Professional Documents

Culture Documents

Test 8 Solution

Test 8 Solution

Uploaded by

lalshahbaz57Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test 8 Solution

Test 8 Solution

Uploaded by

lalshahbaz57Copyright:

Available Formats

CAF-02 Test 8 Solution

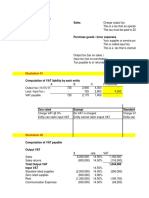

Answer-1 0.5

Mr. Anwar

Income and tax thereon

For TY 2021

Rs. in

Calculation of taxable income ‘000’

Income from business (W-1) 2,805 0.5

Agricultural income- Exempt 200 0.5

Total Income 3,005

Less : Agricultural income- Exempt (200) 0.5

Taxable income 2,805 0.5

Rs. in

(W-1) Income from business ‘000’

Profit before tax 1,100 0.5

Add: Sewing machines wrongly expensed 1,500 0.5

Software cost wrongly expensed 790 0.5

Salary to brother paid in cash (30 x 12) 360 0.5

Damages paid to customer (allowed) - 0.5

Interest on loan paid (Personal use) 180 0.5

3,930

Less: Advance received from customer (200) 0.5

Initial allowance on sewing machine (1,500 x 25%) (375) 0.5

Tax depreciation on sewing machine [(1,500 – 375) x 15%] (169) 2.5

Amortization on computer software [(790/4) x (334/365)] (181) 2.5

Lease rentals paid (allowed) - 0.5

Agriculture income (exempt) (200) 0.5

Income from business 2,805

Page 1

You might also like

- Chapter-21 (Solved Past Papers of CA Mod CDocument67 pagesChapter-21 (Solved Past Papers of CA Mod CJer Rama100% (4)

- Test 9 SolutionDocument3 pagesTest 9 Solutionlalshahbaz57No ratings yet

- Term Test 2 SolutionDocument5 pagesTerm Test 2 Solutionlalshahbaz57No ratings yet

- Assessment 1: Suggested Solution CAF-06Document3 pagesAssessment 1: Suggested Solution CAF-06BablooNo ratings yet

- Suggested Solutions/ Answers - Fall 2018 Examinations Financial Accounting (M4) - Managerial Level-2Document6 pagesSuggested Solutions/ Answers - Fall 2018 Examinations Financial Accounting (M4) - Managerial Level-2Shiza ArifNo ratings yet

- Mock Mar 24 Solution - Final R-2Document14 pagesMock Mar 24 Solution - Final R-2parveen khanNo ratings yet

- Suggested Solutions/ Answers Spring 2017 Examinations 1 of 7Document7 pagesSuggested Solutions/ Answers Spring 2017 Examinations 1 of 7Ayaz MobileNo ratings yet

- TAX SOLUTIONS (2) Corrected 2aaDocument12 pagesTAX SOLUTIONS (2) Corrected 2aaketty sambaNo ratings yet

- Taxation Solution 2017 SeptemberDocument11 pagesTaxation Solution 2017 Septemberzezu zazaNo ratings yet

- IFRS-9 SolutionDocument2 pagesIFRS-9 SolutionWaseim khan Barik zaiNo ratings yet

- Frsa Module III Problems SolutionsDocument34 pagesFrsa Module III Problems Solutionsaijaz ahmed nagthan01No ratings yet

- CEV 1 2024 SolutionDocument2 pagesCEV 1 2024 SolutionLayola MdlaloNo ratings yet

- Taxation Solution 2018 MarchDocument11 pagesTaxation Solution 2018 MarchNg GraceNo ratings yet

- Term Test 1 (Sol.)Document5 pagesTerm Test 1 (Sol.)iamneonkingNo ratings yet

- TAXC371+-+Second+Opportunity+2019+Solution+ UpdatedDocument18 pagesTAXC371+-+Second+Opportunity+2019+Solution+ UpdatedakeeraNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsDeven PrajapatiNo ratings yet

- 2021 Seminar Paper Marking SchemeDocument12 pages2021 Seminar Paper Marking Schemesayuru423geenethNo ratings yet

- TEST 3 SolutionDocument3 pagesTEST 3 SolutionlusandasithembeloNo ratings yet

- Solution Test 7Document1 pageSolution Test 7eimannaveed6No ratings yet

- Term Test-1 SolutionDocument6 pagesTerm Test-1 Solutionlalshahbaz57No ratings yet

- Test 1 SolutionDocument3 pagesTest 1 SolutionAmna Asif DarNo ratings yet

- Sampa Video Solution Harvard Case Solution 1Document10 pagesSampa Video Solution Harvard Case Solution 1Héctor SilvaNo ratings yet

- Suggested Solution Assessment Test 01: Rise School of AccountancyDocument3 pagesSuggested Solution Assessment Test 01: Rise School of AccountancyiamneonkingNo ratings yet

- Business Taxation - Semester-4Document8 pagesBusiness Taxation - Semester-4Alina ZubairNo ratings yet

- Docshare - Tips - Sampa Video Solution Harvard Case Solution PDFDocument10 pagesDocshare - Tips - Sampa Video Solution Harvard Case Solution PDFnimarNo ratings yet

- Cheque: Page 1 of 8Document8 pagesCheque: Page 1 of 8Null FilerNo ratings yet

- Schedule C Form With AnnexDocument4 pagesSchedule C Form With Annexgirma1299No ratings yet

- Introduction To Business Finance (Fin201) : How Corporate Taxes Influence Business Decisions???Document15 pagesIntroduction To Business Finance (Fin201) : How Corporate Taxes Influence Business Decisions???Syed Musa RazaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Final CMADocument6 pagesFinal CMAManjari AgrawalNo ratings yet

- Draft ReportDocument8 pagesDraft Report0264192238No ratings yet

- Statement of Accounts For PartnershipDocument3 pagesStatement of Accounts For PartnershipAsadUllahNo ratings yet

- Test 7 SolutionDocument2 pagesTest 7 Solutionls786580302No ratings yet

- TXCHN 2018 Jun ADocument7 pagesTXCHN 2018 Jun AALEX TRANNo ratings yet

- Financial Accounting - Semester-3: Suggested Solutions/ Answers Fall 2015 ExaminationsDocument2 pagesFinancial Accounting - Semester-3: Suggested Solutions/ Answers Fall 2015 ExaminationsAsimsaNo ratings yet

- Muhammad Aiman Bin Mohd Azri ID 20050142 Sec 4 (A)Document10 pagesMuhammad Aiman Bin Mohd Azri ID 20050142 Sec 4 (A)Aiman AzriNo ratings yet

- Launch Jasper ReportDocument2 pagesLaunch Jasper ReportZelalem RegasaNo ratings yet

- CFAP 5 Winter 2022Document2 pagesCFAP 5 Winter 2022ZainioNo ratings yet

- Havells Income STMT 2009-2013Document11 pagesHavells Income STMT 2009-2013K.GayathiriNo ratings yet

- ASS 1 2021 Part A SolutionDocument4 pagesASS 1 2021 Part A SolutionOdzulaho DemanaNo ratings yet

- Financial Statement Analysis QuestionsDocument11 pagesFinancial Statement Analysis QuestionsShrunaliNo ratings yet

- Profit and Loss of MankindDocument2 pagesProfit and Loss of MankindsarvodayaprintlinksNo ratings yet

- CFAP 5 Winter 2021Document7 pagesCFAP 5 Winter 2021Faltu BatNo ratings yet

- Muhammad Izwan Bin Ros Zulkeflee 1811170224 Atx-CDocument2 pagesMuhammad Izwan Bin Ros Zulkeflee 1811170224 Atx-CPutera IzwanNo ratings yet

- Suggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Document7 pagesSuggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Muhammad Usama SheikhNo ratings yet

- ANSWERDocument9 pagesANSWERLeesaa88No ratings yet

- Suggested Solutions/ Answers - Spring 2018 Examinations 1 of 6 Management Accounting (G3) - Graduation LevelDocument6 pagesSuggested Solutions/ Answers - Spring 2018 Examinations 1 of 6 Management Accounting (G3) - Graduation LevelKamran ArifNo ratings yet

- Touchtone Talent Agency: ParticularsDocument4 pagesTouchtone Talent Agency: Particulars003amirNo ratings yet

- Seminar Solutions Consolidations 3 Question 2Document2 pagesSeminar Solutions Consolidations 3 Question 2张紫翠No ratings yet

- Milkiy FF 2011Document263 pagesMilkiy FF 2011Asfawosen Dingama100% (1)

- E Text 2A HRH 567 PDFDocument3 pagesE Text 2A HRH 567 PDFgunjan88No ratings yet

- 18-Winter 2018 - SFM SaDocument7 pages18-Winter 2018 - SFM SaSalman Ahmed RabbaniNo ratings yet

- Financial Accounting and Reporting 1: School of AccountancyDocument3 pagesFinancial Accounting and Reporting 1: School of AccountancyAli OptimisticNo ratings yet

- Sip 3Document5 pagesSip 3mohit sharmaNo ratings yet

- WEEK 9 Solution To Questions On Statement of Cash FlowsDocument3 pagesWEEK 9 Solution To Questions On Statement of Cash Flowsvictoriaahmad95No ratings yet

- SS Tutorial 3 Sample ExamDocument4 pagesSS Tutorial 3 Sample ExamFeahRafeah KikiNo ratings yet

- Spice Deals MemoDocument2 pagesSpice Deals MemoSelma IilongaNo ratings yet

- Marks Question No. 2 (A) (I) Journal Entries: Rupees Debit CreditDocument2 pagesMarks Question No. 2 (A) (I) Journal Entries: Rupees Debit CreditAsimsaNo ratings yet

- Sampa Video SpreadsheetDocument4 pagesSampa Video SpreadsheetVarsha ShirsatNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet