Professional Documents

Culture Documents

Sba Reviewer

Uploaded by

Cygresy Gomez0 ratings0% found this document useful (0 votes)

5 views2 pagesThe document outlines the high-low method for calculating variable and fixed costs. Step 1 identifies the highest and lowest activity levels with their associated costs. Step 2 calculates the variable cost per unit by taking the difference between the highest and lowest total costs and dividing by the difference in activity levels. Step 3 calculates fixed cost for the highest level by subtracting the variable cost per unit multiplied by activity units from the highest total cost. Step 4 develops the cost formula as Total Cost = Fixed Cost + Variable Cost per Unit x Activity Level.

Original Description:

N/A

Original Title

SBA-REVIEWER

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the high-low method for calculating variable and fixed costs. Step 1 identifies the highest and lowest activity levels with their associated costs. Step 2 calculates the variable cost per unit by taking the difference between the highest and lowest total costs and dividing by the difference in activity levels. Step 3 calculates fixed cost for the highest level by subtracting the variable cost per unit multiplied by activity units from the highest total cost. Step 4 develops the cost formula as Total Cost = Fixed Cost + Variable Cost per Unit x Activity Level.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesSba Reviewer

Uploaded by

Cygresy GomezThe document outlines the high-low method for calculating variable and fixed costs. Step 1 identifies the highest and lowest activity levels with their associated costs. Step 2 calculates the variable cost per unit by taking the difference between the highest and lowest total costs and dividing by the difference in activity levels. Step 3 calculates fixed cost for the highest level by subtracting the variable cost per unit multiplied by activity units from the highest total cost. Step 4 develops the cost formula as Total Cost = Fixed Cost + Variable Cost per Unit x Activity Level.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

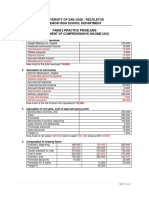

High low Method

Step 1: Choose Highest & Lowest level of activities

hours cost

Highest 18,000 452 =8,136,000

Lowest 4,600 218 =1,002,800

Difference 4,400 132

=(18,000 x 452) - (4,600 x 218)

18,000 - 4,600

=8,136,000 - 1,002,800

13,400

=532.32

Step 2: Compute Variable Cost

Variable Cost = HAC - LAC

HAU - LAC

=

Step 3: Compute Fixed Cost

Fixed Cost = HAC - (Variable cost per unit x HAU)

=

=

Fixed Cost = LAC - (Variable cost per unit x LAU)

=

Step 4: Develop the Cost formula

Y= a + b(x)

Y =80 + 0.03 (9,100)

Y=353

Note 1 Sales -

Sales Discounts -

Sales Returns and allowances -

Net Sales -

Note 2 Beginning Inventory 200,000

Add: Purchases 3,000,000

Freight-in 30,000

Total 3,030,000

Less: Purchase Discounts 10,000

Purchase returns and allowances 20,000 3,000,000

TGAS 3,200,000

Less: Ending Inventory 280,000

Cost of sales 2,920,000

Note 3 Interest Income 10,000

Gain on Sale of Equipment 100,000

Gain from expropriation of asset 100,000

Other Income 210,000

Note 4 Rent Expense - Sales dep't 120,000

Sales Salaries 400,000

SSS premium expense - sales dep't 18,000

Philhealth premium expense - sales dep't 6,000

Pag-ibig premium expense - sales dep't 4,000

Advertising 160,000

13th month pay - sales dep't 30,000

Depreciation - store equipment 70,000

Delivery Expense 200,000

Total Distribution Costs 1,008,000

Note 5 Light, heat & water expense 320,000

Rent Expense - office 80,000

Repair & maintenance 50,000

Office/admin salaries 150,000

Taxes and Licenses 14,000

SSS premium expense - admin dep't 4,000

Philhealth premium expense - admin dep't 2,000

Pag-ibig premium expense - admin dep't 2,000

13th month pay - admin dep't 12,500

Depreciation - office equipment 40,000

Accounting & Legal Expenses 150,000

Office Expenses 250,000

General and Administrative expenses 1,074,500

Note 6 Earthquake Loss 300,000

Other Losses 300,000

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- 2020 AICPA Released Questions FAR Blank Answer KeyDocument52 pages2020 AICPA Released Questions FAR Blank Answer KeyGift Chali100% (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Test Bank 2 - Ia 3Document31 pagesTest Bank 2 - Ia 3Xiena100% (6)

- Ind As ChartsDocument20 pagesInd As ChartsvishnuvermaNo ratings yet

- Final - Home Office Branch of AccountingDocument13 pagesFinal - Home Office Branch of AccountingHazel Jane Esclamada100% (1)

- Uber Business Model (2023)Document52 pagesUber Business Model (2023)ratty1971100% (1)

- Quiz Chapter 2 Statement of Comprehensive IncomeDocument13 pagesQuiz Chapter 2 Statement of Comprehensive Incomefinn mertensNo ratings yet

- Quizzes - Chapter 2 - Statement of Comprehensive IncomeDocument6 pagesQuizzes - Chapter 2 - Statement of Comprehensive IncomeAmie Jane Miranda100% (3)

- Statement of Financial Position/Retained EarningsDocument5 pagesStatement of Financial Position/Retained EarningsShane TabunggaoNo ratings yet

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Sol. Man. - Chapter 2 - Statement of Comprehensive IncomeDocument15 pagesSol. Man. - Chapter 2 - Statement of Comprehensive IncomeKATHRYN CLAUDETTE RESENTE100% (1)

- 4-2 Endless CompanyDocument3 pages4-2 Endless CompanyyayayaNo ratings yet

- How To Read French Financial Statements PDFDocument4 pagesHow To Read French Financial Statements PDFPurmah Vik100% (1)

- Accounting For Managers (Assignment One (E-Finance) ) Question OneDocument7 pagesAccounting For Managers (Assignment One (E-Finance) ) Question OnehananNo ratings yet

- Course Code: ACT 201 Course Title: Cost & Management Accounting Section: 2Document4 pagesCourse Code: ACT 201 Course Title: Cost & Management Accounting Section: 2Wild GhostNo ratings yet

- Final Exam Review2aStudentDocument9 pagesFinal Exam Review2aStudentFatima SNo ratings yet

- Statement of Comprehensive Income Part 2 StudentDocument7 pagesStatement of Comprehensive Income Part 2 StudentAG VenturesNo ratings yet

- Accounting 2 - Suggested Answers of Assignment - Income StatementDocument5 pagesAccounting 2 - Suggested Answers of Assignment - Income StatementLorraine Anne TawataoNo ratings yet

- 2 - Income Statement & Closing Entries AnsweredDocument2 pages2 - Income Statement & Closing Entries Answeredbolaemil20No ratings yet

- 4 2 Endless Company PDFDocument3 pages4 2 Endless Company PDFJulius Mark Carinhay TolitolNo ratings yet

- Activity - Statement of Comprehensive IncomeDocument6 pagesActivity - Statement of Comprehensive IncomeGrace HernandezNo ratings yet

- Statement of Comprehensive Income Part 2Document8 pagesStatement of Comprehensive Income Part 2AG VenturesNo ratings yet

- Income Statement: Format: Single Step: List All Revenues and SubtotalDocument2 pagesIncome Statement: Format: Single Step: List All Revenues and SubtotalRabia RabiaNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Income StatementDocument6 pagesIncome StatementMohamed Yusuf KarieNo ratings yet

- Assignment 2 Solution Fall 2023 MBA 5241EDocument11 pagesAssignment 2 Solution Fall 2023 MBA 5241EDhyan HariaNo ratings yet

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- Chapter 2Document40 pagesChapter 2ellyzamae quiraoNo ratings yet

- Madamot Company Year 2022 (End) Year 2021 (Beg)Document11 pagesMadamot Company Year 2022 (End) Year 2021 (Beg)VonDrei MedinaNo ratings yet

- 2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)Document20 pages2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)ahmedNo ratings yet

