Professional Documents

Culture Documents

Investment

Investment

Uploaded by

Ali Usama0 ratings0% found this document useful (0 votes)

10 views2 pagesThe document outlines the details of a proposed hotel project in Lahore, Pakistan, including an estimated total cost of PKR 1.28 billion to be funded equally through equity and debt. It provides the projected after-tax net operating cash flows over 5 years. Key assumptions and the project scope involving a 100-room hotel are defined. Metrics like payback period, net present value (NPV), and internal rate of return (IRR) are identified to evaluate the project's viability against the investor's required 25% rate of return.

Original Description:

investment appraisal

Original Title

investment

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the details of a proposed hotel project in Lahore, Pakistan, including an estimated total cost of PKR 1.28 billion to be funded equally through equity and debt. It provides the projected after-tax net operating cash flows over 5 years. Key assumptions and the project scope involving a 100-room hotel are defined. Metrics like payback period, net present value (NPV), and internal rate of return (IRR) are identified to evaluate the project's viability against the investor's required 25% rate of return.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views2 pagesInvestment

Investment

Uploaded by

Ali UsamaThe document outlines the details of a proposed hotel project in Lahore, Pakistan, including an estimated total cost of PKR 1.28 billion to be funded equally through equity and debt. It provides the projected after-tax net operating cash flows over 5 years. Key assumptions and the project scope involving a 100-room hotel are defined. Metrics like payback period, net present value (NPV), and internal rate of return (IRR) are identified to evaluate the project's viability against the investor's required 25% rate of return.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Certainly, let's adjust the assumptions and details to reflect the currency in Pakistani

Rupees (PKR) and the location in Lahore, Gulberg, Pakistan.

1. Estimated Cost of Project (in PKR):

Land and Building: PKR 800 million

Plant and Machinery: PKR 320 million

Working Capital: PKR 160 million

Total Estimated Cost: PKR 1.28 billion

2. Source of Finance:

Equity: PKR 640 million

Debt (Bank Loan): PKR 640 million

3. 5 Years After-Tax Net Operating Cash Flows (NOCF) (in PKR):

Year 1: PKR 64 million

Year 2: PKR 76.8 million

Year 3: PKR 89.6 million

Year 4: PKR 102.4 million

Year 5: PKR 115.2 million

4. Assumptions:

Occupancy Rate: 70%

Average Room Rate: PKR 15,000 per night

Operating Expenses: 60% of revenue

Tax Rate: 30%

5. Project Scope:

Products: Hotel services, rooms, restaurant, event spaces.

Location: Lahore, Gulberg, Pakistan.

Land and Building: 50,000 sq. ft. with 100 rooms.

Plant and Machinery: Furnishings, kitchen equipment, etc.

Working Capital Requirements: Covers day-to-day operational costs.

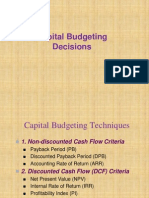

6. Payback Period, NPV, and IRR:

Payback Period: Determine when the initial investment is recovered.

Net Present Value (NPV): Discount future cash flows to present value.

Internal Rate of Return (IRR): Find the rate of return that makes NPV zero.

7. Investor's Required Rate of Return:

Assuming a 25% required rate of return.

Conclusion/Analysis:

Payback Period: Ideally, shorter is better.

NPV: A positive NPV indicates a potentially profitable project.

IRR: Should be greater than the required rate of return for a viable investment.

You might also like

- Investment Evaluation CriteriaDocument10 pagesInvestment Evaluation CriteriaGosaye Desalegn100% (1)

- G4 Bethesda CompanyDocument37 pagesG4 Bethesda CompanySylvia MiraNo ratings yet

- FFM Updated AnswersDocument79 pagesFFM Updated AnswersSrikrishnan SNo ratings yet

- Capital Budgeting Decisions: Dr. Narayan Baser SPM Pdpu GandhinagarDocument60 pagesCapital Budgeting Decisions: Dr. Narayan Baser SPM Pdpu GandhinagarAman MakkadNo ratings yet

- Capital Budgeting (Principles & Techniques)Document31 pagesCapital Budgeting (Principles & Techniques)Shashank100% (4)

