Professional Documents

Culture Documents

DR Prashant Mane

DR Prashant Mane

Uploaded by

Jean HarveyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DR Prashant Mane

DR Prashant Mane

Uploaded by

Jean HarveyCopyright:

Available Formats

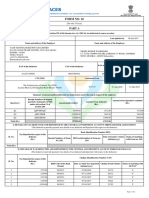

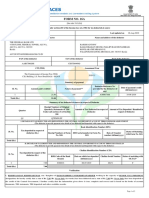

Dr.

Prashant Tukaram Mane

Naval Store Depot,Ghatkopar

Material Organisation

To, Date :-

Principal Controller of Defence Accounts Navy Imprest Section

Sub: - Amount not reflected in Annual Tax Statement for the Year 2022-23

Respected Sir,

I Dr.Prashant Tukaram Mane, Medical Officer II have joined MO(MB) Ghatkopar in September

2021.Being citizen of India I have been regularly paying my income tax as per the provisions of the

Income Tax Act,1961. However, I have observed certain differences in Form 26 AS (Annual tax

statement) described in table below.

(Amount in INR)

F.Y. Shortfall

Amount not

reflected in

Actual Working as per Current status as per Annual tax

Details Income Tax Act,1961 Annual Tax Statement statement

2022- Yearly Contractual

2023 Payment 900,000 290,242 609,758

TDS deducted 90,000 29,024 60,976

Request you to provide explanation for shortfall of contractual payment and TDS observed in Annual tax

statement for F.Y.2022-2023 generated by TDS centralized processing cell of Income tax department.

Regards,

Dr.Prashant Tukaram Mane

Medical Officer II

Pan No : AJIPM5250H

Encl: Annual tax statement for FY 2022-2023

You might also like

- Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument3 pagesCertificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySvsSridharNo ratings yet

- Agcpa9205b 2019-20Document2 pagesAgcpa9205b 2019-20HRNo ratings yet

- Form 16 FormatDocument2 pagesForm 16 FormatParthVanjaraNo ratings yet

- Form 16 Part A Name and Address of The Employer Name and Designation of The EmployeeDocument3 pagesForm 16 Part A Name and Address of The Employer Name and Designation of The EmployeeishaqmdNo ratings yet

- Geeta - Form 16 A 2022-23Document2 pagesGeeta - Form 16 A 2022-23Sourabh PunshiNo ratings yet

- Form16 SignedDocument7 pagesForm16 SignedrajNo ratings yet

- Abfpw1788f 2017-18 PDFDocument2 pagesAbfpw1788f 2017-18 PDFNikhil121314No ratings yet

- Form16-2018-19 Part ADocument2 pagesForm16-2018-19 Part AMANJUNATH GOWDANo ratings yet

- DD ProjectDocument2 pagesDD Projectjatin kuashikNo ratings yet

- Form 16 2020 21Document6 pagesForm 16 2020 21Manoj MahimkarNo ratings yet

- EyspsDocument2 pagesEyspsrasoolvaliskNo ratings yet

- Form 16 FY 18-19 PART - ADocument2 pagesForm 16 FY 18-19 PART - Asai venkataNo ratings yet

- Form 16 FY 19-20Document6 pagesForm 16 FY 19-20Anurag SharmaNo ratings yet

- PPT-on-GST Annual-ReturnDocument33 pagesPPT-on-GST Annual-Returnshrutha p jainNo ratings yet

- GTL InfraDocument9 pagesGTL InfraVinay JainNo ratings yet

- 1 - Form16 - 218 - FY 2021-22Document9 pages1 - Form16 - 218 - FY 2021-22Sasi NimmakayalaNo ratings yet

- Aayush JainDocument3 pagesAayush Jaindingle2No ratings yet

- Recibo 2019-2020Document2 pagesRecibo 2019-2020Bruno SouzaNo ratings yet

- From16 A PDFDocument2 pagesFrom16 A PDFAadarshNo ratings yet

- It 000130136938 2023 12Document1 pageIt 000130136938 2023 12MUHAMMAD MAJID AKHTER USMAN BASHEERNo ratings yet

- (2021 Tax Memo) Year-End Tax Compliance RemindersDocument2 pages(2021 Tax Memo) Year-End Tax Compliance RemindersMary Joy BautistaNo ratings yet

- Bos 44566Document24 pagesBos 44566Bhavani KannanNo ratings yet

- Reply For Hashim KhanDocument2 pagesReply For Hashim Khanhamza awan0% (1)