- ACC124 Part2Document6 pagesACC124 Part2Christine LigutomNo ratings yet

- Solution NIngDocument3 pagesSolution NIngfahim tusarNo ratings yet

- Less: Cost of Goods Sold: Capital ExpenditureDocument3 pagesLess: Cost of Goods Sold: Capital Expenditurefahim tusarNo ratings yet

- Acc 109 p2 Quiz Statement of Comprehensive IncomeDocument11 pagesAcc 109 p2 Quiz Statement of Comprehensive IncomeRonel CastillonNo ratings yet

- Pateros Catholic SchoolDocument4 pagesPateros Catholic Schooljohn nathanNo ratings yet

- SCI WeiLong TradingDocument4 pagesSCI WeiLong TradingJoyce CalmaNo ratings yet

- Fabm2 First Grading ReviewerDocument3 pagesFabm2 First Grading ReviewerjhomarNo ratings yet

- Exercise 2 Income Statement - MerchandisingzzzsDocument2 pagesExercise 2 Income Statement - MerchandisingzzzsMarc Viduya0% (1)

- QUIZ - CHAPTER 2 - Printing STATEMENT OF COMPREHENSIVE INCOMEDocument6 pagesQUIZ - CHAPTER 2 - Printing STATEMENT OF COMPREHENSIVE INCOMEAllen Kate Malazarte0% (1)

- AccountingDocument5 pagesAccountingMarinie CabagbagNo ratings yet

- Chapter 4 - Ia3Document10 pagesChapter 4 - Ia3Xynith Nicole RamosNo ratings yet

- Fundamentals of ABM 2Document2 pagesFundamentals of ABM 2Xivaughn SebastianNo ratings yet

- Ventura, Mary Mickaella R - Comprehensive Income - p.88 - Group3Document7 pagesVentura, Mary Mickaella R - Comprehensive Income - p.88 - Group3Mary VenturaNo ratings yet

- Comprehensive IncomeDocument9 pagesComprehensive IncomeJesiah PascualNo ratings yet

- Sample Functional Form of Statement of Comprehensive IncomeDocument2 pagesSample Functional Form of Statement of Comprehensive IncomeHazel Joy DemaganteNo ratings yet

- Chapter 2 Statement of Comprehensive IncomeDocument4 pagesChapter 2 Statement of Comprehensive IncomebwimeeeNo ratings yet

- RUNNING HEAD: Accounting Questions 1Document6 pagesRUNNING HEAD: Accounting Questions 1Chirayu ThapaNo ratings yet

- Assignment: Lecturer, Southeast Business School (SBS), Southeast UniversityDocument4 pagesAssignment: Lecturer, Southeast Business School (SBS), Southeast UniversityMd. Shaidur JamanNo ratings yet

- Multi-Step Income Statement: Key Terms and Concepts To KnowDocument5 pagesMulti-Step Income Statement: Key Terms and Concepts To KnowĐức NguyễnNo ratings yet

- Events After The Reporting PeriodDocument5 pagesEvents After The Reporting PeriodIohc NedmiNo ratings yet

- Requirement 1:: (Leave No Cells Blank - Be Certain To Enter "0" Wherever Required. Omit The "$" Sign in Your Response.)Document5 pagesRequirement 1:: (Leave No Cells Blank - Be Certain To Enter "0" Wherever Required. Omit The "$" Sign in Your Response.)Md AlimNo ratings yet

- Answers in AbmDocument6 pagesAnswers in AbmJEANNE DENISSE MENDOZANo ratings yet

- Chap1-3 Illustration ProblemsDocument8 pagesChap1-3 Illustration ProblemscykablyatNo ratings yet

- Cash Flows PAS7Document10 pagesCash Flows PAS7Jenyl Mae NobleNo ratings yet

- DAIBB MA Math Solutions 290315Document11 pagesDAIBB MA Math Solutions 290315joyNo ratings yet