- Case... Phuket Beach HotelDocument3 pagesCase... Phuket Beach HotelSanjay Kumar JainNo ratings yet

- Capital Budgeting: Dr. Akshita Arora IBS-GurgaonDocument24 pagesCapital Budgeting: Dr. Akshita Arora IBS-GurgaonhitanshuNo ratings yet

- 2.3 Capital Budgeting PDFDocument26 pages2.3 Capital Budgeting PDFOwlHeadNo ratings yet

- Establishment of Dhaba Project ReportDocument2 pagesEstablishment of Dhaba Project Reportjyotikokate83% (6)

- MODULE 8 Capital BudgetingDocument9 pagesMODULE 8 Capital BudgetingLumingNo ratings yet

- CH 08 RevisedDocument51 pagesCH 08 RevisedBhakti MehtaNo ratings yet

- Project Brief: 18 Holes Golf Course & Club, 5 To 7 Star Hotel at IslamabadDocument4 pagesProject Brief: 18 Holes Golf Course & Club, 5 To 7 Star Hotel at IslamabadTARIQNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingavtaarNo ratings yet

- Project FinanceDocument19 pagesProject FinancejahidkhanNo ratings yet

- Roll Number 17 PDFDocument14 pagesRoll Number 17 PDFWasim AttaNo ratings yet

- Capital BudgetingDocument39 pagesCapital BudgetingSiddhesh AsatkarNo ratings yet

- Capital ExpenditureDocument24 pagesCapital Expenditureamol_patil591278No ratings yet

- C B E T: Apital Udgeting Valuation EchniquesDocument55 pagesC B E T: Apital Udgeting Valuation EchniquesClash RoyaleNo ratings yet

- Working Capital ProblemsDocument4 pagesWorking Capital ProblemsAkshata ShrivastavaNo ratings yet

- Theoretical and Conceptual Questions: (See Notes or Textbook)Document4 pagesTheoretical and Conceptual Questions: (See Notes or Textbook)raymondNo ratings yet

- Practice Question For Capital Budgeting: Ans: NPV (P) Rs. 5381, NPV (Q) Rs. 3814Document3 pagesPractice Question For Capital Budgeting: Ans: NPV (P) Rs. 5381, NPV (Q) Rs. 3814Sumit Kumar SahooNo ratings yet

- Working Capital ProblemsDocument3 pagesWorking Capital ProblemsSayonarababayNo ratings yet

- Chapte R: CAPITAL BUDGETING - Investment DecisionsDocument56 pagesChapte R: CAPITAL BUDGETING - Investment DecisionsSurya SivakumarNo ratings yet

- Vikas Patel Oil ExpellerDocument15 pagesVikas Patel Oil ExpellerSuresh VarmaNo ratings yet

- Working Capital ManagementDocument2 pagesWorking Capital ManagementShaikh GM33% (3)

- MS 3412 Capital BudgetingDocument6 pagesMS 3412 Capital BudgetingMonica GarciaNo ratings yet

- CA 51014 - Strategic Cost Management Capital BudgetingDocument9 pagesCA 51014 - Strategic Cost Management Capital BudgetingMark FloresNo ratings yet

- Capital Budgeting DecisionsDocument30 pagesCapital Budgeting Decisionskd231No ratings yet

- Noodles Manufacturing UnitDocument2 pagesNoodles Manufacturing UnitsweeturituNo ratings yet

- Project ReportDocument5 pagesProject ReportSajith KumarNo ratings yet

- Namibia University: of Science and TechnologyDocument6 pagesNamibia University: of Science and TechnologyMegan-Jane RobinsonNo ratings yet

- L-4 Project AppraisalDocument9 pagesL-4 Project Appraisalattitudefirstpankaj8625No ratings yet

- Capital Budgeting Decisions: Chapter - 8Document49 pagesCapital Budgeting Decisions: Chapter - 8garv2114No ratings yet

- Faculty: Ahamed Riaz: Capital Budgeting DecisionsDocument51 pagesFaculty: Ahamed Riaz: Capital Budgeting DecisionsShivani RajputNo ratings yet

