Professional Documents

Culture Documents

Etmoney CG Fy2023-24

Uploaded by

KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Etmoney CG Fy2023-24

Uploaded by

KumarCopyright:

Available Formats

January, 21 2024

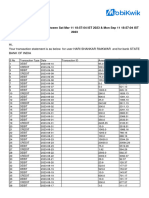

CAPITAL GAINS STATEMENT Total tax to be paid

Name 397*

DEEPAK CHARAYA

PAN Tax due to Equity Gains Tax due to Debt Gains

BDQPC8134B

Statement Period Taxed@15% Taxed@30%

Short term

FY 2023-24 0 382

Total Short Term Gains

Debt : 1,272 Equity : 1 Taxed@10% Taxed@20%

Long term

Total Long Term Gains 0 0

Debt : 0 Equity : 74,481

TRANSACTIONS

Purchase Units Redemption Gains

SNo Date Value Acquisition Value Date Value STCG LTCG

Debt

Motilal Oswal 5 Year G-Sec FoF Direct - Growth

Folio No: 91039218036

1 22-09-2023 1,691.24 1,691.24 156.466 16-10-2023 1,688 -3.24 0

2 22-09-2023 8,185.27 8,185.27 757.264 16-11-2023 8,243.42 58.16 0

3 25-09-2023 3,679.82 3,679.82 340.765 16-11-2023 3,709.5 29.68 0

4 26-09-2023 735.96 735.96 68.153 16-11-2023 741.9 5.94 0

5 27-09-2023 773.96 773.96 71.537 16-11-2023 778.74 4.78 0

6 29-09-2023 390.15 390.15 36.142 16-11-2023 393.43 3.29 0

7 29-09-2023 422.81 422.81 39.168 16-11-2023 426.38 3.56 0

8 29-09-2023 852.96 852.96 79.015 16-11-2023 860.14 7.18 0

9 03-10-2023 1,193.94 1,193.94 110.624 16-11-2023 1,204.23 10.29 0

10 06-10-2023 3,588.82 3,588.82 333.329 16-11-2023 3,628.55 39.73 0

11 06-10-2023 11,029.45 11,029.45 1024.413 16-11-2023 11,151.56 122.11 0

12 09-10-2023 2,591.87 2,591.87 241.097 16-11-2023 2,624.53 32.67 0

13 10-10-2023 3,636.05 3,636.05 338.111 16-11-2023 3,680.61 44.56 0

14 10-10-2023 2,468.65 2,468.65 229.556 16-11-2023 2,498.9 30.26 0

15 27-10-2023 574.97 574.97 53.208 16-11-2023 579.21 4.24 0

16 27-10-2023 9,201.02 9,201.02 851.465 16-11-2023 9,268.88 67.86 0

17 27-10-2023 1,913.87 1,913.87 177.110 05-12-2023 1,934.01 20.14 0

18 27-10-2023 1,678.48 1,678.48 155.327 01-01-2024 1,719.49 41.01 0

19 27-10-2023 693.97 693.97 64.220 01-01-2024 710.92 16.95 0

20 30-10-2023 3,766.81 3,766.81 348.914 01-01-2024 3,862.51 95.71 0

21 01-11-2023 15,239.24 15,239.24 1410.819 01-01-2024 15,617.91 378.66 0

22 01-11-2023 6,653.67 6,653.67 615.984 01-01-2024 6,819 165.33 0

23 06-11-2023 2,927.85 2,927.85 269.845 01-01-2024 2,987.21 59.37 0

24 06-12-2023 2,619.87 2,619.87 239.741 01-01-2024 2,653.96 34.09 0

Fund Total 86,510.67 86,510.67 8012.273 87,782.99 1,272.33 0

Debt Sub Total 1,272 0

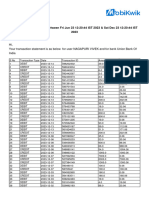

Equity

Parag Parikh Flexi Cap Fund Direct-Growth

Folio No: 10427440

1 08-11-2021 999.97 999.97 18.242 18-09-2023 1,165.24 0 165.27

2 26-11-2021 926.84 926.84 17.374 18-09-2023 1,109.8 0 182.96

3 26-11-2021 73.14 73.14 1.371 18-09-2023 86.7 0 13.56

4 01-12-2021 999.96 999.96 18.849 18-09-2023 1,191.97 0 192.01

5 06-12-2021 999.96 999.96 19.035 18-09-2023 1,203.74 0 203.77

6 20-12-2021 999.97 999.97 19.085 18-09-2023 1,206.9 0 206.92

