Professional Documents

Culture Documents

New IB BM Book (Dragged)

Uploaded by

celinejaalouk0 ratings0% found this document useful (0 votes)

4 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageNew IB BM Book (Dragged)

Uploaded by

celinejaaloukCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

350977_3.9_Bus Man IBDP_362-374.

indd Page 362 10/02/22 6:05 PM elhiddn /146/HO02478/work/indd

3.9 Budgets (HL only)

Conceptual understandings

Change in the business structure can impact a business’s financial resources.

Creativity in financial reporting can have diverse impacts in a business.

Ethical financial and accounting practices can be a form of sustainable business

behaviour.

SYLLABUS CONTENT

By the end of the chapter, you should be able to understand:

the difference between cost and profit centres (AO2)

the roles of cost and profit centres (AO2)

constructing a budget (AO2, AO4)

variances (AO2, AO4)

the importance of budgets and variances in decision-making (AO2).

The difference between cost

and profit centres (AO2)

In many ways cost centres and profits centres are similar. They both relate to aspects of a

business’s operation for which it is possible to calculate important cost and revenue figures. In A cost centre is a

spite of this, there is a distinct difference. distinct part (perhaps a

division or department) of

For a cost centre it is possible to calculate the associated costs. Thus, the finance department a business for which costs

or the department providing IT services to a business could be cost centres. For these areas it is can be calculated.

straightforward to calculate costs such as wages and salaries, heating and lighting. However, it A profit centre is

is impossible to calculate the revenues earned by areas of the business such as the finance or IT similar to a cost centre,

and is a part of a business

department as they do not charge separately for their services.

for which costs and

Profit centres can calculate both costs and revenues. As an example, Alphabet Inc is an American revenues (and thus profits)

multinational technology company which owns a number of subsidiaries including Google and can be determined.

Fitbit. These subsidiary businesses

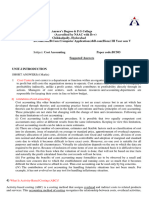

incur costs and earn revenues. For Cost centres Profit centres

these reasons Google and Fitbit

could both be profit centres for Variable costs, e.g. Divide up fixed and variable costs

Divide up fixed costs, as for cost centres

Alphabet Inc. e.g. rent and rates

materials charge to

appropriate areas

There are a number of ways in

which a business can create Compare cost and revenues for

each profit centre

cost or profit centres within its Product, brand or Product, brand or Product, brand or

division A division B division C

organization.

Does each centre meet it profit

1 Some large businesses might Cost centres aim to control costs effectively, to compare the target? How did the performance

operate a number of factories, costs of products or to establish prices of the profit centres compare?

offices or branches. In these Figure 3.9.1 The difference between cost and profit centres

362 Business Management for the IB Diploma

You might also like

- JDE Enterprise Profitability SolutionDocument244 pagesJDE Enterprise Profitability SolutionSanjay GuptaNo ratings yet

- (Trading Ebook) Pristine - Micro Trading For A Living Micro Trading For A Living PDFDocument54 pages(Trading Ebook) Pristine - Micro Trading For A Living Micro Trading For A Living PDFjairojuradoNo ratings yet

- Funds Management - PresentationDocument29 pagesFunds Management - PresentationRakesh100% (1)

- 8 Suggested Answers Pe II Cost Accounting Part IDocument453 pages8 Suggested Answers Pe II Cost Accounting Part IFranc Grošelj80% (5)

- FM PresentationDocument35 pagesFM Presentationprchari1980No ratings yet

- Cost Accounting and Control OutputDocument21 pagesCost Accounting and Control OutputApril Joy Obedoza100% (5)

- Intro S4HANA Using Global Bike Case Study CO-CCA Fiori en v3.3Document39 pagesIntro S4HANA Using Global Bike Case Study CO-CCA Fiori en v3.3Erwin MedinaNo ratings yet

- 21decentralized Operations and Segment ReportingDocument130 pages21decentralized Operations and Segment ReportingAilene QuintoNo ratings yet