- UNIT V: Working Capital Management and Contemporary Issues in FinanceDocument56 pagesUNIT V: Working Capital Management and Contemporary Issues in FinanceSantosh DhakalNo ratings yet

- LEDs & CompressorsDocument146 pagesLEDs & Compressorsyanzhifeng29No ratings yet

- Capital Budgeting DecisionsDocument50 pagesCapital Budgeting DecisionspiyushNo ratings yet

- Capital Budgeting DecisionsDocument36 pagesCapital Budgeting DecisionsPrashant SharmaNo ratings yet

- Mech Bicycle RimsDocument8 pagesMech Bicycle Rimsharish rajputNo ratings yet

- CFAP 4 BFD Winter 2022Document6 pagesCFAP 4 BFD Winter 2022Ammar FatehNo ratings yet

- Capital BudgetingDocument45 pagesCapital BudgetingPranav ChandraNo ratings yet

- Project On Jute WeavingDocument3 pagesProject On Jute WeavingArjyoBasuNo ratings yet

- Capital Budgeting DecisionsDocument44 pagesCapital Budgeting Decisionsarunadhana2004No ratings yet

- Capital BudgetingDocument37 pagesCapital Budgetingyashd99No ratings yet

- Question SFM GMDocument3 pagesQuestion SFM GMPraDeepMspNo ratings yet

- Unit 4 Capital BudgetingDiscounted TechniquesDocument22 pagesUnit 4 Capital BudgetingDiscounted Techniquesvishal kumarNo ratings yet

- 2 - INTRO TO Financial FSDocument19 pages2 - INTRO TO Financial FSmuhammad akbar bahmiNo ratings yet

- Poultry Farming Project Proposal2Document38 pagesPoultry Farming Project Proposal2afreenahmadNo ratings yet

- FINMAN2Document4 pagesFINMAN2Vince BesarioNo ratings yet

- MAS 10 - Capital BudgetingDocument10 pagesMAS 10 - Capital BudgetingClint AbenojaNo ratings yet

- BAJRANGDocument23 pagesBAJRANGvikash BhadoriaNo ratings yet

- Capital Budgeting SxukDocument10 pagesCapital Budgeting Sxuk10.mohta.samriddhiNo ratings yet

- Theoretical and Conceptual Questions: (See Notes or Textbook)Document14 pagesTheoretical and Conceptual Questions: (See Notes or Textbook)raymondNo ratings yet

- 6790 18282 1 PBDocument8 pages6790 18282 1 PBfebri zebuaNo ratings yet

- Financial Planning ( Fish Farming Business)Document12 pagesFinancial Planning ( Fish Farming Business)Nabeel AhmadNo ratings yet

- Chapter - 8: Capital Budgeting DecisionsDocument45 pagesChapter - 8: Capital Budgeting DecisionsNirmal ThomasNo ratings yet

- GRC FinMan Capital Budgeting ModuleDocument10 pagesGRC FinMan Capital Budgeting ModuleJasmine FiguraNo ratings yet

- Financial Management Session 9Document19 pagesFinancial Management Session 9Khushi HemnaniNo ratings yet

- ImperialismDocument22 pagesImperialismAli UsamaNo ratings yet

- GMAT SyllabusDocument8 pagesGMAT SyllabusAli UsamaNo ratings yet

- Prof - Sidra HRM 8th LectureDocument27 pagesProf - Sidra HRM 8th LectureAli UsamaNo ratings yet

- Prof - Sidra HRM 9th LectureDocument33 pagesProf - Sidra HRM 9th LectureAli UsamaNo ratings yet

- Atlas HondaDocument15 pagesAtlas HondaAli UsamaNo ratings yet

- BLAW2Document2 pagesBLAW2Ali UsamaNo ratings yet

- CH 25 Production and GrowthDocument5 pagesCH 25 Production and GrowthAli UsamaNo ratings yet

- Prof - Sidra HRM 7th LectureDocument19 pagesProf - Sidra HRM 7th LectureAli UsamaNo ratings yet

- Business StatisticsDocument4 pagesBusiness StatisticsAli UsamaNo ratings yet

- Packages Annual Report Assignment 1Document2 pagesPackages Annual Report Assignment 1Ali UsamaNo ratings yet