7 21-12-2021 999.95 999.95 19.078 18-09-2023 1,206.45 0 206.5

8 20-01-2022 999.97 999.97 18.547 18-09-2023 1,172.88 0 172.9

9 27-01-2022 999.96 999.96 19.353 18-09-2023 1,223.85 0 223.89

10 31-01-2022 999.96 999.96 19.048 18-09-2023 1,204.56 0 204.6

11 02-03-2022 999.97 999.97 20.045 18-09-2023 1,267.61 0 267.64

12 21-03-2022 999.95 999.95 19.418 18-09-2023 1,227.96 0 228.01

13 04-04-2022 999.97 999.97 18.525 18-09-2023 1,171.48 0 171.52

14 21-04-2022 999.96 999.96 19.322 18-09-2023 1,221.88 0 221.92

15 26-04-2022 999.93 999.93 19.569 18-09-2023 1,237.5 0 237.57

16 02-05-2022 999.94 999.94 20.014 18-09-2023 1,265.65 0 265.7

17 17-05-2022 999.94 999.94 20.697 18-09-2023 1,308.84 0 308.9

18 23-05-2022 999.96 999.96 20.850 18-09-2023 1,318.51 0 318.55

19 02-06-2022 999.96 999.96 20.293 18-09-2023 1,283.29 0 283.32

20 22-06-2022 999.93 999.93 21.776 18-09-2023 1,377.07 0 377.14

21 04-07-2022 999.97 999.97 21.197 18-09-2023 1,340.46 0 340.49

22 21-07-2022 161.8 161.8 3.288 18-09-2023 207.93 0 46.13

Fund Total 20,160.96 20,160.96 394.976 25,000.24 0 4,839.27

Tata ELSS Tax Saver Fund Direct-Growth

Folio No: 4881845/10

1 20-01-2020 413.3 413.3 19.878 20-09-2023 750.15 0 336.86

2 04-05-2020 999.99 999.99 62.543 20-09-2023 2,360.24 0 1,360.25

3 08-06-2020 1,000 1,000 57.939 20-09-2023 2,186.5 0 1,186.5

4 14-07-2020 1,499.94 1,499.94 84.435 20-09-2023 3,186.4 0 1,686.46

5 24-08-2020 999.96 999.96 51.426 20-09-2023 1,940.71 0 940.75

6 01-09-2020 999.95 999.95 51.539 20-09-2023 1,944.97 0 945.02

7 21-09-2020 1,499.94 1,499.94 78.300 01-01-2024 3,252.97 0 1,753.03

8 20-11-2020 999.96 999.96 45.968 01-01-2024 1,909.74 0 909.78

9 25-11-2020 499.99 499.99 23.151 01-01-2024 961.81 0 461.82

Fund Total 8,913.02 8,913.02 475.179 18,493.48 0 9,580.47

Bank of India Manufacturing & Infrastructure Direct-Growth

Folio No: 9103569846

1 01-10-2021 891.57 891.57 29.032 18-09-2023 1,272.18 0 380.61

2 11-10-2021 499.97 499.97 15.767 18-09-2023 690.91 0 190.94

3 11-10-2021 749.97 749.97 23.651 18-09-2023 1,036.39 0 286.41

4 19-10-2021 999.96 999.96 31.337 18-09-2023 1,373.19 0 373.22

5 19-10-2021 749.95 749.95 24.192 18-09-2023 1,060.09 0 310.14

6 01-11-2021 399.99 399.99 12.594 18-09-2023 551.87 0 151.88

7 22-11-2021 499.99 499.99 15.974 18-09-2023 699.98 0 199.99

8 29-11-2021 999.95 999.95 32.646 18-09-2023 1,430.55 0 430.6

9 01-12-2021 499.98 499.98 15.807 18-09-2023 692.66 0 192.69

10 20-12-2021 999.94 999.94 32.413 18-09-2023 1,420.34 0 420.4

11 03-01-2022 499.97 499.97 15.082 18-09-2023 660.89 0 160.92

12 01-02-2022 499.99 499.99 15.188 18-09-2023 665.54 0 165.55

13 02-03-2022 499.99 499.99 16.393 18-09-2023 718.34 0 218.35

14 02-03-2022 499.97 499.97 16.971 18-09-2023 743.67 0 243.7

15 01-04-2022 499.98 499.98 15.403 18-09-2023 674.96 0 174.98

16 25-04-2022 499.99 499.99 15.654 18-09-2023 685.96 0 185.97

17 02-05-2022 499.98 499.98 15.698 18-09-2023 687.89 0 187.91

18 09-05-2022 999.95 999.95 34.233 18-09-2023 1,500.09 0 500.14

19 12-05-2022 999.94 999.94 34.902 18-09-2023 1,529.41 0 529.46

20 17-05-2022 999.95 999.95 33.533 18-09-2023 1,469.42 0 469.46

21 20-05-2022 999.95 999.95 34.163 18-09-2023 1,497.02 0 497.07

22 01-06-2022 499.98 499.98 16.561 18-09-2023 725.7 0 225.73

23 13-06-2022 499.99 499.99 17.482 18-09-2023 766.06 0 266.08

24 27-06-2022 499.98 499.98 17.427 18-09-2023 763.65 0 263.67

25 01-07-2022 499.98 499.98 17.494 18-09-2023 766.59 0 266.61

26 15-07-2022 499.97 499.97 16.783 18-09-2023 735.43 0 235.47

27 25-07-2022 128.74 128.74 4.141 18-09-2023 181.46 0 52.71

Fund Total 17,419.55 17,419.55 570.521 25,000.23 0 7,580.66

Kotak ELSS Tax Saver Fund Direct-Growth

Folio No: 6371354/79

1 06-08-2019 397.62 397.62 8.684 18-09-2023 879.52 0 481.9

2 22-11-2019 1,000 1,000 20.075 18-09-2023 2,033.22 0 1,033.22

3 23-12-2019 999.98 999.98 19.653 18-09-2023 1,990.48 0 990.49

4 21-01-2020 999.99 999.99 19.016 18-09-2023 1,925.96 0 925.97

5 16-03-2020 2,000.02 2,000.02 48.416 18-09-2023 4,903.62 0 2,903.6

6 07-04-2020 1,999.99 1,999.99 52.136 18-09-2023 5,280.39 0 3,280.4

7 20-04-2020 999.98 999.98 24.292 18-09-2023 2,460.32 0 1,460.34

8 26-05-2020 999.99 999.99 25.145 18-09-2023 2,546.71 0 1,546.72

9 22-06-2020 999.99 999.99 22.452 18-09-2023 2,273.96 0 1,273.97

10 23-07-2020 332.99 332.99 6.971 18-09-2023 706.03 0 373.04

Fund Total 10,730.55 10,730.55 246.840 25,000.2 0 14,269.65

Quant ELSS Tax Saver Fund Direct-Growth

Folio No: 5102580545

1 06-08-2020 2,999.8 2,999.8 27.305 18-09-2023 8,390.19 0 5,390.39

2 27-08-2020 1,499.95 1,499.95 12.503 18-09-2023 3,841.88 0 2,341.93

3 01-09-2020 1,999.85 1,999.85 17.446 18-09-2023 5,360.75 0 3,360.9

4 10-09-2020 714.37 714.37 6.207 18-09-2023 1,907.27 0 1,192.9

Fund Total 7,213.97 7,213.97 63.461 19,500.09 0 12,286.12

Motilal Oswal Nifty Next 50 Index Fund Direct - Growth

Folio No: 91039218036

1 22-09-2023 6,137.78 6,137.78 383.154 06-10-2023 6,105.06 -32.72 0

2 22-09-2023 507.47 507.47 31.679 16-10-2023 510.01 2.54 0

3 22-09-2023 598.59 598.59 37.367 25-10-2023 575.01 -23.58 0

4 22-09-2023 2,627.63 2,627.63 164.031 05-12-2023 2,906.04 278.41 0

Fund Total 9,871.47 9,871.47 616.231 10,096.11 224.65 0

Motilal Oswal Nifty Midcap 150 Index Fund Direct - Growth

Folio No: 91039218036

1 22-09-2023 8,125.36 8,125.36 302.367 16-10-2023 8,226.08 100.72 0

2 22-09-2023 3,297.58 3,297.58 122.712 25-10-2023 3,185.04 -112.54 0

3 22-09-2023 718.54 718.54 26.739 25-10-2023 694.02 -24.52 0

4 22-09-2023 4,140.7 4,140.7 154.087 30-10-2023 4,017.22 -123.49 0

5 25-09-2023 2,732.25 2,732.25 101.141 30-10-2023 2,636.86 -95.4 0

6 25-09-2023 2,055.95 2,055.95 76.106 05-12-2023 2,236.03 180.08 0

Fund Total 21,070.39 21,070.39 783.152 20,995.24 -75.15 0

HDFC ELSS Tax Saver Direct Plan-Growth

Folio No: 15756490/85

1 18-09-2019 724.33 724.33 1.455 04-12-2023 1,623.14 0 898.8

2 02-12-2020 1,499.93 1,499.93 2.787 04-12-2023 3,109.06 0 1,609.14

Fund Total 2,224.26 2,224.26 4.242 4,732.2 0 2,507.94

Motilal Oswal Nifty 50 Index Fund Direct - Growth

Folio No: 91039218036

1 22-09-2023 10,181.36 10,181.36 610.657 06-10-2023 10,171.1 -10.26 0

2 22-09-2023 947.97 947.97 56.857 06-10-2023 947.01 -0.96 0

3 22-09-2023 5,144.86 5,144.86 308.578 25-10-2023 5,005.23 -139.63 0

4 25-09-2023 5,329.73 5,329.73 319.666 25-10-2023 5,185.08 -144.65 0

5 26-09-2023 1,065.95 1,065.95 63.966 25-10-2023 1,037.55 -28.4 0

6 27-09-2023 1,055.95 1,055.95 63.189 25-10-2023 1,024.94 -31 0

7 29-09-2023 555.47 555.47 33.374 25-10-2023 541.34 -14.13 0

Fund Total 24,281.27 24,281.27 1456.287 23,912.25 -369.03 0

Motilal Oswal Nifty Smallcap 250 Index Fund Direct - Growth

Folio No: 91039218036

1 22-09-2023 1,068.52 1,068.52 39.790 16-10-2023 1,104.02 35.5 0

2 22-09-2023 15,212.66 15,212.66 566.495 30-10-2023 15,195.15 -17.5 0

3 25-09-2023 45.1 45.1 1.678 30-10-2023 45.01 -0.09 0

4 25-09-2023 1,844.5 1,844.5 68.628 05-12-2023 2,067.01 222.51 0

Fund Total 18,170.78 18,170.78 676.591 18,411.19 240.42 0

Motilal Oswal Midcap Fund Direct-Growth

Folio No: 91039082651

1 18-09-2023 999.94 999.94 13.977 20-09-2023 980.06 -19.88 0

Fund Total 999.94 999.94 13.977 980.06 -19.88 0

JM ELSS Tax Saver Fund Direct Plan-Growth

Folio No: 79911001393

1 22-10-2019 999.99 999.99 51.009 20-09-2023 1,958.64 0 958.65

2 20-12-2019 1,000.01 1,000.01 50.133 20-09-2023 1,925 0 924.99

3 27-12-2019 2,000.01 2,000.01 99.895 20-09-2023 3,835.76 0 1,835.75

4 20-01-2020 1,000 1,000 48.993 20-09-2023 1,881.23 0 881.23

5 30-04-2020 500 500 31.479 20-09-2023 1,208.73 0 708.72

6 18-05-2020 1,500 1,500 105.705 20-09-2023 4,058.85 0 2,558.85

7 26-05-2020 500 500 33.782 20-09-2023 1,297.16 0 797.15

8 25-06-2020 500 500 29.151 20-09-2023 1,119.34 0 619.34

9 27-07-2020 499.97 499.97 27.935 20-09-2023 1,072.65 0 572.67

10 25-08-2020 999.95 999.95 52.486 20-09-2023 2,015.35 0 1,015.4

11 01-09-2020 999.96 999.96 52.752 20-09-2023 2,025.57 0 1,025.61

12 30-10-2020 499.99 499.99 25.642 01-01-2024 1,093.29 0 593.31

13 20-11-2020 999.96 999.96 45.531 01-01-2024 1,941.3 0 941.34

14 25-11-2020 499.97 499.97 22.901 01-01-2024 976.43 0 476.45

15 07-12-2020 499.98 499.98 21.947 01-01-2024 935.75 0 435.77

Fund Total 12,999.78 12,999.78 699.341 27,345.03 0 14,345.23

Axis ELSS Tax Saver Direct Plan-Growth

Folio No: 91056535431

1 13-01-2020 405.68 405.68 7.532 20-09-2023 610.8 0 205.13

2 16-03-2020 1,999.99 1,999.99 43.612 20-09-2023 3,536.69 0 1,536.7

3 26-03-2020 1,999.98 1,999.98 47.336 20-09-2023 3,838.69 0 1,838.71

4 11-05-2020 1,499.99 1,499.99 34.524 20-09-2023 2,799.71 0 1,299.71

5 30-06-2020 1,000.02 1,000.02 21.259 20-09-2023 1,723.99 0 723.97

6 01-09-2020 999.96 999.96 19.507 20-09-2023 1,581.91 0 581.95

7 12-10-2020 1,499.93 1,499.93 28.843 01-01-2024 2,555.12 0 1,055.2

