Professional Documents

Culture Documents

Enterprise Risk Management

Uploaded by

Yves Nicollete LabadanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Enterprise Risk Management

Uploaded by

Yves Nicollete LabadanCopyright:

Available Formats

PALAWAN STATE UNIVERSITY

COLLEGE OF BUSINESS AND ACCOUNTANCY

PUERTO PRINCESA CITY

ENTERPRISE RISK MANAGEMENT

PrE 4: ENTERPRISE RISK MANAGEMENT

2ND Semester | SY: 2023-2024

TOPIC 1

Overview

• Define Risk.

Risk is a possibility that something bad will happen that could possibly

impact our plans and achievement of our objectives. Organizations

need to identify, assess, and manage risks to achieve their goals,

including protecting the organization's assets and avoiding

unexpected losses.

• Enterprise Risk defined.

• What is Enterprise Risk Management (ERM)?

• Enterprise Risk and Expected Loss

• Value at Risk

o Value at Risk methods

• Identify and explain different types of enterprise risk

o Financial Risk: Types of Financial Risk

o Operational Risk

o Strategic Risk

• Scope of Risk Management

• Principles and aims of risk management

ENTERPRISE RISK MANAGEMENT - 1 -

DISCUSSION:

RISK

What is risk? Risk is the level of uncertainty about future events. Organization

mangers need to identify, assess and respond to risk in order for the organization

to achieve its goals and objectives and its vision. Risk must be managed to an

acceptable level to adequately protect the organizational assets and to mitigate

losses. Even though risks are difficult to determine and quantify, management

should make the best effort to identify, assess, and respond to them. This section

focuses on the enterprise risk management (ERM) model. ERM provides a

comprehensive approach to risk identification, assessment, and response.

ENTERPRISE RISK DEFINED.

Enterprise risk is a condition that may prevent an organization from achieving its

objective. Some business risk is easy to locate. We put sprinkler systems in buildings

and buy insurance policies to protect against fires. Retail stores put magnetic

detectors at entrance doors to detect shoplifters and prevent theft. But some

enterprise risks, which are risks that would cause losses or put the ability of the

business to function appropriately in jeopardy, aren't always as easy to identify.

Although risks often are difficult to determine and quantify, management should

make the best effort to identify risks and their probabilities of occurrence.

Several organizations provide guidance to assist with the design and

implementation of an effective enterprise-wide risk management approach. The

latter part of this topic focuses on the most widely used and accepted enterprise

risk management framework, the COSO Enterprise Risk Management Integrated

Framework, a comprehensive approach to assessing an organization's risk.

ENTERPRISE RISK MANAGEMENT

Enterprise Risk Management (ERM) is, in its simplest definition, risk management

practiced at the enterprise level. It puts the core strategic mission of the enterprise

at the center of the discussion, driving all possible responses to potential risks in a

holistic approach. This has not always been the case. The ever-increasing

complexity of the world is engendering new and sometimes previously

unimagined risks, ones that don’t always fall within what was considered

traditional risk management practice. The need for a different approach had

become increasingly clear over the last two decades or so, and ERM emerged to

the fore as a response to these new challenges. ERM is still evolving, a fitting

testament to the fact the ERM is itself an ongoing process and not a one-time

project. This section will describe the history of risk management as a backdrop to

better understand what is now considered cutting-edge ERM.

ENTERPRISE RISK MANAGEMENT - 2 -

ENTERPRISE RISK AND EXPECTED LOSS

In a business context, risk is defined as the level of exposure to a chance of loss.

For example, if BSA Company determines that a particular risk could result in a loss

up to P500,000.00, the company would be willing to spend up to P500,000.00 to

mitigate the risk. The amount of the loss calculated by the company represents

the maximum possible loss (extreme or catastrophic loss). This loss often is referred

to as the value at risk (Var). VaR includes cash flow at risk, earnings at risk, and

earnings per share (EPS) distribution (mean and variance). Normal risk models

cannot deal with totally unexpected losses such as an atomic attack.

VALUE AT RISK (VaR)

As noted, historical performance over long periods of time average rates of return

to accommodate fluctuations of unusually high or low returns. But as the name

implies, historical provides a retrospective indication of risk. When reviewing a

portfolio, historical volatility illustrates how risky the portfolio had been over the

some previous period of time. It provides no indication about the current market

risk of the portfolio. VaR gives the organizations the ability to assess current risk.

VaR is the maximum loss within a given period of time and given a specified

probability level (level of confidence). Unlike retrospective risk metrics that

measure historical volatility, VaR is prospective. It quantifies market risk while it is

being taken.

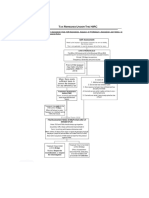

Figure 1 – Value at Risk Characteristics

Application VaR can be applied to any portfolio that can be

reasonably be marked to market performance on a

regular basis. VaR is not applicable to real estate or

other illiquid assets.

Time Frame/Horizon VaR evaluates a portfolio’s performance over a specific

period of time, such as trading day, week, or a month.

Base Currency VaR measures risk in a currency. Any currency can be

used.

VaR measurement A resulting Var measure summarizes a portfolio’s market

risk with a single number.

VALUE AT RISK (VaR) METHODS:

ENTERPRISE RISK MANAGEMENT - 3 -

The historical method estimates risk based on actual historical

returns for a time period by putting them in order from worst to

best. The historical method assumes that history will repeat itself

Historical Method from a risk perspective. A histogram plot correlates the

frequency of returns with losses. The results indicate the

confidence level related to the occurrence of a worst-case

daily loss. (For example, if we invest $1,000, we are 95%

confident that our worst daily loss will not exceed $40 ($1,000 ×

4%).)

The variance-covariance method assumes that stock returns

Variance are normally distributed. Expected (or average) return and a

Covariance Method standard deviation are estimated, and a normal distribution

curve is plotted. By reviewing the normal curve, one can see

exactly where the worst percentages lie on the curve.

A Monte Carlo simulation refers to any method that randomly

Monte Carlo generates trials. This method involves developing a model for

Simulation future returns and running multiple hypothetical tests through

the model. It enables calculating the expected loss and the

variance related to the losses and the probabilities associated

with the maximum loss.

TYPES OF ENTERPRISE RISK

Hazards Risk related to natural disasters such as storms, floods, etc.

Risk is caused by the inability to finance the business, including

Financial short-term (liquidity) and long-term (solvency). This risk can be

influenced by internal factors such as strategic decisions or

external factors such as global economic conditions.

Risk is related to the mix of fixed and variable costs in a

Operational company's cost structure. Risk increases with the proportion of

fixed costs. Operational risk can also arise from the internal

process and system failures, personnel, legal and compliance

issues, and political instability.

Strategic Risk related to planning and strategic decisions.

Business Risk Risk related to the fundamental viability of a business—the

question of whether a company will be able to make sufficient

sales and generate adequate revenues to cover its operational

expenses and turn a profit.

FINANCIAL RISK

ENTERPRISE RISK MANAGEMENT - 4 -

Financial risk, as the term suggests, is the risk that involves financial loss to firms.

Financial risk generally arises due to instability and losses in the financial market

caused by movements in stock prices, currencies, interest rates, and more.

TYPES OF FINANCIAL RISK:

a) Market Risk

This type of risk arises due to the movement in prices of financial

instruments. Market risk can be classified as Directional Risk and Non-

Directional Risk. Directional risk is caused due to movement in stock price,

interest rates, and more. Non-Directional risk, on the other hand, can be

volatility risks.

b) Credit Risk

Also known as default risk. This type of risk arises when an organization fails

to fulfill its obligations towards its counterparties. Credit risk can be

classified into Sovereign Risk and Settlement Risk. Sovereign risk usually

occurs due to complex foreign exchange policies. On the other hand,

settlement risk arises when one party makes the payment while the other

party fails to fulfill the obligations.

c) Liquidity Risk

This type of risk arises out of an inability to execute transactions. Liquidity

risk can be classified into Asset Liquidity Risk and Funding Liquidity Risk.