- AHJPT8244M - Show Cause Notice For Proceedings Us 148A - 1063028654 (1) - 20032024Document4 pagesAHJPT8244M - Show Cause Notice For Proceedings Us 148A - 1063028654 (1) - 20032024hadassaha VNo ratings yet

- 02012020fin RT4 PDFDocument1 page02012020fin RT4 PDFPAO TPT PAO TPTNo ratings yet

- Ministry of Finance (Department of Revenue) : The Gazette of India: Extraordinary (P Ii-S - 3 (Ii) )Document1 pageMinistry of Finance (Department of Revenue) : The Gazette of India: Extraordinary (P Ii-S - 3 (Ii) )Vishal KanadeNo ratings yet

- PAS 8 - Template in Answering Error CorrectionDocument2 pagesPAS 8 - Template in Answering Error CorrectionJasmine GabianaNo ratings yet

- Medhavi Giri FORM 16 TDSAPRIL TO OCT2022Document9 pagesMedhavi Giri FORM 16 TDSAPRIL TO OCT2022prateek gangwaniNo ratings yet

- Form 16-2021-2022 - UnlockedDocument9 pagesForm 16-2021-2022 - Unlockedvhacky123No ratings yet

- GST Returns: BackgroundDocument3 pagesGST Returns: BackgroundPrakash PalanisamyNo ratings yet

- M.F.Report. October-2020 FinalDocument22 pagesM.F.Report. October-2020 FinalMuhammad NasirNo ratings yet

- Form 16: SLN Facility Management Private LimitedDocument10 pagesForm 16: SLN Facility Management Private LimitedChetan NarasannavarNo ratings yet

- FormatDocument5 pagesFormatPurvi SehgalNo ratings yet

- OLD Income Tax Performa-2021-22Document13 pagesOLD Income Tax Performa-2021-22Research AccountNo ratings yet

- Annual.202111684 Form16 - Kaustubh KandharkarDocument8 pagesAnnual.202111684 Form16 - Kaustubh KandharkarKaustubh KandharkarNo ratings yet

- It 000130635883 2023 12Document1 pageIt 000130635883 2023 12MUHAMMAD MAJID AKHTER USMAN BASHEERNo ratings yet

- REPUBLIC OF THE PHILIPPINES FROM Rdo 27Document5 pagesREPUBLIC OF THE PHILIPPINES FROM Rdo 27ernestaguilar.valentinoNo ratings yet

- It Reply Merge - PavaniDocument5 pagesIt Reply Merge - Pavanibharath reddyNo ratings yet

- Tax Advisory BIR Form Shall Be Used For VAT PDFDocument1 pageTax Advisory BIR Form Shall Be Used For VAT PDFAndrew Benedict PardilloNo ratings yet

- It 000129188024 2023 11Document1 pageIt 000129188024 2023 11MUHAMMAD MAJID AKHTER USMAN BASHEERNo ratings yet

- RMC No. 125-2020Document1 pageRMC No. 125-2020Raine Buenaventura-EleazarNo ratings yet

- Nation: MarketDocument9 pagesNation: MarketDebashis MitraNo ratings yet

- Government of Andhra Pradesh: G.O.Rt - No: - DatedDocument2 pagesGovernment of Andhra Pradesh: G.O.Rt - No: - DatedChintham ReddyNo ratings yet

- 2307 FormDocument3 pages2307 FormK and F Construction Dev't CorpNo ratings yet

- Tri Hita Karana ForumDocument14 pagesTri Hita Karana Forumtonitoni27No ratings yet

- Binder 1Document2 pagesBinder 1PARAMJEETSINGHNo ratings yet

- GST RFD-01 - 37AABCJ1299A1ZS - EXPWOP - 201904 - FormDocument3 pagesGST RFD-01 - 37AABCJ1299A1ZS - EXPWOP - 201904 - FormkotisanampudiNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToRajesh AntonyNo ratings yet

- Nov 2021-97th EditionDocument13 pagesNov 2021-97th EditionSwathi JainNo ratings yet

- NSEIT Declaration For Sec 206ABDocument1 pageNSEIT Declaration For Sec 206ABsam franklinNo ratings yet

- Title BookDocument1 pageTitle Bookbap1986No ratings yet

- Income Tax Payment Challan: PSID #: 41614961Document1 pageIncome Tax Payment Challan: PSID #: 41614961Zubair KhanNo ratings yet

- 1form 16 Novopay PDFDocument2 pages1form 16 Novopay PDFTirupathi Rao TellaputtaNo ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet