Professional Documents

Culture Documents

EPF Withdrawal Process Guide

Uploaded by

vickymartinsingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EPF Withdrawal Process Guide

Uploaded by

vickymartinsingCopyright:

Available Formats

EPF Withdrawal Process Guide

1. 1. Check Eligibility: Confirm that you meet the criteria for withdrawing from your EPF

account. Common reasons include retirement, unemployment, purchasing a house,

medical emergencies, marriage, education, etc.

2. 2. Gather Required Documents: Depending on your reason for withdrawal, gather

necessary documents like identification proof, bank account details, employment

details, and any specific forms or certifications needed for your withdrawal reason.

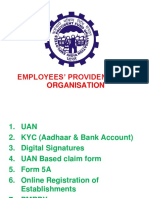

3. 3. UAN and KYC Verification: Make sure your Universal Account Number (UAN) is active

and your KYC (Know Your Customer) details are updated and verified on the EPFO

(Employees' Provident Fund Organisation) portal.

4. 4. Login to EPFO Portal: Access the EPFO portal using your UAN and password. If you

haven't activated your UAN, you need to do it first.

5. 5. Visit Online Claims Section: Navigate to the 'Online Services' tab and select 'Claim

(Form-31, 19, 10C & 10D)' from the drop-down menu.

6. 6. Enter Details for the Claim: Fill in the required details in the claim form. The form and

details will vary based on your withdrawal reason.

7. 7. Upload Documents (if required): For certain withdrawal reasons, you might need to

upload scanned copies of relevant documents.

8. 8. Submit the Application: After verifying all the details and documents, submit your

application. You may receive an OTP on your registered mobile number for verification.

9. 9. Tracking the Application: Post submission, you can track the status of your claim

through the EPFO portal.

10. 10. Receiving the Amount: Upon approval, the withdrawal amount will be credited to

your registered bank account, usually within 15-20 days.

You might also like

- How To Claim Shares and Dividend Transferred To Iepf AuthorityDocument8 pagesHow To Claim Shares and Dividend Transferred To Iepf AuthorityChetan Patel100% (3)

- Online PF EPS Withdrwal process-TCTSL and TCPSLDocument13 pagesOnline PF EPS Withdrwal process-TCTSL and TCPSLganeshkumar330No ratings yet

- EPF Transfer & Withdrawal Process Guidelines For Ex Employees Final 10.02.2022Document12 pagesEPF Transfer & Withdrawal Process Guidelines For Ex Employees Final 10.02.2022jeyasreevinodhkumarNo ratings yet

- User Manual FOR Covid-19 Vaccination Certificate RequestDocument11 pagesUser Manual FOR Covid-19 Vaccination Certificate RequestMohammed Razwin K PNo ratings yet

- 10A Filing ProcessDocument3 pages10A Filing ProcessNaveen AppsNo ratings yet

- Account Opening GuidelinesDocument11 pagesAccount Opening GuidelinesGraphic MasterNo ratings yet

- EPF Online Withdrawal Process - Unexempted EmployeesDocument7 pagesEPF Online Withdrawal Process - Unexempted EmployeesKrishna RaoNo ratings yet

- Assignment III Security Trading and Applied Finance - Kamran Rauf - F20MBA304Document6 pagesAssignment III Security Trading and Applied Finance - Kamran Rauf - F20MBA304Kamran RaufNo ratings yet

- 19 PF Withdrawal (Settlement) Process Flow PDFDocument2 pages19 PF Withdrawal (Settlement) Process Flow PDFVenkateshNo ratings yet

- InstructionsDocument3 pagesInstructionsyashgarg3206No ratings yet

- PF EngDocument9 pagesPF Engassasin3545No ratings yet

- HelpFile PDFDocument1 pageHelpFile PDFPradeep Kumar YadavNo ratings yet

- OTCP PF Guidelines PDFDocument5 pagesOTCP PF Guidelines PDFvishnu5b8No ratings yet

- Ofs Era Claim FormDocument2 pagesOfs Era Claim Formbanira.luv3000No ratings yet

- Welcome To Symbiosis International (Deemed University) : A. Admission FormalitiesDocument3 pagesWelcome To Symbiosis International (Deemed University) : A. Admission FormalitiesSoumyadip RoychowdhuryNo ratings yet

- Procedure For How To Enroll For Digital SignatureDocument18 pagesProcedure For How To Enroll For Digital SignatureAngshuman GogoiNo ratings yet

- Instructions To Members For Filing Claims U/p 68 L A Eligibility To File Online Claim For The Purpose "Outbreak of Pandemic (COVID-19) "Document1 pageInstructions To Members For Filing Claims U/p 68 L A Eligibility To File Online Claim For The Purpose "Outbreak of Pandemic (COVID-19) "ShambadityaNo ratings yet

- Process To Submit PF GrievanceDocument9 pagesProcess To Submit PF GrievancePADMALOCHAN DASHNo ratings yet

- GUIDELINES: How To Make Online Applicaiton: Step 1Document7 pagesGUIDELINES: How To Make Online Applicaiton: Step 1Himanshu KaleNo ratings yet

- Digital Account Opening Solution - GuidelinesDocument4 pagesDigital Account Opening Solution - GuidelinesMujeeb MaqboolNo ratings yet