Asset Liquidity risk arises either due to insufficient buyers or insufficient

sellers against sell orders and buys orders, respectively.

d) Legal Risk

This type of financial risk arises out of legal constraints such as lawsuits.

Whenever a company needs to face financial losses out of legal

proceedings, it is a legal risk.

e) Asset-backed Risk

This type is the chance that asset-backed securities—pools of various types

of loans—may become volatile if the underlying securities also change in

value. Sub-categories of asset-backed risk involve the borrower paying off

a debt early, thus ending the income stream from repayments and

significant changes in interest rates.

f) Foreign Investment Risk

Investors holding foreign currencies are exposed to currency risk because

different factors, such as interest rate changes and monetary policy

changes, can alter the calculated worth or the value of their money.

Meanwhile, changes in prices because of market differences, political

changes, natural calamities, diplomatic changes, or economic conflicts

ENTERPRISE RISK MANAGEMENT - 5 -

may cause volatile foreign investment conditions that may expose

businesses and individuals to foreign investment risk.

OPERATIONAL RISK

"Operational Risks" is a risk that includes errors because of the system, human

intervention, incorrect data, or other technical problems. Every firm or individual

has to deal with such an operational risk in completing any task/delivery.

Operational risks may include:

a) System errors

b) Internal control errors

c) Product issues

d) Human errors

e) Improper management

f) Quality issues

In the case of individuals, we can drill it down to error because of self-process

or other technical problems.

STRATEGIC RISK

a) Industry Margin Squeeze

As industries evolve, a succession of changes can occur that threatens all

companies within that sector. One particular threat is that profit margins

will be eroded for all companies in that sector. The industry will become a

no-profit zone from factors such as overcapacity and commoditization.

The best countermeasure for this margin squeeze is shifting the

compete/collaborate ratio among the firms. When the industry is growing,

and margins are large, companies can compete nearly on all fronts and

ignore collaboration. However, this 100 to zero ratio of competition to

collaboration should dramatically shift when the margins decline.

Collaboration may include sharing back office functions, coproduction or

asset-sharing agreements, purchasing and supply chain coordination,

joint R&D, and collaborative marketing.

b) Technology Shift

Technology risks can impact a company's performance. But the entrance

of new technology into the industry can make companies' products and

services obsolete quickly. For example, the film processing industry

experienced a significant shift with introducing digital imaging into a

formerly film-based process. However, most firms don't always know how

and when technology will succeed in the marketplace. Risk managers

ENTERPRISE RISK MANAGEMENT - 6 -

can double bet-that invest in two or more versions of technology

simultaneously. Hence, no matter which version prevails, the company

comes out as a winner.

c) Brand Erosion

Brands are susceptible to an array of risks that can appear overnight and

threaten to destroy the brand. One of the most effective

countermeasures to brand erosion is redefining the scope of brand

investment past marketing to other factors that affect a brand, like service

and product quality. Another countermeasure involves the continuous

reallocation of brand investment based on the early detection of

weaknesses by measuring the critical dimensions of the brand

continuously.

d) Competitor

Competitors are the company's major sources of risk, whether from the

threat of new products or lower-cost structures. One of the most

detrimental risks is the one-of-a-kind competitor that emerges in the

market and seizes most of the market share. Constantly scanning the

need for this type of competitor is crucial because the best response is to

change the business design once identified rapidly. This response allows a

company to minimize the strategic overlap from the competitor and

establish a profitable position in an adjacent marketplace.

e) Customer Priority Shift

One of the most significant risks associated with customers is the shift in

customers' preferences. Two effective countermeasures are the

continuous creation and analysis of proprietary information and fast and

cheap experimentation. Ongoing innovation and research enable

companies to detect the next phase of customer preferences in the

industry. The quick and affordable experiment helps managers to

determine the right product variations to offer different customers fast.

These approaches help companies retain and grow their customer bases

and increase revenue per customer and overall profitability.

(Customer priority shift is another form of strategic risk. Customers'

preferences can change gradually or overnight without any prior notice

to a company. To help understand customers' preferences, companies

need to create and analyze proprietary information continuously. Also,

companies should use fast and cheap experimentation methods with

customers. This helps companies identify the proper product variations to

offer to different customers.)

f) Project (New-Project Failure)

ENTERPRISE RISK MANAGEMENT - 7 -

All projects face risks, but a new project faces the chance of not working

correctly, not attracting profitable customers, that competitors will copy

it, or that it grows too slowly. The best protection against these types of risk

is to begin with an accurate assessment of the project's chance of success

before it is launched. The next step is to review past projects'

performances, both internally and externally. Three methods to help a

company systematically improve the project's odds of success are smart

sequencing, developing excess options, and employing the stepping-

stone method. Smart sequencing means launching the better-

understood, more controllable projects first. Developing excess

opportunities while planning the project will also help to ensure the best

one is used. The stepping stone method involves creating a series of

projects that lead from uncertainty to success and make the ultimate

project a success.

g) Market Stagnation

Many companies have had their market value plateau or even decline

because they could not find new sources of growth. In order to counter

this risk of stagnating volume growth demand, innovation can be applied.

This involves redefining a company's market to expand the value offered

to customers beyond product functionality. This could reduce company

costs, capital intensity, cycle time, and risk, improving profitability.

Risks are identified by bringing the team together; the organization has to

bring together the project team, board, stakeholders and discuss essential

questions about the goals and then jot down what can be the risky

elements in the entire project. There is a need to have open discussions

on what could go wrong and what hindrances are most likely to occur?

What kind of harm will it cause to the project? Can it be avoided or

covered up? It is crucial to identify the threats that come with the project

and eventually find out the opportunities that risks create and use it for its

overall benefit.

In this lesson we have talk about many different risk terms. It is important to

understand the different risk terms because the managerial solution to the risk is

informed by where the risk comes from.

SUMMARY:

Firms face a variety of risks. Risk is affected by the volatility of an outcome and

the time horizonan event is expected to take place. The most common types

of risk are business risk, haxard risk, financial risk, operational risk, strategic risk,

legal risk, compliance risk, political risk, inherent risk, residual risk and liquidity risk.

Source

ENTERPRISE RISK MANAGEMENT - 8 -

Parrino, R., Kidwell, D., and Bates, T. (2017). Fundamentals of Corporate Finance,

4th Edition. Hoboken, NJ: John Wiley & Sons.

ENTERPRISE RISK MANAGEMENT - 9 -

You might also like

- Module 1 - Enterprise RiskDocument10 pagesModule 1 - Enterprise RiskLara Camille CelestialNo ratings yet

- Lecture 1 FRMDocument13 pagesLecture 1 FRMAmanksvNo ratings yet

- beninsDocument5 pagesbeninsCjade MamarilNo ratings yet

- Introduction to Risk Management PrinciplesDocument9 pagesIntroduction to Risk Management PrinciplesRohanne Garcia AbrigoNo ratings yet

- 1.2 How Do Firms Manage Financial Risks (1) - 1661260933946Document20 pages1.2 How Do Firms Manage Financial Risks (1) - 1661260933946ashutosh malhotraNo ratings yet

- Financial Risk Management: BY S.LingeswariDocument26 pagesFinancial Risk Management: BY S.Lingeswarilvinoth5No ratings yet

- Module in Financial Management - 04Document11 pagesModule in Financial Management - 04Angelo DomingoNo ratings yet

- Module in Financial Management - 04Document11 pagesModule in Financial Management - 04Karla Mae GammadNo ratings yet

- Risk Categories of Business RiskDocument3 pagesRisk Categories of Business RiskblahblahblahNo ratings yet

- Module 7 Risk MnagementDocument10 pagesModule 7 Risk MnagementddddddaaaaeeeeNo ratings yet

- Risk and Risk ManagementDocument4 pagesRisk and Risk ManagementShayne EsmeroNo ratings yet

- Managing Enterprise RiskDocument34 pagesManaging Enterprise Riskbaskoro suryoNo ratings yet

- Chapter 03 RMIDocument9 pagesChapter 03 RMISudipta BaruaNo ratings yet

- ACT1110 Fundamental Concepts of Risk ManagementDocument61 pagesACT1110 Fundamental Concepts of Risk ManagementRica RegorisNo ratings yet