- 0108 Futures MagDocument68 pages0108 Futures MagPaul FairleyNo ratings yet

- Basic Principles of HedgingDocument22 pagesBasic Principles of HedgingAleen MukherjeeNo ratings yet

- Case Studies Financial ManagementDocument15 pagesCase Studies Financial ManagementRahul Sharma0% (2)

- Divisional Performance Measures and Transfer Pricing NotesDocument83 pagesDivisional Performance Measures and Transfer Pricing NotesShreya PatelNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- New Syllabus - Budgets (HL Only)Document12 pagesNew Syllabus - Budgets (HL Only)Sonam ThakkarNo ratings yet

- Answers To Univ Qs On Responsibility Centres: Suggested AnswerDocument25 pagesAnswers To Univ Qs On Responsibility Centres: Suggested AnswerRATNo ratings yet

- Cost and Profit CentresDocument2 pagesCost and Profit Centresani003No ratings yet

- Session 11 Transfer Pricing - Rev2Document47 pagesSession 11 Transfer Pricing - Rev2Ahmed MunawarNo ratings yet

- New IB BM Book (Dragged) 4Document1 pageNew IB BM Book (Dragged) 4celinejaaloukNo ratings yet

- Cost-Volume-Profit Relationships: Learning ObjectivesDocument27 pagesCost-Volume-Profit Relationships: Learning ObjectivesChau ToNo ratings yet

- Chapter 06Document10 pagesChapter 06yousufmeahNo ratings yet

- Answers: 高顿财经ACCA acca.gaodun.cnDocument12 pagesAnswers: 高顿财经ACCA acca.gaodun.cnIskandar BudionoNo ratings yet

- Module IV - Cost & Prod. AnalysisDocument20 pagesModule IV - Cost & Prod. AnalysisApoorv BNo ratings yet

- AMAX AutomobilesDocument2 pagesAMAX AutomobilesIshu Rungta تNo ratings yet

- Ch-6 Resposibility AccounyingDocument27 pagesCh-6 Resposibility AccounyingMelat TNo ratings yet

- Cost CentresDocument4 pagesCost CentresSantosh Kumar KondaboinaNo ratings yet

- Cost Accounting Project: Submitted By: Palka Jamwal Year Section A Roll No.-784Document12 pagesCost Accounting Project: Submitted By: Palka Jamwal Year Section A Roll No.-784Ekta AnejaNo ratings yet

- Business Area Vs Profitability SegmentDocument1 pageBusiness Area Vs Profitability SegmentShankar KollaNo ratings yet

- Are Depreciation and Amortization Included in Gross Profit - InvestopediaDocument5 pagesAre Depreciation and Amortization Included in Gross Profit - InvestopediaBob KaneNo ratings yet

- Reporting For Control: Prepared by Shannon Butler, Cpa, Ca Carleton UniversityDocument48 pagesReporting For Control: Prepared by Shannon Butler, Cpa, Ca Carleton UniversityMariela CNo ratings yet

- Chapter 9 To 10Document40 pagesChapter 9 To 10floraNo ratings yet

- Chapter 12Document2 pagesChapter 12Faye GoodwinNo ratings yet

- What Is The Break-Even Point?: Earlier StagesDocument6 pagesWhat Is The Break-Even Point?: Earlier Stagesitachi uchihaNo ratings yet

- A Profit CenterDocument7 pagesA Profit CenterFitria JulitaNo ratings yet

- Case Study Responsibility AccountingDocument6 pagesCase Study Responsibility Accountingmonika thakur100% (1)

- Tugas Bahasa Inggris - Dina Adila Putri & Rio Alvyrani - Doc 1Document10 pagesTugas Bahasa Inggris - Dina Adila Putri & Rio Alvyrani - Doc 1Serlima Anggina7No ratings yet

- ACC - ACF1200 Workbook Topic 9Document8 pagesACC - ACF1200 Workbook Topic 9wesley hudsonNo ratings yet