- Our Admission Process: Step 1: ApplicationDocument5 pagesOur Admission Process: Step 1: Applicationhussien amareNo ratings yet

- GuideDocument5 pagesGuidejanclaudinefloresNo ratings yet

- Requirement For Digital Account Opening, RDADocument2 pagesRequirement For Digital Account Opening, RDAhassanpc574No ratings yet

- How To Use EhomeaffairsDocument6 pagesHow To Use EhomeaffairsDavidNo ratings yet

- Provident Fund Steps - UANDocument38 pagesProvident Fund Steps - UANSandip ChaudhuriNo ratings yet

- Online Application Procedures: Procedures For Uploading The Required DocumentsDocument3 pagesOnline Application Procedures: Procedures For Uploading The Required DocumentsKama GeneralNo ratings yet

- Instructions For OnlineDocument3 pagesInstructions For OnlineRam MohanreddyNo ratings yet

- Direct Tax and Compliance Farheen 202200535 WordsDocument11 pagesDirect Tax and Compliance Farheen 202200535 Wordsnaazfarheen7777No ratings yet

- Claiming Refund From IEPF AuthorityDocument17 pagesClaiming Refund From IEPF Authoritycharith.nitkNo ratings yet

- Iifl - Zahir AlamDocument3 pagesIifl - Zahir AlamZAHIR ALAMNo ratings yet

- Ionic Digital FAQsDocument3 pagesIonic Digital FAQsKevin AndreasNo ratings yet

- National Apprenticeship Promotion Scheme (NAPS) Claim Payout ProcessDocument4 pagesNational Apprenticeship Promotion Scheme (NAPS) Claim Payout ProcessMohit KhatriNo ratings yet

- Visa Wizard HollandDocument3 pagesVisa Wizard HollandIjju ZaidiNo ratings yet

- IEPF Claim Instruction KitDocument10 pagesIEPF Claim Instruction KitAmit ZalaNo ratings yet

- GUIDELINES: How To Make Online Applicaiton: Step 1Document3 pagesGUIDELINES: How To Make Online Applicaiton: Step 1Venkatesh GirdharNo ratings yet

- Online PF Transfer GuidelineDocument4 pagesOnline PF Transfer GuidelineMr. YALAMATI GANESH 11131A02B1No ratings yet

- ApplicationDocument2 pagesApplicationpersonalagencyworkNo ratings yet

- Welcome To Teleperformance CDO!Document12 pagesWelcome To Teleperformance CDO!kevin gaperNo ratings yet

- E Licencing Updated Flyer2 6Document2 pagesE Licencing Updated Flyer2 6Farai ChamisaNo ratings yet

- Export and Import Procedure PDFDocument18 pagesExport and Import Procedure PDFJubaida Alam JuthyNo ratings yet

- CCL Introduction Packet - Updated 11.21.2023Document7 pagesCCL Introduction Packet - Updated 11.21.2023rijwan.md1989No ratings yet

- Step by Step Guide To Apply For OCIDocument1 pageStep by Step Guide To Apply For OCIYagnesh PatelNo ratings yet

- NIST University Application Flow - 2024-25Document5 pagesNIST University Application Flow - 2024-25ArmaanNo ratings yet

- Internal Audit ManualDocument11 pagesInternal Audit ManualAnudeep ReddyNo ratings yet

- By Teamlease in 2 To 3 Working Days From The Date of KYC UpdationDocument3 pagesBy Teamlease in 2 To 3 Working Days From The Date of KYC UpdationParvezNo ratings yet

- Chapter 10Document6 pagesChapter 10ag gNo ratings yet

- Name: Golingan, Christian Jay R. Couse: BSBA 701 International Trade and BusinessDocument6 pagesName: Golingan, Christian Jay R. Couse: BSBA 701 International Trade and BusinessChristian Jay GolinganNo ratings yet

- Guideline For: Undergraduate Admissions 2018Document2 pagesGuideline For: Undergraduate Admissions 2018mahmadwasiNo ratings yet

- Important Information For Admission Offer Holders UG 2021 - FADocument6 pagesImportant Information For Admission Offer Holders UG 2021 - FAalternatorNo ratings yet

- Ep Fact 1952Document47 pagesEp Fact 1952KYC CELL LUDHIANANo ratings yet

- SCSDCDSCDocument5 pagesSCSDCDSCAmish GangarNo ratings yet

- E Filing NoteDocument9 pagesE Filing NoteanymoneyNo ratings yet

- Procedures For Digital AccessDocument9 pagesProcedures For Digital Accesskimj4o800No ratings yet

- Standard Operating Procedure (SOP) : For Industrial UseDocument5 pagesStandard Operating Procedure (SOP) : For Industrial UseNamit KumarNo ratings yet

- Claim Process PDFDocument2 pagesClaim Process PDFpizza nmorevikNo ratings yet

- Stipend Reimbursement Process Under NAPSDocument3 pagesStipend Reimbursement Process Under NAPSVishu MakwanaNo ratings yet

- Export & Import Info Part-1Document4 pagesExport & Import Info Part-1Pranil VermaNo ratings yet

- Unclaimed Money - Step by Step Guide how you claim your moneyFrom EverandUnclaimed Money - Step by Step Guide how you claim your moneyNo ratings yet