- Principles of Risk: Minimum Correct Answers For This Module: 4/8Document12 pagesPrinciples of Risk: Minimum Correct Answers For This Module: 4/8Jovan SsenkandwaNo ratings yet

- Risk Management:: A Helicopter ViewDocument2 pagesRisk Management:: A Helicopter ViewTony NasrNo ratings yet

- Study Notes The Building Blocks of Risk ManagementDocument19 pagesStudy Notes The Building Blocks of Risk Managementalok kundaliaNo ratings yet

- Alternative Risk TRF e 02Document5 pagesAlternative Risk TRF e 02Vladi B PMNo ratings yet

- Week 2 Learning Material 20240225124705Document20 pagesWeek 2 Learning Material 20240225124705Erikka Mykaela AguilaNo ratings yet

- Screenshot 2022-12-05 at 6.19.06 PMDocument10 pagesScreenshot 2022-12-05 at 6.19.06 PMMehar MujahidNo ratings yet

- Chapter 11: Risk ManagementDocument31 pagesChapter 11: Risk ManagementKae Abegail GarciaNo ratings yet

- CMA 19 II-Section-DDocument22 pagesCMA 19 II-Section-DAkash GuptaNo ratings yet

- Introduction About The TopicDocument50 pagesIntroduction About The TopicchikkegoudaNo ratings yet

- Managing Financial Risk: OutcomesDocument35 pagesManaging Financial Risk: OutcomesprabodhNo ratings yet

- Copy of SS-BF-II-12 WEEK 8 Lecture NotesDocument3 pagesCopy of SS-BF-II-12 WEEK 8 Lecture NotesSheanne GuerreroNo ratings yet

- What's Your Risk Appetite - J. David Dean and Andrew F. GiffinDocument4 pagesWhat's Your Risk Appetite - J. David Dean and Andrew F. GiffinaesolerNo ratings yet

- Enterprise: Should BeDocument8 pagesEnterprise: Should BeBobNo ratings yet

- 18 Risk ManagementDocument28 pages18 Risk ManagementReyansh SharmaNo ratings yet

- GBERMIC - Module 11Document8 pagesGBERMIC - Module 11Paolo Niel ArenasNo ratings yet

- Topics: Source of Risk, Type of Risk Dealt by Treasure Management, Implications and Limitations of Risk ManagementDocument21 pagesTopics: Source of Risk, Type of Risk Dealt by Treasure Management, Implications and Limitations of Risk ManagementAayush GaurNo ratings yet

- Germic 1 3Document74 pagesGermic 1 3Mark CorpuzNo ratings yet

- Effect of Uncertainty On Objectives) Followed by Coordinated and Economical Application of Resources ToDocument6 pagesEffect of Uncertainty On Objectives) Followed by Coordinated and Economical Application of Resources ToKatrina Vianca DecapiaNo ratings yet

- GBERMICDocument34 pagesGBERMIC12abm.dinglasandymphnaNo ratings yet

- Risk Management - Value CreationDocument63 pagesRisk Management - Value CreationHijabeu CoNo ratings yet

- Risk ManagementDocument34 pagesRisk ManagementMarky AlmueteNo ratings yet

- Enterprise Risk Management Bfa 214Document38 pagesEnterprise Risk Management Bfa 214Palma TsokaNo ratings yet

- Financial Risk Management NotesDocument95 pagesFinancial Risk Management Notesafeefa siddiquaNo ratings yet

- Risk Management: Prof Mahesh Kumar Amity Business SchoolDocument41 pagesRisk Management: Prof Mahesh Kumar Amity Business SchoolasifanisNo ratings yet

- Risk Management & Internal Control: An Integrated ApproachDocument37 pagesRisk Management & Internal Control: An Integrated ApproachLiza Mae MirandaNo ratings yet

- RM Lesson #1 (Jan 28 2022)Document16 pagesRM Lesson #1 (Jan 28 2022)SonnyNo ratings yet

- Measuring and Mitigating Financial RiskDocument9 pagesMeasuring and Mitigating Financial RiskRaj KumarNo ratings yet