- Cost ManagmnetDocument5 pagesCost ManagmnetJOYDIP PRODHANNo ratings yet

- Matz Usry Part 3 - 1Document250 pagesMatz Usry Part 3 - 1taha tahaNo ratings yet

- Responsibility Accounting, Investment Centres, and Transfer PricingDocument51 pagesResponsibility Accounting, Investment Centres, and Transfer Pricingstrzelec62No ratings yet

- Cost AccountingDocument38 pagesCost AccountingLuccha RaiNo ratings yet

- Segmented Reporting, Investment Center Evaluation, and Transfer PricingDocument3 pagesSegmented Reporting, Investment Center Evaluation, and Transfer Pricingeskelapamudah enakNo ratings yet

- Mgtp04 - Prelim ReviewerDocument6 pagesMgtp04 - Prelim ReviewerAngel Rose CoralesNo ratings yet

- A Primer On Financial StatementsDocument9 pagesA Primer On Financial StatementsKarol WeberNo ratings yet

- Responsibility AccountingDocument25 pagesResponsibility AccountingAndrew MirandaNo ratings yet

- Background Note 2 - Operating LeverageDocument8 pagesBackground Note 2 - Operating LeverageENS SunNo ratings yet

- 72823cajournal Feb2023 20Document7 pages72823cajournal Feb2023 20S M SHEKARNo ratings yet

- Cost AccountingDocument38 pagesCost AccountingLuccha RaiNo ratings yet

- Logisticmanagement 09Document12 pagesLogisticmanagement 09Budy AriyantoNo ratings yet

- Cost Accounting NotesDocument68 pagesCost Accounting NotesIrene ElipeNo ratings yet

- Intro S4HANA Using Global Bike Case Study CO-CCA en v4.1Document36 pagesIntro S4HANA Using Global Bike Case Study CO-CCA en v4.1jspm3912No ratings yet

- Study Guide For Module No. 6Document5 pagesStudy Guide For Module No. 6ambitchous19No ratings yet

- Cost Accounting and BudgetDocument16 pagesCost Accounting and BudgetCeclie DelfinoNo ratings yet

- Profitability Analysis Vs Profit Center Vs Business AreaDocument2 pagesProfitability Analysis Vs Profit Center Vs Business Areaspetr1No ratings yet

- Cost of ProdDocument2 pagesCost of ProdRoma Fe MabanagNo ratings yet

- Segment Reporting, Decentralization, and The Balanced ScorecardDocument36 pagesSegment Reporting, Decentralization, and The Balanced ScorecardiamnumberfourNo ratings yet

- Profit Centers vs. Business AreasDocument4 pagesProfit Centers vs. Business Areassneel.bw3636No ratings yet

- Costingmaterials and LabourDocument12 pagesCostingmaterials and LabourANISAHMNo ratings yet

- What Is Cost AccountingDocument3 pagesWhat Is Cost AccountingMariwin MacandiliNo ratings yet

- BBBE2053 Tutorial T1 (Answer)Document3 pagesBBBE2053 Tutorial T1 (Answer)Xue Jing LowNo ratings yet

- 74601bos60479 FND cp1 U3Document13 pages74601bos60479 FND cp1 U3kingdksNo ratings yet

- MBA 801: C A C 1: O: OST Ccounting Lass VerviewDocument6 pagesMBA 801: C A C 1: O: OST Ccounting Lass VerviewbabysmeillNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Tok 2Document3 pagesTok 2celinejaaloukNo ratings yet

- New IB BM Book (Dragged) 5Document1 pageNew IB BM Book (Dragged) 5celinejaaloukNo ratings yet

- New IB BM Book (Dragged) 9Document1 pageNew IB BM Book (Dragged) 9celinejaaloukNo ratings yet

- New IB BM Book (Dragged) 7Document1 pageNew IB BM Book (Dragged) 7celinejaaloukNo ratings yet

- New IB BM Book (Dragged) 13Document1 pageNew IB BM Book (Dragged) 13celinejaaloukNo ratings yet

