 Decimal Places.) : Profit Margin Ratio Company Choose N/ Choose D / Barco / Kyanmohitgaba19No ratings yet

- Fixed Costs $15,000 Variable Costs $8,627: Sales Revenue $29,502Document3 pagesFixed Costs $15,000 Variable Costs $8,627: Sales Revenue $29,502Umair KamranNo ratings yet

- Garrison 17e GEs PPT Chapter 6Document19 pagesGarrison 17e GEs PPT Chapter 6Jawad ahmadNo ratings yet

- Acct 3503 Test 2 Format, Instuctions and Review Section A FridayDocument22 pagesAcct 3503 Test 2 Format, Instuctions and Review Section A Fridayyahye ahmedNo ratings yet

- Materi Lab 5 - Consolidated Techniques and ProceduresDocument7 pagesMateri Lab 5 - Consolidated Techniques and ProceduresrahayuNo ratings yet

- Lecture 2 PDFDocument62 pagesLecture 2 PDFsyingNo ratings yet

- B02037 - Ex - Financial AnalysisDocument6 pagesB02037 - Ex - Financial AnalysisNguyen Minh QuanNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Levinas, Otherwise Than BeingDocument23 pagesLevinas, Otherwise Than BeingElikaRafiNo ratings yet

- HCP9982 Battery Sensor Bypass Device: Installation Instruction SheetDocument4 pagesHCP9982 Battery Sensor Bypass Device: Installation Instruction SheetWaltteri LehtinenNo ratings yet

- Fraud TriangleDocument23 pagesFraud TriangleFarhan Farook Abdulla0% (1)

- Graphic Organizer Ep12 PDFDocument1 pageGraphic Organizer Ep12 PDFLyka FigerNo ratings yet

- Inglish GramarDocument69 pagesInglish GramarRaju100% (3)

- Dowry: HistoryDocument12 pagesDowry: HistorysarayooNo ratings yet

- Synthesis Paper: Submitted By: Jeric Cataag Boctuanon Submitted To: Wendell A. AlferezDocument4 pagesSynthesis Paper: Submitted By: Jeric Cataag Boctuanon Submitted To: Wendell A. AlferezMarie Fe EgarNo ratings yet

- Digitization DigitalizationDocument1 pageDigitization Digitalizationace espinosaNo ratings yet

- Mod 6 Fuels and CombustionDocument58 pagesMod 6 Fuels and CombustionVarsha VarmaNo ratings yet

- Minutes of English Panel MeetingDocument3 pagesMinutes of English Panel MeetingMichelle DuncanNo ratings yet

- Module 1 Pre-Finals, Chapter 4 - Basic Features of Microsoft WordDocument16 pagesModule 1 Pre-Finals, Chapter 4 - Basic Features of Microsoft WordCherry Ann Singh EnateNo ratings yet

- Basan V PeopleDocument1 pageBasan V PeopleLotsee ElauriaNo ratings yet

- Chapter ResearchDocument50 pagesChapter ResearchChekka Hiso GuevarraNo ratings yet

- Astha SiddhiDocument2 pagesAstha SiddhiSadernNo ratings yet

- Rakesh SharmaDocument2 pagesRakesh SharmaKarandeep Singh CheemaNo ratings yet

- ElectricalDocument43 pagesElectricalryanNo ratings yet

- Calculus of Inductive ConstructionsDocument18 pagesCalculus of Inductive ConstructionshandsomelogNo ratings yet

- My Dream VacationDocument4 pagesMy Dream VacationMarcela Lm LmNo ratings yet

- Aiatsl: (Wholly Owned Subsidiary of Air India Limited)Document1 pageAiatsl: (Wholly Owned Subsidiary of Air India Limited)Ashna anilkumar pNo ratings yet

- CNN E: Learning Convolutional Neural Networks With Interactive VisualizationDocument11 pagesCNN E: Learning Convolutional Neural Networks With Interactive VisualizationSanjeebNo ratings yet

- Former Bhs Students' Federal Lawsuit Against AisdDocument38 pagesFormer Bhs Students' Federal Lawsuit Against AisdAnonymous Pb39klJNo ratings yet

- Rca (Pearl) Tc1102a Mp3 Player ManualDocument22 pagesRca (Pearl) Tc1102a Mp3 Player ManualSedivy CestovatelNo ratings yet

- WRITING UNIT 6 Health-Giving-Advice - Carpio RamiroDocument8 pagesWRITING UNIT 6 Health-Giving-Advice - Carpio RamiroRamhiroCarphioNo ratings yet

- The English Long BowDocument6 pagesThe English Long BowBruno BarbosaNo ratings yet

- ABCDE Bundle ICU - FadilDocument26 pagesABCDE Bundle ICU - Fadilfadil85No ratings yet