- C1 Introduction of Risks and Business RisksDocument37 pagesC1 Introduction of Risks and Business RisksMinh Tâm TrầnNo ratings yet

- Measuring Risk: Advanced Topics: Presented By: Bandeep Manka Neha Gaur Nidhi Shikha Shweta Swati AggarwalDocument60 pagesMeasuring Risk: Advanced Topics: Presented By: Bandeep Manka Neha Gaur Nidhi Shikha Shweta Swati Aggarwalbandeep12No ratings yet

- Final Final PeriodDocument40 pagesFinal Final PeriodRhea May BaluteNo ratings yet

- Risk Analysis And Management ToolsDocument8 pagesRisk Analysis And Management ToolsBHARATH TEJA REDDY MUNAKALANo ratings yet

- Risk Measure Estimation in FinanceDocument4 pagesRisk Measure Estimation in FinanceAli SaeiNo ratings yet

- Financial and Business Risk ManagementDocument75 pagesFinancial and Business Risk ManagementrochelleandgelloNo ratings yet

- T1-FRM-1-Ch1-Risk-Mgmt-v3.3 - Study NotesDocument21 pagesT1-FRM-1-Ch1-Risk-Mgmt-v3.3 - Study NotescristianoNo ratings yet

- Measuring Investment RiskDocument6 pagesMeasuring Investment Riskselozok1No ratings yet

- Risk Management ReviewerDocument7 pagesRisk Management ReviewerPhoebe WalastikNo ratings yet

- CMA Exam Review - Part 2 - Section D - Risk ManagementDocument2 pagesCMA Exam Review - Part 2 - Section D - Risk Managementaiza eroyNo ratings yet

- UOB Risk Management 2Document10 pagesUOB Risk Management 2jariya.attNo ratings yet

- Unit 7 - Risk Management and CGDocument31 pagesUnit 7 - Risk Management and CGKeshav SoomarahNo ratings yet

- Risk Management An IntroductionDocument5 pagesRisk Management An IntroductionRajesh KumarNo ratings yet

- CH 1 Foundations of Risk ManagementDocument162 pagesCH 1 Foundations of Risk ManagementMohd RizzuNo ratings yet

- Mba Iii Financial Risk ManagementDocument75 pagesMba Iii Financial Risk ManagementSimran GargNo ratings yet

- Acctg 320 Risk Management SummaryDocument14 pagesAcctg 320 Risk Management SummaryMeroz JunditNo ratings yet

- Assignment: Prepared ByDocument12 pagesAssignment: Prepared ByShamin ArackelNo ratings yet

- Report About RM 1Document20 pagesReport About RM 1Zaid ZatariNo ratings yet

- Sma Audit Scope of WorkDocument5 pagesSma Audit Scope of WorkYves Nicollete LabadanNo ratings yet

- Non Audit Engagements0Document23 pagesNon Audit Engagements0Yves Nicollete LabadanNo ratings yet

- Topic 1-Human Behavior and The Dynamic Work Environment: Learning OutcomesDocument7 pagesTopic 1-Human Behavior and The Dynamic Work Environment: Learning OutcomesYves Nicollete LabadanNo ratings yet

- Study GuideDocument2 pagesStudy GuideYves Nicollete LabadanNo ratings yet

- Tax Remedies FlowchartDocument4 pagesTax Remedies FlowchartYves Nicollete LabadanNo ratings yet

- Tax-Remedies (Govt-Remedies-Highlights)Document38 pagesTax-Remedies (Govt-Remedies-Highlights)Yves Nicollete LabadanNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Ias 36 PDFDocument4 pagesIas 36 PDFCarmela Joaquin Valbuena-PaañoNo ratings yet

- Comparison of Future Contracts with Forward ContractsDocument4 pagesComparison of Future Contracts with Forward ContractsSidharth ChoudharyNo ratings yet

- Report On MNGT 8Document15 pagesReport On MNGT 8Rhea Mae CarantoNo ratings yet

- CBN Rule Book Volume 4Document1,006 pagesCBN Rule Book Volume 4Justus OhakanuNo ratings yet