- Voluntary Non-Financial Disclosure and The Cost of Equity Capital: The Case of Corporate Social Responsibility ReportingDocument58 pagesVoluntary Non-Financial Disclosure and The Cost of Equity Capital: The Case of Corporate Social Responsibility ReportingRyan PermanaNo ratings yet

- Chapter 08testing The Purchasing Power Parity TheoryDocument30 pagesChapter 08testing The Purchasing Power Parity Theorybildy100% (1)

- HSL Looking Glass: Retail ResearchDocument4 pagesHSL Looking Glass: Retail ResearchumaganNo ratings yet

- 1-SECP - Saboohi IsrarDocument15 pages1-SECP - Saboohi Israranum naeemNo ratings yet

- Summary, Findings and ConclusionDocument10 pagesSummary, Findings and ConclusionmgajenNo ratings yet

- Auditing 2: Review Exercises - OLDocument7 pagesAuditing 2: Review Exercises - OLVip BigbangNo ratings yet

- 132224994603260076ABFDocument1 page132224994603260076ABFSamuel TobsonNo ratings yet

- Capitalisation AssignmentDocument5 pagesCapitalisation AssignmentFayis FYSNo ratings yet

- Maple Leaf Cement: Horizontal Analysis: Balance SheetDocument9 pagesMaple Leaf Cement: Horizontal Analysis: Balance SheetkilleroffNo ratings yet

- Summer Internship ReportDocument16 pagesSummer Internship ReportRavi MehraNo ratings yet

- ProblemsDocument2 pagesProblemsHuynh Thi Phuong ThuyNo ratings yet

- Advantages and Disadvantages of FIFO MethodDocument2 pagesAdvantages and Disadvantages of FIFO MethodMohammad MHNo ratings yet

- Evaluation of Nippon India Growth FundDocument15 pagesEvaluation of Nippon India Growth FundArunesh KushwahNo ratings yet

- Irins Expert Advisor v1.8 Manual FileDocument6 pagesIrins Expert Advisor v1.8 Manual FileMichael NabuaNo ratings yet

- Chapter 7Document49 pagesChapter 7Dr. Menna KadryNo ratings yet

- Balance Sheet Valuation Methods: Book Value MeasureDocument43 pagesBalance Sheet Valuation Methods: Book Value MeasureodvutNo ratings yet

- Calculating Irr For A Project With Mixed StreamDocument6 pagesCalculating Irr For A Project With Mixed StreamPratibha Jaggan-MartinNo ratings yet

- Bram 2016Document270 pagesBram 2016Frederick SimanjuntakNo ratings yet

- Rate NPV 351,212,178.13 365,660,986.27 290,844,716.89 207,520,203.54 Irr 180% 128% 189% 329%Document1 pageRate NPV 351,212,178.13 365,660,986.27 290,844,716.89 207,520,203.54 Irr 180% 128% 189% 329%pinkieNo ratings yet

- 11 Acc ch1 AnsDocument7 pages11 Acc ch1 AnsAbhijit BharadeNo ratings yet

- f2 AnswersDocument68 pagesf2 AnswersKeotshepile Esrom MputleNo ratings yet

- Growington: (Company Secretary and Compliance Officer) M.No: 57186Document97 pagesGrowington: (Company Secretary and Compliance Officer) M.No: 57186Contra Value BetsNo ratings yet

- Resume 0462 A D3 For Shambhvi JaiswalDocument1 pageResume 0462 A D3 For Shambhvi Jaiswalhevobem530No ratings yet

- I3investor - A Free and Independent Stock Investors PortalDocument3 pagesI3investor - A Free and Independent Stock Investors PortalleekiangyenNo ratings yet

- ABSNet GlossaryDocument37 pagesABSNet Glossaryapi-3778585No ratings yet

- EfficientlyInefficient ExercisesDocument34 pagesEfficientlyInefficient ExerciseswqivvfpwssxhccdznlNo ratings yet