8 30-10-2020 500.01 500.01 9.498 01-01-2024 841.4 0 341.4

9 25-11-2020 500 500 8.459 01-01-2024 749.36 0 249.36

10 17-12-2020 999.97 999.97 15.795 01-01-2024 1,399.23 0 399.27

11 22-12-2020 1,999.93 1,999.93 32.063 01-01-2024 2,840.37 0 840.44

Fund Total 13,405.45 13,405.45 268.428 22,477.28 0 9,071.84

Equity Sub Total 1 74,481

Total 1,273 74,481

*Note:

The total tax to be paid is inclusive of Cess @ 4%.

For Debt Mutual Funds or Funds that attract non-Equity Tax Treatment, Acquisition Value is arrived by applying Cost Indexation using latest Cost Inflation Index values

issued by the Income Tax Department.

For Equity Mutual Funds or Funds that attract Equity Taxation, Acquisition value has been adjusted to the closing NAVs of Jan 31, 2018 for all such Funds purchased

prior to Jan 31, 2018.

Short Term Debt Gains are taxed as per your income tax slab.

The Gains computed in the above statement have considered the provisions of Section 94(7) of the Income Tax Act on Dividend Stripping.

Disclaimer:

For the computation of Capital Gains, the first-in-first-out Principle is applied for mapping each of your redemptions against your purchases.

The statement does not account for deductions of STT and TDS, if any, at the time of redemptions.

For Funds that enjoy Indexation benefit, the Purchase Price is Indexed based on the latest Cost Inflation Index Values available (issued by the Income Tax

department) as on the date of generation of this statement for that specific year of Purchase.

This tax statement is only for investments sold in FY 2023-24 & doesn't account for any sale before FY 2023-24 and/or carried forward losses you may have and/or

investments in products other than Mutual Funds.

For simplification sake, the purchase values,redemption values and gains are rounded off to 2 decimal spaces and units are 3 decimal places.

Repeating the computation may lead to slight variance in the capital gains.

Gains for redemptions whose purchase transactions could not be found or acquisition values could not be arrived at have been excluded.

The capital gains/loss & tax statement is a value-added feature of ETMONEY and is meant to serve as a reference only. This statement shouldn't be considered as an

advice for determining your tax liability and you are advised to consult your tax advisor to verify the correctness and appropriateness of the statement and determine

your overall tax liability.

"ETMONEY" and each of their Directors,employees or associates will not be liable for either determining your tax liability or any loss or damage arising out of any

actions/decisions arising out of your reliance on the contents of this statement.

ONE APP FOR YOUR PERSONAL FINANCE NEEDS

Spends Tracker Smart Deposit Direct Mutual Funds Loans

A TIMES OF INDIA GROUP COMPANY

https://etmoney.com | help@etmoneycare.com

Mutual fund investments are subject to market risks.