- For Use With Business Analysis and Valuation 6e by Palepu, Healy and Peek (ISBN 9781473779075) © 2022 Cengage EMEADocument21 pagesFor Use With Business Analysis and Valuation 6e by Palepu, Healy and Peek (ISBN 9781473779075) © 2022 Cengage EMEAFilip PopovicNo ratings yet

- Non Current LiabilitiesDocument7 pagesNon Current LiabilitiesRomano CruzNo ratings yet

- Narasimham Committee on Banking Sector Reforms (1998Document4 pagesNarasimham Committee on Banking Sector Reforms (1998Sumit MehtaNo ratings yet

- Investment Analysis and Portfolio Management (ACFN 632)Document62 pagesInvestment Analysis and Portfolio Management (ACFN 632)habtamuNo ratings yet

- Donors TaxDocument6 pagesDonors TaxMachi KomacineNo ratings yet

- 21 FAR460 SS SET 1 Dec21 Kel - StudentDocument9 pages21 FAR460 SS SET 1 Dec21 Kel - StudentRuzaikha razaliNo ratings yet

- Narrative Report MseDocument12 pagesNarrative Report MseAxel HagosojosNo ratings yet

- Common Account Opening Form for Public Sector BanksDocument20 pagesCommon Account Opening Form for Public Sector BanksMr. RajkumarNo ratings yet

- Building Brazil's Derivative CapabilityDocument7 pagesBuilding Brazil's Derivative CapabilityKc CruzNo ratings yet

- Malaysian Stock Market Impacted by Macroeconomic FactorsDocument2 pagesMalaysian Stock Market Impacted by Macroeconomic FactorsHitesh BalNo ratings yet

- Wincorp Investment Dispute Ruling AnalyzedDocument42 pagesWincorp Investment Dispute Ruling AnalyzedCatherine DimailigNo ratings yet

- Credit Report: Shannon CoxDocument60 pagesCredit Report: Shannon CoxShanNo ratings yet

- Example: Historical Financial StatementsDocument10 pagesExample: Historical Financial StatementstopherxNo ratings yet

- What Is Market Stabilization SchemeDocument5 pagesWhat Is Market Stabilization Schemezaru1121100% (1)

- Fin1 Eq2 BsatDocument1 pageFin1 Eq2 BsatYu BabylanNo ratings yet

- CH 03Document50 pagesCH 03lexfred55No ratings yet

- UK Financial Regulations Easily Understood Revision Guide For CeMap CeFA 1 SampleDocument14 pagesUK Financial Regulations Easily Understood Revision Guide For CeMap CeFA 1 SampleZahid ChowdhuryNo ratings yet

- NI ACT With CasesDocument27 pagesNI ACT With CasesTaisir MahmudNo ratings yet

- Chapter 9 - Ending The VentureDocument60 pagesChapter 9 - Ending The VentureTeku ThwalaNo ratings yet

- Solution AC3 PrelimDocument12 pagesSolution AC3 PrelimYashi SantosNo ratings yet

- Group Assignment - FIN201Document13 pagesGroup Assignment - FIN201NguyễnĐứcBảoNo ratings yet

- Leveraged Buyout (LBO) AnalysisDocument4 pagesLeveraged Buyout (LBO) AnalysisAtibAhmedNo ratings yet

- Credit BossDocument8 pagesCredit Bossuttamdas79No ratings yet

- Chapter 13 Dividend Policy DecisionDocument23 pagesChapter 13 Dividend Policy DecisionMd. Sohel BiswasNo ratings yet

- Intermediate Accounting 3 ReviewerDocument22 pagesIntermediate Accounting 3 ReviewerRichelle Joy Bonggat100% (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetFrom EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetRating: 5 out of 5 stars5/5 (2)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- How to Measure Anything: Finding the Value of Intangibles in BusinessFrom EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorFrom EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo ratings yet

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Note Brokering for Profit: Your Complete Work At Home Success ManualFrom EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNo ratings yet

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- Streetsmart Financial Basics for Nonprofit Managers: 4th EditionFrom EverandStreetsmart Financial Basics for Nonprofit Managers: 4th EditionRating: 3.5 out of 5 stars3.5/5 (3)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)