- Draft SciDocument5 pagesDraft SciMariella Antonio-NarsicoNo ratings yet

- HorngrenIMA14eSM ch04Document75 pagesHorngrenIMA14eSM ch04Zarafshan Gul Gul MuhammadNo ratings yet

- 08.12.2017 Activity - Acfunda LabDocument2 pages08.12.2017 Activity - Acfunda LabPatOcampoNo ratings yet

- (Chap 26) MaDocument16 pages(Chap 26) MaDuong TrinhNo ratings yet

- Intellectual Property: Valuation, Exploitation, and Infringement Damages, 2016 Cumulative SupplementFrom EverandIntellectual Property: Valuation, Exploitation, and Infringement Damages, 2016 Cumulative SupplementNo ratings yet

- People PerspectiveDocument1 pagePeople PerspectiveCygresy GomezNo ratings yet

- PE ReportDocument4 pagesPE ReportCygresy GomezNo ratings yet

- RESULTDocument7 pagesRESULTCygresy GomezNo ratings yet

- Statistical Analysis Hands On ActivityDocument4 pagesStatistical Analysis Hands On ActivityCygresy GomezNo ratings yet

- Lesson 1 and 2Document4 pagesLesson 1 and 2Cygresy GomezNo ratings yet

- INTAXDocument42 pagesINTAXCygresy GomezNo ratings yet

- Page 125 126 MSDocument3 pagesPage 125 126 MSCygresy GomezNo ratings yet

- Page 116 118Document4 pagesPage 116 118Cygresy GomezNo ratings yet

- MS ReportDocument18 pagesMS ReportCygresy GomezNo ratings yet

- STATISTICALDocument20 pagesSTATISTICALCygresy GomezNo ratings yet

- Page 119 121 BarengDocument3 pagesPage 119 121 BarengCygresy GomezNo ratings yet

- MANAGEMENT SCIENCE AshDocument4 pagesMANAGEMENT SCIENCE AshCygresy GomezNo ratings yet

- Management Science Lesson AutosavedDocument19 pagesManagement Science Lesson AutosavedCygresy GomezNo ratings yet

- Activity in EntrepDocument1 pageActivity in EntrepCygresy GomezNo ratings yet

- FM - Financial Ration AnalysisDocument2 pagesFM - Financial Ration AnalysisCygresy GomezNo ratings yet

- GlobalizationDocument2 pagesGlobalizationCygresy GomezNo ratings yet

- FirstDocument4 pagesFirstCygresy GomezNo ratings yet

- Innovators and EntrepreneursDocument2 pagesInnovators and EntrepreneursCygresy GomezNo ratings yet

- Globalization ExamDocument2 pagesGlobalization ExamCygresy GomezNo ratings yet

- LICUDO Requirement 1Document2 pagesLICUDO Requirement 1Cygresy GomezNo ratings yet

- Tolerance of RiskDocument1 pageTolerance of RiskCygresy GomezNo ratings yet

- Values Formation and Moral RecoveryDocument3 pagesValues Formation and Moral RecoveryCygresy Gomez100% (1)

- As An IllustrationDocument1 pageAs An IllustrationCygresy GomezNo ratings yet

- A Constant Force Acting On A Heavy Body Causes ItDocument1 pageA Constant Force Acting On A Heavy Body Causes ItCygresy GomezNo ratings yet

- Newton Was Interested by ExperimentalDocument1 pageNewton Was Interested by ExperimentalCygresy GomezNo ratings yet

- Governance DEFINITIONDocument9 pagesGovernance DEFINITIONCygresy GomezNo ratings yet

- The Only Notable Ancient Astronomer in RomanDocument1 pageThe Only Notable Ancient Astronomer in RomanCygresy GomezNo ratings yet

- He AlsoDocument1 pageHe AlsoCygresy GomezNo ratings yet

- As A Result of PtolemyDocument1 pageAs A Result of PtolemyCygresy GomezNo ratings yet

- NewtonDocument1 pageNewtonCygresy GomezNo ratings yet

- Case Nowyouseeitjetfa 121004054109 Phpapp01Document12 pagesCase Nowyouseeitjetfa 121004054109 Phpapp01Samarth KudalkarNo ratings yet