You might also like

- Etmoney CG Fy2021-22Document6 pagesEtmoney CG Fy2021-22Fake lookNo ratings yet

- StatementDocument7 pagesStatementHarishankar raikwarNo ratings yet

- Sanin 1312Document1 pageSanin 1312Field CollectionNo ratings yet

- Repayment Schedule - 164454650Document3 pagesRepayment Schedule - 164454650arunghodke12No ratings yet

- Installment Schedule Document 0009423 2 17 05 2021Document2 pagesInstallment Schedule Document 0009423 2 17 05 2021sorowako46No ratings yet

- Número de Préstamo: 1015368328 Tipo de Préstamo: CONSUMO Tasa: 26.04Document2 pagesNúmero de Préstamo: 1015368328 Tipo de Préstamo: CONSUMO Tasa: 26.04Joel Diaz MatosNo ratings yet

- COMPARTAMOSDocument1 pageCOMPARTAMOSAristides Pardo CarhuapomaNo ratings yet

- EMIloanDocument2 pagesEMIloanAnkit KumarNo ratings yet

- BCE updateDocument6 pagesBCE updatePaing Soe ChitNo ratings yet

- Simulador: Cuota Días Fecha de Pago Capital Interés Comisión ITF Seguro Seguro Todo Riesgo Otros Valor Cuota BalanceDocument1 pageSimulador: Cuota Días Fecha de Pago Capital Interés Comisión ITF Seguro Seguro Todo Riesgo Otros Valor Cuota BalanceLuis Carlos Obando ChafloqueNo ratings yet

- Repayment Schedule - 141117158....Document3 pagesRepayment Schedule - 141117158....amanyadav557104No ratings yet

- Installment Schedule Document 3610302721000149Document2 pagesInstallment Schedule Document 3610302721000149Poetra Oetama BoestiantoNo ratings yet

- Caja CuscoDocument1 pageCaja CuscoJeff MaqueraNo ratings yet

- Loan Repayment Schedule: Customer DetailsDocument3 pagesLoan Repayment Schedule: Customer DetailsJasbind yadavNo ratings yet

- Loan Schedule 09-06-2023Document1 pageLoan Schedule 09-06-2023Dennis CoconNo ratings yet

- Sarwoto - 023614Document5 pagesSarwoto - 023614Mardi AntoNo ratings yet

- CL00410151127684_20-03-2024.pdfDocument10 pagesCL00410151127684_20-03-2024.pdfcadarg2004712No ratings yet

- My TradesDocument4 pagesMy TradesAnsh KaushikNo ratings yet

- ExtDocument2 pagesExtjhonny654diazNo ratings yet

- Repayment Schedule 155908415Document2 pagesRepayment Schedule 155908415tonyfitness.gymNo ratings yet

- Installment Schedule Document 0012530 2 17 02 2022Document2 pagesInstallment Schedule Document 0012530 2 17 02 2022sorowako46No ratings yet

- Repayment Schedule: Askari Bank LTDDocument2 pagesRepayment Schedule: Askari Bank LTDAzhar QureshiNo ratings yet

- BIS All Recharges 12037313 20231023120143Document1 pageBIS All Recharges 12037313 20231023120143cristomonte835No ratings yet

- Repayment Schedule - 122139593Document2 pagesRepayment Schedule - 122139593Calvin SymssNo ratings yet

- Repayment Schedule 173913275Document2 pagesRepayment Schedule 173913275Vishal BawaneNo ratings yet

- Adobe Scan Jan 08, 2024Document2 pagesAdobe Scan Jan 08, 2024santhana arockiarajNo ratings yet

- Salesactivity JanDocument7 pagesSalesactivity JanKanishka BandaraNo ratings yet

- Amort Sched TCH Sample 2Document1 pageAmort Sched TCH Sample 2Jaypee AustriaNo ratings yet

- AfdolDocument3 pagesAfdolafdholkosmetikNo ratings yet

- Repayment Schedule - 100343948Document2 pagesRepayment Schedule - 100343948Nani RocksNo ratings yet

- A A StatementDocument26 pagesA A Statementviveknagapuri000No ratings yet

- Repayment Schedule - 79072589 - 221216716Document3 pagesRepayment Schedule - 79072589 - 221216716ishitasharma1793No ratings yet

- Agreement Cardview 04762121002689 IndraDocument1 pageAgreement Cardview 04762121002689 IndrasalmanNo ratings yet

- Repayment Schedule: Instl NumDocument2 pagesRepayment Schedule: Instl NumKishore KumarNo ratings yet

- Taksit Sayısı Tarih Taksit Anapara Faiz KKDF BSMV Kalan Ana paraDocument1 pageTaksit Sayısı Tarih Taksit Anapara Faiz KKDF BSMV Kalan Ana paraPasha BlackAxe TurkOgameNo ratings yet