- Plant Assets, Natural Resources, and Intangible Assets: Accounting Principles, Ninth EditionDocument21 pagesPlant Assets, Natural Resources, and Intangible Assets: Accounting Principles, Ninth EditionMehedi HasanNo ratings yet

- Week 11. Depreciation and Its MethodsDocument30 pagesWeek 11. Depreciation and Its MethodsNahum Dave MancillaNo ratings yet

- AA Metals Case.440Document2 pagesAA Metals Case.440Aravind NairNo ratings yet

- ACM C A08 Construction Equipment Management Assignment 2: Submission Deadline: 2 September, 10amDocument2 pagesACM C A08 Construction Equipment Management Assignment 2: Submission Deadline: 2 September, 10amRushikesh ChevaleNo ratings yet

- Checklist For DividendDocument2 pagesChecklist For DividendKhalid MahmoodNo ratings yet

- Asset Class 150% DDB 200% DDB SL SYD Depreciation MethodDocument4 pagesAsset Class 150% DDB 200% DDB SL SYD Depreciation MethodIsmayuni MukharromahNo ratings yet

- Comparative Analysis of Prism Cement LTD With JK Cement LTDDocument57 pagesComparative Analysis of Prism Cement LTD With JK Cement LTDMitul KathuriaNo ratings yet

- Quiz Internal AccountingDocument3 pagesQuiz Internal AccountingMili Dit100% (1)

- Property, Plant and EquipmentDocument6 pagesProperty, Plant and EquipmentDianna DayawonNo ratings yet

- Cma CDocument14 pagesCma CNaman agrawalNo ratings yet

- Indigolearn: Accounting Standard 5Document7 pagesIndigolearn: Accounting Standard 5chandreshNo ratings yet

- Group Case Study 1 - ABC Sietron Furniture SDN BHDDocument18 pagesGroup Case Study 1 - ABC Sietron Furniture SDN BHDizzarulshazwanNo ratings yet

- Lecture CHAPTER 10 LESSEE ACCOUNTINGDocument7 pagesLecture CHAPTER 10 LESSEE ACCOUNTINGLady Pila0% (1)

- AFS SolutionsDocument19 pagesAFS SolutionsRolivhuwaNo ratings yet

- Manual Instructions For SAP Note 2448924Document11 pagesManual Instructions For SAP Note 2448924Cokie ManNo ratings yet

- Douglas KinghornDocument24 pagesDouglas KinghornAnonymous 3DG7N5No ratings yet

- Financial Statements Template - Closed CorporationDocument42 pagesFinancial Statements Template - Closed CorporationLoveNo ratings yet

- ABM BF W3 Module 5 FinalDocument29 pagesABM BF W3 Module 5 Final30 Odicta, Justine AnneNo ratings yet

- Grade11 Fabm1 Q2 Week6Document19 pagesGrade11 Fabm1 Q2 Week6Mickaela MonterolaNo ratings yet

- Assessment Activities Module 1: Intanible AssetsDocument16 pagesAssessment Activities Module 1: Intanible Assetsaj dumpNo ratings yet

- FRS 8 Ig (2016)Document4 pagesFRS 8 Ig (2016)David LeeNo ratings yet

- Session 6 Long Term Assets - HandoutDocument18 pagesSession 6 Long Term Assets - HandoutPranav KumarNo ratings yet

- Definition and Explanation:: (1) - Adjusting Entries That Convert Assets To ExpensesDocument8 pagesDefinition and Explanation:: (1) - Adjusting Entries That Convert Assets To ExpensesKae Abegail GarciaNo ratings yet

- Intercompany Transfers of Services and Noncurrent Assets: Mcgraw-Hill/IrwinDocument71 pagesIntercompany Transfers of Services and Noncurrent Assets: Mcgraw-Hill/IrwinannisaNo ratings yet

- Module 8 AgricultureDocument9 pagesModule 8 AgricultureTrine De LeonNo ratings yet