- RepaymentSchedule T02217031023123112 28 12 23Document3 pagesRepaymentSchedule T02217031023123112 28 12 23gaurimshinde1No ratings yet

- STOCK MARKET CLOSING PRICESDocument34 pagesSTOCK MARKET CLOSING PRICESEdgar Francisco Hernandez PeñuelasNo ratings yet

- External Image UrlDocument5 pagesExternal Image Urlrahul sharmaNo ratings yet

- All Order Costing Report by Ship Date: CommentsDocument38 pagesAll Order Costing Report by Ship Date: Commentsshayne lafsNo ratings yet

- Installment Schedule Document 0008603 2 17 09 2020Document2 pagesInstallment Schedule Document 0008603 2 17 09 2020sorowako46No ratings yet

- Marlon Mateo Dugay 49683109662 Full UpdatingDocument1 pageMarlon Mateo Dugay 49683109662 Full UpdatingMarlon DugayNo ratings yet

- Loan Account No 111041486 Name: MD Morshad KhanDocument1 pageLoan Account No 111041486 Name: MD Morshad Khanমোঃ জহুরুল ইসলামNo ratings yet

- 26082023-0918 Grafic RambursareDocument11 pages26082023-0918 Grafic RambursareLuiza TanaseNo ratings yet

- Installment Schedule Document 0009048 2 17 01 2021Document2 pagesInstallment Schedule Document 0009048 2 17 01 2021sorowako46No ratings yet

- Amort Sched TCH SampleDocument1 pageAmort Sched TCH SampleJaypee AustriaNo ratings yet

- Installment Schedule Document 0013660 2 17 11 2022Document2 pagesInstallment Schedule Document 0013660 2 17 11 2022sorowako46No ratings yet

- Pakan dan CN Ratio Per 3 HariDocument42 pagesPakan dan CN Ratio Per 3 Harigndr officialNo ratings yet

- 8###1-Money Market UnlockedDocument1 page8###1-Money Market Unlockeddavidwanjunji.dm5No ratings yet

- All Order Costing Report by Ship Date: CommentsDocument39 pagesAll Order Costing Report by Ship Date: Commentsshayne lafsNo ratings yet

- Odometer Detail: Distance End Odometer Start Odometer DateDocument34 pagesOdometer Detail: Distance End Odometer Start Odometer DateHumaira ImaNo ratings yet

- Acc Statement 1120566636663 2023-10-01 2023-10-31 20231215111413Document1 pageAcc Statement 1120566636663 2023-10-01 2023-10-31 20231215111413Agung MaharNo ratings yet

- Ledger AccountDocument1 pageLedger Accountkaurtraders5No ratings yet

- Summary Coal HaulingDocument12 pagesSummary Coal HaulingAryo Prastyo AjiNo ratings yet

- Installment Schedule Document 0009854 2 17 09 2021Document2 pagesInstallment Schedule Document 0009854 2 17 09 2021DedeidarNo ratings yet

- KuramathiDocument3 pagesKuramathiSubani GunarathnaNo ratings yet

- Valuation of Preference Shares Investment in GTNDocument36 pagesValuation of Preference Shares Investment in GTNjsphdvdNo ratings yet

- 1-Control Détaille 2023Document66 pages1-Control Détaille 2023Dah ManNo ratings yet

- Cálculo IndicadoresDocument5 pagesCálculo IndicadoresDaniel RodriguezNo ratings yet

- RepaymentDocument5 pagesRepaymentBalasahebNo ratings yet

- Operational Status of 20mN Class Ion Engine Subsystem For ETS-VIIIDocument8 pagesOperational Status of 20mN Class Ion Engine Subsystem For ETS-VIIIKumarNo ratings yet

- RAC Brochure 1Document4 pagesRAC Brochure 1KumarNo ratings yet

- Safety Data Sheet Cryogel ZDocument6 pagesSafety Data Sheet Cryogel ZKumarNo ratings yet

- NASA Space Power Facility Capabilities For Environmental Testing in ADocument20 pagesNASA Space Power Facility Capabilities For Environmental Testing in AgezhoubapichanakiNo ratings yet

- GFRP ChinaDocument3 pagesGFRP ChinaKumarNo ratings yet

- Hall Thruster Development For Japanese SDocument7 pagesHall Thruster Development For Japanese SKumarNo ratings yet

- Instructions: Rotary Lobe BlowersDocument15 pagesInstructions: Rotary Lobe BlowersKumarNo ratings yet

- Pressure Vessels FinalDocument38 pagesPressure Vessels FinalKumarNo ratings yet

- ReportTransactionStatement - Do - 1522Document4 pagesReportTransactionStatement - Do - 1522Shaikh Hassan AtikNo ratings yet

- Annual Report 2019Document4 pagesAnnual Report 2019Rahman GafarNo ratings yet

- MASDocument45 pagesMASk.balaga.513134No ratings yet

- Chapter 6 Business Formation Sections 3-4Document25 pagesChapter 6 Business Formation Sections 3-4kparsons938512No ratings yet

- Lesson 4.ledger and Trial BalanceDocument9 pagesLesson 4.ledger and Trial BalanceDacer, Rhycheall HeartNo ratings yet

- Module 3 Banking and Financial InstitutionDocument19 pagesModule 3 Banking and Financial Institutionkimjoshuadiaz12No ratings yet

- StockDocument4 pagesStockNiño Rey LopezNo ratings yet

- FAR - Contribution No AnsDocument4 pagesFAR - Contribution No AnsSherrydelle Gwen BeleganioNo ratings yet

- Modul Ajp Dan Neraca LajurDocument5 pagesModul Ajp Dan Neraca Lajurricoananta10No ratings yet

- Secondary Market, Trading MechanismDocument15 pagesSecondary Market, Trading MechanismNaveen JohnNo ratings yet

- Dores Marie Pateno Hobby Shop FinancialsDocument2 pagesDores Marie Pateno Hobby Shop FinancialsLyca MaeNo ratings yet

- Mutual Funds Question Paper 2Document9 pagesMutual Funds Question Paper 2studysks2324No ratings yet

- What Are Control Accounts? - Discounts - The Operation of Control Accounts - The Purpose of Control AccountsDocument48 pagesWhat Are Control Accounts? - Discounts - The Operation of Control Accounts - The Purpose of Control AccountsAnh TúNo ratings yet

- Indian School Muscat: Page - 1 - of 7Document7 pagesIndian School Muscat: Page - 1 - of 7Devansh AsawaNo ratings yet

- Globiva Services Private Limited - Company Profile, Directors, Revenue & MoreDocument7 pagesGlobiva Services Private Limited - Company Profile, Directors, Revenue & Moreroshankumar078673No ratings yet

- Module 9Document32 pagesModule 9Precious GiftsNo ratings yet

- Medfield Pharma SolnDocument12 pagesMedfield Pharma Soln818 Kashyap DantroliyaNo ratings yet

- Industry Report For AUTO MFRS FOREIGNDocument10 pagesIndustry Report For AUTO MFRS FOREIGNPrimož KozlevčarNo ratings yet

- Teuer Furniture Students ExcelDocument19 pagesTeuer Furniture Students ExcelAlfonsoNo ratings yet

- LAW-resa-corporation Flashcards Study GuideDocument27 pagesLAW-resa-corporation Flashcards Study Guiderose annNo ratings yet

- Cash Flow and Financial Planning Cash Budgeting ScriptDocument2 pagesCash Flow and Financial Planning Cash Budgeting ScriptAouabdi HanineNo ratings yet

- Chapter 6 Share CapitalsDocument5 pagesChapter 6 Share CapitalsShreya AgarwalNo ratings yet

- FA2A - Study GuideDocument67 pagesFA2A - Study GuideHasan EvansNo ratings yet

- 100 KPIsDocument110 pages100 KPIsMohammad AbdulaalNo ratings yet

- Shareholder's Equity 2 - PracAccDocument19 pagesShareholder's Equity 2 - PracAccClyn CFNo ratings yet

- v2 Assignment Due 26.3.2023Document24 pagesv2 Assignment Due 26.3.2023alisa rachelNo ratings yet

- IND AS 7 Cash Flow StatementDocument10 pagesIND AS 7 Cash Flow StatementCharu JagetiaNo ratings yet

- Quizzer For QE 3BSA Management ServicesDocument15 pagesQuizzer For QE 3BSA Management ServicesSara ChanNo ratings yet

- Unpaid Dividend-16-17-I2Document102 pagesUnpaid Dividend-16-17-I2bindu pathakNo ratings yet

- B Sheet 14-15Document106 pagesB Sheet 14-15Gagan Soni deaf100% (1)